India’s economic recovery is strengthening in the recent months in the backdrop of impressive progress in vaccinations and ongoing economic reforms; major economic and business indicators have shown noteworthy improvements in the last six months, on the back of significantly improved consumer and business sentiments.

Demand Recovery

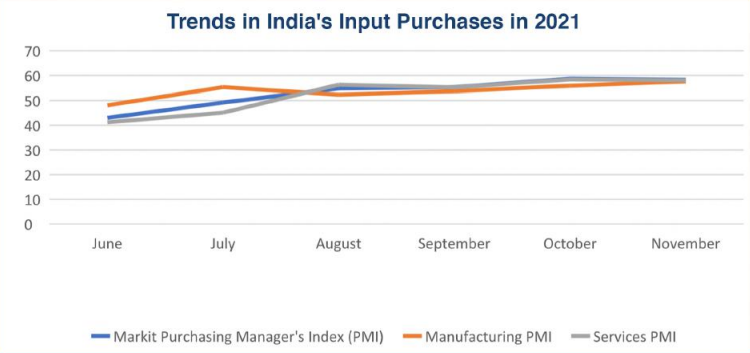

Changes in passenger vehicle and retail sales (household consumption) reflect increasing demand patterns, probably due to the pandemic-driven safety measures, such as increased use of hygiene/immunity-building nutrients/digital products and personal mobility preferences. Marking a growth of more than 62%, the festival season driven growth in sales of passenger vehicles in October suggests a strong recovery in demand, followed by a smaller (6%) deceleration in November. Market research and consulting firm, RedSeer has estimated the online sales between August and November 2021 around $9.6 billion. The increase in economic activity and demand is reaffirmed by a steady growth witnessed in Markit PMI Manufacturing that is reflective of the mood of the businesses who made bold input purchases. Markit PMI Services slightly dropped in November from its October level, mainly because prices charged rose at a slower pace in November compared to October. According to the Markit index analysis, despite reporting the biggest jump in input costs since April, firms were only able to pass on some of costs to customers, pointing to further pressure on margins.

Supply Side Dynamics

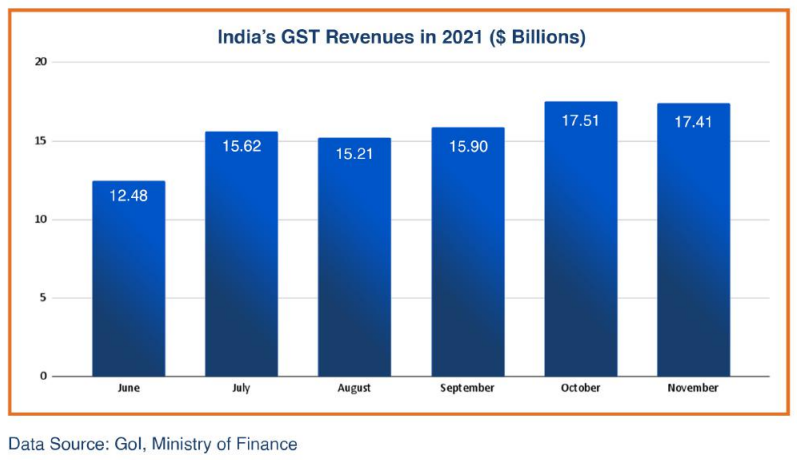

Changes in value of Goods and Services Tax (GST) collection is indicative of business momentum in the country. The GST revenue collections for November 2021 rose in terms of local currency, however, they slipped by about half percent in $ terms. The GST revenues for November 2021 were 25% more than the GST revenues in November 2020. GST collections reflect an upward trend, in tandem with the economic recovery trends despite the earlier disruptions in supply of semi-conductors during the second wave of the pandemic (April-July). The uptrend in GST revenues is expected to continue supported by the continuing recovery in economic activity.

