Overview

This Report provides a review of the economic developments in the first quarter (Q1) of Indian Fiscal Year (FY) 2023-24 (April-June 2023). India’s economic growth in Q1 was on the expected lines amidst positive trends in consumer spending and demand, public and private investment, inflation, and service sector activities.

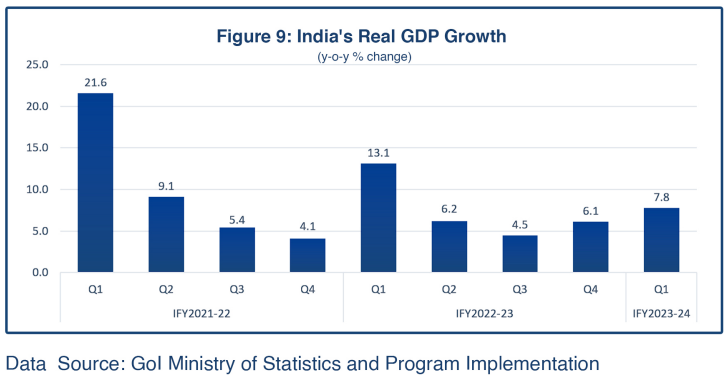

On August 31, 2023, India’s Ministry of Statistical and Program Implementation (MoSPI) released the official economic data for the first quarter of FY2022-23. It showed India’s economy expanded 7.8%, significantly up from the previous quarter’s 6.1% expansion; the strong result was expected by most economic agencies but a bit lower than the 8% growth forecast by the Reserve Bank of India (RBI). An impressive growth in Q1FY2023-24, however, reaffirms resilient economic recovery in India in the post-COVID19 period, despite ongoing supply disruptions and geopolitical challenges. That said, India, like any other economy, faces headwinds (high inflation, low external demand) in the short and medium terms as it seeks to retain its growth momentum.

This solid real GDP growth in Q1FY2023-24, together with a manageable trade deficit, decent retail growth, increased services activity, and rising public capital expenditure (capex) and private investment, has lifted market sentiment. Nevertheless, India’s recovery remains uneven. Most economic activities, like agriculture, mining, manufacturing, electricity, construction, hotel, and transport, showed a slower pace of growth in Q1FY2023-24 compared with Q1FY2022-23. To maintain growth momentum, the Indian government will need to address lingering domestic risks (e.g., rising inflation, unseasonal heavy rains) and external challenges, while enhancing public capex to attract more private investment.

Like other major economies, India continues to face high retail inflation, tight monetary conditions, lower capital inflows, and exchange rate pressure due to the prolonged Russia-Ukraine conflict. India has held interest rates steady since April 2023, which has contributed to improving profit margins and bringing down consumer prices. Corporate performance in the April-June quarter pointed to a sharp pick-up in profits, though the result was not broad-based, pointing to lower input prices. Retail inflation remained within the RBI’s target band of 2%-6%, lifting consumer spending. Overall, during Q1 India’s economy showed stabilizing signs, with recovery in some important areas like domestic demand, public and private investment, inflation, foreign exchange reserves, manufacturing, and services sector.

