Overview

This Report provides a review of the economic developments in the fourth and final quarter of Indian Fiscal Year (FY) 2022-23 (January-March 2023). India’s economic growth in Q4 was higher than expected amidst mixed trends in consumer spending and demand, public and private investment, inflation, and manufacturing.

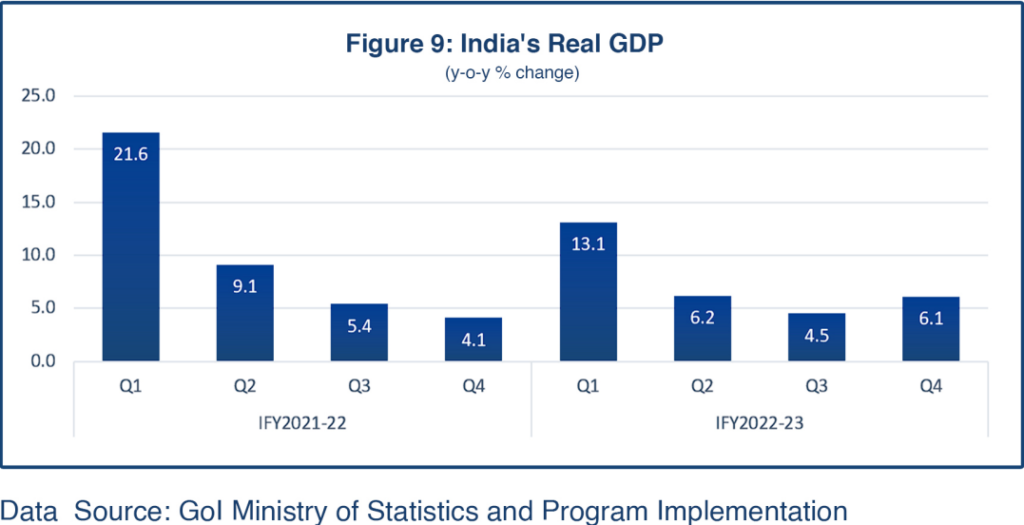

On May 31, 2023, India’s Ministry of Statistical and Program Implementation (MoSPI) released the official economic data for the fourth quarter of Indian FY2022-23. It showed India’s economy expanded 6.1%, significantly more than the 5% growth expected by most economic agencies and the Reserve Bank of India (RBI); with this strong quarterly performance, India’s full-year real Gross Domestic Product (GDP) growth is estimated at 7.2%. The strong growth in Q4 also implies India’s economic recovery is on the right path following COVID-19, despite ongoing supply disruptions and geopolitical challenges. That said, India, like any other economy, faces headwinds in the short- and medium-terms as it seeks to retain its growth momentum.

This stronger-than-expected GDP growth in Q4, together with a manageable trade deficit, reasonable retail growth, rising public capital expenditure (capex) and private investment, and relatively better industrial activity, has spurred optimism in markets regarding India’s economic bounce. Weak public and private consumption was offset by robust investment and a much lower-than-estimated trade deficit. Nevertheless, India’s recovery is not even across all sectors. To maintain growth momentum, the Indian government will need to address lingering domestic risks (e.g. rising inflation, poor monsoon) and external challenges, while enhancing public capex to attract more private investment.

Like other major economies, India continues to face high retail inflation, tight monetary conditions, lower capital inflows, and exchange rate pressure due to the hike in international prices and prolonged Russia-Ukraine conflict. India has paused tightening its monetary policy since January, improving profit margins and bringing down consumer prices, though inflation remained outside the RBI’s target band of 2%-6%, impacting consumer spending. Overall, during Q4 India’s economy showed stabilizing signs, with recovery in some important areas like domestic demand, public and private investment, inflation, foreign exchange reserves, agricultural output, services, and trade.

