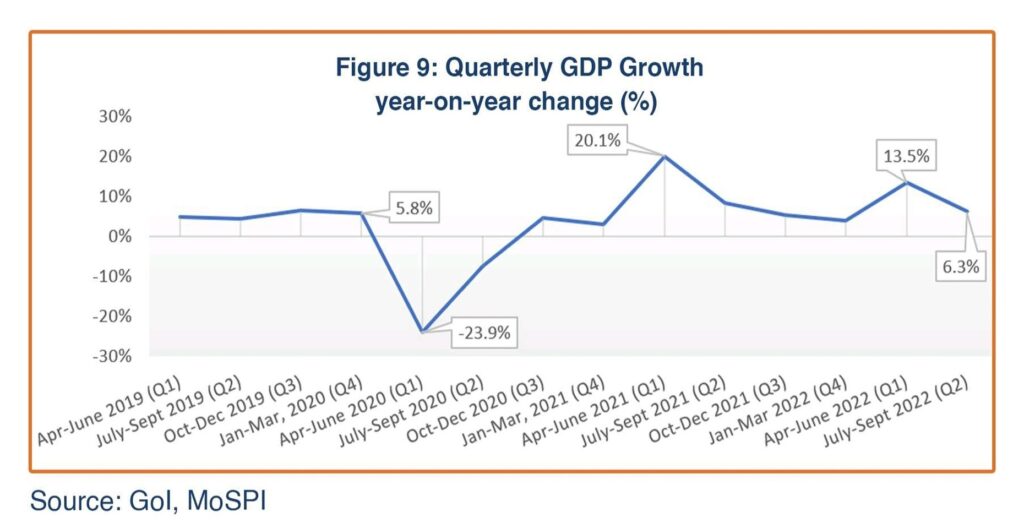

India’s economic performance for December 2022 showed progress, with positive movement in demand, input purchases, and monetary indicators, on top of an impressive recovery in industrial output. However, an increase in urban unemployment, a static trade deficit, and reduced capital expenditure in December were worrying spots. Nevertheless, the Indian economy is treading on a firm growth path post-COVID, posting 6.3% growth for the second quarter of fiscal year 2022-23 (July-September 2022).

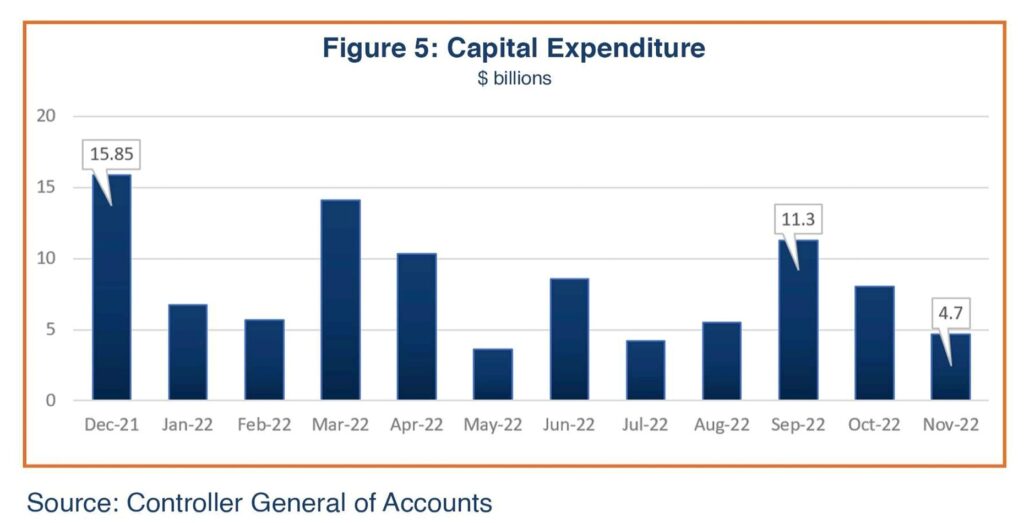

Retail activity in December 2022 continues to improve on the back of the festival/wedding season, with sales value gains of 16% over the corresponding pre-Covid period of 2019 value. On the supply side, the Markit Purchasing Managers’ Indices (PMI) for Manufacturing and Services improved significantly to 57.8 and 58.5, respectively. The overall unemployment rate in December rose to 8.3% from the previous month’s 8.0%, albeit with better labor participation in urban areas. Goods and Services Tax (GST) and rail freight revenues were steady in tandem with the market activities and increased compliance. but capital expenditure was down to $4.7 billion from $8 billion in the previous month.

