Key Takeaways

- Strong Economic Growth in Q1: India’s GDP grew by 7.1% in Q1 FY2024-25, driven by robust domestic consumption and investment activities. Projected GDP growth for FY2024-25 remains strong, with key institutions forecasting growth between 6.5% and 7.3%.

- Inflation Remains Under Control: Annual consumer inflation dropped to 3.5% in July 2024, below the Reserve Bank of India’s (RBI) target of 4.0%, signaling price stability. The RBI has held the repo rate steady at 6.5%, balancing inflation control with economic growth. Food price volatility remains a challenge due to weather-related disruptions, but inflation is nonetheless expected to average 4.5% in FY2024-25.

- Trade and Investment Trending Upward: India’s total merchandise and services trade reached USD 261.47 billion in Q1 FY2024-25, but a widening trade deficit of USD 31.17 billion signals the need for strategic export policies. Foreign direct investment remained resilient, with total inflows of USD 22.49 billion during Q1 FY2024-25, supported by strong investments in renewable energy and infrastructure.

- Services and Agriculture Sectors Especially Strong: The services sector continues to drive India’s economic performance, contributing 54.7% to gross value added, while manufacturing and construction showed steady growth. Agriculture benefited from favorable monsoon conditions, contributing to rural demand and economic expansion.

- Positive Economic Outlook: India’s economic outlook for FY2024-25 remains positive, with projections indicating stable inflation and strong GDP growth supported by government measures. Global factors, such as the potential recovery of Western economies and monetary policy easing, could further enhance capital inflows and export performance.

- Opportunities and Challenges for US and Foreign Firms: Robust growth and stable prices create a favorable macroeconomic environment for business. Key sectors such as services, manufacturing, and renewable energy offer particularly attractive opportunities for US firms. However, geopolitical risks and elections in the United States and India could introduce uncertainties.

- In Focus – Union Budget 2024-25: The Union Budget presented on July 23, 2024, emphasizes fiscal consolidation and investment, with a projected fiscal deficit of 4.9% and a record allocation of INR 11.11 lakh crore (approx. USD 132.26 billion) for capital expenditure, equivalent to 3.4% of GDP. Social expenditures target nine strategic priorities, including agriculture, employment, infrastructure, and energy security.

Meghna Chadha

Senior Economic Researcher

Malachy Nugent

VP, Financial Services & Head of Research

Recent Economic Performance

India’s economy continues to demonstrate robust performance, with several key indicators reflecting positive trends.

Growth

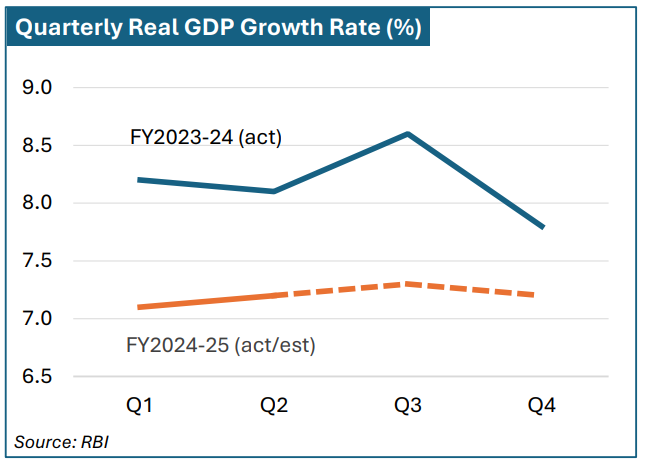

In Q1 of FY 2024-25, the country’s GDP grew by 7.1%, and the Reserve Bank of India (RBI) forecasts further steady growth, with 7.2% expected for Q2, 7.3% for Q3, and 7.2% for Q4. This economic strength is underpinned by strong domestic consumption, improving investment activity, and a promising recovery in the agricultural sector, thanks to favorable monsoon conditions.

