India’s economic performance picked up in September 2022, mainly reflecting growth in demand despite the continuing uncertain geo-political conditions. Consumer sentiment and the demand recovery have shown positive trends through the first six months of fiscal 2022-23, following a renewed festive season without COVID restrictions and a relatively narrower demand-supply gap with improved semiconductor supplies. Strong consumer demand is perhaps the most important engine of economic growth. However, downward movements were visible in industrial activity and the sustaining core consumer inflation remains the dampener for the economic performance.

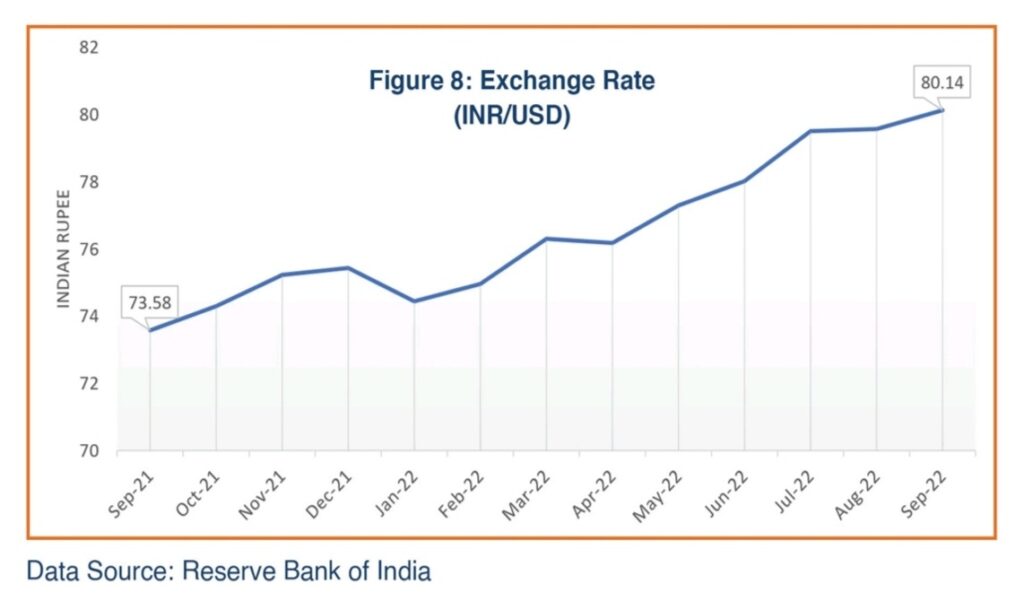

Retail activity has shown improvement on the back of the economic revival and strong festival season. Retail businesses reported sales value gained 21.0% over the pre-Covid September 2019 value. Positive movements were visible in September 2022 in most indicators, namely Goods and Services Tax (GST) collections, retail sales, exports, unemployment rate, input inflation, and capital expenditure; but negative movements in consumer inflation and the foreign exchange rate continue to challenge fiscal and monetary policymakers. While crude oil and food prices are moderating upon improving supply chain conditions, the problems of non-food inflation and global recession are the constraints to greater economic activity. Despite RBI’s efforts to avoid the psychological level of 80 for the Indian Rupee against the US Dollar, the domestic currency touched its new lowest point (81.84) against the US Dollar in September. Global recessionary pressures continue to affect India’s external sector; however, India has shown relatively better resilience compared to other advanced economies.

