India’s strong economic performance for November 2023 was supported by solid domestic demand, controlled inflation, robust manufacturing growth in October, decent input purchases, and increased investments. Most indicators were elevated but external demand remained suppressed.

Retail activity in November 2023 showed greater demand and consumer spending with the festival and wedding season. A decent rise in retail sales was visible in the number of sales of passenger vehicles and other consumer durables. On the supply side, the Markit Purchasing Managers’ Indices (PMIs) for the manufacturing industry softened a bit in November mainly due to lower external orders but remained firmly above the breakeven level of 50. The overall unemployment rate in November witnessed a decline of almost one-percentage point from the previous month on an increase in factory worker hiring. Goods and Services Tax (GST) and rail freight revenues were steady in tandem with market activities and increased compliance. Government investment in infrastructure projects (capital expenditure) was nearly half the previous month’s level yet was substantial and per the budgeted spending.

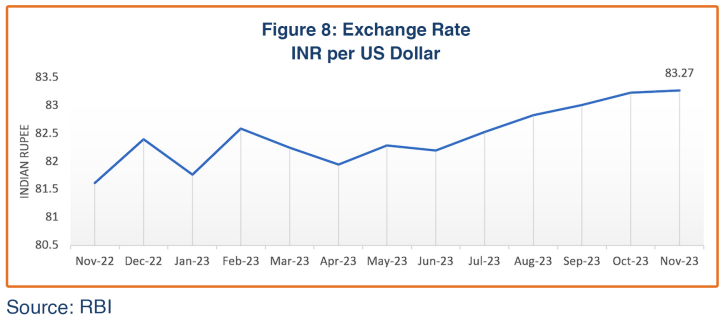

India’s external sector continues to reflect the impacts of volatile conditions and tightening liquidity globally, with merchandize export earnings falling in November. India’s trade deficit rose significantly during the month owing to increased import bills. Net Foreign Direct Investment (FDI) saw some positive movement in inflows albeit weaker global investment sentiment continues to show impact. India’s foreign exchange reserves surpassed the $600 billion mark after a gap of about four months, and the Indian rupee was relatively stable at an average of 83.27 against the US dollar.

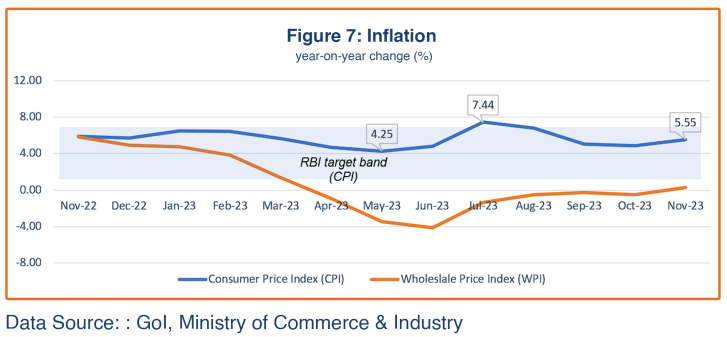

Firming prices for vegetables, fruit, and non-food items led to an uplift in the consumer price index (CPI), but it remained within the RBI target band. While core inflation in India is now controlled, the risks of higher commodity prices continue, and the RBI has noted that it will not cut the repo rate until CPI inflation stabilizes at 4%. The wholesale price index (WPI) returned to growth territory after seven consecutive months of decline in November 2023.

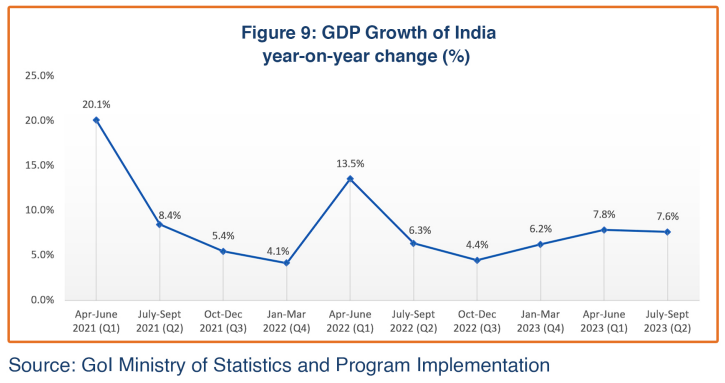

India printed an impressive economic growth of 7.6% during the second quarter of FY2023-24 driven by a solid manufacturing growth, robust urban demand, and improved government spending. The Agriculture and Services sector’s performance was not very enthusiastic during the second quarter of FY2023-24; corporates reported profits and the overall market sentiment remained buoyant.