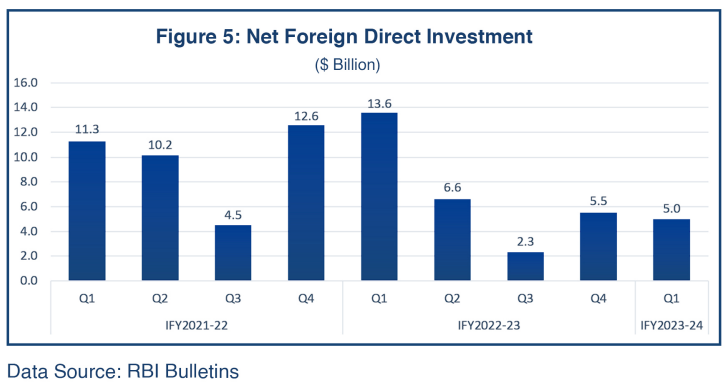

The RBI’s intermittent interventions and India’s strong financial system helped the economy face geopolitical challenges with reasonable resilience. During Q1, the Indian rupee depreciated marginally against the US dollar. The average retail inflation was 6.2% in Q1, compared with 6.2% in the previous quarter, and foreign exchange reserves also recouped. While net foreign direct investment (FDI) inflows picked up substantially in Q1, India’s total net inflows during FY2022-23 dropped 27% from the previous year. Merchandize exports and imports continued their downward movements during Q1 on a sequential basis but moderated on a year-on-year (YOY) basis, and the risk to India’s current account deficit eased as the YOY trade deficit reduced.

Downside risks continue to dominate India’s external sector as tighter monetary policies are expected to prevail globally owing to high inflation and high unemployment. India’s expected GDP growth in Q1 has solidified optimism in the market, but going forward the growth outlook is by no means without risks, including global uncertainties that may impact India’s external sector performance and the unseasonably heavy rains that may impact its rural economy and agriculture output. For sustained development, India needs to increase investment in the rural economy, to push consumer spending and crowd in more private investments. Despite all these challenges, India’s economic fundamentals remain robust.

