Executive summary

As in business and more so in society today, changes and disruptions are part and parcel of our ways of working. The global economy is at a crucial juncture as disruptive technologies such as artificial intelligence, Internet of Things (IoT), augmented/virtual reality are being embraced with an expectation of yielding long term economic gains. These emerging technologies will converge to form building blocks for powerful business solutions that are greater than the sum of their parts. In the world of customization where enterprises are tailoring their offerings to serve their customers, underlying connectivity infrastructure is constantly evolving. The advancement in connectivity has been the key factor in fuelling the growth of digital disrupters. As heterogeneous technology ecosystems are typically complex, the collaborative effort seems critical. The cohesive approaches among service providers, vendors and regulators along with academia and public sector organizations are expected to ideate, plan, build, and operate business models to accommodate customized connectivity and deliver innovative service propositions.

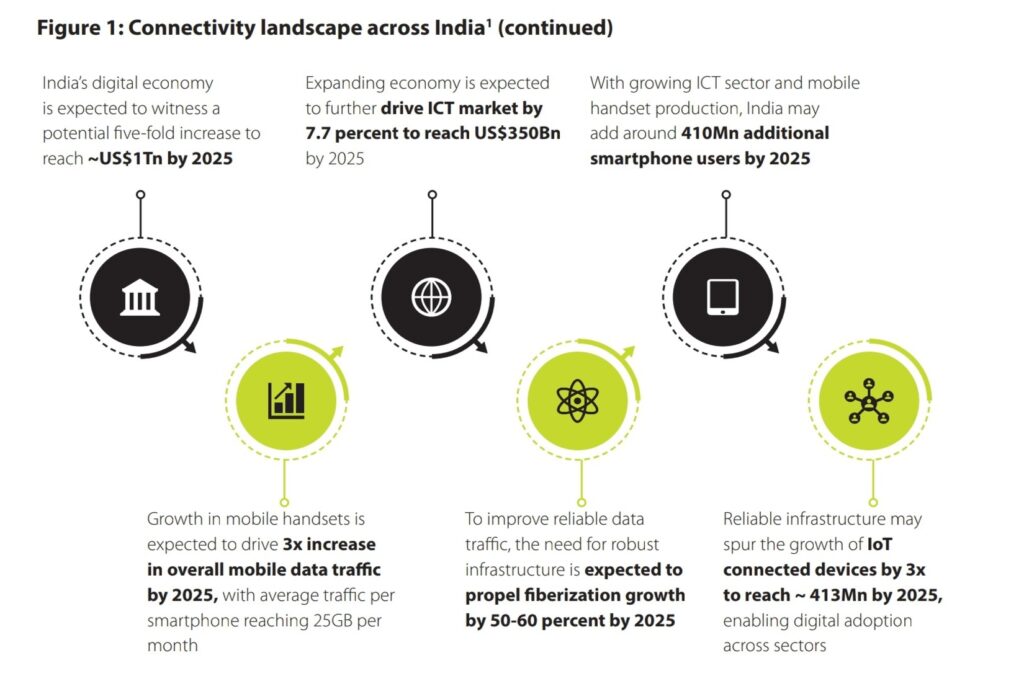

Future connectivity promises to lead consumers, industries and the government to new frontiers of productivity and innovation. To be at par with developed counterparts such as the US, China, and South Korea, India needs to address challenges in a time-bound manner coupled with sizeable investments to fulfil the Digital India vision, thus creating significant economic value. Irrespective of certain key challenges such as the need for significant influx of capital and the building of a dynamic and integrated network, the service providers are expected to expand network footprint and continuously upgrade their network to build capacities and coverage across rural and urban India.

The “Future of Connectivity in India” report lays out a bold and complex path that India’s mobility business will encounter in coming years as a wave of digitalization is ushering us into a new era. This report presents a view on:

- India’s current telecom ecosystem across rural and urban landscape along with initiatives focussing on improving broadband access, quality, and performance

- Potential measures to mitigate existing Digital India initiative challenges across the entire lifecycle of the program in terms of project rollout, operations, and monetization

- Key learnings from global practices to spearhead infrastructure rollout to provide affordable, adaptable, assured, and agnostic model for connectivity. This includes

- Proliferation of small cell infrastructure

- Expansion across fibre footprint to deliver high capacity solutions

- Transitioning over wireless giga-backhauling based microwave networks

- Building complementary ecosystem through deployment of Wi-Fi networks

- Fast tracking introduction of 5G plans to unlock next generation services

- Enhancing resilience of cyber security apparatus with increasing internet penetration

- Activating multi – mix technologies for making cities smarter

- Approach to build future connectivity roadmap for India through technology and consumer behaviour shift driving service and product innovation. This includes focus across

- Right of Way for enhancing fibre broadband penetration

- Spectrum availability and allocation for enhancing wireless broadband

- Securing cloud services and enhancing data privacy

- Enhancing infrastructure sharing for deep access of services

- Encouraging manufacturing and investment across research and development

State of connectivity and infrastructure in India

The fledgling digital ecosystem will drive the future connectivity requirements as it evolves

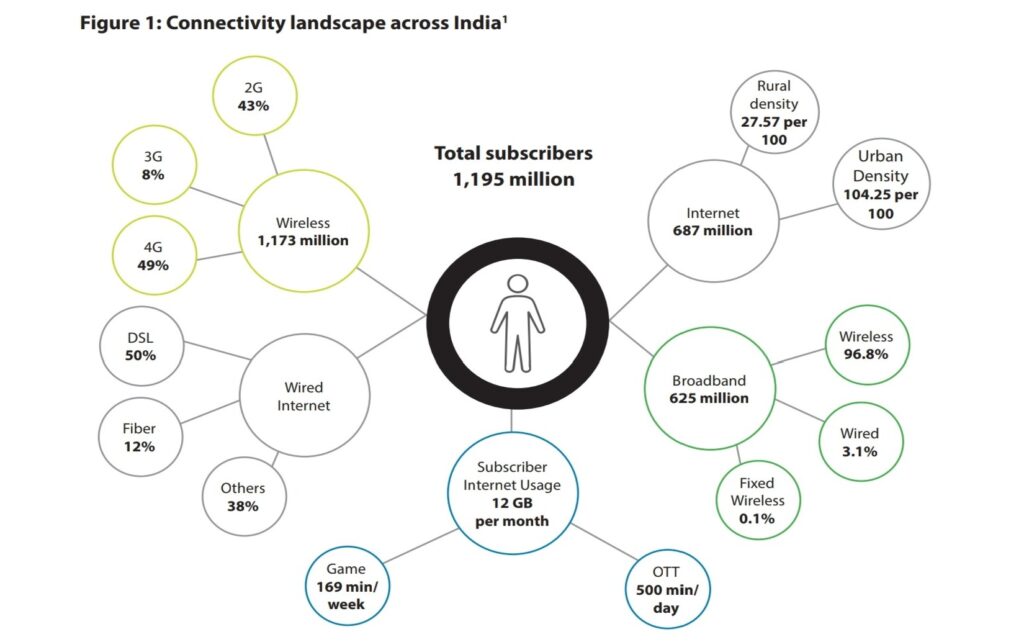

India has witnessed immense growth in broadband users as well as in mobile data consumption per user. The black swan event of 2020 in the COVID-19 has further accelerated the pace of digital transformation with increased demand for seamless high-speed connectivity and virtualization of everything.

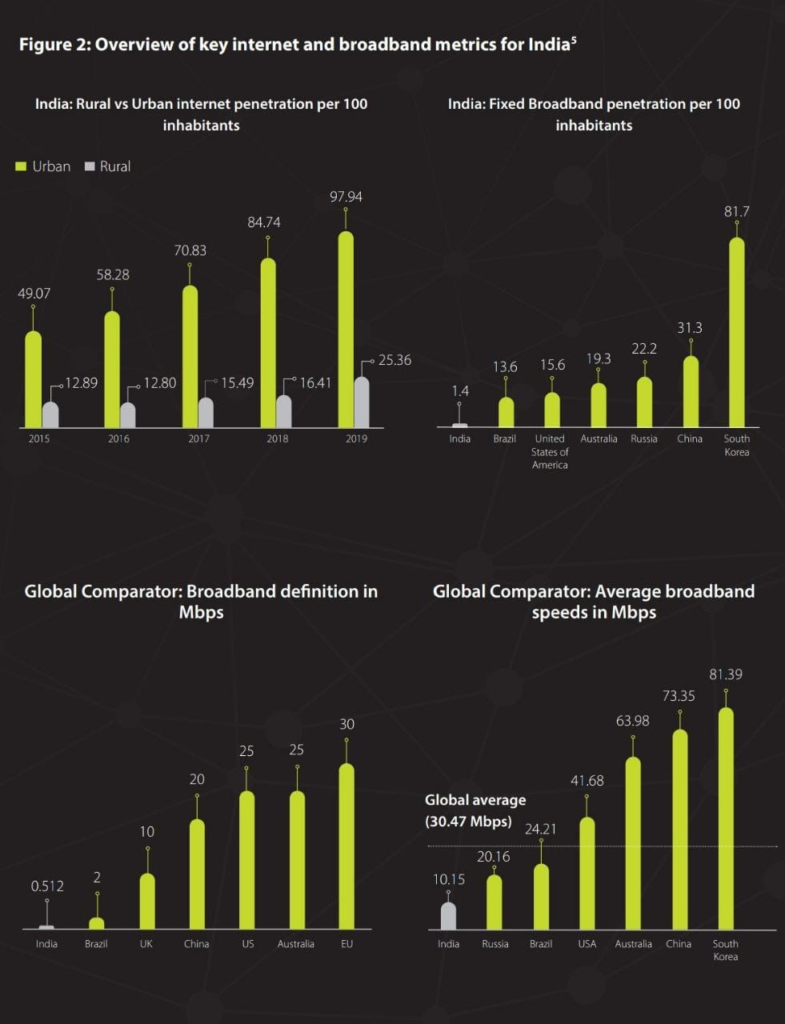

Although India’s internet and data consumption are on the rise, it largely remains an urban phenomenon.

