The economic growth dynamics in India continue to show mixed signs during April 2023, the first month of the fiscal year FY2023-24. Consumption spending was sustained at the rural as well as the urban level, and other demand-driving indicators, such as lower trade and private investment, weighed on growth due to the continued gloominess in global economic conditions. Manufacturing and services activities picked up substantially in April 2023, generating higher than expected domestic sales, GST revenues, and rail freight volume, but the unemployment rate continued to remain high at around 8% owing to the incremental labor participation rate. While the Indian economy has shown reasonable resilience, the impact of the global slowdown and geopolitical challenges is evidently continuing, as exports and imports activities slowed down during the month.

According to the latest data released by the Government of India (Gol), industrial output for March 2023 was much lower than the previous month due to a marked deceleration in manufacturing sector performance. Nonetheless, overall consumer sentiment appeared positive during April 2023, which will hopefully set the tone for the new fiscal year 2023-24. Monthly data from March 2023 shows rising capital goods investment, which, if continued, will help sustain the momentum in economic growth in the new fiscal year.

The Indian rupee strengthened a bit as foreign exchange reserves grew in April due to the Reserve Bank of India’s (RBI) sustained efforts to buy US currency from both spot and forward markets. Retail and wholesale inflation both fell on the back of lower-than-expected inflation and better vegetable output driven by unexpected rains during the month.

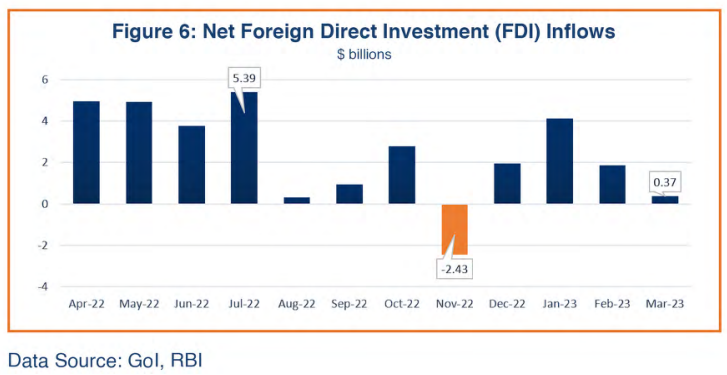

Net FDI flows were down to $-0.64 billion in March 2023, resulting in a total of only $28 billion net inflow for the full FY2022-23, a decline of 27.5% from the previous year. At the same time India’s foreign exchange reserves recovered substantially in March and the Indian rupee appreciated slightly to an average of 82.25 against the US Dollar, from 82.59 in the previous month.

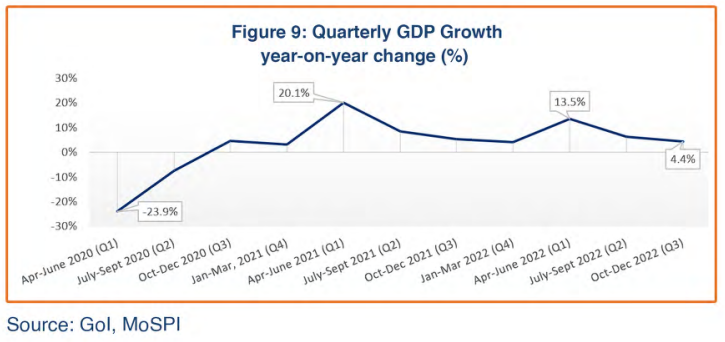

The Indian economy recorded 4.4% growth in the third quarter of FY2022-23 (October-December 2022), on the back of a strong performance in the agriculture and services sectors. Growth in the manufacturing sector and capital expenditure were uneven throughout FY2022-23. India has shown some resilience to the continuing geopolitical challenges and its domestic economy continues to grow; however, continued volatility in the external sector may dent its economic growth outlook as FDI inflows decline. Demand from India’s main global markets (the US and the EU) does not appear to be recovering in the short-term. On the positive side inflation is under control and is expected to remain so for the next several months. The enhanced capital expenditure outlined in the latest Union Budget can help revive sustainable growth in manufacturing and generate the stronger demand needed to achieve the forecasted GDP growth of 6.4% in FY2023-24.