The graph shows India’s quarterly GDP growth rates for FY2023-24 and projected growth for FY2024-25, reflecting a slight moderation as the economy transitions into FY2024-25. In Q1 of FY2023-24, growth was 8.2%, while it decreased to 7.1% in Q1 FY2024-25. A similar pattern is seen across the following quarters, with FY2023-24 posting higher growth rates (8.1% in Q2, 8.6% in Q3, and 7.8% in Q4) compared to

FY2024-25, where projected growth stabilizes at 7.2% in Q2, 7.3% in Q3, and 7.2% in Q4. This trend indicates a gradual stabilization in economic performance, likely influenced by a normalization of post-pandemic recovery and steadying inflation dynamics.

A key driver of India’s Q1 economic performance was the solid growth in real Gross Value Added (GVA), which increased by 6.8%. While this pace marks a decline from the 8.3% growth seen in Q1 of the previous fiscal year, the secondary sector, including construction, utilities, and manufacturing, remained a significant contributor. Additionally, private consumption and capital investment were robust, with Private Final Consumption Expenditure (PFCE) and Gross Fixed Capital Formation (GFCF) rising by 7.4% and 7.5%, respectively. Nominal GVA growth outpaced real growth, reaching 9.8%, reflecting the resilience of the economy in both real and nominal terms.

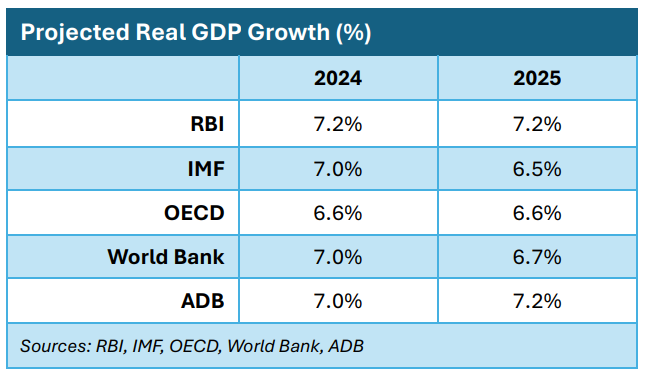

According to the projections from key institutions, India’s real GDP growth is expected to remain robust through FY 2024 and FY 2025. As shown in the table, the RBI projects 7.2% growth for both 2024 and 2025. Similarly, the International Monetary Fund (IMF) has upgraded its forecast for India’s GDP growth in FY 2024- 25 by 20 basis points to 7.0%, from its earlier estimate of 6.8% in April. However, the IMF expects growth to ease slightly to 6.5% in 2025. Projections from the Organization for Economic Co-operation and Development (OECD), World Bank, and Asian Development Bank (ADB) remain similarly optimistic, forecasting growth rates between 6.6% and 7.2% over the next two years, indicating a broad consensus of sustained economic momentum for India. These projections underscore the resilient and steady growth trajectory that India is expected to maintain in the coming years.

The monsoon season continues to play a crucial role in shaping agricultural sector growth, which has direct implications for food prices and inflation. In 2023, rainfall was 94% of the long-period average (LPA), enabling a healthy Kharif crop sowing season, with over 378 lakh (37.8 million) hectares covered—representing a 14.1% increase compared to the previous year. The pulses cultivation area alone saw a remarkable 50% growth. These developments in agriculture have boosted rural demand and contributed significantly to overall economic growth.

Looking ahead, the forecast for the 2024 southwest monsoon predicts above-normal rainfall at 106% of the LPA, reinforcing expectations for another strong agricultural season. This projected output bodes well for stable food prices and moderate inflation, as increased crop yields are likely to help contain food price inflation—a key driver of overall inflation in India. Combined with continued sectoral growth and investment, these factors position the Indian economy for sustained expansion in the coming quarters, while maintaining inflation at manageable levels.

