US-India Strategic Partnership Forum

About USISPF

As the only independent not-for-profit institution dedicated to strengthening the U.S.-India partnership in Washington, D.C. and in New Delhi, USISPF is the trusted partner for businesses, non-profit organizations, the diaspora, and the governments of India and the United States.

Vision

The US-India Strategic Partnership Forum (USISPF) is committed to creating the most powerful partnership between the United States and India.

Mission

We build, enable, advocate, facilitate, and guide partnerships between the two countries by providing a platform for all stakeholders to come together in new ways that will create meaningful opportunities with the power to change the lives of citizens in both countries.

Author

The US-India Strategic Partnership Forum (USISPF) is committed to creating the most powerful partnership between the United States and India. This report was researched and written by Nisha Rajan, Senior Policy Coordinator at the US-India Strategic Partnership Forum, assisted by Divya Chandra, Research Intern, under the overarching guidance of Vishal Wanchoo, Sr. Advisor at the Forum.

EXECUTIVE SUMMARY

India can become a reliable manufacturing hub through augmenting its participation in Global Value Chains (GVCs), for which it will need to enhance its competitiveness. Post-COVID dynamics present numerous opportunities to India and other Asian economies to host global manufacturers; however, global manufacturers will establish their manufacturing facilities where business climate is conducive to manufacturing, the cost of doing business is least and labor markets are favorable for manufacturing activities. This Report offers an analysis of India’s competitiveness viz-a-viz Thailand and Vietnam in Ease of Doing Business (EODB), Cost of Doing Business and Labor Markets, identifies areas of improvement, and provides specific recommendations for the Indian policy interlocutors to improve India’s competitiveness in these areas for increasing participation in GVCs, specifically in hi-tech sectors, such as defense, electronics and medical devices.

Post-COVID, the global firms’ interest to diversify can fulfil India’s need to grow its manufacturing sector under the “Aatmnirbhar” (Self-Reliance) Initiative while creating numerous high-paying domestic jobs. Through participation in global value chains, India can reap benefits of global integration and increase its share in global trade while making the domestic industry more competitive, especially when COVID has led to an above-average adoption of automation and digitization of work processes in India. According to The USISPF Hi-Tech Manufacturing in India Report, the hi-tech sectors in India have the potential to offer an additional investment of US$21 billion and create 550,000 direct jobs and 1,400,000 indirect jobs over the next five years.

India’s performance of various parameters under three heads – Ease of Doing Business, Cost of Doing Business and Labor Markets – using the latest World Bank Ease of Doing Business Index and World Economic Forum Competitiveness Report, and a comparison with that of Thailand and Vietnam, shows that India needs to focus on specific areas to improve its performance, such as:

- Obtaining approvals/licenses/permits for starting a business and implementation of Single-Window System;

- Access to Capital for Small and Medium Enterprises (SMEs);

- Taxadministrationtocutdownthenumberofhoursittakesfortaxsubmission; o Connectivitytotheglobalshippingnetworks;

- Uninterruptedpowersupplyforfactoryoperations;

- Time to complete compliance procedures at the border; and

- Laborproductivitylevels/skills.

The Report makes specific recommendations for

ENHANCING EASE OF DOING BUSINESS BY

- Streamlining land/property procedures;

- Bringing efficiency in tax administration;

- Implementing Single-window approval system pragmatically;

- Improving electricity regulatory environment;

- Ensuring enforceability of contracts; and

- Enhancing trade facilitation.

IMPROVING LABOR PRODUCTIVITY BY

- Providing flexibility in Labor Laws to encourage employers to impart trainings to workers;

- Investing more in Industrial Townships for ease of availability of skilled labor; and

- Enhancing Capacity Building(Skills)efforts through PPP-modeled skilling institutes

CUTTING COST OF DOING BUSINESS BY

- ImprovingexecutionofInfrastructureProjectandprioritizingpassage/ implementation of the New Logistics Policy to reduce cost of moving goods and improve connectivity;

- Optimizing modal mix and continued impetus to dedicated freight corridors;

- Emphasizing inclusion of Warehousing in state policy framework; and

- Developing the supplier ecosystem to enable free access to cost-efficient raw

- materials/components.

The Report concludes that India has taken numerous initiatives to improve ease of doing business; however, more focused work in several aspects of the economy will turn India’s endeavor to become a competitive “global manufacturing hub” into reality sooner than later. To attract foreign investment and technology in manufacturing sector, India needs to ensure the predictability and stability of regulatory practices while enduring FDI liberalization and ease of doing business. Besides, reforms in land and labor markets are needed to facilitate establishment of factories in India. India can leverage low-cost labor competitiveness by increasing labor productivity through providing enough flexibility in labor laws to enable employers to invest in trainings of the workers. While the Government should undertake to facilitate policy measures, industry can partner in the ecosystem by offering technical support and needed investments. India needs to create an ecosystem exponential growth of semiconductors that are used in several hi- tech sectors (aerospace, civil aviation, autos, medical devices, electronics etc.) that can play a major role in accelerating the growth of the overall manufacturing sector and help project India in coming years as the Hi-Tech Manufacturing Hub for the world.

INTRODUCTION

COVID 19 is a crisis facing every country across the world and like all crises it also presents an opportunity for pathbreaking reforms, re-aligning priorities, and reconfiguring policies to address the economic slowdown and enable the revival of businesses. Post-COVID dynamics have necessitated the need to strengthen India’s supply chain management and PM Modi has emphasized the significance of aligning India’s manufacturing sector with the recent “Aatmnirbhar” (Self Reliance) initiative to make India a global manufacturing hub. Coincidently, deliberations are now taking place about diversifying Global Value Chains (GVCs) with many of the multinational companies (MNCs) in view of their consideration to shift parts of their production platforms away from China into friendlier countries. Post-COVID, the global firms’ interest to diversify can fulfil India’s need to grow its manufacturing sector while creating numerous high-paying domestic jobs.

According to a recent World Economic Forum (WEF) study, COVID 19 pandemic has led 58% companies in India to adopt automation faster than the global average of 50%; and 87% companies in India are accelerating digitization of work processes compared to the global average of 84%. This is a unique opportunity for India to enhance its competitiveness in digital future that can help the Government’s endeavor to create technologically sophisticated GVCs in India. That said, with a huge domestic market and increasing consumer demand, there remains enough scope for India to continue participating in low-skilled labor intensive tasks requiring human capital.

Through participation in global value chains, India can reap numerous benefits of global integration. India’s share in global merchandise trade remains nearly 2%, almost static for a decade, while China’s share is more than 7 times that of India’s share. Evidently, GVC participation supports trade growth. According to the Global Value Chains Development Report, 2019, more than two-thirds of the global trade now occurs through GVCs that tend to reduce trade barriers, lower the costs of moving goods, advance use of technology and automation, create jobs and drive significant economic growth. The World Development Report (WDR 2020), released in November 2019 says “GVCs can continue to boost growth, create better jobs, and reduce poverty provided that industrial countries pursue open and predictable policies”.

Highlighting the significance of the high-tech manufacturing sector in India, the U.S.-India Strategic Partnership Forum (USISPF) in 2019 released a study conducted by its members, highlighting the opportunities and the challenges in India’s high-tech manufacturing sector. According to The USISPF Hi-Tech Manufacturing in India Report, the hi-tech sectors in India have the potential to offer an additional investment of US$21 billion and create 550,000 direct jobs and 1,400,000 indirect jobs over the next five years.

To prepare for participation in the GVCs, India needs to promote policies that are conducive to investment, that build the skills of domestic small and medium enterprises (SMEs) and that foster competitiveness of cost and ease of doing business. This will also make India’s manufacturing sector more productive and create a strong ecosystem within the country.

Business conditions in the Indian manufacturing sector continue to improve and the business sentiment seems to be positive overall as global giants such as GE, Siemens, HTC, Toshiba, and Boeing have shown interest in setting up manufacturing plants in India. In the past five years, India has taken several initiatives to improve ease of doing business with an aim to make the environment more conducive for manufacturing. USISPF commends India’s initiatives to slash Corporate Tax rates, the introduction of the Performance Linked Incentive Scheme in select sectors, and passage of new Labor Codes and Single-Window Clearance system. These are positive steps towards creating an ecosystem in the country, however, more focused approach in several aspects of the economy will fructify India’s goal to become a competitive “global manufacturing hub”.