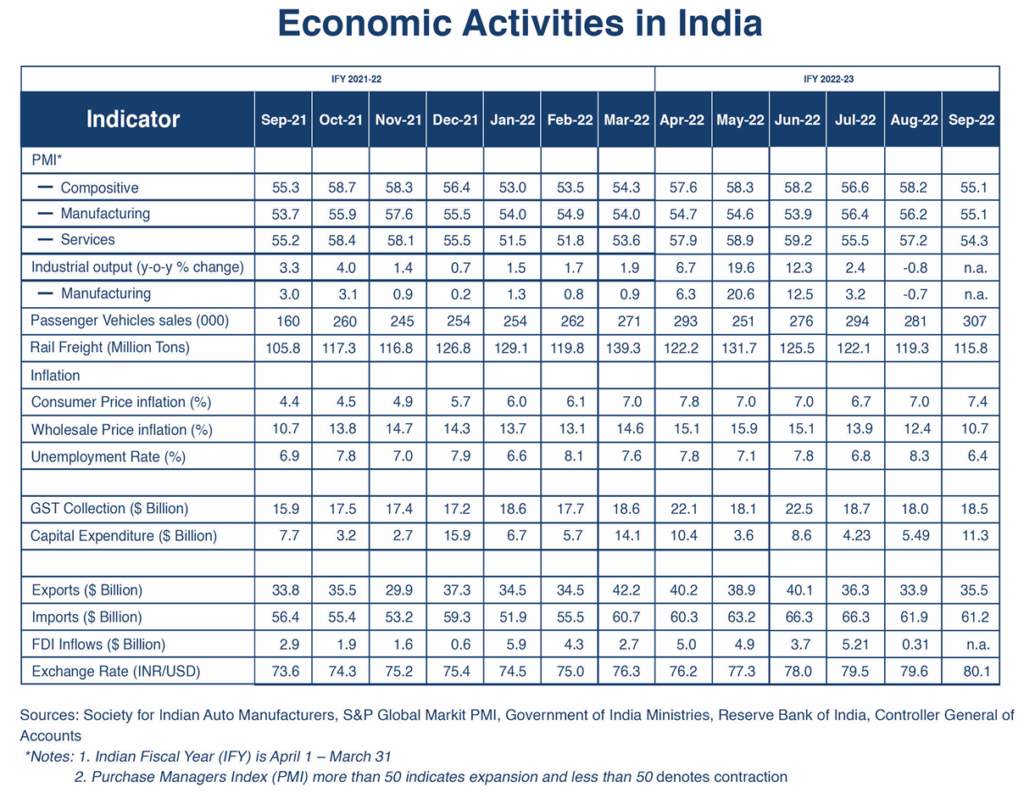

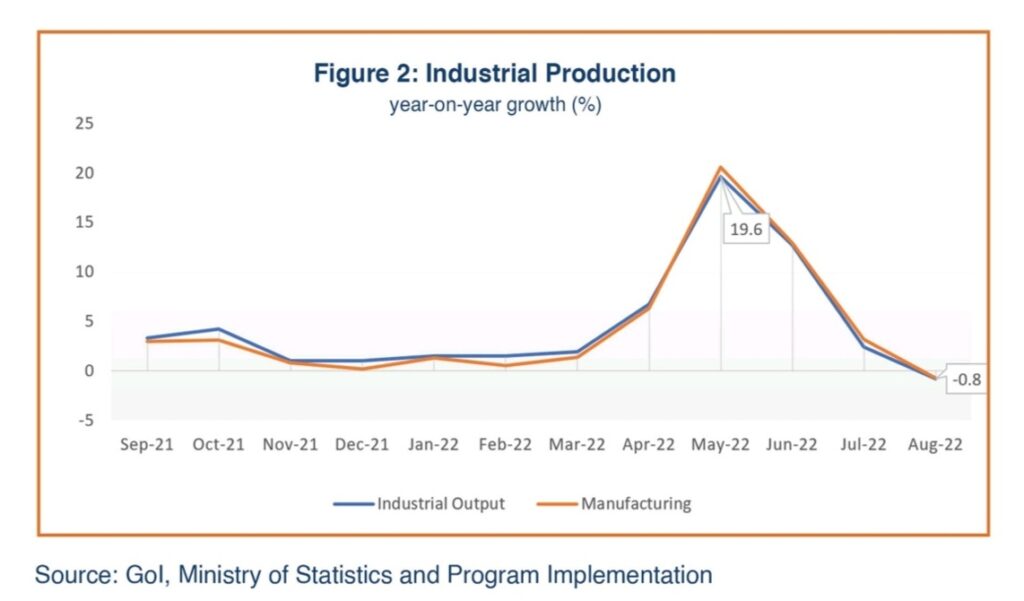

On the supply side, the Markit Purchasing Managers’ Index (PMI) for Manufacturing moderated to 55.1, and the PMI for Services was also down from the previous month. The Composite PMI was down from August due to heavy rains and floods suspending economic activities such as construction and mining, but still remained much above 50 points, indicating expansion in business transactions, albeit at a slower pace. The overall unemployment rate was down significantly to 6.4% from the previous month’s 8.3%, mainly on account of an impressive performance in the agriculture and services sectors. Goods and Services Tax (GST) collections sustained growth in September 2022 on the back of a continued uptick in industrial transactions, higher rates, and increased compliance.