Demand Side Indicators

Consumption Spending

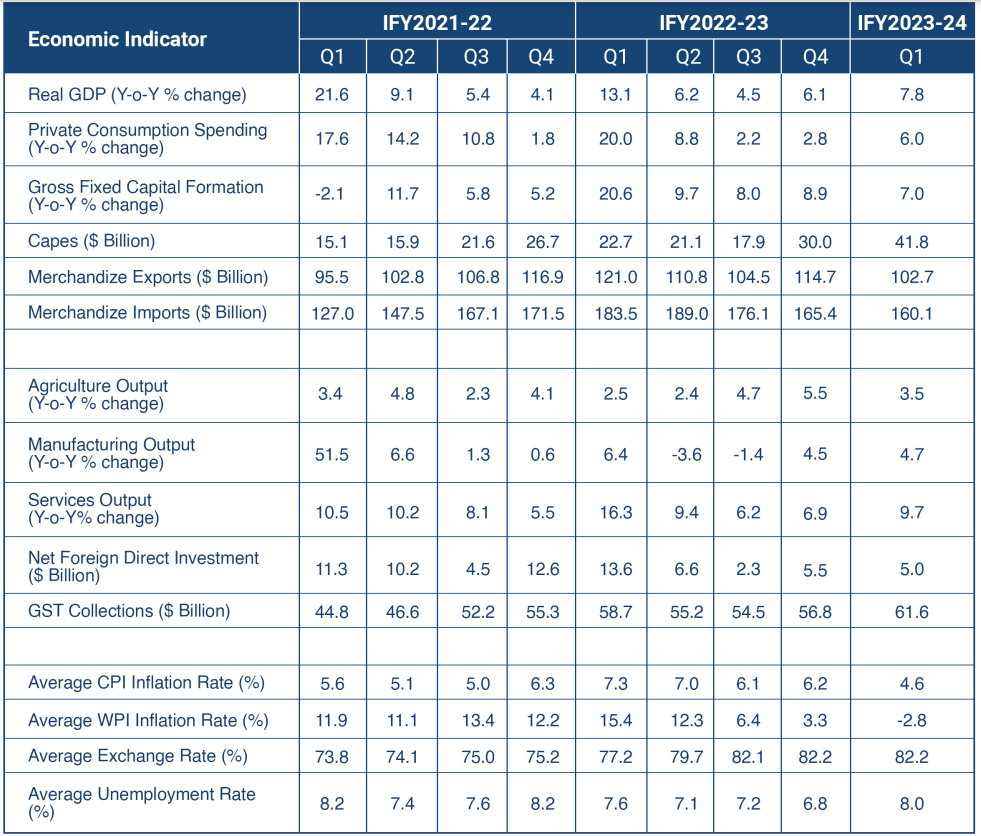

Demand in the economy exhibited a robust 6% growth rate YOY during Q1, compared with the 2.8% YOY growth in the previous quarter (Figure 1). Much of the pick-up in private consumption – the biggest component of India’s demand – seems to be driven by increased services activity, especially in trade, hotels, transport, and personal services. Demand gains were also driven by relatively lower inflation pressures from April through June 2023; urban demand (measured in terms of passenger car sales) improved 7% from the previous quarter despite the continuing high cost of car loans, while rural demand (measured by number of two-wheeler vehicle sales) went up nearly 11%. Retailers reported a marginal increase in rural spending with the easing of inflation in Q1; however, rural sales are still recovering, albeit unevenly. Corporate profits also improved on account of improved demand. The RBI estimated a healthy bank credit growth rate of 15.4% during Q1, even though the cost of credit remained high due to liquidity tightening.

According to the Retailers Association of India (RAI) latest report, total retail sales in Q1FY2023-24 registered an average growth of 6.7% over the sales levels recorded for Q1 of the previous year. During Q1FY2023-24, high-frequency indicators showed that a rise in urban incomes had boosted sales of expensive cars, Apple mobile phones, and air travel. A fall in food, crude oil and raw material prices enhanced demand for services, such as air travel, and manufactured items like cars and smartphones. The sustaining rise in urban retail sales in Q1FY2023-24 suggests domestic demand remains one of the main drivers of the economic recovery in India. India’s resilient consumer demand was evident in data on loans as buyers of homes, cars, vacations, or college education helped garner a chunk of retail customers in total bank credit. That said, the uncertainties and challenges of higher inflation (setting in since July) may suppress consumption spending in coming months, particularly from rural parts of the country.

Investment

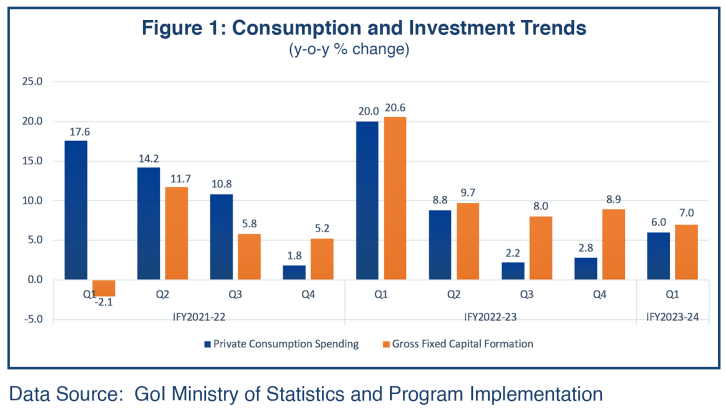

In the first quarter of the current fiscal year, investment in fixed assets grew 7% YOY, compared to the 8.9% growth recorded in the previous quarter (Figure 1). Gross Fixed Capital Expenditure growth was aided by strong government capex and a reviving private investment cycle. India utilized more than 27% of its total FY2023-24 capital expenditure allocation of $120.91 billion during the first quarter (Figure 2) versus 23% spent in Q1 of the previous year; in addition, a majority of the States too reported higher capex expenditure in Q1FY2023-24 compared to the same period in the previous year. Steady State capex activities are expected to expand industrial capacities to meet expanding demand.

Economists opine that the government’s Production-Linked Incentive (PLI) schemes in specific sectors (such as large-scale electronics manufacturing, IT hardware, pharmaceuticals, telecom and networking, consumer electronic appliances, textiles, and food processing) are encouraging private investments, which could trigger more investments going forward.

Higher corporate revenues and increased credit financing led to a sustained increase in private capex. Economists have observed that corporate profitability may not be impacted due to higher debt levels, and given easing commodity price pressure, operating profits will be maintained.

