Executive Summary

This Report presents a snapshot of the merchandize import and export patterns of India’s foreign trade from 2010 – 2021. According to our analysis of these and the recent trends, India is now moving up the value chain, with manufactured products weighing prominently in the country’s export basket. The Report notes emerging export opportunities for the U.S. industry considering global supply sourcing diversification and the recent policy focus on manufacturing in India. On the exports side, the U.S. remains India’s top destination.

The Report also discusses patterns, noting the prominence of Chinese supplies that have contributed substantially to India’s ballooning bilateral trade deficit with China, despite several attempts made by the Indian policymakers to gain additional market access in China. The pattern of top imports underscores the significant raw material content in India’s imports basket. India’s increasing import dependency for the inputs is high, thus making the manufactured (value-added) products exports more vulnerable to imports – a condition that may neutralize the gains if not corrected.

The last Section of the Report focuses on India’s current fiscal year trade deficit trends. To manage trade deficits, India will need to develop a robust domestic ecosystem; an aggressive export-oriented strategy may do the balancing act. India’s WTO-compliant Production Linked Incentive (PLI) Scheme is the silver lining that will boost both domestic manufacturing and exports in the short-medium term, firming up the country’s growth trajectory.

The Report concludes that India may optimize the benefits of its growing manufactured product exports if it remains focused on developing a robust domestic manufacturing sector. A strong export-oriented domestic ecosystem will not only help reduce India’s import dependence on input supplies but also improve the country’s competitiveness, with a reliable supply system, in the region for attracting global manufacturers.

Snapshot of India’s Annual Merchandize Export and Import Trends

Merchandize Exports

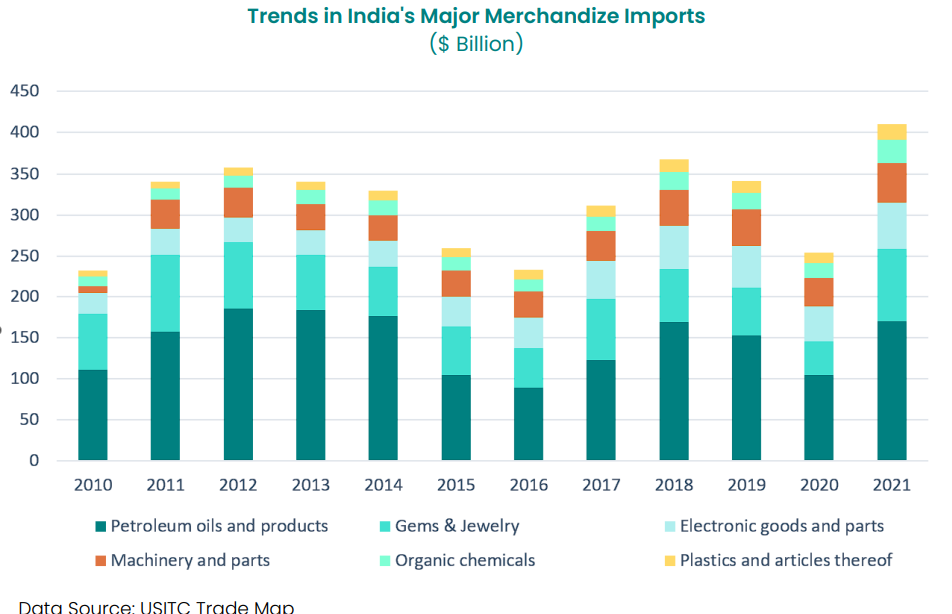

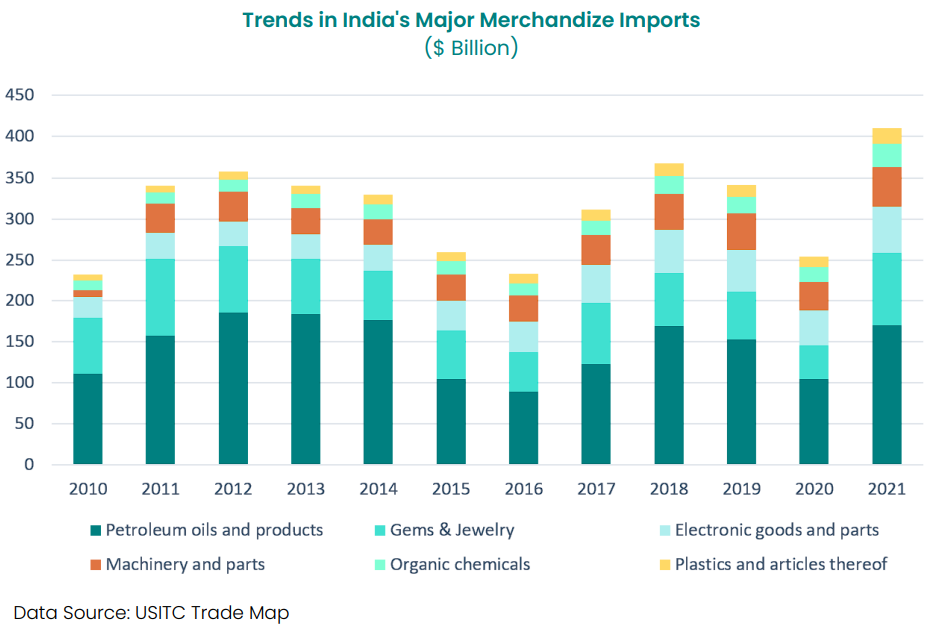

Merchandize Imports

Major Pointers:

