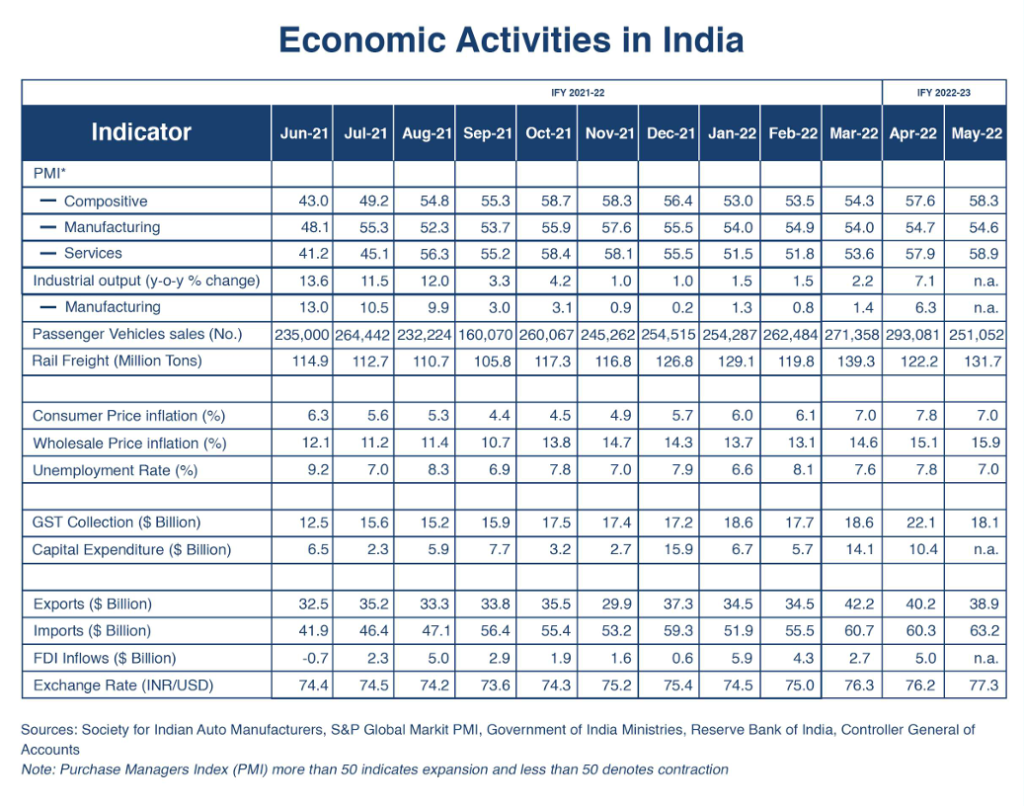

The performance of high-frequency indicators for May 2022 indicates a pickup in economic activity in India despite the continuing worldwide challenges of inflation and supply chain disruptions. Overall business sentiment was still positive though somewhat lower than in March due to greater disruptions from the Russia-Ukraine conflict. Demand patterns showed resilience despite continuing inflation and supply disruptions, manufacturing and service activities picked up significantly, external trade continued to do well, and unemployment dipped during May 2022; however, consumer and input price inflation remained a concern.

Retail businesses reported sales value gains in May that were 24% higher than that of corresponding period pre-Covid in 2019. Passenger vehicle sales were less than the previous month, albeit growth was still visible despite continuing supply disruptions. On the supply side, the Markit Purchasing Managers’ Indices (PMI) for Manufacturing was down marginally while the PMI for Services was 1% up from the April level. The Composite PMI also rose 1% from April and has remained above 50 points for eleven months consecutively, indicating expanding business transactions in a sustainable manner. The overall unemployment rate was down to 7% from the previous month’s 7.8% as factories resumed hiring..

