Economic activities in India picked up in March 2023, particularly supported by solid performance by the private sector. Consumption spending continued its upward trend, albeit with a few gains from the previous month. Industrial output growth was at a 4-month high on the back of stronger than expected manufacturing output; but services sector growth moderated a tad from last month. The trade gap was larger than expected in March owing to weaker exports and ballooning imports. The Indian Rupee strengthened a bit as foreign exchange reserves grew in March. Both retail and wholesale inflation fell more than expected and repo rates were left unchanged.

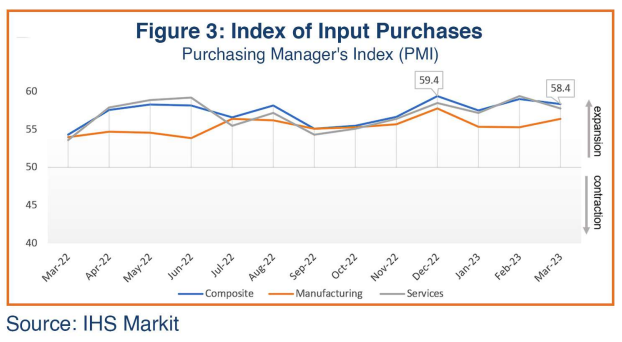

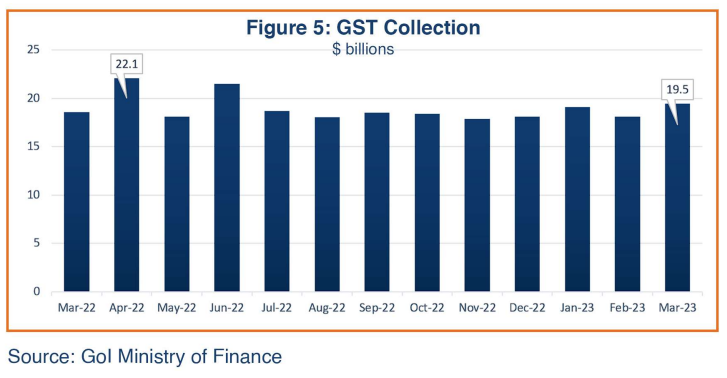

Retail sales in rural areas have shown improvement on the back of easing inflation, but they are still below pre-COVID levels. Passenger car sales, an indicator of urban consumption, showed little gain. On the supply side, the Markit Purchasing Managers’ Indices (PMI) for Manufacturing and Services both recorded expansion. The overall unemployment rate in March, however, increased, mainly due to the weaker labor market, especially in the rural sector. Goods and Services Tax (GST) and rail freight revenues surged in tandem with market activities and increased compliance.

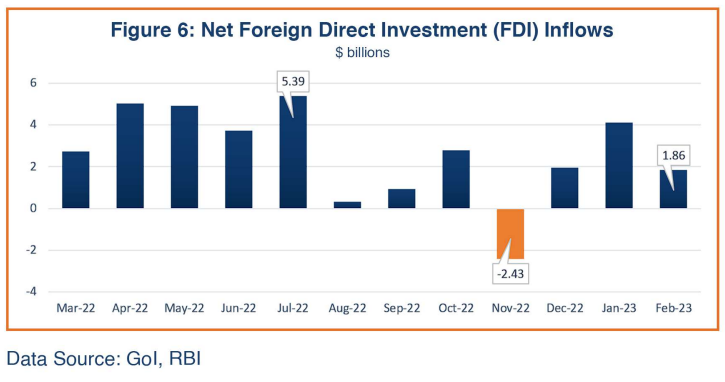

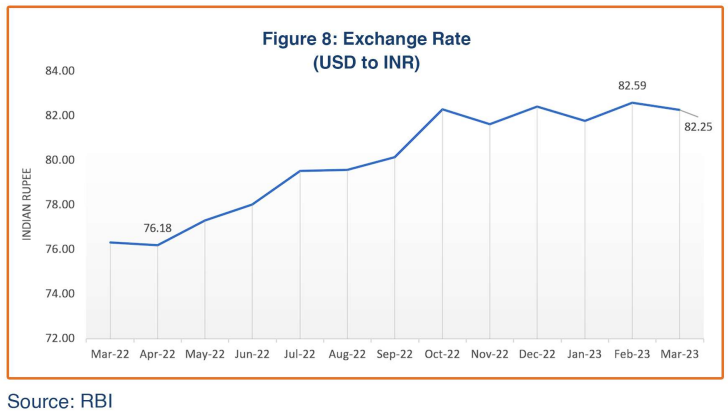

As expected, currently facing a volatile global economy, India’s exports growth in March decelerated, but the trade deficit was substantially up from the previous month. Net FDI flows almost halved in February 2023 from the previous month (latest available). India’s foreign exchange reserves recovered substantially in March and the Indian Rupee appreciated slightly to an average of 82.25 against the US Dollar, from 82.59 in the previous month.