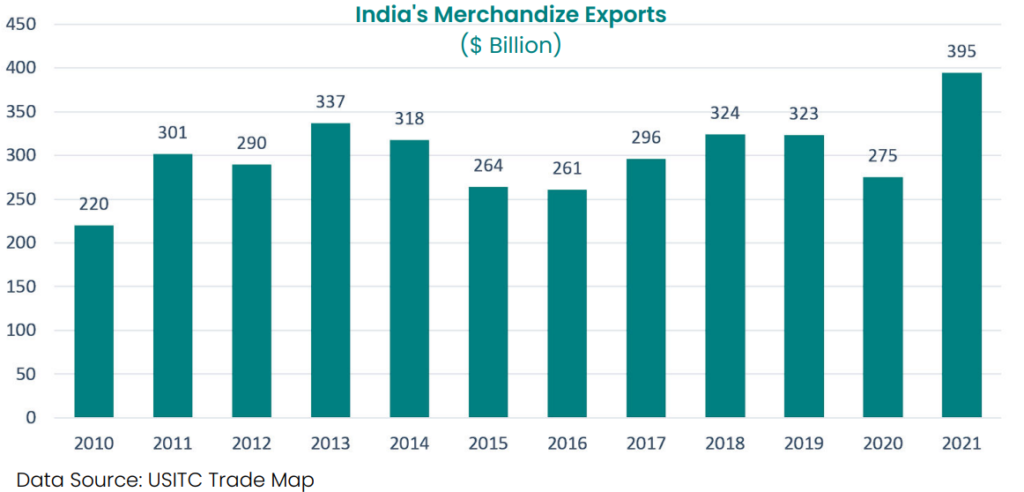

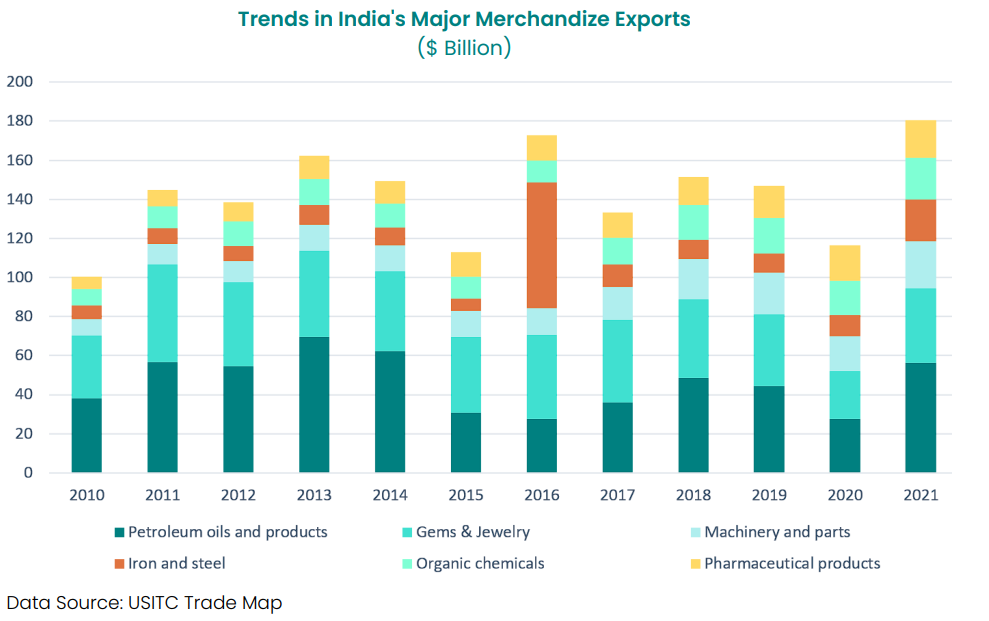

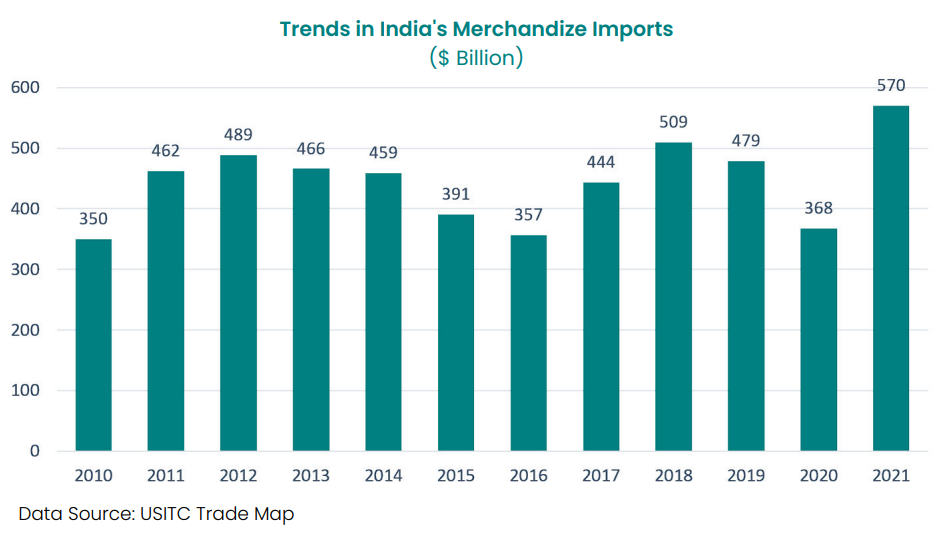

- India’s annual trade trends since 2010 show an overall upward trajectory, both exports and mports, barring a few stints in 2015, 2016 and 2020. An increasing share of value-added manufacturing items (including tech goods) in India’s export basket since 2017 suggests India is inching up the value chain in the global market.

- That said, India’s imports of the required raw materials/components for export production of value-added items (petroleum products, pharmaceuticals, machinery, and jewelry) have also increased. These trends seem sustaining and point to India’s increasing import dependency for inputs that needs the attention of the policymakers.

- The impact of the global slowdown was reflected in India’s external trade since 2013 when both exports and imports declined during 2014-16 period. Exports came down from $318 billion in 2014 to $261 billion in 2016; and imports came down from $459 billion in 2014 to $357 billion in 2016. The decrease in imports was led by a steep fall in international crude oil prices since 2014 and its significant effect on the Indian economy and the country’s import bill for the succeeding couple years was visible. The analysis of the major commodity-wise data reveals that the fall in merchandise exports in 2015 and 2016 was led by a decline in exports of value-added manufacturing items and some traditional primary products.

- A slow but a sustained upward trend in India’s merchandize exports was evident from 2017 until 2019 during which the exports growth was led by value-added items (such as petroleum products, organic chemicals, pharmaceuticals, and machinery) and their share in total India’s total exports increased. Similarly, imports of inputs/components also increased during this period.

- The year 2020 reflected the pandemic impact on the external trade when most of the world economies witnessed lockdowns with least economic activity and major supply disruptions.

- The year 2021 witnessed India’s trade recovering with an impressive export growth of 43%, albeit on a low base, reflecting impact of lifting of the pandemic restrictions and increased global demand. India’s merchandize imports in 2021 rose more than 53% to $572.6 billion. More demand for crude oil, chemicals, plastics, and iron & steel items led to increased imports, affirming increased industrial activity during the year.