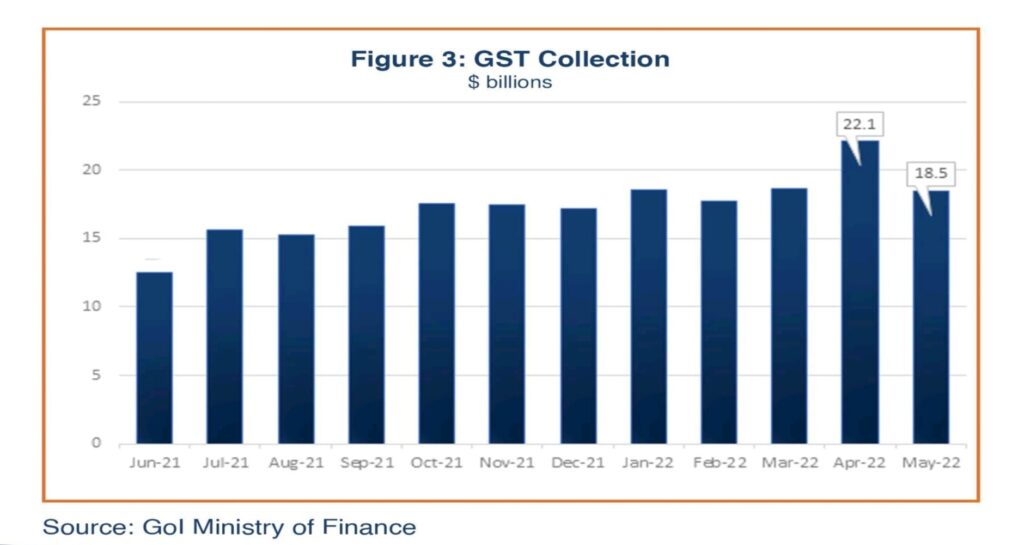

As expected, Goods and Services Tax (GST) collections were 18% down in May, compared with end-of-fiscal-year peak recorded in the April. Monthly rail freight volume, at 131.7 million tons, was 8% higher than the April level, reflecting increased business activities.

