The Indian economy continues to be daunted by uncertainties as any other global economies facing uncertainties due to continuing supply disruptions caused by Russia-Ukraine. Indian Fiscal Year 2022-23 (FY2022-23, beginning April 2022) started with continuing concern on rising inflation that has engulfed the course of the economic growth of India for at least a quarter. Deepening inflationary pressures limited business confidence in April 2022, the first month of FY2022-23. While the overall business sentiment was still positive, it was much lower than that observed in March due to greater disruptions from the Russia-Ukraine conflict.

Economic activities continued to slow down due to mounting international fuel prices and supply disruptions, though signs of growth are visible in domestic and international demand patterns. Service activities picked up with the end of pandemic-related restrictions, but the swelling retail inflation remained the biggest spoilsport to the economic outlook. Analysts expect the Reserve Bank of India (RBI) to accelerate its monetary tightening in a bid to manage the ballooning inflation.

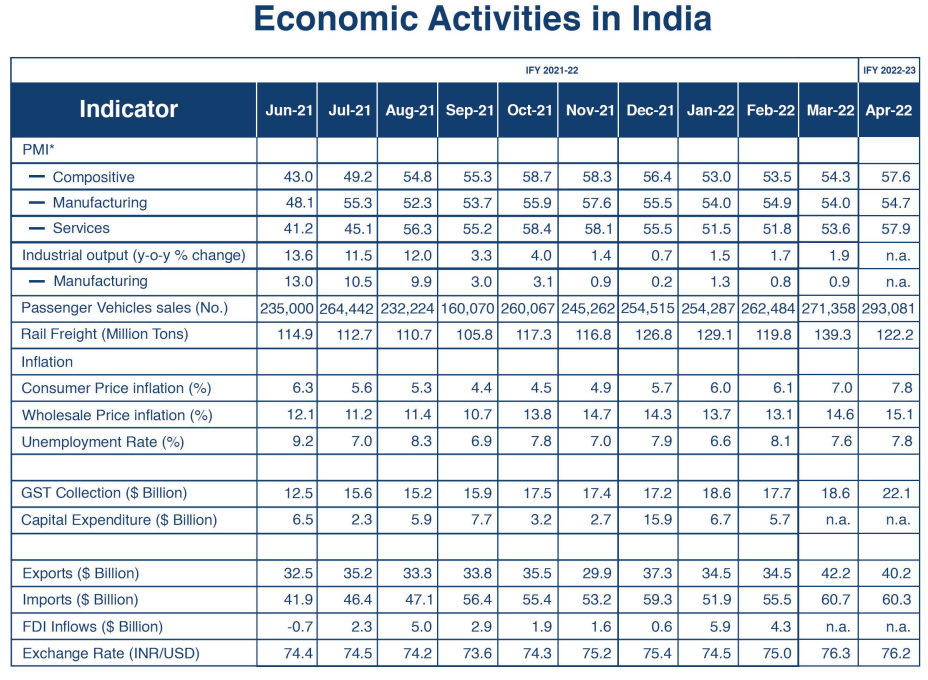

Retail businesses reported sales value gains in April across the country, and passenger vehicle sales in April were also 8% higher than the previous month. On the supply side, the Markit Purchasing Managers’ Indices (PMI) for Manufacturing was up marginally while the PMI for Services was significantly up from the March level. The Compositive PMI at 57.6 also grew 6% from March The overall unemployment rate was slightly up 7.8% from the previous month’s 7.6%.

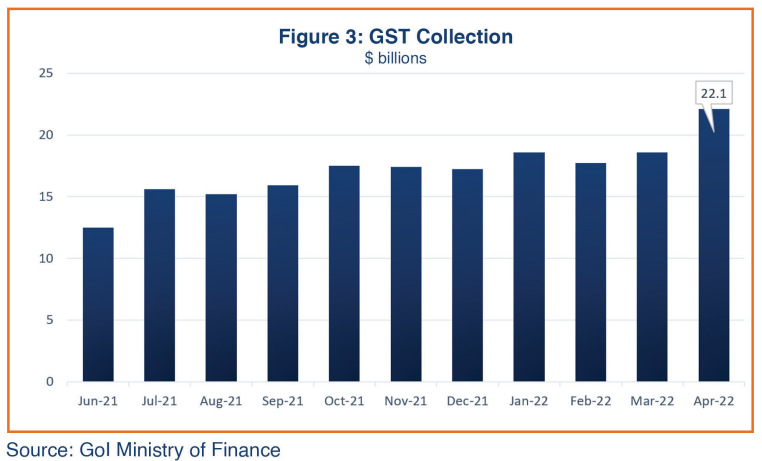

Goods and Services Tax (GST) collections were almost 20% up in April, compared with the March revenues, depicting robust business transactions and increased compliance. Monthly rail freight volume at 122 million tons was lower than the March level of 139 million tons.