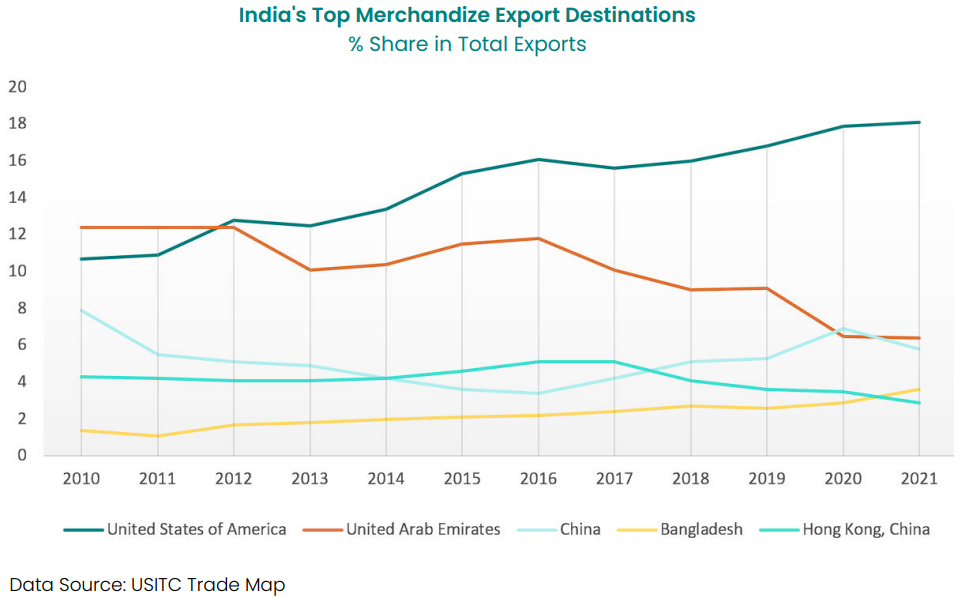

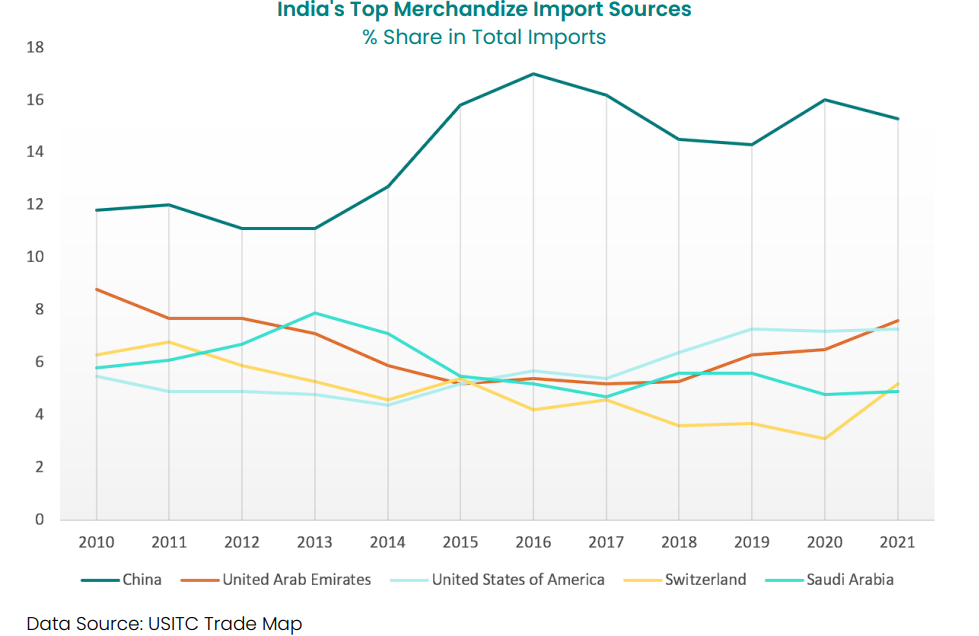

- In terms of directional trade engagements, the United States remains India’s significant export market with a trade balance in favor of India; on the other hand, China has remained India’s biggest supplier of imported merchandize, albeit with a huge trade gap against India.

India’s Plodding Exports in FY2022-23 – A Fallout of Global Slowdown

The world trade growth is downward and almost every country is struggling to maintain growth in exports; and India is no exception. The Ministry of Commerce data indicates that Indian exports gradually recovered after the Covid-19 and IFY2021-22 witnessed Indian exports rising faster than ever to touch $422 billion. The upward journey of India’s merchandize exports continued until June 2022, after which the cascading impact of the global slowdown started reflecting in India’s export growth. Global slowdown conditions have suppressed demand and, therefore, India’s export growth rate has slowed to only 10% for the first nine months of the FY2022-23 (Apr-Dec 2022); incidentally, the corresponding rate of growth for imports was 25%, generating a trade deficit level that was 60% higher than the one in the previous year. The latest Economic Survey released by the Government of India on January 31, 2023, has cautioned India’s export growth trajectory to be flat in the FY2023-24 if the global economy does not pick up. The IMF’s World Economic Outlook has projected the volume of world trade to dip from 10.1% in 2021 to 4.1% in 2022, and further to 3.2% in 2023 while The World Trade Organization (WTO) has projected a growth of only 1% in global trade in 2023.

For the Apr-Dec 2022 period, the y-o-y drop in India’s exports was apparent in gems and jewelry, chemicals, iron and steel, and textiles that constitute about 16% of total merchandize exports; barring petroleum products and telecom instruments, export growth for most other categories was lackluster. Merchandize exports data for the period April-December 2022 of IFY2022-23 also indicates that manufactured products (value-added products) make up a significant portion of India’s exports. Top five major items in India’s export basket include petroleum products (22% of total merchandize exports), pearls/gems & jewelry/precious metals (8.6% share), pharmaceuticals (4.3% share), iron and steel (3% share) and phones (2.6% share). Raw material/intermediates and capital goods are also exported from India, i.e., organic chemicals (2.2% share in total merchandize exports), iron and steel engineering items (2.2%), Aluminum (2%), and auto components (1.6%).

