Foreword

In Spring 2019, the USISPF Board decided to launch an initiative comprising of senior global executives from different industries to develop a set of recommendations as the Government of India advances a hi-tech manufacturing ecosystem in India.

India is primarily viewed as a software and services industry base, while countries like China, USA, and Germany are considered as the global manufacturing hubs. India has been a strong player in select industries like Automobile and Food Processing, but lags the hi-tech manufacturing sectors, contributing less than 3% of the global output. Over the last few years, the Government of India (GOI) has placed emphasis on increasing India’s manufacturing competitiveness. USISPF and its members support GOI’s endeavors, such as Make in India, aimed at making India a global manufacturing hub. While the Government has initiated reforms toachieve the goals of increasing the manufacturing sector contributions from 16% to 25% of the Gross Domestic Product (GDP) by2025, industry members have found certain challenges that need to be addressed urgently.

India’s high-tech sectors (such as electronics, aviation, medical devices) have the potential to offer an additional investment of USD 21 billion and create 550,000 direct jobs and 1,400,000 indirect jobs over the next 5 years. Given the significance of the increasing role of high-tech industry sectors in the global market and India’s vast potential in the sector, USISPF members have conducted a study to examine the factors that are impacting India’s competitiveness for companies planning to setup manufacturing operations in India, and how these challenges can be addressed to make India a dynamic player in the global value chain.

Based on the collective inputs from the USISPF members, some of the major challenges identified include the need for a strong supplier ecosystem, reduction in logistics cost, enhance skilled workforce, and enabling regulatory policies. To address these challenges and to enhance India’s competitiveness, a set of policy changes for the near and long-term have been recommended for further consideration by the Government. Industry looks forward to working with the Government to make India a world-class manufacturing hub that can strengthen domestic manufacturing as well as support India’s export sector to create the much-needed jobs for Indians.

Mukesh Aghi

President & CEO

US-India Strategic Partnership Forum

Introduction

Hi-tech manufacturing is typically characterized by recurring large spend on R&D and willingness to invest in innovation, technology, and associated infrastructure by companies.

Some of the key characteristics of hi-tech manufacturing include:

- High spend on R&D

- Recurring large investments into R&D

- R&D spend typically>3% of revenues

- High innovation rate

- Relatively higher proportion of businesses undertaking technological innovation in the industry

- Significant technological endowment in final product

- Products with intelligent devices embedded

- Large capital investments in technology and infrastructure

- Requirement for a diverse pool of highly skilled personnel

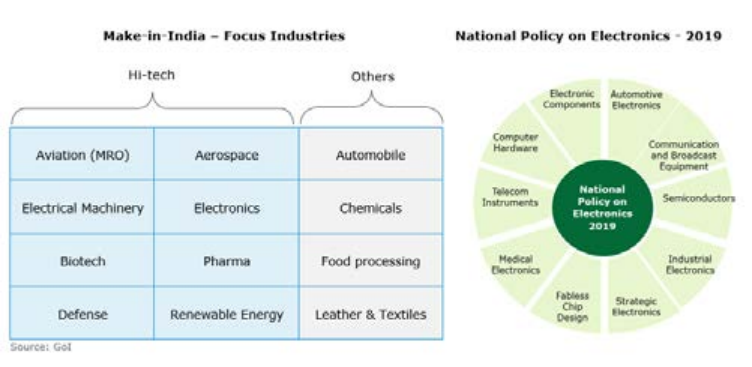

From among the industries that qualify as hi-tech, the Government of India (GoI) is focusing on select ones and segments through its flagship programmes.

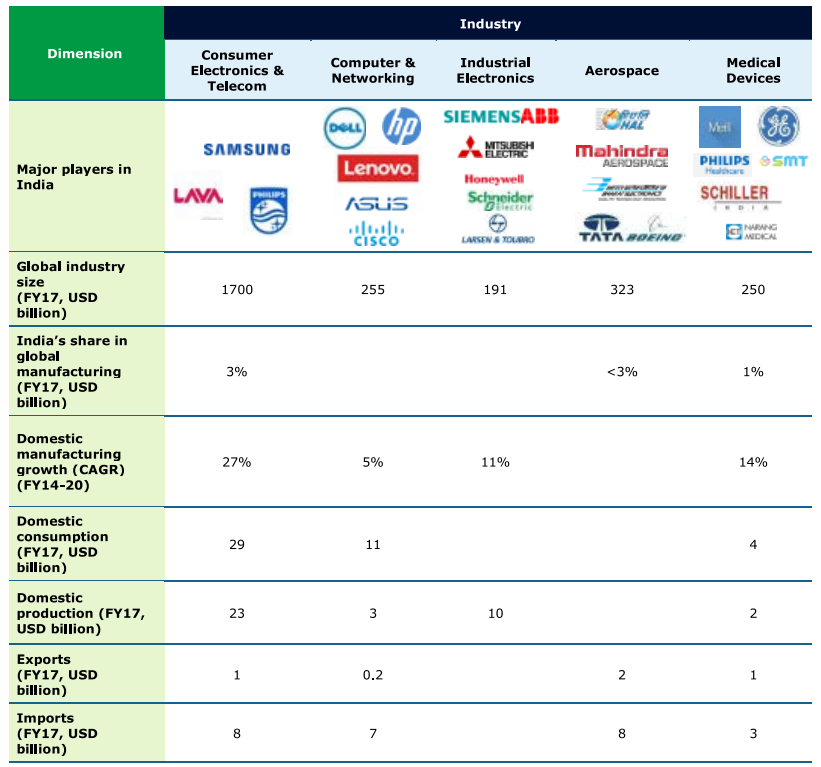

From the above, Electronics, Aerospace and Medical Devices have witnessed the entry of various global MNCs into India for manufacturing. But India’s share in global production within these sectors is less than 3%.

