A joint report by Ernst & Young (EY) and the U.S.-India Strategic Partnership Forum (USISPF) has shed light on the profound challenges faced by India’s pay-to-play online skill gaming industry following the recent GST tax amendments levying 28% on deposits.

The report highlights the impact of the pay-to-play model that has been at the receiving end of the revised GST regime. The games can broadly be fantasy games, card games, and casual games. Depending upon the format of the game, the impact of the new GST regime has either been detrimental to the companies’ revenue and margins or has been outright catastrophic, making the business model completely unviable. Annexed below are the calculations as extracted from the report for real-time casual games with a smaller number of the player pool that stands as the worst hit format.

The study highlights how elevated taxation has triggered a cascade of repercussions, including funding constraints, reduced growth trajectories, job losses, and heightened uncertainty across the sector. As part of this study, the report provides the findings of the survey conducted by USISPF of 12 companies in this sector, and the global best practices to reach the recommendation. Here are the key findings:

Impact of GST hike on the Industry:

Funding Challenges:

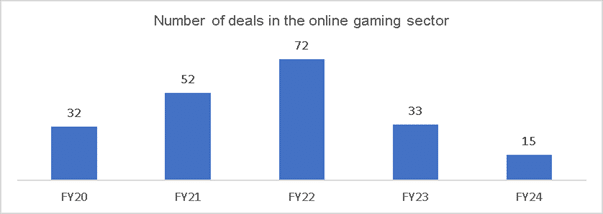

- Funding Winter: Since 2019, the Indian gaming sector has attracted FDI of $2.6 billion from domestic and global investors, 90% of the FDI was attracted in the pay-to-play format of the online gaming sector. 2021 stood out as the most significant year in attracting investments, and no capital has been raised in the sector since 1st October 2023. Some companies reported a complete withdrawal of global marque investors just at the onset of the new GST regime.

Number of deals in the online gaming sector

Muted Revenue and Growth:

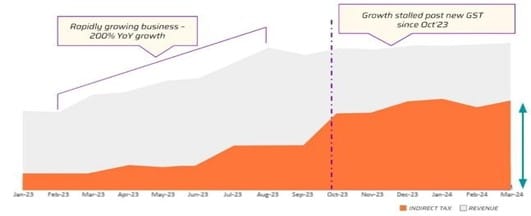

- High Tax Impact: Before the amendment, the GST cost constituted 15.25% of the revenue. However, since October 1st, 2023, the GST cost has increased manifold, with GST now consuming 50-100% of the revenue for 33% of companies and even surpassing total revenue for startups. These startups now have to operate at a loss. Notably, the report highlights that the impact of the GST also depends upon the formats. For instance, in the case of casual games, the exponential increase in GST is threatening the business viability.

- Stalled Revenue Growth: Over half of the sector’s enterprises are either staring at stagnant revenues or shrinking topline, with 25% experiencing growth declines of up to 50%. This marks a stark departure from previous growth rates exceeding 100-200%. The study attributes this turnaround in business prospects to the new GST regime.

Graph indicating the impact of the new GST regime where a participating company reported that the indirect tax constitutes 70% of their revenue, leaving no operating margin.

Job Losses:

- Job erosion: Decreased margins due to increased GST (being absorbed by the companies) had a ripple-down effect in employee layoffs and a complete pause in hiring specialist skills such as technology, product, animation, and design. Most companies have reported impacted jobs in terms of no hiring, layoffs, and shutting down operations altogether. The new GST regime has created concerns about the viability of the sector and is keeping away the right talent from joining the workforce, further exacerbating the sector’s woes.

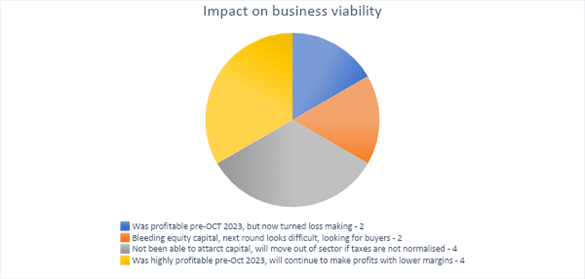

Future Outlook:

- Uncertain Prospects: Owing to all the above reasons, only a handful of entities remain profitable and are surviving at lower margins compared with the 1st of October 2023 scenario. Post GST amendment, most companies have either turned into loss-making entities or are bleeding capital. Few have highlighted that they will need to move out of the sector and the rest are considering taking the business to another country if taxes are not normalized.

