Summary

Following the first report on Enhancing India’s Global Value Chains (GVCs), this report provides a deeper comparative analysis and evaluation of the Ease of Doing Business (EODB) in India vis-a-vis Southeast Asian powerhouses and the emerging economies of Vietnam and Thailand. This report is the second in a series of USISPF Studies conducted to assess India’s competitiveness for participation in GVCs within the high-end manufacturing sector, particularly of electronic components.

This report assesses the costs and ease of moving goods across borders in an era where supply chains have been disrupted due to the COVID-19 pandemic.

Thailand and Vietnam, like the East Asian powerhouse of China and Korea, have grown their economies by leveraging their export potentials which is directly linked to the participation of GVCs. India, a burgeoning Asian giant, wants to enhance its manufacturing capabilities and boost its exports globally. This report indicates the gaps that India needs to fill in order to attract investments from the GVCs.

The report deep dives to understand the reasons and the areas where the present gaps exist and how they can be mitigated and how ease of doing business can be enhanced through timely policy.

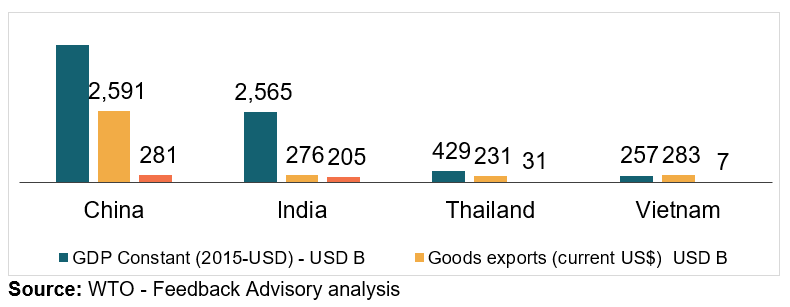

Exports in 2020

Since time immemorial, trade has been the bedrock of economies. The Industrial Revolution saw Britain dominate the 19th century as it manufactured and exported goods all across the planet. An increase in reliable and cheaper communication tools with reduced transportation time, costs and reduced tariffs have proliferated the growth of GVCs worldwide.

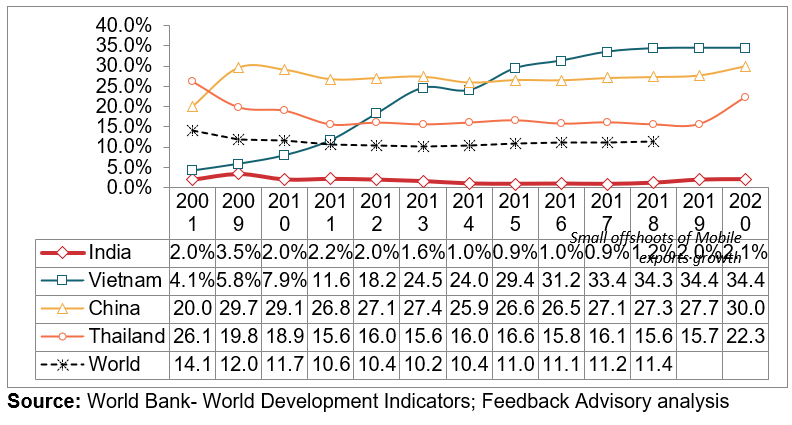

The following chart below tracks the exports across China, India, Thailand, and Vietnam. While China leads the pack and the global economy in exports, the remarkable statistic here is Vietnam, whose economy is a tenth of India’s near three trillion GDP, but has more goods exported than India.

Another observation that stands out is that the share of India’s ICT exports in its total exports has remained almost static @2% over the last two decades. In case of Vietnam, it has grown from 4% to 34% during the same period.

Key Concerns

- Apart from tariffs, there are non-tariff measures (NTM), in the form of policies which preclude tariffs and tariff-rate quotas. Technical regulations on trade have inverse impacts on the economic growth. Multinationals have an alacrity to invest in countries with least NTMs as more regulation preclude foreign direct investments.

NTMs can be broadly divided into two groups technical and non-technical measures.

These can be further divided into:

1) Technical Measures

- Regulatory impact assessment issues, such as conformity assessment of standards

- Testing and Certification procedures

2) Non-Technical Measures

- Compulsory Registration with the Bureau of Indian Standards (BIS)

- Physical Price-labeling requirements

- Delays in Approvals Certification

- Loads of complex documentation at Customs

- Forced Logistics or Distribution Channels

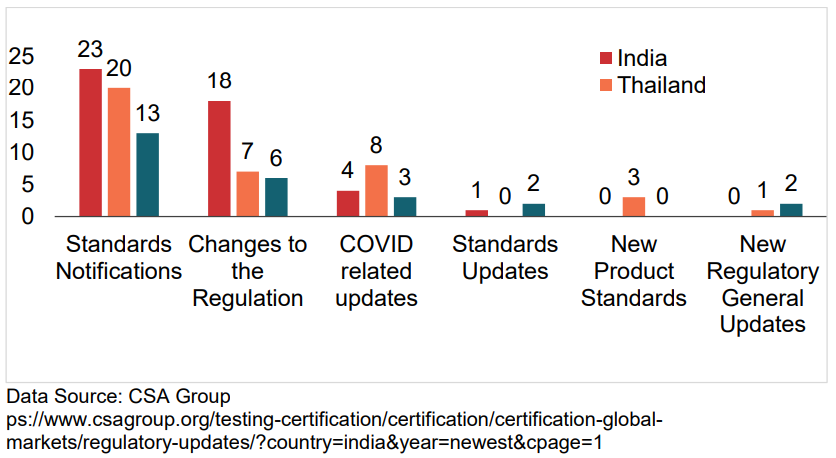

Unpredictable Regulatory Environment

Furthermore, India’s bureaucracy is viewed as a complicated labyrinth of multiple layers of ministries, with regulations in an unstable regulatory climate with frequent changes in conformity assessment.

