This Report provides a review of the economic developments in the third quarter of Indian Fiscal Year (IFY) 2022-23. India’s economic growth in Q3 slowed down amidst moderating demand, intermittent public investments, global slowdown and less-than-expected performance of the manufacturing sector.

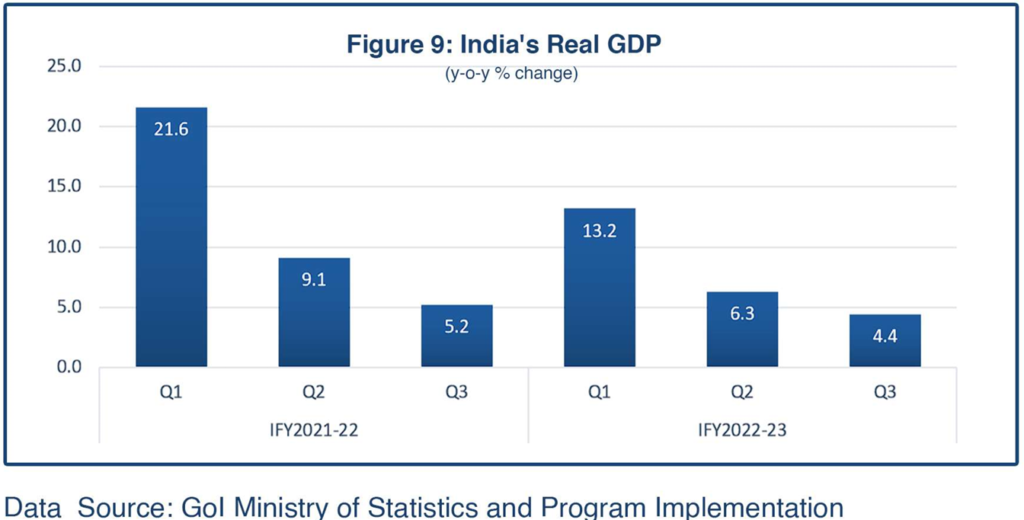

In Q2 (July-September 2022) of IFY 2022-23 India’s Real Gross Domestic Product (GDP) growth had slowed to 6.3% from 13.2% in Q1 (April-June 2022); for Q3 (October-December 2022) as well, the pace of growth has slowed down to 4.4%. Available data for Q3 FY2022-23 indicate that economic activity in India remained reasonably resilient to global challenges, with consumption demand driven by a recovery, albeit slow, in consumer spending, especially on services (tourism/travel and hospitality). The Government of India (Gol) National Statistical Office (NSO) also revised upwardly India’s GDP growth for FY2021-22 to 9.1% from its earlier estimate of 8.7% while releasing the third quarter data for the current fiscal year.

During FY2022-23, India marched slowly on the economic recovery path after the spells of COVID during FY2020-21 and 2021-22. Like other major economies, India faced high inflation rates, capital outflows and exchange rate pressures due to the hike in international prices and prolonged Russia-Ukraine conflict since February 2022. India had to resort to a tighter monetary policy that dampened the corporate profits and impacted consumer spending. Though macroeconomic vulnerabilities were evident throughout the first six months of the IFY2022-23 (April-September 2022), such as the persistent inflation outside the RBI’s target band of 2%-6%, falling GDP growth, weaker corporate profits, falling exports and increasing imports, depleting foreign exchange reserves, depreciating currency, capital outflows and lackluster performances of manufacturing sector, the economy seemed to be stabilizing with recovery in some areas (domestic demand, inflation, foreign exchange reserves, agriculture output, services, and trade deficit) during Q3. The RBI took appropriate measures to stabilize the exchange rate and control inflation by siphoning off excess liquidity and raising interest rates by 250 basis points between May and December 2022. The Government also took short-term measures to manage the current account deficit (CAD).

