Key Takeaways

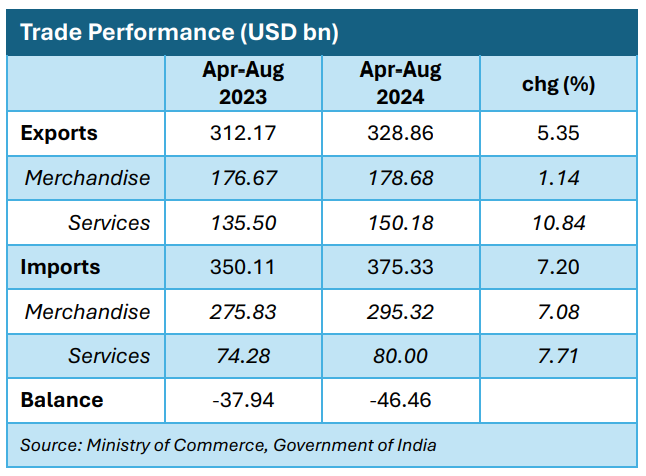

- Steady Trade Growth Amid Global Challenges: India’s total trade reached USD 328.86 billion for April–August 2024, up 5.35% from the previous year. This growth reflects resilience amid global economic headwinds, with sectors like engineering goods and services maintaining momentum.

- Modest Merchandise Export Growth: Merchandise exports grew by 1.14% to USD 178.68 billion, driven by resilient sectors such as engineering goods and chemicals. The Production-Linked Incentive (PLI) scheme supports domestic manufacturing, but global demand, particularly in Europe, remains subdued.

Meghna Chadha

Senior Economic Researcher

Malachy Nugent

VP, Financial Services & Head of Research

- Services Sector as a Key Export Driver: Services exports rose 10.84% to USD 150.18 billion. Strong global demand for IT services, business process outsourcing, and financial services highlights India’s leadership, with the services trade surplus setting weaknesses in merchandise exports.

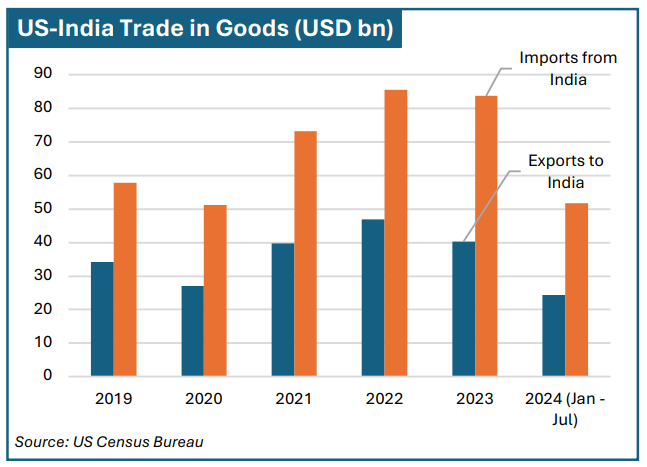

- India–US Trade Relations Strengthen: The United States remains India’s largest export destination, with exports reaching USD 51.71 billion from January to July 2024, driven by pharmaceuticals, textiles, and IT services. US exports to India totaled USD 24.32 billion, led by machinery and high-tech goods. The deepening strategic relationship oVers significant growth potential.

- Export Diversification and Growth Potential: India’s focus on value-added sectors like electronics, pharmaceuticals, and machinery reflects a strategic push toward export diversification, in line with the Foreign Trade Policy 2023, which emphasizes moving up the value chain to sustain long-term growth.

- Positive Outlook for Key Export Sectors: The remainder of FY2024–25 looks promising for exports in pharmaceuticals, engineering goods, and chemicals. Government support and global demand are expected to sustain growth, positioning India well for continued export expansion.

- In Focus: Free Trade Agreements (FTAs): India’s recent FTAs with partners like the UAE, Australia, and EFTA nations are unlocking new markets and expanding India’s global trade footprint. Ongoing negotiations with the European Union and the UK, as well as initiatives like the Indo-Pacific Economic Framework (IPEF), reflect India’s focus on building resilient trade relationships and gaining wider market access.