Inflation

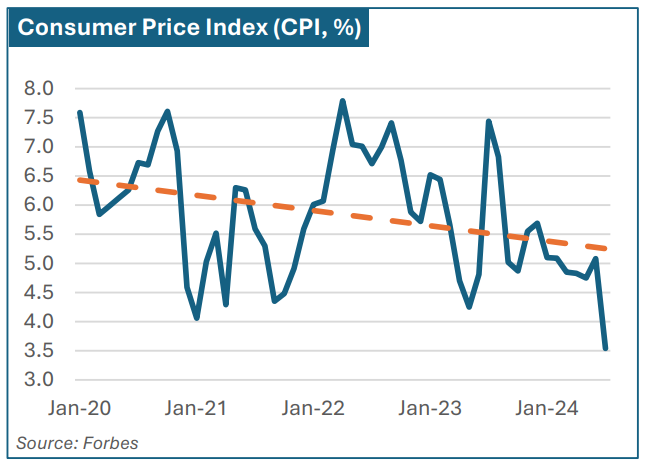

Inflation was volatile in Q1 but showed improvement by the end of the quarter. June 2024 saw a temporary surge in headline inflation to 5.1%, driven primarily by rising food prices. Extreme weather conditions disrupted the supply of key staples such as onions, tomatoes, and potatoes, contributing to significant food price volatility. In May 2024, the Consumer Food Price Index (CFPI) had already risen sharply to 8.7%, a marked increase from 3.0% in May 2023, highlighting the persistent challenges in controlling food-related inflation.

However, in July 2024 India’s annual consumer inflation rate dropped to 3.5%, marking the lowest level in nearly five years and remaining below the RBI’s target of 4.0%. Core inflation, which excludes volatile food and fuel prices, also eased to 3.1%. This notable decline reflects the effectiveness of the RBI’s monetary policies, alongside targeted government interventions that helped stabilize broader price levels.

While inflation has moderated overall, food inflation remains a pressing concern due to the ongoing impact of climatic disruptions. The RBI’s monetary tightening measures, including a cumulative 250 basis point increase in the repo rate from May 2022 to February 2023, coupled with government actions such as price cuts on LPG, petrol, and diesel, have played a crucial role in controlling inflation. Nevertheless, food price volatility continues to challenge inflation management, particularly as external factors and weather-related risks exert pressure on supply chains.

The combination of these internal and external forces means that while India has achieved significant price stability in many sectors, inflation remains sensitive to fluctuations in food prices, underlining the importance of continued vigilance in managing both monetary policy and food supply conditions.

Interest Rates

In August 2024, the RBI held its benchmark repo rate steady at 6.5% for the ninth consecutive meeting. This decision aims to steer inflation towards its medium-term target of 4.0% while continuing to support economic growth, as anticipated by the market. The move follows a rise in annual inflation, which hit 5.1% in June 2024, marking a four-month peak due to increasing food prices, yet remaining within the RBI’s target range of 2-6%. The central bank has adjusted its economic growth forecast for fiscal year 2024-25 to 7.2%, with slight revisions for each quarter: 7.1% for Q1 (revised from 7.3%), 7.2% for Q2, 7.3% for Q3, and 7.2% for Q4. It also updated its inflation projections to 4.4% for Q2 (up from 3.8%), 4.7% for Q3 (up from 4.6%), and 4.3% for Q4 (down from 4.5%). Additionally, the RBI has kept the standing deposit facility (SDF) rate at 6.25% and maintained the marginal standing facility (MSF) and bank rates at 6.75%. This tight monetary approach reflects the RBI’s commitment to managing inflation while nurturing economic growth in the context of global monetary policy divergence and financial market volatility.

Trade and Investments

In the first quarter of FY2024-25, India’s total trade in merchandise and services reached USD 261.47 billion, a notable increase from USD 245.18 billion in the same period of the previous fiscal year. Imports also rose significantly to USD 292.64 billion from USD 272.72 billion, widening the trade deficit to USD 31.17 billion, up from USD 27.55 billion year-on-year. This growing trade deficit indicates a widening imbalance between imports and exports.

Despite the deficit, the Indian rupee remained relatively stable against the US dollar, fluctuating between 81.96 in April 2023 and 83.58 in July 2024, a depreciation of nearly 2% over that period. The resilience of the rupee, amidst a widening trade deficit, reflects the need for careful economic and monetary management to address external imbalances and to strategically enhance export performance and manage import costs effectively.