Demand Indicators

Retailers have reported a growing rural demand with the easing of inflation, as seen in the higher sales of two-wheel vehicles. However, passenger vehicle retail sales in India (a parameter of urban demand) slipped 3% sequentially to 282,674 units in April 2023 owing to enhanced prices of cars after stricter emission regulations kicked in from April 1. According to the Retail Association of India (RAI), April sales numbers are getting closer the pre-COVID levels; FY2022-23 retail sales in particularly jumped 34% from previous fiscal. The RBI reported healthy bank credit growth at 15.2% at the end of April, up slightly from the previous month, even though the cost of credit remains high due to liquidity tightening. The sustained sentiment in the market during FY2022-23 suggests domestic demand continues to drive the economic recovery in India.

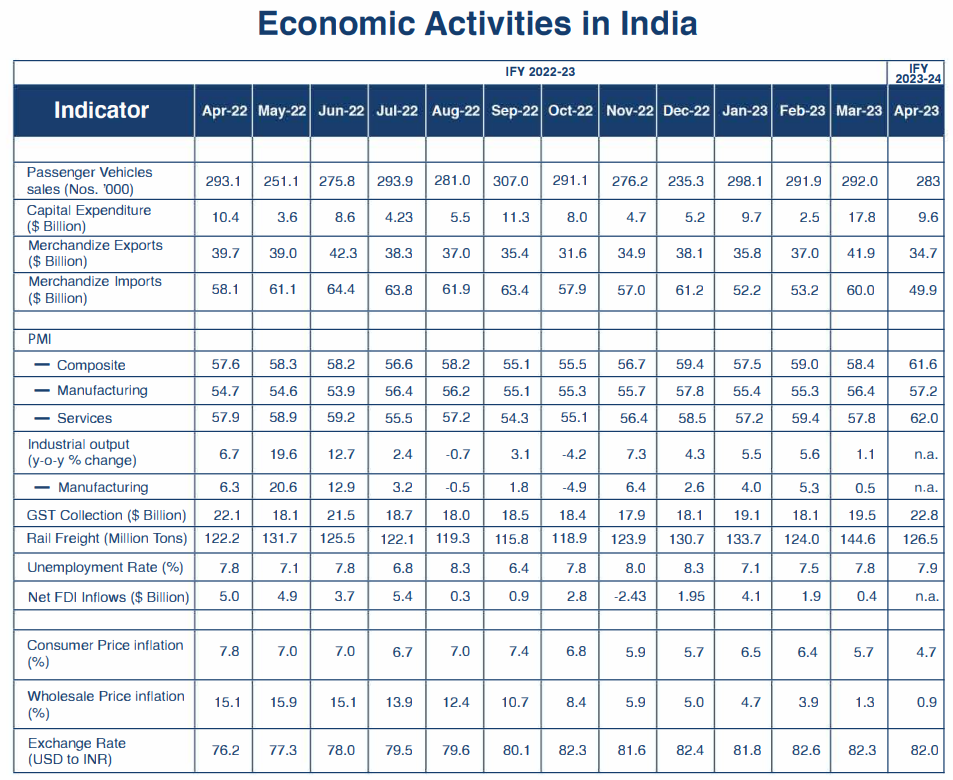

Government Capital Expenditure

Public sector capital expenditure (capex) was erratic for the entire fiscal year 2022-23 (Figure 1), and private sector capex did not pick up to the desired extent. However, the combination of an upswing in the property cycle and several large government infrastructure initiatives is likely to drive capex in FY2023-24. According to market observers, a meaningful capex revival in India is likely once the RBI pauses its liquidity tightening, which will lower borrowing costs and push demand.

