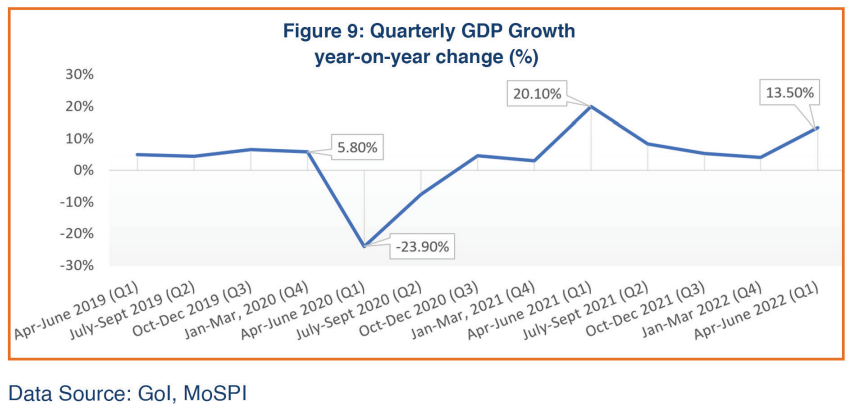

India’s economic performance continues to show mixed trends, indicating growth momentum in some high frequency indicators but mild to negative signals in select indicators. Backed by gains in demand recovery, robust agriculture performance, a pickup in manufacturing and services activities, and an increase in investment, India’s economic performance for the first quarter of FY2022-23 (April-June 2022) was impressive at 13.5%. That said, high inflation and the swelling trade deficit continue to impact the demand-supply balance and remain causes of concern among policymakers. India’s central bank, the Reserve Bank of India (RBI), has responded to the concerns by raising the repo interest rates 140 basis points since May 2022, to 5.4%, and is expected to continue tightening in coming months.

Positive trends were visible in August 2022 in most indicators, namely the Purchase Managers’ Index for services and manufacturing, GST collection, retail sales, bank credit entries, and capital expenditure, while negative trends in inflation, exports, unemployment, and the foreign exchange rate weighed on economic performance. While oil prices are moderating, the problems of food inflation and declining exports are constraining greater economic activity. Despite RBI’s interventions, the domestic currency touched its lowest point against the US Dollar in August. Global recessionary pressures continue to affect India’s external sector.

