Embracing Web 3.0 Could be a Watershed Moment for India

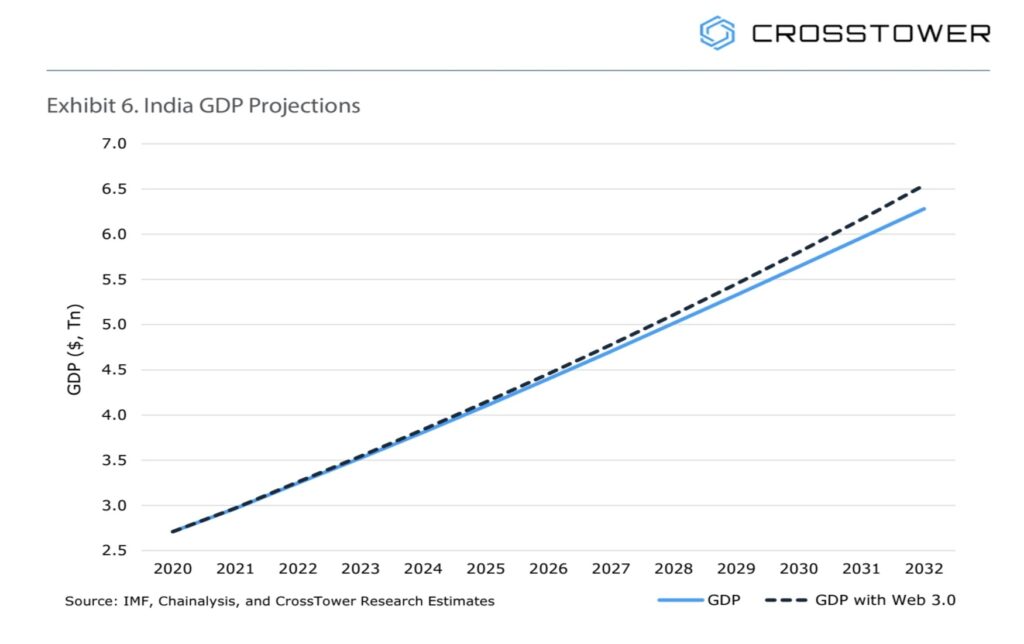

India’s geopolitical power, status, and leadership over the next 20 years is inextricably linked to the policies and regulatory framework that it implements today with respect to digital assets and the Web 3.0 industry. Digital assets that use blockchain and distributed ledger technology are increasingly recognized as the catalyst for future innovation, economic growth, and financial inclusion. Many believe this digital-world, paradigm-shift to Web 3.0 will be as consequential as the birth of the internet. We strongly agree. In fact, we firmly believe that India is uniquely positioned to become a world leader in this new digital economy. Digital assets like Bitcoin, Ether, Solana, Algorand, stablecoins, and other blockchains are the fuel of the future financial ecosystem and Web 3.0. To provide some perspective, in 2013, the market capitalization of the digital asset market was approximately $1.5 billion, whereas today, the market capitalization is at nearly $3.0 trillion1. By our estimates, embracing and fostering this technology in India could contribute an additional $1.1 trillion of economic growth to its GDP over the next 11 years.

India is distinctively qualified to benefit from this profound transformation of the financial and technology ecosystems. India is undergoing a rare confluence of economic, demographic, and technological megatrends, which is likely to catapult innovation and materially influence the quality of life of the citizens of India. The Indian population is thirsty for growth. First, India is extremely entrepreneurial, considering that it is the 3rd largest startup ecosystem globally, according to Startup India2. In 2020, 83% of Indians saw good opportunities to start a firm in the area where they live, far above the global average of 51%3. Second, India has the highest natively-digital population in the world, with the largest youth population of any country4. Third, but not last, Indian citizens are very technologically-savvy, with a developer base of approximately 2.8 million in 2020, which compares to approximately 4.4 million in the US5. Quite notably, India is projected to have the most developers of any country by 20236. With coding excellence, entrepreneurial spirit, and the thirst for growth, it is almost certain that capital inflows from abroad are likely, fostering fuel and promise for the future of the Indian economy and people.

Highly critical for the success of economic growth, however, will be a thoughtful, deliberate framework and action plan to foster innovation in Web 3.0 and digital assets. If we analogize the development of the internet to that of digital assets and Web 3.0, it would be useful to note why the US succeeded with the internet compared to other major countries. Success of the US in the internet industry is illustrated by 17 US firms being amongst the top 25 major public tech companies by market capitalization worldwide7. The US became a hotbed for tech firms in the early days of the internet largely due to the numerous frameworks that policymakers implemented early on, creating a structure for massive innovative projects. India should consider substantively similar structures, such as private/public partnerships, grants and frameworks for education at every level, sandboxes for regulatory clarity, venture capital programs and incentives for foreign investment, and other strong and clear policies. This will thrust India into a world leadership role in digital assets and Web 3.0. India is uniquely perched to seize this current opportunity. If India does not harness the power of its young demographics, the savviness of its technology talent, and the thirst for success of the Indian people, other countries may outbid India in the opportunity to be a leader.

