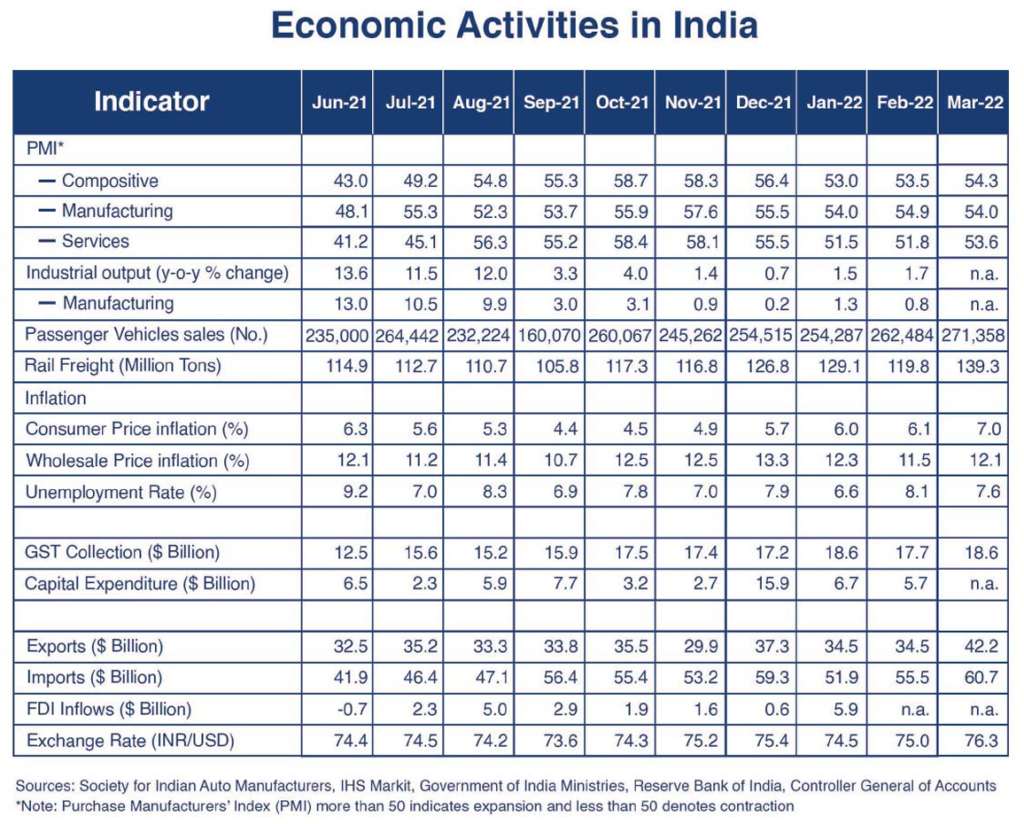

Despite a receding third wave of COVID, India’s economic recovery was below expectation in March 2022, the last month of the Indian fiscal year (IFY) 2021-22. Economic activities in March slowed down a bit due to mounting international fuel prices and supply disruptions related to the Russia-Ukraine war; however, growth was visible in certain pockets. Overall, there were mixed trends demand patterns and services activities seem to be picking up with the removal of pandemic-related restrictions, but the swelling retail inflation remained the biggest spoilsport. Managing the challenge of inflation caused by rising oil prices while maintaining growth in the economy will be the Reserve Bank of India’s (RBI) priority in coming months. Due to the global geopolitical dynamics, the Indian economy continues to be daunted by uncertainties.

Post-third wave of COVID, retail businesses reported sales gains in March, and passenger vehicle sales were also 3% higher than the previous month. On the supply side, the Markit Purchasing Managers’ Indices (PMI) for Manufacturing was down while the PMI for Services was up from their February levels, but the Compositive PMI continued to grow at above 50 points, indicating expansion of business transactions during March. The overall unemployment rate was down to 7.6% from the previous month’s 8.1%, reflecting an improvement in business sentiment and hiring.