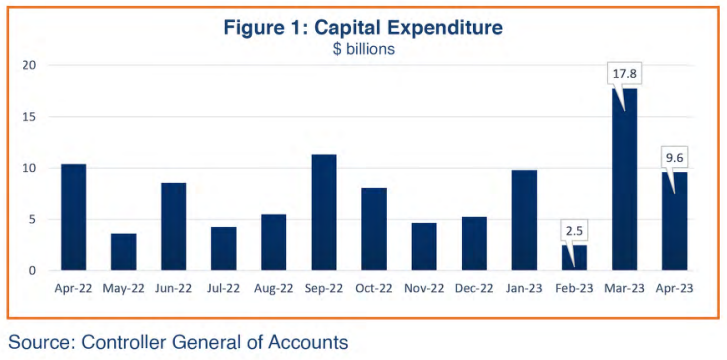

Trade

India’s merchandize exports dropped more than 17% in April 2023, the first month of FY2023-24, to $34.7 billion from the previous month’s $41.9 billion (Figure 2). Export performance continues to lag since the onset of the global economic slowdown. Falling commodity prices have also affected export earnings. Exports of electronic goods, pharmaceuticals, oil-meals, oil seeds, rice, and spices grew significantly in April 2023 while most other major categories witnessed deceleration, such as petroleum products, gems & jewelry, textiles, plastics, and chemicals. Global demand for petroleum products, gems/jewelry and textiles has weakened due to the continuing gloomy economic conditions.

India’s merchandize imports, at $49.9 billion in April 2023, were also about 17% down from the previous month’s $60 billion. India’s imports across all products recorded deceleration in April barring a few items, such as pulses, iron & steel, machinery and wood pulp and wastepaper. Overall, India’s trade deficit in April 2023 also fell about 17%, to $15.3 billion from $18.1 billion, in line with the symmetrical decline in exports and imports.

The Gol Commerce Ministry has released final trade numbers for FY2022-23, showing goods exports worth more than $450 billion, an increase of 6.7% over the previous fiscal year; and the total goods and services exports for the FY2022-23 surged 14.7% to nearly $776 billion.

Supply Side Indicators

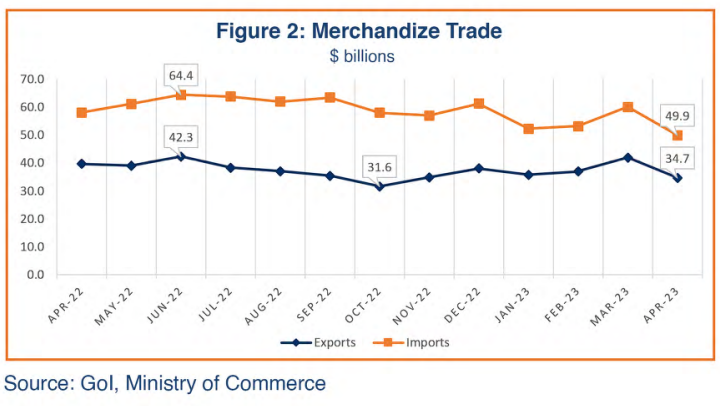

Input Purchases

Overall business sentiment in the opening month of the new FY2023-24 (April 2023) was robust, with the Composite Markit Purchase Managers Index (PMI) surging to 61.6 from 58.4 in the previous month. Continuing stronger demand for goods and services led to rapid expansion in both manufacturing and services activities (Figure 3; a PMI above 50 reflects the optimistic mood of businesses that have made bold input purchases in anticipation of increased demand). The latest reading recorded the twenty-first consecutive month of business activity expansion, reaffirming sustained economic recovery. The Services PMI for April 2023, at 62.0, was higher than March’s 57.8 and it peaked in almost 13 years. The Manufacturing PMI was at a four-month high at 57.2, reflecting manufacturing sector expansion on improved output and new orders.

According to the S&P Global Survey, although input costs at the composite level rose at the steepest pace since January, and consumer prices reached a four-month high, the overall rate of inflation remained below its long-run average. Manufacturing activities were the best in terms of demand and output since December 2022, but that improvement did not translate into increased hiring as job market conditions remained unchanged. The survey results suggest India will continue to be one of the fastest-growing major economies despite the slowing global growth that has undermined momentum in many countries.