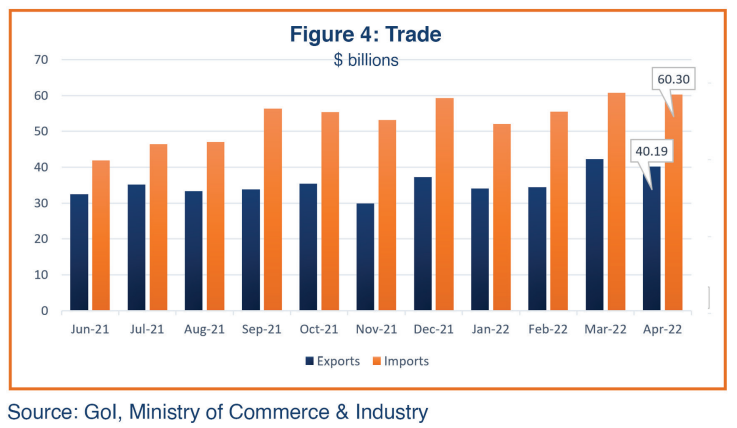

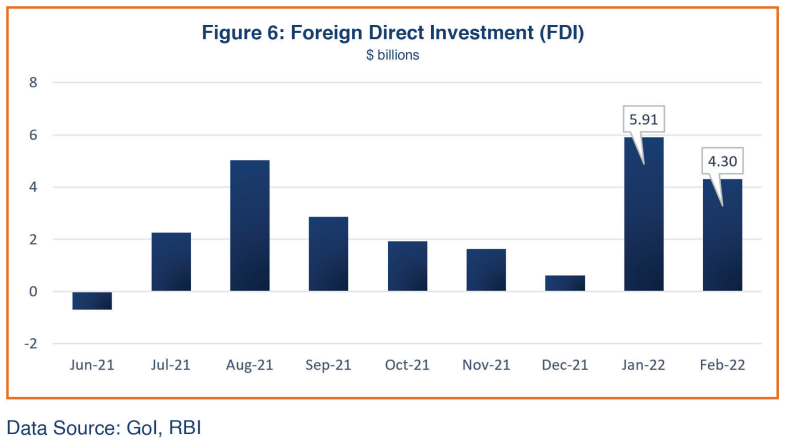

India’s foreign trade performance in April 2022 was remarkable; however, merchandise exports were down 5% from the March 2022 level. With impressive growth in both exports and imports, India grossed goods and services exports worth $675 billion in the last fiscal year that closed on March 31, 2022. After sustaining a downward trend from September-December 2021, foreign direct investment (FDI) inflows recorded a significant jump in January 2022, peaking at $5.9 billion, and followed by additional $4.3 billion in February 2022.

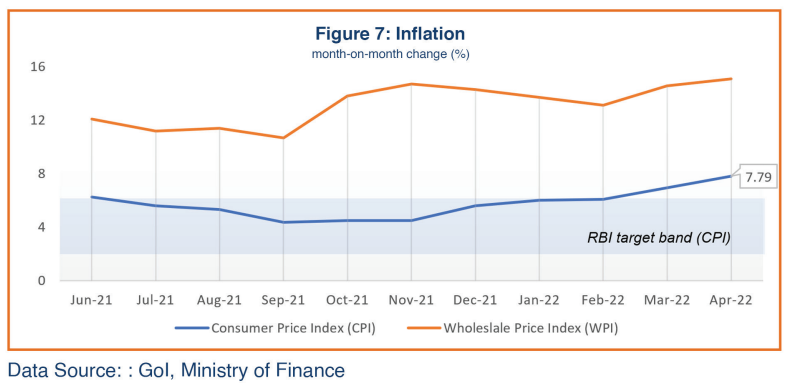

The consumer price index (CPI) rose to 7.78% in April from the previous month’s 6.95%, remaining above the Reserve Bank of India (RBI) target ceiling of 6.00% for the fourth consecutive month. The wholesale price index (WPI) also surged to 14.5% in April, marginally down from the previous month’s 11.6%, showing impact of higher global fuel prices.