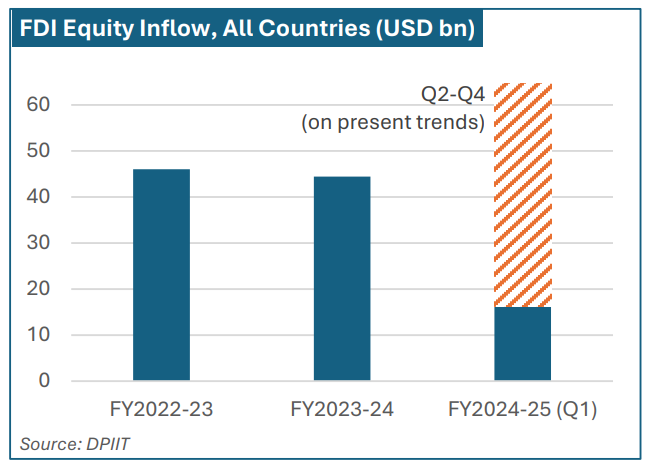

The data on Total FDI Equity Inflows from FY2022-23 to Q1 FY2024-25 shows a slight decline in investment inflows over the past two years. FDI inflows were USD 46.03 billion in FY2022-23, but this figure dropped to USD 44.42 billion in FY2023-24, reflecting a marginal decrease of around 3.5%. However, despite this previous decline, Q1 FY2024-25 saw a strong start, with FDI inflows already reaching USD 16.18 billion, indicating that if the current trend continues, FY2024-25 could match or even surpass the previous year’s total.

The resilience in FDI inflows reflects the continued attractiveness of India’s economy, particularly in sectors like renewable energy and infrastructure. While tech-driven sectors such as services and computer software and hardware remain dominant, there is increasing interest in sustainable investments, particularly in non-conventional energy.

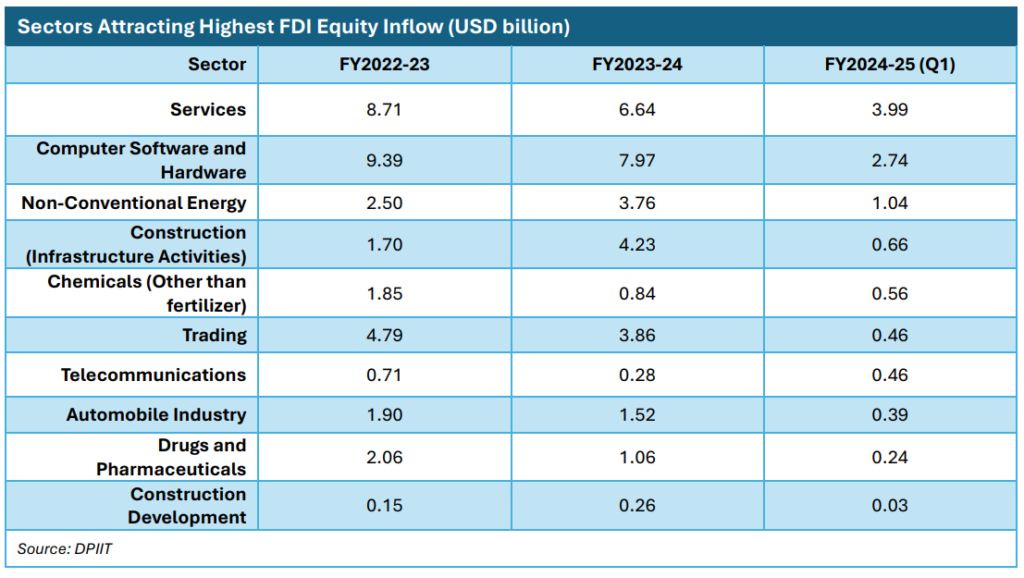

The data highlights the sectors attracting the highest FDI equity inflows over FY2022-23, FY2023-24, and Q1 FY2024-25. Services and Computer Software and Hardware have consistently remained the top two sectors, though both saw a decline from FY2022-23 to FY2023-24. Services fell from USD 8.71 billion to USD 6.64 billion, while Computer Software and Hardware dropped from USD 9.39 billion to USD 7.97 billion over the same period. However, both sectors showed signs of recovery in Q1 FY2024-25, with Services recording USD 3.99 billion and Computer Software and Hardware attracting USD 2.75 billion.