This Report attempts to examine India’s competitiveness in attracting Global Value Chains in high-tech manufacturing viz-a-viz its neighboring economic competitors. This Report also aims to recommend actionable policy measures to help prepare India to participate in Hi-Tech Global Value Chains by enhancing its competitiveness in the region.

Scope and Methodology

India aspires to be a significant player in the global value chains, and the post COVID dynamics present opportunities for India to host global manufacturing giants. When a global business considers setting up a factory in a country, the primary competitiveness parameters it evaluates include market size, geography, government support, openness of market, ease and cost of doing business, availability and quality of land/labor/capital, quality of ecosystem to procure raw material/components, infrastructure and logistics, and ease of trading across borders.

In an effort to assess India’s competitiveness in component manufacturing in specific sectors (Defense, Electronics and Medical Devices) viz-a-viz its closest competitors, Vietnam and Thailand, the USISPF has initiated a study to explore the areas of improvement in India’s soft and hard infrastructure.

In the first phase of the study we would focus on the following parameters:

- Ease of Doing Business

- Labor Market

- Cost Competitiveness (generic aspects)

To make specific recommendations to the Government of India, our methodology is a combination of secondary research of the World Economic Forum’s Competitiveness Index and World Bank’s Ease of doing Business index. Our research has been supplemented with primary meetings done with 5 Fortune 500 foreign multinationals engaged in manufacturing/contract manufacturing in electronics and aerospace, a Fortune 500 Indian Global Conglomerate engaged in manufacturing of a wide range of products and a multinational Express Service Provider operating in India for decades.

