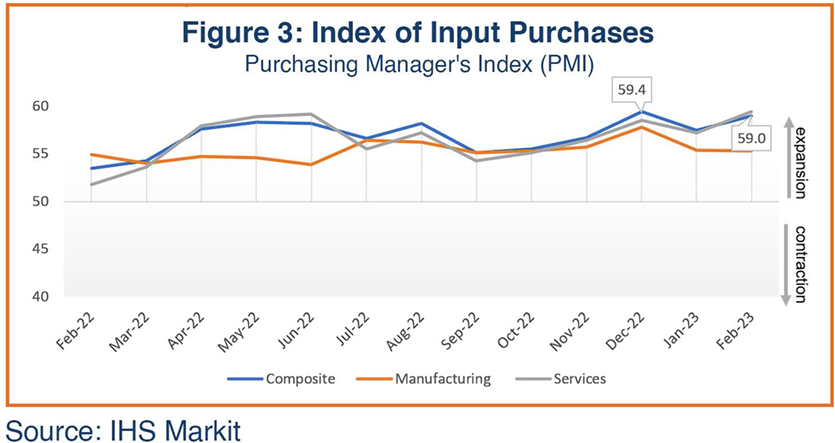

India’s economic performance for February 2023 reflected diverse trends – featuring a slowdown in exports, stagnant demand, a weaker currency, and lower foreign exchange, but the pick-up in manufacturing output and capital expenditure, and a marginal reduction in inflation, were encouraging. Overall, India’s economic recovery continues but it remains patchy and slow.

Retail activity in February 2023 continued to improve, but at a relatively slower pace, with sales value gains of 10% over the corresponding pre-Covid period of February 2020. On the supply side, the Markit Purchasing Managers’ Indices (PMI) for Manufacturing and Services both recorded expansion. The overall unemployment rate in February, however, increased, mainly due to the seasonal factors impacting rural employment. Goods and Services Tax (GST) and rail freight revenues were steady in tandem with the market activities and increased compliance, and capital expenditure was up from the previous month.

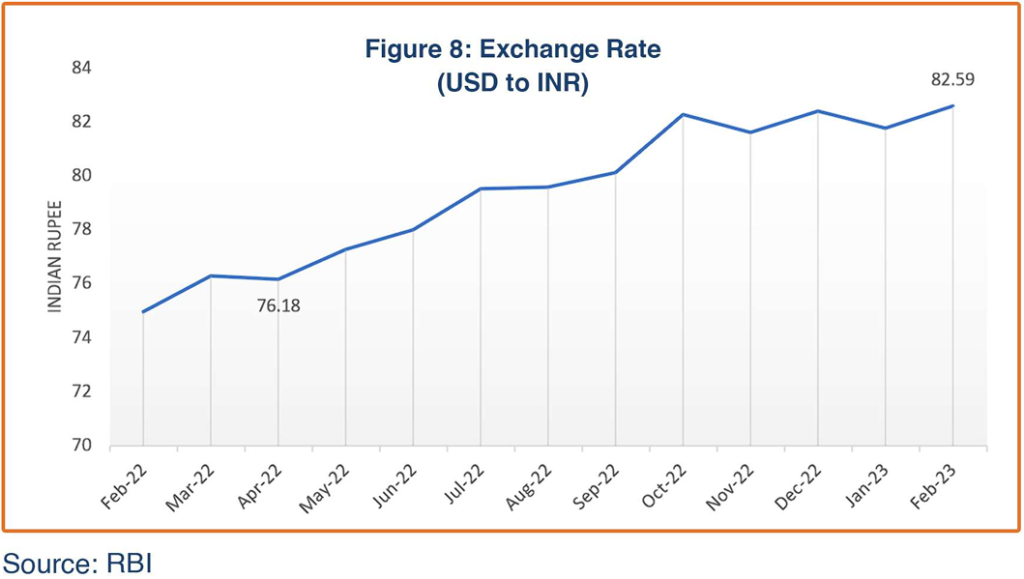

As anticipated, currently facing a volatile global economy, India’s exports and imports in February were stagnant or registered only a small increase, and the trade deficit was down marginally from the previous month. At the same time, net FDI flows more than doubled in January 2023 from the previous month (latest available). India’s foreign exchange reserves decreased to $562 billion in February and the Indian Rupee depreciated to an average of 82.59 against the US Dollar, from 81.76 in the previous month.