While internet penetration across both rural and urban

India doubled during 2015 – 2019, the digital divide

remains almost consistent across the five-year period.

Expanding the network infrastructure and various last mile

service options across rural India is a crucial for the digital

ecosystem to truly encircle India.

Expanding broadband footprint to improve penetration and performance would be crucial

Broadband penetration in India is driven through mobile broadband. India’s fixed broadband penetration at 1.4 per 100 inhabitants2 is being amongst the lowest across global comparators. Driven by digital and smart solutions, the future of connectivity is expected to support massive improvements in network coverage and performance, with higher and reliable broadband speeds being one of the key improvements. While the rest of the world has been more cognizant in assuring such demands and have been revising their broadband definitions and minimum speed thresholds, India still defines and terms the internet service as broadband if it delivers speeds at 512 Kbps3 or higher.

International Telecommunication Union (ITU) defines broadband as a transmission capacity that is faster than 2.0 Mbps. Improving minimum threshold of broadband definition to further commensurate with global standards would be a step in the right direction.

This will help in creating required baselines for enabling

different types of services and further extend to meet

growing connectivity requirements as demanded by the

consumers of today.

India’s average mobile broadband speed of 10.15 Mbps is only a third of the global average. India was ranked 130th among 176 countries in terms of average mobile Internet download speeds in 20194.

The coverage, quality, and speed of broadband internet is expected to determine adoption of use cases for deployment of next generation technologies. Inability to provide such characteristics could hamper potential benefits of several use cases, services, and offerings.

In view of the above, various initiatives across deployment of optical fibre network, small cells, Wi-Fi, and enhanced 4G – LTE networks are being implemented to expand and improve the fixed and wireless infrastructure across the country, further enhancing the rural and urban broadband connectivity.

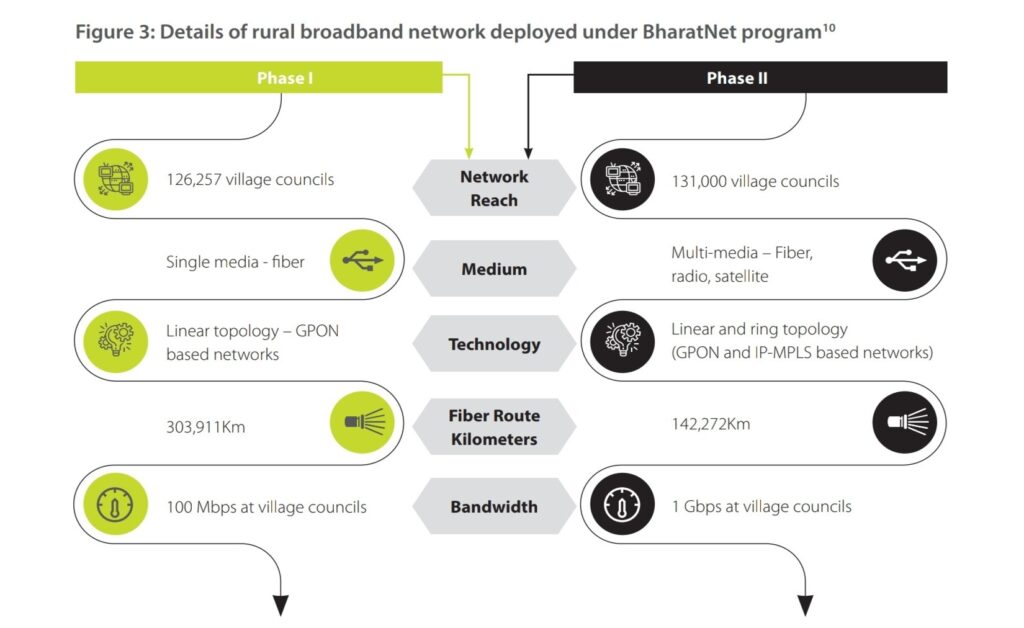

Digital India initiatives are aiding in expanding digital footprint in rural India

Access to broadband is limited for India’s population which lives in rural and remote areas. As of 2019, only ~21 percent of the rural populace were broadband subscriber vis-à-vis ~74 percent in urban areas6. Low fibre footprint and microwave bandwidth – network backhaul solutions coupled with limited monetization opportunities have created bottlenecks in rolling out last mile – broadband services across villages. In order to reduce this large digital divide, availability of widespread, non-discriminatory access to public funded broadband infrastructure with quality services at affordable prices, is critical in rural areas.

India is expanding its digital footprint through various initiatives and programs focusing on building a pan-India broadband network for rural connectivity. Department of Telecommunications (DoT) is currently funding these programs via the Universal Services Obligation Fund (USOF), with an investment of ~ US$6bn7.

With network infrastructure cost of ~ US$24,0008 per village council, BharatNet was initiated to scale up the rural infrastructure by deploying 1.7mn fibre Km9 with GPON and IP-MPLS based network architecture across 250,000 village councils (or Gram Panchayats) under two phases.

While the project was approved in 2011, the physical infrastructure rollout commenced in 2014 for Phase-I. Subsequently, work commenced in 2018 for Phase-II and is presently underway covering remaining projected villages. Since, then completion of project milestones has faced several roadblocks. But, more importantly, even for the village councils that have been connected, there has been no usage, primarily due to lack of connectivity to actual end points (like Schools, Hospitals, Factories, and Mobile Towers).

The key focus of the PPP framework could potentially involve accelerating the deployment, upgrading existing network, and enhancing utilization of network infrastructure to further serve affordable broadband services across rural India. Apart from being used as an instrument for easing finance and capacity constraints, it can be used as an effective tool in network monetization and improved service delivery.

Service providers are focused on improving broadband access, quality and performance for urban India

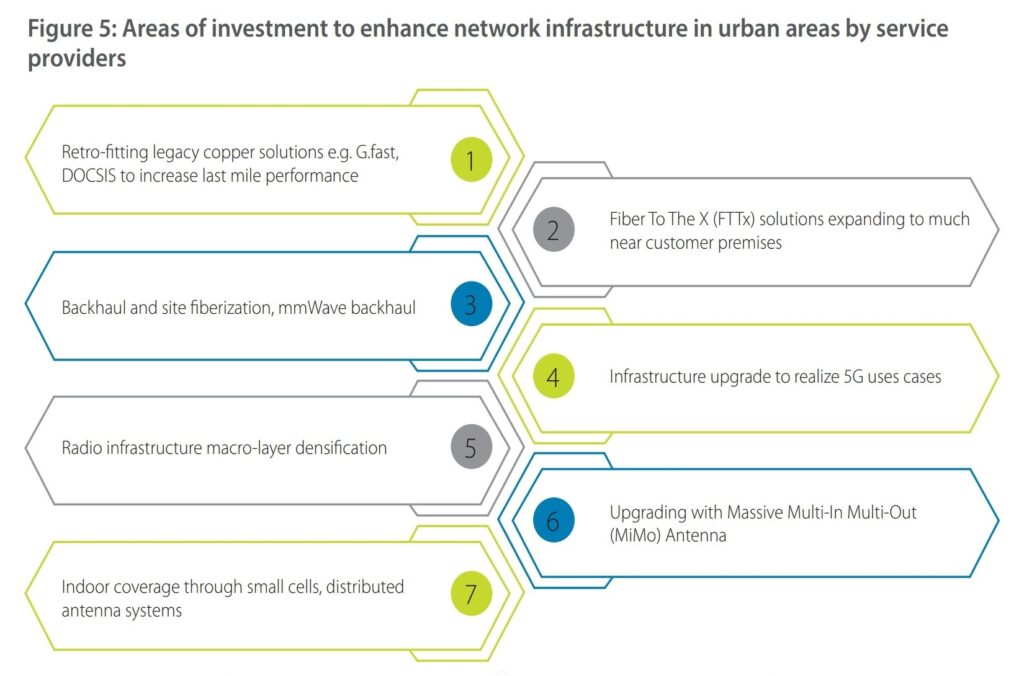

Urban lifestyle has already boosted the requirement of digital connectivity anytime and anywhere through any devices. With increasing demands for reliable and enhanced broadband in terms of scale, throughput, and latency, service providers are continuously investing in enhancing their network infrastructure.

Service providers are expected to spend around US$16.1bn12 during the years 2020 – 2024 to upgrade and enhance their wireless infrastructure. With 4G services constituting majority of the total mobile data traffic, service providers are likely to continue their focus on enhancing their respective 4G networks by introducing 5G enabling technologies such as massive Multiple Input Multiple Output (MIMO) adaptive antenna, Dynamic Spectrum Re-farming (DSR) from 3G to 4G as well as deploying advance carrier aggregation solutions.

While in rural and semi-urban areas, service providers can easily deploy macro sites for increased coverage and capacity. However, the key focus in urban areas is expected across increased deployment of small cells for network densification.

This would further support enhancing indoor coverage, reducing outdoor coverage holes, and improving capacity constraints. From being nimble, quick to install, and in many ways more affordable than constructing large conventional cell sites, small cells are likely to contribute approximately 7-10 percent13 of overall wireless infrastructure cost in the next five years.

Moreover, a combination or Heterogeneous Network (HetNet) of small cells, pico cells, and indoor Wi-Fi points would be leveraged to further enhance the indoor coverage and meet diversified requirements to better serve customers.