Government spending, which accounts for about 10% of India’s GDP, dropped 0.7% YOY in Q1, compared with a 2.3% growth recorded in the previous quarter. Capital expenditure has accounted for a rising share of total Indian government spending in the last few years. India’s investment to GDP ratio was down to 34.5% in Q1 FY2023-34 from the 10-year peak of 36% recorded in Q4 FY2022-23. Government spending continues to be a major driver of growth.

The central government hopes the wide multiplier effect of public capex can help create more jobs, as well as spur demand, which can lead businesses and industry to spend more money on capital investment.

Trade

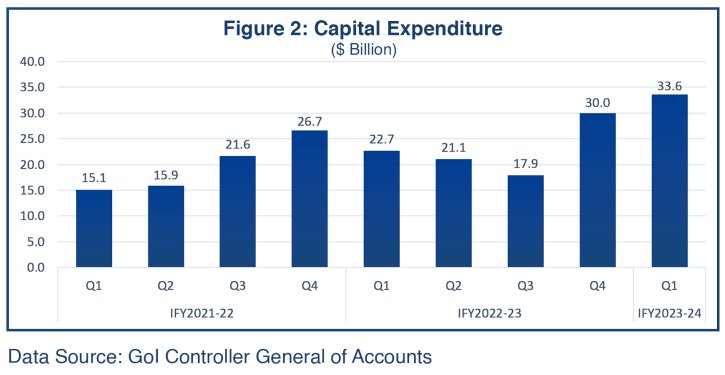

India’s merchandize exports for Q1 were valued at a seven-quarter low of $102.7 billion, declining 15.1% ΥΟΥ and 10.5% from the previous quarter (Figure 3). Global gloomy economic conditions continue to weigh on the export sector. Downward movements were visible in major export categories, such as gems and jewelry, steel goods, and textiles, while significant growth of 56% appeared in electronic goods exports. The growth in electronics exports in Q1FY2023-24 was led by mobile phones exports (52% of total electronic exports), which has shown tremendous growth following the government’s announcement of the Smartphone Production-linked Incentive (PLI) Scheme in 2020. On the other hand, demand for petroleum products, gems and jewelry, and textiles has weakened due to stubbornly high inflation rates and higher borrowing costs in advanced economies that are major export markets for India. Export performance in the first quarter of FY2022-23 was robust but it slowed from the second quarter onwards.

The Indian Department of Commerce (DOC), along with the Department for Promotion of Industry and Internal Trade (DPIIT), Invest India, and Indian missions abroad, has identified 40 export markets for enhancing merchandize exports, including the United States and European Union, which collectively account for 85% of India’s total exports. Indian policymakers target a total of $900 billion worth exports of goods and services in FY2023-24, up from the previous year’s exports of $770 billion, through focusing on select markets. According to Commerce Ministry officials India is seeking free trade agreements (FTAs) with more countries, especially in Latin America and Africa, which are expected to improve its export performance in coming years and help the country reach its target of $2 trillion exports by 2030.

Imports of goods in Q1, at $160.1 billion, were down 12.7% YOY and 3.2% from the previous quarter (Figure 3). Import bills for crude, coal, fertilizers, and edible oils were down in value terms due to lower commodity prices.

India’s trade deficit swelled 13.2% to $57.4 billion in Q1, from $50.7 billion in the previous quarter. However, expanding service exports provided cushioning to the current account deficit (CAD) that was ballooning in the previous three quarters. Indian policymakers are optimistic that the CAD will remain viable and manageable in FY2023-24, while some agencies expect the CAD to rise in the second quarter of the current fiscal as they see merchandise exports decline further and imports growing due to increase in crude prices.