Trade Performance: April – August 2024

India’s total trade during the first five months of the fiscal year (April–August 2024) reflected steady growth, with exports reaching USD 328.86 billion, up 5.35% compared to the same period in 2023. Imports rose by 7.20%, totaling USD 375.33 billion. As a result, the trade deficit widened to USD 46.46 billion from USD 37.94 billion during the same period last year. The increase in imports was largely driven by higher global energy prices and India’s continued reliance on crude oil imports, despite eVorts to diversify energy sources. Export growth, while positive, was tempered by global economic uncertainty and sluggish demand for key commodities, especially in major markets like Europe.

Merchandise Trade

Merchandise exports saw modest growth of 1.14% during this period, rising to USD 178.68 billion, while imports surged by 7.08%, reaching USD 295.32 billion. This rise resulted in the merchandise trade deficit widening to USD 116.64 billion, up from USD 99.16 billion during the same period in 2023. The surge in imports reflects India’s dependence on imported raw materials and capital goods, particularly crude oil, coal, and machinery. The slower growth in exports can be attributed to weaker demand from key trading partners such as Europe, where economic recovery has been sluggish. However, sectors like engineering goods and chemicals displayed resilience, supported by industrial policies like the Production Linked Incentive (PLI) scheme, which is boosting domestic production. Non-petroleum and non-gems & jewelry exports, which exclude volatile commodities, grew by 5.27% to USD 135.75 billion, suggesting stable but growing demand for value-added goods such as engineering products and chemicals. Imports in this segment also rose by 5.14%, reaching USD 186.25 billion. The balanced growth in these sectors highlights India’s gradual climb up the value chain, although high costs of intermediate goods, particularly from China, continue to weigh on import costs.

Services Trade

India’s services sector continued to be a key driver of export growth, with services exports rising by 10.84% to USD 150.18 billion during the April–August 2024 period. The services trade surplus expanded to USD 70.18 billion, up from USD 61.22 billion during the same period last year. This strong performance was bolstered by high global demand for Indian IT services, business process outsourcing, and financial services. As global companies increasingly seek cost-eVective solutions, Indian IT firms have continued to capitalize on their global reach, helping oVset weaker merchandise export growth.

Services imports also grew by 7.71%, reaching USD 80.00 billion, driven by increasing demand for foreign technical and business services to support India’s growing industrial sectors. The widening services trade surplus has helped counterbalance India’s widening merchandise trade deficit, reinforcing the critical role of services in India’s overall trade framework.

Trade Forecast for FY2024-25

As India enters the latter half of FY2024-25, trade growth is projected to maintain steady momentum, largely driven by the robust performance of the services sector. Between April and August 2024, services exports grew by 10.84%, reflecting strong global demand for Indian IT services, business process outsourcing, and professional services. This sector is expected to continue providing a cushion against volatility in merchandise trade, contributing to a substantial trade surplus in services, which will help offset the widening merchandise trade deficit.

One of the key risks to India’s trade in the coming months will be the potential for a spike in global commodity prices, particularly oil. Energy imports make up a significant portion of India’s import bill, and any sustained rise in oil prices could sharply increase the trade deficit. Although rising imports of capital goods are necessary for building long-term productive capacity, India’s dependence on imported crude oil remains a vulnerability, especially if export growth slows due to global economic uncertainty.

Exports in sectors such as engineering goods, chemicals, and pharmaceuticals are expected to continue their growth, buoyed by government initiatives like the PLI scheme, which aims to increase domestic manufacturing output. However, the global economic environment remains challenging, with slowing demand in key markets such as Europe and China likely to impact export volumes. Merchandise exports grew by only 1.14% between April and August 2024, indicating a slowdown that may persist if global conditions do not improve.

On the import side, India’s reliance on crude oil, intermediate goods, and machinery will keep merchandise imports elevated, contributing to a widening trade deficit. Imports grew by 7.08% during the same period, driven by the demand for energy and capital goods, pushing the merchandise trade deficit to USD 116.64 billion. Unless there is a significant improvement in global commodity prices or a reduction in import volumes, the deficit is likely to remain.

In the non-petroleum and non-gems & jewelry segment, India’s trade performance has remained relatively stable, with exports growing by 5.27% and imports increasing by 5.14% between April and August 2024. This segment reflects demand for Indian value-added goods such as engineering products and chemicals, sectors that are less volatile than commodity-based exports. However, rising costs of intermediate imports, particularly from China, continue to weigh on the trade balance in this category.

Expected Performance with the United States

India’s trade relationship with the United States is expected to continue growing steadily, with India likely maintaining its trade surplus. Strong exports of pharmaceuticals, textiles, and IT services to the United States will be key drivers of this surplus, reflecting India’s competitive advantages in laborintensive and service-based sectors. However, inflationary pressures and shifting monetary policies in the United States could dampen demand for Indian exports, posing some risks to future growth.