High-capacity bandwidth networks would also require deep fiberization (as near to the customer as possible) and would further continue to drive investments.

Moreover, service providers are also likely to focus on upgrading mid-haul networks such as Carrier Ethernet Networks (CEN) and fibre aggregation points to build capacity and offer last-mile fibre (FTTX) services. In this regards they are expected to spend around US$3.2bn14 during the year 2020 – 2024 to expand fixed access connectivity and transforms network infrastructure.

Accelerating connectivity initiatives in India

Key learnings from suitable global practices to spearhead infrastructure rollout and support future connectivity in India

India is on the path to build more efficient and scalable

networks as both government and industry are looking

at successfully reaping the benefits of next-generation

connectivity and digital services. With significant

infrastructure gaps and financial stress on the telecom

sector, India requires certain decisive actions to cater to

the growing need for secure on-demand connectivity. This

shall further enable innovative capabilities arising across

different sectors.

a. Proliferation of small cell infrastructure

Network densification through Heterogeneous Networks (HetNet) is gaining traction and mainly being used for indoor coverage and is expected to rise for improving service quality and customer experience. This need has also given opportunity for industry players to offer ‘small-cell-as-a-service’, ‘HetNet-as-a-service’, to densify their network, thereby enabling 4G expansion and prepare for impending launch of 5G. Following are actions to expediting the small cell infrastructure deployment:

- Enable single window clearance for approvals required for installation to avoid dealing with multiple agencies

- Simplify process to ease access to street furniture and other existing assets

- Allow non-discriminatory access to asset inventory and buildings per municipality to all service providers

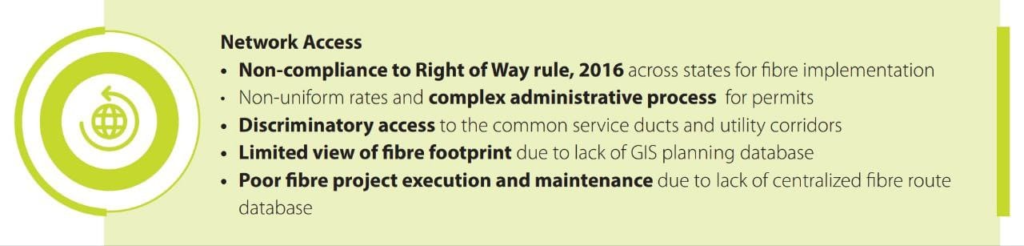

b. Expand fibre footprint to deliver high capacity solutions

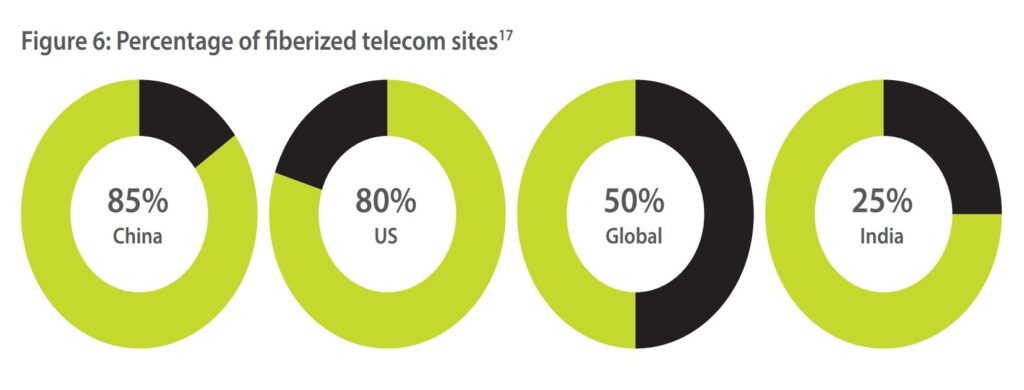

Fiberization is essential for deploying scalable next generation infrastructure. However, only approximately 25 percent of the telecom sites in India are fiberized. With regards to total fibre deployed versus population ratio i.e., fibre kilo-meter per capita, India currently lags global peers and stands at just 0.1x when compared to USA’s 1.4x and China’s 0.9x15.

The Gazette Notification on Right of Way (RoW) issued by the government in the year 2016 was an effort to expedite the deployment of underground (fibre cables) and telecom tower infrastructure. However, these new rules are yet to bring benefits to the Indian telecoms infrastructure sector due to implementation challenges at state and local municipal levels. Only 16 states out of 36 States/UTs have broadly aligned their policy with RoW policy as notified in the last four years16. Some key measures that could aid the endeavour would include:

Promote sharing of fibre to reduce cost of deployments, along with establishing dig once maintenance policy, common ducts, and utility corridors

Stimulate investments in fibre expansion through Public-Private Partnerships (PPP)

Promoting and incentivizing rollout of optical fibre cables with upcoming public utility and infrastructure projects across all new construction in India

Simplification of process and collaborative institutional mechanism between centre, state and local bodies to expedite RoW approvals

Encourage policies for pooling fibre assets across states to create a single national infrastructure.

c. Transitioning over wireless giga- backhauling based microwave networks

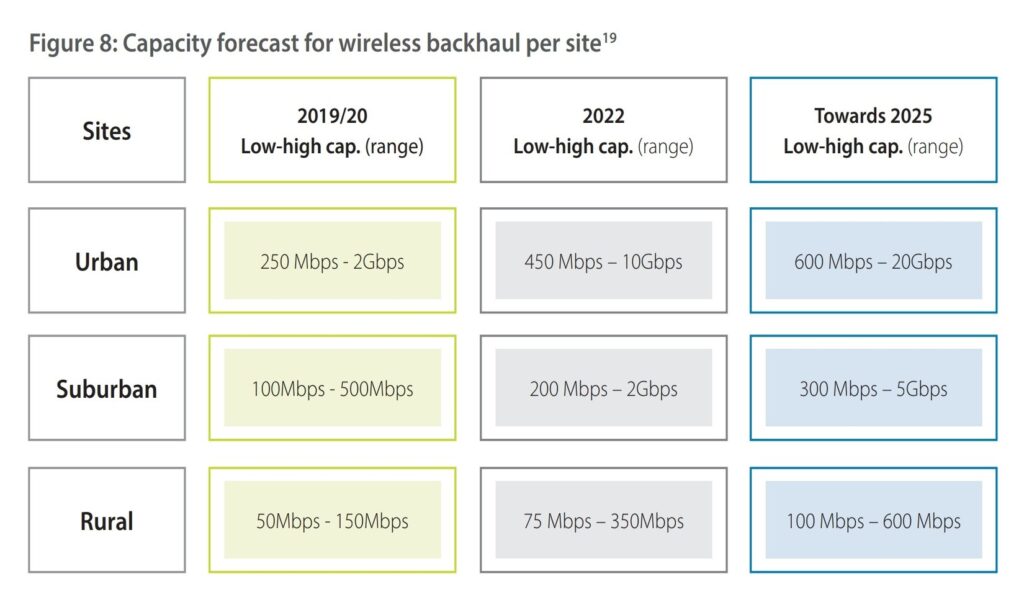

5G sites is expected to rely on integrated access backhauling through a combination of microwave and fibre network solution. Cost-effective microwave solutions through E (71-86 GHz) and V (57-71 GHz) band spectrum – permitted worldwide for ultra-high capacity gigabit backhauling can be used to manage high traffic at a shorter distance.

In 2017, the majority share of backhaul links deployed across all types of networks was in the traditional microwave spectrum band i.e., 7 GHz to 40 GHz (56.1 percent) bands. Whereas fibre backhaul was minimal at 26.2 percent with significant share being driven with increase support to 4G services. However, globally with increase in fiber-optic backhaul connectivity reaching at 40.2 percent of macro-cell sites by 2025, it is expected to eclipse microwave in the 7 GHz to 40 GHz band with 38.2 percent.18

Advent of high throughput services is further expected to enable eased adoption of microwave links in the 41 GHz to 100 GHz bands which may double from 5.1 percent to 12.6 percent during the period 2017-2025. Operating under such high frequency bands will enable operators to introduce alternative backhaul connectivity, further reducing and optimizing fibre and capex requirements.

With increased data consumption, sites would require capacity upgrades. Key actions for maximizing wireless backhaul capacity would include:

- Expedite allocation of additional spectrum (E and V bands) to service providers for addressing backhaul bandwidth crunch

- Use of multi-carrier or carrier aggregation and MIMO microwave link solution may be explored to maximize capacity on existing spectrum in case of absence of E and V bands.