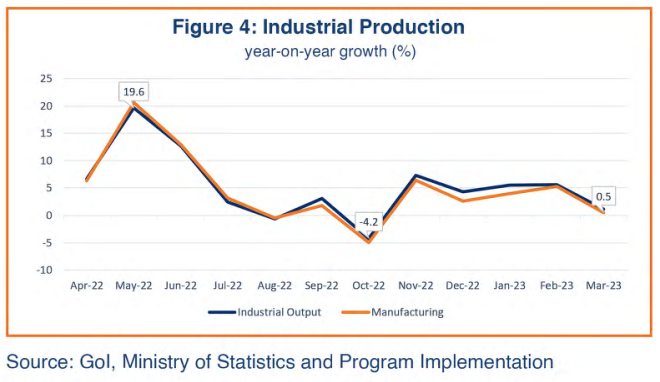

Industrial Production

India’s industrial production growth rate on a year-on-year (y-o-y) basis decelerated to 1.1% in March 2023 compared with 5.5% in February 2023. Growth in industrial production was led by mining and manufacturing output (Figure 4). Manufacturing, which accounts for 77% of total industrial production, recorded 0.5% growth, compared with 5.3% growth in the previous month; mining output growth, which comprises 14% of total industrial output, increased 6.8% vs. the 4.6% growth in the previous month; but the growth rate in power generation (8.0% of total industrial production) moderated to 1.6% compared with the previous month’s 8.2% growth rate. Capital goods production (a proxy for investments) within the manufacturing sector increased 8.1% in March 2023, slower than the 10.5% increase seen in February.

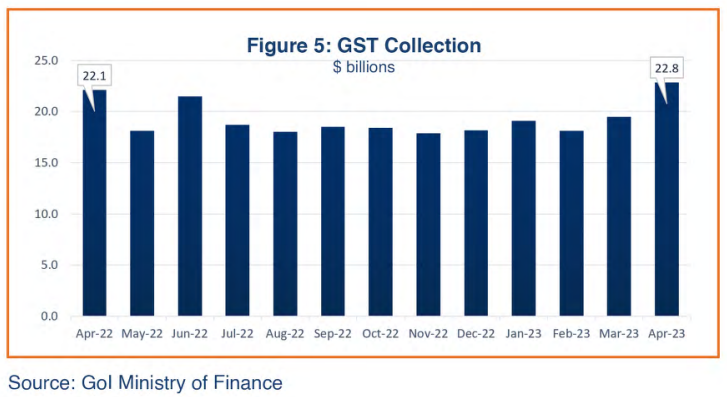

GST Revenues

India’s Goods and Services Tax (GST) collections throughout FY2022-23 showed moderate recovery trends. In April 2023, GST collections peaked at $22.8 billion, up from the previous month’s $19.5 billion, an indication of sustained consumer spending and increased compliance (Figure 5). The collections for April 2023 marked the second consecutive monthly rise. Analysts note that rising GST collections reflect a combination of a pick-up in economic activity, increased tax rates, increased compliance, and some effect of inflation. The Gol expects a 12% y-o-y rise in GST collections in the current FY2023-24.

Net Foreign Direct Investment

Foreign direct investment (FDI) flows showed mixed trends throughout fiscal year 2022-23. Net FDI inflows peaked in July 2022 at $5.39 billion, after which flows reversed drastically, becoming a $2.43 billion net outflow in November 2022. FDI inflows regained momentum starting in December 2022, albeit with little stability (Figure 6), which the government attributed to the uncertainty of geopolitical tensions and economic slowdown. In keeping with the UNCTAD World Investment Report (DATE) warning that “investor uncertainty and risk aversity could put significant downward pressure on global FDI”, in India the fiscal year 2022-23 net FDI inflows collapsed by more than 27%, to $28 billion from the previous year’s $38.62 billion.

Inflation

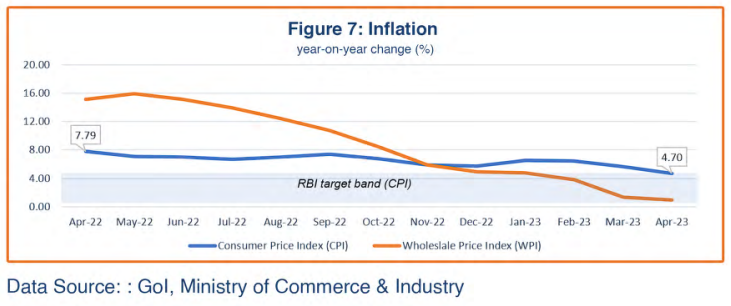

Consumer Price Index (CPI) inflation unexpectedly fell to an 18-month low of 4.7% in April, from 5.66% in March 2023, remaining below the Reserve Bank of India’s (RBI) upper target limit for the second consecutive month this year. Retail inflation in India was also recorded within the RBI target band of 2%-6% for November and December 2022 (Figure 7). Food prices, which account for about 40% of the CPI total, were softer during the month following an above-normal rainfall, leading the drop in CPI inflation; core inflation (non-food excluding fuel) also declined to 4.9% in April from 5.8% in the previous month. The RBI in its April Monetary Policy Committee meeting decided to maintain its key interest rate at 6.5% for now, having raised the benchmark repo rate by 250 basis points during FY2022-23.