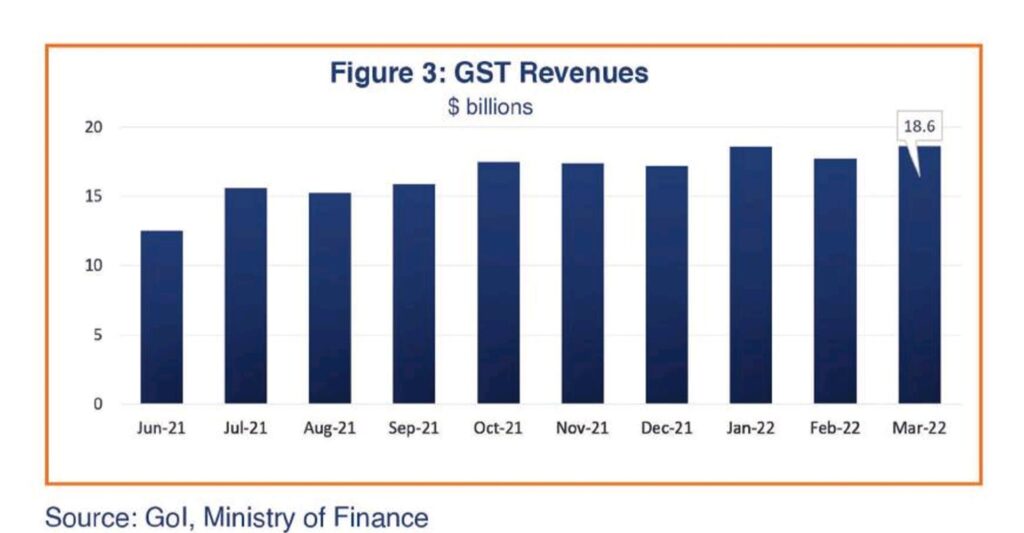

Goods and Services Tax (GST) collections were up 5% in dollar terms in March, compared with the February revenues, depicting an upsurge in business transactions and increased compliance. Monthly rail freight volume was the highest ever in March at 139 million tons –16% higher than the February level reflecting the positive business sentiment.

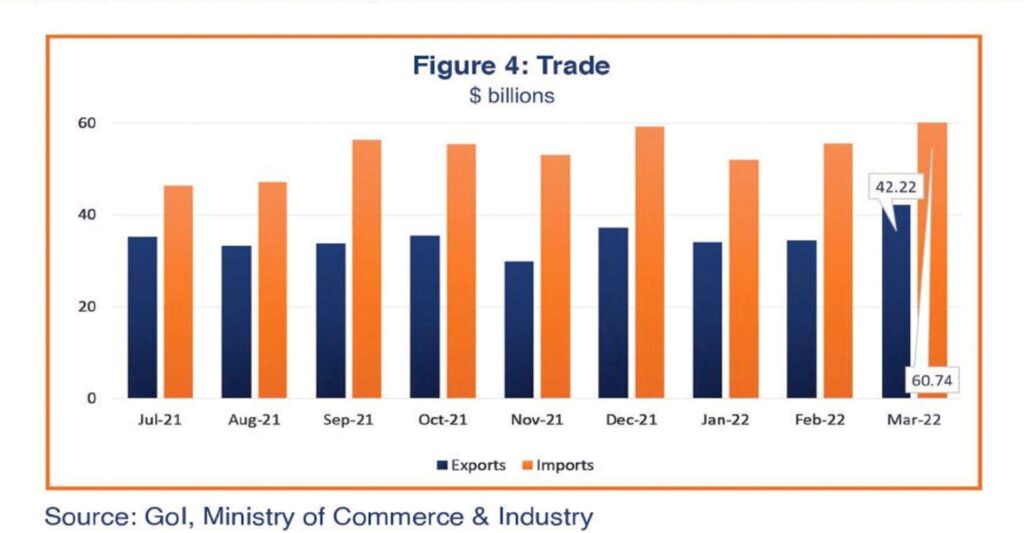

India’s foreign trade performance in March 2022 was remarkable, with impressive growth in both exports and imports and surpassing the government’s export target of $400 billion for the full fiscal year.