The RBI measures, along with a strong financial system in place, helped the Indian economy face the geo-political challenges with a reasonable resilience. During Q3 of IFY2022-23, the Indian Rupee appreciated by one percent against the US Dollar. The retail inflation came down to the year’s low at 5.72% in December 2022 and foreign exchange reserves also recouped. However, total net FDI inflows fell drastically, and capital outflows continued. Likewise, merchandize exports and imports continued the downtrend during Q3, but the trade deficit was substantially down from Q2. India’s external sector risks are still looming as the global economic slowdown continues.

Global growth prospects continue to be gloomy in the wake of the prolonged war initiated by Russia in February 2022. Downside risks continue to impact India’s external sector as tighter monetary policies are expected to prevail globally owing to high inflation and high unemployment conditions. The outlook for India’s growth in Q4 will likely be the same or marginally higher than Q3, mainly due to the expected rebound in demand, investment, agriculture, and services output. However, industrial growth continues to stagnate, and the export outlook seems bleak. A modest growth is likely to appear in some areas in IFY2023-24 on the back of the Gol’s budget commitment to fiscal consolidation despite allocating one of India’s biggest-ever increases in capital spending. Economists also expect a further interest rate hike of 25 basis points in April 2023 to tame the CPI inflation that surged above the RBI’s 6% target ceiling again in January 2023. The sustainability of India’s economic growth momentum remains contingent on addressing domestic challenges such as persistent inflation, significant private investments, and external challenges, such as the global economic slowdown and the uncertainty of geopolitical situations

Demand Side Indicators

Consumption Spending

Demand in the economy exhibited 2.1% improvement y-o-y during Q3, much smaller than the 8.8% growth in the previous quarter (Figure 1). Demand gains were driven by lower inflation pressures in November and December 2022 and the usual festival season buying spree by consumers. Corporate profits also improved a tad on account of improved demand. Vehicle sales grew, albeit slowly, the real estate sector reported to be bouncing back. The share of private consumption expenditure the GDP rose to the highest level this fiscal year in Q3, which included the festive season, at 61.6%, but it was lower than the 63% share in the same quarter the previous year. Due to the increase in interest rates, higher borrowing costs suppressed demand in several sectors, such as automobiles, housing, and high-end consumer durables.

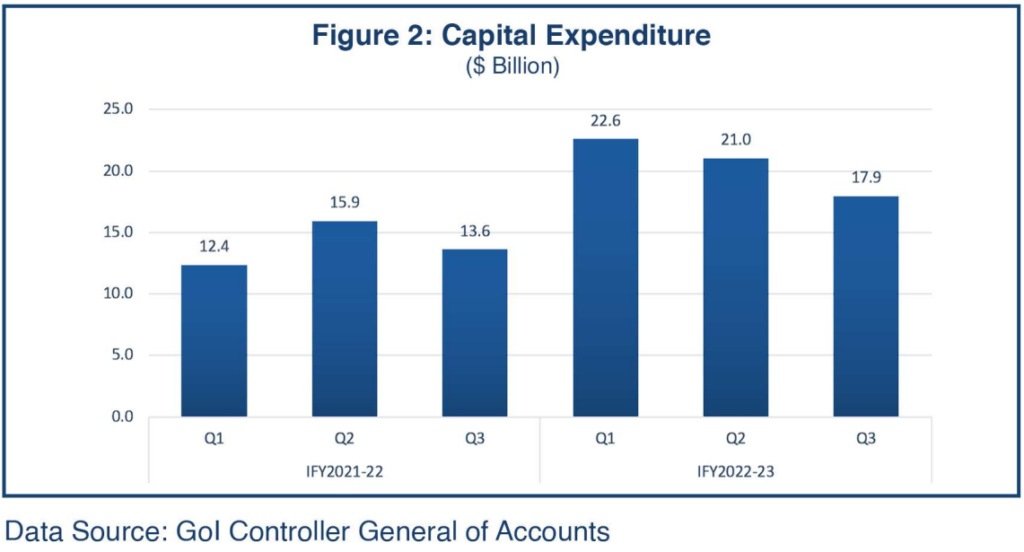

Investment

India’s investment to GDP ratio fell slightly to around 32 in Q3 from 34 in Q2. Gross Fixed Capital Formation (GFCF), which measures investment activity in the economy, grew at an impressive 8.3% in the third quarter, but it accelerated at a slower pace compared to the second quarter’s 9.8% (Figure 1). Even though a robust growth in investments reflects the higher capital expenditure (capex) push by the government, the public spending capex) fell 10% in Q3 from Q2 level (Figure 2).