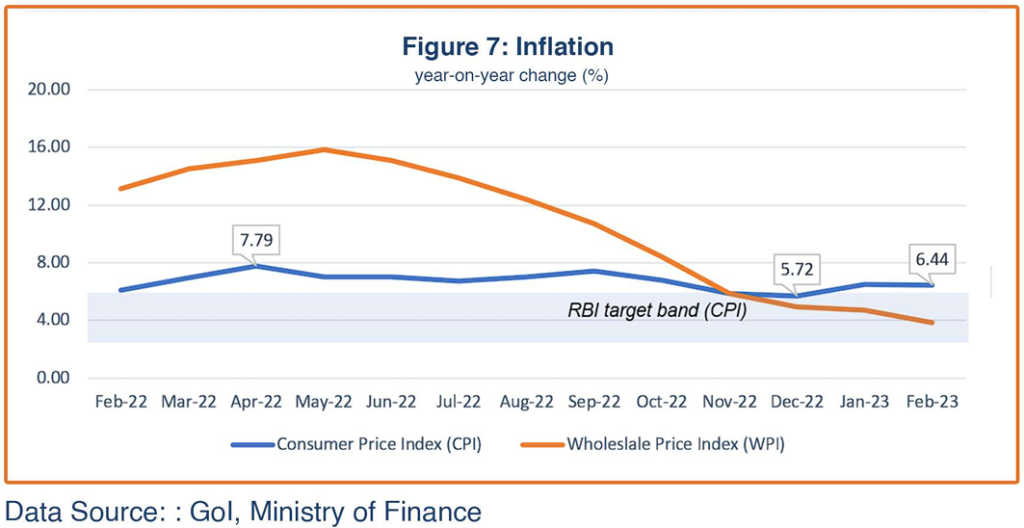

CPI inflation dropped a tad to 6.4% in February 2023, yet above the RBI target band of 2%-6%, led by higher food prices; core inflation also rose beyond 6%. The wholesale price index (WPI), in contrast, dropped to 3.9% in February, maintaining its downward trajectory for the last nine months.

India recorded 4.4% growth for the third quarter of IFY2022-23 (October-December 2022), on the back of a strong performance in the agriculture and services sectors. Growth in the manufacturing sector has been uneven throughout the current fiscal year and it has become a cause of concern.

The Government of India presented its Union Budget FY2023-24 on February 1, which included enhanced capital expenditure that the government hopes will help in crowding private investments. With a resilient financial system, a growing services and agriculture economy that drives a strong demand, and an emphasis on infrastructure development, India’s growth outlook appears bright in the long term. However, an uneven recovery in its manufacturing sector and uncertainty in the exports sector may dent India’s economic growth prospects in the short term.

Demand Indicators

Retail sales in February 2023 showed an uptrend in consumption demand, but the increase was relatively lower than the previous several months. Driven by demand for cars and utility vehicles, passenger vehicle sales moderated by 2% from the previous month, depicting a sustained overall positive sentiment in the market despite higher auto loan costs. The RBI reported healthy bank credit growth at 15.5% at the end of February, compared with 16.3% a month ago, even though the cost of credit remains high due to liquidity tightening. The Retailers Association of India (RAI) survey reported 10% higher sales during February 2023 compared to the pre-pandemic sales recorded for February 2020, but rapid growth in categories such as consumer durables and electronics, food, and groceries. The sustained, reasonable rise in retail sales during the current IFY2022-23 suggests domestic demand is the main driver of the economic growth for the year.