On the import side, India’s demand for US goods, particularly in energy, aircraft, and industrial machinery, is expected to remain strong, contributing to balanced trade growth. The continued expansion of the US-India strategic partnership, including sectoral cooperation and potential trade agreements, will play a crucial role in enhancing bilateral trade volumes and supporting India’s overall trade performance for the remainder of FY2024–25.

Analysis: India’s Export Trends from 2019 to 2024

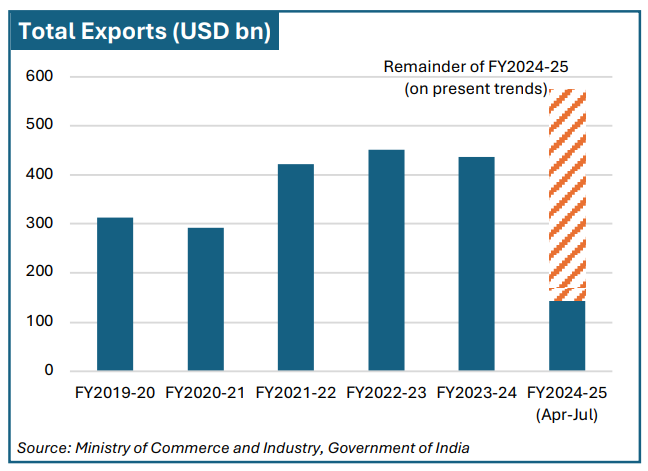

India’s export landscape from FY2019–20 to FY2024–25 highlights periods of sharp fluctuations, reflecting broader global economic shifts.

2019–2022: Pre-Pandemic Decline Followed by Sharp Recovery

India’s exports contracted by 6.88% in FY2020–21 from FY2019–20, declining to USD 291.81 billion, primarily due to severe global disruptions caused by the COVID-19 pandemic. Supply chain breakdowns, factory shutdowns, and a collapse in global demand were critical factors. Key sectors like petroleum and textiles saw significant drops as industrial production stalled worldwide.

However, the subsequent recovery in FY2021–22 was dramatic, with exports surging by 44.62% to USD 422 billion. This rebound was driven by a revival in global demand as economies reopened, supported by India’s strategic initiatives such as the PLI schemes. The sharp growth in sectors like pharmaceuticals and petroleum products reflected India’s ability to capture pent-up global demand during this period, particularly in essential industries like healthcare and energy. India also benefited from rising crude oil prices, which increased the value of its refined petroleum exports.

2022–2024: Moderate Growth Followed by Recent Decline

By FY2022-23, export growth had returned to a more moderate 6.89%, with total exports reaching USD 451.07 billion. While post-pandemic demand remained robust, particularly in sectors like machinery and electrical goods, the global economy faced new challenges such as inflationary pressures, rising interest rates, and supply chain bottlenecks. These challenges moderated growth compared to the previous year’s rapid recovery. Nevertheless, India’s consistent performance in pharmaceuticals and high-tech machinery indicated its evolving role in more value-added exports.

In FY2023-24, India saw a slight decline of 3.1%, bringing exports down to USD 437.07 billion. This decline was largely driven by global headwinds, including reduced consumer demand in key export markets like the United States and Europe, as well as continued disruptions in global supply chains. Geopolitical tensions, particularly the Russia-Ukraine conflict, exacerbated these issues, creating volatility in energy markets and inflationary pressures that dampened global trade activity. Certain sectors, such as precious stones and jewelry, experienced lower demand, while resilient sectors like electrical machinery still showed positive trends, reflecting India’s diversification into higher-value sectors.

In 2023, India adopted a new Foreign Trade Policy (FTP) that aims to boost the country’s export performance significantly by addressing both structural and operational barriers to trade. With the ambitious goal of reaching USD 2 trillion in exports by 2030, the policy prioritizes automation, streamlined processes, and targeted initiatives to enhance India’s participation in global trade.

Projection for FY2024–25

Based on our analysis of India’s performance in the first half of the year (April-August 2024), if exports continue to grow in line with current trends, they are projected to reach between USD 575–600 billion for FY2024–25. This optimistic projection hinges on the sustained recovery of global demand and India’s ability to capitalize on emerging sectors like e-commerce, green technology, and high-tech manufacturing, as emphasized in FTP 2023. However, the realization of these projections will depend on how eVectively India manages ongoing challenges such as high logistics costs, supply chain disruptions, and geopolitical uncertainties.