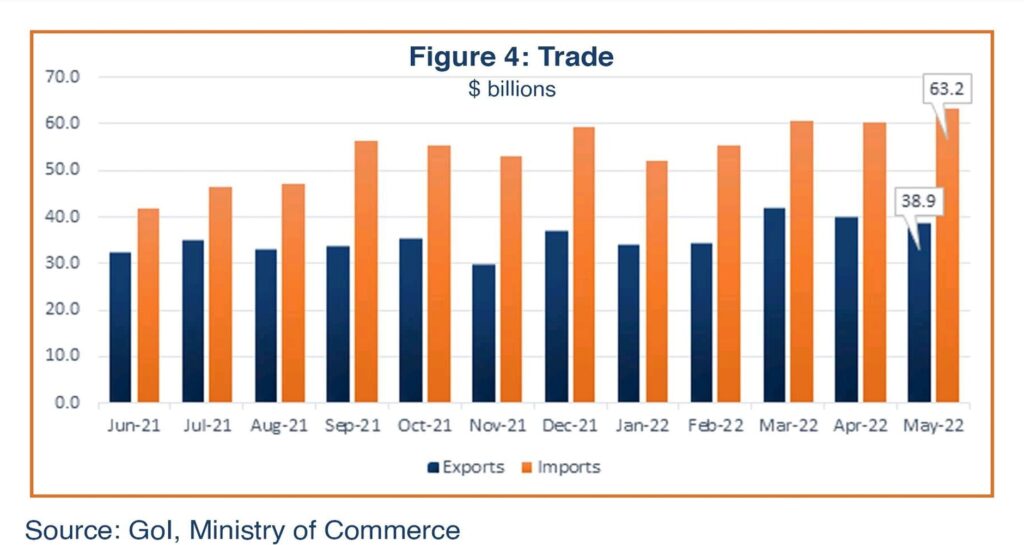

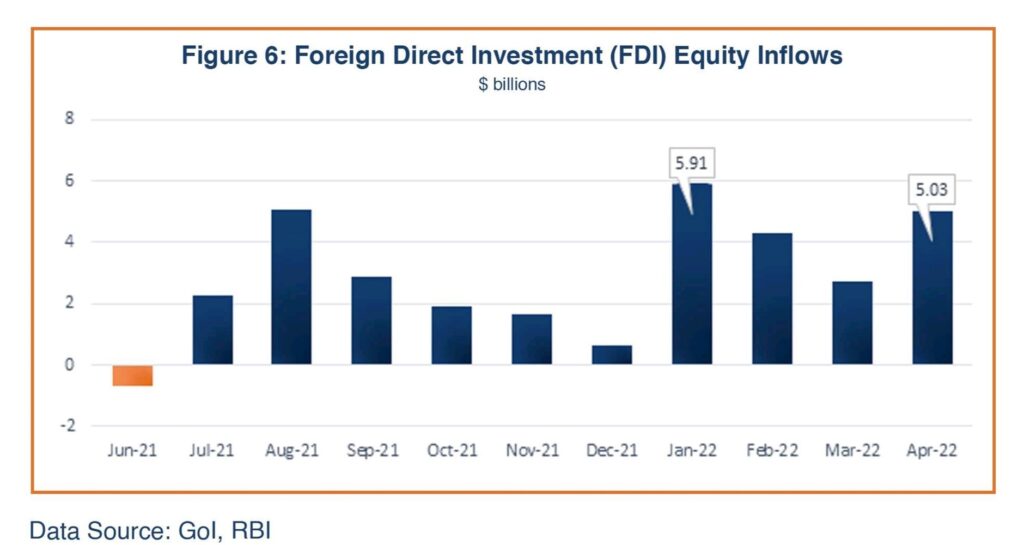

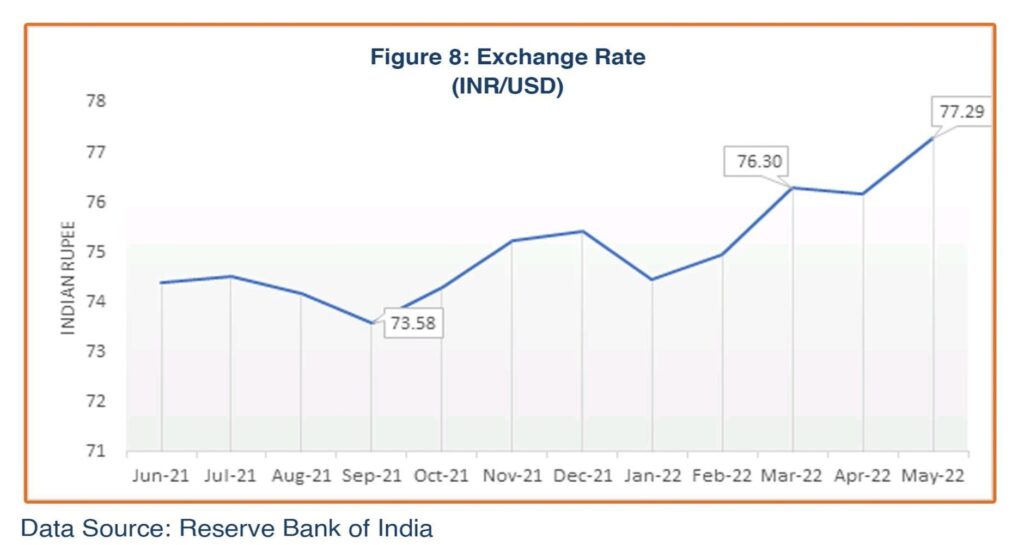

On the external side, India’s foreign trade performance in May continued to be remarkable, with merchandise exports down just slightly from April. The government has estimated $83.7 billion in total FDI inflows (including equity inflows, reinvested earnings, and other capital) for IFY 2021-22, compared with the previous year’s $82 billion. India’s foreign exchange reserves have slipped to around $600 billion and the Indian currency fell further against the US dollar in May; in response the RBI sold $10 billion in the spot market to contain further depreciation and voiced its intention to intervene if the rupee becomes excessively volatile going forward.