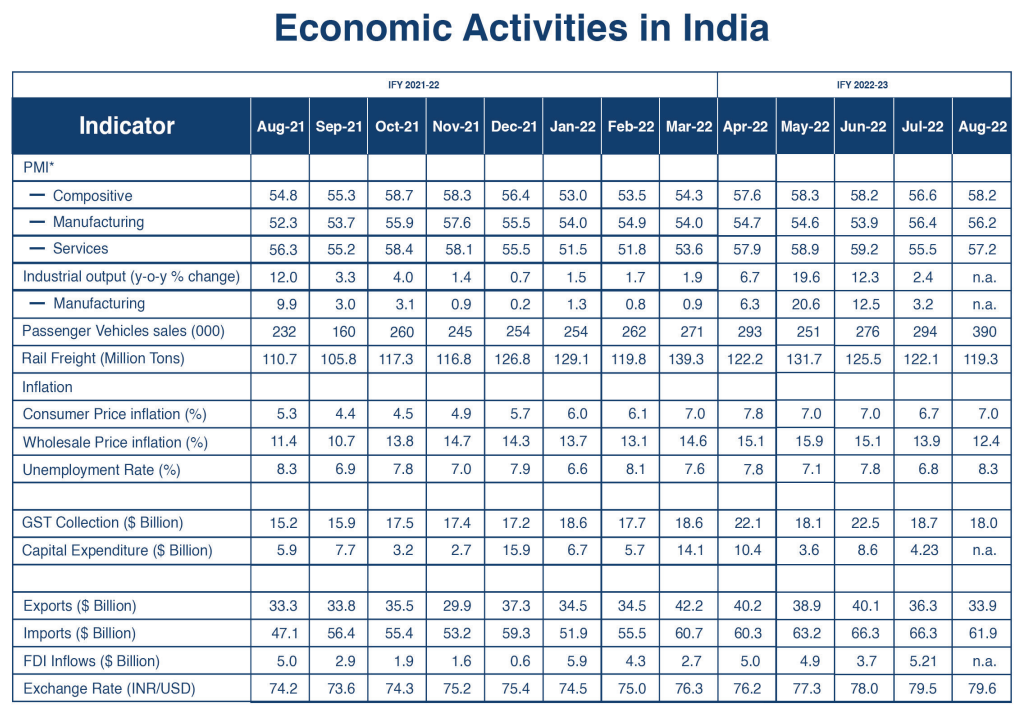

Retail businesses reported sales value gained 15% over the pre-pandemic August 2019 value. Passenger vehicle sales increased about 33% from the previous month as the festival season begins in India. On the supply side, the Markit Purchasing Managers’ Indices (PMI) for Manufacturing moderated marginally, the PMI for Services was up from the previous month. The Composite PMI also moved up from July and remained much above 50 points, indicating strong expansion in business transactions. The overall unemployment rate was up significantly to 8.3% from the previous month’s 6.8%, mainly on account of a slowdown in agriculture activities during the ongoing monsoon season.

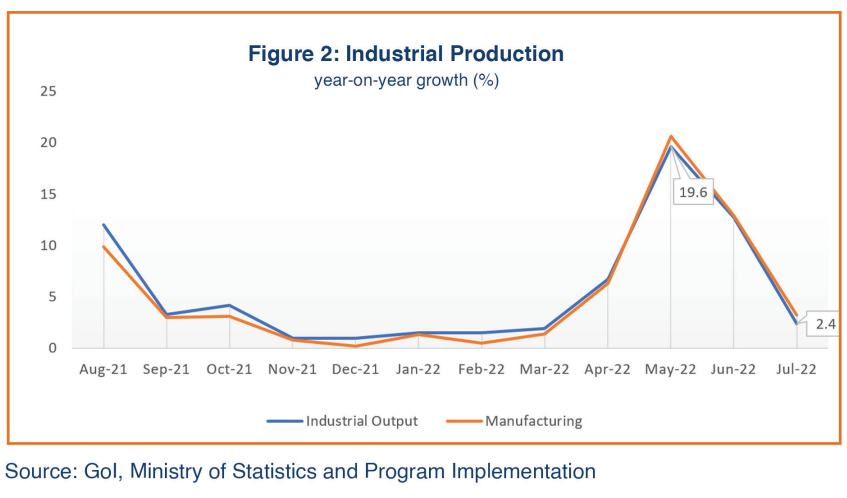

Goods and Services Tax (GST) collections were decent in August in rupee terms, reflecting a continued uptick in industrial transactions and increase in tax compliance; however, monthly collections in dollar terms appear slightly lower due to depreciation in the domestic currency.