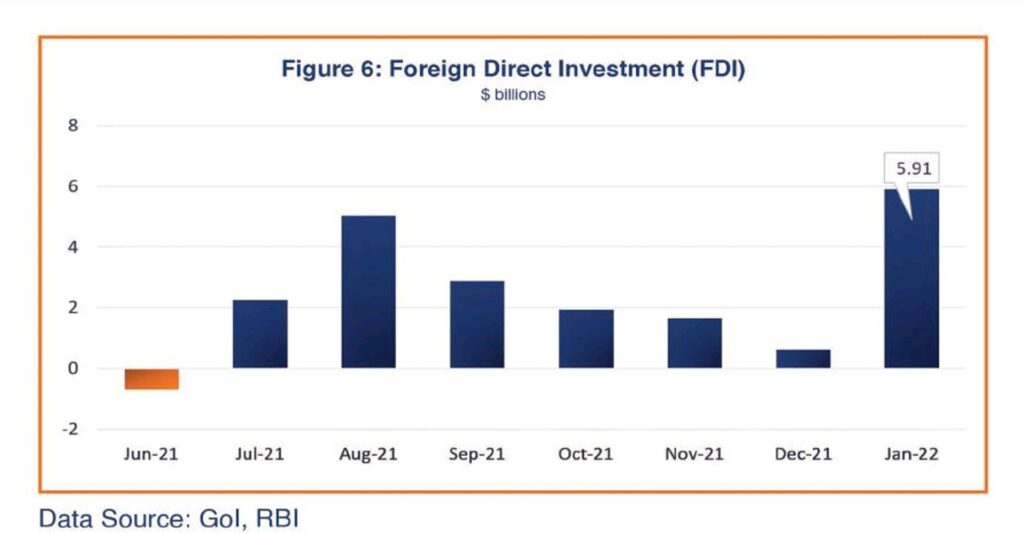

After sustaining a downward trend from September-December 2021, FDI inflows recorded a significant jump in January 2022 (latest available), peaking at $5.9 billion. By comparison, India’s FDI inflows were less than $1 billion in December 2021