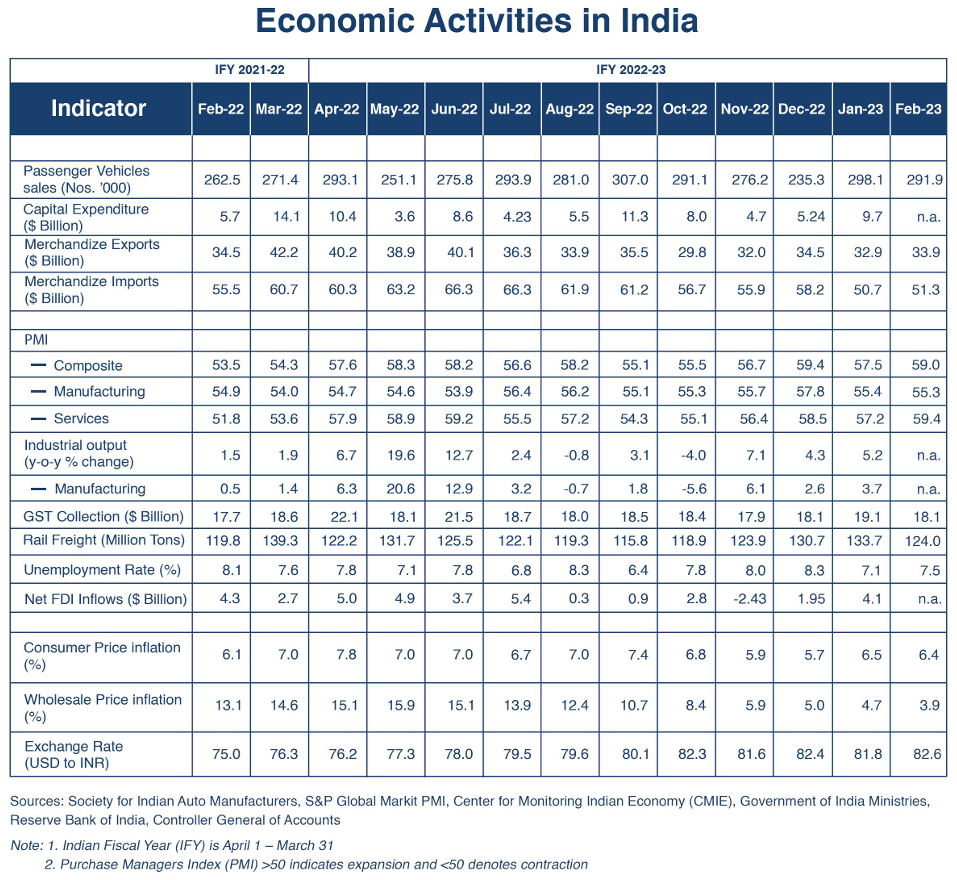

Government Capital Expenditure

Capital expenditure growth has been patchy for the entire fiscal year 2022-23 so far (April 2022-January 2023 Figure 1). The finance minister expects to meet the fiscal deficit target of 6.4% of GDP in 2022-23, which is a much lower deficit than the 9.3% recorded in the previous two COVID years. Though the government is faced with the challenges of low privatization receipts and expenditure pressures, most analysts still expect it to achieve a fiscal deficit below 6% in the next fiscal year (2023-24). The Union Budget 2023-24 released in February, reiterates the government’s goal of lowering the fiscal deficit below 4.5% of GDP by FY2025-26.

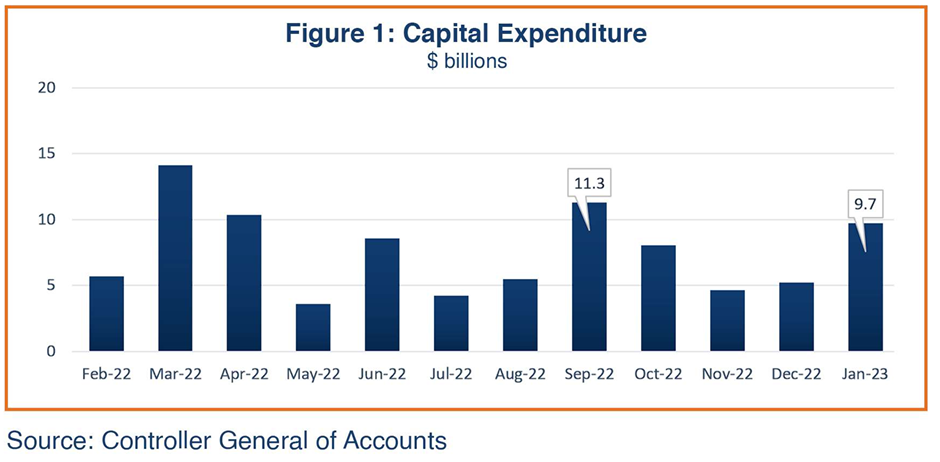

Trade

India’s merchandize exports were up 3% in February to $33.9 billion from the previous month’s $32.9 billion (Figure 2). Export performance in the first quarter of the current fiscal year was robust but slowed from the second quarter. Exports of iron ore, jewelry, electronic goods, spices, and oil-meals picked up in February 2023 while several categories witnessed deceleration in export sales, such as petroleum products, textiles, plastics, chemicals, and engineering items.

India’s merchandize imports, at $51.3 billion in February 2023, were marginally up from the previous month’s $50.2 billion. India remains a major importer of fuel to meet its increasing domestic demand, but a marked reduction was printed in imports of gold, silver, pearls and stones, cotton, fertilizers, and metal ores. India’s trade deficit in February 2023, at $17.4 billion, was also marginally lower than the previous month’s $17.8 billion.