As India remains integrated with the global markets, India’s export performance will likely remain lackluster due to the continuing recessionary conditions worldwide. That said, exports in September recovered 5.0% from the previous month. Meanwhile, imports were down marginally from September 2022 and FDI inflows in August 2022 (latest available data) slumped significantly from the previous month. India’s foreign exchange reserves, though still high, have been affected by macroeconomic uncertainties, slipping to its lowest to $533 billion in September while the Indian rupee fell less than one percent against the US dollar to 80.14 from the previous month.

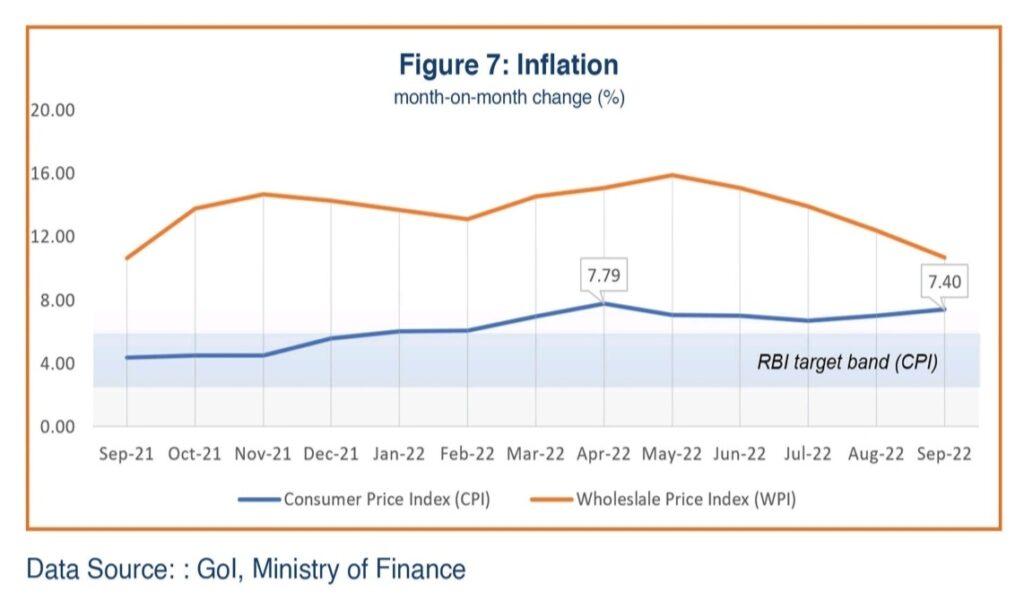

Higher food prices continue to impact the consumer price index (CPI) of inflation, which recorded 7.4% in September 2022, up from the previous month’s 7.0%. The CPI is still above the RBI target ceiling of 6.0% albeit under control compared with other major economies. The RBI again scaled up the interest rates by 50 points in September in a bid to contain excessive liquidity. The wholesale price index (WPI) dropped to 10.7% in September from the previous month’s 12.4%, to the lowest level this fiscal year.

While India has shown reasonable resilience to supply disruptions from persistent geo-political disturbances, the near-term economic growth outlook for India remains volatile given the uncertainties of global recession and China’s economic slowdown. But against the backdrop of ongoing structural reforms, India’s longer-term prospects appear strong. Considering the continuing global concerns that may impact performance in subsequent quarter, the RBI has revised India’s FY2022-23 GDP growth to 7.0% from its earlier projection of 7.2%. The International Monetary Fund (IMF) has also cut its economic growth forecast for India to 6.8% in IFY 2022-23 on account of extended geopolitical tensions and an aggressive monetary policy tightening globally.

Demand Recovery Trends

Retail sales in September 2022 showed an uptrend in consumption demand. Vehicle sales were up 9.0% from the previous month despite costlier auto loans. RBI reported bank credit growing 12.6% at the end of September, compared with 15.5% in August, pointing to slower but still rising demand for credit.

The monthly survey by the Retailers Association of India (RAI) reported 21.0% higher sales during September compared to the pre-pandemic sales recorded for September 2019. While most food items have faced inflation, retailers reported higher sales for groceries and food items. A sustained rise in retail and passenger vehicle sales during the first six months of the fiscal 2022-23 shows rising consumer demand that will likely have a multiplier effect on the overall economic growth of India.