COMPETITIVENESS FRAMEWORK

EASE OF DOING BUSINESS –

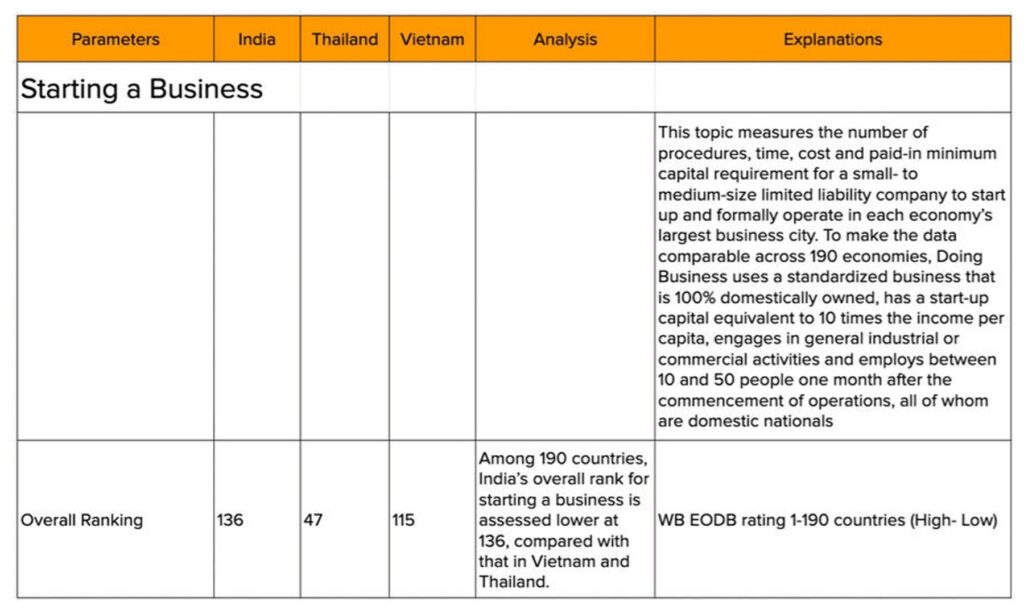

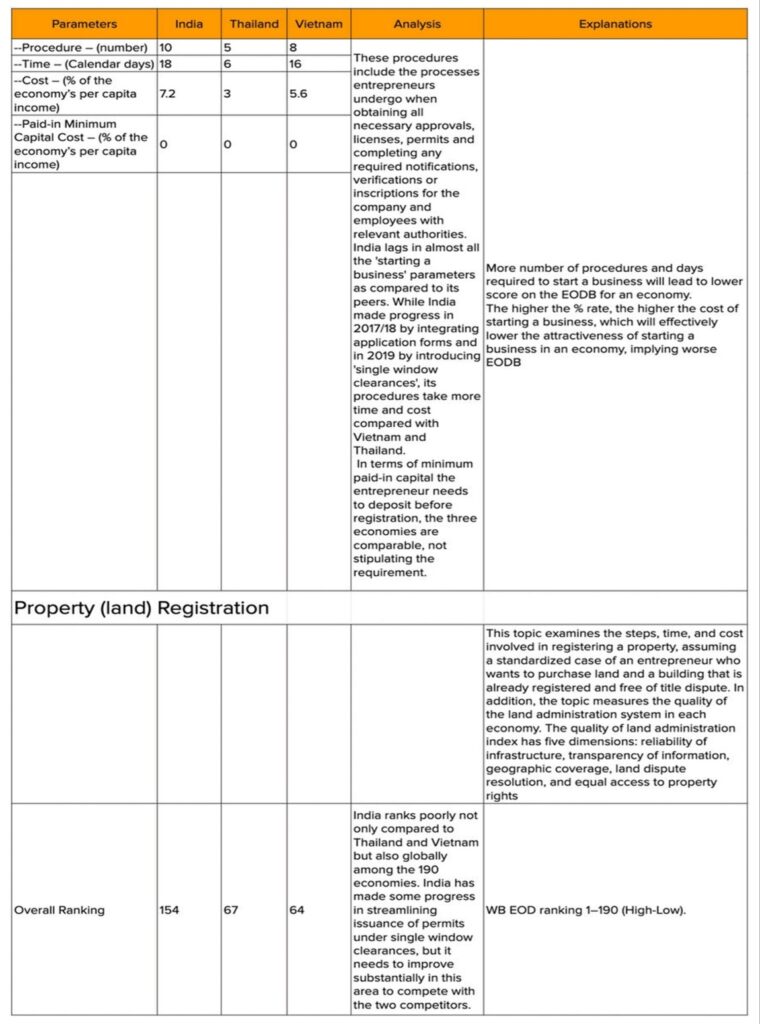

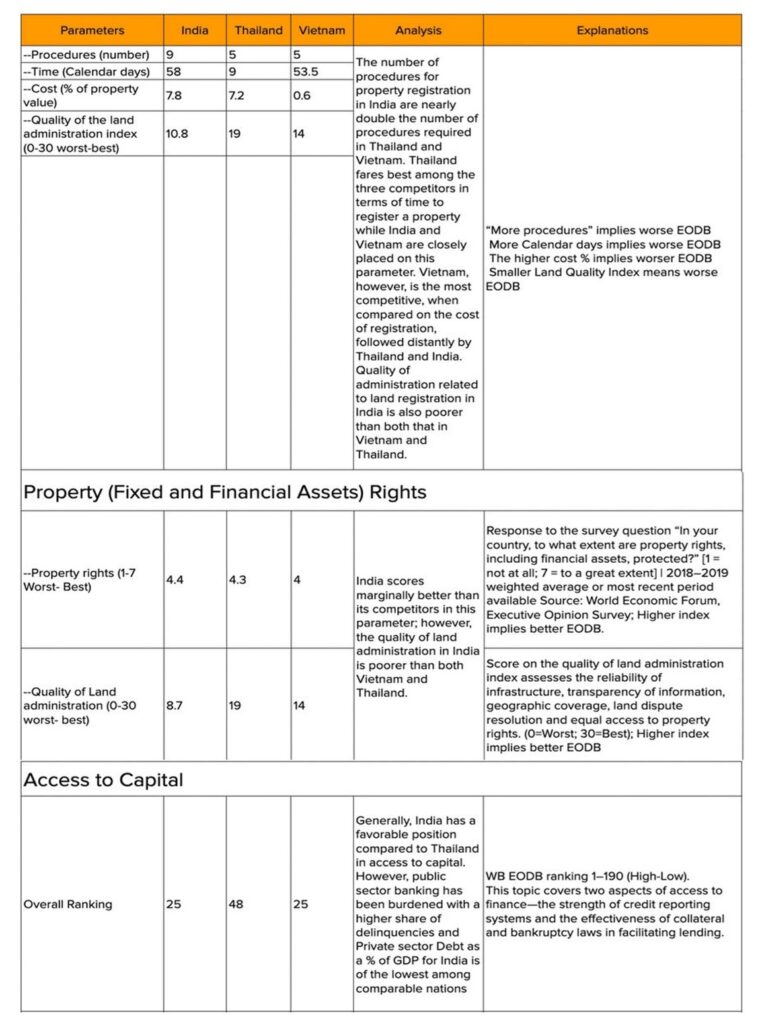

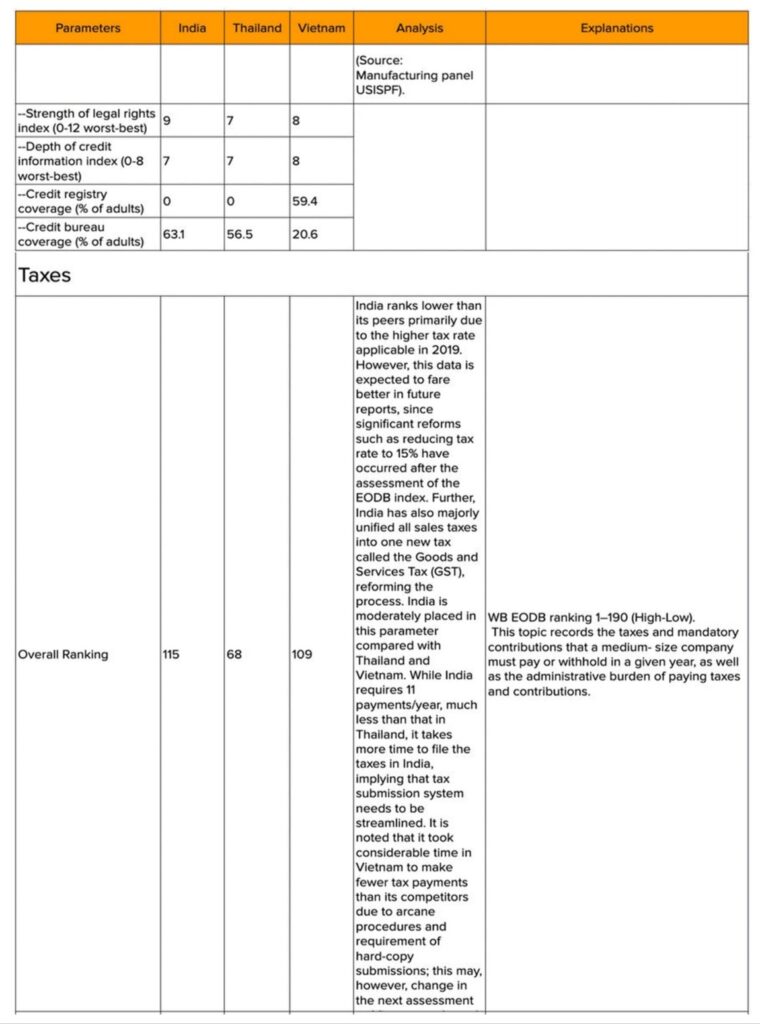

EODB (Economies are ranked on their ease of doing business by the World Bank, from 1–190 (High-Low). A high ease of doing business ranking means the regulatory environment is more conducive to the starting and operation of a local firm. Performance of all parameters are benchmarked until May 1, 2019 and reforms undertaken by economies thereafter may improve the ranking in future). India ranked 63, Thailand 21 and Vietnam 70 in the World Bank EODB, 2020.

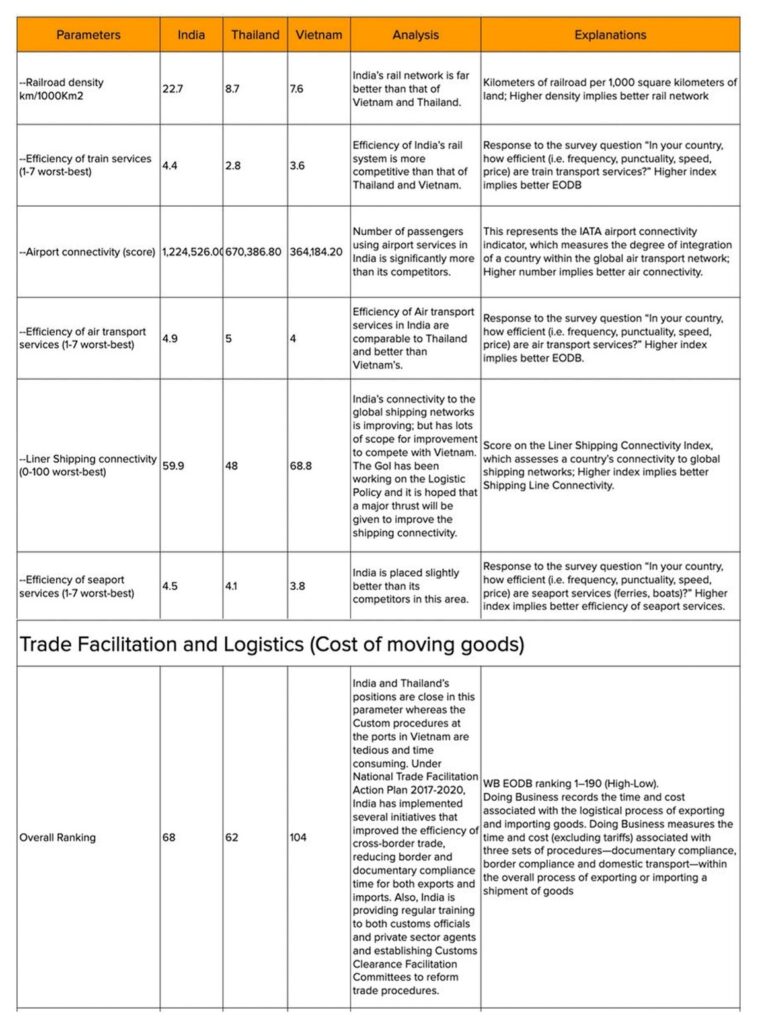

The following table presents most of the parameters drawn from the World Bank EODB, 2020, namely, Starting a Business, Property (Land) Registration, Property (Fixed and Financial Assets) Rights, Access to Capital, Taxes, and Trade Facilitation and Logistics. However, parameters on Infrastructure and Labor Markets are drawn from the World Economic Forum Competitiveness Report, 2019 that assessed 141 countries from 1- 141 (High-Low). India ranked 68, Thailand 40 and Vietnam 67 in the WEF Competitiveness Report, 2019.

ANALYSIS AND IDENTIFICATION OF AREAS FOR IMPROVEMENT

EASE OF DOING BUSINESS FOR SETTING UP A FACTORY

According to the World Bank’s annual report on the Ease of Doing Business (EODB), ‘Doing Business 2020: Comparing Business Regulations in 190 Economies’, India ranks 63rd out of 190 countries and has moved up by 14 spots this year. This jump is quite significant given that India’s rank in 2014 was 142. While this is a true reflection of the diligent efforts of the government to improve India’s position in the global rankings, more is needed to ensure the entire country is holistically benefitted. While some procedures may have been simplified in metro cities (Delhi and Mumbai where the World Bank measures progress), businesses highlight that the fundamental difficulties in doing business in India remain when it comes to property registration, sanctity of contracts, cost of moving goods and cost of credit.

The approval processes are gradually getting better and, theoretically, a single window clearance system is being implemented; however, the compliance mechanism remains very hard, usually resulting in huge penalties for businesses. That said, large companies in urban/metro areas generally partner with the state governments and contribute through CSR programs, which facilitate their relationship with the government and help in getting cooperation from the authorities. However, MSMEs remain very vulnerable and get exploited by authorities on compliance and quality issues, leaving lot of leeway for corruption to seep in. In addition, complex regulatory framework in India due to multiple stakeholders involved at state and center level lead to a murky environment. For instance, medical devices sector is controlled by 13 different departments and a manufacturer needs to get approval from 13 different divisions.

Land Acquisition/Registration

Over the last five years, India’s ranking on the World Bank’s EODB index has remarkably improved from 142 in 2015 to 63 in 2020. While the improvement is impressive, businesses report that the ground reality in some areas remains difficult requiring more policy actions for ease of doing business.