On the back of a lower-than-expected growth in the third quarter of the current fiscal year and in view of the uncertainties of the Russia-Ukraine crisis, the government’s Chief Economic Adviser estimates India’s economic growth will be 7-8.5% in the current FY2022-23. Finance Minister Sitharaman has been quoted as saying that India can manage 8% growth despite inflation challenges. The disruptions arising out of the Russia-Ukraine crisis have started showing impact on India’s foreign exchange reserves, putting pressure on the Indian Rupee which has become weaker. The war may also impact the government’s plans for significant increases in public expenditure on infrastructure, its fiscal deficit, support for private investments, and further digitization of the financial system this year.

Demand Recovery Trends

Retail sales in April 2022 witnessed customers returning with buying mood. Vehicle sales were also up about 8% from the March level despite the continuing chip shortages. Retail sales value in April was even higher than its corresponding period pre-Covid in 2019. The monthly survey by the Retailers Association of India (RAI) highlighted 23% year-on-year higher sales during April across all sectors (restaurant sales, consumer durables and electronic sales), saying “customers are back in the stores/shopping and retailers are witnessing quantity growth, but it is important to note that about 10% of this growth can be accounted to inflation”. Higher volume of sales each month point to a positive private consumption trajectory going forward; however, the persisting consumer price inflation may dampen the rate of demand recovery in India.

Higher commodity prices could also undermine buoyant private consumption trends in India as households

spend more on those commodity items.

Supply Side Dynamics

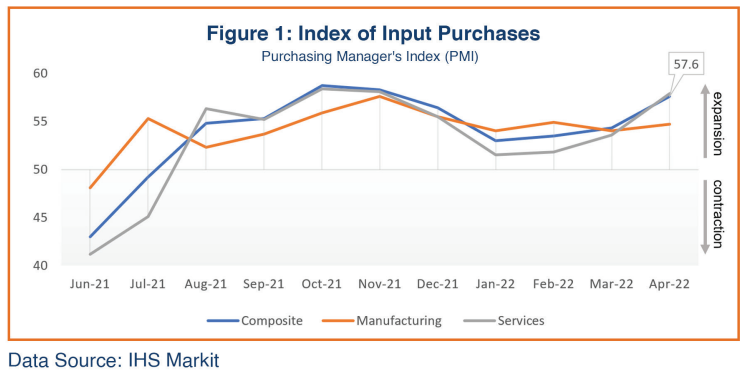

Input Purchases

The sustained momentum in economic activity since August 2021 has been reaffirmed by a steady Markit Purchase Managers Index (PMI) Manufacturing Activity Index above 50, reflecting the optimistic mood of the businesses that have made bold input purchases in anticipation of increased demand (Figure 1). The Composite index in April 2022 improved remarkably from March’s 54.3 to 57.6. The Services index increased significantly to 57.9 in April from 53.6 in March amidst receding COVID restrictions; the PMI for Manufacturing was also up to 54.7 from the previous month’s 54, indicating slight improvement in production activities. Manufacturing PMI has consistently remained above 50 for the last ten months, hinting at a sustainable expansion pattern in production activities. According to the Markit index analysis, factory activity in India picked up in April, led by a solid increase in domestic and global demand as pandemic restrictions were eased; but rising international fuel prices pushed input costs to a five-month high. With the ongoing increases in sales and input purchasing, growth is expected to sustain in the near term per the S&P Global analysis.