Exports of Value-added Products Becoming Vulnerable to Imported

Input Supplies

A closer analysis of the commodity trade of India shows that India’s exports of value-added products, such as petroleum products, jewelry, pharmaceuticals, electronic goods including telecom instruments have significant import content of raw material/components. Growth of exports of manufactured products signals positive movement of the economy up the value chain; however, export growth remains vulnerable to changes in imported supplies. Dependency on imports can be a challenge, as has been evident from the supply chain disruptions caused by the pandemic and the recent geopolitical tensions. Many research studies have shown that the import intensity of India’s exports (the degree of value addition of an imported item that is exported) has risen over the last two decades from 9% to nearly 20%, barring a stint in 2016 when it declined to 17.6% from the peak of 25.9% in 2012. The latest

OECD Trade in Value Added (TIVA) 2021 Indicators highlighted that the foreign value-added content of India’s exports was 19.8% in 2018. The sectors of Indian exports with high import intensity are petroleum products, chemicals and pharmaceuticals, metals, electrical and electronic equipment, and gems and jewelry, constituting more than 50% of total merchandize exports. Although the global economic conditions will still govern the growth of the overall export sector, India must contemplate to reduce import dependency for intermediates through an export-oriented industrialization. The Government of India’s recent efforts, such as Production Linked Incentives (PLI), National Logistics Policy, and the Free Trade Agreements (FTAs) strategy are positive steps in the direction of improving India’s competitiveness that will enhance domestic manufacturing. A developed domestic ecosystem will not only support jobs in India, but it will also ensure uninterrupted raw material/components supplies that will attract global manufacturers who can bring benefits of technology and scale production to increase India’s share in the global exports.