Over the last five years, India’s ranking on the World Bank’s EODB index has remarkably improved from 142 in 2015 to 63 in 2020. While the improvement is impressive, businesses report that the ground reality in some areas remains difficult requiring more policy actions for ease of doing business.

Electricity Regulatory Environment

Getting electricity connection in India has become easier with only 3-4 steps; however, it remains time-consuming. Businesses report that buying electricity is not cost-competitive either, as grid transaction is not yet transparent in India, largely remaining relationship based. USISPF members also report power interruption at times. Backup generators are not economically viable options. India’s Power sector is characterized with substantial leakage in accounting with nearly 25% of electricity is not paid for. Better coordination and engagement among the central and state governments, financial institutions, distribution companies and developers can help the power sector. Thailand and Vietnam stand more competitive than India in this parameter. Thailand increased the transparency of electricity tariff changes as well as streamlined the number of procedures needed to obtain a new connection.

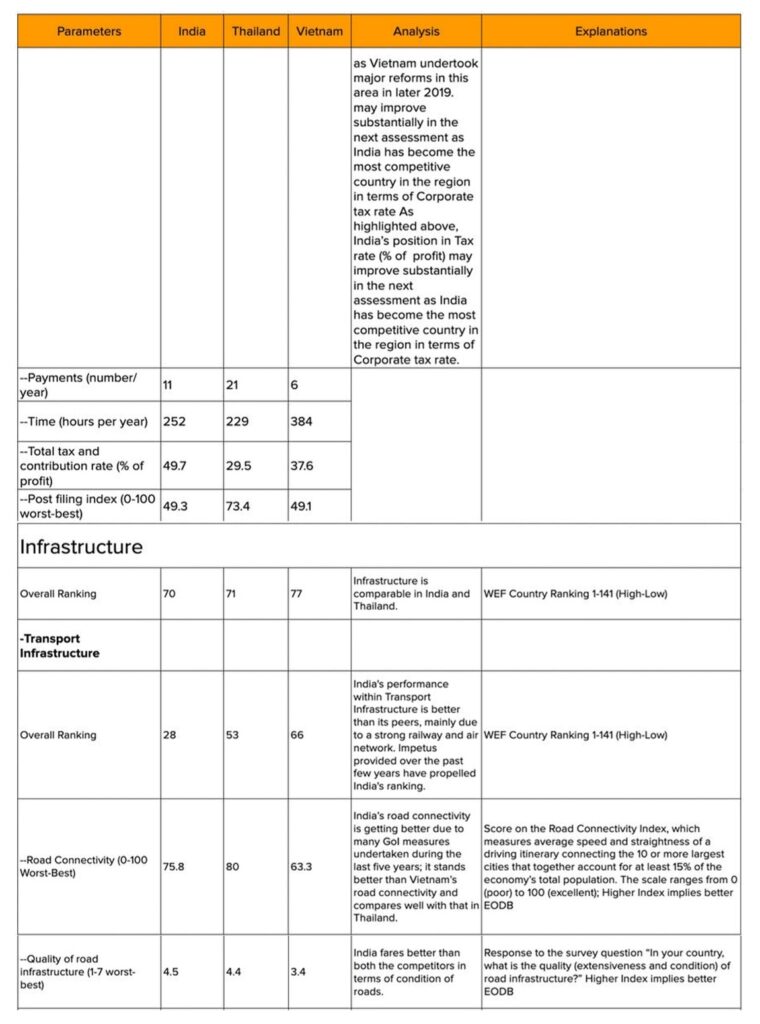

Tax Payment Procedures

India’s procedures are reforming every year in direct tax payment procedures, requiring 11 payments/year at present; however, businesses note the procedures take considerable time and result in higher cost due to delays. Import tax payments at the Customs take considerable time and result in delays in clearance of consignments. Vietnam, where businesses are required to make 6 payments every year, made paying taxes easier in late 2019 by no longer requiring hard copy submission of the value-added tax return and allowing joint payment of the business license tax and value-added tax. Vietnam also made paying taxes less costly by reducing the employer’s contribution to the labor fund. Thailand has made paying taxes easier by enhancing its online platform for calculating and filing corporate income tax. USISPF highlights that there is room for improvement and India can take cues from these best practices.

Sanctity of Contracts

Unambiguous and predictable legislative rules supported by an efficient judiciary that preserves the sanctity of contracts is a prerequisite for successful commercial transactions. However, this aspect of doing business in India remains a major challenge. While it takes 496 days in China, 400 days in Vietnam and 420 days in Thailand to enforce a contract through the courts in case of a dispute, in India it, alarmingly, takes almost 4 years (at par with Bangladesh, which ranks lowest among the South Asian economies).

Vietnam made enforcing contracts easier over the last two years by adopting a new code of civil procedure and by introducing a consolidated law on voluntary mediation. It further made enforcing contracts easier by making judgments rendered at all levels in commercial cases available to the public online. Thailand made enforcing contracts easier by introducing a system that allows users to pay court fees electronically. Thailand also reduced enforcement times by increasing the automation and efficiency of enforcement processes.

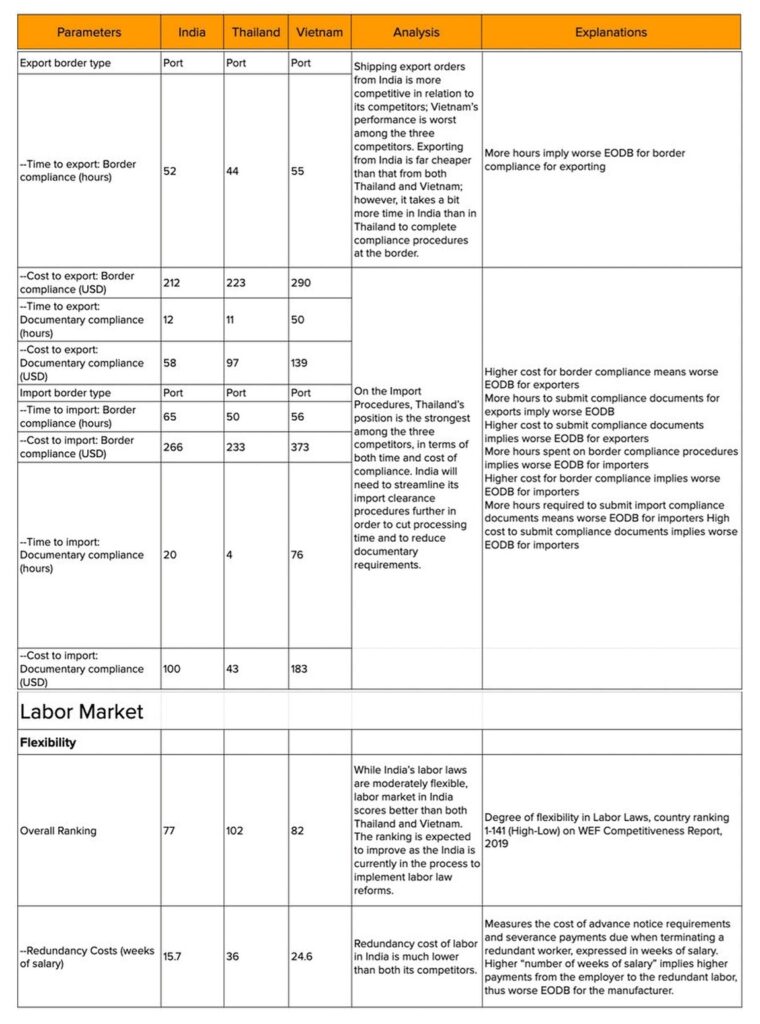

Trade Facilitation

Easier trading across borders finds a favorable spot when global manufacturers consider export production as part of their GVC commitments. It is encouraging to see India faring well in trade facilitation reforms which is well-captured in the World Bank EODB index with India ranking at 68, ahead of Indonesia and Vietnam, but still behind Thailand (62). India over the last few years has put several export-import procedures online in accordance with its Trade Facilitation Agreement (TFA) commitments.

The Government has taken proactive measures keeping the customs operational 24×7. Several measures like 24×7 clearance, helpdesk facility, waiver of penalty etc. have also been announced and are welcome. However, the priority clearances are given only to essential goods. IT goods such as laptops, notebooks, services are also used by priority sectors i.e. healthcare, pharmaceuticals etc. The accumulation of goods at ports/warehouse is also leading to mishandling/damages to the imported cargo.