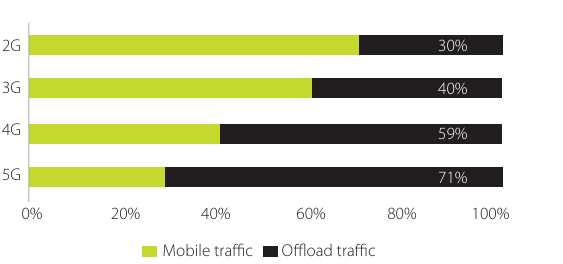

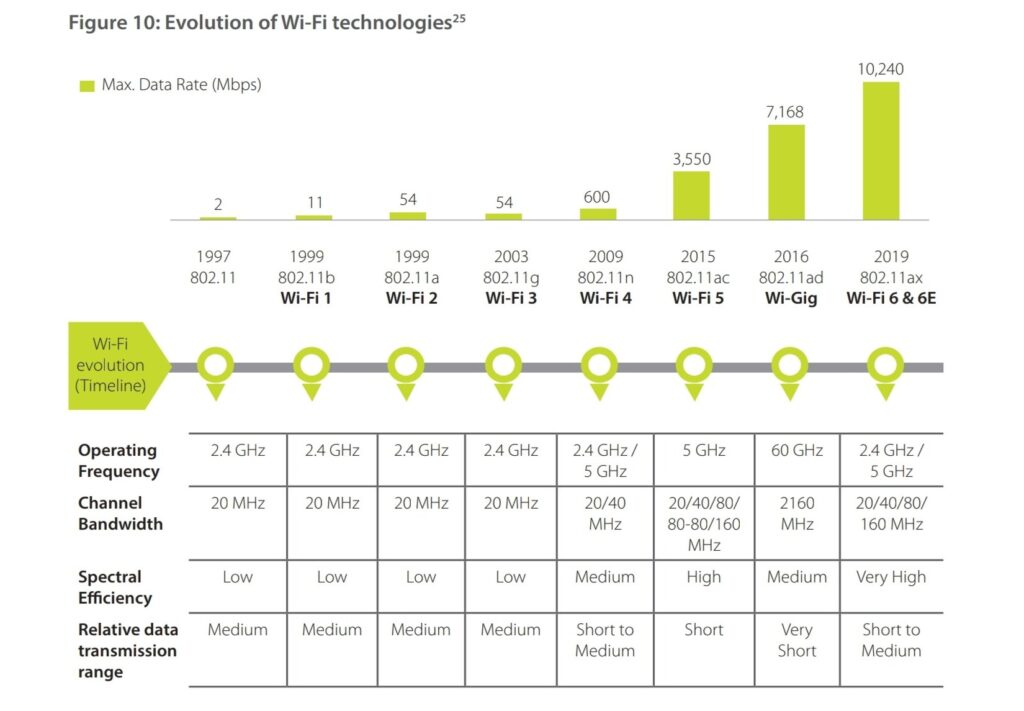

d. Building complementary ecosystem through Wi-Fi

With the advancement in the Wi-Fi standards, the global Wi-Fi hotspot coverage is expected to reach 628 million global public Wi-Fi hotspots at CAGR of 30.2 percent from 2018-2023. During this period, Wi-Fi 6 hotspots may also grow 13-fold to reach 11 percent of all public Wi-Fi hotspots20. Wi-Fi solutions have been enabling connectivity at homes, offices and public places as well as have been leveraged extensively for augmentation of capacity and coverage for existing mobile networks.

By 2022, the Wi-Fi devices are expected to account for 56.8 percent21 percent of Internet traffic globally. This would be attributable to the increase in proportion of mobile data offload to Wi-Fi devices or hotspots. Even though India already has large amount of unlicensed Wi-Fi spectrum (India has delicensed ~ 600 MHz spectrum from 5.15 – 5.35 GHz, 5.47-5.875 GHz), it lags market leaders in terms of the number of Wi-Fi hotspots or access points deployed.

Based on the global average of one Wi-Fi hotspot per 150 people, India should have approximately 8 million hotspots22 as compared to just over 100,00023 hotspots currently deployed across all existing service providers. The public sector players, i.e., BSNL is the leading public hotspot provider in India.

The proliferation of Wi-Fi remains to be minimal in India’s

communication infrastructure due to:

- Availability of cheap mobile data with average mobile data rate for one gigabyte (GB) of US$0.09 vis-à-vis the global average of US$5.0926 has kept subscribers latched on to the cellular networks, rather than accessing the Wi-Fi network, in turn hindering the growth of outdoor Wi-Fi solutions in India. This has further resulted in data boom across mobile data traffic with monthly data usage increasing four-fold in last four years and 4G subscriber growth of by 132 percent between 2016-201827

- Lack of monetization models with initial focus only on public Wi-Fi use case with limited time-bound free usage. However, globally, Wi-Fi data-offloading and roaming substitute use cases had driven Wi-Fi growth in the U.S. and European market

Acknowledging the essential role of Wi-Fi for providing high-speed, reliable, and affordable wireless broadband connectivity to consumers and enterprises, the FCC in the US has allocated 1.2 GHz of spectrum (5.9-7.1 GHz) for license-exempt use. Countries across Europe are already considering similar regulation, and numerous countries in Latin America and Asia may also follow suit. However, the Indian telecom service providers are not in favor of such a regulation and have argued for level playing-field for entities providing similar services. In this band, only Wi-Fi products complying with the latest Wi-Fi standard, Wi-Fi 6E is expected to be deployed to take full advantage of its high data rates, very low latencies, and improved coexistence features.

In India, the band currently has incumbent users including f ixed links for mobile backhaul and fixed satellite service. The use of the uppermost part of the 6GHz band (7,025 MHz to 7,125MHz) will be discussed at WRC-23 for Region 3 (which includes India) with a view to opening it for IMT applications such as 5G.However, the band 6425-7125 MHz is being discussed for Region 1 and the development of an ecosystem for IMT is currently in place. The band is currently allocated to the mobile service on a primary basis in all three Regions therefore can be used for IMT type systems.

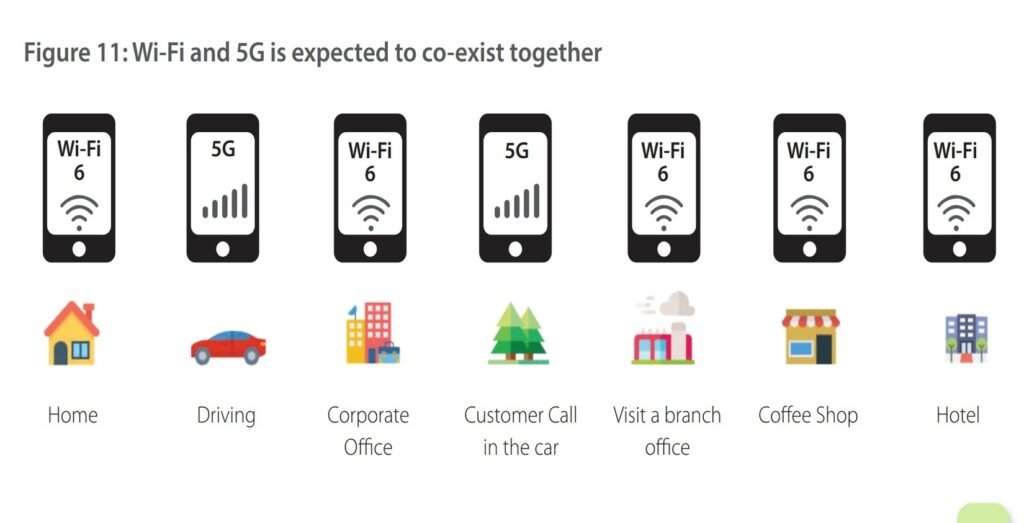

5G and Wi-Fi 6E both can achieve gigabit speeds with low latency, thereby enhancing user experience. As the former will be used primarily by mobile devices, Wi-Fi is expected to play a significant role for residential and commercial environment due to its low cost of implementation and maintenance. Whereas Wi-Fi can support multiple devices like tablets, printers, laptops, TVs, etc., 5G can only be accessed by devices equipped with individual SIM cards.

Depending on the need, choice can be made between 5G and Wi-Fi. In case of factory automation, Wi-Fi can be used to manage manufacturing operation, while 5G can be used to create a campus wide network, or vice versa. These can also co-exist depending on the need of connectivity.

With significant potential benefits, 5G and Wi-Fi are technologies that are expected to work together, rather than compete, to enable enhanced user experience.

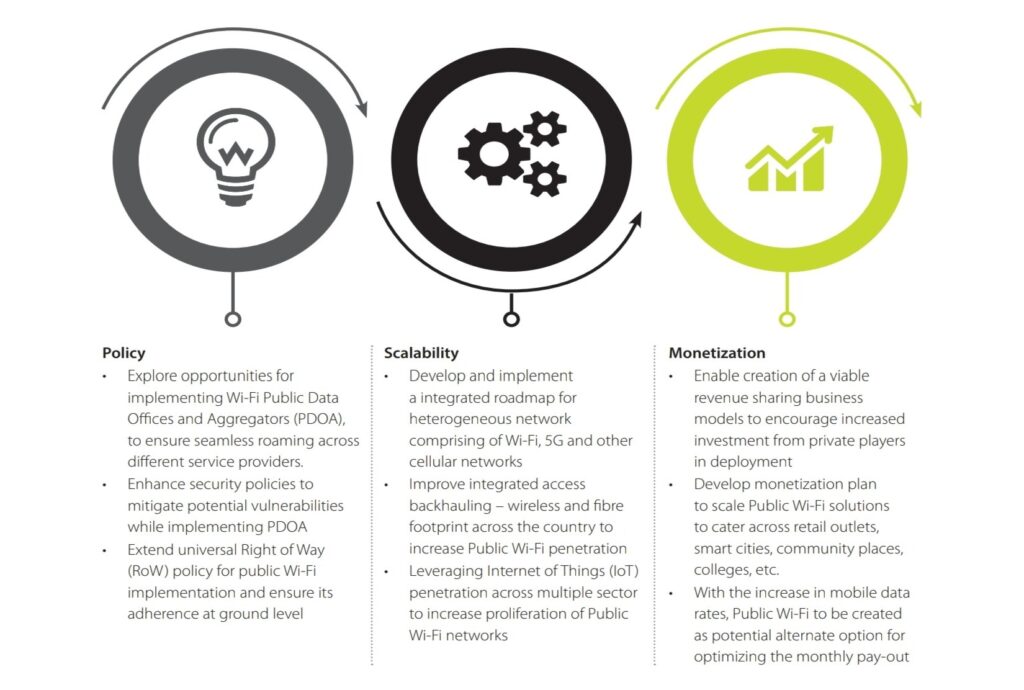

Boosting the state of Wi-Fi deployment

The Govt. of India has established very aggressive targets to reach 10 million hotspots by the year 2022, however, to reach this level, India needs to focus on the following:

e. Fast tracking 5G plans for commercial launch

380 operators are investing in 5G networks in the form of tests, trials, pilots, planned, and actual deployments of which 73 operators across 41 countries have launched mobile and Fixed Wireless Access (FWA) based 5G services28. India is far from commercial launch of 5G service with spectrum auction still impending and crisis prevailing due to COVID-19 pandemic with the nation in various stages of lock down.