Key Export Commodities

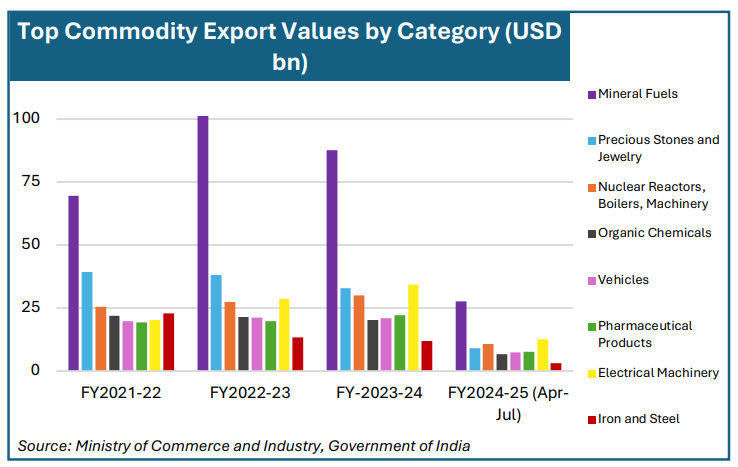

India’s export success is driven by a few key sectors that have consistently ranked among the top commodity exports over the past five years.

Mineral fuels, especially petroleum products, continue to dominate India’s export portfolio. From FY2021–22 to FY2022–23, exports in this sector surged from USD 69.57 billion to USD 101.24 billion, driven by rising global crude prices and robust energy demand. This surge underscores India’s critical role in the global value chain, where it refines imported crude oil and exports high-value petroleum products.

Precious stones and machinery are also steady export performers, consistently ranking among India’s top exports. The jewelry sector remains a key contributor despite global economic slowdowns, particularly with strong demand from markets like the United States. Additionally, nuclear reactors, machinery, and electrical equipment have seen steady growth, supported by the PLI schemes, which are bolstering India’s advanced manufacturing capabilities. Pharmaceuticals represent a strategic growth sector for India, solidifying the country’s reputation as the “pharmacy of the world.” In FY2023–24, pharmaceutical exports reached USD 22.11 billion, reflecting strong global demand for generic medicines. FTP 2023 aims to support this growth further by introducing regulatory streamlining and export incentives to enhance India’s global competitiveness in the pharmaceutical industry.

Key Trade Relationships

India’s trade relationship with the United States has grown significantly over recent years, solidifying the United States as one of India’s most important trading partners. India has consistently maintained a trade surplus with the United States, largely driven by the export of labor-intensive goods such as textiles, gems and jewelry, pharmaceuticals, and IT services. These sectors capitalize on India’s competitive advantages—low labor costs and a highly skilled workforce—allowing it to oVer goods and services at a lower cost than competitor economies.

By contrast, US exports to India, while growing steadily, are more concentrated in high-value sectors such as machinery, aircraft, and technology products. The gap between exports and imports highlights the divergent trade dynamics: India’s exports are largely made up of labor-intensive, lowercost goods, while US exports to India tend to be high-value, capital-intensive products that require advanced manufacturing capabilities.

India’s trade surplus in this bilateral relationship has widened over time, with the US trade deficit increasing from USD 23.66 billion in 2019 to USD 43.31 billion in 2023. This trend is explained in part by India’s export structure, as the country specializes in labor-intensive, lower-cost goods like textiles, which are less economically feasible to produce in the United States. Additionally, India’s IT and pharmaceutical sectors have become global leaders, further boosting export performance to the United States in high-demand areas such as software services and generic medicines.

The United States exports higher-value products to India, such as machinery, aircraft, and advanced technology, which, while growing, have not kept pace with the rapid increase in India’s exports. This imbalance highlights the comparative advantage India holds in producing labor-intensive goods, while the United States focuses on capital-intensive, high-tech products. However, India’s export basket is increasingly shifting towards more value-added goods like electronics, signaling potential shifts in trade dynamics as the country moves up the global value chain.