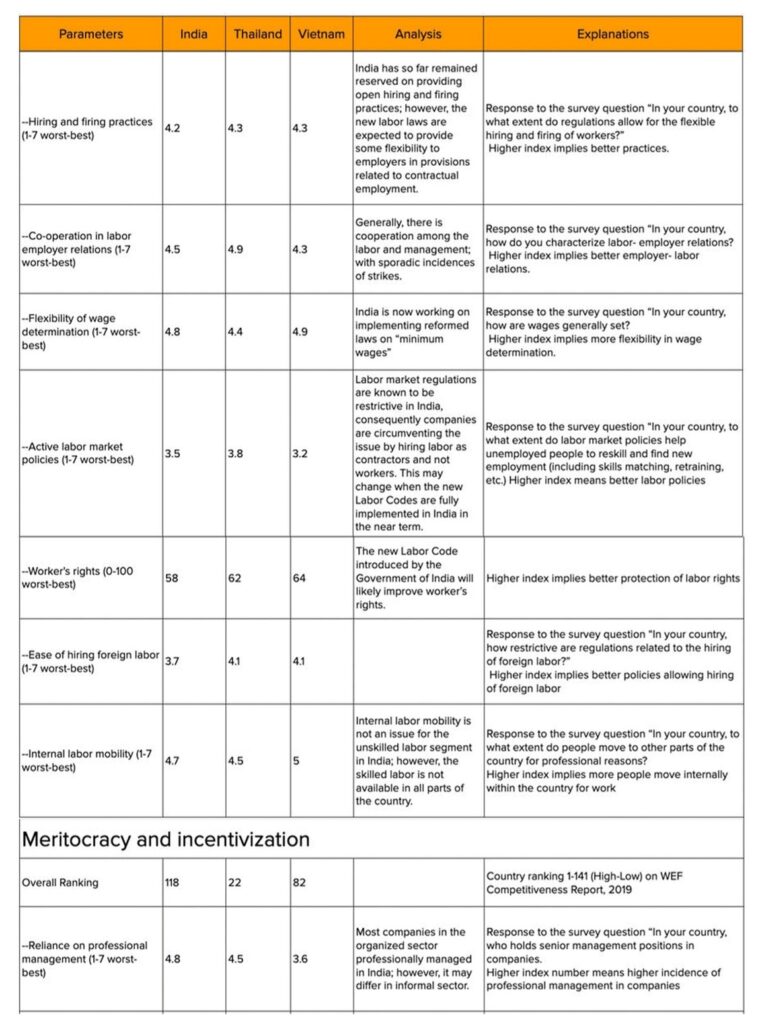

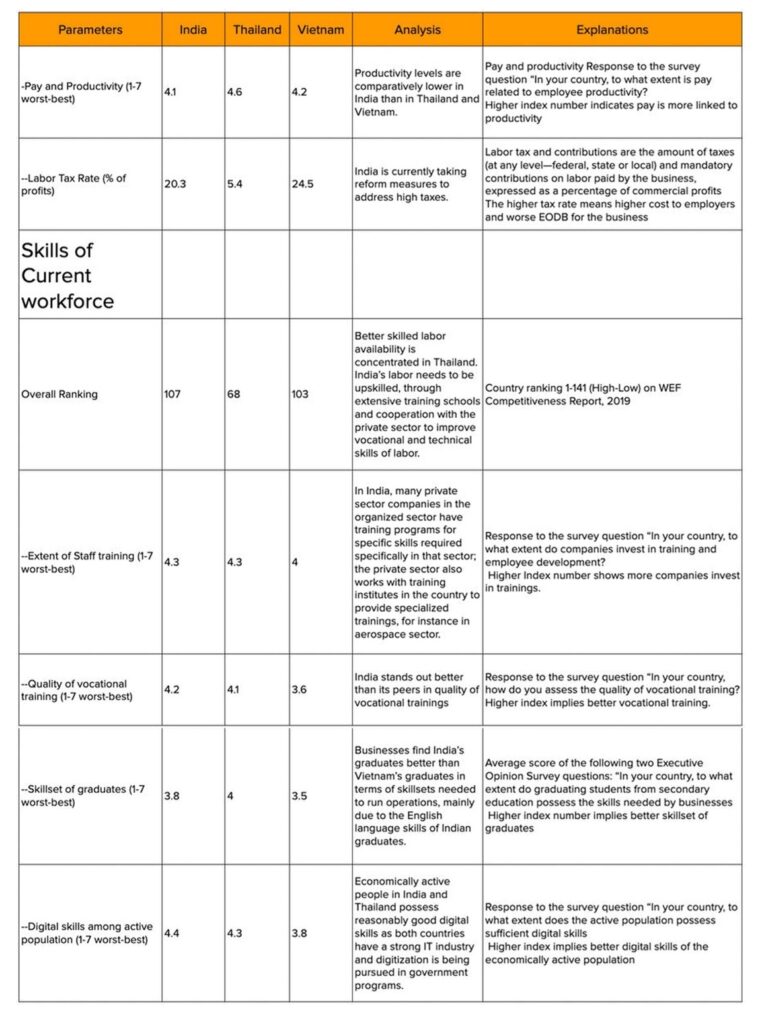

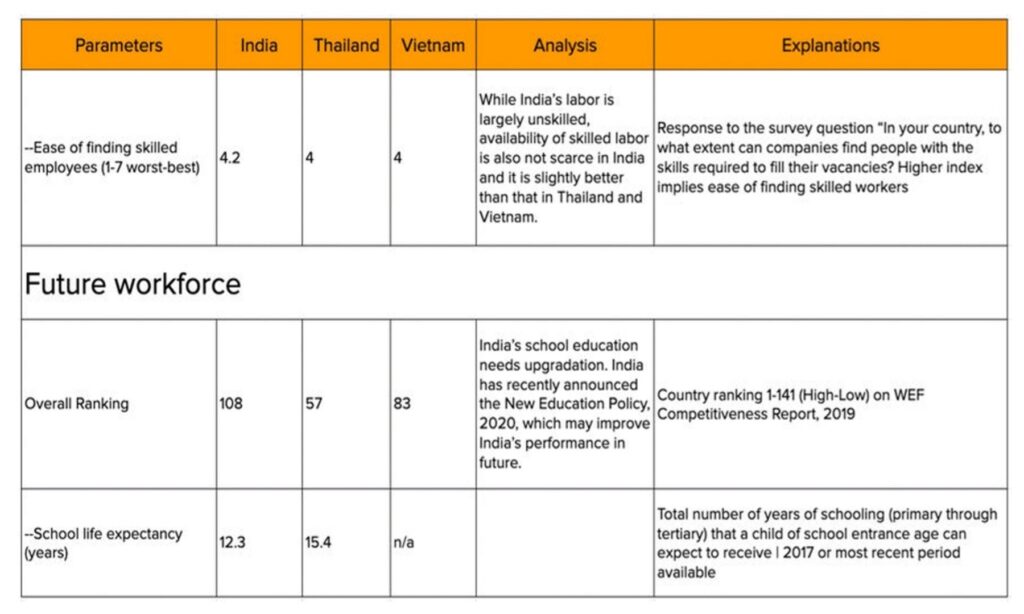

LABOR MARKET

Labor is abundantly available in India and wage rates are generally lower than those in Vietnam and Thailand. This appears to make India competitive in labor market. That said, labor productivity in India remains a major issue due to the skill factor of labor. India needs to become competitive to become a significant part of the global value chains for which scale manufacturing need to be focused through improved labor productivity. Scale manufacturing is apt for India where labor is abundantly available; however, it is important to increase labor productivity through developing focused training and skill development programs. According to the USISPF Hi-Tech Manufacturing in India study, labor costs are low in India compared with countries China and Taiwan; however, the current advantage that India has as a global engineering hub is weakening (compared with South East Asia) due to relatively higher wage inflation and short supply of skilled labor.