Non-Conventional Energy (i.e. renewables) has experienced steady growth, rising from USD 2.50 billion in FY2022-23 to USD 3.76 billion in FY2023-24. In Q1 FY2024-25, the sector recorded USD 1.04 billion, and if this trend continues, it could surpass the previous year’s inflows, underscoring India’s positioning in the global shift toward clean energy investments.

Other notable sectors include Construction (Infrastructure Activities), which saw a significant jump from USD 1.70 billion in FY2022-23 to USD 4.23 billion in FY2023-24, although inflows slowed to USD 0.67 billion in Q1 FY2024-25. Sectors like Chemicals, Trading, and Telecommunications displayed fluctuations but maintained steady inflows, while Automobile Industry and Drugs and Pharmaceuticals experienced reduced inflows. Construction Development remained the smallest sector with only marginal gains.

The evolving FDI landscape highlights India’s growing attractiveness not only for tech-driven sectors but also for emerging areas like infrastructure and renewable energy, aligning with the nation’s development priorities and global sustainability trends.

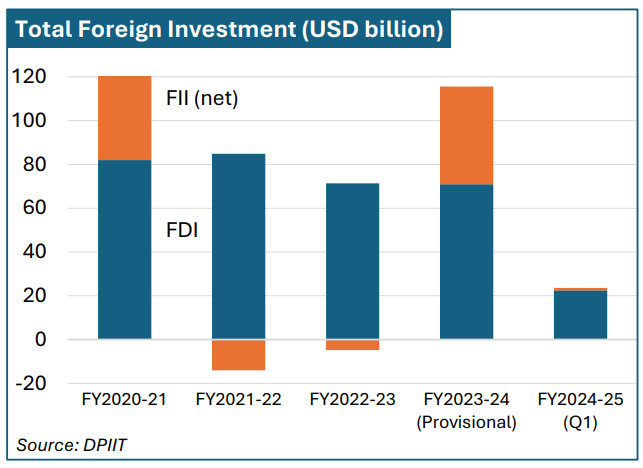

The trends in Foreign Direct Investment (FDI) and Foreign Institutional Investors (FII) investments show that while FDI inflows experienced steady growth from FY2020-21 to FY2021-22, they saw a significant decline of 16% in FY2022-23, stabilizing in FY2023- 24. Q1 FY2024-25 shows promising figures with USD 22.5 billion in FDI inflows, although year-on-year comparisons are not yet available.

In terms of FII investments, the data reveals considerable fluctuations, with a substantial outflow of USD 14.1 billion in FY2021-22. However, investor sentiment improved sharply in FY2023-24, with net inflows of USD 44.6 billion. Q1 FY2024-25 saw modest inflows of USD 1.1 billion, indicating cautiously optimistic foreign investor confidence in India’s markets.

Economic Outlook for FY2024-25

The economic outlook for FY2024-25 remains positive, with inflation trending low and stable, aiming toward the RBI’s 4.0% target. India’s GDP is projected to grow at a steady 7.2% for the year, supported by strong domestic consumption, improving investment activity, and favorable agricultural conditions due to above-normal monsoon forecasts. This growth trajectory is further underpinned by robust performances in the services and manufacturing sectors, alongside significant government-led infrastructure investments.

Inflation dynamics have improved significantly, with the annual consumer inflation rate at 3.5% as of July 2024, the lowest in nearly five years. Core inflation has also eased to 3.1%, signaling broader price stability. However, food price volatility remains a concern, driven by external factors like extreme weather events. The RBI expects headline inflation to average 4.5% for FY2024 25, with further moderation anticipated, contingent on managing food prices and other supply-side constraints.

India’s trade dynamics present a mixed picture. The trade deficit widened to USD 31.17 billion in Q1 FY2024-25, largely due to increased import demand and currency fluctuations. Nevertheless, the Indian rupee has shown stability, and FDI inflows have remained robust, especially in key sectors such as renewable energy, infrastructure, and technology, with total inflows reaching USD 22,491 million during Q1 FY2024-25.