Performance of key hi-tech manufacturing industries

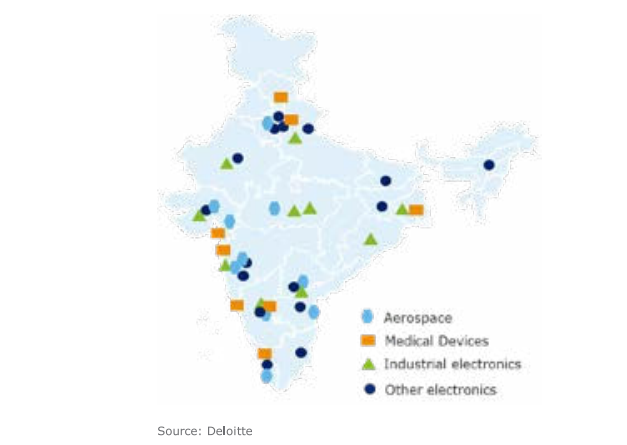

A significant share of the domestic consumption is currently through imports. Of the remaining manufactured in India, the manufacturing locations are primarily in the Western and Southern parts of the country, besides the National Capital Region.

Major manufacturing locations for hi-tech manufacturing industries

Potential for the future

While the key hi-tech industries currently have significant imports with limited manufacturing done in India, there is immense potential for the future given the Government’s focus and sector specific incentives, aiming to make India a global manufacturing hub.

The sectors of electronics, aerospace and medical devices alone have the potential to offer an additional investment of ~USD 21 Bn and create 550,000 direct jobs and 1,400,000 indirect jobs over the next 5 years. While significant interest exists among the global companies to set up/ scale up manufacturing in India, there are dimensions that need to be addressed.

In the subsequent pages we shall address the key factors that are impacting the competitiveness for companies planning to setup manufacturing operations in India. Aligned to these, the support required from the Government of India (GoI) for the near-long term has been indicated.

Electronics

Overview

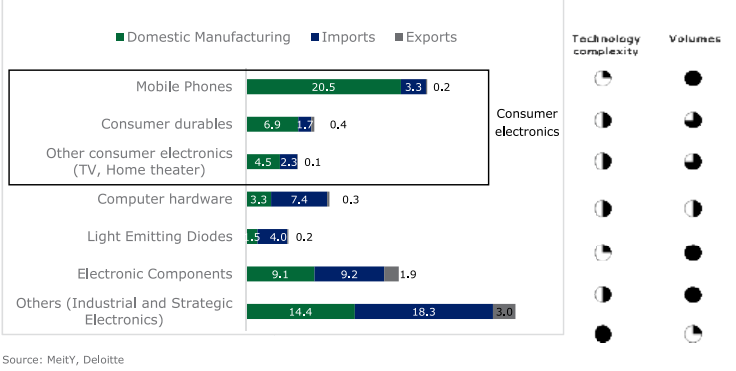

Consumer electronics (mobile phones, consumer durables) forms about 50% of the total electronics industry in India, with mobile phone manufacturing accounting for 21%.

Indian Electronics Industry – Segments (FY18, USD Bn)

During the period FY15-17, imports grew at a CAGR of 7.9%, while domestic manufacturing grew at 23.3%. Exports have remained constant at USD 6 billion over the same period. While domestic value addition has grown significantly in the mobile phones segment, it has remained low in other segments. This has led to imports being significantly more in the other segments; especially those that have a higher technology complexity.

A combination of nation-wide initiatives, policy changes, demographic drivers and positive collateral impact. from other factors is creating demand for domestically manufactured electronics products. Some of the nation-wide initiatives undertaken by the Government include

- UIDAI

- Expected to boost demand for biometric applications with focus on encouraging digital payments

- Digital India

- Aims to transform India into a digitally enabled society and achieve net zero import in electronics by 2020

- National Knowledge Network

- To provide a unified high speed network backbone for educational institutions in India

- National Optic Fibre Network

- To provide broadband connectivity to 200,000+ gram panchayats and enable e-services and e-applications nationally

Additionally, demand drivers such as increasing urbanization, young population with growing incomes and an increasing need for automation to improve efficiencies have positively impacted the industry. To accelerate the demand drivers various policies have been introduced by the Government

- Preferential Market Access (PMA)

- Provides a minimum quota of 30% for domestic players in the procurement of electronic goods by the Government

- Applicable for all ministries other than Defense and for products that are manufactured by companies registered in India.

- Export incentives scheme

- Merchandise Export from India Scheme (MEIS) focused on increasing the exports by providing incentives which are payable as a percentage (2, 3, 4, 5 or 7%) of realized FOB value (in free foreign exchange). Scheme was applicable for 237 electronics products

- Since there was a concern of the MEIS scheme being non-compliant with WTO norms, a new scheme that would be compliant with WTO norms is being evaluated by the Government

- GST implementation and revision in BCD

- Multiple taxes and cascading effect of taxes eliminated

- Reduced cost of manufacturing and logistics

- Exemption to capital goods required for manufacture of specific electronic products

- New scheme proposed for inviting global companies to set up mega manufacturing plants in advanced technology such as semi-conductor fabrication, lithium batteries, laptops, computer servers, etc.