India has not mandated a wage rate for unskilled labor; however, wage rate has been mandated for skilled workers. Skilled labor is typically paid better wages in India than in Thailand or Vietnam. In Aerospace, many schools have invested in trainings and a few private sector companies have trained schools under the “train the trainer” programs. As a result, availability and employability has improved and cost has been optimized in Aerospace sector, where India has emerged better than Vietnam and Singapore. However, it is not enough, given the anticipated scale of production of hi-tech defense goods in future and the opportunity to leverage India’s huge English-speaking talent pool. In other Hi tech components sectors – such as, Semiconductor, Alloys processing industry there is scarcity of skilled workforce due to which scale manufacturing is impacted. On the job training is needed to increase productivity of labor. The USISPF Hi-Tech Manufacturing in India Report also highlights that India has limited labor force as compared with Taiwan/South Korea/Japan where the electronics industry is much more developed. Shortages of qualified engineers with an electronics manufacturing background and shortage of skill sets for large-scale manufacturing are making India less competitive.

USISPF members report that skilled engineering workforce is also not always available everywhere in India; getting unskilled labor is not an issue but skilled is, especially in areas other than metro areas. Within India, labor mobility is not a major issue as typically unskilled labor move frequently which can easily be replaced anyway; but labor mobility is not prevalent so much for skilled category, which typically limits the prospects of getting trained manpower for hi-tech industries located in non-metro cities.

COST COMPETITIVENESS

Logistical Infrastructure: Need for Greater Share of Railways in the Modal Mix

Logistical infrastructure is a critical enabler in economic development and growth. India’s ranking in the World Bank’s Logistics Performance Index (LPI) has dropped from 35th position in 2016 to 44th in 2018. Despite having a comparable ranking vis-a-vis Thailand and Vietnam (as per our analysis in the previous section), there are practical issues. In this section, we highlight challenges associated with infrastructure, air cargo and warehousing that are adversely impacting performance of the logistics sector. Freight traffic in India is expected to treble in the coming decade and thus it is critical for investments and reforms to keep pace.

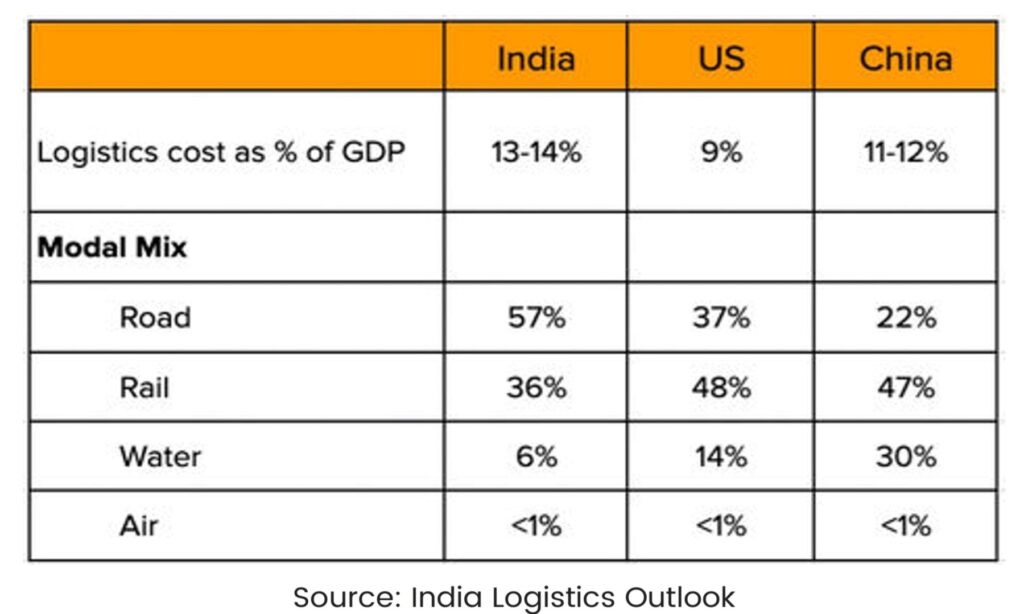

Logistics infrastructure covering road, rail, waterways and air network of a country is the underlying foundation that supports all economic activity. The following table provides the modal mix of the India vis a vis the US and China, with comparable continental surface area.

Efficient logistics connect firms to domestic and international markets, affects the efficiency of the manufacturing global value chains, and competitiveness of a country’s economy within these value chains. As is evident from the numbers, logistics cost as a percentage of GDP for India is well above the similar ratios for the US and China. Logistics costs are known to be strongly (inversely) correlated with the Logistics Performance Indicator and thus it comes as no surprise that India needs to reduce these costs to improve its LPI ranking.

The share of rail freight in India’s modal mix is currently at 36 percent1 and when compared to China and the U.S. where this share is almost 50 percent, it is low. This analysis when coupled with the fact that cost for coastal shipping is INR 0.15-0.2 per ton km, INR 1.5 for railways and INR 2.5 for road2 reveals the entire story – there is overuse of high-cost modes like road at the expense of cost effective and sustainable modes like inland waterways and railways in India. As a consequence of the higher dependence on road transport, businesses face higher transportation costs, slower and inconsistent transfer efficiency, all while adversely impacting the environment. Carbon Dioxide or CO2 emissions from road are 84g per ton-km as compared to the 28g from railways and 15g from waterways.3

——————————————————————————-

1 Mckinsey study computed based on sectoral investment trends

2 India on the cusp of a Logistics Revolution

3 Mckinsey study

Decongesting Cargo Handling on International Airports

India has a network of approximately 154 airports- of these 114 are domestic airports, 10 are for customs and 14 are International airports. At present, private air freighters are permitted to use only the International airports for international cargo handling. However, problems such as procedural bottlenecks of customs clearance, congestion at cargo terminal, reducing dwell time, challenges of handling hazardous cargo are causing significant delays leading to demurrage. Air cargo typically involves shipment of highly time sensitive, temperature controlled and high-value goods with little tolerance for delays.

Given that India is developing as one of the fastest growing air cargo markets across the globe, it presents ample opportunities for industry operators. The Government should consider opening up the domestic airports to international air freighters to ease the existing congestion and procedural bottlenecks.

Warehousing

Sophisticated warehousing systems is another important trigger for trade and an efficient warehouse can bring a 15-20% cost reduction in the entire logistics operations. India’s warehousing sector achieved a much needed impetus triggered by GST in 2017 and grant of “infrastructure status” to warehousing. Since then, the sector has witnessed a rapid change towards institutionalization – transforming from being unorganized to attracting international players towards consolidation and formalization. On the demand side, the increasing dominance of e-commerce, third party logistics players and corporates have catapulted operations. In our analysis, we comment on the existing regulatory and policy environment as a key enabler to enhancing competitiveness.

The National Logistics policy is in the discussion stage, each of the 29 states in India have their independent logistics and warehousing policy infrastructure. Research by Knight Frank indicates that as of May 2020, only eight states have a valid policy infrastructure with an additional two working on it. The remaining 19 states do not have policy provisions covering warehousing. In an environment where attracting domestic and foreign investment is central to development, states need to focus on creating investor friendly policies as well as creating monetary and non-monetary incentives.

USISPF understands that the Government of India has been working on a draft National Logistics Policy and Unified Logistics Law, with a focus on creating more dedicated freight corridors, making railways a major mode of freight, and increasing use of inland waterways. While some of our members in the express delivery business have pointed to few concerns, we hope to get a chance to comment on the draft Unified Logistics Law when it is released for public comment.

Supplier Ecosystem and Costs

In a research study by USISPF and Deloitte, it was found that in specific hi-tech industries such as consumer electronics, key components (semiconductor, display and panel, electronic resins) constituting a significant portion of the manufacturing process are unavailable in India. These components together constitute almost 80-85% of the total material cost and manufacturers have to depend on sourcing these products through imports. Imports, on the other hand, are imposed with varying level of duties, depending on product classification. These weak supplier ecosystems when combined with high input costs result in inefficiencies adversely impacting cost competitiveness. For instance, the Aerospace sector in India majorly depends on imports of MRO parts in the absence of lack of availability within India. MRO parts are subject to 5%-30% custom duties and the custom clearance procedures of MRO parts are cumbersome that raise the administrative cost and burden of importing MRO parts, compared with other neighboring economies where the admin burden is minimal at ports.

RECOMMENDATIONS

Building a strong trust is the key to improving business environment and attracting investment. Businesses seek a predictable and stable business environment with reliable public services, such as uninterrupted water and electricity. India has signaled its stance to open for business and global investments. For an efficient network of domestic as well as global manufacturing enterprises, USISPF recommends that India takes the following actions:

ENHANCE EASE OF DOING BUSINESS

Streamline Land/Property Procedures

Land acquisition is not a major problem in politically stable states of India; however, it can be extremely difficult in some states, with opaque processes in place for zoning, registration of ownership, and ownership title. USISPF recommends the Government of India to speed up the establishing of clear/transparent and flexible procedures for land-zoning for industrial activity and registration process for ownership of land.