Trade

Merchandize exports for Q3 were pegged at $96 billion, decelerating 6% y-o-y from $103 billion, and 9% from the previous quarter, facing headwinds from gloomy economic conditions globally. Downward movements were visible in exports of gems & jewelry, steel goods, and textiles. Imports of goods, at $171 billion, were up 2% y-o-y in Q3 but down 10% from the previous quarter (Figure 3). While oil imports remained significantly high, imports of fertilizers, edible oils and plastics were down. India’s trade deficit shot up to $75 billion for Q3, compared with $65 billion in Q3: sequentially, the trade deficit shrank almost 10% ifrom Q2 to 03.

Supply Side Indicators

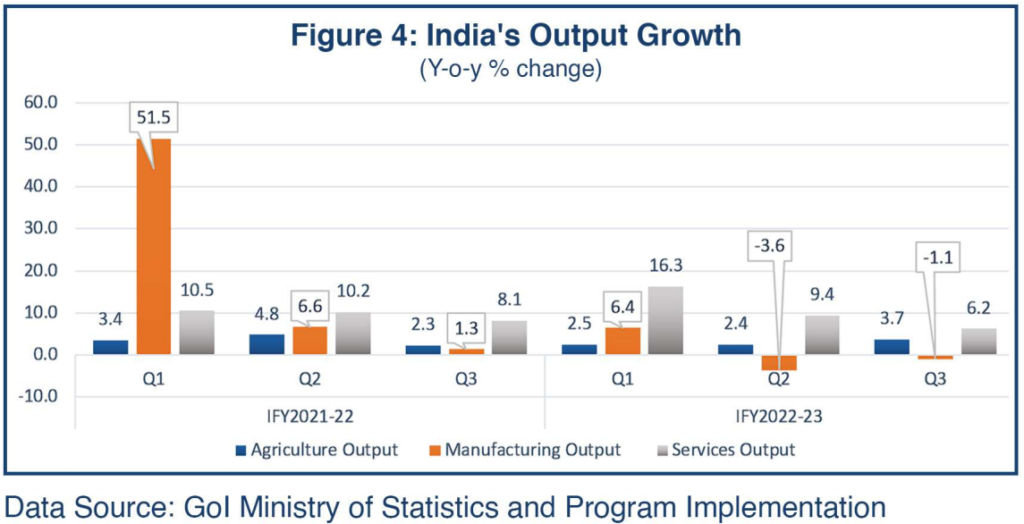

Output growth

Agriculture output expanded 3.7% in Q3 on account of a good monsoon crop, compared to 2.4% growth in Q2 (Figure 4).

The key sector of manufacturing shrank 1.1% y-o-y in the third quarter, following a contraction of 3.6% in Q2, reflecting declining demand and exports and high input costs. According to some observers, the overall trend of subdued demand has led to major reduction in the growth of the manufacturing sector, which has played an important role in slowing GDP growth. However, other subsectors in the industrial output fared better. The electricity, gas, water supply and other utility services expanded 8.2% in Q3, compared to 6% last quarter; similarly, construction also improved to 8.4% in Q3 from 5.8% in Q2. Mining expanded by 3.7%, compared to 0.4% in Q2. While manufacturing output appears to have slowed down, the PMI (S&P’s Purchasing Managers Index) indicators suggest a good performance of the manufacturing sector in the final quarter of IFY2022-23.