Supply Side Dynamics

Input Purchases

The overall business sentiment in September 2022 was weaker than in previous months. The Composite Markit Purchase Managers Index (PMI) slipped to 55.1 from 58.2 in August, the weakest in the current fiscal year but still well above 50, reaffirming the continued expansion in economic activities, albeit at a slower pace compared to several previous months (Figure 1). A PMI above 50 reflects an expansionary mood among business managers. The Services index softened to 54.3 from 57.2 and the Manufacturing PMI index was slightly down to 55.1 from the previous month’s 56.2, implying that manufacturing activities recorded a relatively stronger growth than the services sector. Weaker purchasing power due to persistent high inflation affected economic activities in both the services and manufacturing sectors. According to S&P Global, new orders grew the least in six months, amid softer increases in the manufacturing and services economies. Input cost inflation eased to the lowest so far in about two years due to slowdowns in manufacturing and services across subsectors.

Industrial Production

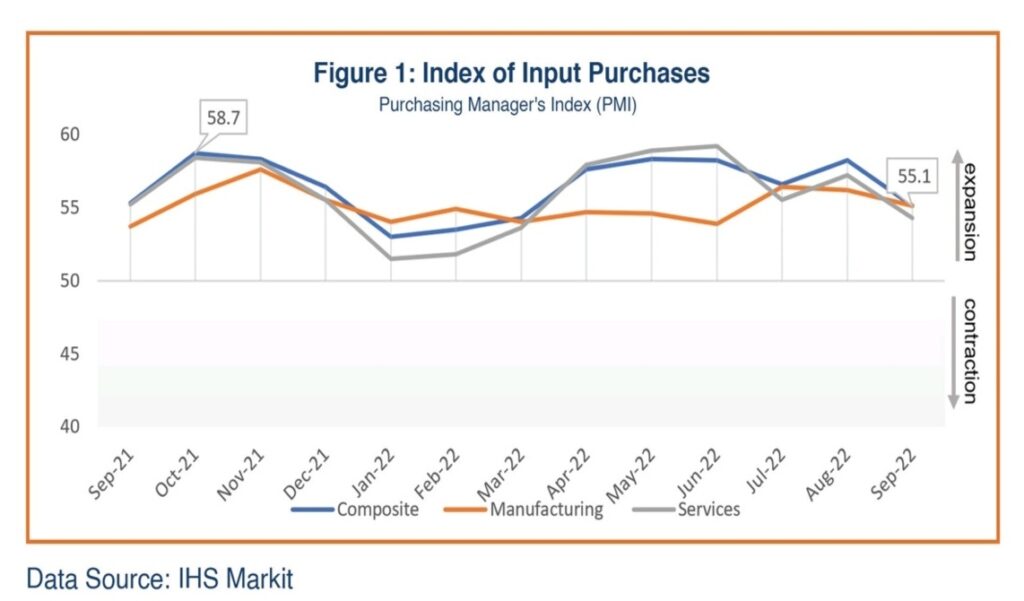

Total industrial production fell short of market expectations, contracting 0.8% in August 2022 compared to the corresponding period of last year, the first contraction since February 2021. Growth across all segments slowed considerably compared to the previous month, generating a contraction in the overall growth in industrial output.

Manufacturing, which accounts for 77% of total industrial production, shrunk 0.7% year-on-year in August from a growth rate of 3.2% in the previous month; mining, which comprises 14% of total industrial output, contracted 3.9%, compared with growth of 3.3% year-on-year in July, and the growth rate in electricity production (8% of total industrial production), at 1.4%, was also down compared to the 2.3% achieved in July. The slowdown in industrial activity was impacted by heavy rains and flood conditions that restricted mining and construction activities. Capital goods production within the manufacturing sector showed a 5.0% growth in August 2022, hinting at continued but slower growth in investment, down slightly from 5.8% in the previous month.

A rise in industrial production growth is indicative of positive strides in India’s economic recovery, but unfavorable geopolitical trends hobble the sustainability in growth. Lackluster industrial output in August 2022 reflects the impact of a slowdown in global growth that is being felt by domestic manufacturing companies. Key export sectors like textiles, petroleum products, machinery and equipment saw a sequential fall in the Index of Industrial Production (IIP) in August.