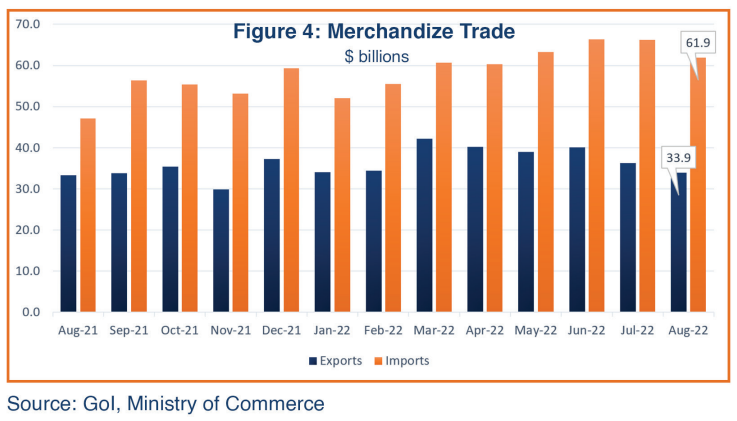

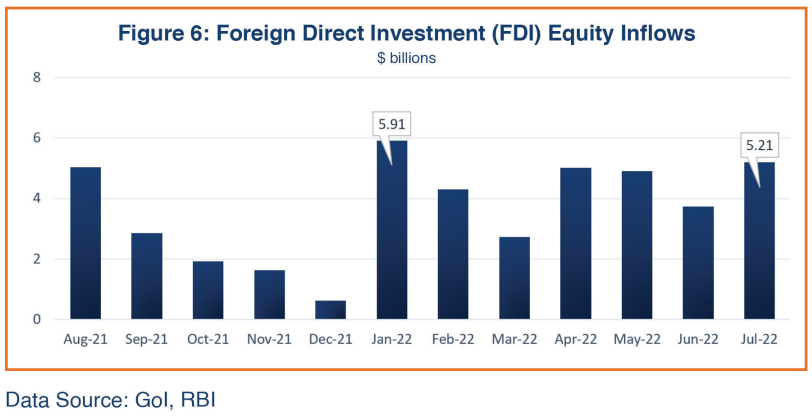

On the external side, as expected, India’s foreign trade performance in August was lackluster compared with the last several months; merchandise exports dropped about 9% from the previous month; imports were also down 7% from July 2022. The FDI equity inflows in July 2022 (latest available data) witnessed a significant jump from the previous month. India’s foreign exchange reserves, though still high, have been affected by macroeconomic uncertainties, slipping to $553 billion in August while the Indian rupee fell against the US dollar.

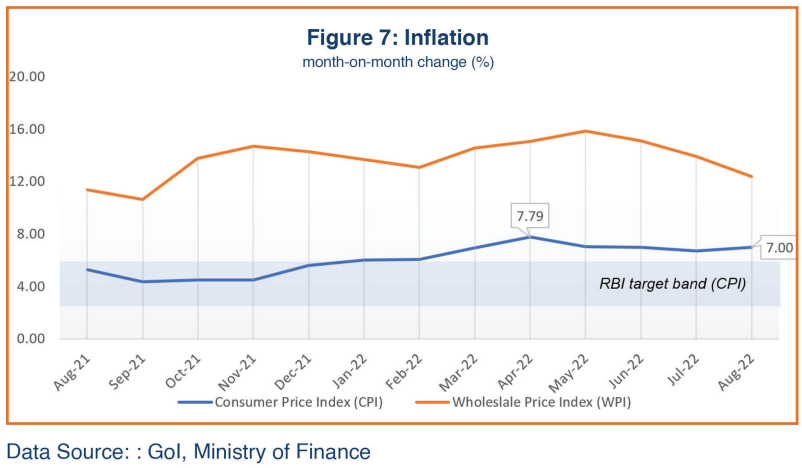

Higher food prices and lower global edible oil prices pushed the consumer price index (CPI) to 7% in August 2022, up from the previous month’s 6.7%, and non-food inflation continues to remain a concern. The CPI has been above the RBI target ceiling of 6.0% for eight months. The wholesale price index (WPI) dropped to 13.9% in August from the previous month’s 13.9%, but input costs remain an issue for manufacturers.

Backed by a rebound in consumption and impressive performance by the agriculture and services sectors, India’s real GDP (at constant prices) registered a remarkable growth of 13.5% for the first quarter of the current fiscal (April-June 2022), albeit still less than the projected 16.2%. However, the near-term economic growth outlook for India remains uncertain due to continuing inflationary pressures, rising COVID cases, ongoing supply chain disruptions, and global recessionary conditions. The longer-term prospects appear strong if energy and commodity prices ease. The RBI projected FY2022-23 GDP growth at 7.2% based on its Q1 forecast at 16.2%, Q2 at 6.2%, Q3 at 4.1%, and Q4 at 4%, but a downward revision is likely considering the continuing global concerns that may impact the performance in subsequent quarters.

Demand Recovery Trends

Retail sales in August 2022 showed an uptrend in consumption demand. Vehicle sales were up 9% from the previous month despite costlier auto loans. RBI reported bank credit growing 15.5% at the end of August, compared with 14.5% in July, pointing to the sustained demand for credit.

The monthly survey by the Retailers Association of India (RAI) reported 15% higher sales during August compared to the pre-pandemic sales recorded for August 2019. While most items have faced inflation, retailers reported higher sales for costly items (such as sports goods, footwear, jewelry) but lower sales for cheaper products, implying gains in sales in higher income groups. A broad-based pickup in retail sales is expected as the 3-month festival season begins in August/September.