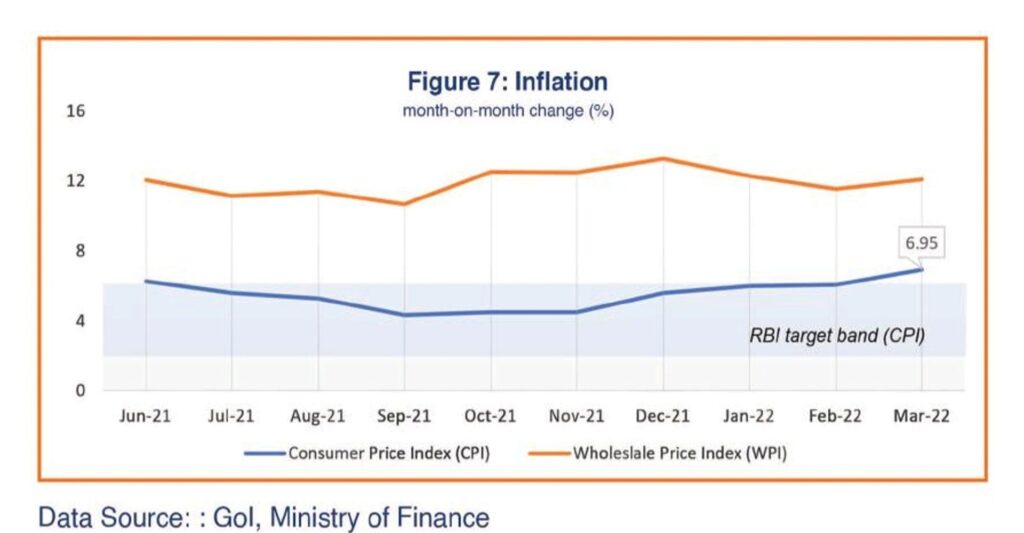

The consumer price index (CPI) rose to 6.95% in March, up from the previous month’s 6.09% and crossing yet again the Reserve Bank of India (RBI) target ceiling of 6.00%. The wholesale price index (WPI) also surged to 12.1% in March, up from 11.5% recorded in February, indicating rising input costs for manufacturers due to higher global fuel prices.

On the back of a lower-than-expected growth in the third quarter of the current fiscal year and in view of the uncertainties arising out of the Russia-Ukraine crisis, the Gol has revised its estimate of GDP growth down to 8.9% from 9.2% previously. The economic growth outlook for India appears uncertain at this time due to global uncertainty, rising inflation, and continued supply chain disruptions.

Going forward, the disruptions arising out of Russia-Ukraine crisis may impact India’s current account deficit in the near term, putting pressure on its currency. The war may also impact the government’s plans for significant increases in public expenditure on infrastructure, support for private investments, and further digitization of the financial system this year, as announced in the Union Budget for Fiscal Year 2022-23.

Demand Recovery Trends

Retail sales picked up in March 2022. Vehicle sales were also up about 3% from the February level despite the continuing chip shortages. The monthly survey by the Retailers Association of India (RAI) highlighted higher sales even in categories, such as garments and footwear, that were recording weaker sales during the earlier months. Retailers are hopeful that quantitative growth will be restored, and business will track back in IFY 2022-23 as restrictions are lifted and consumers are stepping out to catch up on their social lives. Sales automation firm Bizom, which transacts with 7.5 million retail stores across the country and tracks orders by Mom-and-Pop stores, reported expansion in commodity sales, beverages, and packaged food categories but lower sales in homecare and personal care products. That said, the observed growth in sales value may not be entirely volume-driven given persisting consumer price inflation.

Consumption sentiment seems to be buoyant as Indian consumers are spending more on recreational and entertainment activities also. According to a recent Deloitte Consumer Tracker report, with “business as usual” and travel restrictions gradually easing, Indians have resumed their business travels, with about 83% of consumers saying they are likely to travel for business within the next three months.

The recovery signs in private consumption augur well for demand, but the uncertainties of a sustained sentiment due to the impending challenges of high inflation will likely impact India’s growth in the near-term. Higher commodity prices could also undermine buoyant private consumption trends in India as households spend more on those items.