The service sector components remained the major driver of overall growth in India, albeit the growth momentum slowed down from 9.4% in the September 2022 quarter to 6.2% in the December 2022 quarter. On the services side as well, PMI indicators point to sustaining growth.

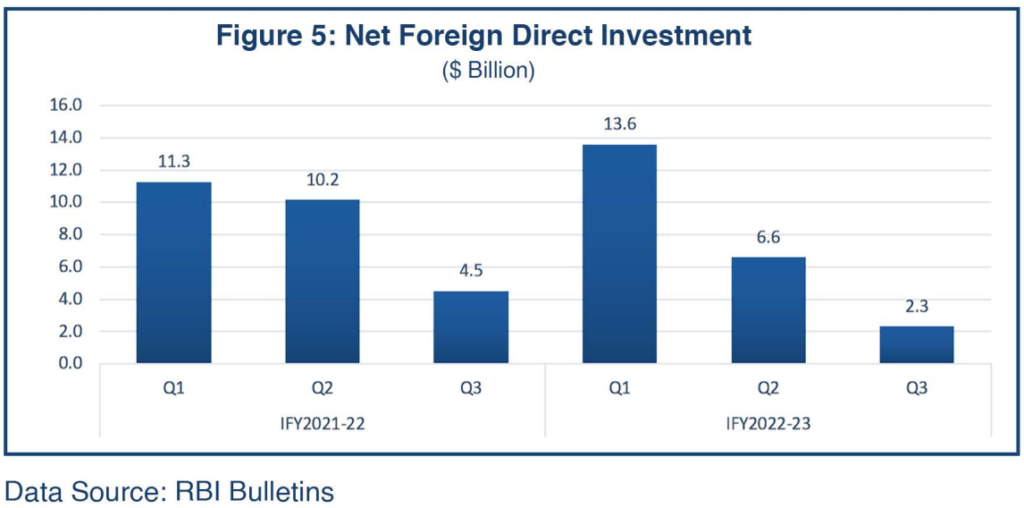

Foreign Investment

Net FDI inflows for Q3 continued to fall significantly since capital outflows continued; net inflows in Q3, at $2.32, were only half of the $4.5 billion in the previous year’s corresponding period; sequentially, the Q3 FDI net inflows were down from $6.6 billion in Q2 and 8.7 billion in Q1 (Figure 5). According to observers, FDI inflows in India are facing headwinds from the ongoing global slowdown.

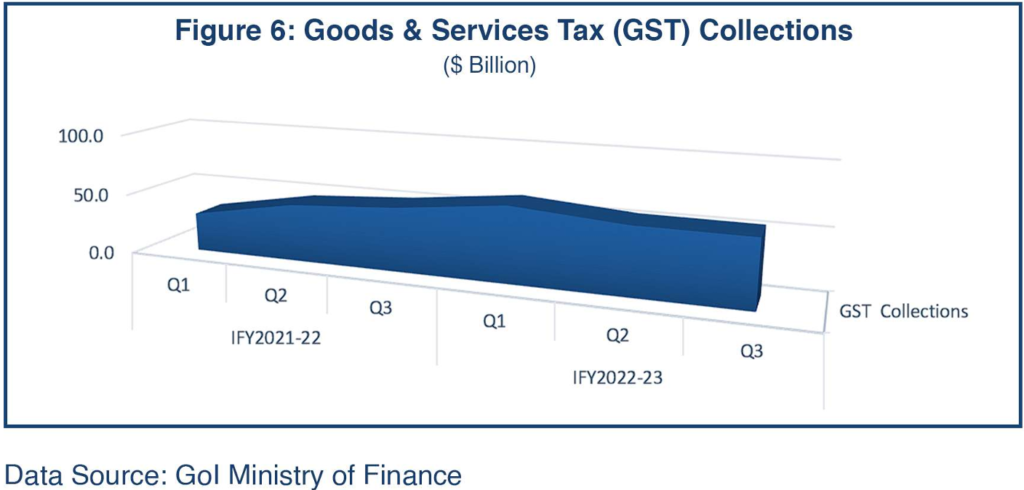

Good and Services Tax (GST) Revenues

Overall, GST collections have been expanding due to increased compliance and higher inflation. However, Q3 witnessed a marginal reduction in GST collection, probably due to easing inflation in November and December 2022 (Figure 6). India has been working on its tax administration, including the GST and the personal income tax, and that has made the tax system more effective and fiscally better for the country.