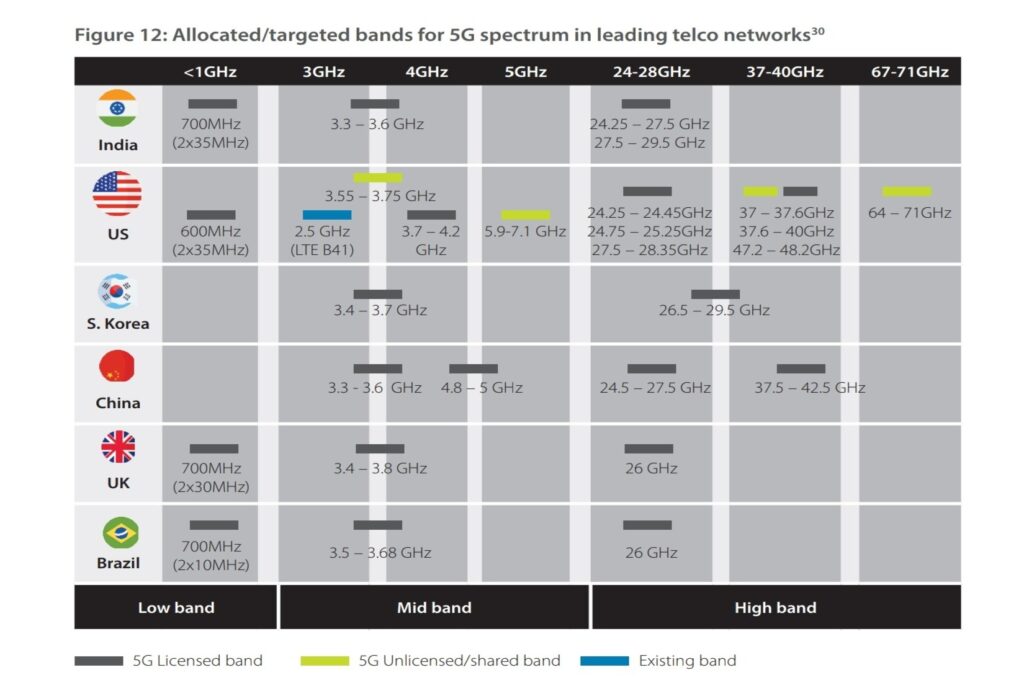

Successful use case implementation would require trials to be conducted in order to integrate relevant technology solutions with industry verticals. Globally, operators are targeting and allocating all types of spectrum comprising of the following;

- Licensed spectrum – Exclusive use with over 40 bands globally, presently available for LTE

- Shared Spectrum – New shared paradigm to meet public and private needs. E.g. 3.5 GHZ in US, 3.7 GHz in Germany

- Unlicensed Shared Spectrum – Shared use of spectrum resource for 5G NR-U and Wi-Fi6E (5.9 – 7.1 GHz)

While progress has been made on policy front with the following steps, giant strides would be required to transition into a 5G future.

- DoT has issued guidelines for 5G field trials and allocated up to 400 MHz of radio waves with fixed uniform fee of ~US$71 for the 5G trial license29. The validity of licenses ranges from three month to two years, depending on the purpose of the trial. Till date however no trial spectrum has been allocated even after more than year after initial announcement

- The spectrum blocks of 100 MHz in 3.5 GHz band, 400 MHz in 26 GHz band and other potential milli-meter bands have been identified for 5G

- Spectrum across three key frequency ranges – sub-1 GHz, 1-6 GHz and above 6 GHz are presently being explored. This is expected to cover capabilities and use cases to support widespread coverage, optimized mix of coverage and capacity benefits, and high capacity – ultra high broadband speed requirements

Though trials to assess technology characteristics and various use cases are being conducted by the OEMs in collaboration with operators in their respective test beds, field trials across rural, semi-urban, and urban areas are yet to be conducted.

With advent of next generation connectivity solutions and digital service platforms, telcos are also seen forging partnerships across the value chain to explore opportunities for new services leading to new business models and intermediaries.

Private Network Enablers

- Adoption of network slicing capabilities will enable rollout of services with diverse set of performance requirements. Coupled with dedicated spectrum, companies can install private wireless networks to cater to their specific requirements

- In Germany, private licenses are being allocated across 3.7-3.8 GHz spectrum. Approx. 33 companies have bought 5G private licenses so far including Bosch, BMW, BASF, Lufthansa, Siemens and Volkswagen

- Sweden will reserve 80MHz of frequencies between 3720MHz and 3800MHz for local and regional licenses while France and Netherlands are going ahead in securing frequencies for the same as well.

Edge Computing Services Providers

- Cloud companies have emerged providing infrastructure resources for computing, storage, and processing and provide capabilities across ‘Network-as a-Service’

- Microsoft is planning to create Azure Edge Zones with AT&T, Rogers, Telefonica, Vodafone Business, SK Telecom, Telstra, Etisalat, and NTT Communications. It plans to bring compute, storage, and networking closer to end users

- AT&T and British Telecom (BT) plan to develop new Network Edge Computing (NEC) use cases to enhance 5G broadband capabilities across enterprises and residential areas in US and UK market respectively

- Reliance Jio and Microsoft have partnered to deploy Azure cloud services to target enterprises and small business users.

Tower and Infrastructure Providers

- Tower infrastructure providers are looking at small cell and hyper-dense networks to provide a growth opportunity across digital connectivity

- US tower companies are expected to leverage fiber networks to deploy small cell antennas and increase wireless density across cities in the US

- Indian tower companies are expected to jointly explore new growth areas such as fiber sharing, small cells, data centers, and Wi-Fi offloading. Moreover, they are planning to create smart small cells in India in the near term.

Content Delivery Platforms

- With more than 30 OTT platforms and increase in network data throughput, the average time spent on watching online video in India (on digital platforms) have risen by 57 percent to reach 126 min/day from 2017 to 2019 31

- OTT streaming video uses over 60 percent of the global internet bandwidth with Netflix using an estimated 15 percent of global downstream internet traffic32

- Netflix, Amazon Prime, HOOQ, Eros, Disney+, Hotstar – have now expanded across Asia Pacific region by collaborating with telcos including IPTV and DTH platforms players.

Accelerating connectivity

initiatives in India

Key learnings from suitable global practices to spearhead infrastructure rollout and support future connectivity in India

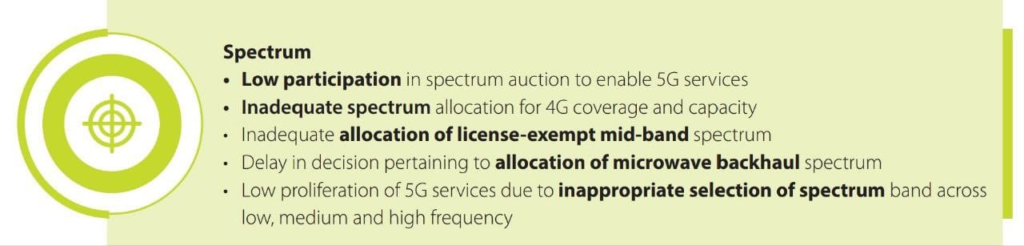

It is imperative to develop an exhaustive strategy and implementation roadmap for releasing 5G spectrum across low, mid and high spectrum bands. India is yet to finalize the spectrum across the 600MHz, 1.4GHz, 2.6GHz, 4.8GHz, 26GHz, 31GHz, 47GHz and E & V bands (for microwave – access backhaul traffic).

Moreover, allocation of an adequate amount of spectrum in the 6 GHz band for license-exempt use will benefit the consumers due to the availability of affordable wireless broadband solutions. However, the Indian telcos would not agree to license-exempt usage of 6 GHz spectrum and have argued for level playing-field for entities providing similar services. For realizing the potential of 5G across the use case horizon, there will be a need for availability of spectrum across all recommended bands at appropriate contiguous blocks.