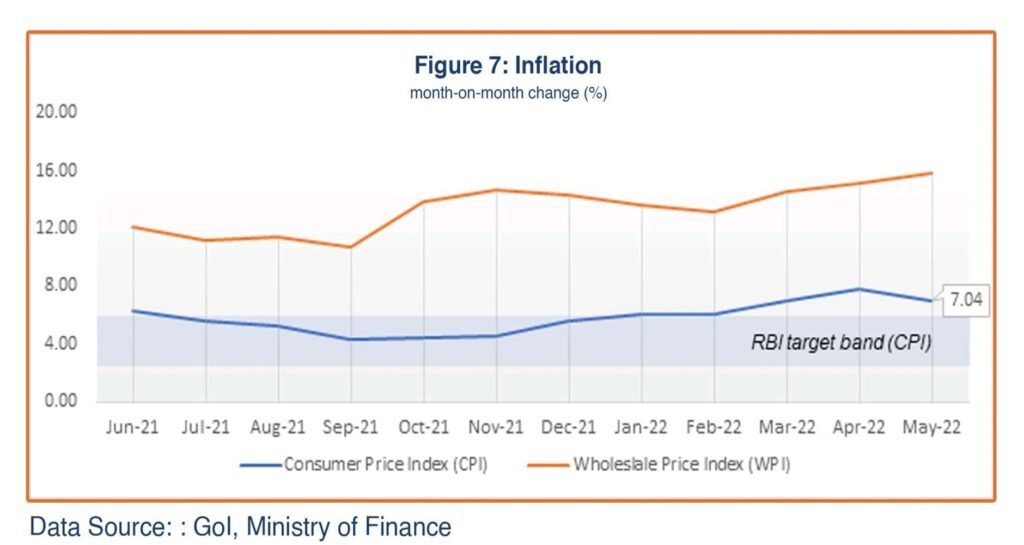

The cut in fuel excise duties and ban on wheat exports helped lower the consumer price index (CPI) to 7.04% in May 2022 from the previous month’s 7.79%, albeit still above the RBI target ceiling of 6.00%. The wholesale price index (WPI) rose to 15.88% in May, up from the previous month’s 15.08%, indicating rising input costs for manufacturers due to higher oil prices. The RBI and Finance Ministry have hinted at coordinated efforts going forward to manage the inflation and fiscal deficit without compromising on budgeted capital expenditure.

The near-term economic growth outlook for India remains uncertain on account of global political tensions, persistent inflation, increasing COVID cases, and continued supply chain disruptions; but the long-term growth prospects remain strong once international energy and commodity prices stabilize. The RBI, IMF, and World Bank have all revised downward their estimates for India’s GDP growth, to the 7.2-7.5% range for FY 2022-23, on the back of the lower than expected 8.7% GDP growth in FY 2021-22 and continuing uncertainties. Going forward, the government’s fiscal and RBI’s monetary policies will determine the pace of recovery for the Indian economy.

Demand Recovery Trends

Retail sales in May 2022 witnessed an upsurge in consumption demand, despite persisting retail inflation. Vehicle sales were down 14% from the previous month sales level, but automakers find their sales volume robust despite chip shortages and continuing disruptions in supplies. The monthly survey by the Retailers Association of India (RAI) reported 24% year-on-year higher sales during May across most sectors (restaurant sales, consumer durables and electronic sales), and underscored “the steady improvement in sales growth in April and May as compared to the pre-pandemic levels”. Higher volume of sales each month point to a positive private consumption trajectory going forward; however, consumer price inflation may dent the rate of demand recovery.

