Executive Summary

As expected, restrictions of the pandemic between late December 2021 and January 2022 interrupted the economic recovery in India. Recovery in economic transactions continued, albeit at a relatively slower pace in January, but braking in some areas and rising inflation kept Indian policymakers sitting on the edge.

Consumption sentiment was down a bit in January as the third wave of the pandemic hit the country and several States imposed restrictions on mobility and markets. On the supply side, the Markit Purchasing Managers’ Indices (PMI) for both Manufacturing and Services were down from their December 2021 levels, albeit still above 50, indicating continued expansion in production activities. (PMI more than 50 indicates expansion and below 50 shows contraction.) The pandemic led to the slowest growth in seven months in industrial output, exports dropped 7.5% and imports slumped more than 12%. However, the unemployment rate fell in January to 6.6%, a significant improvement over the previous month’s 7.9%.

Goods and Services Tax (GST) collections recorded strong growth in January, suggesting increased business transactions and increased tax compliance efforts. Rail freight volumes are on the uptrend since September 2021, rising to 129.11 million tons in January from 126.78 million tons in December 2021.

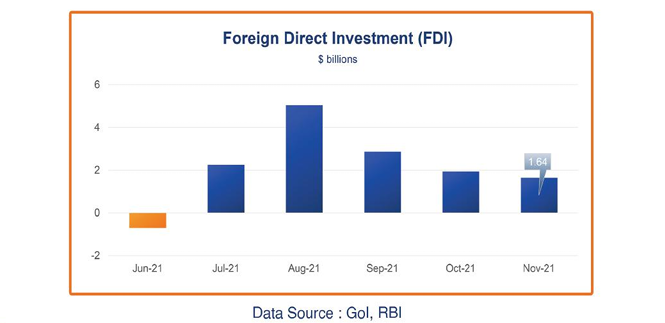

The downward trend continued in FDI inflows, reaching only $1.64 bn in November 2021 (the latest available data), down from a peak of $5.01 billion in August 2021.

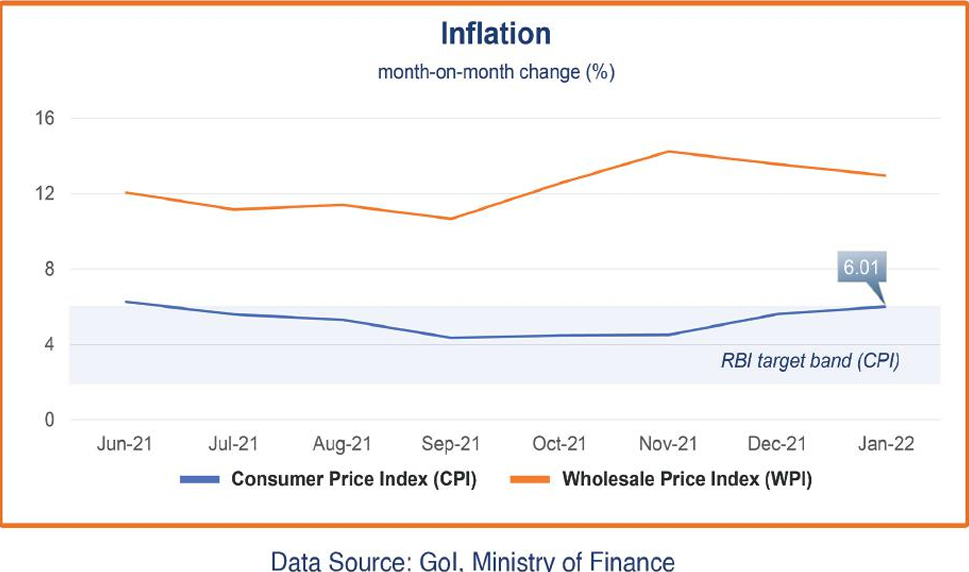

The consumer price index (CPI) increased to 6.01% in January, crossing the Reserve Bank of India (RBI) target ceiling of 6.00% due to higher food prices, but the wholesale price index (WPI) moderated in December 2021, indicating lower input costs for manufacturers.

The Government of India budget for Fiscal Year 2022-23, presented on February 1, 2022, significantly increases plans for public expenditure on infrastructure and provides impetus to private investments and financial inclusion through increased digitization efforts while continuing support to vulnerable sectors, such as hospitality and travel.

Overall, the economic growth outlook for India appears positive despite some interruptions caused by the pandemic. While the budget announcements reflect the aspirational goals of the Indian government for sustaining high growth rates in the medium and long terms, the key remains in the effective and timely implementation of the proposals.