Supply Side Indicators

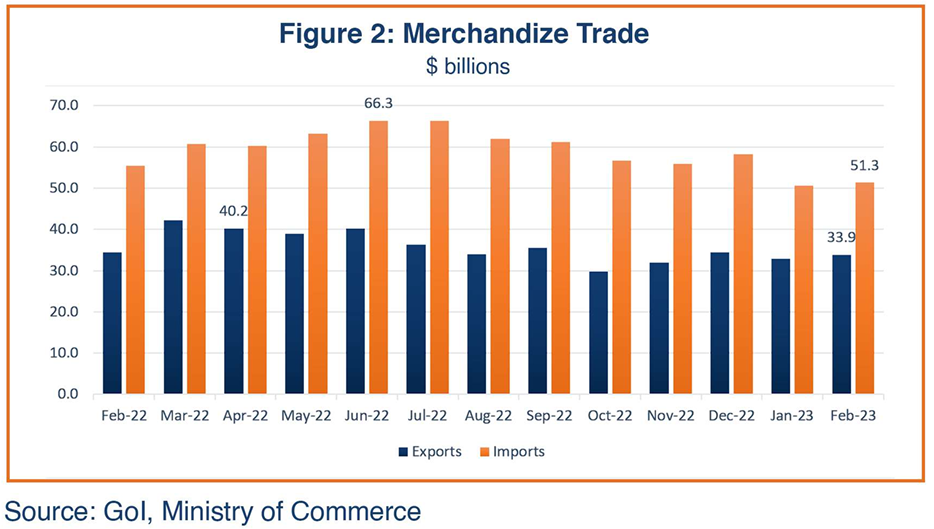

Input Purchases

Overall business sentiment in February 2023 was upbeat with the Composite Markit Purchase Managers Index (PMI) rising to 59 from 57.5 recorded in January 2022, indicating an uptick in manufacturing and services activities (Figure 3; a PMI above 50 reflects the optimistic mood of businesses that have made bold input purchases in anticipation of increased demand). The latest reading recorded straight expansion in business activities over the last 19 months. The Services PMI was buoyant at 59.4 from 57.2, and the Manufacturing index was largely stagnant at 55.3 from January’s 55.4.

Trends for the majority of the current fiscal year suggest a sustained recovery in India’s service economy. According to S&P Global, new orders grew sharply, indicating strong underlying domestic demand in February 2023; but global demand was at its lowest since the beginning of the year. The latest PMI Survey also notes job creation failed to gain meaningful traction as firms did not do much hiring.