- BCD exemption on machines used for manufacturing of semi-conductor devices, electronic IC or flat panel display

In summary, the demand side factors provide a very positive outlook for the industry and segments such as ‘high-volume low-complexity’ products (Eg: mobile phones) have been able to leverage them to a significant extent. Products categorized by high volume segments have been relatively easier to localize driven by lower operating cost and proximity to customer base (reduced logistics cost). On the other hand, ‘low-volume high-complexity’ products require consolidation of the demand for multiple geographies and making India an export node (India for the World) for the manufacturing facility to be viable. In the subsequent section we shall evaluate the factors that have been impacting the competitiveness of the industry, and inhibiting additional investments by global companies into this industry in India.

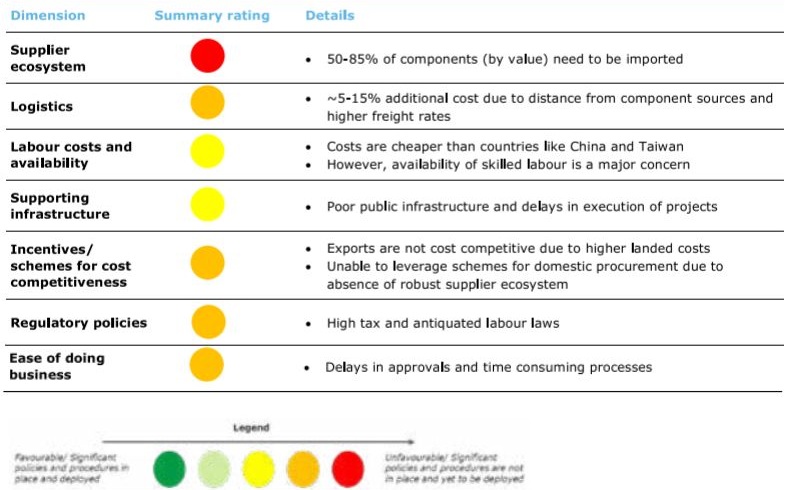

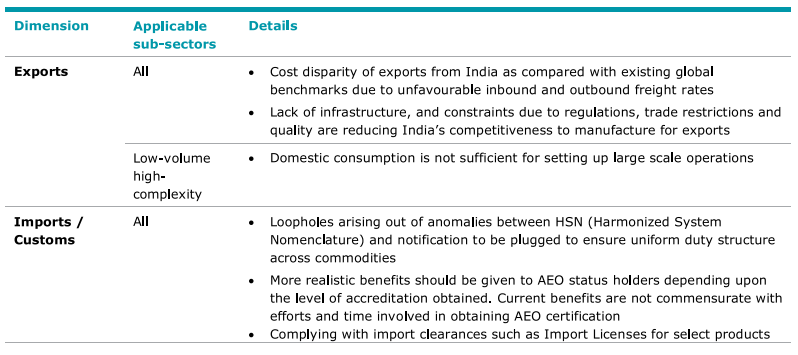

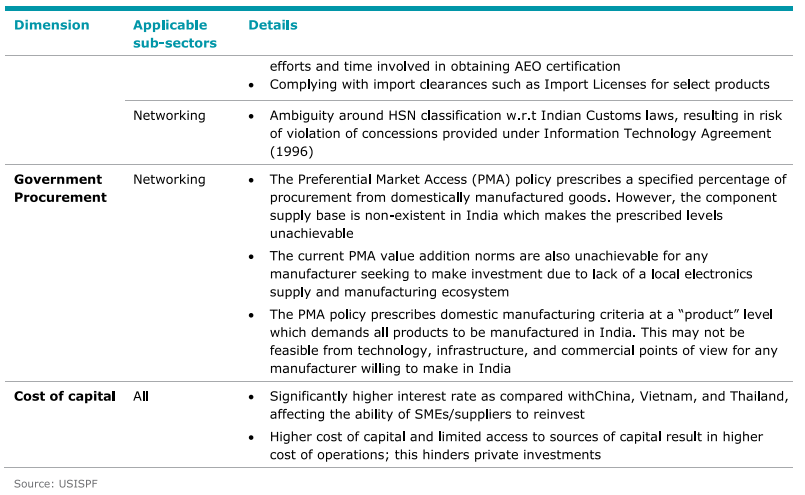

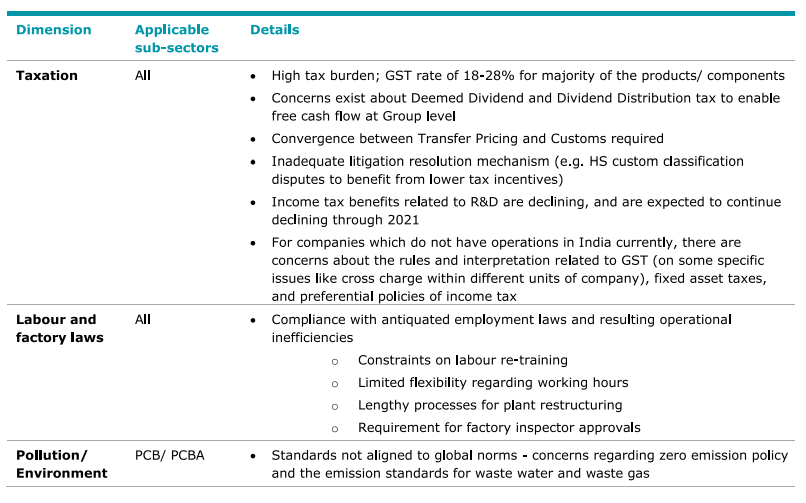

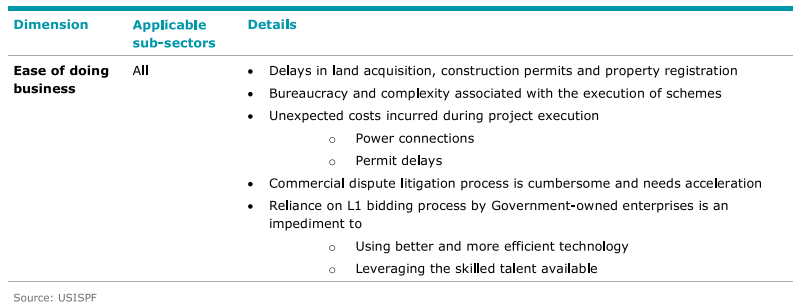

Factors impacting manufacturing competitiveness in India

Summary

An analysis of the major factor conditions and regulatory policies indicates challenges across most dimensions impacting competitiveness