Demand Recovery Trends

Household consumption reflected mild stagnation in demand during January due to the third-wave pandemic related restrictions on mobility and store timings in certain markets. Vehicle sales were marginally down and retail sales of consumer products were also slightly thinner than the December 2021 level. January usually sees a relative drop in demand for food products, as it comes soon after the high-demand festive season in India. The monthly survey by the Retailers Association of India (RAI) also revealed lower sales in January for beauty products, wellness and personal care, furniture and furnishings, apparel and clothing, and footwear. Still, sales automation firm Bizom, which transacts with 7.5 million retail stores across the country and tracks orders by Mom-and-Pop stores, reported that restrictions during the Omicron wave had less of an impact on business performance than was the case in the previous two waves.

Supply Side Dynamics

Input Purchases

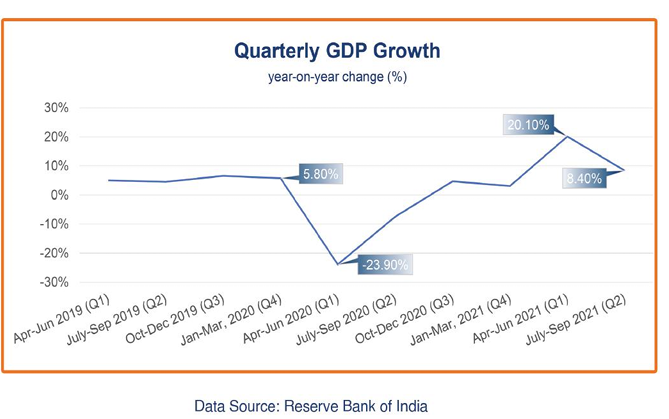

The sustained momentum in economic activity since August 2021 has been reaffirmed by a steady Markit PMI Manufacturing Activity Index above 50, reflecting the optimistic mood of the businesses that have made bold input purchases in anticipation of increased demand (Figure 1). The Composite index in January rose to 56.4 from the 53.0 recorded in December 2022, indicating a buoyancy in production activities. However, the narrower Services index fell to the lowest level in six months, to 51.5 in January and from 55.5 in December 2021, amidst imposition of mobility restrictions due to the Omicron variant as well as inflationary pressures. The Manufacturing index was also down marginally, from 55.5 in December 2021 to 54.0 in January. According to the Markit index analysis, both output and new orders recorded their slowest growth in four months, but rates of expansion remained historically elevated as manufacturers sought to rebuild input stocks by purchasing additional raw materials and semi-finished items. Input cost inflation softened to a four-month low but remained relatively high.

Industrial Production

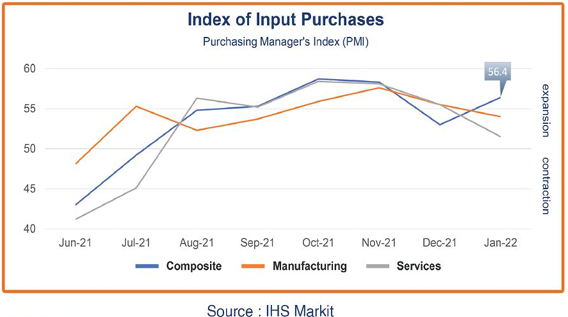

Growth in industrial production slowed to 0.4% year-on-year in December 2021, dropping from 1.3% in November 2021 (Figure 2); it was the slowest growth in eight months. Production in December 2021 vs November 2021 slumped in most major sectors: manufacturing (-0.1% vs 0.9%), mining (2.6% vs 5%), and electricity (2.8% vs. 2.1%). The pick-up in production in core industries during the second and third quarters of 2021 raised hopes of a stronger revival of industrial growth; however, a less-than expected performance of the manufacturing sector (that accounts for more than 77% in the industrial output), coupled with a 4.6% contraction in capital goods production, has moderated the expectations of the industrial sector for January 2022.

GST Revenues

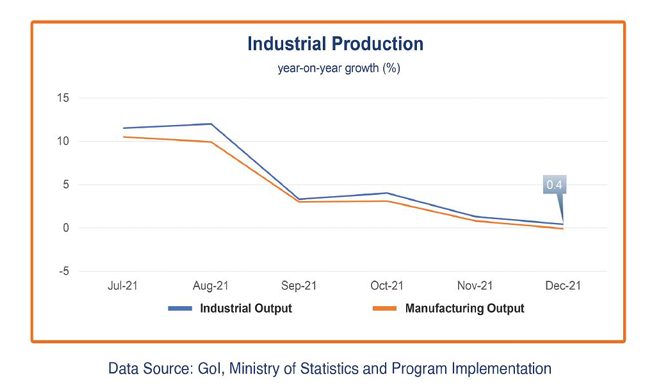

Changes in value of Goods and Services Tax (GST) collection is considered an indicator of business transactions. The GST revenue collections for January were up 8% from December 2021, to nearly $18.6 billion (Figure 3). GST collections are reflecting an upward trend, in tandem with the restored economic activity. That said, while economic recovery has helped, tightening of compliances may have also contributed to higher collection. Though GST revenues have so far been maintained, Omicron-driven uncertainty may impact specific segments of services, leading to lower GST collections in coming months.