Supply Side Dynamics

Input Purchases

The steady Markit Purchase Managers Index (PMI) Manufacturing Activity Index above 50 in May 2022 reaffirms the continuing momentum in economic activity. A PMI above 50 reflects the optimistic mood of businesses that have made bold input purchases in anticipation of increased demand (Figure 1). The Composite index in May 2022 improved more than one percentage point to 58.3 from April’s 57.6. The Services index was up to 58.9 in May from 57.9 in April amidst receding COVID restrictions and increasing contact-based activities; the PMI for Manufacturing dropped marginally 54.6 from the previous month’s 54.7, indicating improvement in production activities but at a slower pace. Manufacturing PMI has consistently remained above 50 for the last eleven. months, showing a sustainable expansion pattern in production activities and recovery across the manufacturing sector. However, high input costs due to high fuel prices remain a concern that continue to impact manufacturing sector output. Factory activity in India picked up in May due to higher domestic and global demand as pandemic restrictions ease; this favorable effect was visible in labor markets with more hiring and unemployment rate decreasing to 7% from the previous month’s 7.8%

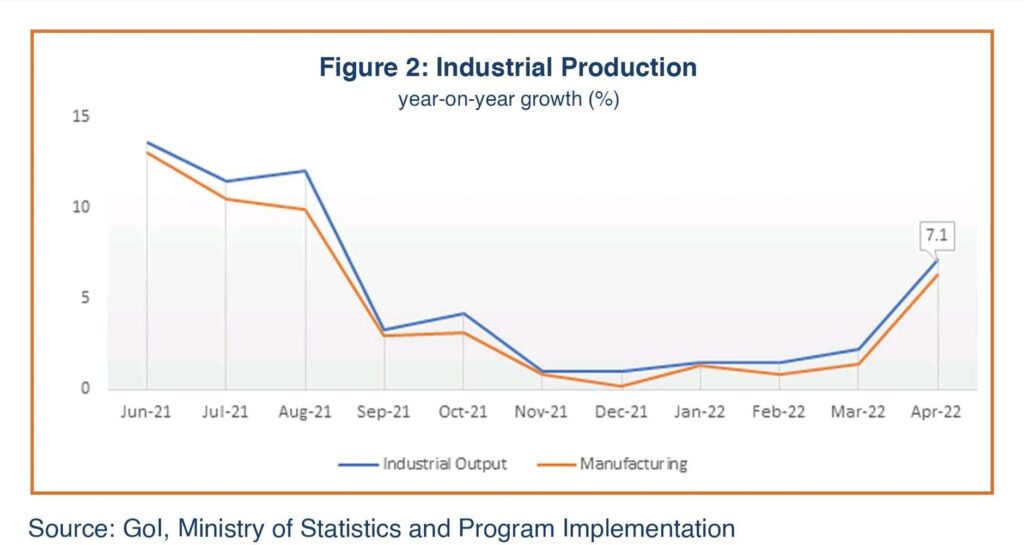

Industrial Production

Total industrial production continues to improve compared to last year, rising 7.1% year-on-year in April 2022, up from an upwardly revised 2.2% in March (Figure 2). Impressive growth across all segments has generated the strongest growth in industrial production in eight months. Manufacturing, which accounts for 77% of total industrial production, increased 6.3% year-on-year in April, from 1.4% the previous month; mining, which comprises 14% of total industrial output, almost grew double to 8% year-on-year in April from March, and growth in electricity production (8% of total industrial production) also doubled to nearly 12%, from 6.1% in March. Capital goods production within the manufacturing sector showed a significant 14.7% growth, implying higher growth in investment.

GST Revenues

Changes in the value of Goods and Services Tax (GST) collection are considered an indicator of business transactions. The GST collections for May 2022 were down 18% from the previous month, to more than $18 billion (Figure 3). Analysts have indicated that the GST collections are in tandem with the economic activity, and the reduction in collections compared with the previous month was expected as the collections for the last month of the fiscal year (reflected in April) have usually been more than other months. Railway freight loading rose 8% in May to 131.7 million tons from the previous month, reflecting increased economic activity.

Trade

During May 2022, Indian exports grossed $39 billion, marginally down from the previous month’s $40 billion in April (Figure 4). India’s merchandise imports were $63 billion in May, up from $60 billion from the previous month, reflecting partially the relative upward movement in industrial activity led by rising demand, but also the effect of rising global oil prices that raised the final cost of most imported goods. India’s trade deficit remains elevated, due to India’s continued dependence on import supplies of specific products, such as edible oils, fertilizers, and project goods; the rise in international prices of fertilizers, natural gas, coal, metals, and edible oils have also contributed to the swelling import bill.