Bring Efficiency in Tax Administration

Efficient tax administration and efficient tax dispute resolution are two elements at the center of ease of doing business in any economy. In India, trends portray that the tax litigation process takes years to resolve. The delay in dispute resolution, costs involved, along with the increasing magnitude of cases calls for an efficient policy of tax dispute resolution by the government. Adopting some international best practices, settling long- standing tax litigations or arbitrations, moderating tax rates to reinforce independence and fairness in the assessment proceedings. MSMEs find the complex GST filing system a painful process, who often do not have the bandwidth to deal with the difficulties of administrative burden. We recommend that Government should accord high priority to simplifying the tax filing system.

Introduce Single-window Approvals Pragmatically:

USISPF recommends enforcement of the Single-window Clearance system in the spirit of its intent. There is an urgent need for simplification where the industry interacts with only one regulator who, in turn, can coordinate and complete intra-agency approval processes across all states. Automation and intra agency coordination can help reduce multiplicity of paperwork and expedite approval process.

Improve Electricity Regulatory Environment: USISPF recommends the expeditious passing of the Draft Electricity Act Amendment 2020, at the earliest so that companies can push their investment plans in near future. Continuing reforms in Electricity Policy regulatory framework to expand safety, reliability, and efficiency in power generation, transmission & distribution, and grid management will be helpful. While the UDAY scheme has made progress in the power sector in select states, an urgent need remains for ensuring timely payments by DISCOMs to increase investor confidence and ensure viability of projects. Promoting renewable energy consumption through relaxation in stringent banking norms and lowering the cost of funding for the power sector can attract foreign manufacturers to set up factories in India.

To improve the power supply, the Government may continue to encourage

investment in India’s energy sector by

- Working with the states to implement power sector and tariff policy reforms;

- Focusing on smooth integration of variable renewable energy and power system flexibility; and

- Promoting use of Natural Gas through incorporating natural gas into the GST regime, eliminating subsidies for LPG in city gas distribution, accelerating development of City Gas Distribution networks, and providing incentives and regulatory clarity on construction of natural gas and LNG infrastructure.

Ensure enforceability of Contracts:

Delays in arbitration and litigation upon a breach of contract often lead to economic losses, increased legal costs, and lesser revenues, eventually resulting in reduced rate of return on investments. Therefore, the Central Government and the Courts should be coordinated to ensure that contracts are enforced and honored.

Enhance Trade Facilitation

USISPF members emphasize implementation of committed reforms under the WTO Trade Facilitation Agreement (TFA) to improve efficiency at its ports through automation and intra-agency coordination. The TFA measures will ultimately result in a lesser cost of business with improved logistics and lesser delays. In the wake of the Covid-19 crisis, in addition to essential goods, the importers of IT goods should also be accorded priority clearances; otherwise business continuity is hampered. Currently, the importers are not able to clear the goods from customs port/warehouse in timely manner and the excess storage of goods is leading to mishandling/damage to the imported cargo. Therefore, It is recommended to issue a directive to the custodians for safe handling of cargo.

IMPLEMENT LABOR MARKET REFORMS

Provide Flexibility in Labor Laws to Improve Productivity of Labor

Restrictive labor practices have been cited as one of the major factors hindering the business climate in India. Big multinationals will not enter into labor-intensive manufacturing unless India moves to a system that provides flexibility in the labor market and resolves labor disputes swiftly. About 90 per cent of Indian workers are employed in the informal sector characterized by low- productivity and low-skill. India must move quickly to reform labor laws to formalize the sector. Due to the rigidity in the present labor regime, industrial manufacturers are forced to hire labor on short-term contracts with minimalistic training investments that leaves the workers unskilled and with no job security.

USISPF hails the Government of India’s initiatives to consolidate and reform the labor laws. Labor reforms with the new policy are yet to be tested since policy provisions are not entirely clear to the industry. USISPF members emphasize the need to have a flexible labor law that protects rights of workers as well as allow decisions of employers to hire and fire redundant labor. This will also encourage employers’ investment in capacity building through training to increase labor productivity. Industry looks forward to the implementation of the Social Security Code that should ideally introduce healthcare and safety provisions for the workers.

Invest More in Industrial Townships To Improve the Availability of Skilled Labor

According to industry estimates, approximately one million engineers are added per year in India. The availability of this huge talent pool, however, is restricted to non-metro/suburbs. The Government should focus on facilitating establishment of Industrial Townships with modern amenities, such as hospitals, schools, colleges and institutes, so that industries can have access to skilled labor locally.

Enhance Capacity Building (Skills) Efforts

The WEF Competitiveness Report highlights that countries with a solid innovation capability like Korea, Japan and France, or increasing capability, like China, India and Brazil must improve their talent base. India needs to grow its skills base to create high value jobs. A diverse skill set is required as the production of highly complex and evolving products go up. Government and the private sector in partnership can prioritize skill development activities at the school and college level, as well as apprenticeships, internships, higher education and workforce reskilling and upskilling programs. The government can partner with the private sector and invest resources in higher education sector and include digital and high-tech vocational training targeted to specialize hi-tech component manufacturing.

India should have the potential to become a strategic market for global Innovation and Technology manufacturers with all the human capital having capability to understand advanced and emerging technologies, namely, Artificial Intelligence (AI), the Internet of Things (IoT), robotics, machine learning (ML), etc. The English-speaking technology talent of India with proper training can drive innovation in the high-tech industry, which can further add to the growth of the technology manufacturing sector. Similarly, in the civil aviation sector to achieve 15% – 20% growth in manufacturing 2000 aircrafts are needed for which pilots/engineers are needed along with Investments. The GoI should focus on this area of comparative advantage and invest in specialized skilling institutes on a PPP model.

CUT COST OF DOING BUSINESS

Improve Execution of Infrastructure Project and Prioritize

Passage/Implementation of Logistics Policy To Reduce Cost Of Moving Goods Infrastructure development in India will be a critical factor to ensure the success of Atmanirbhar Bharat Initiative, as the success of the manufacturing sector will be contingent on the conducive infrastructure they operate within. USISPF welcomes the recent steps by the Government, particularly the launch of the National Infrastructure Pipeline and we believe that it will uplift and improve the national infrastructure, which will also aid the manufacturing sector in the country. We would like to submit, for the Government of India’s further consideration, some recommendations on Project Development and Improved Connectivity that could aid the existing policy and regulatory environment for infrastructure development.

Infrastructure Project Development

USISPF recommends the government to induce further private sector investment in the country to aid in infrastructure development projects, via the Public Private-Partnership (PPP) model that has proven to be successful in the recent years. USISPF would like to submit the following long- term and short-term recommendations on this matter:

Long-term priorities

- Develop structural solutions (e.g. a government nodal office) and mechanisms for centralized coordination of policy and regulatory issues from tendering to execution of long-term projects.

- Create an Infrastructure Regulatory Council/ General Infrastructure Council of experts that is mandated to overlook all aspects of PPPs in India – from regulation, to issue resolution to skills development.

- Identify 1-2 pilot projects/sectors for a deep dive on specific issues and challenges and to prepare a set of recommendations/white paper by the HLWG. Potential sectors can include Railways, Ports, or others.

Short-term priorities

Develop a model PPP contract for implementation of infrastructure projects in India. This contract should be prepared in consultations with the government and & private sector and should incorporate aspects related to:

- Appropriate distribution of risks for controllable and uncontrollable factors.

- Arbitration of international standards.

- Best practices from successful infrastructure projects from other emerging and developed

Improved Connectivity

The foremost consideration for a business while deciding to set up a manufacturing unit, is the cost efficiency. Integrated logistics and manufacturing activities can result in substantial cost savings and efficient business operations. Aspects like rail/road/port connectivity should allow manufacturers and logistics companies to work closely without geographical considerations and without policy restrictions. Ease of connectivity to airports/ports/national highways is a must.

The present multi modal mix is skewed towards road. While Highways have been developed well in the Central Indian Provinces, this needs to be extended to other parts of the country. USISIPF members find the Entry Tax system for states too cumbersome causing delays, E-Way bill system is not working properly in all parts of the country due to lack of broadband availability in all checkposts.