Supply Side Indicators

Output growth

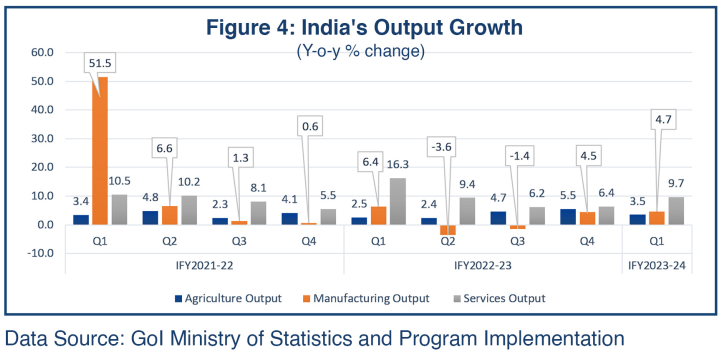

The agriculture output growth rate slowed to 3.5% in Q1FY2023-24 on account of an uncertain monsoon and fluctuating prices during May and June, compared to the 5.5% growth in the previous quarter (Figure 4). That said, agriculture output growth reflected the resilience of the sector, registering 3.5% compared with the 2.5% growth rate witnessed in the same quarter of the previous year. India has witnessed erratic rainfall in 2023 but the overall total is lower than normal; the resultant lower reservoir levels will have implications for the winter crops that have a higher dependency on irrigation.

Industrial production growth in Q1FY2023-24 picked up marginally; the Gross Value Added (GVA) YOY growth rate in the manufacturing sector rose to 4.7%, from 4.5% in the previous quarter, but it was significantly down compared with the 6.4% growth rate in Q1FY2022-23 (Figure 4). GVA YOY growth rate in the mining sector was 5.8% in Q1FY2023-24, compared to 4.3% growth in the previous quarter, but it was lower than the 9.5% growth rate printed for Q1FY2022-23. The construction sector grew 7.9% in the first quarter of FY2023-23, compared with the 10.4% growth rate of the previous quarter, and almost half of the 16% growth rate witnessed in the first quarter of FY2022-23. Likewise, the Purchasing Managers Index indicators also suggested a dismal performance by the manufacturing sector in Q1FY2023-24.

In contrast, the services sector remained one of the major drivers of GDP growth in Q1FY2023-24; the YOY growth in the services GVA, at 9.7%, was much above the previous quarter’s 6.9% growth rate (Figure 4). The average services PMI stood at 60.6 in the first quarter of FY2023-24 exceeding market expectations of 60. The robust performance of services was supported by trade, hotels, transport, and communication services related to broadcasting that grew 9.2% YOY in Q1FY2023-24.

Foreign Investment

Net FDI inflows for Q1 continued to fall significantly as capital outflows continued; however, net inflows in Q1, at $4.97 billion, were relatively down from the previous quarter (Figure 5). Investor uncertainty and risk aversion continue to put downward pressure on global FDI, including on India net FDI inflows that reflected mixed trends during the first quarter of FY2023-24. According to the latest data released by the Department for Promotion of Industry and Internal Trade (DPIIT), FDI equity inflows dipped by 34% to $10.94 billion during Q1FY2023-24, compared with $16.59 billion during Q1FY2022-23. Due to higher FDI outflows, the net FDI inflows continue to be tame.

Good and Services Tax (GST) Revenues

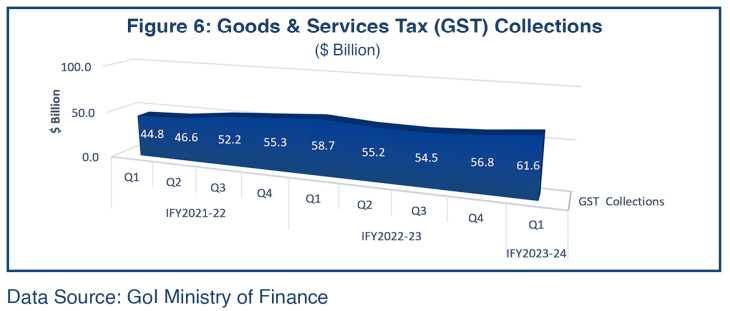

Overall, GST collections have been expanding due to increased compliance and higher inflation. Q1FY2023-24 witnessed an eight-quarter high of $61.6 billion, rising 8.5% from the previous quarter (Figure 6). Gross GST collections in FY2022-23 rose 22% on a YOY basis. A sustained rebound in economic activities supporting the buoyancy in gross tax collections has raised expectations of higher GST revenues for the current fiscal. India has been working to improve its tax administration, including the GST and the personal income tax, and that has made the tax system more effective and fiscally better for the country.