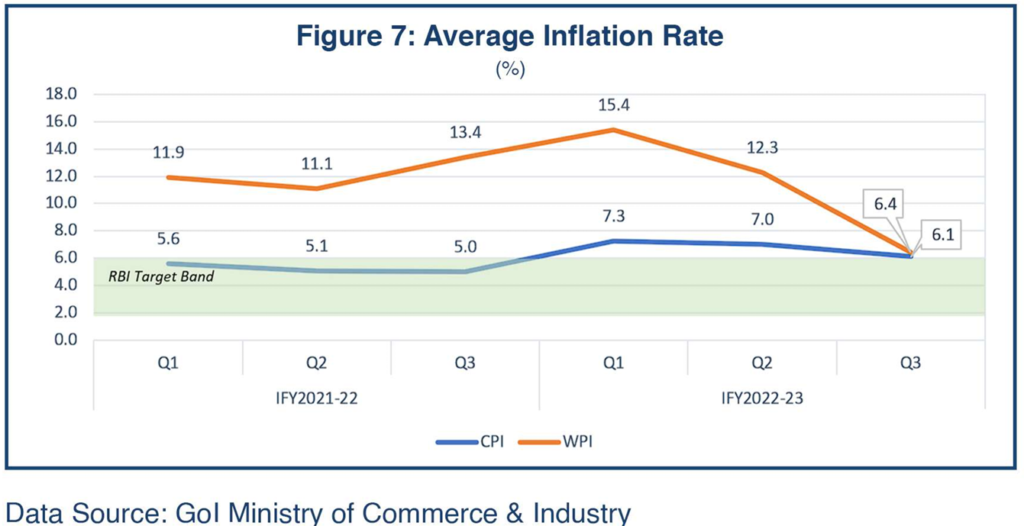

Consumer Price Index (CPI) Inflation

Inflation, both CPI and WPI, eased significantly during November and December 2022, driven largely by the falling price of vegetables; however, the non-food inflation (excluding fuel) remained high. The average CPI inflation for the December quarter was down to 6.1% from 7% in the September quarter. Food prices firmed up considerably during the first two quarters of the fiscal year, along with the core goods prices, driving the CPI inflation beyond the RBI target ceiling of 6%. The positive inflation-dampening impact of RBI increases in the repo rate since May 2022 \ was reflected during Q3 when both CPI and WPI were on the downtrend (Figure 7). The RBI expects a gradual recovery inflation in IFY2023-24; however, risks remain in the wake of the global uncertainties.