India should adopt a model, such as Industrial Corridors, that allows manufacturers and logistics companies to work closely without geographical considerations. Industrial corridors integrate logistics and manufacturing activities resulting in cost savings and efficient business operations.

Aspects like rail and road connectivity in these corridors can be planned and implemented so that the entire operation can function seamlessly. To incentivize manufacturing into these corridors, governments can consider subsidizing business operations

With the advent of global value chain manufacturers, India will also need to encourage operations of multinational logistic services providers. GVCs often use express delivery service providers to ensure uninterrupted and timely delivery/shipment of consignments. We recommend that priority be given to facilitate operations of global Logistics companies that can freely provide solutions to the supply chain participants.

Our express delivery member companies have voiced concern regarding the uncertainty in business continuity due to the existing licensing regime that provide discretionary power to the authorities to cease the license from express delivery service provider. Foreign investors lose trust if the policy environment is not conducive enough to bring a sense of stability. Government policies and laws should not mandate usage of specific modes of delivery, leaving it at the discretion of the logistics companies and the manufacturers; this will facilitate reliability of supplies in the chain.

Optimizing modal mix and continued impetus to dedicated freight

corridors

Critical to meeting demands of growing freight traffic and removing inefficiencies is achieving the right modal balance i.e. rail and waterways for long distances, rail for medium and roads including expressways for short distances including last mile connectivity. Therefore, USISPF recommends that India adopts a balanced network design that enables the railways to capture a larger share of the freight traffic and redirecting investments towards the railways.

An efficient network design will have increased investment in railways to create capacity on high density corridors and thus augment movement of a greater volume of traffic on existing rail track infrastructure. Under the Eleventh Five Year Plan of India (2007–12), the Ministry of Railways started constructing a new Dedicated Freight Corridor (DFC) in two long routes- the Eastern and Western freight corridors. Once operational, they will lead to a shift of close to 70% of the freight traffic towards these corridors, strengthen India’s present rail infrastructure to carry additional traffic and achieve reduction in cost of transportation. Under the Golden Quadrilateral Freight Corridor (GQFC), funding for four additional freight corridors has been approved and is expected to be implemented.

The government should continue to fund these infrastructure investments given low private sector appetite and pursue public private partnerships in smaller and service focused infrastructure.

Warehousing

A fully operational statutory framework is critical to achieving success at the policy level. Emphasis should be given to the operationalization of Warehousing in the existing state policy frameworks and where these are missing, states should be given timelines to create and implement their independent policies re Warehousing. The Center can assist the states by providing centralized data resources of guidance on policy formulations and institute a monitoring mechanism. Creating a competitive environment between states to attract investments in warehousing would prove beneficial.

Supplier Ecosystem and Costs

While “Make in India” was a great initiative, it did not take off as envisioned because supply chains were not complete and raw material/components are not available within India. In Auto industry its only now after so many years that 75% localization has been received. However, in Hi-tech sectors, such as healthcare, aerospace and electronics, the lack of ecosystem is a major concern for global manufacturers.

Ecosystem needs to be developed. Where supplier ecosystems are weak and key components are not available locally in India, the Government needs to reduce high tax and duty burden on imports of the products/components. A convergence between transfer pricing regulation and income tax benefits and customs would address existing anomalies.

Global value chain participants need free access to raw material and components for uninterrupted supplies. Until the feedstock is not available locally, the Government needs to facilitate imports of inputs at competitive prices by removing tariff and non-tariff barriers.

Availability of Raw Material/Components can be improved by:

-Amending Domestic Content Requirements

Domestic Content Requirements are not desirable practices in global markets as they tend to lead to anti-competition and do not provide the level-playing field to foreign players. Domestic content requirements, such as the DPITT Preference to Make in India Order of June 4, 2020 in respect of procurement of capital goods, can sometimes pose challenges to manufacturing expansion plans of global Original Equipment Manufacturers (OEMs) who are using high technology and low volume equipment, depriving them of a level playing field. These requirements will also limit India’s access to investments in high technology products. USISPF members recommend the following policy measures:

- Allow exports from India by global organizations through their India facilities/suppliers to offset to domestic content requirements for government procurement policy. This would bring more investments in high technology and increase the number of high-paying jobs in India.

- GFR (May 15, 2020 amendment) mandates public procurement below INR 200 crores ($26 Million) through domestic open tender. This restricts foreign manufacturers or its dealers importing certain special-purpose equipment and parts from participation. USISPF recommends that for specialized machinery, procurement of parts be allowed from original OEMs for the life of the equipment; this will ensure the machine operations with maximum safety, efficiency and productivity, not disturbing the anticipated return value on the investments of end-users. When parts are not available from the OEMs, then procurement from open market tenders may be allowed.

- Consider exemption from the May 2020 General Financial Rules (GFR) barring sales from China to foreign companies who have establishments both in China and India; the Order will potentially be detrimental to who have long-term investments plans for India.

-Reforming Trade Policy

India needs to review its trade policy that can strengthen both demand and supply sides. Import substitution policies are not likely to help in the absence of a solid domestic supply base of raw materials and components. USISIPF recommends the following:

- Reduce peak tariffs and rationalize inverted duties. Domestic industry efficiency can be increased through competition rather than protection.

- India can only make for the world and increase its manufacturing capability, if trade barriers are removed. Facilitation of imports of inputs/components is essential in the absence of a strong ecosystem within the country. U.S. manufacturers in India continue to struggle with market access restrictions ranging from tariffs differing from bound rates to technical barriers to trade, such as duplicative testing requirements and domestic standards.

- Adhere to globally accepted standards boost exports with inherent trust on quality and safety among wide number of stakeholders. It helps attracting investments to support domestic manufacturing products of globally acceptable standards.

- Priority Customs Clearances for Information & Technology (IT) goods – The Government has taken proactive measures keeping the customs operational 24×7. Several measures like 24×7 clearance, helpdesk facility, waiver of penalty etc. have also been announced and are welcome. However, the priority clearances are given only to essential goods. IT goods such as laptops, notebooks, services are also used by priority sectors i.e. healthcare, pharmaceuticals etc. Thus, the importers of IT goods should also be given priority clearances; otherwise, business continuity is hampered in the wake of the Covid-19 crisis. The importers are not able to clear the goods from customs port/warehouse and the excess storage of goods is leading to mishandling/damage to the imported cargo. It is recommended to issue a directive to the custodians for safe handling of cargo.

CONCLUSION

In the past five years, India has taken numerous initiatives to improve ease of doing business with an aim to make the environment more conducive for manufacturing. USISPF appreciates India’s initiatives to slash Corporate Tax rates, the introduction of the Performance-Linked Incentive Scheme, GST system, Insolvency and Bankruptcy Code, consolidation of labor laws into four Labor Codes and approval of single-window clearance system. These are positive steps towards creating an ecosystem in the country, however, more focused work in several aspects of the economy will turn India’s endeavor to become a competitive “global manufacturing hub” into reality sooner than later.

If India wants to develop its manufacturing sector to host export manufacturing, it needs to begin by participating in global value chains, for which the Indian industry needs to become competitive. To attract foreign investment and technology in manufacturing sector, India needs to ensure the predictability and stability of regulatory practices while enduring FDI liberalization and ease of doing business. Besides, reforms in land and labor markets are needed to facilitate establishment of factories in India. India can leverage low-cost labor competitiveness by increasing labor productivity through providing enough flexibility in labor laws to enable employers to invest in trainings of the workers. While the Government of India should undertake to facilitate policy measures, industry can partner in the ecosystem by offering technical support and needed investments. Economics of scale can become feasible with a highly productive and innovative workforce backed by skill development programs. The skill development of engineers and operators working in manufacturing units is required to make them competitive in the global scenario. Partnership between the government, academia and the industry can fill technology gaps in the hi-tech manufacturing sector.

With a target of achieving a $5-trillion economy by 2024, India is currently attempting to energize its manufacturing sector through high-tech industries, specifically through establishing a complete component network. An ecosystem needs to be created for exponential growth of semiconductors, as they are used in several hi-tech sectors (aerospace, civil aviation, autos, medical devices, electronics etc.) that can play a major role in accelerating the growth of the overall manufacturing sector and help project India in coming years as the Hi-Tech Manufacturing Hub for the world.