Details across each of the above dimensions have been provided in the subsequent sections.

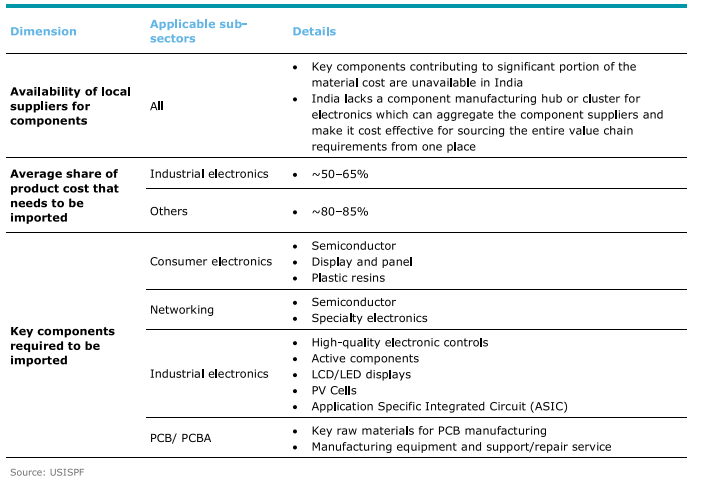

Supplier ecosystem and cost of components

Domestic production is expected to cater to only about 25% of the total demand by 2020. This is primarily due to a weak supplier ecosystem for components, affecting particularly the high-complexity, low-volume product segments.

An illustrative BOM (Bill-of-Material) for a Set Top Box, which is an example of high-complexity low-volume product, has been detailed below. In this example, nearly 85% of the components (by value) are being imported due to weak supplier ecosystem in India.

Illustrative Bill-of-Material breakup for a Set Top Box (STB)

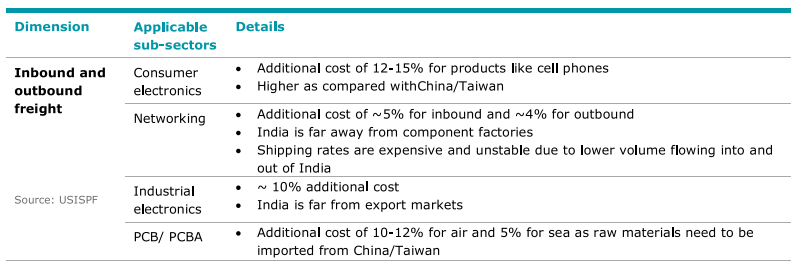

Logistics

Across sectors, the additional impact on product cost due to logistics is 5-15%. This is primarily because of the incremental cost incurred for importing components into India, along with higher freight rates owing to lower import/export volumes.

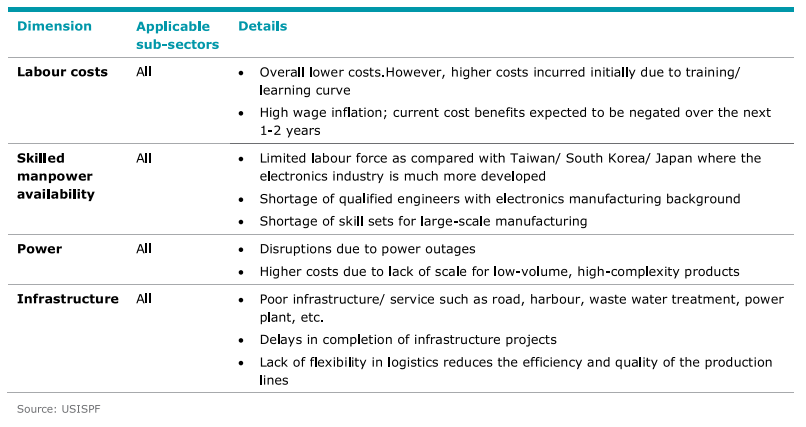

Conversion factors and support infrastructure

While labour costs are low compared with countries like China and Taiwan, the current advantage that India has as a global engineering hub is weakening (compared with South East Asia / MEA) due to relatively higher wage inflation and short supply of skilled labour.