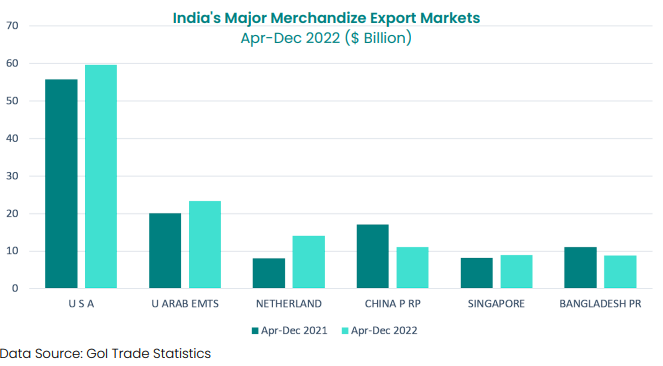

Top Three Destination of Exports

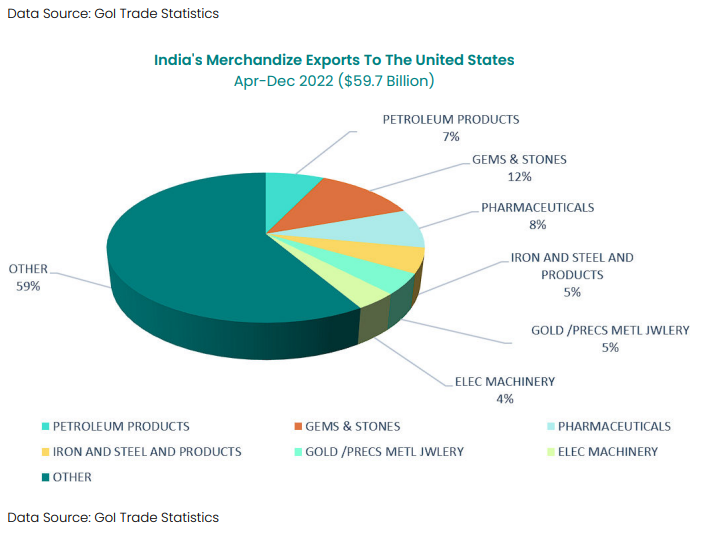

The merchandize exports data, based on foreign countries’ share, reveals that India’s top three destinations for April-December 2022 period of the fiscal year 2022-23 are the United States (18% of total merchandize exports), UAE (7% share) and Netherlands (4% share). India’s major exports to the United States include value-added products, such as gems & jewelry, petroleum products, pharmaceuticals, iron & Steel products, electrical machinery, and mobile phones. The major items exported from India to UAE are gems & jewelry, mobile phones, petroleum products and iron & Steel; and to Netherlands are organic chemicals, Aluminum, iron & steel, and petroleum products. China remained India’s third largest export destination from IFY2018-19 to IFY2021-22, with exports of items such as iron & steel goods, electronic goods, marine products, spices, organic and inorganic chemicals, and petroleum products. However, Netherlands replaced China, appearing as a major export destination for organic chemicals, metal, and petroleum products in the current IFY2022-23; this may be an outcome of an economic slowdown in China owing to its zero Covid policy. India has maintained trade surplus with the United States and Netherlands while it has trade deficit with UAE and China.

Export Opportunities for India as Global Supply Chain Diversifies

As global manufacturers have started shifting away from China, Indian manufacturers stand to gain. Recently, global mobile manufacturers that are exploring additional destinations have scaled up the export market through the contract manufacturing in India, taking India’s export of telecom instruments to $8.8 billion, with a significant 74% growth y-o-y basis for the first three quarter of the IFY2022-23 (Apr-Dec 2022). This may be an indication of a future trends, and if considerable shift of manufacturing from China to India takes place, then China’s exports may be analyzed for fresh export opportunities for the Indian manufacturers. For instance, China’s exports to the United States in select sectors where Indian manufacturers face competition from China (such as, machinery, vehicles, furniture, footwear, organic chemicals etc. where Chinese exports are multifold than that of India) can present enormous export opportunities for the Indian manufacturers. Similarly, India’s comparative advantage in auto component sector may be leveraged due to the fallout of China.

Given these export opportunities arising from the global supply sourcing diversification and the Government’s PLI support, India’s manufacturing sector is expected to engage more aggressively in mergers and acquisitions to move up the value chain, ultimately resulting in providing a strong ecosystem that can reduce imports of raw materials in the medium-long run.