In terms of broader trade relationships, India’s top trading partners over the past five years have been the United States, China and the UAE, followed by Russia and Saudi Arabia. In FY2023-24, trade with the United States reached USD 119.71 billion in goods, while China closely followed at USD 118.39 billion. Though the United States has consistently held the top spot, China briefly overtook it during FY2020-21 due to pandemic-related disruptions. India’s trade with China is primarily driven by imports of electronics and machinery, contributing to a persistent trade deficit. The UAE also remains a key supplier of energy to India, particularly oil.

India’s trade relationships with key partners such as the United States, China, Russia, and the UAE reveal diverse dynamics. While India enjoys a trade surplus with the United States, it faces significant deficits with China and Russia due to its reliance on imports of electronics, machinery, and energy products. The US-India relationship remains central to India’s trade strategy, with the growing surplus highlighting India’s expanding export base. However, India’s persistent trade deficits with China and Russia underline the need for greater diversification of trade partners and a reduction in dependence on key imports, especially in critical sectors like energy and technology.

The data from January to July 2024 reflects this continuing trend, with India exporting USD 51.71 billion in goods to the United States while importing USD 24.32 billion, leading to a US trade deficit of USD 27.39 billion. This persistent surplus indicates the strength of India’s production capacity in sectors where labor cost differentials play a major role.

In Focus: India’s Free Trade Agreements

India-US Trade Relations and Future FTA Prospects

India and the United States share a significant bilateral trade relationship, though there is no formal Free Trade Agreement (FTA) between the two nations. In 2019, the United States revoked India’s Generalized System of Preferences (GSP) status, impacting USD 5.6 billion worth of Indian exports, particularly in the pharmaceuticals, textiles, and agricultural sectors. Despite this, the United States. remains a key trading partner, with both countries continuing to engage in discussions to resolve trade issues and explore avenues for future collaboration.

At the 2024 US-India Trade Policy Forum (TPF), both nations reaffirmed their commitment to strengthening economic ties, with bilateral trade likely surpassing USD 200 billion in 2023. Key outcomes included the resolution of all seven WTO disputes and agreements on market access for significant goods, marking a pivotal step in advancing trade relations. The forum identified critical areas for future collaboration, including building resilient supply chains, advancing digital trade, and streamlining high-tech product trade. A major development was the mutual recognition of conformity assessments for non-agricultural goods, which will reduce duplicative testing, lower compliance costs, and simplify the trade of industrial products such as machinery and electronics. Further engagement on intellectual property rights, digital trade frameworks, and diversifying pharmaceutical supply chains was emphasized. Additionally, discussions on social security agreements and removing barriers to technology transfers set a positive agenda for 2024. Both nations also agreed to develop forward-looking roadmaps across priority sectors like critical minerals and clean energy. The TPF solidified the platform for addressing outstanding trade issues and sustaining the positive trajectory of bilateral trade.

In recent years, the evolving global economic landscape has prompted both nations to explore new avenues for enhancing trade cooperation. A notable example is the Indo-Pacific Economic Framework for Prosperity (IPEF), launched by the United States in May 2022. This multilateral initiative, which includes India and 13 other regional partners, seeks to promote economic growth, resilience, and sustainability across the Indo-Pacific. The IPEF could be a key opportunity for India and the United States to deepen their economic ties, especially in areas like trade, supply chain resilience, and clean energy development, even in the absence of a formal FTA. However, there is skepticism about whether the IPEF will be truly groundbreaking compared to FTA-like approaches.

India’s strategic focus on FTAs highlights its commitment to fostering international economic partnerships, expanding global market access, and securing foreign investment. Recent agreements.

with economic blocs such as the European Free Trade Association (EFTA), Australia, and the UAE provide clear examples of how India is reshaping its global trade relationships. These agreements are crucial for India’s long-term goals of boosting exports, creating jobs, and driving sustainable development. As India continues to engage with global powers such as the United States, these agreements serve as models for what a potential US-India FTA could look like.

India-EFTA Trade and Economic Partnership Agreement (TEPA)

Signed on March 10, 2024, the India-European Free Trade Association (EFTA) Trade and Economic Partnership Agreement (TEPA) represents a key advancement in India’s trade relations with developed economies outside the European Union. The agreement spans Switzerland, Iceland, Norway, and Liechtenstein, with EFTA committing to USD 100 billion in foreign direct investment (FDI) over the next 15 years, expected to generate one million jobs in India across sectors such as pharmaceuticals, machinery, and food processing.