Incentives and regulatory policies

Though the Government has announced numerous schemes/policies to support the companies setting up manufacturing operations in India, there are still some areas to be addressed as these are not on a par with major manufacturing hubs such as China.

Incentives/ schemes for cost competitiveness

Regulatory policies and ease of doing business

Other key industries: Aerospace and Medical Devices

Overview – Aerospace

Indian aerospace industry has been growing annually at a rate of 20% (2018). While the aerospace industry’s value chain consists of four stages, in India the industry is mainly concentrated in Design and Engineering & IT solutions.

Value chain of Aerospace Industry

India’s aerospace manufacturing industry is still in its nascent stage as it is traditionally dominated by defense-related manufacturing. Indian Aerospace & defense market to reach more than USD 23 Bn by 2024, and is currently dominated by Hindustan Aeronautics Limited (HAL) and associated suppliers.

During the last couple of years, tier II and tier III suppliers have started making components for the global commercial aerospace market. Increasing global airline traffic, replacement of old fleet in mature markets like Europe, and addition of new aircraft in growing markets like India are some of the key demand drivers for the civil aviation sector. By 2020, passenger traffic at Indian airports is expected to increase to 421 million from ~309 million in 2017-18 (CAGR of 17%, fastest growing domestic aviation market in the world). On a long term basis, leisure travel spending is expected to grow at 7.1% while business travels spending to grow at 7.0% (2018-28).

MRO is also emerging as a major sector with OEMS, airlines, and private MRO service providers setting up their businesses in India. By 2028, the MRO industry is likely to grow over USD 2.4 Bn from USD 0.8 Bn in 2018.

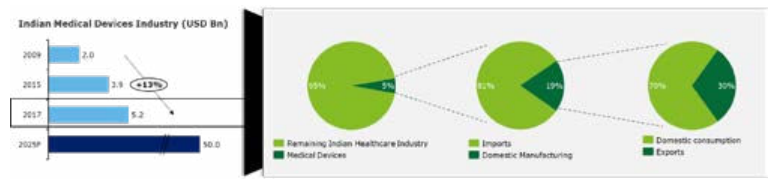

Overview – Medical Devices

Indian medical devices industry is around ~USD 5.2 Bn (2017) and is expected to grow to USD 50.0 Bn by 2025.

Medical devices industry accounts for 5% of the Indian healthcare industry with imports forming ~81% of the total consumption, and 30% of the domestic manufacturing (~USD 0.3 Bn) is targeted for exports. While 750-800 medical devices manufacturers are present in India their average revenue is in the range of USD 6-7 Mn. Equipment and instruments account for 54% of the total industry (by revenue), but only ~10% of the same are domestically manufactured.

Currently, per capita medical device spending in India is USD 3 as compared to USD 7 in China and USD 42 in Russia. With growing incomes and expansion of Government schemes like Ayushman Bharat, coverage and access to healthcare is expected to significantly increase over the next few years. Additionally, changing lifestyles have resulted in an increase in chronic diseases (like diabetes) while the share of population above 65 years of age is projected to be 7% by 2020. All these factors are expected to contribute to the growth of medical devices industry in India over the next decade.

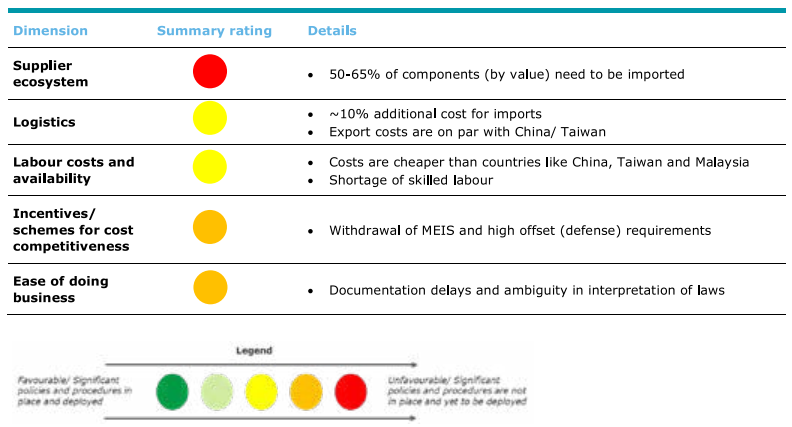

Factors impactingmanufacturing competitiveness in India

Summary

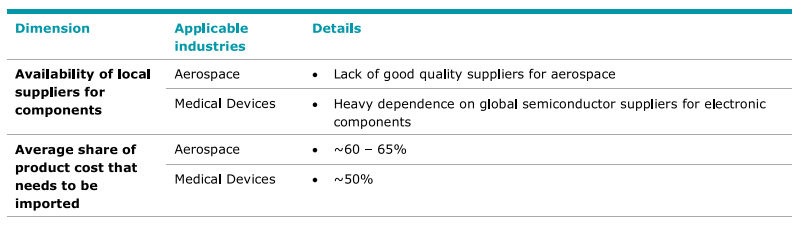

Similar to Electronics industry, availability of a strong supplier ecosystem is one of the major factors impacting the competitiveness of aerospace and medical devices industries in India.