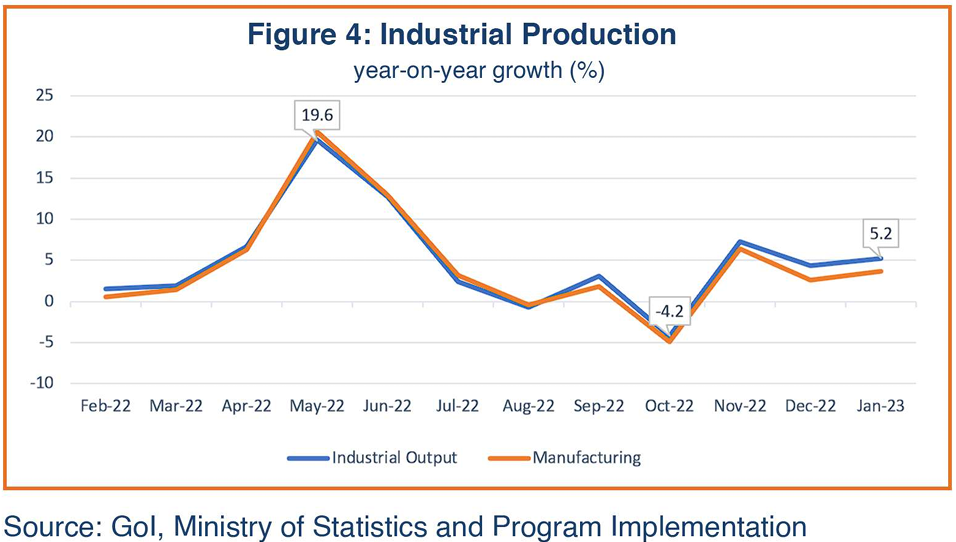

Industrial Production

India’s industrial production growth on a year-on-year (y-o-y) basis accelerated to 5.2% in January 2023 from 4.3% in December 2022. Increases in industrial production were led by electricity, mining, and manufacturing output (Figure 4). Growth across all segments recovered compared to the previous month, generating an acceleration in overall industrial output growth. Manufacturing, which accounts for 77% of total industrial production, recorded 3.7% growth, compared with an upwardly revised 2.6% growth in December 2022; mining output growth, which comprises 14% of total industrial output, at 8.8% was down from 9.8% in the previous month; and the growth rate in power generation (8% of total industrial production) was impressive at 12.7%, even higher than the 10.4% recorded in the previous month. Capital goods production within the manufacturing sector increased 11% in January 2023, compared to 7.6% growth recorded in December 2022, suggesting a growth in investments. The trajectory of industrial output throughout the year has remained erratic, suggesting an uneven recovery, and reflecting the impact of persistent supply chain disruptions.

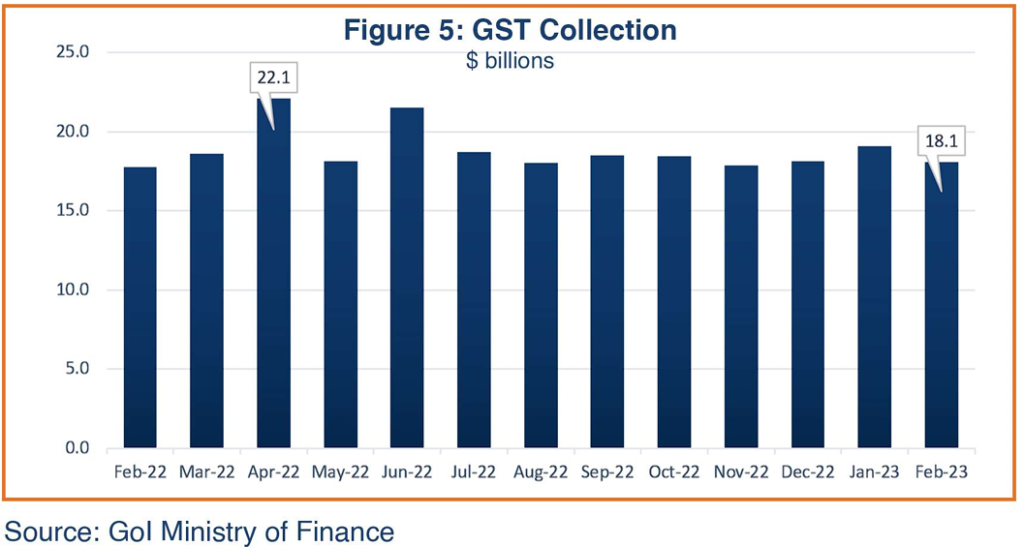

GST Revenues

Goods and Services Tax (GST) collections have sustained between $18.0 and $18.5 billion per month since July 2022. In February 2023, GST collections are estimated at $18.1 billion, an indication of consistent consumer spending (Figure 5). Analysts note that rising GST collections reflect a combination of a pick-up in economic activity, increased tax rates, increased compliance, and some effect of inflation.