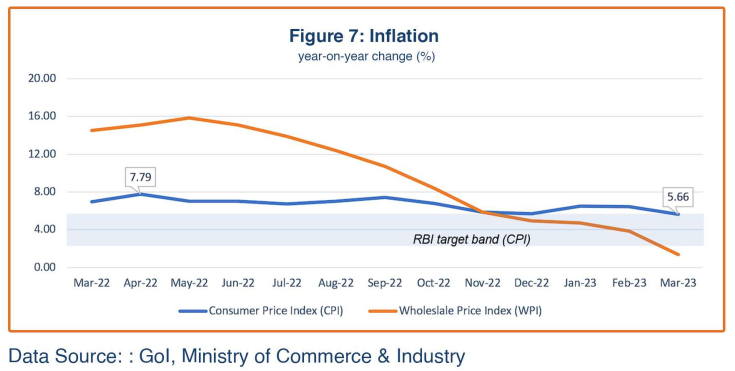

Retail inflation unexpectedly dropped to 5.7% in March 2023, within the RBI target band of 2%-6%, led by lower food prices; core inflation also fell below 6%. The wholesale price index (WPI), dropped to a record 1.3%, maintaining its downward trajectory for the last ten months.

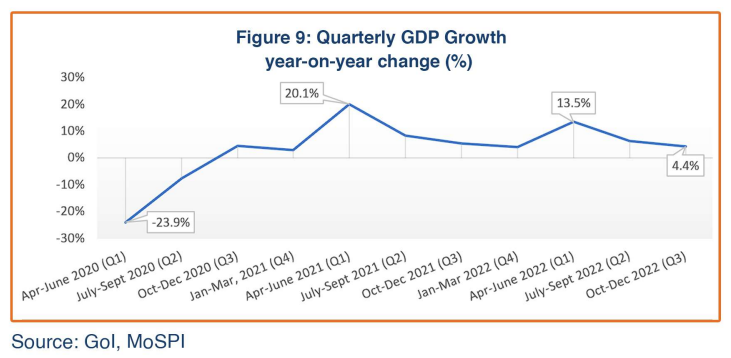

India recorded 4.4% growth for the third quarter of FY2022-23 (October-December 2022), on the back of a strong performance in the agriculture and services sectors. Growth in the manufacturing sector and capital expenditure have been uneven throughout the current fiscal year. The Government of India presented its Union Budget FY2023-24 on February 1, which included enhanced capital expenditure that the government hopes will help in crowding private investments. With a resilient financial system, a growing services and agriculture economy that drives strong demand, and an emphasis on infrastructure development, India’s growth outlook appears bright in the long term. However, an uneven recovery in its manufacturing sector and uncertainty in the exports sector may dent India’s economic growth prospects in the short term. Moreover, continuing geopolitical challenges have led the IMF to scale down its annual GDP growth forecasts for FY2023-24 to 5.9% from 6.1%.

Demand Indicators

Retailers have reported an uptick in rural demand with the easing of inflation; however, rural sales have not yet fully recovered to pre-COVID levels. Passenger vehicle sales were marginally up from the previous month, depicting a sustained overall positive sentiment in the market despite the high cost of auto loans. The RBI reported healthy bank credit growth at 15% at the end of March, compared with 15.5% a month ago, even though the cost of credit remains high due to liquidity tightening. The sustained, reasonable rise in retail sales during FY2022-23 suggests domestic demand is driving the economic recovery in India. The recovery signs in private consumption augur well for demand, but the uncertainties and challenges of higher crude prices may negatively impact sentiment. Higher commodity prices could also undermine buoyant private consumption trends in India as households spend more on those items.