Details across each of the above dimensions have been provided in the subsequent sections.

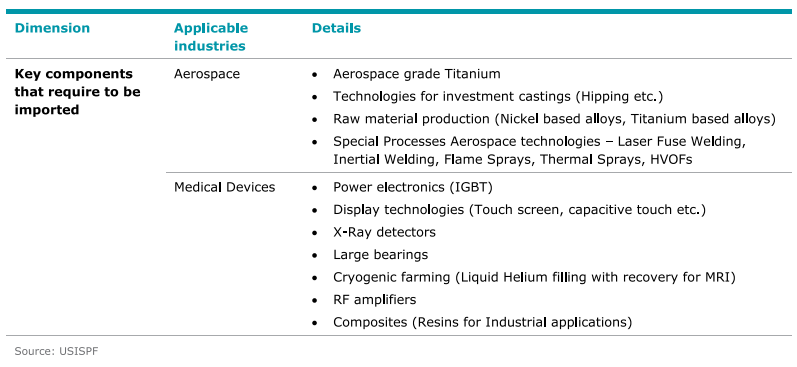

Supplier ecosystem and cost of components

Majority of the components required need to be imported, especially for the aerospace industry.

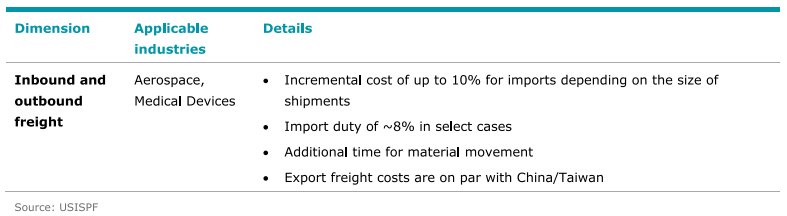

Logistics

The relatively high share of imports in the components increases the overall cost of products manufactured in India. Besides the additional costs, there are concerns on the time spent on material movement.

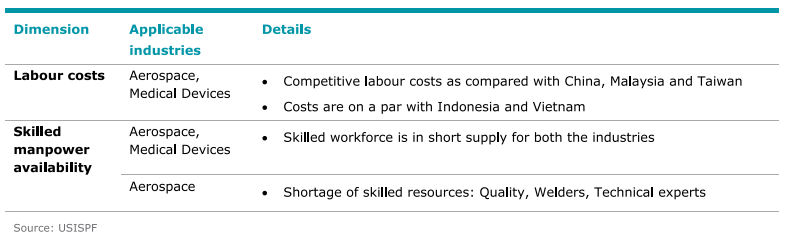

Conversion factors and support infrastructure

Labour costs in India are lower than most of the other countries, though availability of skilled workforce is a concern.

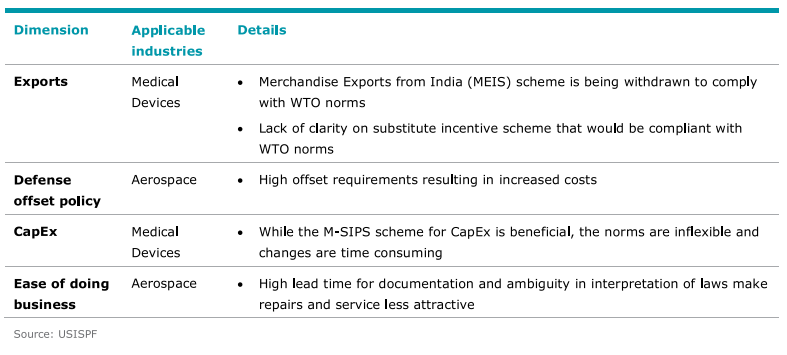

Incentives and ease of doing business

Conclusions and Recommendations

Given the strong demand drivers across all the focus industries, additional support from the Government in terms of policy changes would significantly improve the competitiveness of manufacturing in India. This would aid investments in manufacturing across the focus industries of electronics, aerospace and medical devices. And in the next 5 years, the expected investments and job creation is ~USD 21 Bn, 550,000 direct jobs, and 1,400,000 indirect jobs.

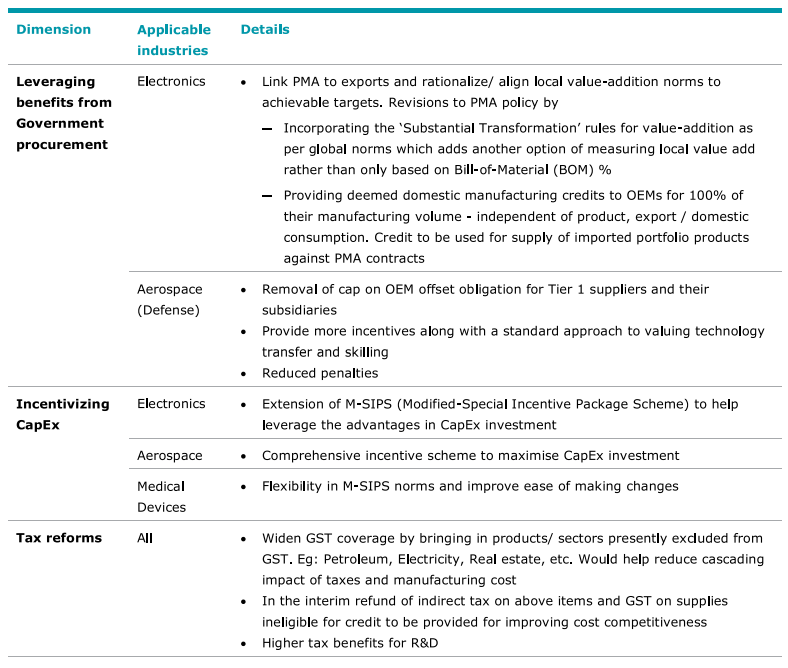

The policy changes that would be required to drive these investments and attract global companies have been summarized under two areas (near-term and long-term) for further consideration by the Government.