The PLI Scheme and the direct tax reforms and the new Free Trade Agreements (FTAs) are expected to improve India’s competitiveness in the region. However, they are, by no means, enough; in addition, the trade facilitation and other Ease of Business reforms will continue to play a crucial role as India aspires to become a manufacturing and export hub for global manufacturers. The bottom line to enhance India’s external sector performance, and thereby to becoming a major player in the global market, is a strong manufacturing sector with an ecosystem that is resilient to geopolitical shocks, ensuring reliable and quality supplies. According to an earlier USISPF study Enhancing India’s GVCs Competitiveness, boosting India’s competitiveness is the key if India wants to become a global exporting hub. While India is now focusing on enhancing domestic manufacturing capabilities, it also needs to continue to improve logistics, ease of doing business, and rationalize cost of credit and power.

The government of India has recently shown progressive stance on its FTA Strategy (implementing FTAs with UAE and Australia) that is expected to create additional opportunities for the country’s trading community. India has concluded several FTAs and preferential trade agreements, and is further engaged in negotiations with important partners, such as the UK, Canada, Israel, EU (27 members), Eurasia (5 members), and Gulf Cooperation Council (6 members) among other individual partner countries in Asia Pacific and Africa. India stepped out of RCEP; however, it may consider re-joining the RCEP in future. If the EU FTA negotiations are concluded timely, then India can get deeper integration into a major region and may look on the horizon to expand its trade.

India’s Rising Imports – Current Trends

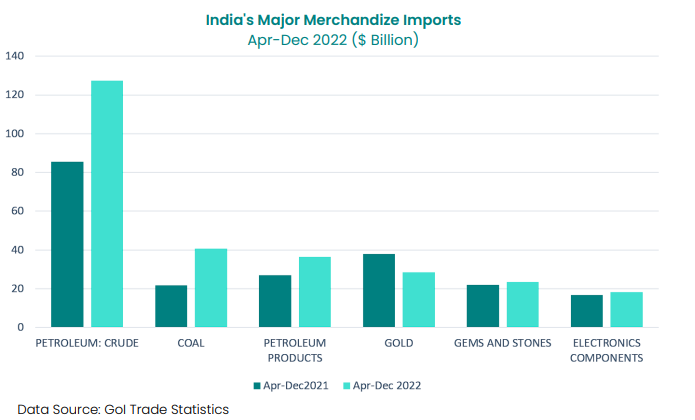

India’s imports have continuously risen in value terms to alarming levels for the current fiscal year 2022-23 to more than $127 billion, recording a year-on-year (y-o-y) increase of 25%. According to the latest Government of India (GoI) trade data released for Apr-December 2022 (first three quarters of the Indian fiscal year (IFY) 2022-23) , five major categories of imports during the first three quarters of IFY2022-23 constituting about 70% of India’s total imports, include energy imports (crude oil, coal, petroleum products – 37%), electronic goods (11%), pearls/gems/precious metal (10%), machinery (6%), and chemicals (5%). The highest increase was seen in energy imports, specifically in coal imports.

The outbreak of Russia-Ukraine conflict led this year’s supply disruptions resulting in skyrocketing international prices of oil, coal, and gas. India remains a major crude oil importer and the share of energy imports was 30% in the previous year but due to the inflated energy prices for most of the current fiscal, its share in India’s total import bill has risen to 37% in the current fiscal. Similarly, unprecedented hike in edible oil prices globally increased y-o-y India’s import bill by 15% for the Apr-December 2022 period. Apart from oils and coal, India’s imports of electronic components, plastic raw material and iron & steel also rose significantly. India’s manufacturing sector is facing under-utilization of capacity due to lack of an adequate ecosystem whereby industry ends up importing basic raw materials and components to produce finished goods.