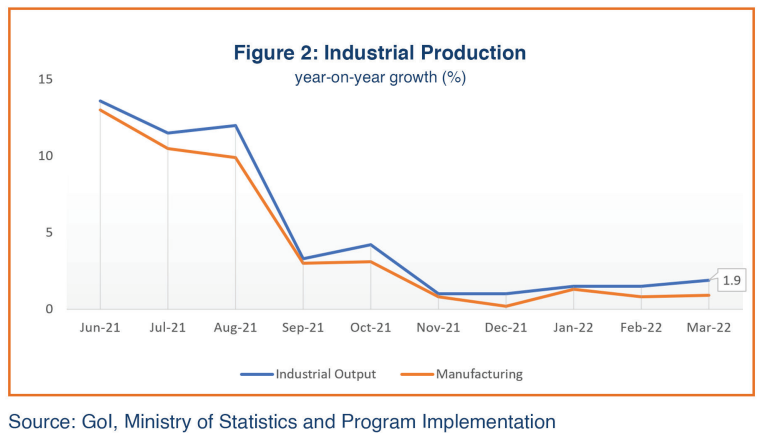

Industrial Production

Total industrial production continues to improve slowly compared to last year, rising 1.9% year-on-year in March 2022, up from 1.5% in February (Figure 2). Manufacturing, which accounts for 77% of total industrial production, increased marginally to 0.9% year-on-year growth in March, from 0.8% the previous month; mining, which comprises 14% of total industrial output, grew 4% year-on-year basis in March (compared to 4.5% in February) and growth in electricity production (8% of total industrial production) improved substantially to 4.9% year-on-year, from 4.5% in February. Capital goods production within the manufacturing sector showed a meagre 0.7% growth, implying depressed growth in investment. The industrial output for the entire FY 2021-22 grew 11.3%; but it was on a low base as the factory output had contracted by more than 8% in FY 2020-21.

GST Revenues

Changes in the value of Goods and Services Tax (GST) collection are considered an indicator of business transactions. The GST revenue collections for April 2022 were up 19% from the previous month, to more than $22 billion (Figure 3). Analysts have indicated that the GST collections are now on a sustainable trajectory, reflecting an upward trend, in tandem with the restored economic activity, and the tightening of compliances. Indian FY2022-23 appears to have started on a positive note in terms of GST revenues, with April 2022 collections surpassing the earlier record monthly collections ever recorded throughout the FY2021-22; however, inflationary pressure may have a negative impact on economic activities and therefore GST collections in the coming months.

Trade

During the first month of FY2022-23 (April 2022), Indian exporters shipped goods worth $40.2 billion down from the peak of $42.2 billion in March (Figure 4). During FY2021-22, goods exports grossed nearly $422 billion, surpassing India’s target of $400 billion. India’s merchandize imports were $60.3 billion in April, slightly down from $60.7 billion from the previous month, reflecting partially the relative upward movement in industrial activity along with rising global oil prices caused by geopolitical crisis situations. India’s total merchandize import bill for FY2021-22 was $610 billion. India’s trade performance for the FY 2021-22 was impressive with total goods & services exports rising 36% to $675 billion and total imports growing 46% to $744 billion. India has set a target to touch $2 trillion worth of exports by FY 2027-28.

Trade observers expect India’s trade deficit to remain elevated, partially due to India’s continued dependence on import supplies of specific products, such as edible oils, fertilizers, and project goods, and partially due to the rise in international prices of fertilizers, natural gas, coal, metals, and edible oils.

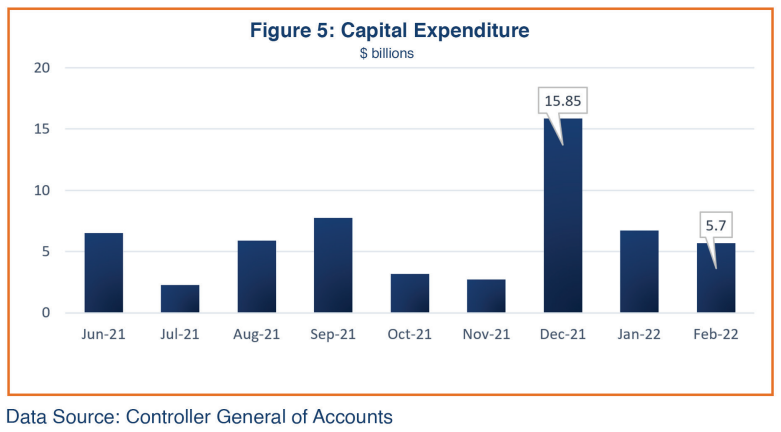

Government Spending

The budget for FY2022-23 augments public capital expenditure by more than 34%, to nearly $101 billion, reflecting the government’s focus on building public infrastructure. According to the latest Controller General of Accounts (CGA) Monthly Report, the monthly capital expenditure was highest in December 2021 at $15.85 billion, mainly on account of loan disbursement for the Air India deal. Capital expenditure was down more than half to $6.72 billion in January 2022 and further to $5.7 billion in February (the latest available – Figure 5). Analysts have flagged that India may have to incur higher expenditures on food and fertilizer subsidies if these markets remain affected by the continuing Russia-Ukraine war for an extended period.

The surging import bill is adding to the risks threatening India’s fiscal deficit target. The government in February announced plans to sell up to a 5% stake in Life Insurance Corporation (LIC) of India’s, the country’s public sector insurance giant, in hopes of raising $12 billion in revenue, though the final initial public offering of a 3.5% stake in mid-May raised only about $2.8 billion on the public market due to global uncertainty and eroding demand for equities. According to market observers, finding investors for such a large offering was bound to be a challenge in the current global economic environment, and foreign funds have reportedly withdrawn more than $16 billion from stocks this year.