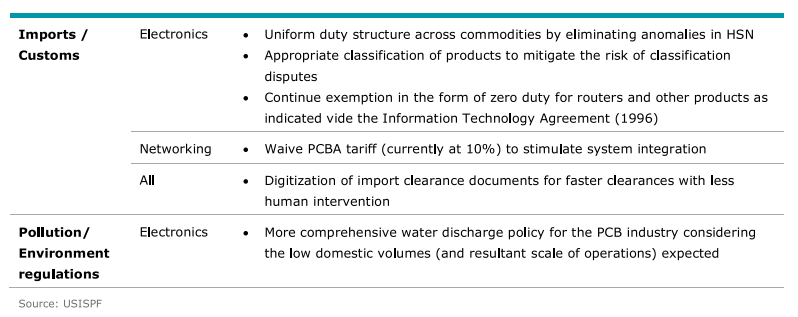

Policy changes required to impact industry conditions in the near-term

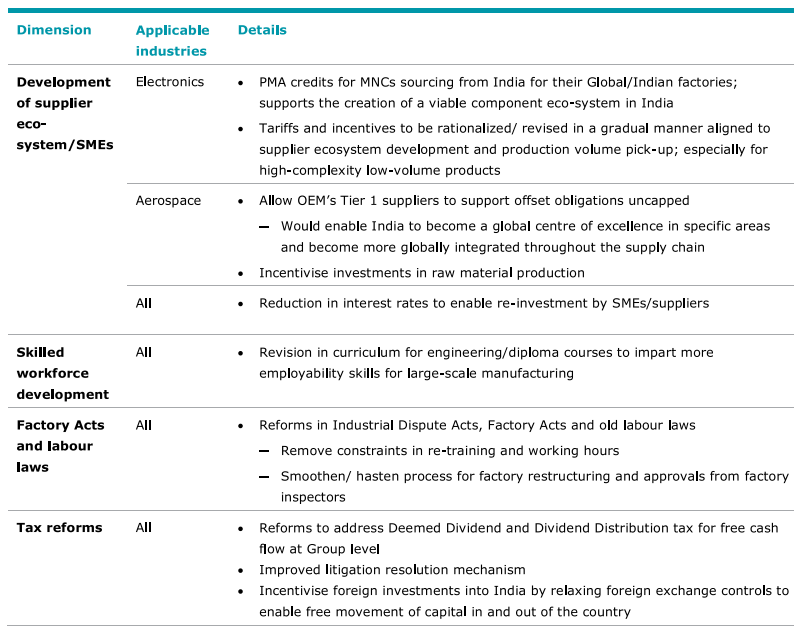

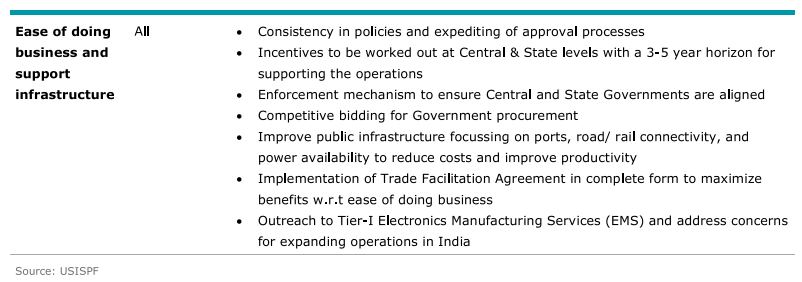

Policy changes required to impact industry conditions in the long-term

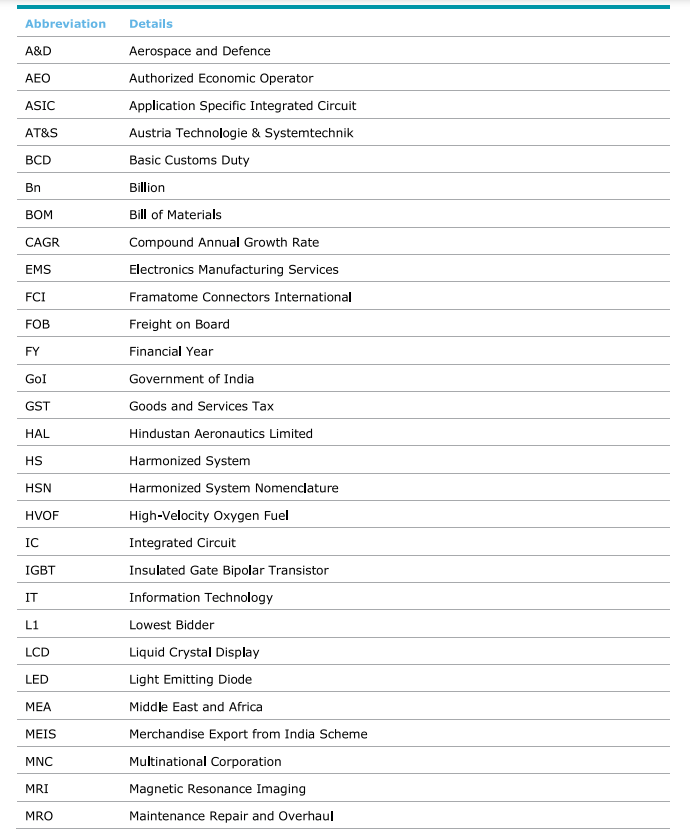

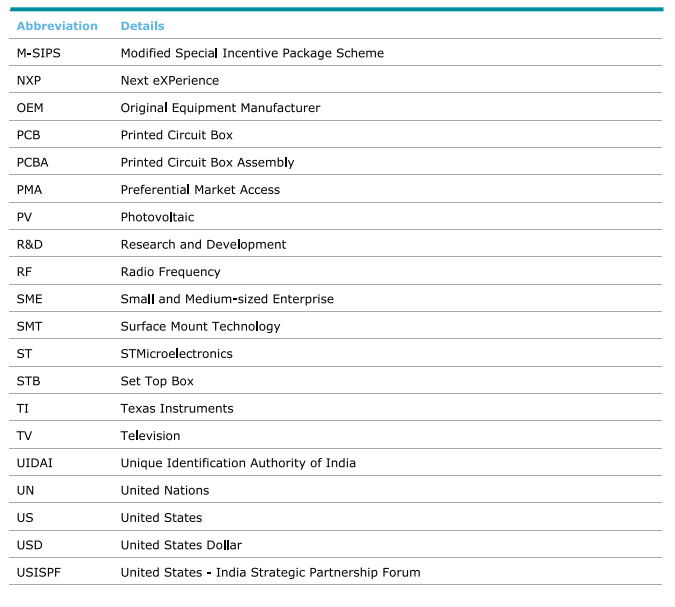

Abbreviations

References

- https://www.cii.in/sectors.aspx?enc=prvePUj2bdMtgTmvPwvisYH+5EnGjyGXO9hLECvTuNtzD8aRMyMwXwI ukeRiZBns

- https://www.ibef.org/download/Aviation-July-2017.pdf

- https://www.iata.org/pressroom/pr/Pages/2018-09-04-02.aspx

- https://www.iata.org/pressroom/pr/Pages/2018-09-04-02.aspx

- https://www.researchgate.net/profile/Roger_Moser2/publication/257331755_The_Future_of_the_Indian_A erospace_Industry_-_A_Delphi_based_Analysis_of_the_Political_Technological_and_Economic_Context_2019/links/56cc534b08aee3cee543 6b3d/The-Future-of-the-Indian-Aerospace-Industry-A-Delphi-based-Analysis-of-the-Political-Technological-and-Economic-Context-2019.pdf

- https://www.financialexpress.com/infrastructure/airlines-aviation/aerospace-industry-growth-in-india-over-two-times-of-gdp-says-md-of-aequs-aerospace/1310231/

- http://makeinindiadefence.gov.in/admin/webroot/writereaddata/upload/recentactivity/Indian-Aerospace-Taking-Off.pdf

- https://www.bdo.in/en-gb/insights/publications/indian-aerospace-manufacturing-ecosystem

- https://www.marketwatch.com/press-release/india-aerospace-defense-market-to-reach-more-than-usd-23-billion-by-2024-growing-at-5-cagr-2018-09-20