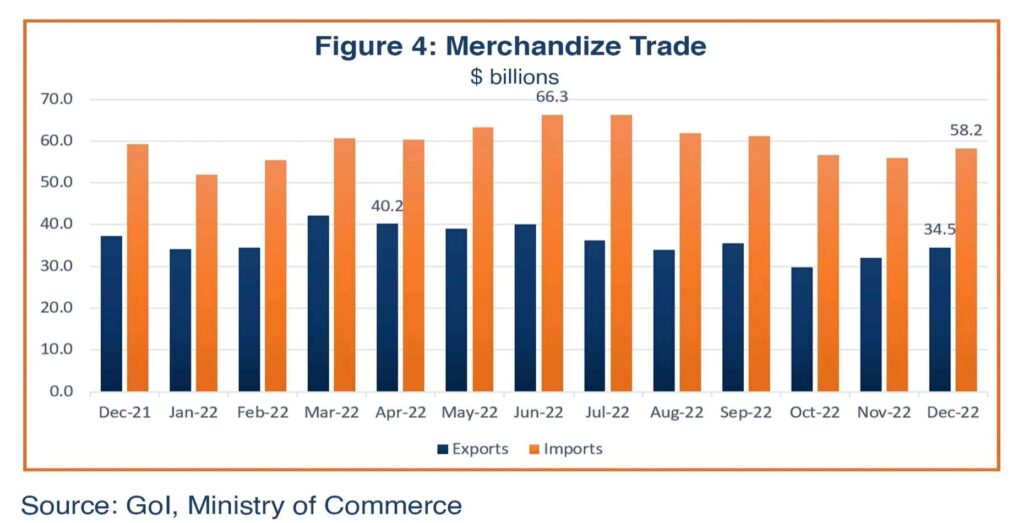

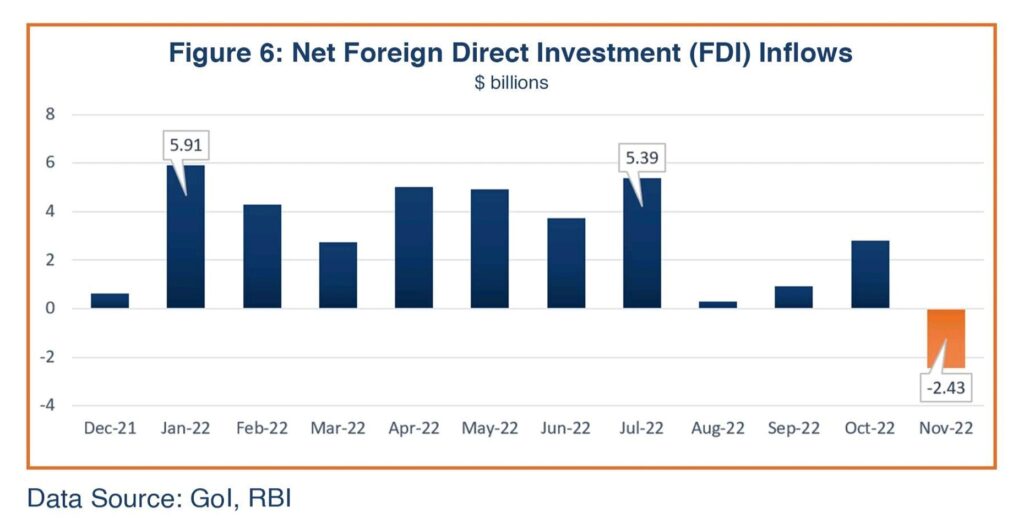

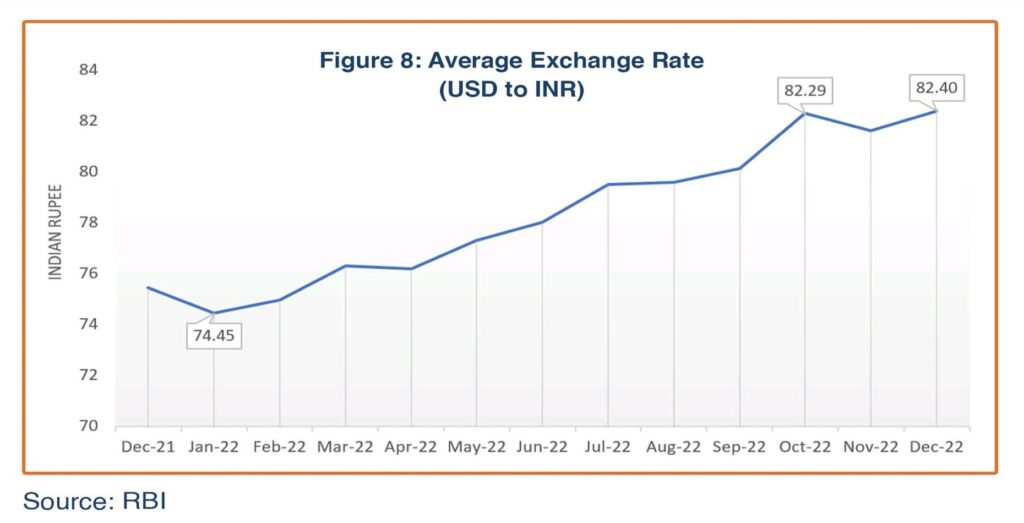

Despite currently facing a volatile global recession, Indian exports posted 7.8% sequential growth in December 2022; future export performance will depend upon the degree and the length of the global economic slowdown. Imports rose to $58.24 billion from the previous month’s $55.9 billion, and the trade deficit was constant, falling marginally to $23.8 billion from $23.9 billion in the previous month. Net FDI flows fell significantly, from a net inflow of $2.8 billion in October 2022 to a net outflow of $2.43 billion in November (latest available). India’s foreign exchange reserves improved to $563 billion by December-end from $561 billion a month earlier, but the Indian Rupee tumbled to an average of 82.40 against the US Dollar from 81.77 in the previous month.