Policy recommendation:

- Path ahead: Amend the valuation mechanism for online money games to levy GST from the current “full-face value of total deposits” to GGR/platform fees, i.e., the amount retained by online gaming platforms for operating a game.

These findings illustrate how high taxes have caused a severe negative impact on an industry that was once heralded as a sunrise sector, attracted 90% of the USD 3 bn FDI, and created over 100,000 jobs in a short period. India still accounts for 1.1% of the global gaming market and if managed well, it could have been a sustainable driver of the Indian economy while creating 250,000+ high-quality jobs in the coming years. However, owing to the onerous tax regime, the online skill gaming sector is facing funding challenges, a catastrophic decline in revenues, reduced growth, severe job losses, and an uncertain future. The recommended solution aims to make the tax burden more manageable.

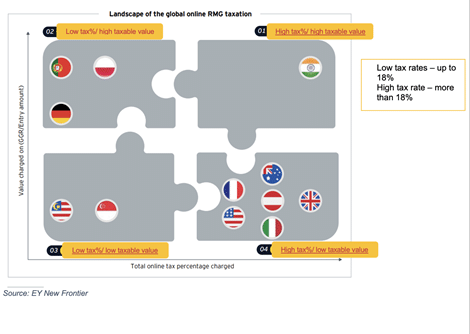

India has the most onerous Indirect Taxation regime for online skill gaming

Overall, India has the most onerous and highest Indirect Taxation regime for online skill gaming. Most countries globally tax on GGR/platform fees, which are the actual revenue for the platforms for the service they provide. In limited cases where countries levy indirect taxes on deposits, the tax rate is lower to maintain parity with GGR models and not burden the sector with unduly heavy tax liability. For example, Poland and Portugal tax on deposits but the rate is 12% and 8% respectively.

It is also worth noting that various jurisdictions tax games of skill and games of chance differently. Certain jurisdictions go a step further to define games such as fantasy games, e-sports, etc

Globally, a High Tax Regime Has Led to an Increase in Illegal Operators.

The increase in GST cost will lead customers to move towards alternative options such as offshore or illegitimate platforms that do not charge GST or impose lower rates resulting in an increase in gambling addiction, fueling of the offshore market, and loss of revenue for the exchequer. A news report quoted AIGF, a gaming industry body in India, which estimates that offshore illegal betting and gambling entities are causing the national exchequer to lose USD $2.5 billion annually.

Commenting on the report, Dr. Mukesh Aghi, President & CEO of USISPF, said, “In aligning with global practices, India should clearly distinguish between games of skill and games of chance for online gaming taxation and regulation. India can benefit from this approach by bringing in new-age technologies and investments from across the world. Our study indicates that the impact is concentrated in real-time games limited to fewer players where the business model is still evolving. The gaming sector needs support to grow and bring out the best possible efficiencies.”

Download the full report: https://usindiataxforum.org/wp-content/uploads/2020/11/Impact-of-new-GST-law-on-skill-based-online-games_Print_Filev2.pdf

About the US-India Strategic Partnership Forum (USISPF):

The US-India Strategic Partnership Forum (USISPF) is committed to creating the most powerful partnership between the United States and India. As the only independent not-for-profit institution dedicated to strengthening the U.S.-India partnership in Washington, D.C., and in New Delhi, USISPF is the trusted partner for businesses, non-profit organizations, the diaspora, and the governments of India and the United States.

About EY

EY exists to build a better working world, helping create long-term value for clients, people, and society and build trust in the capital markets. Enabled by data and technology, diverse EY teams in over 150 countries provide trust through assurance and help clients grow, transform, and operate. Working across assurance, consulting, law, strategy, tax, and transactions, EY teams ask better questions to find new answers for the complex issues facing our world today. EY refers to the global organization and may refer to one or more of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. Information about how EY collects and uses personal data, end a description of the rights individuals have under data protection legislation are available via ey.com/privacy. EY member firms do not practice law where prohibited by local laws.

For media inquiries, please contact:

Akshobh Giridharadas

agiridharadas@usispf.org

+1 404 7404928

Ankit Jain

ajain@usispf.org

+1 (@224)-460-7900

For details on the report, please contact:

Shweta Kathuria

skathuria@usinfoundation.org