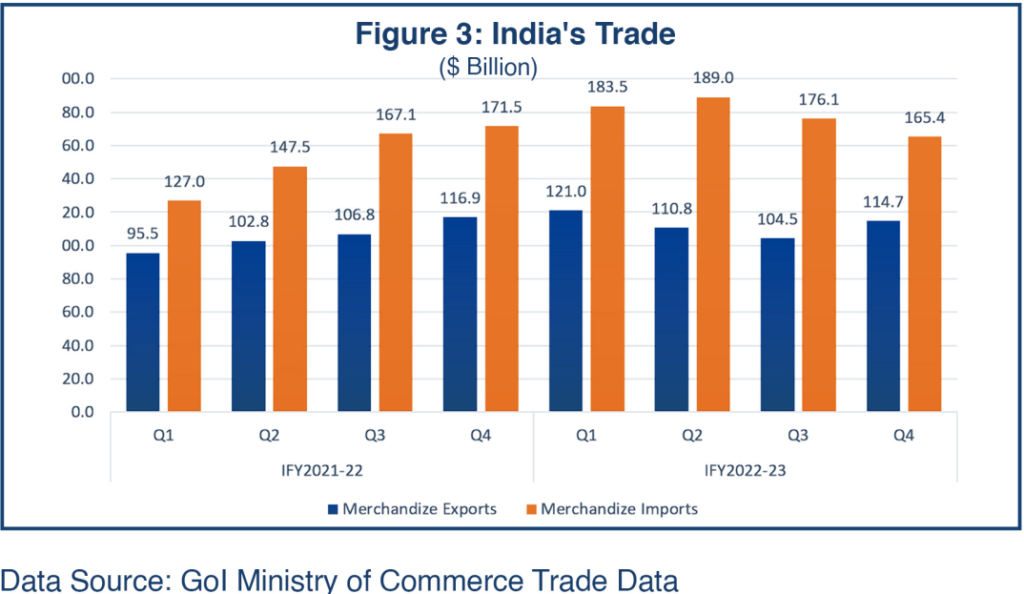

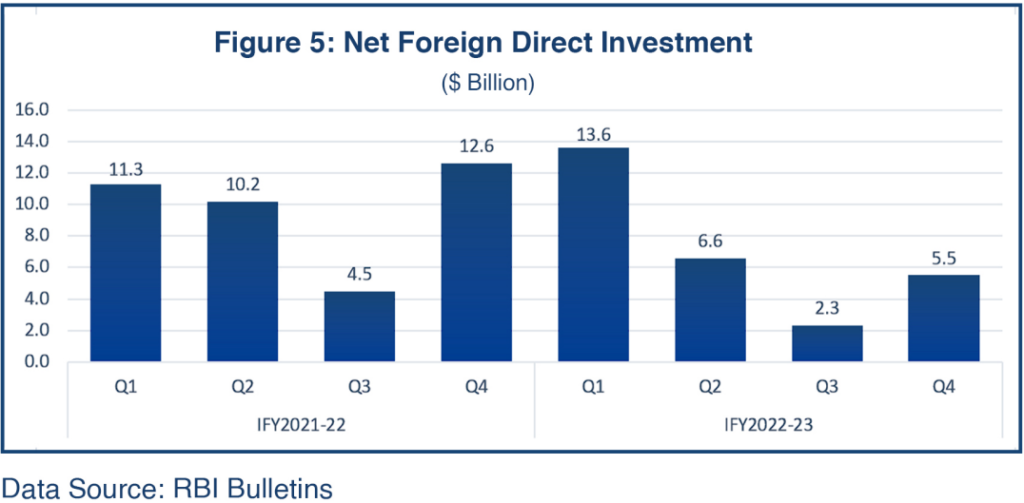

The RBI’s aggressive measures and India’s strong financial system helped the economy face geopolitical challenges with reasonable resilience. During Q4, the Indian rupee depreciated marginally against the US dollar. The average retail inflation was 6.2% in Q4, compared with 6.1% in Q3, and foreign exchange reserves also recouped. While net FDI inflows picked up substantially in Q4, India’s total net inflows during FY2022-23 dropped 27% from the previous year. Likewise, merchandize exports picked up in Q4 sequentially but moderated on a year-on-year (YOY) basis. Merchandize imports continued their downtrend during Q4 and the risk to India’s current account deficit eased as the YOY trade deficit reduced.

Downside risks continue to dominate India’s external sector as tighter monetary policies are expected to prevail globally owing to high inflation and high unemployment. India’s more-than-expected GDP growth in Q4 has raised optimism in the market, and the RBI has raised its growth estimates for the year to 7.2%. However, economists warn the growth outlook is not without risks, including the prevailing uncertainties of global challenges, which can impact India’s external sector performance, and India’s dependency on the monsoon rains, which can impact its rural economy. For sustained development, India needs to increase investment in the rural economy, to push consumer spending and crowd in more private investments.