Supply Side Dynamics

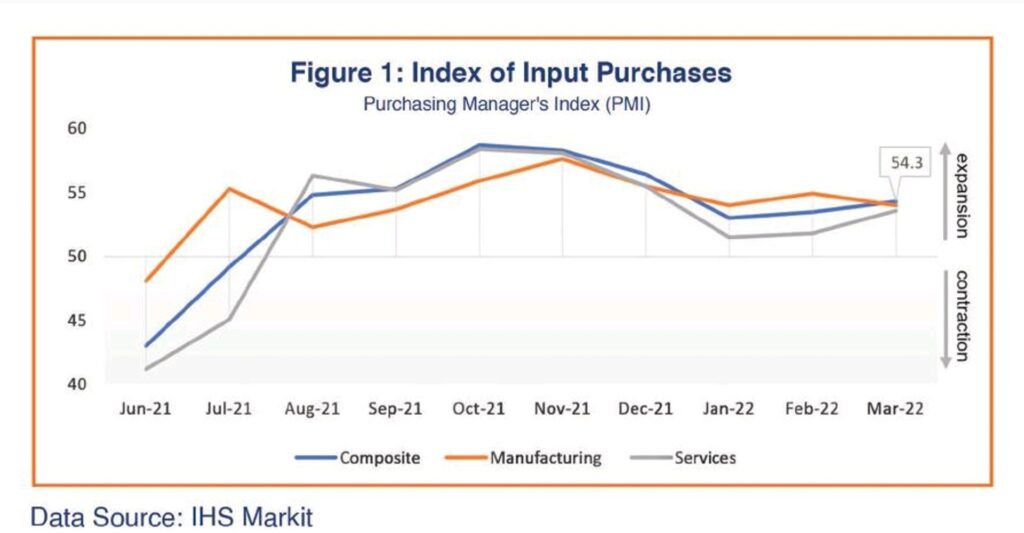

Input Purchases

The sustained momentum in economic activity since August 2021 has been reaffirmed by a steady Markit Purchase Managers Index (PMI) Manufacturing Activity Index above 50, reflecting the optimistic mood of the businesses that have made bold input purchases in anticipation of increased demand (Figure 1). The Composite index in March 2022 improved to 54.3 from the 53.5 recorded in February. The Services index increased to 53.6 in March from 51.8 in February amidst receding COVID impact; however, the PMI for Manufacturing was down to 54 from the previous month’s 54.9, indicating slight reduction in production activities. According to the Markit index analysis, sustained inflationary challenges kept business confidence suppressed in March. Continuing higher costs due to a rise in prices of chemicals, energy, food, labor, metals, plastics, and retail-related components impacted firms, and the increase in input cost inflation in March was higher than that recorded in February.

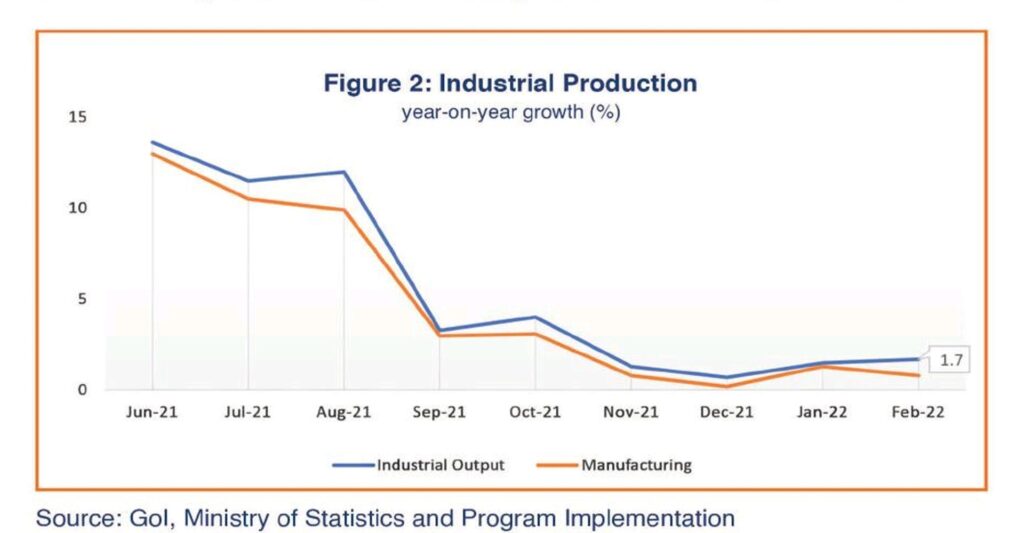

Industrial Production

Total industrial production continues to improve slowly compared to last year, rising 1.7% year-on-year in February 2022, up from 1.5% in January (Figure 2). Manufacturing, which accounts for 77% of total industrial production, moderated to 0.8% year-on-year growth in February, from 1.3% the previous month, but mining, which comprises 14% of total industrial output, expanded to 4.5% year-on-year growth in February (from 2.8% in January) and growth in electricity production (8% of total industrial production) improved substantially to 4.5% year-on-year, from 0.9% in January. It is noted that the third wave of COVID had impacted economic activity in January and February 2022 after several states had imposed restrictions to control the number of cases. Capital goods and consumer goods production within the manufacturing sector has been witnessing a broad-based contraction as a result.