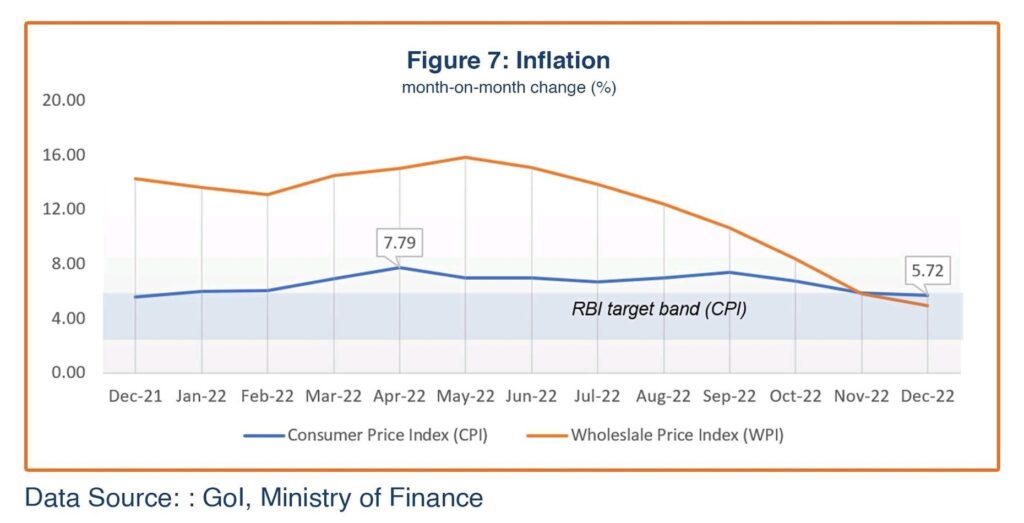

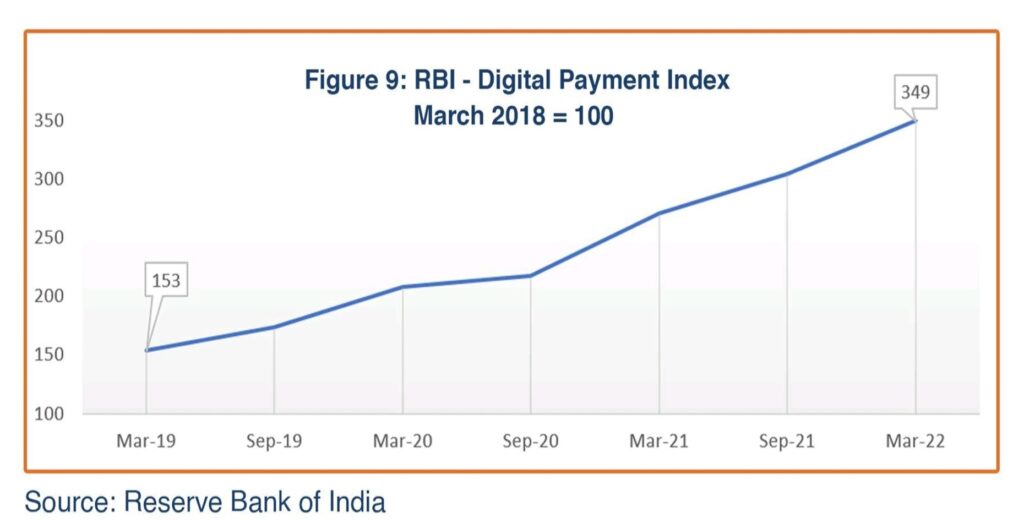

Easing vegetable and fruit prices led the fall in the consumer price index (CPI), which dropped to 5.72% in December 2022 from the previous month’s 5.88%, which was the lowest level in 2022 and, more importantly, below the RBI target of 6.0% for the second month in a row. The RBI has kept its forecast of retail inflation for fiscal year 2022-23 at 6.7% due to the continuing uncertainty of food price pressures and global risks of costlier imports. The wholesale price index (WPI) further dropped significantly to 4.95% in December from 5.85% in the previous month. The narrowing gap between the CPI and WPI indicates good management of inflation. The RBI-Digital Payment Index (RBI-DPI) continues its four-year rise, promoting greater liquidity in the market.

After recording an impressive cumulative growth of 9.6% during the first six months of FY2022-23, the Government of India is now preparing to announce its Union Budget FY2023-24 on February 1. A senior IMF official recently reiterated that she expects 2023 to be a tough year amidst the continuing war conditions, global inflationary challenges, and COVID related supply disruptions. Although India has shown a reasonable resilience to these challenges and its inflation rate is showing positive signals, yet the policymakers have a daunting task to manage its fiscal consolidation while increasing investments (read capital expenditure) and keeping inflation under control. Also, the external sector faces uncertainties from geopolitical tensions, a depreciating currency, and toughening global trade conditions. Due to these uncertain global concerns, the government expects India’s growth in fiscal year 2022-2023 to reach between 6.8% and 7%.

Demand Recovery Trends

Retail sales in December 2022 showed an uptrend in consumption demand. Vehicle sales were down 15% from the previous month due to seasonality and moderating exports but auto companies hailed continued passenger vehicle sales despite higher auto loan and long-term insurance costs. The RBI reported healthy growth in bank credit at 17.4% at the end of December, compared with 17.2% a month ago, even though the cost of credit remains high due to liquidity tightening. The monthly Retailers Association of India (RAI) survey reported 16% higher sales during December compared to the pre-pandemic sales recorded for December 2019, and with easing consumer inflation retailers reported higher sales for apparel, home decor, beauty, personal care, quick service restaurants, footwear, food, and grocery. That said, the growth is “cautious”, according to the RAI survey, as the consumer is still grappling with some lingering inflationary challenges. A sustained reasonable rise in retail sales during the first nine months of the current IFY2022-23 suggests domestic demand will drive overall annual economic growth.