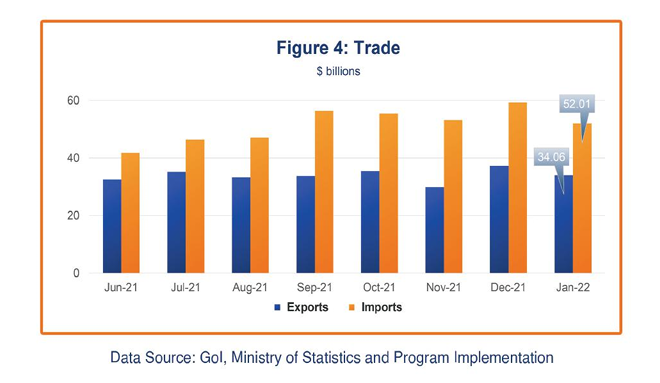

Trade

India’s monthly goods exports reached a record $37.29 billion in December 2021, following recovery in economic activities and increased global demand post second wave of the pandemic, but exports decelerated 8.7% on month-on-month basis, to $34.06 billion in January (Figure 4). During FY 2021-22 to date (April 2021-January 2022), exports have grossed more than $335 billion, on track to meet India’s target of $400 billion by March 31, 2022. India’s merchandise imports were $52.01 billion in January, down from $59.27 billion the previous month, reflecting the relative sluggishness in industrial activity.

FY 2022-23 Budget

The combination of the government’s $26 billion production-linked incentive (PLI) scheme (for automobiles, drones, consumer goods, solar modules, and semiconductors), various export promotion schemes, and reduced corporate tax rates for new entities will likely increase private investment and strengthen India’s manufacturing and export sectors. In line with the industry demand, the budget augments public capital expenditure by more than 34%, to nearly $101 billion, reflecting the government’s focus on building public infrastructure.

To aid the post-pandemic economic recovery in India, the budget also focuses on strengthening supply side fundamentals, but lesser concentration is noted for the social sector, with 8% and 28% increased spending slated for health and education sectors, respectively. The thrust for private investment in the budget continues, with credit lines extended by $6.7 billion (to a total cover of $67 billion) for pandemic-hit sectors such as hospitality and travel. To encourage private investments and strengthen the startup ecosystem, the government has extended the tax exemption for startups by one additional fiscal year.

Foreign Direct Investment (FDI)

Monthly FDI inflows peaked in August 2021 at $5.04 billion, after which the inflows have slid to $2.87 billion in September 2021, $1.93 billion in October 2021, and $1.64 billion in November 2021 (Figure 5). The downtrend in FDI flows is in line with the UNCTAD Annual Investment Trend Monitor’s latest release, which reports FDI inflows in India were 26% lower in 2021 despite a 77% rebound in global foreign direct investment flows, mainly because large M&A deals in India recorded in 2020 were not repeated in 2021. India attracted nearly $82 billion worth of FDI inflows in 2021 and undertook several tax reforms and ease of doing business measures, such as labor reforms, GST rationalization, relaxed FDI norms in select sectors, implementation of Single Window System and easier customs procedures.

Inflation

After hovering in the 4-5% range between July and November 2021, the consumer price index (CPI) increased to 6.01% in January, crossing the RBI’s target ceiling of 6.00%, mainly due to soaring prices of edible and crude oil (Figure 6). India is a major importer of palm oil, and despite a cut in the edible oil tariffs the cost of edible oil rose in January. As per the recent budget, the government is working on medium- and long-term plans to encourage domestic oilseed production and cut dependence on imported edible oils.

The wholesale price index (WPI) further softened to 12.96% in January, from 13.56% December 2021 and 14.23% recorded in November 2021; however, input costs remained high primarily due to rise in prices of mineral oils, crude petroleum and natural gas, basic metals, chemicals, and chemical products, largely due to global supply disruptions.

Despite inflation pressures the RBI has maintained its accommodative monetary stance going into 2022. The central bank anticipates inflation to remain around the upper limit of 6% for the next two months on the back of rising crude oil prices and global supply disruptions. It projects CPI inflation at 5.3% for the whole FY2021-22 (ending March 31, 2022) and 5% for the first half of the next financial year.