GST Revenues

Changes in the value of Goods and Services Tax (GST) collection are an indicator of business transactions and increased tax compliance. The GST collections for September 2022 were up more than 2.0% to $18.5 billion from $18 billion in the previous month (Figure 3). Analysts have indicated that GST collections are rising, aligned to the positive trajectory in economic activities, increased rates and increased compliance.

Trade

The value of India’s merchandize exports picked up 4.5% in September to almost $35.5 billion from the previous month’s $33.9 billion (Figure 4). India’s outstanding export performance until June of this year is now clouded by the onset of global recession and the resultant suppressed demand. Global inflation, the Russia-Ukraine war, China’s economic slowdown, and supply disruptions are hurting economic growth worldwide, leading to poor demand in global trade markets. The exports of India’s engineering items, textiles, and plastics are experiencing a slowdown while petroleum products and electronics exports are still growing. In addition, India’s continuing export restrictions on steel and iron ore pellets have contributed to the deceleration in merchandize exports. Falling exports will likely impact the job market as well.

Nonetheless, Minister Goyal has said he is confident India will sustain export momentum and Indian exports will be able to wither the global headwinds to the target of $2 trillion by 2030. The Ministry of Commerce estimates total services export for September at almost $23.5 billion.

India’s merchandize imports value in September 2022 was slightly down to $61.2 billion from $61.9 billion in August, mainly on account of softening fuel prices and reduced gold imports. The rise in energy commodity prices, such as for natural gas, coal, edible oils and fertilizers, have mainly contributed to India’s ballooning import bill over the last several months.

With exports gaining and imports moderating, the deficit has improved to nearly $25.7 billion in September from $29.0 billion in the previous month. Despite improvement in September, India’s huge trade deficit continues to remain a cause of concern as it is a major component in the country’s current account deficit (CAD) and it can impact the macroeconomic balance, putting pressure on the value of domestic currency.

Trade economists have observed that India may be in for a dismal performance on its external front for the next 18 months, which will impact the final FY2022-23 growth rate.

Government Spending

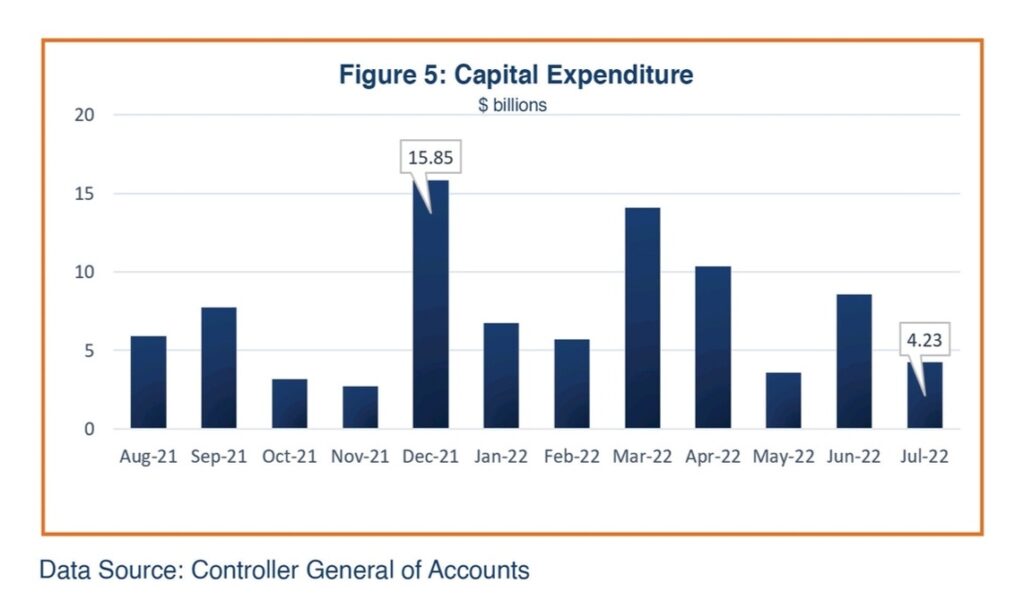

Capital expenditure has been showing moderate growth since January 2022 (Figure 5). Finance Ministry officials have reportedly stated that the government will likely meet the fiscal deficit target of 6.4% of GDP in 2022-23 without having to cut capital expenditure. The government has repeatedly pronounced that its focus on capital expenditure will remain firm even while it tries to control revenue expenditure.