The Indian monetary authority did not change the repo rate at its December 8, 2023, meeting but remains hawkish on inflationary trends. Many economic agencies have revised upward India’s growth forecast for FY2023-24 following cumulative growth of 7.7% recorded for the first half of FY2023-14. Economists have cautioned, however, that the risks of resurgent inflation, severe climatic and monsoon conditions, and geopolitical challenges arising from the continuing Ukraine-Russia war and the Israel-Hamas conflict may moderate the pace of economic growth going forward. IMF’s 2023 Article IV Report has lauded Government economic policies that have resulted in resilient growth on the back of a strong financial stability, and it has suggested rapid structural reforms while continuing the current policies to maintain growth momentum.

Demand Indicators

Retailers reported growth in urban and rural consumer spending, as seen in the higher sales of two-wheel vehicles and four-wheel passenger vehicles. According to auto industry statistics, October saw the best sales in ten months, with car dispatches of over 391,400 units. Automakers are optimistic that the demand momentum will sustain and lift sales across segments this festive season.

The festival season, which lasts for several weeks, has given a boost to domestic demand, with robust customer spending on food, gifts, and home improvements in November 2023. This winter’s wedding season is one of busiest of recent times, which has strengthened growth in demand. The growth rate of bank credit increased to 20.6%, from the previous month’s 20%, even though the cost of credit remains high due to liquidity tightening in effect since April 2023. The sustained positive sentiment in the market during FY2023-24 indicates resilient consumer demand will drive expansion of the Indian economy in the short and medium terms. The Government of India is also continuing fiscal support directed toward the rural economy which could further push rural consumption; however, capital expenditure (capex) is expected to shrink in the next few months.