Supply Side Dynamics

Input Purchases

The overall business sentiment in August 2022 improved from July. The Composite Markit Purchase Managers Index (PMI) increased to 58.2 from 56.6, reaffirming the expansion in economic activities (Figure 1). A PMI above 50 reflects an optimistic mood among businesses. The Services index recovered to 57.2 in August from 55.5 in the previous month. The contact-based businesses, such as hotels, restaurants, and other tourism services are witnessing higher sales following the general reopening and successful vaccination spree within the country. According to S&P Global, the improvement in demand conditions as well as a brighter outlook for the year ahead has driven sentiment among services firms to the highest level in over four years and the rate of service sector job creation to its highest in more than 14 years.

Manufacturing activity stayed strong in August 2022, albeit the PMI Manufacturing index, at 56.2, dipped a tad from the 56.4 recorded in July. Business confidence was generally upbeat on an improvement in demand and easing of input cost inflation. The PMI Manufacturing index turned to expansion mode in July 2021 and has consistently remained above 50 since then, implying a sustainable expansionary pattern across the manufacturing sector. Input price inflation eased to the slowest pace in five months following the softening fuel prices that led the manufacturers to revise output forecasts on anticipation of higher demand. Officials at S&P Global have noted, “inflation concerns, which had dampened sentiment around mid-year, appear to have completely dissipated in August as seen by a jump in business confidence to a six-year high.” But hiring remained low-key in factories.

Industrial Production

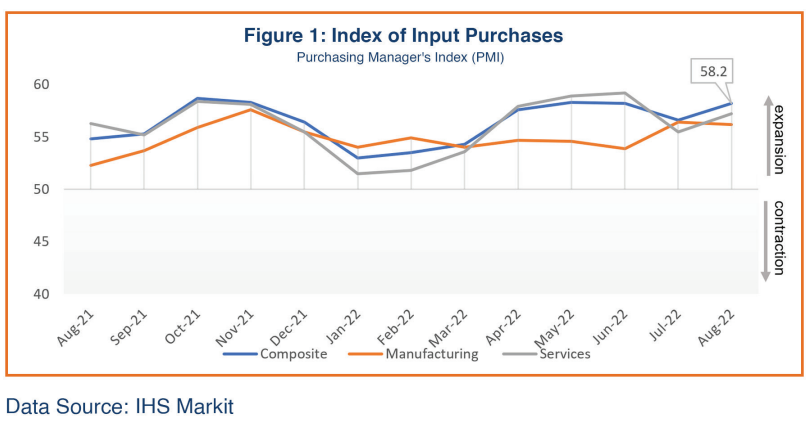

Total industrial production continues to expand compared to last year, rising by 2.4% year-on-year in July 2022 after robust 12.7% growth in June (Figure 2). Growth was seen across all industrial segments except mining. Manufacturing, which accounts for 77% of total industrial production, increased 3.2% year-on-year in July, softer than the 12.9% of the previous month; mining, which comprises 14% of total industrial output, contracted 3.3%, compared with 7.5% year-on-year in June, and the growth rate in electricity production (8% of total industrial production), at 2.3%, was down compared to the 16.4% achieved in June. Capital goods production within the manufacturing sector showed a 5.8% growth, hinting at continued growth in investments despite the sharp reduction from 29% growth in the previous month.

A rise in industrial production growth is indicative of positive strides in India’s economic recovery, but high input costs and unfavorable geopolitical trends hobble the sustainability in growth. Slowing industrial output in July 2022 is reflecting the impact of a slowdown in global growth that is being felt by domestic manufacturing companies. Key export sectors like textiles, petroleum products, machinery, and equipment saw sequential falls in the IIP in July. Happily, there have been recent signs of a reduction in global oil prices, which can benefit manufacturing by way of reduced input costs while helping cut in overall inflation.

GST Revenues

Changes in the value of Goods and Services Tax (GST) collection are an indicator of business transactions and increased tax compliance. The GST collections for August 2022 were up in rupee terms, but marginally down in dollar terms to $18 billion, due to the rupee depreciation during the month (Figure 3). Analysts have indicated that GST collections are stabilized, aligned to the positive trajectory in economic activities.