A significant aspect of TEPA is its tariff reduction commitments. India has agreed to reduce tariffs on 82.7% of its tariff lines, covering 95.3% of EFTA’s exports. This includes substantial tariff cuts on goods such as Swiss watches, chocolates, processed foods, and machinery, helping lower the cost of importing these high-value products into India.

In exchange, EFTA has committed to reducing tariffs on 92.2% of its tariff lines, giving Indian exporters expanded market access. Non-agricultural goods such as textiles, pharmaceuticals, and engineering products will see full tariff elimination, allowing Indian companies to enter these markets with zero or minimal trade barriers. TEPA also strengthens India’s position in global value chains, offering improved access to European markets for services sectors like IT, healthcare, and audiovisual services, while simplifying customs and trade procedures to boost efficiency. The agreement supports India’s broader “Make in India” initiative by fostering investments in critical areas like renewable energy and R&D, enhancing the country’s global trade footprint.

UAE-India Comprehensive Economic Partnership Agreement (CEPA)

The UAE-India CEPA, which came into effect on May 1, 2022, is a landmark in India’s trade diplomacy with the Gulf. The UAE is a significant trading partner, with bilateral trade valued at USD 59 billion in 2019-20. The agreement aims to elevate this to USD 100 billion in goods trade and USD 15 billion in services trade within five years. India secured duty-free access for 90% of its exports, particularly in labor-intensive sectors like textiles, gems and jewelry, and food products.

The agreement also improves access for UAE service providers in key sectors such as IT and financial services. A dedicated annex on pharmaceuticals fast-tracks Indian pharmaceutical products for approval in the UAE, significantly boosting exports. Enhanced access to Indian government procurement and safeguards against import surges demonstrate India’s focus on protecting. domestic industries while fostering international investment.

India-Australia Economic Cooperation and Trade Agreement (ECTA)

Effective from December 29, 2022, the India-Australia ECTA is a cornerstone of India’s trade engagement with the Indo-Pacific region. This agreement, signed after a decade of negotiations, grants Indian goods zero-duty access to 100% of Australia’s tariff lines, with limited transition periods for some goods, especially in sectors like textiles, leather, engineering goods, and medical devices. In addition, Australia has provided market access in 135 sub-sectors, including IT, healthcare, and audiovisual services.

ECTA is expected to generate over one million jobs in India, with visa benefits for Indian chefs and yoga instructors, and post-study work visas for over 100,000 Indian students. The agreement also simplifies the approval process for Indian pharmaceuticals and removes double taxation on IT services, saving Indian companies millions. ECTA strengthens India’s integration into global supply chains, particularly in the Indo-Pacific, and aligns with broader frameworks like the Quad and IPEF.