Wholesale Price inflation in April 2023 further eased to 0.92%, a record 34-month low, mainly on account of the fall across manufactured products’ prices and a sharp dip in fuel, power, and food inflation rates. Business sentiment is expected to improve following the easing of wholesale input prices but the gap between consumer and producer prices continues to be high.

With consumer price inflation hitting an 18-month low of 4.7% in April, the gap between wholesale and consumer price rises has expanded, policymakers will monitor the situation closely as the wider gap between the two may be a sign of falling income and job opportunities in the economy.

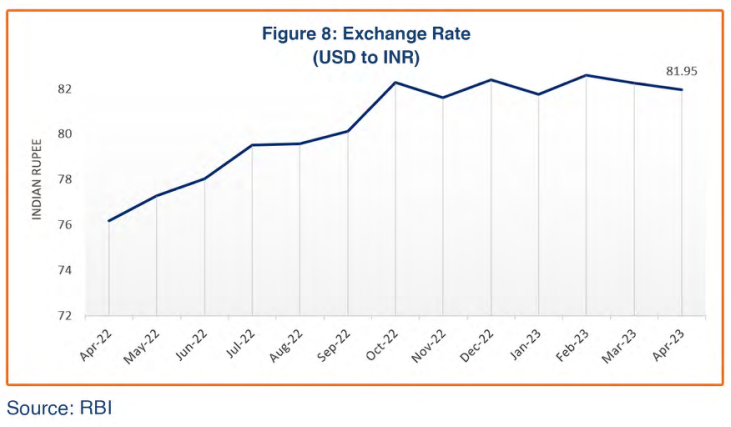

Foreign Exchange

India’s foreign exchange reserves were about $589 billion at the end of April 2023, up approximately $11 billion from March-end. The RBI intervened intermittently in the foreign exchange market for liquidity management, including the selling of dollars, to manage depreciation in the rupee, which impacted exchange reserves. Also, the revaluation changes due to the fall in US bond yields have contributed to the increase in reserves. The Indian rupee (INR) remained weak throughout April, falling to 82.75/USD on April 19; however, later in the month it recovered with the support of slowing outflow of foreign exchange driven by cheap oil imports from Russia. The average monthly exchange rate for April was INR 81.95/USD, compared to the previous month’s INR 82.25/USD (Figure 8).

Economic Outlook

India’s GDP growth rate in the third quarter (October-December 2022) slowed to 4.4% from 6.3% in Q2 and 13.2% in Q1 (Figure 9). The RBI in its recent monetary policy statement noted that the near-term growth outlook remains weaker than previously expected. It has revised its forecast for GDP growth in the current fiscal year down to 6.8%, in line with the IMF’s forecast, reflecting extended geopolitical tensions and continuing aggressive monetary policy tightening globally.

In a positive sign, the growth in industrial and manufacturing activities output has shown increasing demand. In addition, the continuing growth in the agriculture and services sectors, along with a sustained domestic demand and credit growth, should augur well for GDP growth; however, the continuing volatility in global conditions, as well as the lackluster export performance, may negatively impact GDP growth prospects. India’s total exports of goods and services grossed $776 billion in FY2022-23, approximately 14% higher than the previous year. The World Trade Organization has revised its October 2022 global trade growth forecast from 1% to 1.7% for year 2023, and if demand improves in the EU and US it might give a boost to the export sector globally. While the FDI in India declined significantly in FY2022-23, economists are expecting a recovery in FDI inflows in FY2023-24 as India is remains the fastest-growing economy in G20.

The Union Budget for FY2023-24, presented on February 1, 2023, featured a significant increase in capital expenditures, up 0.6 percentage points to 3.3% of GDP to support infrastructure-led economic growth and private investment. The enhanced capital expenditure underscores the government’s focus on supply-side rather than demand-side support. However, the government needs to implement this infrastructure spending aggressively to attract greater private investment, strengthen demand and raise India’s baseline growth potential.