Trade

India’s merchandize exports value dropped to almost $34 billion in August 2022, falling 9% from the previous month’s $36.3 billion (Figure 4). India’s strong export performance through June this year is now under pressure from slowing activity and suppressed demand globally. Global inflation, the Russia-Ukraine war, boiling geopolitical tensions with China, and supply disruptions are hurting economic growth worldwide, leading to poor demand. India’s exports of engineering items, gems and jewelry items, textiles and plastics are witnessing a slumping pattern while chemicals and electronics exports are growing. In addition, India’s export restrictions on wheat, steel, and iron ore pellets have also contributed to the deceleration in merchandize exports.

The Ministry of Commerce estimates total services export for August at almost $23.5 billion.

Federation of Indian Export Organizations (FIEO) Director General has stated that September-November period would be challenging for exports as per the current trend.

India’s merchandize imports value in August 2022 was down to $61.7 billion from $66 billion in July, mainly on account of softening fuel prices. The rise in energy commodities prices, such as natural gas, coal, and metals (such as gold), have mainly contributed to the ballooning import bill of India for the last several months.

With exports growing at a much slower pace compared to imports, the deficit has widened to nearly $29 billion in August. India’s huge trade deficit continues to remain a cause of concern as it is a major component in the country’s current account deficit (CAD) and can impact the macroeconomic balance, putting pressure on the value of domestic currency.

Trade economists have observed that India may be in for a dismal performance on its external front for the next 18 months, which would negatively impact the final FY2022-23 growth rate.

Government Spending

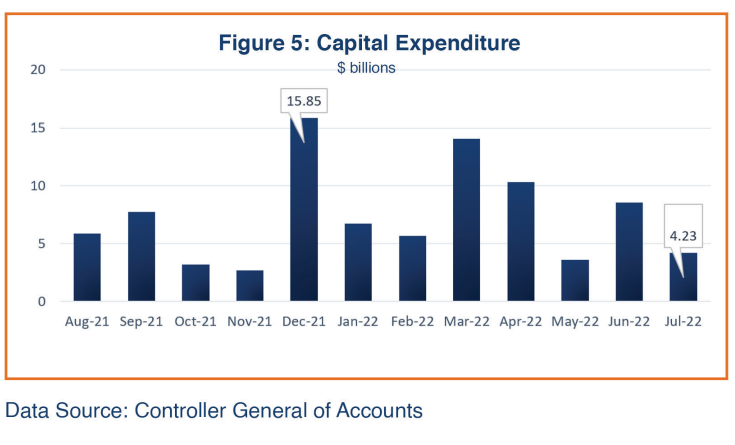

Capital expenditure has been showing moderate growth since January 2022 (Figure 5). Finance Ministry officials have stated the government will likely meet the fiscal deficit target of 6.4% of GDP in 2022-23 without having to cut capital expenditure. The government has repeatedly pronounced its efforts to control revenue expenditure will not lessen its focus on necessary capital expenditures.

Foreign Direct Investment (FDI)

Foreign direct investment (FDI) equity flows showed mixed trends throughout the previous fiscal year. According to the latest data released by the Department of Industrial Policy and Internal Trade (DPIIT), in FY2021-22, FDI equity contracted marginally, by 1%, to $58.8 billion. However, total foreign direct investment (including equity inflows, reinvested earnings, and other capital) into India rose by 2%, peaking at $83.7 billion in 2021-22. The first month of the new fiscal year 2022-23 (April 2022) witnessed India attracting $5 billion in total FDI inflows, followed by $4.92 billion in May and $3.74 billion in June. Net FDI inflows in July peaked at $5.21 billion (Figure 5). Total net FDI inflows into India expanded more than 17% to $13.61 billion in the first quarter of FY2022-23, compared to $11.55 billion for the corresponding period of the previous year.

Inflation

The overall inflation trajectory remains volatile given changes in international commodity prices. The consumer price index (CPI) accelerated to 7% in August 2022 from 6.7% recorded in July, remaining outside the RBI’s upper safety band of 2-6.0% for the eighth month in a row (Figure 6). The rise in CPI was mainly due to a surge in food prices, which account for about 40% of the CPI basket. The supply-chain disruptions owing to the ongoing geopolitical tensions, and increasing global inflation rates, are constantly pushing up domestic inflation. The RBI continued to give priority to price stability by raising the benchmark policy repo rate by 140 basis points since May, to 5.4%, aiming to curb consumer demand. In addition, the government has imposed curbs on exports of wheat, sugar, and rice to cool local prices over fears of a shortfall in rains in some parts of the country that could push up food prices.