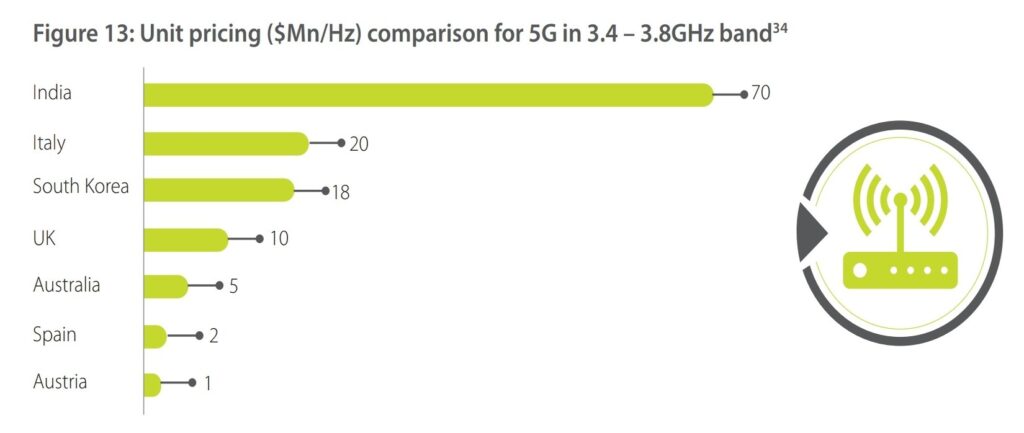

In the next spectrum auction planned, the recommended reserve price suggests that the operators are expected to spend ~ US$9.38bn for 10 MHz spectrum in the 700 MHz band and US$7bn33 for 100 MHz in the 3,300-3,600 MHz band. Given the current state of telcos, this could result in delay in acquisition of 5G spectrum further delaying the 5G roll-out.

b. Deep investments in research and development for 5G and next generation networks

India had earlier reserved a corpus of US$70mn35 for foundation research and development program for developing applications and services pertaining to 5G. More collaboration in global 5G or next generation network forums would aid in development of intellectual property, design led manufacturing and wireless standards, use cases catering to Indian conditions and requirements

c. Develop use cases to create India centric products and solutions

India specific use cases need to be expedited to demonstrate impact on digital value chain across industry verticals. We expect 5G and next generation network will drive convergence among industry players in developing India focused solutions through building hypothesis, testing, and analysing performance or service requirements across industry vertical to create viable business models.

d. Strengthen existing wireless infrastructure to complement 5G services

Enhanced 4G infrastructure for wider area or fall-back coverage with adequate capacity will be critical in the medium term. Operating in conjunction with 5G network in select urban geographies, 4G and hyper dense networks is expected to allow service providers to absorb and stagger high capital requirements. In view of the same, telcos are expected to significantly invest in integrated access backhauling solutions though wireless and fiber deployment, densify networks through HetNet- small cells, Wi-Fi based solutions, and improve network flexibility by virtue of automation and virtualization, etc., to progressively support 5G rollouts.

e. Continue to transform and build 5G – Ready mobile core networks

Though the 5G spectrum auction has got delayed, however, service providers can still work on 5G readiness by deciding “Best of breed” vs “Best of suite” approach for 5G core.

- Best of Breed: Service providers may select individual network function providers and later integrate them by either providing Container as a Service (CaaS)/Platform as a Service (PaaS) environment or by selecting another vendor to do same for them. However, such multi-vendor environment may cause challenges and delays during integration and operational support.

- Best of Suite: In this type of deployment, service providers may select a System Integrator (SI) or a company who would provide pre-integrated 5G core solution including CaaS and PaaS or by selecting another vendor to do same for them with no complexities in terms of integration, security, support, etc. One of these approaches is expected to enable service providers to understand 5G deployment on existing environment and also in case of realizing interworking with 4G or 3G network to provide voice and data services. Overall, it is expected to enable them to quickly launch the 5G services.

f. Enhancing resilience through cyber security apparatus

Across the globe, cyber-attacks are becoming more sophisticated and increasing in frequency with rising internet penetration and digital connectivity. It has been estimated that such attacks cost the global economy one-per cent of annual GDP up to US$575bn36 per year. As 5G ecosystems develop, it would be pertinent to improve cyber security governance and policy framework in India. Some key measures would include:

- Robust policy enforcement and monitoring of data localization requirements

- Emphasis on building holistic, dynamic, enterprise wide cyber risk programs that are continually tested and updated to allow for agility and swift recovery

- Incentivized framework (e.g. liability reduction) may be explored to proactively share cyber incident and threat-related information, and associated defensive strategies

- Incentivized framework (e.g. liability reduction) may be explored to proactively share cyber incident and threat-related information, and associated defensive strategies

- Fostering common standards, approaches and synergies among industry and regulators to improve governance and build expertise.

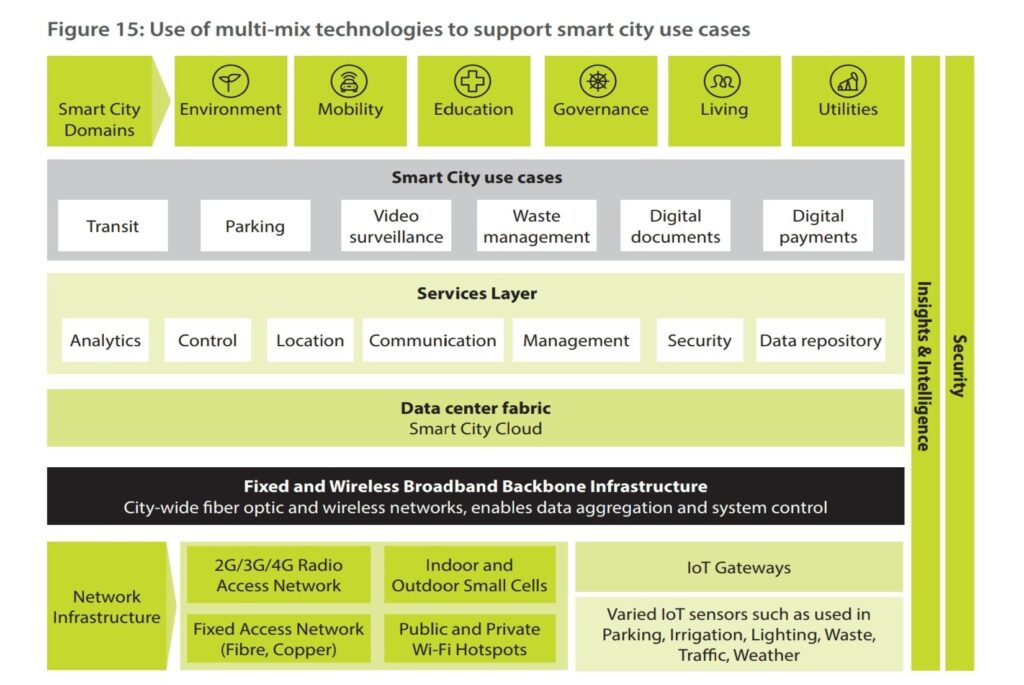

g. Activating multi – mix technologies to make cities smart

The United Nations has predicted that between 2014 and 2050, India will have the highest rate of urbanization among all nations adding another 404 million38 people to its urban population . To accelerate response to this growing urbanization, an investment of ~US$29bn is planned for various projects of which ~US$14bn has already been tendered39. The smart city objectives as per the Smart City Mission is expected to drive future connectivity solutions leveraging new generation platforms and technologies.

To strengthen the use of smart city solutions across education, public safety, transportation, mobility etc. an efficient design with foundational pillars created by the multi-mix of technologies needs to be enhanced. Coupled with next generation technologies, the following areas are needed.

- Enhance network infrastructure and its densification through use of Wi-Fi and small cell solutions

- Run transformational initiative through integrated use of connectivity solution such as 4G, IoT, Edge Computing with digital platforms across cloud services, artificial intelligence, block-chain.

- Improve interoperability between disparate technology platforms and mitigate challenges across legacy city systems to integrate with other services;

- Mitigating data in vertical silos to derive critical insights leading to better decisions, responsive services, and improved efficiency

- Use of advance real-time data analytics to help cities improve decision making and continuously prioritize and respond to events efficiently

- Data and insights to be shared securely across all functions (complying with data privacy rules).