Supply Side Dynamics

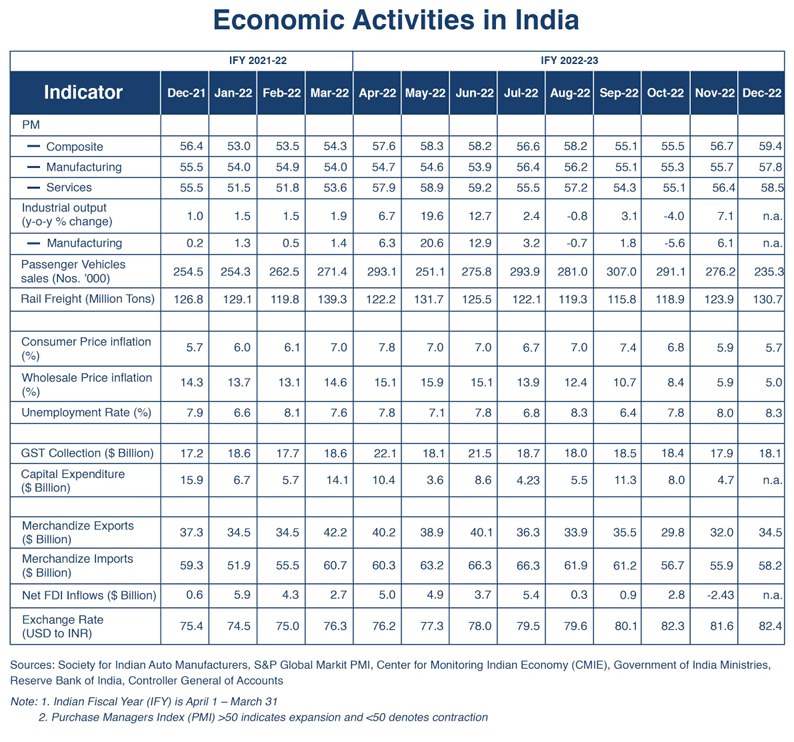

Input Purchases

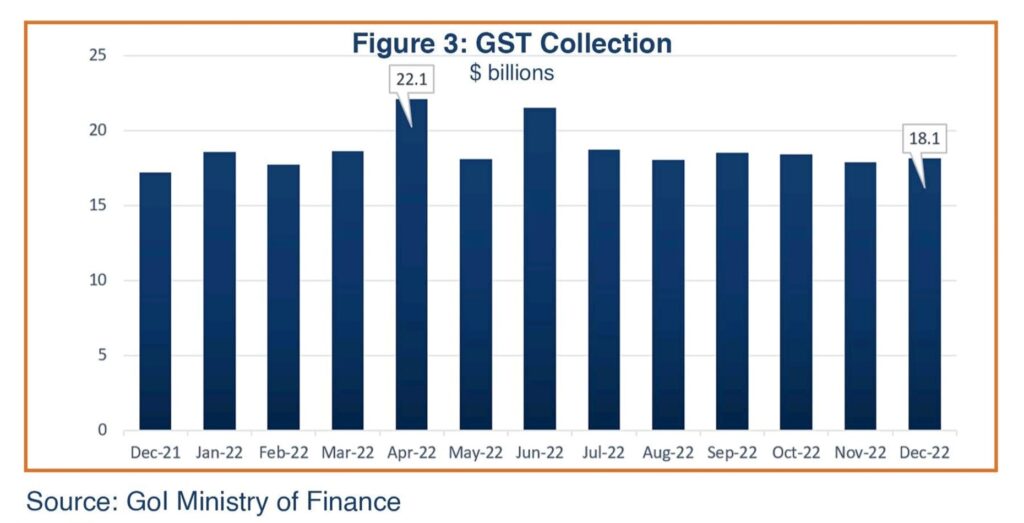

The overall business sentiment in December 2022 was significantly higher than in the previous month, with the Composite Markit Purchase Managers Index (PMI) accelerating from 56.7 to 59.4 (its highest level in over a decade), recording faster expansion in manufacturing and services activities (Figure 1). A PMI above 50 reflects the optimistic mood of businesses that have made bold input purchases in anticipation of increased demand. The Services index soared to 58.5 from 56.4, and the Manufacturing PMI index peaked at 57.8, up from 55.7 the previous month. These trends suggest a sustained recovery in service economy but an erratic recovery in manufacturing. According to S&P Global, new orders grew sharply and at the fastest pace since August, supported by quicker expansions at goods producers and services firms, and foreign sales also improved, albeit at a slower pace; in terms of foreign orders, India and Ireland were the only economies in the world that have done well in December. The PMI Survey notes that employment indicators were better as capacity pressures remained mild.