Demand Side Indicators

Consumption Spending

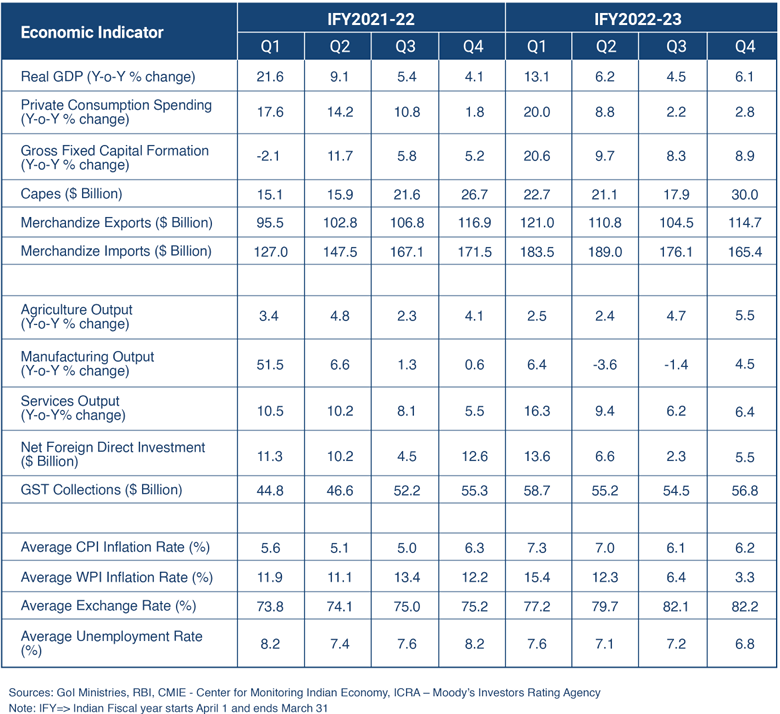

Demand in the economy exhibited a 2.8% growth rate YOY during Q4, better than the 2.2% growth in the previous quarter (Figure 1). Demand gains were driven by relatively lower inflation pressures in February and March 2023; urban demand (measured in terms of passenger car sales) improved about 10% from the Q3 level despite the continuing high cost of car loans, while rural demand (measured by number of two-wheeler vehicle sales) remained subdued. Retailers reported a marginal increase in rural spending with the easing of inflation in Q4; however, the rural sales did not fully match the pre-COVID level. Private consumption may have remained weak in the fourth quarter of FY23 but, overall, it remained strong for the year as a whole. Corporate profits also improved on account of improved demand. The RBI reported an average bank credit growth rate of 15.6% during Q4, even though the cost of credit remained high due to liquidity tightening.

According to the Retailers Association of India (RAI) latest report, total retail sales in FY2022-23 registered growth of 34% over the sales levels during the previous year. During Q4, high-frequency indicators showed that a rise in urban incomes had boosted sales of expensive cars, Apple mobile phones, and air travel. A fall in food, crude oil and raw material prices enhanced demand for services, such as air travel, and manufactured items like cars and smartphones. The sustaining rise in urban retail sales throughout FY2022-23 suggests domestic demand remains one of the main drivers of the economic recovery in India. That said, the uncertainties and challenges of higher inflation kept rural sentiment a bit suppressed, undermining buoyant private consumption spending trends.