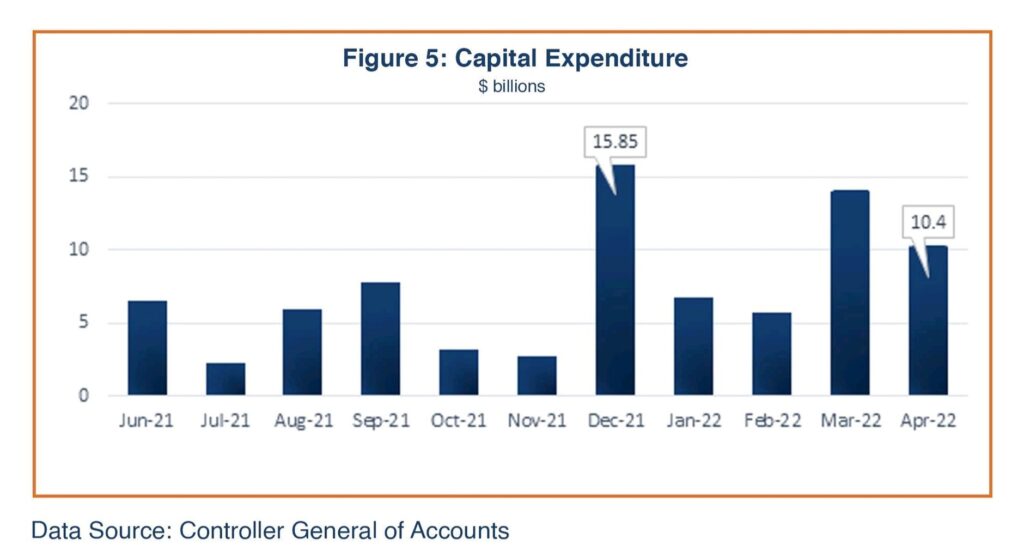

Government Spending

The budget for FY2022-23 augments public capital expenditure by more than 34%, to nearly $101 billion, reflecting the government’s focus on building public infrastructure. According to the latest Controller General of Accounts (CGA) Monthly Report, the monthly capital expenditure was highest in December 2021 at $15.85 billion, mainly on account of loan disbursement for the Air India deal. Capital expenditure was down for January and February, but it surged again in March and April (Figure 5). The Finance Ministry officials have noted that the capital expenditure will be prioritized as it will catalyze the country’s economic growth and that the Ministry will not compromise on the budgeted capex as part of its fiscal measures to deal with inflationary challenges and the surging import bill.

Foreign Direct Investment (FDI)

Foreign direct investment (FDI) flows went up and down throughout the IFY 2021-22. India attracted $5 billion in FDI inflows in April 2022 (Figure 5). According to the latest data released by the Department of Industrial Policy and Internal Trade (DPIIT), in FY2021-22, FDI equity contracted marginally, by 1%, to $58.8 billion. However, total foreign direct investment (including equity inflows, reinvested earnings, and other capital) into India rose by 2%, peaking at $83.7 billion in 2021-22. According to consulting firm Deloitte, over 40% of the 1,200 global business leaders surveyed in the US, UK, Japan, and Singapore plan to make additional or first-time investments in India.

Inflation

At 7.04% in May, the consumer price index (CPI) remained above the RBI’s inflation target ceiling of 6.0% for the fifth month in a row (Figure 6). Tackling high retail inflation remains India’s top priority, as in other major economies. In a bid to check retail inflation, the government cut fuel excise duties and restricted wheat exports in May, which moderated CPI inflation a bit from the previous month’s peak of 7.79%. Wholesale Price inflation rose from 15.1% in April to 15.88% in May 2022 due to persistent high oil prices in the international market. As expected, the RBI has taken monetary measures to contain inflation, raising bank-bank interest rates by 9 basis points in two tranches since May 4, and has indicated it will continue to manage the impact of oil prices in close coordination with the fiscal authorities.