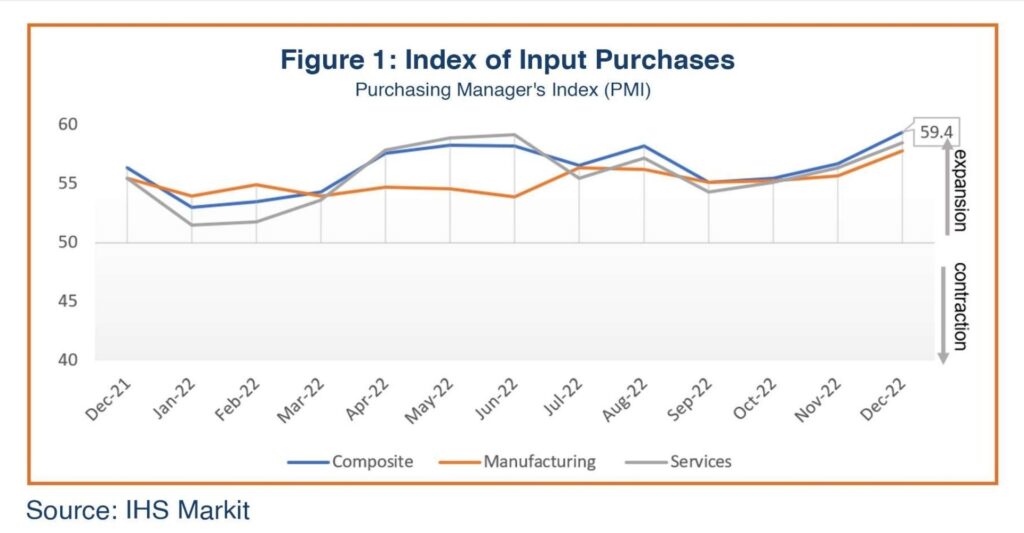

Industrial Production

Total industrial production expanded 7.1% in November 2022, reversing the previous month’s moderation of 4.2%, on the back of a substantial increase in mining and electricity output (Figure 2). Growth across all segments recovered compared to the previous month, generating an acceleration in the overall growth of industrial output. Manufacturing, which accounts for 77% of total industrial production, recovered to 6.1% growth on a year-on-year basis in November compared to a 4.2% contraction the previous month; mining output, which comprises 14% of total industrial output, spurred to 9.7%, compared with the growth of 2.5% in October; and the growth rate in electricity production (8% of total industrial production), at 18.8% was up significantly from the 1.2% growth recorded in the previous month. Capital goods production within the manufacturing sector showed 20.7% growth in November, more than double the 10.3% growth in the previous month, suggesting remarkable growth in investments. The trajectory of industrial output throughout the year has remained erratic, hinting at uneven recovery due to unfavorable geopolitical challenges and supply chain disruptions