Industrial production growth during the last few months is characterized with sharpest rise in capital goods, followed by primary goods, infrastructure goods and intermediate goods. The trends suggest recovery in production and investments. However, in September and October 2021, the overall industrial output growth rate declined due to lower crude oil output and slowdown in electricity generation caused by unexpected weather dampening mining activities.

Rail freights at 116.83 million tons in November 2021 was 0.4% lower than the October 2021 level. Air freight and traffic activities have been on the rise on monthly basis.

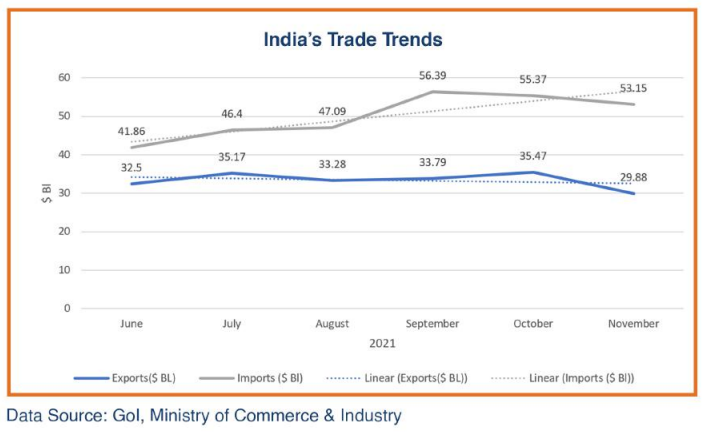

Trade Trends

India’s exports posted a 5% in October 2021 on top of 1.5% growth of September 2021. However, November witnessed a drop of 15.7% in exports activity. Exports rose steadily on monthly basis throughout the year until October 2021. The Government of India has set a target of $400 billion in exports for FY22. During the first half year of Indian Fiscal year 2021-22 (April-November 2021), exports have grossed about $264 billion and the target of $400 seems achievable if the growth momentum continues. According to the WTO, India recorded top export growth of 47% between January and July 2021 backed by strong economic recovery during the second quarter. The uptrend in imports reflects the increase in industrial activities in the country.

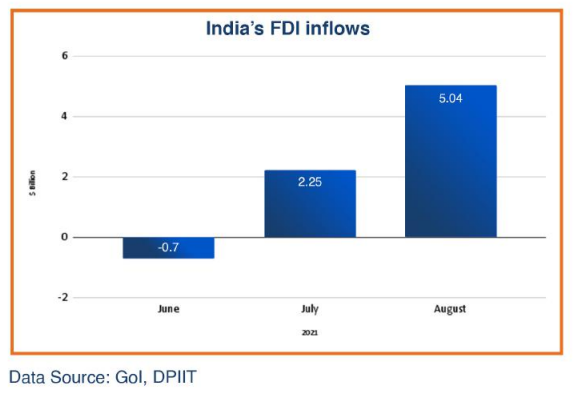

FDI Trends

India has attracted $32.41 billion in foreign direct investment (FDI) inflows between April-August 2021. The Government of India has taken several tax reforms and ease of doing business measures, such as labor reforms, GST rationalization, relaxed FDI norms in select sectors, implementation of Single Window System and easier Customs procedures, that have helped retain investors’ confidence.

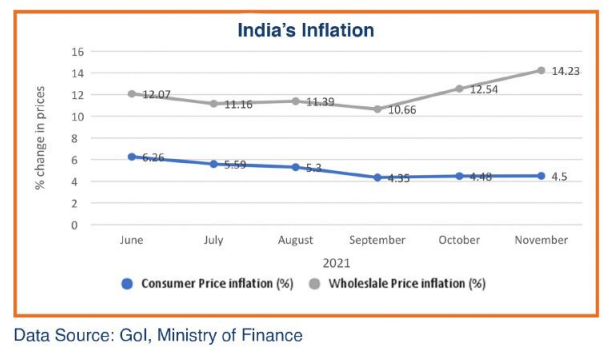

Inflation

On the back of lower food inflation and a relative favorable base, the consumer price index (CPI) has eased further to between 4 and 4.5% since September 2021 from 6.26% in June 2021. The wholesale inflation (WPI) also softened to 10.66% in September 2021 from 12.07% recorded in June 2021; however, input costs remained high despite bold input purchases by businesses. October 2021 recorded a higher WPI inflation at 12.54%, followed by even higher increase of 14.23%. The Government of India (and many other state governments) in November slashed central excise duty and VAT on fuel which is expected to soften inflationary pressures in coming months.