Foreign Exchange

In May 2022, the RBI sold nearly $10 billion in the spot market from foreign exchange reserves to restrict the Indian Rupee’s depreciation against the US Dollar and reduce inflation. The Indian rupee moved in the range of 77.20 to 80.01 in May 2022, hitting its record low for the year at 80.01/US dollar. The average monthly exchange rate for May was 77.29/USD (Figure 8). India’s foreign exchange reserves fell to $596 billion by the end of May 2022, from the peak of $642.45 billion in September 2021. Forward contracts have helped maintain India’s foreign exchange reserves over the last two months in the face of rising imports. The RBI, through its intervention in the spot, future, forward, and overseas derivative markets, has steadied the rupee’s position against its Asian peers, which will also help contain the rise in local prices.

Economic Outlook

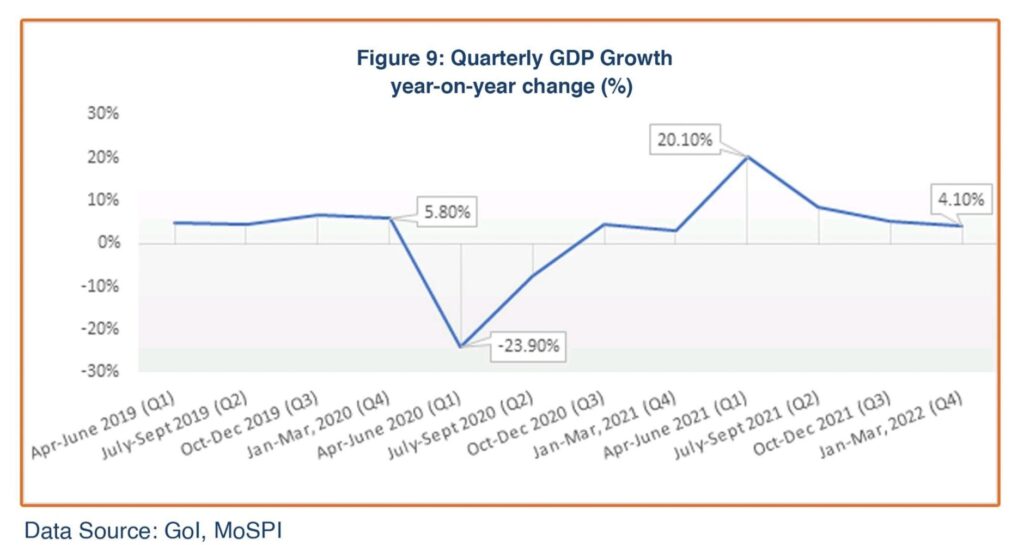

The government’s GDP growth data for the last quarter of Indian Fiscal Year (IFY) 2021-22 (January-March 2022), released in May, shows slower growth of 4.1% on the back of the inflationary pressures, Omicron coronavirus impact, and the supply disruptions caused by the Russian invasion on Ukraine. The government estimates overall GDP growth for IFY 2021-22 at 8.7%, compared with the contraction of 6.6% recorded in IFY 2020-21. These numbers confirm that all GDP segments have emerged stronger than their pre-Covid levels, showing sustained momentum of economic activity for most part of the FY 2020-21.

In view of the continuing uncertainties of the pandemic, Russia-Ukraine crisis, supply chain bottlenecks, international fuel inflation, and slower global growth, the RBI and other observers, such as the IMF and World Bank have revised India’s GDP growth estimates downwards to the 7.2-7.5% range for FY2022-23. The RBI has also raised its inflation projections to 6.7% for the current fiscal year, while the government has pronounced its intention to manage inflation without reducing the capital expenditure. India’s Chief Economic Advisor has noted his optimism on achieving the growth targets, saying “India is in a much better place in terms of inflation as compared to other countries, as the financial sector of the country is in better shape to support growth.” Nonetheless, the economic growth outlook for India remains uncertain currently and will depend on how the global geopolitical scenario unfolds.