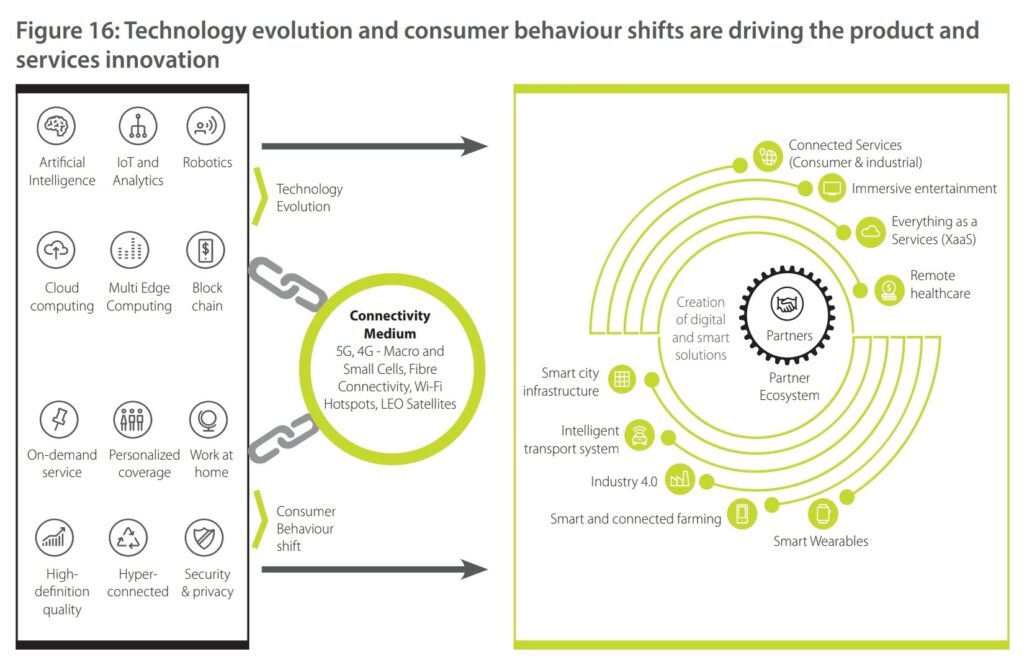

Building the future connectivity roadmap for India

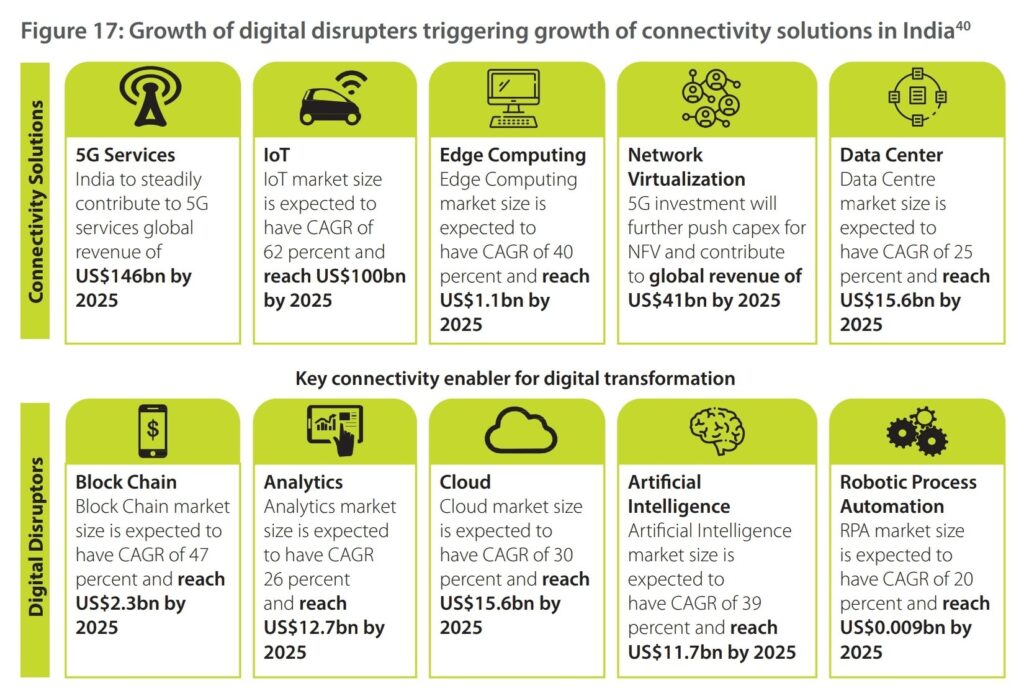

Evolution of data driven technologies such as Artificial Intelligence (AI), Edge Computing, Internet of Things (IoT), Blockchain to name a few, are sparking disruption across sectors. These technologies are enabling service providers to cater to consumer preference shifts and changes through delivery of smart solutions.

Adapting to the varying needs of customer across retail and enterprise, and proliferation of such enabled digital services, telecom service providers are expected to invest significantly in network transformational programs. Legacy networks were closed, complex, in-flexible and had limitations around scalability. These characteristics meant that the networks need to be transformed in the existing digital world where speed, agility, openness, flexibility, and responsiveness are prerequisites for success.

These transformation programs are expected to focus on building cross sector use cases based on varied combination of next generation connectivity and platforms solutions, to maximize business potential value across technology craving and converging industries.

With enhanced coverage, capacity, and performance characteristics, the future of connectivity would be enabled by host of technologies across wireless and wireline services. Telecom radio infrastructure encompassing macro and small cells, fibre connectivity, Low Earth Orbit (LEO) satellites, Wi-Fi and other heterogeneous networks are expected to drive this transformation.

Transformation through digital disruptors such as cloud, block-chain, artificial intelligence and advanced analytics is driving the demand and accelerating deployment of new services.

This capability would enable telcos to rollout differentiated and quicker services with introduction of flexible or micro service-oriented network architecture. However, to realize such opportunities presented by the evolving business models would require strong collaboration between industry verticals, applications and connectivity providers.

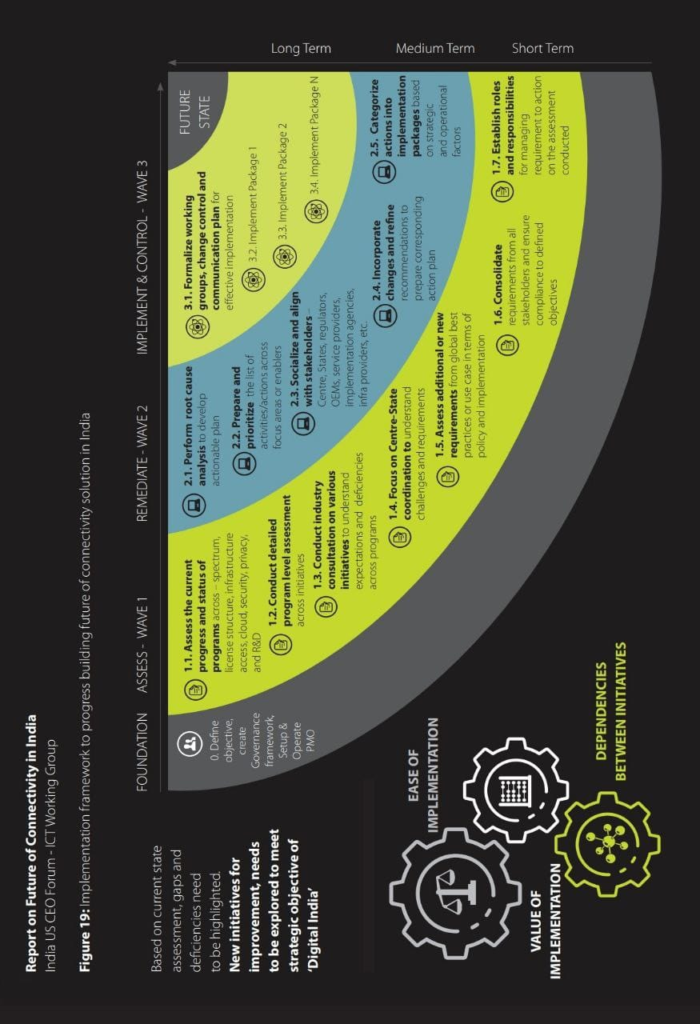

In order to successfully implement the future of connectivity in India, it is very critical to understand the key risk areas and ensure that a robust mitigation plan is created to remove any roadblocks.

Decisive policy mandates with robust implementation would be key to enhance future connectivity in India

To realize the potential benefits of next generation technologies enabled by future connectivity solutions, the policy initiatives across various regulatory reforms needs to be revisited, calibrated and re-aligned with objectives set out as a part of ‘Digital India’ agenda. The on-going structural reforms and regulatory framework requires continuous improvements and show case time bound progress with effective outcomes. Achieving such goals would necessitates constant dialogue on addressing complex issues with key stakeholders across the entire value chain including – the Centre, the States, local governments and agencies, Telecom Service Providers, Internet Service Providers, Infrastructure Providers, handset and equipment manufacturers, the academic community, the innovators and start-ups.

a. Right of Way for enhancing fibre broadband penetration

Fiber rollout needs Right of Way (ROW) permission from multiple state & local govt. bodies for digging roads, laying ducts and fiber cables. In India, cost of & time for getting these permissions are disproportionately higher than other countries.

We believe that the RoW Rules of November 2016 are extremely practical, reasonable and non-discriminatory in nature and if implemented pan-India, shall go a long way to streamline and smoothen the RoW process, and allow for quicker and more efficient broadband rollouts and adoption. Moreover, the following inputs shall also spearhead growth of infrastructure

- Enable creation of a centralized portal for monitoring & implementation of ROW Rules 2016, with single window clearance provisions and an appellate mechanism for escalations

- State RoW policies to be aligned with RoW rules for underground and overhead infrastructure as per Gazette notification of 2016 within a stipulated period

- Extend the present MoUs with the states beyond Gram Panchayats till villages with no charges applicable for RoW permissions

- Enable mandate on part of Power Discoms and Municipal corporation to leasing of poles (Utility/ streetlight) for aerial fiber at a reasonable charge

- Create collaborative institutional mechanism between centre, state, and local bodies driving governance with periodic review to oversee the implementation of RoW rules

- Benchmark tariffs for sharing and utilizing fibre infrastructure through a consultation paper and inputs from industry stakeholders. Cost & sharing tariffs may further be defined or rationalized across Service Areas (circle, zone or districts) to reduce variations across charges applicable over RoW permissions

- Enable digital enterprise resource planning system with an automated process workflow to manage, execute, and monitor application process with inter-departmental approvals. This should also include penalty-based SLA with audit capabilities

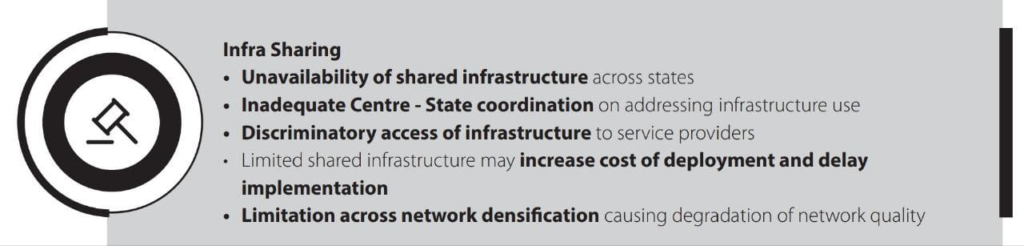

b. Enhancing infrastructure sharing for

deep access of services

Spectrum is a very crucial elements, when it comes to implementation of new technologies like 5G, IoT, etc. Efficient and effective policy level decision are required in this area to support implementation plans of the service providers.

- Enhance the scope of Infrastructure Providers category (IP-1) to provide and share active infrastructure across radio access, backhaul, and core networks such as antenna, feeder cable, base stations and transmission systems to service providers based on mutual agreements

- As per TRAI’s recommendations – all eligible service providers should be allowed to obtain infrastructure from IP-1. Scope should include, but not limited to, RoW, Duct Space, OFC, Tower, Feeder Cable, Antenna, Base Station, IBS, DAS etc. Moreover, IP-1 scope shall not include core network elements such as Switch, MSC, HLR, IN. IP-1 will not be eligible to apply for and assignment of licensed spectrum and under no circumstances be brought under the licensing regime

- Promulgation of guidelines on release of street furniture to Infrastructure Provider-1 at reasonable rates

- Provisioning of 5G infrastructure to be mandated in building codes for large MDUs and office buildings, along with necessary guidelines

- Provisioning of 5G infrastructure to be mandated in building codes for large MDUs and office buildings, along with necessary guidelines

- Build fiber as a national infrastructure with mandatory laying of ducts across all roads, streets, gas, oil, power, railway line & state highways. Develop National Fibre Regulatory Authority overseeing the setup of common service ducts, utility corridors and encouraging sharing of fiber infrastructure across government as well as private players.