Looking ahead, global economic conditions remain a key factor. The anticipated global recovery in 2025, coupled with potential monetary easing in Western economies, could bolster capital inflows into India, further enhancing private investment and export performance. However, ongoing global financial market volatility and geopolitical risks may pose challenges to sustaining external sector stability. Close monitoring of these trends will be crucial to ensure India’s growth momentum remains strong while managing inflationary pressures and external imbalances.

Impact on US Firms and Investments in India

India’s economic performance in 2024 presents both opportunities and challenges for US firms operating in the country. The economy continues to demonstrate robust growth, with GDP projected to grow by 7.2% in FY2024-25, supported by strong domestic consumption, investment activity, and a recovering agricultural sector. This growth, alongside a stable inflation environment—where consumer inflation is now below the Reserve Bank of India’s 4.0% target—has created a favorable macroeconomic backdrop for US businesses.

Key sectors such as services, manufacturing, and renewable energy offer particularly attractive opportunities for US firms. With India’s services sector contributing significantly to GDP growth and FDI inflows remaining strong in sectors like computer software, hardware, and non-conventional energy, US companies in these areas can expect continued expansion opportunities. Additionally, the Indian government’s focus on infrastructure development, with a record INR 11.11 lakh crore (3.4% of GDP, approx. USD 13.23 billion) capital expenditure allocation, is expected to boost demand for technology, construction, and manufacturing inputs, sectors where US companies have established significant footprints.

However, the external environment poses some risks. The expanding trade deficit, which reached USD 31.17 billion in Q1 FY2024-25, alongside rupee depreciation, presents challenges related to currency fluctuations and import costs for US firms. While the rupee has remained relatively stable, US businesses reliant on imports may face increased costs. Strategic management of supply chains and pricing will be crucial for mitigating these risks.

The political landscape, particularly the stability following the re-election of Prime Minister Modi’s government, has maintained continuity in policy reforms. However, global geopolitical risks and domestic policy shifts related to elections in both the US and India could introduce uncertainties. Changes in US trade policy or regulatory frameworks could impact bilateral trade relations and investments, while internal policy developments in India—particularly those affecting taxation and labor laws both at the Center and State levels—will need to be closely monitored by US firms to assess their operational impacts.

Looking forward, the continued emphasis on sectors such as clean energy, infrastructure, and digital technology presents strong growth potential for US investors, particularly in alignment with India’s ambitious development targets. US firms should also watch for opportunities stemming from India’s push for next-generation reforms, which could unlock further investment in labor-intensive industries, digital infrastructure, and climate finance.

Overall, while India’s stable growth and controlled inflation environment create a favorable setting for US firms, vigilance in managing the external risks tied to global economic conditions, trade imbalances, and evolving policy landscapes will be essential for navigating the evolving market dynamics in the coming years.

Policy Recommendations

- Monetary Policy: It may be beneficial for the Reserve Bank of India (RBI) to continue its balanced approach, maintaining a focus on both inflation control and economic growth. With inflation currently trending below the 4.0% target, there could be room for flexibility in future rate decisions, depending on evolving inflation dynamics. Monitoring food price volatility and global commodity trends will likely remain important to ensure inflation stays within the target range.

- Fiscal Policy: Continuing fiscal consolidation efforts, while maintaining a strong emphasis on capital expenditure—particularly in infrastructure, energy, and rural development—could help sustain growth momentum. Given the significant allocation for infrastructure, these investments may prove vital for long-term economic stability. At the same time, maintaining adequate support for rural and social welfare schemes could help boost demand and promote inclusive growth across regions.

- Structural Reforms: Further progress in structural reforms, particularly in labor, land acquisition, and financial markets, could enhance productivity and attract greater foreign investment. The ongoing push for digitalization and innovation, especially in renewable energy and technology sectors, might offer additional avenues for resilience and growth in the coming years.

- External Sector Management: As the trade deficit expands, it will be useful to maintain adequate foreign exchange reserves while managing excessive currency volatility. Strengthening export performance, particularly in high-value sectors, might help mitigate rising import costs and support external sector balance. Exploring strategic trade policies and export incentives could be beneficial in navigating external uncertainties.