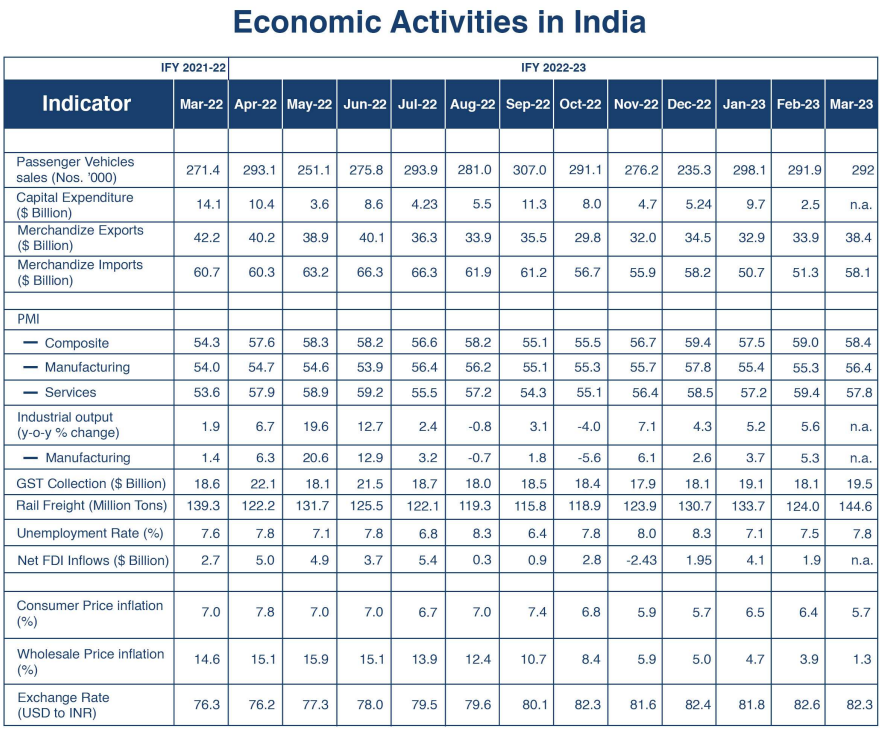

Government Capital Expenditure

Capital expenditure growth has been erratic for the entire fiscal year 2022-23 to date (April 2022-February 2023 – Figure 1). The Government of India has repeatedly underscored its priority for increasing capital expenditures (capex) in hope of crowding in higher private investment; the huge capex budget for FY2023-24 may help if it is translated into full implementation. The finance minister expects to meet the fiscal deficit target of 6.4% of GDP in 2022-23, which is a much lower deficit than the 9.3% recorded in the previous two COVID years. Though the government is faced with the challenges of low privatization receipts and expenditure pressures, most analysts still expect it to achieve a fiscal deficit below 6% in the next fiscal year (2023-24). Union Budget 2023-24, released in February, reiterates the government’s goal of lowering the fiscal deficit below 4.5% of GDP by FY2025-26.

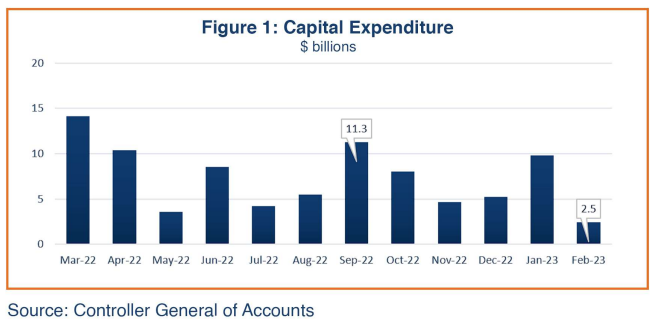

Trade

India’s merchandize exports were up more than 13% in March, the final month of FY2022-23, to $38.4 billion from the previous month’s $33.9 billion (Figure 2). Export performance in the first quarter of the current fiscal year was robust but slowed from the second quarter. Exports of electronic goods, oil-meals, oil seeds, and coffee picked up significantly in March 2023 while most major categories witnessed deceleration in export sales, such as petroleum products, gems & jewelry, textiles, plastics, and chemicals. Global demand for petroleum products, gems/jewelry and textiles weakened due to stubbornly high inflation rates and higher borrowing costs.