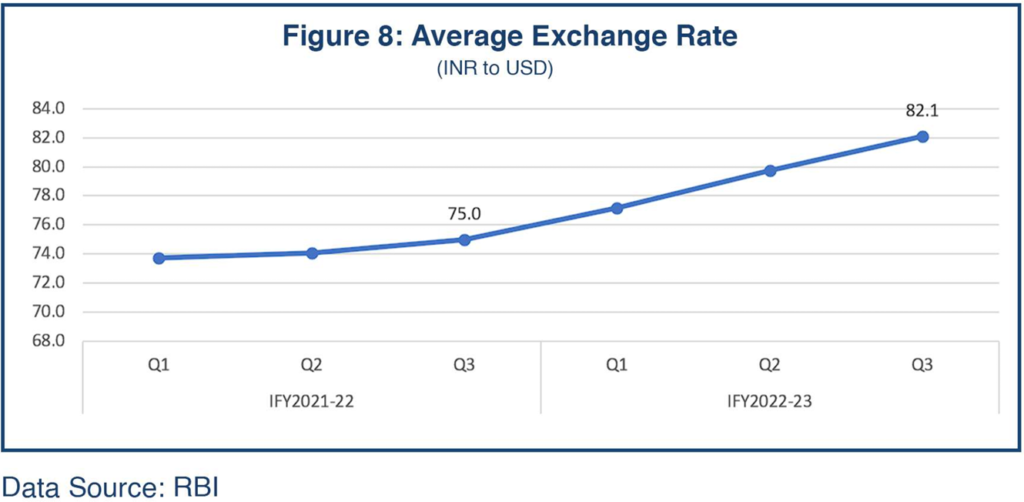

Foreign Exchange

Foreign exchange reserves grew to $578 billion by the end of December 2022 from $531 billion in October-end. During Q3, the Indian Rupee appreciated by one percent against the US Dollar, reaching 81.76 by December-end from 82.29 in October 2022 (Figure 8). The RBI continued its measures to stabilize the exchange rate and control inflation by siphoning off excess liquidity and raising interest rates. As of December-end 2022, the RBI has hiked repo rates by 250 basis points to 6.50% since May 2022.

Economic Growth Outlook

The Indian economy has been recovering after the Covid-19 pandemic and the economy’s momentum seems stable by many measures; but the global slowdown, geopolitical challenges, inflationary pressures, and the impact of rising interest rates have hobbled India’s economic expansion. Therefore, the slowdown in GDP growth in the third quarter of fiscal 2022-23 was driven by both external and domestic factors. The dent in consumer demand may be linked with interest rate hikes intended to bring down inflation. India’s Chief Economic Advisor Subramanian has also attributed revision to past data for the apparent slowdown.

In February 2023, the Gol released the second advanced Real GDP estimate for FY 2022-23, which came in at 7%, compared to a base of 9.1% growth (revised up from 8.7%) in the previous year. GDP growth for the first quarter of 2022-23 has been revised down to 13.2% from 13.5% estimated earlier, but Q2 GDP growth estimates remain the same at 6.3%. The real GDP growth for the third quarter of the fiscal 2022-23 has been reported at 4.4%, compared to 5.2% achieved in the same quarter last year (Figure 9). Cumulatively, the first nine months of IFY2022-23 have posted GDP growth at 7.7%, compared to 11.1% in April-December 2021. India’s GDP growth will need to grow 5.1% in the final quarter to achieve an annual 7% growth. While the Asian Development Bank (ADB) projection matches the Gol’s estimates, the International Monetary Fund (IMF) has forecasted India’s growth at 6.8% in FY 2022-23 in the wake of the existing global challenges (tightening monetary policy cycle, slowing growth and lofty commodity prices). The IMF and World Bank, in their latest reports, have, however, highlighted that the Indian economy will be the fastest growing among major economies in fiscal 2022-23, mainly due to a strong domestic demand. For IFY2023-24, the Government expects a growth of 6-6.8% versus the IMF’s projection of 6.1%. growth.

Clear signs of firm growth are yet to emerge, though a modest growth is likely to appear in some areas in IFY2023-24. The Gol’s budget for FY2023-24 should also help sustain the growth momentum, signaling the government’s commitment to fiscal consolidation while allocating one of the biggest-ever increases (33%) in capital spending to create jobs. Aggregate demand will likely pick up although it would require support through public investment to crowd-in private investment. The RBI continues to monitor inflation movements and economists expect a further rate hike of 25 basis points in April 2023 before pausing until year end. The CPI inflation started falling from 7% in September 2022, but unexpectedly it surged above the RBI’s 6% target ceiling in January 2023. The sustainability of India’s economic growth momentum remains contingent on addressing persistent inflation and attracting more private investments to strengthen the demand.