Investment

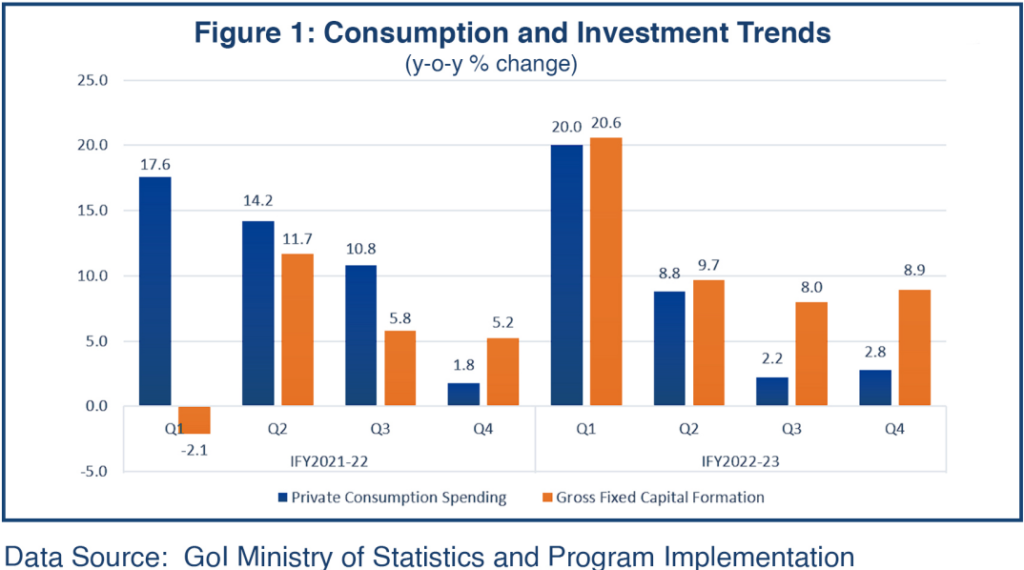

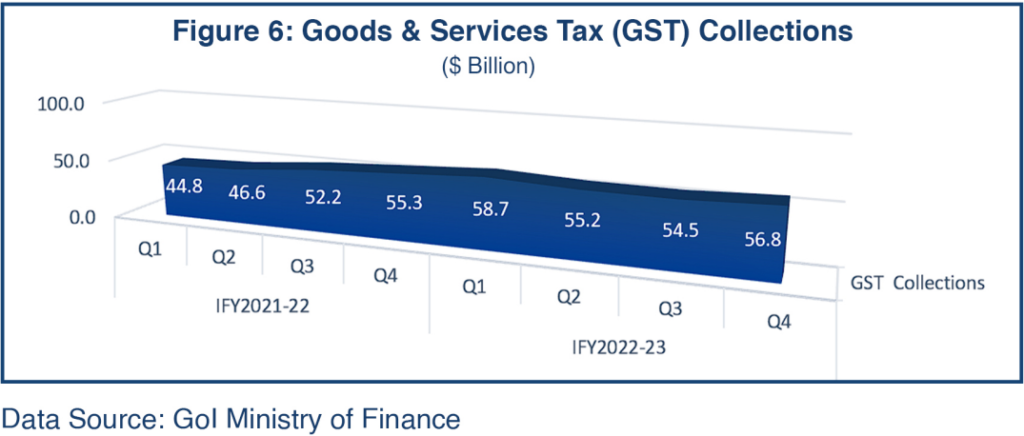

In the fourth quarter, investment in fixed assets grew 8.9% YOY, compared to the 8.0% growth recorded in the previous year (Figure 1). Gross Fixed Capital Expenditure growth was aided by strong government capex and a reviving private investment cycle. Higher corporate revenues and increased credit financing led to a sustained increase in private capex, while higher Goods & Services Tax (GST) collections allowed room for higher government spending in capex (Figure 2).

Corporates witnessed a YOY rise of 11.4% in their revenues in Q4, but sequentially the revenue growth rate was lower, at 5.2% over the Q3 level. According to the Moody’s Investment Rating Agency in India, ICRA, higher revenues were primarily due to demand recovery and price hikes by companies across sectors; but the corporate operating profit margin (the ratio of operating profits to revenue) fell 1.26% YOY during the fourth quarter, mainly due to the elevated conversion costs and higher foreign exchange rates.

Government spending, which accounts for about 10% of India’s GDP, rose 2.3% YOY in Q4, compared with a 0.6% contraction recorded in the previous quarter. Capital expenditure has accounted for a rising share of total Indian government spending in the last few years. India’s investment to GDP ratio reached a 10-year peak of 36% in Q4, up from around 32% in Q3.

Trade

India’s merchandize exports for Q4 were pegged at $114.7 billion, down 1.9% YOY but surprisingly up 9.8% from the previous quarter, despite facing headwinds from gloomy economic conditions globally. Downward movements were visible in major export categories, such as gems and jewelry, steel goods, and textiles, while significant growth appeared in electronic goods exports (including smartphones), oil meals and oil seeds. Global demand for petroleum products, gems and jewelry, and textiles weakened due to stubbornly high inflation rates and higher borrowing costs. Export performance in the first quarter of FY2022-23 was robust but it slowed from the second quarter onwards due to the gloomy economic conditions globally.