India’s merchandize imports, at $58.1 billion in March 2023, were also 13% up from the previous month’s $51.3 billion. India’s imports of traditional products recorded deceleration in March, such as crude oil and coal imports fell about 24%, edible oil imports declined 19%, rough diamonds imports dropped 12% and fertilizer imports were down about 51%. These downward trends were, however, neutralized by substantial increases in other imports during March 2023, such as gold imports skyrocketed 216%, imports of project goods increased 133%, metal ores and minerals imports shot up 65% and iron & steel imports accelerated 21%. India’s trade deficit in March 2023 was higher than expected at $19.7 billion was much higher than the previous month’s $17.4 billion.

Supply Side Indicators

Input Purchases

Overall business sentiment in March 2023 was solid, with the Composite Markit Purchase Managers Index (PMI) at 58.4, down one percent from February’s peak of 59.0 but staying above its long-run average. Continuing strong demand for goods led to expansion in manufacturing activities (Figure 3; a PMI above 50 reflects the optimistic mood of businesses that have made bold input purchases in anticipation of increased demand). The latest reading recorded the 20th consecutive month of business activity expansion. The Services PMI for March, at 57.8, was lower than February’s 59.4, yet still much above the 50-mark threshold. The Manufacturing PMI was at a three-month high at 56.4, reflecting manufacturing sector expansion on improved output and new orders.

Trends for most of the current fiscal year suggest a sustained recovery in India’s service economy while the manufacturing sector recovered sporadically. According to the S&P Global Survey, input costs at the composite level rose at the slowest rate in 2-1/2 years; factory activities were the best since December 2022, but that improvement did not translate into increased hiring as job market conditions darkened.

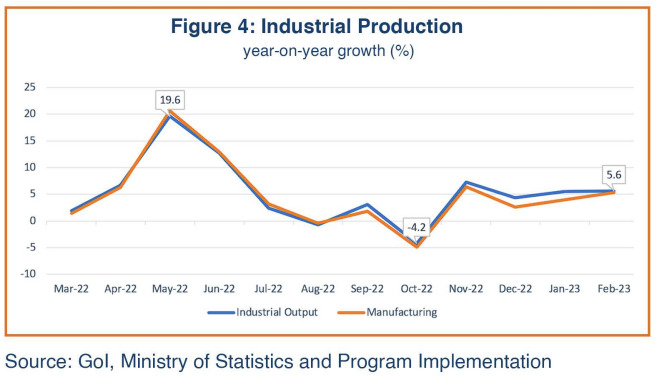

Industrial Production

India’s industrial production growth on a year-on-year (y-o-y) basis accelerated to 5.6% in February 2023 from an upwardly revised 5.5% in January 2023. Increases in industrial production were led by electricity, manufacturing, and mining output (Figure 4). Growth across all segments recovered compared to the previous month, generating an acceleration in overall industrial output growth. Manufacturing, which accounts for 77% of total industrial production, recorded 5.3% growth, compared with 3.7% growth in the previous month; mining output growth, which comprises 14% of total industrial output, fell to 4.6% from 8.8% in the previous month; and the growth rate in power generation (8% of total industrial production) fell to 8.2% vs. the January’s growth rate of 12.7%. Capital goods production (a proxy for investments) within the manufacturing sector increased 10.5% in February, compared to the 11% growth recorded in the previous month. The trajectory of industrial output throughout the year has remained erratic, suggesting an uneven recovery, and reflecting the impact of persistent supply chain disruptions.

GST Revenues

India’s Goods and Services Tax (GST) collections have stabilized throughout the FY2022-23. In March 2023, GST collections were estimated at $19.5 billion, an indication of sustained consumer spending (Figure 5). Analysts note that rising GST collections reflect a combination of a pick-up in economic activity, increased tax rates, increased compliance, and some effect of inflation.

Net Foreign Direct Investment

Foreign direct investment (FDI) flows showed mixed trends throughout fiscal year 2022-23. Net FDI inflows peaked in July at $5.39 billion, after which flows reversed drastically, becoming a $2.4 billion net outflow in November. FDI inflows regained momentum starting in December 2022, albeit with little stability (Figure 6), which the government attributed to the uncertainty of an investment community facing headwinds of geopolitical tensions and economic slowdown.