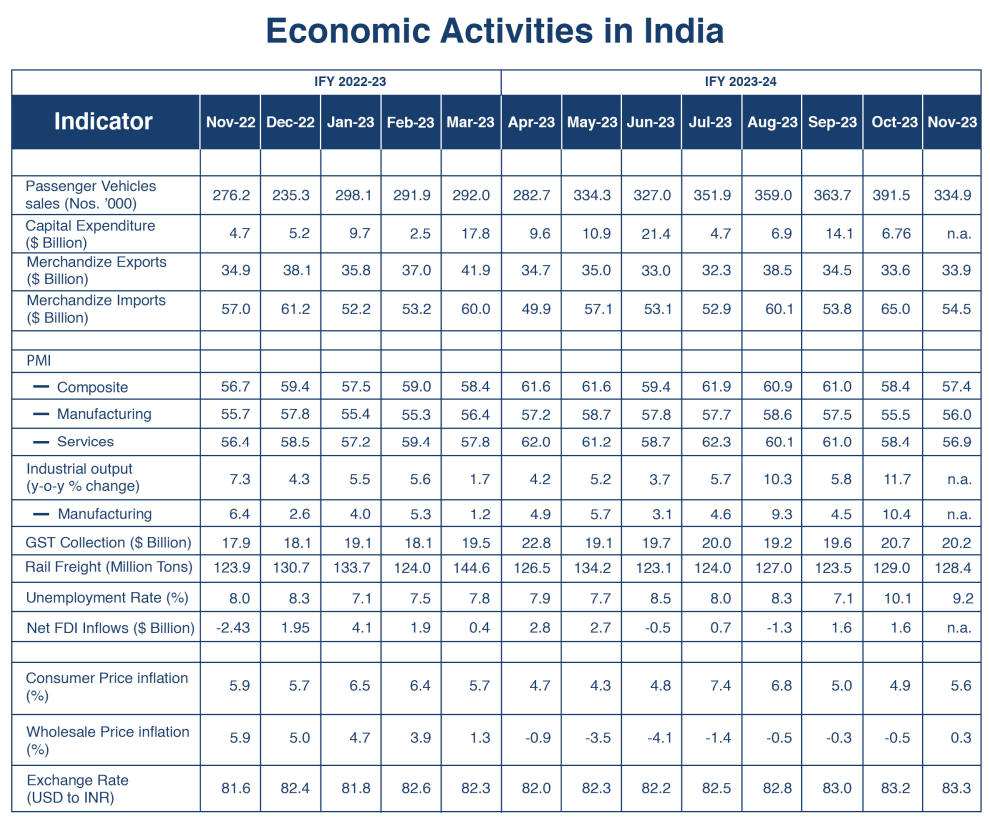

Capital Expenditure

Public sector capital expenditure (capex, a proxy for infrastructure investment) maintained an upward trajectory during the first quarter of the current fiscal year (Figure 1) and contributed substantially to India’s GDP growth rate of 7.8% for the quarter. Capex slowed in the second quarter but remained adequate and aligned to budgeted infrastructure projects financing. Private sector capex has also reportedly picked up, with companies from core capital-intensive sectors including oil and gas, metals, and power reporting impressive capex growth in the first quarter of FY2023-24 compared to the previous year. The government’s Production-Linked Incentives (PLIs) in select sectors, such as electronics and appliances, are also helping increase private sector participation in investments. India’s corporate sector has reported growth in net profits for the second quarter of FY2023-24 (July-September 2023), which is expected to help sustain the momentum in private capex going forward. A relatively stable domestic macroeconomic environment and global opportunities are translating into increasing profitability for Indian corporates. Nonetheless, India’s capex phase still lacks sustainability, showing erratic trends.

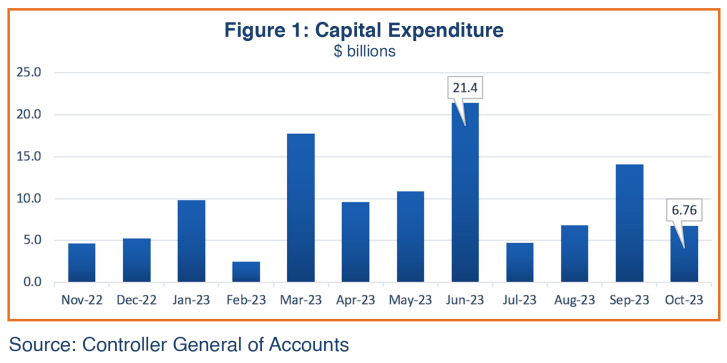

Trade

India’s merchandize exports improved slightly, to $33.9 billion from the previous month’s $33.6 billion (Figure 2). Export performance remains impacted by sluggish global economic conditions, including high inflation rates that have reduced demand in developed economies. While categories such as iron ore, electronic goods, minerals, fruits and vegetables, oil meals, and ceramic products recovered substantially, other major categories saw growth rates moderate, such as petroleum products, textiles, chemicals, and plastics. The growth in India’s electronics exports was led by mobile phone exports, which have shown tremendous growth following the government’s announcement of the Smartphone Production-linked Incentive (PLI) Scheme in 2020. November’s services exports were static at $28.7 billion, like the October 2023 level. India’s Finance Ministry in its September Review projected the exports will recover in the second half of FY2023-24 (October 2023 – March 2024), adding that India’s forex reserve position is “comfortable” and the external account “robust”. In November, the Government also announced a new export strategy to achieve the targeted $2 trillion worth of annual exports by 2030, compared to the current $770 billion realized in FY2022-23.

India’s merchandize imports, at $54.5 billion in November, were down more than 16% from $65.0 billion in the previous month, narrowing the country’s merchandize trade deficit to $20.6 billion, much less than the previous month’s $31.5 billion. Services imports, however, decreased slightly to $13.4 billion in November 2023 from the previous month’s $14.3 billion.

Supply Side Indicators

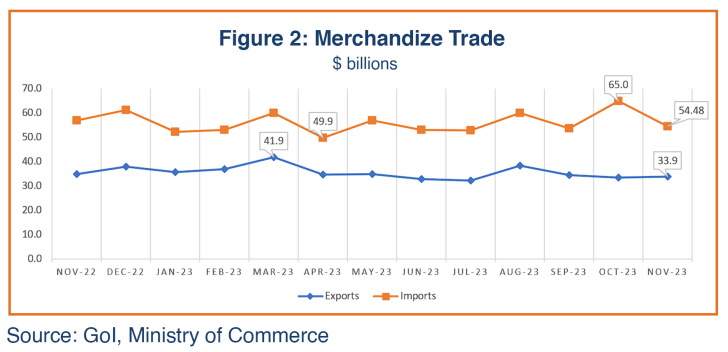

Input Purchases

Overall business sentiment in November 2023 was enthusiastic despite with a lower Composite Markit Purchase Managers Index (PMI) at 57.4, down from the previous month’s 58.4. Growing domestic demand for goods and services led to expansion in manufacturing activities (Figure 3; a PMI above 50 reflects the optimistic mood of businesses that have made bold input purchases in anticipation of increased demand). While service market activities grew at a relatively slower pace during November, the overall Composite PMI reading recorded the 29th consecutive month of business activity expansion, reaffirming sustained economic recovery in India.