Imports of goods in Q4, at $165.4 billion, were down 3.6% YOY and 6.1% from the previous quarter (Figure 3). While oil imports remained significantly high, imports of coal, fertilizers, edible oils, and plastics were down. India’s trade deficit shrank 29.2% to $50.7 billion in Q4, from $71.6 billion in the previous quarter. A lower trade deficit and expanding service exports provided relief to policymakers who were concerned by the swelling current account deficit (CAD) in the previous two quarters. India is optimistic that the CAD will remain viable and manageable in FY2023-24, based on a narrow goods trade deficit recorded during Q4.

Supply Side Indicators

Output growth

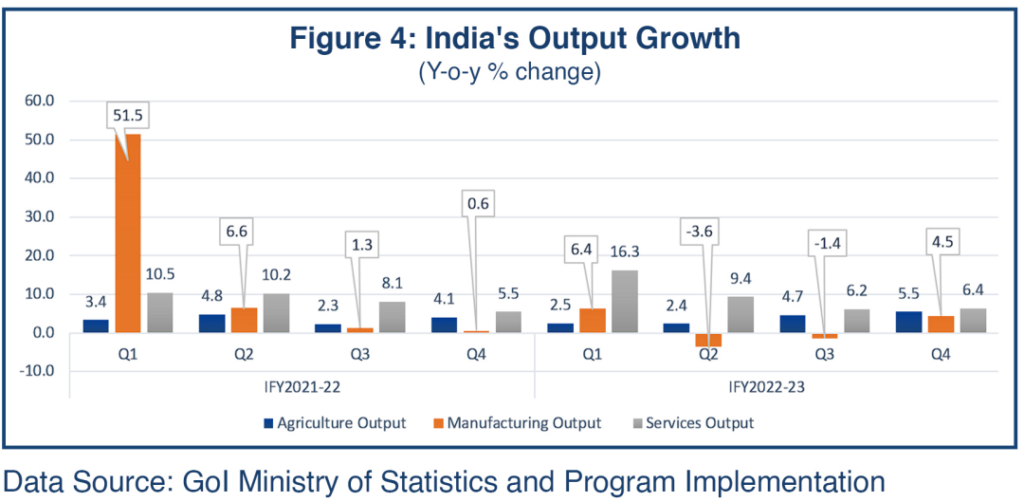

Agriculture output expanded 5.5% in Q4 on account of a good monsoon crop, compared to 4.7% growth in Q3 (Figure 4). While healthy production of the Rabi crop (harvested in Spring) has improved rural sector prospects, any weather-related disruptions could be a dampener going forward. Agriculture, forestry, and fishing grew at 4% in the full FY2022-23, compared to the 3.5% growth rate recorded in the previous fiscal year.

Industrial production growth in the fourth quarter picked up rapidly; the Gross Value Added (GVA) YOY growth rate in the manufacturing sector rose to 4.5%, compared to a contraction of 1.4% in Q3. GVA YOY growth in the mining sector was 4.3% in Q4, compared to 2.3% growth in the previous quarter. The construction sector grew 10.4% in the fourth quarter, almost double the 4.9% growth rate of the previous quarter. Provisional estimates show the GVA of the manufacturing sector grew by 1.3% in the full FY2022-23 after growing 11.1% in FY2021-22. Likewise, the Purchasing Managers Index indicators also suggest strong manufacturing sector performance in Q4.

The services sector remained one of the major drivers of GDP growth in Q4. The YOY growth in the services GVA, at 6.4%, was only 0.2 percentage points higher than in the previous quarter, but the Services PMI stood at 61.2% in May, down slightly from the previous month but still exceeding market expectations of 60. The robust performance of services for the full fiscal year was supported by trade, hotels, transport, and communication services related to broadcasting that grew 14% YOY in FY2022-23 after growing 13.8% in FY22.

Foreign Investment

Net FDI inflows for Q4 continued to fall significantly as capital outflows continued; however, net inflows in Q4, at $5.5, were relatively up from the previous quarter (Figure 5). In keeping with the UNCTAD World Investment Report 2022 warning that “investor uncertainty and risk aversity could put significant downward pressure on global FDI”, in India net FDI inflows collapsed by more than 27% in fiscal year 2022-23, to $28 billion, from the previous year’s $38.62 billion.