Consumer Price Index (CPI) Inflation

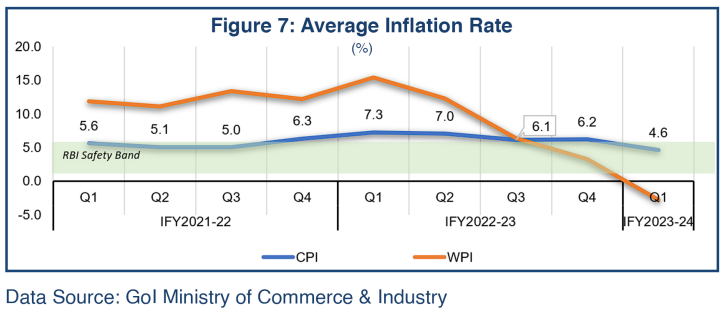

In Q1, the average consumer price inflation (CPI) rate was 4.6%, an eight-quarter low and, more importantly, within the RBI’s target band of 2-6%; sequentially, retail inflation dipped substantially from 6.2% in the previous quarter. (Figure 7). The producer price index (wholesale inflation – WPI), remaining in the deflation mode, dropped significantly to -2.98% from 3.3% in the previous quarter, hinting there is room for more demand recovery.

The RBI increased repo rates by 250 basis points to curb CPI throughout FY2022-23. It paused its rate hike cycle in April 2023, and continued the pause until its August policy review as inflation remained controllable. Inflation, both CPI and WPI, eased significantly during April and May 2023, driven largely by the falling price of food articles and lower oil prices; non-food inflation (excluding fuel) also moderated. However, food prices started rising in the last half of June due to erratic rains throughout the country. By July, the impact of unseasonal rains and floods was visible on vegetable and cereal prices, driving the CPI inflation once again much beyond the RBI target ceiling of 6%. The high food inflation is expected to prevail throughout the Q2FY2023-24 (i.e., July-September 2023). The RBI continues to maintain a hawkish approach, pronouncing its readiness to use policy tools (repo rate hike) when needed.

Foreign Exchange

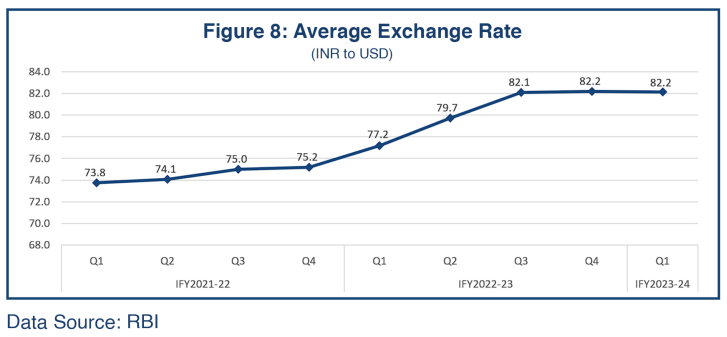

Overall, India’s external sector indicators have improved significantly. Foreign exchange reserves rebounded from approximately $510 billion at the end of Q4FY2022-24 to nearly $528 billion at the end of Q1FY2023-24. The Indian rupee appreciated nominally by 0.06% against the US dollar during Q1FY2023-24, with the average rate of INR82.15/US$, compared with the previous quarter’s average rate of INR82.20/US$ (Figure 8). The RBI continued its measures to stabilize the exchange rate and control inflation by siphoning off excess liquidity but paused interest rates hike. Since April 2023 the interest rate is locked at 6.5%.

Economic Growth Outlook

The Indian economy showed recovery signs after the Covid-19 pandemic and the economy’s momentum seems stable by many measures, but the global slowdown, geopolitical challenges, and inflationary pressures continue to weigh upon the rate of economic expansion in India.