In Focus: Budget for Fiscal Year 2024-25

On July 23, 2024, Finance Minister Nirmala Sitharaman presented the Union Budget for FY2024-25, laying out the government’s revenue and expenditure projections along with its spending priorities for the remainder of the fiscal year. On the revenue side, receipts (excluding borrowings) are estimated at INR 32.07 lakh crore (approx. USD 38.18 billion), marking a 15% increase over the previous year, with tax revenue expected to rise by 11%. On the expenditure side, the government projects total spending of INR 48.21 lakh crore (approx. USD 57.51 billion), which is 8.5% higher than the actual expenditure in 2023-24. Interest payments account for 24% of total expenditure and 37% of revenue receipts. The fiscal deficit is projected at 4.9% of GDP, with a goal to reduce it below 4.5% next year. Significant relief is provided to salaried individuals and pensioners through a higher standard deduction. The government also plans to review and simplify direct and indirect taxes, reduce corporate tax rates for foreign companies, and offer tax incentives for the diamond, mining, and cruise sectors.

In her budget speech Minister Sitharaman emphasized the government’s focus on four key areas, ‘Garib’ (Poor), ‘Mahilayen’ (Women), ‘Yuva’ (Youth), and ‘Annadata’ (Farmer), with significant investments in employment, skilling, and support for MSMEs and the middle class. She also outlined nine strategic priorities to drive the vision of ‘Viksit Bharat’ (Developed India) and ensure broad-based opportunities for all:

- Productivity and Resilience in Agriculture: The government will enhance agricultural productivity by introducing 109 new high-yielding and climate-resilient crop varieties. It plans to transition 10 million farmers to natural farming over the next two years and establish 10,000 bio-input resource centers. Focus will be placed on achieving self-sufficiency in pulses and oilseeds and implementing Digital Public Infrastructure (DPI) in agriculture. A total of INR 1.52 lakh crore (approx. USD 1.81 billion) is allocated for agriculture this year.

- Employment and Skilling: Three key schemes introduced to boost employment are employmentlinked Incentives for Employees’ Provident Fund Organization (EPFO) enrolment, increased female workforce participation through hostels and creches, and a new skilling program for two million youth over five years. The Model Skill Loan Scheme will be revised to offer loans up to INR 7.50 lakh (approx. USD 9,000) with a government guarantee. Additionally, financial support for higher education loans up to INR 10 lakh (approx. USD 12,000) will be provided through evouchers.

- Inclusive Human Resource Development and Social Justice: The government will enhance support for artisans, self-help groups, and marginalized communities through schemes like PM Vishwakarma and PM SVANidhi. The Purvodaya plan aims at developing the eastern region, while the Pradhan Mantri Janjatiya Unnat Gram Abhiyan will improve conditions for tribal communities. Over 100 India Post Payment Bank branches will be set up in the Northeast, with INR 2.66 lakh crore (approx. USD 3.17 billion) allocated for rural development.

- Manufacturing and Services: The budget supports MSMEs with a new guarantee fund offering cover up to INR 100 crore (approx. USD 11.9 million) and improved credit assessments by public sector banks. Mudra loan limits will increase to INR 20 lakh (approx. USD 24,000) for successful borrowers, and financial support will be provided for food irradiation units and quality testing labs. E-Commerce Export Hubs will be established to help MSMEs access global markets, and a scheme will offer internships in top companies to 10 million youth over five years. Urban Development: PM Awas Yojana Urban 2.0 will invest INR 10 lakh crore (approx. USD 119.05 billion) to address housing needs for ten million urban poor and middle-class families, with central assistance of INR 2.2 lakh crore (approx. USD 26.19 billion). Water supply, sewage, and waste management projects will be promoted for 100 cities. The PM SVANidhi Scheme will expand to develop 100 street food hubs annually in select cities over the next five years.

- Energy Security: To advance clean energy, the PM Surya Ghar Muft Bijli Yojana provides free electricity of up to 300 units per month via rooftop solar installations, with 12.8 million registrations to date. Additionally, nuclear energy will play a crucial role in achieving energy security for a “Viksit Bharat.”