Foreign Direct Investment

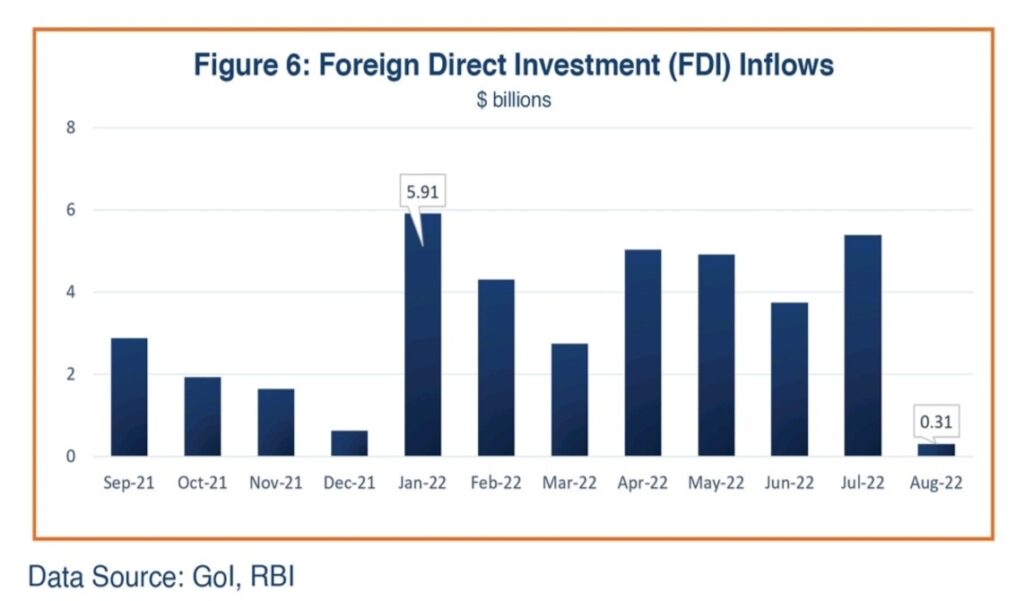

Foreign direct investment (FDI) equity flows showed mixed trends throughout the previous fiscal year. According to the latest data released by the Department of Industrial Policy and Internal Trade (DPIIT), in FY2021-22, FDI equity contracted marginally, by 1.0%, to $58.8 billion. However, total foreign direct investment (including equity inflows, reinvested earnings, and other capital) into India rose by 2.0%, peaking at $83.7 billion in 2021-22. The first month of fiscal year 2022-23 (April 2022) witnessed India attracting $5.0 billion in total FDI inflows, followed by $4.9 billion in May and $3.7 billion in June. Net FDI inflows in July peaked to $5.4 billion in the current fiscal year, just before falling significantly in August (Figure 5). Total net FDI inflows into India expanded more than 17.0% to $13.6 billion in the first quarter of FY2022-23 compared to $11.5 billion for the corresponding period of the previous year.

Inflation

The overall inflation trajectory remains volatile given changes in international commodity prices. The consumer price index (CPI) accelerated to 7.4% in September 2022 from 7.0% recorded in August, but remained outside the RBI’s target band of 2.0-6.0% for the ninth month in a row (Figure 6). The rise in CPI was mainly due to a greater than expected surge in food prices that account for about 40% of the country’s CPI. The supply-chain disruptions owing to the ongoing geopolitical factors and increasingly tightening of global monetary policies are constantly pushing up domestic inflation and weakening the local currency. The RBI continued to give priority to price stability by raising the benchmark policy repo rate; it has raised the benchmark repo rate by 190 basis points since May to 5.9%, aiming to curb consumer demand. In addition, the government has imposed curbs on exports of wheat, sugar, and rice to cool local prices over fears of a shortfall in rains in some parts of the country that could push up food prices.

Wholesale Price Inflation moderated to 10.7% in September from 12.4% in August, the lowest level in about two years, primarily due to broad-based growth in manufacturing and services. Business sentiment is likely to improve following the softening of input prices.