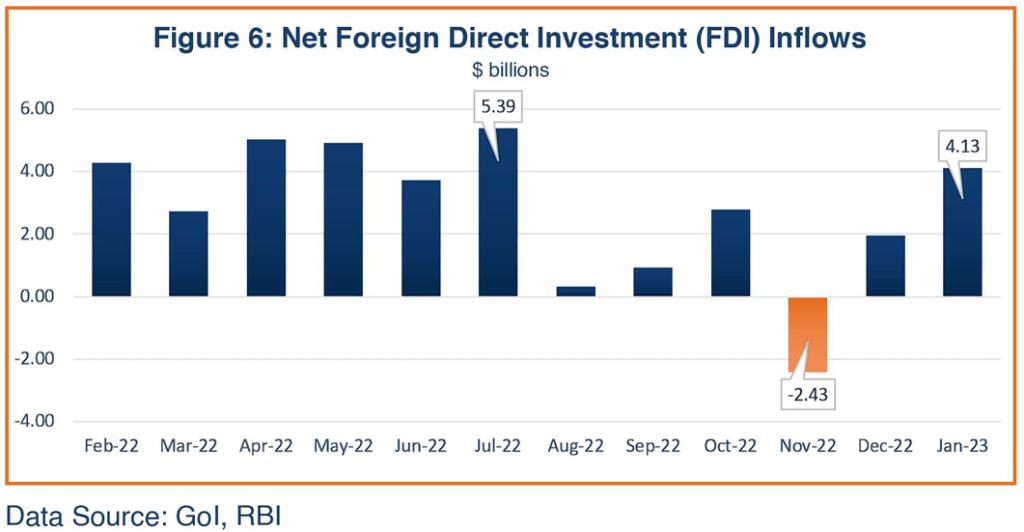

Net Foreign Direct Investment

Foreign direct investment (FDI) equity flows showed mixed trends throughout the fiscal year 2022-23. Net FDI inflows peaked in the current fiscal year in July at $5.39 billion, after which flows reversed drastically, becoming a $2.4 billion net outflow in November; however, a recovery in December 2022 brought up the net inflows to $1.95 billion that more than doubled in January 2023 (Figure 6). The nodal Ministry of the Gol has attributed the downtrend in FDI inflows to a relatively weaker sentiment in the investing community facing headwinds of the geopolitical tensions and the economic slowdown.

Inflation

Consumer Price Index (CPI) inflation was marginally down to 6.44% in February 2023, from 6.52% in the previous month, yet crossing the RBI’s target ceiling of 6.0%. Retail inflation in India was recorded within the RBI target band of 2%-6% for two consecutive months starting in November (Figure 7), then rose again beyond it, mainly due to a more-than-expected increase in food prices, which account for about 40% of the CPI total; core (non-food excluding fuel) inflation also remained high at 6.1%. A weaker rupee, which fell around 10% over the last year, may also be adding to upward price pressures. The RBI continues to monitor prices, stating it projects inflation to remain above 4% for the majority of 2023. The RBI has raised the benchmark repo rate by 250 basis points since May to 6.5%. Economists expect further tightening in RBI’s monetary policy in April 2023. The RBI has forecast retail inflation for Q4 (January-March 2023) at 5.7% and for full FY2022-23 at 6.5%.

Wholesale Price inflation in February 2023 eased to 3.85% from 4.7% in January, the lowest level in more than two years, mainly on account of the fall in crude oil and gas prices along with food and non-food articles. India’s WPI inflation has been declining steadily for the last nine months. Business sentiment is expected to improve following easing of wholesale input prices that might also bode well for retail prices.

Foreign Exchange

India’s foreign exchange reserves were $562 billion at the end of February 2023, down approximately $13 billion from January. The RBI intervenes intermittently in the foreign exchange market for liquidity management, including the selling of dollars, to manage depreciation in the rupee, which can impact exchange reserves. Foreign capital outflows and falling valuation of the currency have contributed to the loss in foreign exchange reserves. The Indian Rupee (INR) remained weak throughout February, falling to its lowest point ever, 82.98/USD on February 27. The average monthly exchange rate for February was 82.59/USD, compared to the previous month’s 81.76/USD (Figure 8).

Economic Outlook

India’s GDP growth rate in the third quarter (October-December 2022) slowed to 4.4% from 6.3% in Q2 and 13.2% in Q1 (Figure 9). The RBI in its recent monetary policy statement noted the near-term growth outlook remains weaker than previously expected. It has revised its forecast for GDP growth in the current fiscal year down to 6.8%, in line with the IMF’s forecast, reflecting extended geopolitical tensions and continuing aggressive monetary policy tightening globally. However, the World Bank has recently made an upward revision in its 2022-23 growth forecast for India, to 6.9% from 6.5% previously, on account of stronger consumption and increased domestic economic activity.

While the services and agriculture sectors continue to enjoy recovery, industrial and manufacturing output have shown a limping growth pattern during the first ten months of the current fiscal year. Continuing volatility in global inflation, as well as uncertain export orders, will likely make a significant difference in the performance of the economy and India’s growth outlook in coming months.

While the services and agriculture sectors continue to enjoy recovery, industrial and manufacturing output have shown a limping growth pattern during the first ten months of the current fiscal year. Continuing volatility in global inflation, as well as uncertain export orders, will likely make a significant difference in the performance of the economy and India’s growth outlook in coming months.

The outlook for inflation remains uncertain owing to the risks of supply disruptions from continuing geopolitical tensions. The RBI, which has raised borrowing costs six times since May, is expected to increase interest rates again in its April review amid inflation exceeding estimates and global central banks tightening further.

Sustained credit growth, a resilient financial sector, and the government’s continued thrust on capital expenditure imply an investment-friendly climate that should push India’s economic growth in the next fiscal year; however, India’s exports may continue to be lackluster if the global slowdown prolongs, which may, in turn, impact GDP growth forecasts.