- Ensure availability and sharing of fibre infrastructure including duct and spare fibre strands created under central and state government initiatives with non-discriminatory access or on a non-exclusive basis at a standard cost-based model to all eligible service providers

- To ensure strong governance and transparency for sharing infrastructure, a National inventory of the fiber should be formulated

c. Spectrum availability and allocation for enhancing wireless broadband

Spectrum is a very crucial elements, when it comes to implementation of new technologies like 5G, Wi-Fi6, satellite, IoT, etc. Given India’s diverse and expansive geography coupled with high population, a ‘Fiber Only’ policy may become detrimental. While fiber is one of the critical components to connect and build a Digital India, microwave spectrum acts as an equally important enabler. It does not replace but complements fiber and can plug crucial gaps that come up during fiber deployment. In addition, it enables faster roll out of services in deep rural & remote pockets as well as dense urban environment.

Microwave deployment is relatively cheaper, easier to maintain, and can provide higher coverage. New generation microwave technologies can also provide high capacities. Thus, it is a sustainable solution to enable high quality broadband services in remote rural India. In urban areas, microwave spectrum can enable high speed backhaul for 5G and industrial use cases.

Efficient and effective policy level decision are required in this area to support implementation plans of the service providers.

- Allocation of adequate backhaul spectrum (E and V bands) for integrated access/backhaul planning with fibre to rollout 5G services along with densification of network

- Develop roadmap for spectrum need and availability by freeing the spectrum being used for non-commercial requirements

- Allocation across currently used bands such as 13GHz, 15GHz, and 18GHz shall be increased wherever applicable

- Analyse global benchmarks and optimize reserve prices for spectrum auction

- Simplify the process of obtaining permissions for radio frequency allocation from WPC and SACFA clearances for respective wireless technologies

- Enabling sharing of microwave spectrum as well in case the operators are coming together to have a common Radio Access Network. Since the RAN is allowed to be shared, it may require a corresponding increase in backhaul bandwidth.

- Identify and rationalize use of new bands across sub-1 GHz, 1-6 GHz and above 6 GHz to catalyse innovation and efficient spectrum usage

- Coordinate with inter-departmental agencies to assess and re-allocate underutilised/ substitutable spectrum for efficient and productive use

d. Future use of satellite technology:

Use of satellite technologies can help bridge digital divide in remote and challenging locations, accelerate 5G expansion and enable new levels of performance for enterprise, telecom, mobility, and government broadband connectivity on land, air and sea. It is expected to provide scope for wider coverage and superior enterprise connectivity in future, subject to regulatory clearances.

Use of satellites and LEO networks has the potential to provide benefits in areas entailing 4G/5G backhaul, mobile hotspots, distance education, telemedicine, village connectivity, in addition to maritime and in f light connectivity.

Considering the massive potential for Satcom services growth in the country in the years to come, there is a need to continuously explore latest satellite technologies to bring better value to customers and expand the market. Satellite services are poised to revolutionise the industry and with the prospective opening of the space sector in India, there will be a scope to serve new market segments and meet the requirements for high-bandwidth, low latency applications with use of LEO connectivity.

- Efficient and effective policy level decisions are required in this area to support implementation plans of the service providers

- Effective co-ordination with agencies for receiving authorisations would be required through upcoming Spacecom Policy being introduced by the Department of Space

- Participating and representing in policy consultations to enable simpler and more friendly regulatory regime with single-window/blanket clearances wherever possible

- Develop implementation roadmap for provision of satellite services and identifying areas of investment

- Establishing Public Private Partnerships for entering into satellite services’ domain.

e. Securing cloud services and enhancing data privacy

Addressing security issues across infrastructure, platform, and services along with data localization and hosting concerns are imperative while building safeguards.

- Enforcement of data protection rights to ensure unauthorized access and breach of personal data including – adequate protection to sensitive personal information; adopt globally; accepted data protection principles

- Provisions governing the cross-border transfer of data

- Enhance lawful interception or access to information hosted within and outside the country

- Establish a clear regulatory framework to manage potential security risks connected with the use of cloud services

- Enhance interoperability through standardization and common use of specification for cloud services across compute and storage APIs, IaaS data models etc.

- Build standardized approach to security assessment, authorization, and continuous monitoring for cloud products and service.

f. Encouraging manufacturing and investment

A lot is required from the governments in order to encourage and incentivize private players to invest and manufacture in India. Quite a lot has been done in the last ten years and more is required in the coming times to support the organizations.

- Develop roadmap and program for in-country/ global testing and certifications for telecom equipment along with encouraging the use of Mutual Recognition Agreement (MRA)

- Encourage set up of fabrication units for electronics chipsets to support local electronics manufacturing

- Encourage set up of fabrication units for electronics chipsets to support local electronics manufacturing

- Stimulate deep fibre investment and passive assets through Public Private Partnerships (PPP), investment funds and the offering of grant funding across various connectivity boosting initiatives

g. Enhancing research and development

Research and development is very cost intensive exercise, with very less visibility on the potential outcomes of the effort being put in. Govt. needs to support such initiatives and ensure organizations are encouraged to actively work in this direction.

- Build cross sector partnerships and build use case labs with industry verticals for developing innovative applications, standards for next generation technologies

- Enhance R&D funding in new technologies for start-ups and entrepreneurs to enable innovation in next generation products and services

- Create a framework for testing and certification of new products and services and simplify approvals/ processes for R&D procurements/imports

- Enhance National IPR policy based on global best practices and provide financial incentives for the development of Standard Essential Patents (SEPs)

Conclusion

Enabling future of connectivity would require a unified public-private sector effort

With technological changes redefining business and operating models across government, industries as well as changing homes and lifestyles, India is well positioned to capture the upside of this disruption. Realizing the upside would require continued focus on enhancing digital infrastructure and connectivity across the nation that is as rural as urban, as unconnected as connected and as unserved as served.

India would require a multipronged strategy to enhance broadband connectivity – leveraging on both fixed and wireless solutions. To ensure wireless broadband growth, 5G spectrum auction in the current fiscal would be important. Given the extensive trials and testing involved as well as timelines for infrastructure deployment, 5G commercial launch could still require year to year and a half for select use cases in select geographies making 2022 as the nearest realistic timeline for 5G commercial launch. With increasing debt and reducing revenues, operators are expected to be conservative in spectrum auctions as well as capex allocation for further network expansion.

Network densification and deep fiberization are key to enable the 5G eco-system and considering the huge capex outlays, telecommunication service provider is not likely to bear this burden alone. Continued government focus on Digital India programs and initiation of public private partnerships for roll out of digital infrastructure would be essential to drive broadband connectivity to all parts of the nation. Several players in the telecom value chain might rise to fulfill this gap in connectivity including web-scale players, Engineering, Procurement, and Construction (EPC) players, utility providers amongst others providing fiber and Wi-Fi infrastructure.

As with any infrastructure build, the right policy environment fostering growth and investment is critical. Given the huge gap in digital infrastructure when compared to global leaders and even between urban and rural connectivity in India; the right policy framework to drive investments, incentives to develop infrastructure and ease of processes would set the tone. Strengthening the policies framework around spectrum, right of way, security, cloud, IoT amongst others and ensuring on-ground implementation is key. Long-term vision and innovative business models with deeper collaboration across value chain players aptly aided by government and regulators are critical to move towards real improvement in the state of connectivity.

The future connectivity is expected to have characteristics of ubiquitous availability, increased reliability, and higher throughput which can be harvested through various innovative use cases across sectors. Despite numerous challenges and vast geography, India is striving to deliver an all-encompassing connected ecosystem to its people. Cross border collaboration, leveraging on learnings and leading practices, participation in technology research programs, carving out opportunities and customization of use cases to the Indian context would aid in India playing a key role in development of future technologies and contributing alongside the global leaders.

In times to come, those who are bold, embrace change and disruption, transform the way they operate — will be the winners.

About us

US-India CEO Forum (the “CEO Forum”) serves as a platform for Private Sectors from the United States and India to collaborate with the two governments for strengthening bilateral economic and commercial ties. The CEO Forum is envisioned as an opportunity for the two governments and the industry to work together to promote economic practices and policies to benefit both, India and the United States.

The latest edition of the CEO Forum, which was constituted in February 2019, presented a robust set of opportunities for growth across a host of industries, including ICT, emerging technologies and digital infrastructure. To further delve into various technology-centric agendas (and to assume greater responsibility in implementing identified opportunities), an ICT Working Group was created with representation from Indian as well as American side.

The ICT Working Group has shortlisted a number of key “opportunities” to pursue in India, including the facilitation of a countrywide connectivity model to deploy technologies that can solve various economic, societal and infrastructural challenges.

This Report on Future of Connectivity has been prepared by the ICT Working Group in consultation with Deloitte to provide a macro-level strategic perspective to Indian policy-makers with regards to making India a truly connected nation.

Acknowledgments

ICT Working Group (India US CEO Forum)

American Tower Corporation

Hewlett Packard Enterprise

Qualcomm Incorporated

Bharti Enterprises Limited

Infosys Limited

Reliance Industries Limited

Tata Consultancy Services

Knowledge Partner

Deloitte Touche Tohmatsu India LLP