Inflation

Consumer Price Index (CPI) inflation unexpectedly fell to a 15-month low of 5.66% in March, from 6.44% in February 2023, dipping below the Reserve Bank of India’s (RBI) upper target limit for the first time this year. Retail inflation in India was recorded within the RBI target band of 2%-6% for November and December 2022 also (Figure 7). Lower food prices, which account for about 40% of the CPI total, drove the drop in CPI inflation; core inflation (non-food excluding fuel) also declined to 5.95% in March from 6.1% in the previous month. The RBI in its April Monetary Policy Committee meeting decided to maintain its key interest rate steady at 6.5% for now, while most observers expected a 25-basis point rise. The RBI governor has said that the war against inflation must continue until a durable decline in inflation closer to target is seen. The RBI raised the benchmark repo rate by 250 basis points during FY2022-23 to 6.5%. The RBI has forecast retail inflation for Q4 (January-March 2023) at 5.7% and for the full FY2022-23 at 6.5%.

Wholesale Price inflation in March February 2023 eased to 1.34%, a record 29-month low, mainly on account of the fall across commodities and food prices. Business sentiment is expected to improve following the easing of wholesale input prices but the gap between consumer and producer prices continues to be high.

Foreign Exchange

India’s foreign exchange reserves were more than $578 billion at the end of March 2023, up approximately $16 billion from February. For FY2022-23, the overall reserves have dropped by $28.86 billion. The RBI intervened intermittently in the foreign exchange market for liquidity management, including the selling of dollars, to manage depreciation in the rupee, which impacted exchange reserves. The Indian Rupee (INR) remained weak throughout March, falling to 82.75/USD on March 16; however, later in the month it recovered with the support of lesser outflow of foreign exchange driven by cheap oil imports from Russia. The average monthly exchange rate for March was INR 82.25/USD, compared to the previous month’s INR 82.59/USD (Figure 8). Since January 2023, the rupee has repeatedly touched the historical low of 83/US Dollar due to an unbalanced current account and comparatively soft monetary policy by the RBI.

Economic Outlook

India’s GDP growth rate in the third quarter (October-December 2022) slowed to 4.4% from 6.3% in Q2 and 13.2% in Q1 (Figure 9). The RBI in its recent monetary policy statement noted the near-term growth outlook remains weaker than previously expected. It has revised its forecast for GDP growth in the current fiscal year down to 6.8%, in line with the IMF’s forecast, reflecting extended geopolitical tensions and continuing aggressive monetary policy tightening globally.

In a positive movement, the growth in industrial and manufacturing output has shown revival signs during the fourth quarter of FY2022-23 (Jan-March 2023). In addition, the continuing growth in the agriculture and services sectors, along with a sustained domestic demand and credit growth, should augur well for the forecasted GDP growth of 7% for FY2022-23; however, the continuing volatility in global inflation, as well as the lackluster export orders during the final quarter, may negatively impact overall GDP growth for FY2022-23. India’s total exports of goods and services grossed $770 billion in FY2022-23, printing a 14% growth from the previous year. The Commerce Ministry hopes to increase the country’s export shipments to $2 trillion by 2030, through a “dynamic and responsive” foreign trade policy inculcating a push to rupee trade, promotion of e-commerce exports, amid global uncertainties.

The Union Budget for IFY2023-24, presented on February 1, 2023, featured a significant increase in capital expenditures to 3.3% of GDP (an increment of 0.6% compared to the IFY2022-23 level) to support infrastructure-led economic growth and private investment. The ratio of capital spending to revenue expenditure peaked at 28.6%, the highest level in two decades. The enhanced capital expenditure underscores the government’s focus on supply-side rather than demand-side support. Furthermore, the government hopes its enhanced capital expenditure will crowd in greater private investment, strengthening demand and raising India’s baseline growth potential.

On the demand side, retail sales of two-wheelers (an indicator of rural demand) in the domestic market have been rising since September 2022, indicating a turnaround in consumer sentiment in rural markets towards recovery, but still below the pre-pandemic level. The combination of better agricultural output, moderating inflation, higher minimum support prices for farm commodities, and availability of water for irrigation (because of healthy reservoir levels) is expected to help increase disposable income and improve consumer sentiment in rural India, which in turn will help local sales of two-wheelers grow further in FY2023-24.

The World Bank has lowered its FY2023-24 growth forecast for India to 6.3% from 7% earlier, due to “slower consumption growth and challenging external conditions”. The IMF has cut India’s FY24 GDP forecast to 5.9% from 6.1% due to the gloomier global growth forecast for 2023, but still predicts that “India will remain the fastest-growing economy over the next two years”. The RBI has revised its growth forecast upwardly to 6.5% for FY2023-24 compared with 6.4% projected earlier, against the backdrop of an expected revival in export growth and easing inflation.