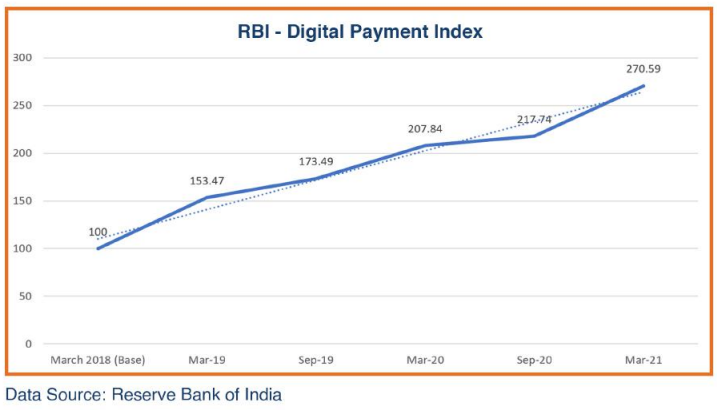

Digital Payments Trend

A steep growth in the Reserve Bank of India Digital Payments Index (RBI-DPI) indicates deepening of digital payments in recent years in the country. RBI-DPI gained 63 points in March 2021 over a period of one year, well during the pandemic, as compared to 54 points in the preceding one-year period. The RBI in October 2021 also announced increase in limit for IMPS transactions that is expected to catalyze digital transfers of funds within the banking system.

Government efforts to bolster growth

In September 2021, the Gol announced expenditure plans of more than $11 billion for a production-linked incentive (PLI) scheme for automobile/drone industries/consumer goods/Solar Modules and for various export promotion schemes. With implementation of these plans, the escalated government spending is expected to boost India’s manufacturing and export capabilities.

Economic Outlook

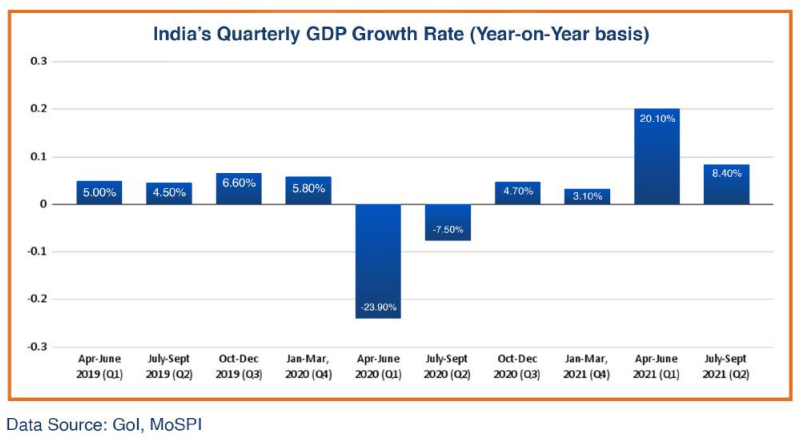

The Government of India’s fast track measures to vaccinate India’s public and the ongoing reforms for uplifting the economy/trade/industry, has led to a remarkable GDP growth of 20.1% in Q1 (April-June 2021) FY 2021-22 despite several partial lockdown conditions in various states. The Q2 (July-September 2021) real GDP was 8.4% higher than it was in September 2020. Compared with the pre-pandemic year, GDP shows a growth of 0.3% from September 2019. As major economic and business indicators are on a positive trajectory, bolstering pace of vaccination, financial inclusion through increased digital transactions, consumption and private investments in addition to a robust infrastructure growth, can enhance the economic performance of the country.