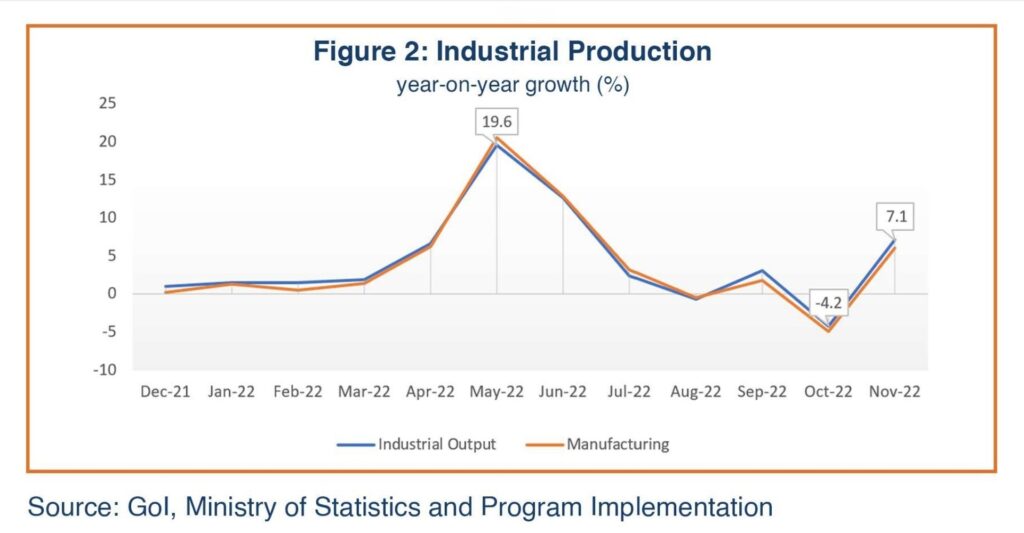

GST Revenues

Goods and Services Tax (GST) collections have been ranging between $18 and $18.5 billion since the beginning of second quarter of the current fiscal year 2022-23. The GST collections for December 2022 were estimated at $18.1 billion (Figure 3). Analysts have indicated that GST collections are reflective of increasing economic activities, increased rates and increased compliance.

Trade

India’s merchandize exports rebounded 7.8% in December 2022 to $34.5 billion from the previous month’s $32 billion (Figure 4). India’s export performance for the first quarter of the current fiscal was outstanding; exports slowed in the second quarter but the whole year is expected to witness growth despite the continued gloomy economic conditions globally. India’s exports in December performed well in commodity groups. such as electronic goods, iron ore, petroleum products, oil meals, tea, rice, tobacco and cereals despite the persisting global economic slowdown. Tea and coffee exports are expected to rise due to India’s recent initiative allowing the local currency in international trade settlements. Export of cotton yarns nosedived due to the continuing rise in the price of raw materials, and India’s textile sector has been severely hit due to suppressed global demand. India’s top export destination in the current fiscal has remained the United States, with exports growing 6.8% y-o-y to $59.57 billion, followed at a distance by UAE, with exports at $23.13 billion.

India’s merchandize imports at $58.2 billion in December were up 4.2% from November’s $55.9 billion, mainly due to continuing high demand in the domestic market. Imports are generally directly related to industrial activity and India witnessed an increase in economic activities in December. India remains a major importer of fuel to fill its increasing domestic demand supply gap. That said, India’s oil import bill (circa 40% of the total import bill) remains a cause of concern in the management of its current account.

Even though exports grew faster than imports in December 2022, the merchandize trade deficit of $23.76 billion remains a concern for India’s external sector and macroeconomic balance, putting potential pressure on the value of the domestic currency going forward.

Government Capital Expenditure

Capital expenditure growth has been moderating since the beginning of the current fiscal year 2022-23; it peaked in September at $11.3 billion but again went downward in October and November (Figure 5 – latest available data). The finance minister expects to meet the fiscal deficit target of 6.4% of GDP in 2022-23, which is a much lower deficit than the 9.3% recorded in the previous two COVID years. Though the Government is faced with the challenges of low privatization receipts and expenditure pressures, it is still expected to trim the fiscal deficit target to less than 6% in its budget for the next fiscal year (2023-24). Businesses expect the next budget to include direct tax reforms, lower import tariffs and an increase in capital expenditure. Capital expenditure growth has been moderating since the beginning of the current fiscal year, though an uptick was visible in September (Figure 5-latest available data). The finance minister has recently reaffirmed her Ministry’s claim to meet the fiscal deficit target of 6.4% of GDP in 2022-23, asserting that there is no fear of stagflation. The government has repeated that it will continue to focus on increasing capital expenditure while reducing revenue expenditure.

Foreign Direct Investment (FDI)

Foreign direct investment (FDI) equity flows showed mixed trends throughout fiscal year 2022-23. Net FDI in July peaked in the current fiscal at $5.39 billion, after which no significant inflows are seen and the inflows reversed drastically, becoming a $2.4 billion net outflow in November (Figure 6-latest available data).

Inflation

The overall inflation trajectory seems to be improving despite continued uncertainties in international commodity prices. The consumer price index (CPI) further moderated to 5.72% in December 2022 from 5.88% in November, remaining below the RBI’s safety ceiling of 6.0% for the second consecutive month (Figure 7). The drop in CPI was mainly due to a more than expected fall in food prices, which account for about 40% of the CPI total. Despite continuing supply-chain disruptions owing to ongoing geopolitical tensions, prices were generally lower, mainly on account of the usual seasonal changes in food prices. The RBI continues to monitor prices, stating it projects inflation to remain above 4% for majority of 2023. The RBI has raised the benchmark repo rate by 225 basis points since May to 6.25%.