India’s real GDP growth in Q4 of FY2022-23 posted a sharp upturn, ending the fiscal year with a positive note owing to higher-than-expected agriculture output, resilient demand, and strong government spending. The first quarter of FY2023-24, continuing the trajectory, witnessed improved demand, impressive performances by the agriculture and service sectors, and elevated government spending – all that pushed the growth to 7.8%, yet a bit below the forecasted 8%.

Economists predict growth to moderate in FY2023-24 as a less-than-normal monsoon, high inflation, weaker consumption spending, and global conditions may suppress the economy. Lower rainfall and the resultant lower reservoir levels may impact the upcoming winter crops that have a relatively higher dependency on irrigation. While indicators suggest that India’s growth is sustained for now, headwinds from the impact of monetary policy tightening in advanced economies, heightened global uncertainties, and the cascading impact of the domestic liquidity tightening will progressively take effect. Going forward, according to most economic agencies, weak global demand and the effect of monetary policy tightening in response to inflationary pressures may bring down India’s GDP growth to a range of 6.3-6.5% in FY2023-24.

On the external side, demand worked in favor of the Indian economy until Q1FY2022-23, after which it fell as central banks across the world started monetary tightening to curb inflation. The decline in global commodity prices helped India reduce its import bill since the beginning of Q1FY2022-23, and India’s surging services exports helped the country manage its current account deficit. Changes in global demand and supply dynamics may continue to influence India’s export-oriented sectors; however, easing inflation and monetary policy in 2024 may help push up household spending. In the current fiscal year, the expected CPI inflation during the second and third quarters will impact demand patterns, especially rural demand. Increased government spending and expected higher private investment during the second half of the current fiscal year, along with an expected improvement of global sentiment in the later months of 2024, may support economic growth momentum in India in FY2024-25.

The RBI has reaffirmed its forecast on Indian economic growth at 6.5% for FY2023-24, with Q2 at 6.5%, Q3 at 6.0%, and Q4 at 5.7%. According to the RBI, the pickup in consumer spending in rural areas reflects the incipient revival of rural demand, and the upcoming festival season and sustained buoyancy in service activities will likely push up private consumption and investment activities despite the upwardly revised retail inflation of 5.4%. The International Monetary Fund (IMF) on July 27 projected India’s real GDP growth at 6.1% in FY2023-24, up from 5.9% estimated in April, citing momentum from stronger-than-expected growth in the fourth quarter of 2022 and stronger domestic investment. However, it also cautioned that the global economy is not “out of the woods” yet and that the battle against inflation is far from over. Moody’s Investor Service recently raised India’s GDP growth forecast for 2023 to 6.7% from 5.5% projected earlier, as the Indian economy posted an impressive 7.8% growth in the April-June 2023 quarter; however, it lowered the 2024 forecast down to 6.1% from the 6.5% projected earlier, due to a projected higher base. According to The World Economic Forum’s Chief Economists Outlook Report released on September 14, 2023, over 90% of economists expect moderate or strong growth this year in South Asia, notably India.

While the IMF’s projections remain below the RBI projections even after upward revision, and external demand, uncertain inflation, and geopolitical tensions pose risks to the RBI’s forecast, the overall outlook for India’s economic growth for FY2023-24 remains optimistic. Economists caution that the growth outlook is by no means without risks. The below-average monsoon rainfall and El Nino impact have raised concerns about food prices and agricultural production. Implementing effective water management solutions is vital for sustaining resilient agriculture output growth. At the same time, India’s unemployment is comparatively high and consumer spending and private investments are lower than they might otherwise be. The government is right on track, increasing capital expenditure, with which it can build world-class infrastructure and crowd in more private investments, including in the green economy. Momentum in investments and rural consumer spending will reinforce solid growth prospects over the next three or four years. Externally, the global economic slowdown dynamics would continue to influence India’s growth prospects in the immediate term. Despite the external challenges, India’s economic fundamentals remain robust.