Wholesale Price inflation moderated to 12.4% in August from 13.9% in July, but it continues to remain high, impacting inputs costs for manufacturers. However, business sentiment has improved following the softening of oil prices in the international market.

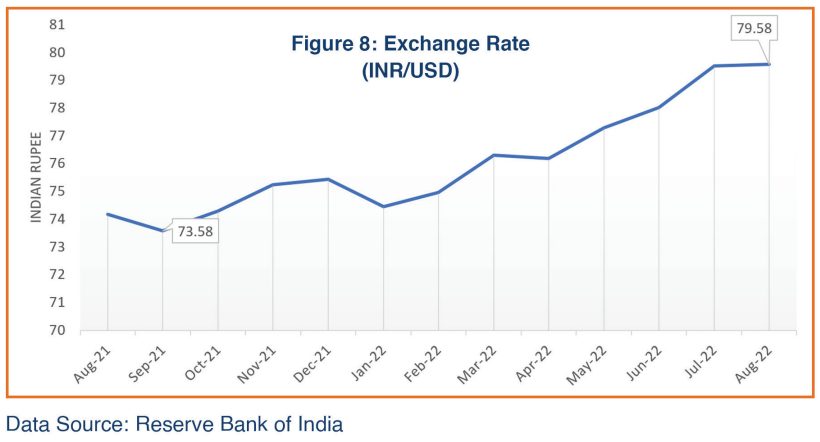

Foreign Exchange

India’s total foreign reserves were $553 billion at the end of August 2022. The rupee again crossed the peak of 80/USD in August 2022. However, persistent foreign inflows into domestic capital markets and softening crude oil prices boosted the local currency. The average monthly exchange rate for August was INR 79.57/USD (Figure 8). The rupee has lost nearly 8% against the US Dollar since January, mainly due to a rise in global crude oil prices, tightening monetary policy, a strengthening dollar post Russia-Ukraine war and continuing foreign capital outflows from India. The RBI’s June announcement allowing global trade in rupees is expected to help enhance foreign exchange inflows and stabilize the rupee going forward.

Economic Outlook

India posted 13.5% growth for April-June 2022 according to the latest government statistics, a strong performance though short of RBI’s projection of 16.2%. The latest data paints a progressive picture for the Indian economy despite global challenges, geopolitical developments leading to supply disruptions and decelerating external demand due to global slowdown. Businesses ramped up capacity as domestic demand recovered during the first quarter of FY2022-23. The agriculture and services sectors supported GDP growth and healthy improvements have been reported in important indicators, like private consumption expenditure, private capital expenditure, and government consumption expenditure. The turnaround in investment from the pre-pandemic levels supported the growth, but trade was impacted by geopolitical changes, high commodity prices and a weaker rupee.

The RBI has forecast FY2022-23 GDP growth at 7.2% based on its Q1 forecast at 16.2%, Q2 at 6.2%, Q3 at 4.1%, and Q4 at 4%; but given the less than expected growth in the first quarter of the year and the continuing global challenges, a downward revision is likely for GDP growth between 6.5-7% for the fiscal year.

Indian businesses are optimistic that softening international prices of fuel, fertilizers, and edible oils will help sustain momentum in demand and lift output levels. Industrial and manufacturing activities have sustained the positive trajectory and capital expenditure is also rising. Consumer demand seems to be improving as the festival season begins in India. However, crude prices will likely make a significant difference on the performance of the economy, as the external sector components in the GDP may prove to be drag on growth.

Major economies around the world, including India, face headwinds from currency depreciation and global recession, but Indian policymakers believe India is relatively well placed to deal with these challenges because of its stable domestic financial and non-financial sectors, high foreign exchanges reserves, and its vaccination success. Nonetheless, the economic growth outlook for India continues to remain uncertain currently and will be influenced by how much the private investment expenditure is incurred and how much the global recession impacts its trade.