Foreign Exchange

India’s foreign reserves were estimated at $538 billion at the end of September 2022. The rupee again crossed 80/USD in September 2022. Persistent foreign fund inflows into capital markets and softening crude oil prices, however, boosted the local currency. The average monthly exchange rate for September was INR 80.14/USD (Figure 8). The rupee has lost nearly 8.8% against the US Dollar since January, mainly due to a rise in global crude oil prices, tightening monetary policies globally, a strengthening dollar post the outbreak of Russia’s war in Ukraine, and continuing foreign capital outflows from India. The RBI’s June announcement allowing global trade in rupees may be expected to help enhance foreign exchange inflows and stabilize the rupee in future.

Economic Outlook

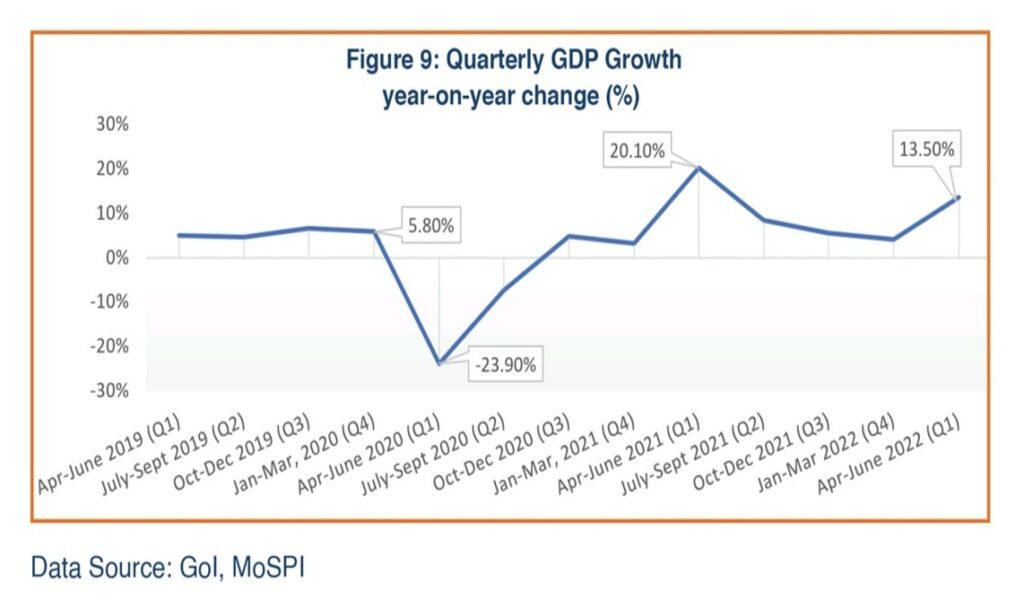

India posted 13.5% growth for April-June 2022 according to the latest government statistics, albeit falling short of RBI’s projection of 16.2%. The latest data paints a progressive picture for the Indian economy despite global challenges, geopolitical developments leading to supply disruptions, and decelerating external demand due to global slowdown. Businesses ramped up capacity as domestic demand continues to recover during the second quarter of fiscal year 2022-23.

The agriculture and services sectors continue to support GDP growth and healthy improvements have been reported in important indicators, like demand, lower input inflation, private consumption expenditure, private capital expenditure and government expenditure. The turnaround in investment from the pre-pandemic levels is expected to support the growth, but trade may be impacted by geopolitical changes, high commodity prices, and a weaker rupee.

The RBI has revised its forecast for FY2022-23 GDP growth to 7.0% from the earlier 7.2% based on the continuing geopolitical challenges, such as supply chain uncertainties, global recession and continuing Russia-Ukraine conflict. Likewise, the IMF has also announced a downward revision in its Indian GDP growth forecast for fiscal 2022-23 to 6.8% on account of extended geopolitical tensions and an aggressive monetary policy tightening globally.

Nonetheless, Indian businesses are optimistic that softening international prices of fuel, fertilizers, and edible oils will help sustain momentum in demand and lift output levels. Industrial and manufacturing activities have sustained on the positive trajectory and capital expenditure is also rising. Consumer demand seems to be improving as the festival season is keeping the cash registers ringing. However, crude prices will likely make a significant difference on the performance of the economy as the external sector components in the GDP may prove to be a stumbling block.

Major economies around the world, including India, face challenges of currency depreciation and the impact of a global recession, but the Indian policymakers have noted that India is relatively well placed to deal with these challenges because of its stable domestic financial and non-financial sectors, rising private capital expenditure, better control on inflation, sufficient foreign exchanges reserves, and its vaccination success. Notwithstanding these positive trends, the economic growth outlook for India remains uncertain.