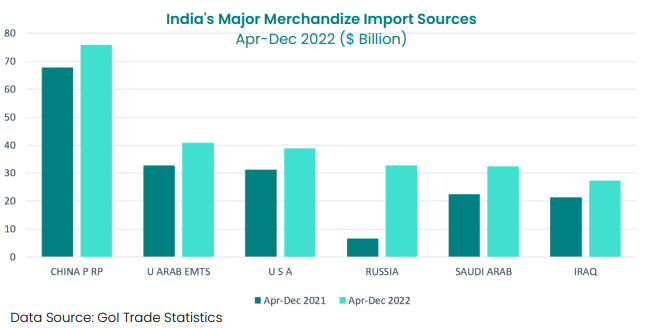

Major Suppliers to India – Dependence on Chinese Supplies Continues

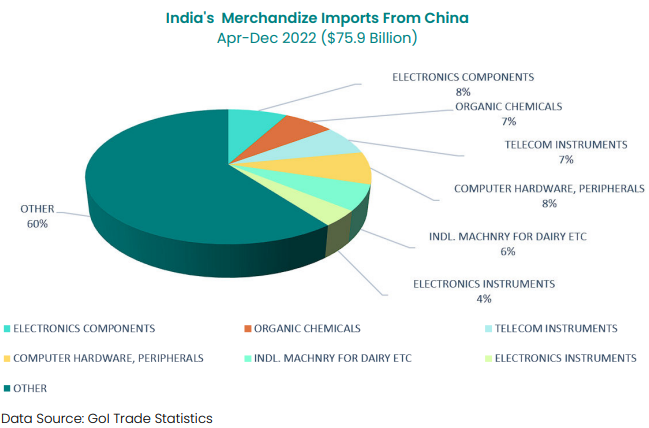

In terms of direction of trade, India’s top merchandize supplier is China with about 14% stake in the country’s total merchandize imports, albeit that does not appear in India’s oil import basket. The total imports from China during the first three quarters of the current IFY 2022-23 has reached $76 billion, rising y-o-y 12%, and it is expected to be well above $100 billion for the whole year. India’s main imports from China include a range of raw materials (Active Pharmaceutical Ingredients – API, chemicals,) and key components (auto, electronic consumer goods, capital goods). In addition, 25% of the auto components, about 80% of electronic components, 46% of consumer electronics, 70% of APIs and 42% of dairy machinery imported in India are from China. Over the last five years, China has remained India’s top supplier of intermediate goods across key sectors and its total exports to India were lowest at $59 billion in 2020. However, after the COVID, the value of Chinese imports into India has grown to levels that indicate India’s substantial reliance on Chinese supplies. For instance, China accounted for more than 65% of India’s total purchases of bulk drugs and drug intermediates in IFY 2020-21.

The Indian policymakers have made numerous attempts to reduce the swelling trade deficit, particularly with China, and have advocated import substitution policies to check dependence on Chinese imports. That said, India may not be able to sideline Chinese influx of much required intermediates at this time. Indian importers have reportedly found China as an easy and cost-competitive supplier with a strong shipping network and access. Moreover, the Chinese cost-effective supplies are imminent for India’s tech-industry that is still evolving, requiring the essential raw material/components to mature to be able to participate in global value chains. Imports from China, like the APIs and drug formulations, provide the Indian pharma industry with raw material for export production. Import substitution policies in select sectors may work but they are not desirable if the country’s export sector is impacted due to these policies. Therefore, reducing import dependence on China will be a daunting task for India and it will require a calibrated approach in consultation with the industry.

UAE Continues to be a Major Oil Supplier to India

India’s second major source, accounting for 7.4% share in the country’s total commodity imports – UAE – mainly supplies crude oil, petroleum products, and gems and stones. India’s Import bill from UAE has increased 25% to $41 billion during the Apr-December 2022 period of the IFY 2022-23, mainly due to the inflated oil and gold prices throughout the year. India-UAE bilateral trade features trade balance in favor of UAE; bilateral trade was around $72 billion in FY2021-22, and it is expected to be around $80 billion for the whole FY2022-23. The India-UAE Comprehensive Economic Partnership Agreement (CEPA), implemented on May 1, 2022, focuses on non-energy sector for diversification in digital trade, services, and government procurement to take the bilateral trade to $100 billion by 2027.

U.S. Exports Diversification Opportunities in India

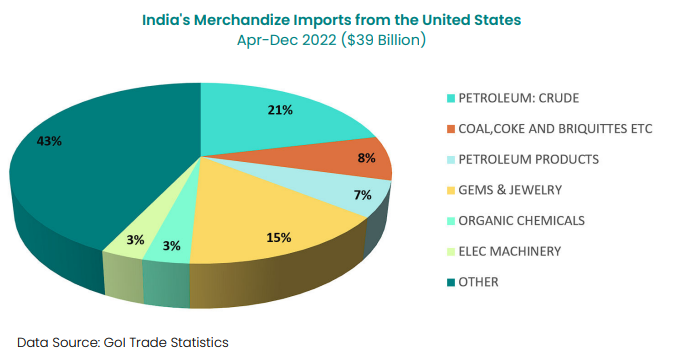

India’s third major supplier of commodities is the United States with 7.1% share in its total merchandize imports, according to the data published for Apr-December 2022 period of the IFY2022-23. US exports to India have increased 25% y-o-y to $41 billion for this period, consisting of mainly energy supplies (crude oil, coal, petroleum products), gems and stones, and gold. US exports to India may be diversified considering India’s recent policy focus on manufacturing sector that will likely generate humongous demand for raw materials/components in the short-medium term in various sectors.

The U.S. faces Chinese competition for exports of electronic goods/components, electrical machinery, organic chemicals, and plastic raw materials to the Indian market. Immense export opportunities exist for the US industry in the above areas of exports to the Indian market, as the value of Chinese supplies of these products are multi-fold that of the US supplies and there is ample scope for the US supplies to meet the increasing demand of the Indian industry. Indian policymakers have also shown their frustration over India’s excessive trade deficit with China and have attempted several times to increase market access in China while reducing imports. Apart from border tensions, the ballooning of India-China trade deficit has remained a contentious issue between both countries and India has contemplated policy measures to curb Chinese imports several times in the past.