- https://www.ibef.org/download/Aviation-May-2019.pdf

- https://www.export.gov/article?id=India-Healthcare-and-Medical-Equipment

- https://www.ibef.org/industry/semiconductors.aspx

- https://www.investindia.gov.in/sector/medical-devices

- https://www.ifpma.org/wp-content/uploads/2017/02/IFPMA-Facts-And-Figures-2017.pdf

- https://www2.deloitte.com/global/en/pages/manufacturing/articles/global-a-and-d-outlook.html

- https://esdmindia.in/esdm

- https://www.alliedmarketresearch.com/factory-automation-market

- https://in.nec.com/en_IN/pdf/Electricalsand Electronics ManufacturinginIndia2018.pdf

- https://www.ibef.org/industry/consumer-durables-presentation

- https://www.ibef.org/download/consumer-durables-may_2019.pdf

- https://www.techsciresearch.com/report/india-led-lighting-market-by-type-led-bulbs-lamps-batten-lights-downlights-etc-by-end-use-sector-commercial-residential-etc-by-application-outdoor-lighting-indoor-lighting-etc-competition-forecast-opportunities/1102.html

- https://www.skpgroup.com/data/resource/skp_the_medical_device_industry_in_india_.pdf

- http://www.makeinindia.com/article/-/v/sector-survey-medical-devices

- http://www.nishithdesai.com/fileadmin/user_upload/pdfs/Research_Papers/The_Indian_Medical_Device_In dustry.pdf

- https://www.advamed.org/sites/default/files/resource/medical_industry_in_india_-_the_evolving_landscape_oppurtunities_and_challenges_white_paper.pdf