Good and Services Tax (GST) Revenues

Overall, GST collections have been expanding due to increased compliance and higher inflation. After a marginal reduction in Q3, GST collections picked up again in Q4 (Figure 6). Gross GST collections in FY2022-23 rose 22% on a YOY basis. Post-pandemic rebound and healthy economic activities supported the buoyancy in gross tax collections. India has been working to improve its tax administration, including the GST and the personal income tax, and that has made the tax system more effective and fiscally better for the country. Higher revenues also helped India meet its FY2022-23 fiscal deficit target of 6.4%.

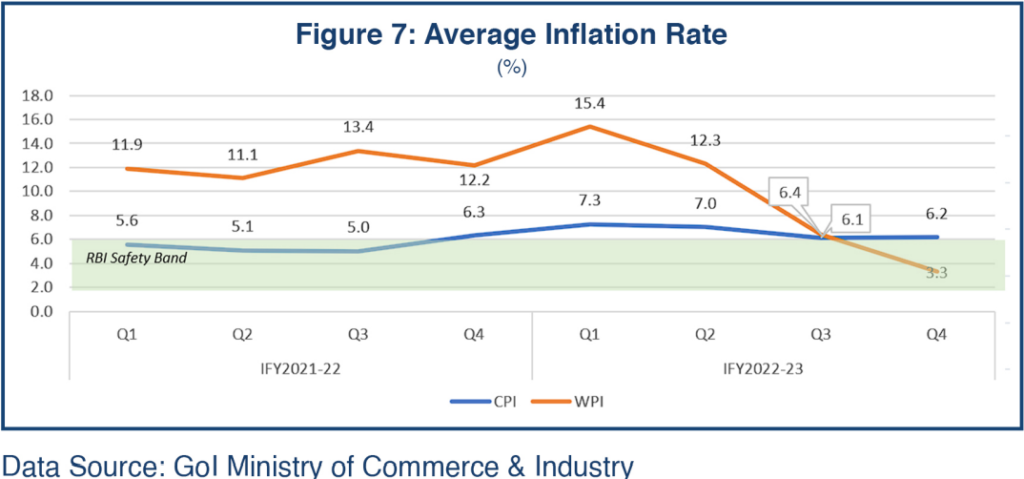

Consumer Price Index (CPI) Inflation

In Q4, the average consumer price inflation (CPI) rate was 6.2%, still outside the RBI’s target band of 2-6%; sequentially, retail inflation rose marginally from 6.1% in Q3. The producer price index (wholesale inflation – WPI) dropped significantly to 3.3% in Q4, compared with 6.4% in Q3, implying that the demand did not recover enough to lift prices.

The RBI increased repo rates by 250 basis points to curb CPI throughout FY2022-23. It paused its rate hike cycle in April 2023, and is expected to continue the pause at the next policy review as inflation continues to moderate. Inflation, both CPI and WPI, eased significantly during the latter half of Q1 (November and December 2022), driven largely by the falling price of food articles and lower oil prices; however, non-food inflation (excluding fuel) remained high. Food prices rose considerably during the first two quarters of the fiscal year, along with core goods prices, driving the CPI inflation beyond the RBI target ceiling of 6%. The RBI expects a gradual recovery inflation next fiscal year; however, risks remain in the face of the global uncertainties.