There are some complex regulations that deter seamless process for businesses in India.

1) Compulsory Registration Order (CRO)

- Whereby manufacturers and importers have to provide the Bureau of Indian Standards (BIS) Registration and test results of products to complete conformity assessment.

- BIS certification time has increased and with no clear Turn Around Time (TAT).

2) Approval For Wi-Fi and Bluetooth-enabled Products

- Significant delays in Turn Around Time (TAT)

3) Risk Assessment of Products Subject to Compulsory Registration

- Applicability of CRO does not appear to be based on risk-assessment analysis

4) E-Pricing Use of Quick Response (QR) Code

- Physical labeling requirements are major barriers to trade. This can often lead to product launch delays.

5) Custom Related Issues

- Excessive and Complex Documentation

- Limited time Period for Re-Importation

- Penalty on Re-Export

- Limitations to the Application of ICT

- Duty Deferment

- Value Addition Criteria for Advance Authorization

- Import of Second-Hand Capital Goods under EPCG

- Repair and Re-export Opportunity

Furthermore, India has higher logistics costs compared to other developed countries, as its excessive dependence on transportation via road for logistics, which is the least economical mode.

Recommendations

The barriers to trade and manufacturing activities can be improved through policy intervention in various areas. While the gap may be significant, India can certainly emulate some of the best global best practices followed across the U.S. and European markets such as combination of conformity assessment routes, supplier’s declaration of conformity and less volatility in policies.

1) Conformity Assessment of Product Standards

The regulatory administration may be improved by

- Adopting self-declaration for products which are under low risk.

- More focus to the Compulsory Registration Order (CRO) compliance.

- Recognizing certification of International Lab Accreditation Cooperation (ILAC) accredited labs

- Improving efficiency in systems and process at Bureau of Indian Standards (BIS) / Wireless and Planning Co-ordination Cell (WPC).

2) Ensuring Policy Stability

Investors are assuaged by stability in policies and deterred by policy volatility. USISPF’s member companies have voiced concern regarding the uncertainty in business continuity due to the existing licensing regime that provides discretionary power to the authorities to cease the license from express delivery service providers. Foreign investors lose trust if the policy environment is not conducive enough to bring a sense of stability.

- Clarity in regulatory policies can be brought by consulting and adopting industry suggestions after drafting rules from those who can provide pragmatic aspects of the business operations.

- Government-wide standards for public consultation. Wherein, government fast tracks responses to queries raised by industry seeking clarifications.

- Implementing the single-window concept in its true spirit can reduce complexities and opaqueness in procedures and rules for approvals and deemed approvals.

3) Improving Custom Procedures

India presently ranks 63 in the World Bank’s Ease of Doing Business (EODB) Index, ascending 14 spots the previous year. Since taking office in 2014, Prime Minister Modi prioritized improving India’s ranking in the top 50 of this Index.

The Central Board of Indirect Taxes and Customs (CBIC) initiated and implemented several reform measures in the recent past focusing on simplifying cross-border trade. This was made possible due to the reduced time and cost of clearance of goods at various customs ports owing to the implementation of measures such as SWIFT, e-Sanchit, revised AEO programme and RFID e-seal programme.

To bring in transparency, more digital acumen, and less human intervention, CBIC introduced the ‘Turant (meaning fast in Hindi) – Faceless Assessment’ for cross-border operations. This is also referred to as Electronic Custom Clearance in developed countries. While this process change is considered a critical reform, it has created few challenges for importers:

- It was expected that the implementation of Faceless Assessment in customs, would reduce the time and cost of clearance of goods. However, it is causing inordinate delays leading to additional costs to the importers.

- Faceless Assessments have adversely impacted businesses of Custom Brokers and Custom House Agents thus resulting in resistance to change.

It behooves that proper coordination and interaction is necessary between trade and customs officials to make this initiative a success. Since the government is determined to roll out such facilitation measures, businesses need to embrace the new mechanism of assessment wholeheartedly. This would require importers to complete the customs assessment process diligently and be certain about the product classification, customs duty rate and valuation of the imported products as it can be tested by new sets of officers, who were not dealing with assessment earlier.

4) Improving Logistics

A constant critique has been the infrastructure laggard and inefficient logistics that preclude efficient mobility for supply chains. For this, our recommendation is to:

- Improve the pace of execution of infrastructure projects.

- Enhance connectivity across all modes of transport.

- Build better warehouse operations.

- Encourage use of multi-modal means of transport

Conclusion

Addressing these gaps through adoption of global best practices in standards and customs, ensuring a reliable policy environment while enhancing and streamlining logistics, can certainly help boost India’s global share of exports.

This will also help Asia’s third largest economy attract fresh investments to further develop its manufacturing sector, as India’s electronics manufacturing sector can play a vital role in realizing India’s goal to be self-reliant (Atmanirbhar) in its true spirit.