GST Revenues

Changes in the value of Goods and Services Tax (GST) collection is considered an indicator of business transactions. The GST revenue collections for March 2022 were up 5% from February, to nearly $18.6 billion (Figure 3). Analysts have indicated that the GST collections are now on a stable trajectory and the current fiscal year’s targets may well be surpassed. GST collections are reflecting an upward trend, in tandem with the restored economic activity, and the tightening of compliances. GST revenues of March 2022 have surpassed the earlier record collections recorded in January; however, inflationary pressure may have a cascading impact on economic activities and GST collections in the near term.

Trade

India’s monthly goods exports reached a record $42.2 billion in March 2022, up 22% from the previous month level (Figure 4). During IFY 2021-22 (April 2021-March 2022), goods exports grossed nearly $418 billion, surpassing India’s target of $400 billion; services exports for the fiscal year 2021-22 are estimated at $250 billion, the highest ever in a single year. India’s merchandize imports were $60.7 billion in March, up almost 9% from the previous month, reflecting partially the relative upward movement in industrial activity along with rising global oil prices caused by geopolitical crisis situations. India’s total merchandize import bill for IFY 2021-22 was $610 billion.

Trade observers expect India’s trade deficit to remain elevated, partially due to India’s continued dependence on import supplies of specific products, such as edible oils, fertilizers, and project goods and partially due to rise in international prices of fertilizers, natural gas, coal, metals, and edible oils.

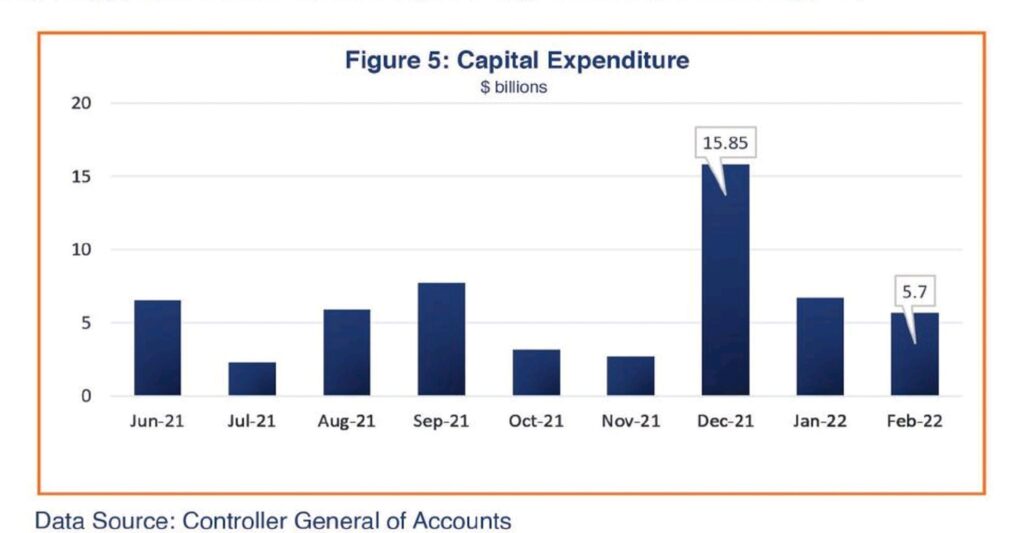

Government Spending

The combination of the government’s production-linked incentive (PLI) scheme (for automobiles, drones, consumer goods, solar modules, and semiconductors), various export promotion schemes, and reduced corporate tax rates for new entities will likely increase private investment and strengthen India’s manufacturing and export sectors. Analysts have flagged that due to the continuing Russia-Ukraine war, India may have to incur higher expenditure on food and fertilizer subsidies, if these markets remain affected for an extended period.