India’s Key Bilateral and Multilateral Trade Agreements

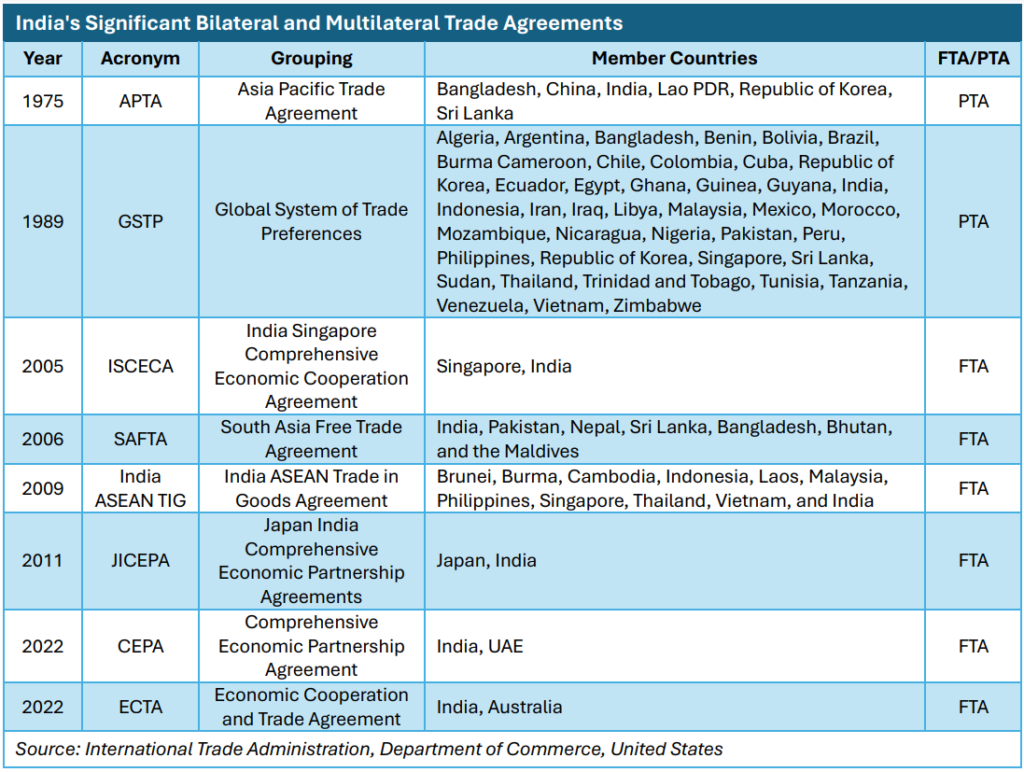

India’s approach to international trade involves a network of both bilateral and multilateral agreements that have evolved over the decades. These agreements not only deepen economic ties and promote foreign direct investment but also align with national initiatives like Atmanirbhar Bharat (“self-reliant India”) to drive domestic growth and self-sufficiency. India’s FTAs and Preferential Trade Agreements (PTAs) reflect its strategic engagement with diverse regions and sectors. They serve as instruments to expand India’s global economic footprint while fostering competitiveness in various industries. The following table summarizes some of India’s significant trade agreements, highlighting the country’s commitment to leveraging international partnerships for economic development:

The Path Forward

India’s recent FTAs with EFTA, the UAE, and Australia, alongside its extensive network of bilateral and multilateral trade agreements, provide a solid framework for expanding its global trade footprint, driving exports, attracting foreign investment, and generating employment. By leveraging these partnerships, India is deepening economic relationships and promoting domestic growth in line with initiatives like Atmanirbhar Bharat (“self-reliant India”). With ongoing negotiations with the European Union and the United Kingdom, successfully concluding these agreements presents a significant opportunity for India to enhance its engagement with major global players. If finalized, India could gain improved market access in key sectors such as technology, services, and advanced manufacturing. These deals would not only bolster India’s trade position but also serve as strategic models for future negotiations, including potential agreements with countries like the United States. By focusing on areas like digital trade, clean energy, and supply chain resilience—and by utilizing its comprehensive array of trade agreements—India can further reinforce its role in global trade and economic diplomacy, positioning itself as a key player in the evolving global economy

This report is intended for informational purposes only and does not constitute investment advice. Readers are encouraged to seek professional advice before making any investment decisions.

Sources

- Directorate General of Foreign Trade, Government of India. Bulletin of foreign trade statistics.

- European Commission. EU-India Free Trade Agreement, Investment Protection Agreement and Geographical Indications Agreement.

- International Trade Administration. (2023, January 12). India – Trade agreements.

- Invest India. (2023, April 13). India’s Foreign Trade Policy 2023: A Roadmap to Boost Exports.

- Invest India. (2024, May 22). Impact of India-EFTA Trade and Economic Partnership Agreement.

- Khorana, S. (n.d.). The FTA: A strategic call for the EU and India. European Council on Foreign Relations.

- Ministry of Commerce and Industry, Government of India. (2024, September). Trade statistics in August 2024 (Document No. PIB2055667) [Press release].

- Ministry of Commerce and Industry, Government of India. Commerce dashboard.

- Ministry of Commerce and Industry, Government of India. Latest trade figures.

- Ministry of Economy, United Arab Emirates. UAE-India Comprehensive Economic Partnership Agreement (CEPA).

- Ministry of Commerce and Industry, Government of India. Export Import Data Bank.

- Press Information Bureau, Government of India. (2022, April 2). Signing of the Economic Cooperation and Trade Agreement (ECTA) between India and Australia [Press release].

- Press Information Bureau, Government of India. (2022, December 29). India-Australia Economic and Cooperation Trade Agreement comes into force [Press release].

- Press Information Bureau, Government of India. (2023, March 31). Foreign Trade Policy 2023 announced [Press release].

- Press Information Bureau, Government of India. (2024, March 10). India-EFTA Trade & Economic Partnership Agreement underlines our commitment to boosting economic progress and create opportunities for our youth: PM [Press release].

- Press Information Bureau, Government of India. (2024, March 10). India-EFTA Trade and Economic Partnership Agreement [Press release].

- The Economic Times. (2024, September 17). India, UK may hold next round of talks on proposed trade agreement in Oct.