Foreign Exchange

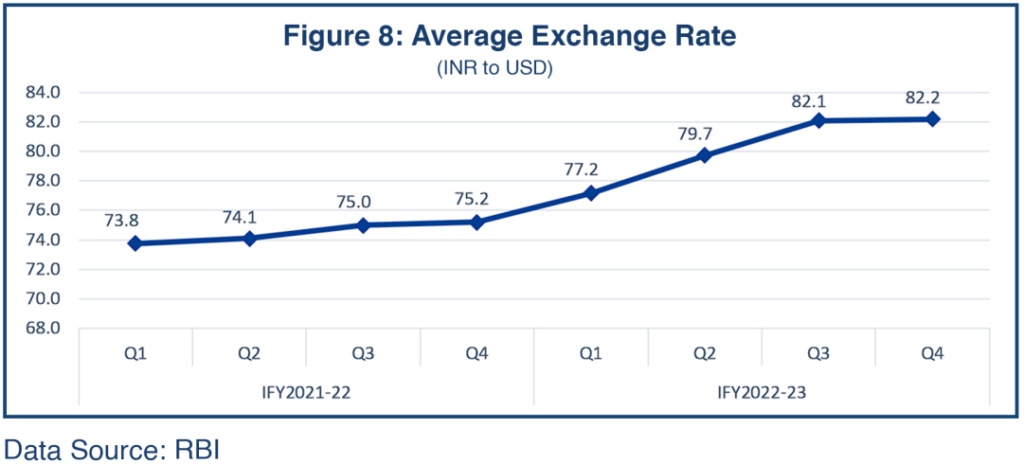

Overall, India’s external sector indicators have improved significantly. Foreign exchange reserves rebounded from approximately $563 billion at the end of Q3 to more than $578 billion at the end of Q4. The Indian rupee depreciated marginally by 0.1% against the US dollar during Q4, reaching the average rate of INR82.25/US$ by March-end, from the previous quarter’s average rate of INR82.10/US$ (Figure 8). The RBI continued its measures to stabilize the exchange rate and control inflation by siphoning off excess liquidity and raising interest rates. As of March-end 2023, the RBI had hiked repo rates by 250 basis points to 6.50% since May 2022.

Economic Growth Outlook

The Indian economy showed recovery signs after the Covid-19 pandemic and the economy’s momentum seems stable by many measures; but the global slowdown, geopolitical challenges, and inflationary pressures continue to impact economic expansion in India. However, India’s real GDP growth in Q3 posted a sharp upturn, displaying resilience in the face of headwinds of the prevailing gloominess globally as well as a difficult global geopolitical backdrop last year. The fourth quarter of FY2022-23 witnessed steady urban demand and elevated government spending that pushed the growth to 6.1%, well above the forecasted 5%.

The RBI has revised its estimates for GDP growth for the full fiscal year 2022-23 to 7.2%, up from the earlier 7.0%, following a stellar performance of the economy during Q4. While observers were pleasantly surprised with the strong growth rate, they also warned of an uneven terrain ahead. FY 2022-23 ended with a positive note owing to higher-than-expected agriculture output, resilient demand, and strong government spending. However, high inflation, particularly for energy and food, and the subsequent monetary tightening weighed on household consumption in urban areas. The merchandize trade deficit for the full fiscal year 2022-23 was 40% larger than that recorded in the previous fiscal year and services export growth was impressive, but not enough to offset the deficit in goods trade.

Economists predict growth to moderate in FY2023-24 as weak manufacturing and global conditions weigh down the economy. While indicators suggest that India’s growth is sustained for now, headwinds from the impact of monetary policy tightening in advanced economies, heightened global uncertainties, and the cascading impact of the domestic liquidity tightening will progressively take effect. Going forward, according to most economic agencies, weak global demand and the effect of monetary policy tightening in response to inflationary pressures may limit India’s GDP growth to a range of 6.3-6.5% in FY2023-24.

Changes in global demand and supply dynamics may influence India’s export-oriented sectors; however, easing inflation and monetary policy in 2024 may help push up household spending; this boost, along with an expected improving of global sentiment, will support economic activity and help regain momentum in India’s growth in FY2024-25.

In January 2023, the IMF had predicted India’s real GDP to grow 6.1% in FY2023-24 and 6.8% in FY24-25; the forecast for FY2024-25 has now been cut to 6.3%. In June 2023, the World Bank and the Asian Development Bank had also reduced their forecasts for India’s growth in FY2023-24 and FY2024-45 to 6.3% and 6.4%, respectively. Now, following an impressive economic performance inQ4, in June 2023 the RBI lifted its forecast for India’s GDP growth to 6.5% for FY2023-24 from its earlier estimate of 6.4%.

Economists caution that the growth outlook is by no means without risks especially about the monsoon and recession risks globally. India’s agriculture sector is particularly vulnerable to extreme weather. At the same time, India’s unemployment is comparatively high and consumer spending and private investments are lower than they might otherwise be. The government is right on track with its plan to increase capital expenditure, with which it hopes to build world-class infrastructure and crowd in more private investments, including in the green economy. Momentum in investments and rural consumer spending will reinforce solid growth prospects over the next three or four years.