The budget for IFY2022-23 augments public capital expenditure by more than 34%, to nearly $101 billion, reflecting the government’s focus on building public infrastructure. According to the latest Controller General of Accounts (CGA) Monthly Report, the monthly capital expenditure was highest in December 2021 at $15.85 billion, mainly on account of loan disbursement for the Air India deal. Capital expenditure was down more than half to $6.72 billion in January 2022 and further to $5.7 billion in February (Figure 5). The Gol, in February, also initiated action for selling its 5% stake in the country’s biggest public sector insurance giant through an initial public offering (IPO).

Foreign Direct Investment (FDI)

Setting new monthly peak, FDI inflows in India were estimated at $5.9 billion in January 2022. FDI flows went on the downtrend after August 2021, when they grossed $5.1 billion, sliding to less than $1 billion in December 2021 (Figure 5). The RBI has reported that India attracted a total of $74 billion in FDI in CY2021. According to the UNCTAD Annual Investment Trend Monitor’s latest release, FDI inflows in India were 26% lower in 2021 despite a 77% rebound in global foreign direct investment flows, mainly because large M&A deals in India recorded in 2020 were not repeated in 2021.

Inflation

After hovering within the RBI’s target band for about six months until December 2021, the consumer price index (CPI) remained above the target ceiling of 6.0% for the third month in a row in March. The retail inflation in March 2022, at 6.9% was even higher than the 6.1% recorded in February, mainly due to soaring prices of staples and oil (Figure 6). Wholesale Price inflation also increased to 12.1% in March 2022, compared with 11.5% recorded in February. The RBI has prioritized maintaining growth of the economy and, thus, maintained an accommodative monetary stance so far, but in its April Monetary Policy Statement announced that it may soon raise rates in response to the recent hike in global oil prices.

Digital Payments

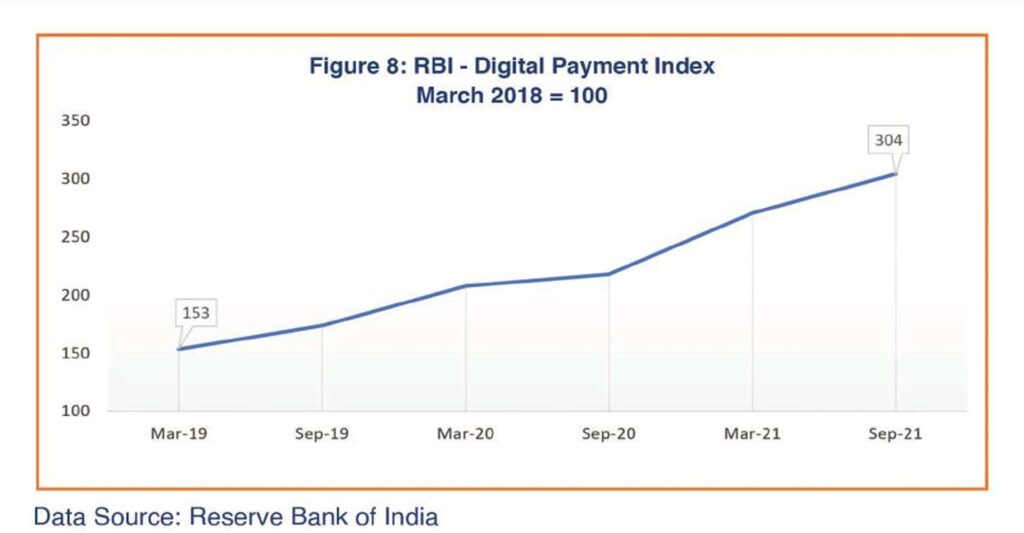

The RBI Digital Payments Index (RBI-DPI) measures the extent of digitization of payments in India across four main variables: payment enablers, infrastructure, performance, and consumer engagement. The index has doubled since the start of the pandemic, rising from 153 in March 2019 to 304 in September 2021 (latest available), demonstrating a consistent growth in the adoption and deepening of digital payments across the country (Figure 7).