The Services PMI for November 2023, at 56.9 points, dropped from the previous month’s reading of 58.4, but service exports remained robust. According to the PMI Survey, growth in services activity in India decelerated in November owing to competitive pressures and inflationary forces. India’s services PMI reading has sustained a level above breakeven for 28 months, heightening optimism on the sector’s outlook.

Manufacturing activity PMI slightly improved to 56 in November 2023, primarily due to an expansion in new domestic and external business orders and moderation in the cost of raw materials, which together heightened business confidence according to the S&P Global Market Survey Reports. The sustained growth in new business orders also led to an increase in hiring. The unemployment rate in November fell to 9.2% from the previous month’s 10.1%, marked by increased hiring in factories.

Industrial Production

India’s year-on-year industrial production growth rate in October 2023 peaked to a 16-month high of 11.7%, compared to the 5.8% growth rate recorded in September 2023 (Figure 4). A better-than-expected performance by electricity, mining and manufacturing output, and a pick-up in festive demand drove the surge in industrial growth in October 2023. Economists remain optimistic about festive and wedding season demand during the next three months.

Manufacturing, which accounts for 77% of total industrial production output, recorded growth of 10.4% in September, compared with 4.5% in the previous month. The growth rate in mining output, comprising 14% of total industrial output, also accelerated to 13.4% in October, compared to the 11.5% growth rate in the previous month. The power generation (8.0% of total industrial production) growth rate rose to 20.4% in October, compared with the previous month’s 15.3%. Production of capital goods (indicative of growth in investments) within the manufacturing sector posted a 16-month high growth rate of 22.6%, compared with the 7.4% growth rate recorded in September 2023.

Domestic demand will be the key driver of industrial performance in India for the rest of the current fiscal year as merchandize exports will likely remain weaker due to gloominess in global economy. But industrial output also faces downside risks from increasing inflation.

GST Revenues

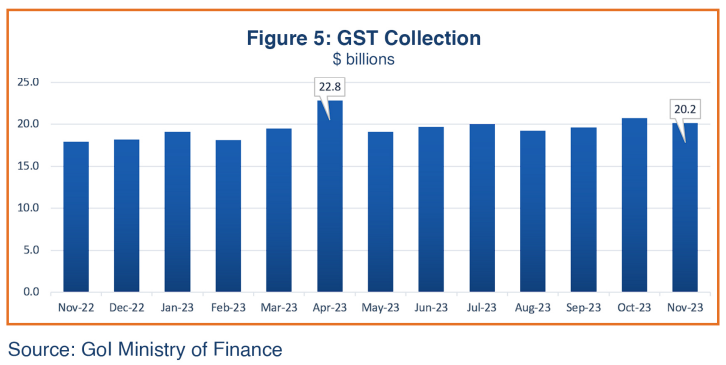

November 2023 Goods and Services Tax (GST) collections, maintaining a robust pace, are estimated at $20.2 billion, slightly down from the previous month’s $20.7 billion (Figure 5). A slower rise in average gross monthly GST collections in November was due to a delayed onset of festive season this year. The healthy growth in GST revenues in the current fiscal year is reflected in increased domestic transactions, as well as improved compliance. Industry expects the GST authorities to announce rate rationalization as the growth in GST collections is stabilizing.

Net Foreign Direct Investment

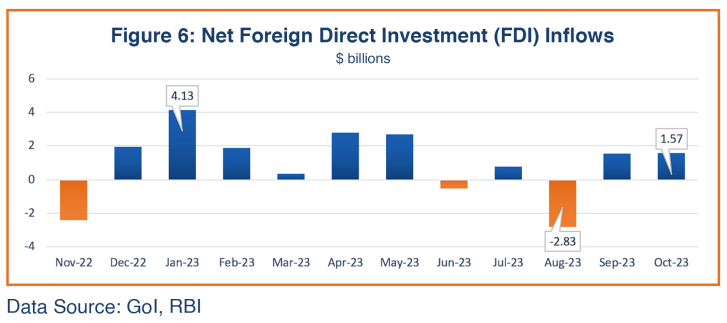

FDI inflows remain lackluster (Figure 6), mainly due to the geopolitical tensions that are weighing upon investor sentiment globally. According to the latest RBI data, total net FDI for October 2023 was $1.57 billion. The impact of moderating gross FDI and a rise in repatriation, along with shrinking foreign institutional investments (FIls), dampened the external sector in November 2023; however, performance is expected to improve in coming months as the trade deficit has fallen and Flls are returning as of the beginning of December.