- Infrastructure: Infrastructure development is prioritized with a record allocation of INR 11.11 lakh crore (approx. USD 132.26 billion) for capital expenditure, representing 3.4% of GDP. The fourth phase of the Pradhan Mantri Gram Sadak Yojana (PMGSY) will provide all-weather connectivity to 25,000 rural habitations, while INR 11,500 crore (approx. USD 1.37 billion) will be invested in flood mitigation projects in Bihar and other states.

- Innovation, Research & Development: The government will operationalize the Anusandhan National Research Fund with INR 1 lakh crore (approx. USD 11.9 billion) to boost basic research and prototype development. A INR 1,000 crore (approx. USD 120 million) venture capital fund for space technology aims to expand India’s space economy fivefold over the next decade.

- Next Generation Reforms: A new Economic Policy Framework will facilitate reforms in labor, tax simplification, and climate finance. Labor reforms will integrate e-shram and other portals, while rules for Foreign Direct Investment will be simplified. The introduction of NPS-Vatsalya, a pension scheme for minors, and a review of the New Pension Scheme (NPS) for adults are also planned.

The 2024-25 Budget demonstrates a commitment to infrastructure, innovation, and social inclusion while maintaining fiscal discipline. Increased capital expenditure, along with strong support for MSMEs and startups, positions India for sustained growth. Effective implementation, especially in infrastructure and energy, will be crucial. The focus on fiscal consolidation and ambitious reforms will be key to maintaining India’s growth momentum and achieving the vision of a USD 5 trillion economy by 2025.

This report is intended for informational purposes only and does not constitute investment advice. Readers are encouraged to seek professional advice before making any investment decisions.

Sources

- Asian Development Bank. (2024). Asian Development Outlook April 2024.

- Department for Promotion of Industry and Internal Trade, Government of India. (2024). FDI factsheet: June 2024.

- Directorate General of Foreign Trade, Government of India. (2024). Trade statistics.

- Federal Reserve Bank of St. Louis. (2024). India/US exchange rate (EXINUS).

- Forbes. (2024). Inflation rate in India.

- India Meteorological Department. (2023, September 30). Earth System Science Organization (ESSO) Ministry of Earth Sciences (MoES) India Meteorological Department 2023 Southwest Monsoon End of Season Report.

- India Meteorological Department. (2024, May 27). Updated Long Range Forecast Outlook for the 2024 Southwest Monsoon Season (June-September) Rainfall and Monthly Rainfall and Temperature for June 2024.

- International Monetary Fund. (2024). World Economic Outlook Update: July 2024.

- Invest India. (2024). India’s union budget 2024-25: Key highlights.

- Ministry of Commerce, Government of India. (2024). Latest trade figures.

- Ministry of Finance, Government of India. (2024). Economic survey 2023-24.

- Ministry of Statistics and Programme Implementation, Government of India. (2024, August 30). National Accounts Data [Press release].

- Ministry of Statistics and Programme Implementation, Government of India. (2024). Consumer Price Index (CPI).

- Ministry of Statistics and Programme Implementation, Government of India. (2024). Title of the webpage on CPI.

- Press Information Bureau, Government of India. (2024, June 12). Consumer Price Index Numbers on Base 2012=100 for Rural, Urban and Combined for the Month of May 2024 [Press release].

- Press Information Bureau, Government of India. (2024, July 8). The Department of Agriculture & Farmers’ Welfare has released progress of area coverage under kharif crops as on 8th July 2024 [Press release].

- Press Information Bureau, Government of India. (2024, July 17). India shines as IMF upgrades GDP forecast to 7% in FY24-25.

- Press Information Bureau, Government of India. (2024, July 22). Government’s Prudent Monetary & Trade Policy Supported by Strong Output Growth Reduces Retail Inflation to a Four-Year Low of 5.4% in FY24 [Press release].

- Press Information Bureau, Government of India. (2024, July 23). Summary of the Union Budget 2024-2025 [Press release].

- Reserve Bank of India. (2024, August 22). Minutes of the Monetary Policy Committee Meeting, August 6 to 8, 2024 [Press release].

- World Bank. (2024, September 3). India’s economy to remain strong despite subdued global growth [Press release].