The RBI has increased the limit for IMPS transactions that should catalyze digital transfers of funds within the banking system, and it has launched a Universal Payment Interface (UPI)-based payments product on feature phone in March 2022, that allows users to make offline digital payments through feature phones.

Economic Outlook

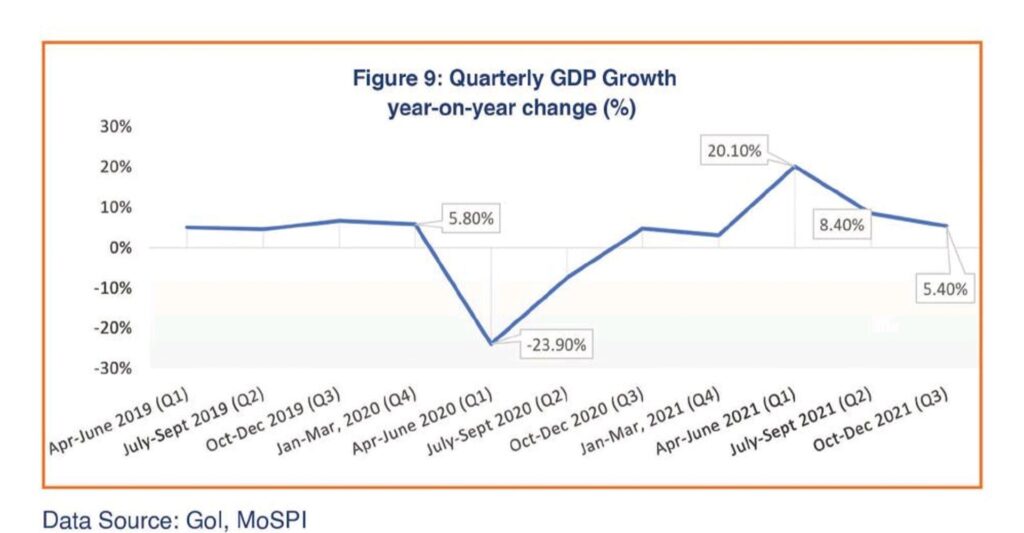

The Government of India’s fast track measures to vaccinate the public, and the increase in trade activity and industrial production, led to a remarkable rebound in GDP growth in the first half of FY 2021-22. Year-on-year, real GDP grew by 20.1% in the first quarter of FY 2021-22 (Apr-Jun 2021), despite partial lockdown conditions in several states, followed by an 8.4% year-on-year growth in the second quarter (Jul-Sep 2021), and a slower 5.4% growth in third quarter (October-December 2021; Figure 8) that is below the expectations of most economists. Subsequently, the government has scaled back its overall growth forecast for IFY 2021-22 to 8.9% per cent, from 9.2% estimated earlier.

After a respite from the pandemic disruptions, the Indian economy is currently stuck in ambiguity owing to recent geopolitical developments. Most economic think tanks expect India’s GDP growth at less than 8% in IFY2022-23. While the India Credit Rating Agency (ICRA) has revised its forecast for India’s real GDP growth in FY2022-23 to 7.2% from 8.0% on account of high commodity prices, the World Bank has slashed India’s GDP forecast for IFY 2022-23 to 8% from 8.7% predicted earlier, naming deteriorating supplies and rising inflation from the Russia-Ukraine conflict. The World Bank has also noted that household consumption will be constrained by the incomplete recovery of the labor market from the pandemic and inflationary pressures in India. A downtrend in FDI inflows persisted for several months in 2021. As per the Reserve Bank of India (RBI) data, a total FDI inflow of US$ 74 billion has been reported in the calendar year 2021 compared to US$ 87.6 billion in the calendar year 2020. The economic growth outlook for India appears uncertain in the near term and its growth may sustain depending upon how soon international energy and commodity prices stabilize. The Indian policymakers have a daunting task to control inflation when commodity prices are spiked with unpredictable and sporadic economic recovery.