Inflation

India’s retail inflation rate increased to 5.55% in November 2023, compared to 4.87% in October. The year-on-year Consumer Price Index (CPI) inflation rate, at 5.55%, is within the RBI target band of 2-6% (Figure 7); however, the RBI has set a target of 4% retail inflation before it starts lowering repo rates. Food prices, which account for about 40% of the CPI total, firmed up during the month but non-food inflation remained low. RBI economists have highlighted that core inflation in rural as well as urban areas is stabilizing, as reflected in a broad-based easing of price pressures across goods and services. The RBI’s Monetary Policy Committee, in its December meeting, decided to maintain the rep0 rate at 6.5% (Figure 8), with inflation forecast for FY2023-24 at 5.4%, and projections of 5.6% and 5.2% for Q3 and Q4, respectively. The RBI has flagged its concerns on the inflation outlook.

Breaking the seven-month-long deflationary trend, India’s Wholesale Price Index (WPI) inflation rate turned positive in November to 0.26%, up from the previous month’s -0.52%, due to increase in the prices of food articles, minerals, machinery and equipment, computers and electronics, optical products, motor vehicles, and transport equipment. A high base effect had partially contributed to the past seven-month negative trajectory of the WPI, as well as relatively lower input prices in non-food sector governed the WPI deflation during most of 2023.

Foreign Exchange

India’s foreign exchange reserves were more than $604 billion at the end of November 2023, a total gain of about $18 billion from the previous month. The foreign currency assets, which form the major component of the foreign exchange reserves, increased as the Indian currency became more stable following RBI interventions and an influx of foreign institutional investors to the Indian market. Other components of the reserves, gold, and special drawing rights (SDRS, or supplementary reserve assets maintained by the IMF) stayed stable. The reserve levels have declined since their October 2021 peak of $645 billion as the RBI has actively bought and sold foreign exchange in the market to smooth volatility caused by global developments.

The rupee remained almost stable throughout November 2023, with an average monthly exchange rate of INR 83.27 (Figure 8). The RBI has noted that the INR has exhibited low volatility compared to emerging market economy peers in the calendar year 2023.

Economic Outlook

Beating expectations, India’s real gross domestic product (GDP) grew 7.6% in the second quarter of FY2023-24 (July-September 2023; Figure 9), mainly driven by robust investments, steady urban demand, and impressive output growth in the manufacturing sector.

The RBI has revised its forecast of annual economic growth upwards to 7% for FY2023-24 from the earlier 6.5%, following the more than expected cumulative growth of 7.7% recorded for the first half of the fiscal year. Economists have, however, projected slower growth rates of 6.0% for Q3, and 5.8% for Q4. According to the RBI Governor, domestic economic activity is strong due to robust domestic demand, but risks to India’s outlook prevail, including geopolitical tensions, global economic slowdown, and unpredictable agriculture output. The festival season demand and sustained buoyancy in manufacturing activities are expected to push up private consumption while increasing corporate profits will promote investment activities.

The Asian Development Bank (ADB) in December raised its FY2023-24 growth forecast for India to 6.7% from the 6.3% announced three months ago, joining many other economic agencies to revise up projections following India’s stronger-than-anticipated growth of 7.6% in the September quarter. The International Monetary Fund (IMF) on October 10 had projected India’s real GDP growth at 6.3% in FY2023-24, up from 6.1% estimated in July, citing momentum from stronger-than-expected growth in consumption during April-June 2023.

In its Article IV 2023 Report released December 18, 2023, the IMF commended India’s economic reform policies that led to economic resilience and financial stability, surpassing market expectations in 2023 despite global headwinds. Shifts in the supply chain and manufacturing along with a solid financial system have made India a focus among international investors. The IMF prescribes continued policies to sustain economic stability and rapid structural reforms to unleash India’s economic potential. The S&P Global Ratings has highlighted that India’s economic growth prospects should remain strong over the medium term, with GDP expanding 6.4%-7% annually in fiscal years 2024-2026. While inflation, agricultural output concerns, and global slowdown are likely to weigh on industrial activity, a durable consumption recovery may help sustain growth momentum in India.