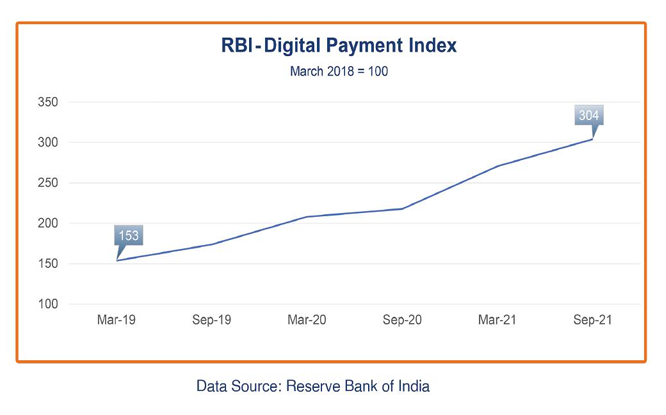

Digital Payments

The RBI Digital Payments Index (RBI-DPI) measures the extent of digitization of payments in India across four main variables: payment enablers, infrastructure, performance, and consumer engagement. The index has doubled since the start of the pandemic, rising from 153 in March 2019 to 304 in September 2021 (latest available), demonstrating a consistent growth in the adoption and deepening of digital payments across the country (Figure 7).

In October 2021, RBI announced an increase in the limit for IMPS transactions that will, when implemented, catalyze digital transfers of funds within the banking system, and in its December 2021 Monetary Policy Review proposed a UPI-based payments product on feature phone that would augment the pace of the adoption of digital payments in India even further.

The FY 2022-23 budget also provides for setting up 75 digital banking units in 75 districts and bringing 105,000 post offices under the banking system. When implemented, the move will likely accelerate digitization of banking and financial inclusion in the country. The budget also proposed launching of blockchain-based digital rupee that should help enhancing the digital economy of India.

Economic Outlook

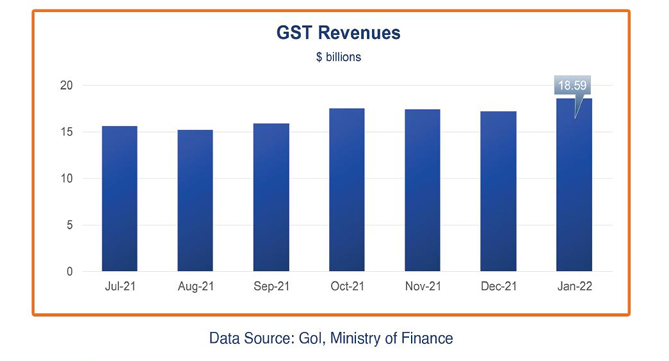

The Government of India’s fast track measures to vaccinate the public, and the ongoing reforms for uplifting the economy, trade activity, and industrial production, led to a remarkable rebound in GDP growth in the first half of FY 2021-22. Year-on-year, real GDP grew by 20.1% in the first quarter of FY 2021-22 (Apr-Jun 2021), despite partial lockdown conditions in several states, and a further 8.4% year-on-year growth in the second quarter (Jul-Sep 2021; Figure 8); by September 2021 nominal GDP had slightly exceeded its pre-pandemic level of September 2019. Major economic and business activities have shown noteworthy improvement on the back of significantly improved business sentiments, and momentum in consumption is reflected in the bank credit data released by the RBI, which rose 9.2% on year-on-year basis in December 2021.

Still, uncertainties remain regarding the sustainability and pattern of pent-up demand. Most economists have cautioned that the economic recovery witnessed since July 2021 has not been broad-based and certain sectors, such as trade, transport, and tourism, still require consistent government support as well as increased private investment. The FY 2022-23 budget highlights the government’s desire to accelerate growth despite disruptions caused by the pandemic, including a significant hike in planned capital expenditure that, if implemented, will have a multiplier effect on growth in the medium term. The government also approved spending an additional $2.7 billion for the $135 billion Gati Shakti Project to develop connectivity infrastructure in the country. Commenting on the budget in its most recent report, the RBI says it expects the renewed emphasis on public investment through infrastructure development to crowd-in private investment and strengthen job creation and demand in FY 2022-23.

Inflation suppressed consumption levels during 2021 but the Finance Ministry is optimistic consumer prices will moderate going forward in anticipation of fresh winter crop and better prospects for food grain production.

Restrictions to curb the spread of the pandemic between December 2021 and January may temporarily interrupt the economic recovery; but overall, the Indian economy may sustain high growth rates with the effective and timely implementation of the proposed FY 2022-23 budget measures to boost private investments.