Wholesale Price inflation in December dropped substantially to 4.95% from 5.85% in November, the lowest level in two years, mainly due to broad-based growth in manufacturing and services. Business sentiment is expected to improve following further easing of input prices. Now, the Indian government has suspended duty-free imports of soyabean oil under the Tariff Rate Quota regime as edible oil prices across the globe have softened. According to the Solvent Extractors Association of India, the price of palm oil has dropped 30%. while soybean oil rates have declined 10% and sunflower oil prices have slid by 7% in the global market.

Foreign Exchange

India’s foreign reserves were $563 billion at the end of December 2022, gaining approximately $2 billion from November end. Until September 2022, the RBI had intervened intermittently in the foreign exchange market for liquidity management, including the selling of dollars, to manage depreciation in the rupee, which resulted in reduction of exchange reserves. Foreign capital outflows and higher international prices also contributed to slumping foreign exchange reserves and depreciation. The Indian Rupee touched its weakest level, 82.97/USD, on December 19 and the average monthly exchange rate for December peaked at 82.40/USD, above than previous average peak of 82.29/USD recorded in October 2022 (Figure 8). The Rupee recovered a tad due to restored sentiment in foreign fund inflows in capital markets and the growing impact of the RBI decision in June 2022 to allow global trade in rupees.

Digital Payments

India is seeking to become a cashless society, pushing consumers to adopt online payment methods. The continuous rise in the RBI Digital Payment Index (RBI-DPI) reveals an increasing trend in digital payment use over the last four years and observers expect it to continue its growth trajectory (Figure 9). Expanding digital payments will improve liquidity flow in the market, cutting down the cost of cash flow management.

The RBI formulated its Digital Payment Index to assess the extent of digital payment operations across India. Published with a lag of four months, the RBI-DPI includes payment parameters, namely, enablers (such as Internet, mobile, bank accounts, Aadhaar, traders etc.), demand and supply infrastructure (such as credit/debit cards, mobile/Internet banking, bank branches, business correspondents, ATMs, QR codes, and intermediaries), performance (such as volume and value of digital payments, cash withdrawals, unique users, currency in circulation etc.) and consumer centricity (awareness and education, declines, complaints, frauds, and system downtime).

Economic Outlook

The second quarter (July-September 2022) GDP growth rate in India slowed to 6.3% from 8.4% in the corresponding period of the previous year (Figure 10). The RBI in its recent monetary policy statement noted that the near-term growth outlook remains weaker than previously expected. It has revised its forecast for the current fiscal GDP growth down to 6.8%, in line with the IMF’s forecast, which reflects extended geopolitical tensions and continuing aggressive monetary policy tightening globally. However, the World Bank has recently made an upward revision in its 2022-23 growth forecast for India, to 6.9% from 6.5% previously, on account of stronger consumption and increased domestic economic activity.

Businesses have welcomed the easing of inflation. The narrowing gap between input and consumer prices will send positive signals to the business community and lift demand sentiment and output levels. Industrial and manufacturing output have shown a diverse growth pattern during the first eight months of the current fiscal year. Continuing volatility in global inflation management, as well as uncertain export orders, will likely make a significant difference in the performance of the economy and India’s growth outlook in coming months.

Gita Gopinath, First Deputy Managing Director and former Chief Economist at the IMF, cautioned recently in Davos that the global economy may face a tough year ahead because of the uncertainties around the world, and that while headline inflation may have peaked in some sectors it is still trending up in some countries, which may hamper the global growth further. Major economies around the world, including India, face challenges from currency depreciation and the impact of global recession, but Indian policymakers have voiced confidence they will weather the challenges because of India’s strong financial sector, rising private capital expenditure, better control on inflation, and reviving foreign exchange reserves. The government will present its Union Budget 2023-24 on February 1, amidst geo-political uncertainties, high inflation and slowing world economic growth. Economists and the business community expect an announcement of calibrated fiscal measures that may push domestic sources of growth to maintain the steady economic growth trajectory in the coming years. Overall, India’s economic growth outlook depends on private investment expenditure and the magnitude and length of the global recession.