Foreign Direct Investment (FDI)

Foreign direct investment (FDI) flows went on the downtrend after August 2021, when they grossed $5.1 billion, sliding to less than $1 billion in December 2021 before jumping again to $5.9 billion in January 2022.

India attracted $4.3 billion in FDI inflows in February 2022 (Figure 5). The Reserve Bank of India (RBI) has reported that India attracted a total of $74 billion in FDI in 2021 compared to US$ 87.6 billion in the calendar year 2020. According to the UNCTAD Annual Investment Trend Monitor’s latest release, FDI inflows in India were 26% lower in 2021 despite a 77% rebound in global foreign direct investment flows, mainly because large M&A deals in India recorded in 2020 were not repeated in 2021.

Inflation

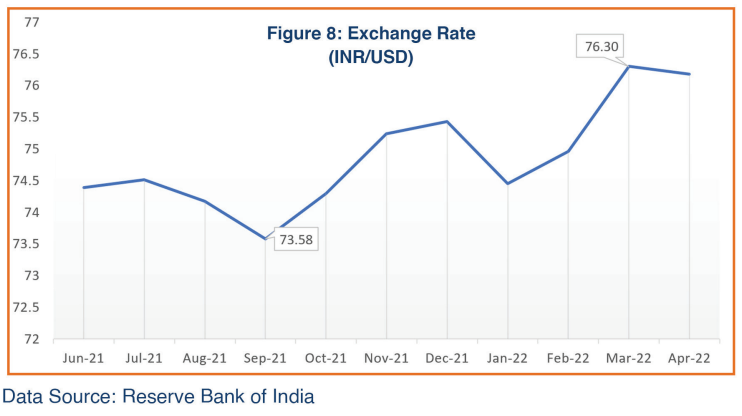

The consumer price index (CPI) remained above the RBI’s inflation target ceiling of 6.0% for the fourth month in a row in April. The first month of the new FY2022-23 opened with concerns of high retail inflation, at 7.8%, even higher than the expected 7.5%, mainly due to the skyrocketing prices of oil and food (Figure 6). Wholesale Price inflation moderated slightly 14.5% in April from 14.6% recorded for March 2022. In its April 8 meeting, the RBI Monetary Policy Committee prioritized managing inflation over supporting growth even while keeping the interest rate unchanged. The rupee has also fallen steadily in recent months and is approaching a record low against the US dollar.

Foreign Exchange

The RBI’s net outstanding forward dollar purchases rose to $65.79 billion at the end of March compared to $49.11 billion as of end February. In February, the RBI had sold a net $771 million in the spot market. The Indian Rupee moved in the range of 75.76 to 76.97 in the month of March.

In March, the rupee hit its first record low for the year, breaking below 76.91/US dollar. India’s foreign exchange reserves fell to $597.73 billion by the end of April 2022, from the peak of $642.45 billion in September 2021.

Economic Outlook

The economic growth outlook for India appears uncertain currently due to global uncertainty, rising inflation, increasing COVID cases, and continued supply chain disruptions; but the growth may sustain depending upon how soon international energy and commodity prices stabilize. The future RBI’s monetary policy will decide course of the recovery path for the Indian economy.

On the back of a lower-than-expected growth in the third quarter of the current fiscal year and in view of the uncertainties of the Russia-Ukraine crisis, the Chief Economic Adviser of the Gol now estimates India’s economic growth between 7% and 8.5% for the current FY 2022-23. Finance Minister Sitharaman has been quoted as saying that India can manage 8% growth despite inflationary pressures. The International Monetary Fund recently lowered its growth forecast to 8.2% which is higher than 7.2% by the Reserve Bank.

The Government of India’s fast track measures to vaccinate the public, and the increase in trade activity and industrial production, led to a remarkable rebound in GDP growth in the first half of FY2021-22. Year-on-year, real GDP grew by 20.1% in the first quarter of FY 2021-22 (Apr-Jun 2021), despite partial lockdown conditions in several states, followed by an 8.4% year-on-year growth in the second quarter (Jul-Sep 2021), and a slower 5.4% growth in third quarter (October-December 2021 (Figure 8). Subsequently, the government scaled down its overall growth forecast for FY 2021-22 to 8.9% per cent, from 9.2% estimated earlier.