Trade Balance concerns

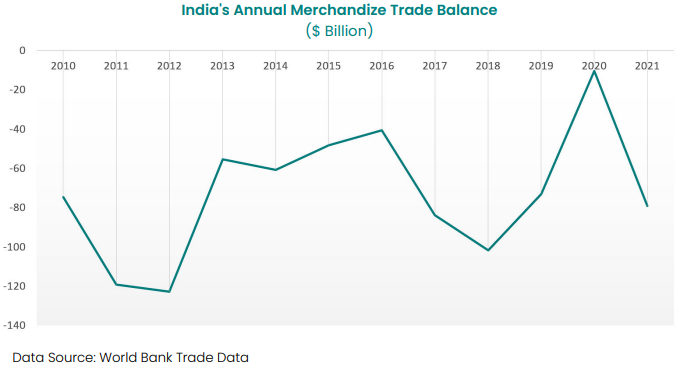

Annual Trends

Current Trends

India has witnessed an unprecedented rise in imports in the current fiscal year while the export growth has been sluggish despite the falling Rupee. As per the Government of India data, merchandise imports in FY2022-23 (Apr-Dec) hit a record $552 billion, registering an y-o-y increase of 25%; the exports for the same period increased only 10% to $336 billion, leaving a whopping trade deficit of $216 billion that was about 59% higher than the previous year.

The excessive rise in imports may impact on the strength of the domestic industry. According to some trade economists, in the short run, a trade deficit may curb inflation but over a time, a large trade deficit weakens domestic industries and decreases job opportunities. The Indian Rupee, like many other currencies, has depreciated against the US Dollar throughout 2022 due to the liquidity management efforts globally, which has also contributed to a higher import bill this year. India’s dependence on crude-oil imports is well-known; India procures about 85% of its crude oil supplies through imports. During Apr-Dec 2022, crude oil alone accounted for nearly 23% of India’s total imports, and that with all petroleum and electronic goods accounted for nearly 49%. In an interesting development, India’s oil trade engagement with Russia has been increasing since the two partners contracted discounted oil prices after the Western Sanctions on Russian supplies in March 2022. Given India’s increasing demand and need for energy security, this new development may sustain and help cut the energy import bill to some extent.

India’s rising trade deficit concerns are understandable as it is critical for countries to maintain export-import balance to maintain growth momentum. Higher imports and low exports could negatively impact the economy and lead to devaluation of the currency. To cut the rising import bill India may consider import substitution/restrictions; but import substitution alone may not be a viable solution since it ultimately leaves the domestic industry uncompetitive. India is seeking deeper economic integration in the global market and the GoI’s “Aatmanirbhar Bharat” (Self-Reliant India) Initiative has promoted development of manufacturing in India for export production. A blanket import substitution will, therefore, be against the spirit of the Aatmanirbhar Bharat; an increase in imports may not necessarily be bad if it is for items that are vital and the shortages of domestic supplies may impact the growth of the sector. For instance, increased imports of intermediates imply a boost in industrial activity and domestic demand in India, which are both crucial for the economic growth of the country. That said, a calibrated approach may be adopted to use import substitution as a temporary tool in select sectors, such as chemicals, auto components and APIs where India’s domestic manufacturers in the organized sector are moving up the supply chain, merging/acquiring smaller raw material suppliers. However, import substitution may not work in the case of high-tech electronic goods where the domestic manufacturing industry is still evolving to become a reliable supplier in the global supply chain. Industry consultations may be held to identify specific sectors where temporary import restrictions may prove beneficial.

Conclusion

India’s rising trade in manufacturing goods point to India’s growing role in global value chains; that said, India’s exports of manufactured products have high import content that intensified vulnerability of India’s exports towards imports in the current year when supply chain disruptions caused by the geo-political conditions affected raw material supplies. A roadmap to strengthen the ecosystem for component/raw material manufacturing will certainly help curtail India’s import dependency as well as help enhance the country’s competitiveness for export production.

Geopolitical changes, such as the continuing war between Russia and Ukraine, slowdown in China and the resultant global slowdown presented both challenges and opportunities to countries. While India is expected to gain as a fallout of China plus one approach of the global manufacturers, India is currently faced with the problem of ballooning merchandise trade deficit that has a significant bearing on India’s overall growth, as exports and imports account for nearly 40% of the GDPs, and a higher negative balance can suppress the country’s GDP growth. No doubt, India’s import bill has grown outrageously during the current fiscal year, which must be reduced in a calibrated manner. India may reduce its reliance on imported crude oil by diversifying its energy usage to alternative sources, such as solar renewables and hydrogen gas. Likewise, to reduce reliance on Chinese supplies (electronic goods/components, electrical machinery, organic chemicals, and plastic raw materials), India may explore alternative sellers, such as the United States.

Given the increasing share of manufactured products in India’s export basket, it is imminent to develop the manufacturing sector. Rather than only focusing on reducing reliance on imported materials, India will immensely benefit by staying focused on developing industry capacities, acquiring new capabilities/technologies while upgrading the existing ones, and improving trade facilitation for deeper integration with Global Value Chains. The GoI’s WTO-compliant PLI scheme is a silver lining that is expected to provide the much-required fillip to both the domestic manufacturing sector as well as India’s exports, while de-risking supply chains in the medium-long term.