Introduction

1.1 Overview of Web 3.0

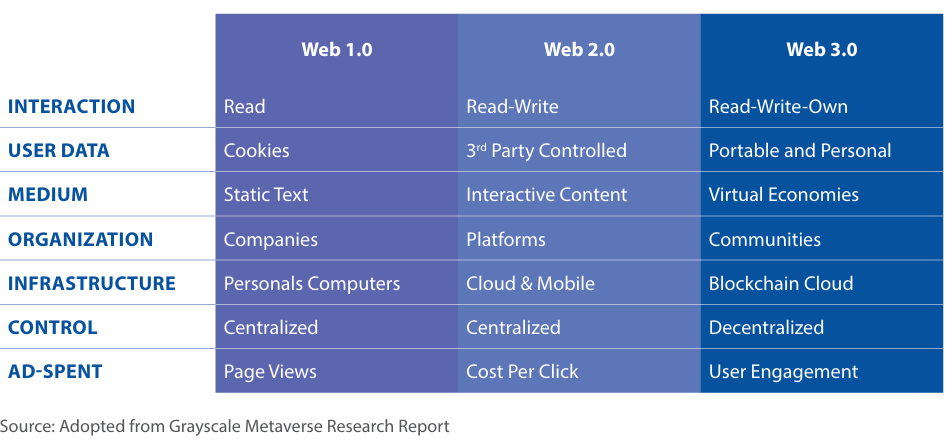

Web 3.0 is the next iteration or phase of the evolution of the Web/internet that has the promise of being as revolutionary as the internet. Web 3.0 is built upon the core concepts of decentralization, openness, and greater user utility, with digital assets fueling the blockchain ecosystem. In Web 1.0, people were the consumers of data (such as search engines). In Web 2.0, people were both consumers and contributors of data (such as social media). In Web 2.0, people’s data is owned by large organizations, such as Facebook, Google, and Amazon. In Web 3.0, the data is owned by consumers and resides on blockchain networks, as opposed to centralized organizations.

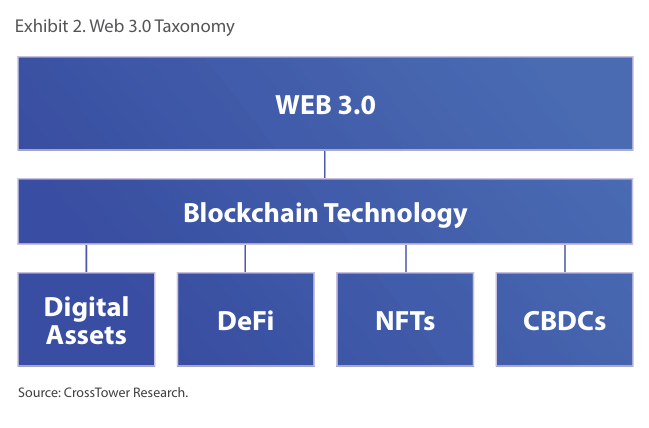

Within the realm of Web 3.0 is blockchain technology, digital assets, stablecoins, non-fungible tokens (NFTs), and central bank digital currencies (CBDCs), among other components. We provide a brief overview of each below. However, because we are in such a nascent stage of development, we will likely see an evolution of the taxonomy of digital assets.

Most of the media attention regarding the first well-known blockchain, Bitcoin, focuses on the “store of wealth” and/ or its use as a “medium of exchange” or as legal tender. This would be missing the larger context of the promise of blockchain and what Web 3.0 can achieve. Instead, focus on this new technology as the infrastructure that facilitates the movement of value on the internet.

Such use cases demonstrate that Web 3.0’s potential reach extends far beyond f inancial services and can be profoundly impactful for India as long as it acts now to become a leader in this space.

- Web 3.0 refers to a decentralized internet that draws on blockchain technology.

- Blockchain technology refers to the use of a digital ledger, and is notable for offering transparency to processes, given that the ledger is often public.

- Decentralized finance (DeFi) refers to open and automated financial services enabled by digital asset technology.

- Digital assets are virtual assets, such as cryptocurrencies, stablecoins, CBDCs and related technologies.

- Non-fungible tokens (NFTs) are tokens that represent ownership of or claim to a unique item, often one that is digital.

- Central bank digital currencies (CBDCs) are digital assets issued by central banks.

- Cryptocurrencies, or “crypto”, are digital assets whose transactions are cryptographically verified.

The Opportunity

Digital asset technology offers India significant economic opportunity to participate in the booming and quickly developing Web 3.0 industry. Blockchain protocols are typically public and open source, which allows people worldwide to develop real-world use cases on these blockchains, facilitating incredible growth and driving rapid adoption. There are significant use cases for these blockchains outside of financial services, in sectors such as media, healthcare, manufacturing, agriculture, regulation, government, entertainment, real estate, supply chains, and digital identity. Use cases grow at significant rates and are as possible as the imagination and innovation, which is why building a multi-approach framework for development is critical for this flourishing technology. This is a foundational technology, which takes time to scale, but once scaled and mature, it will transform almost all sectors and business systems. Can this type of innovation happen without digital assets? The short answer is no. Native assets are necessary for blockchains to function, depending on the specific consensus method. A digital asset token is simply a unit measure of the ledger, which is required to calculate value within the ecosystem. The token is a way to incentivize the validators to validate transactions on a blockchain. Adding the layer of having transaction fees on the network makes it difficult for malicious actors or spam-bots to attack the network.

2.1 Economic Opportunity

Compares to that of the Internet

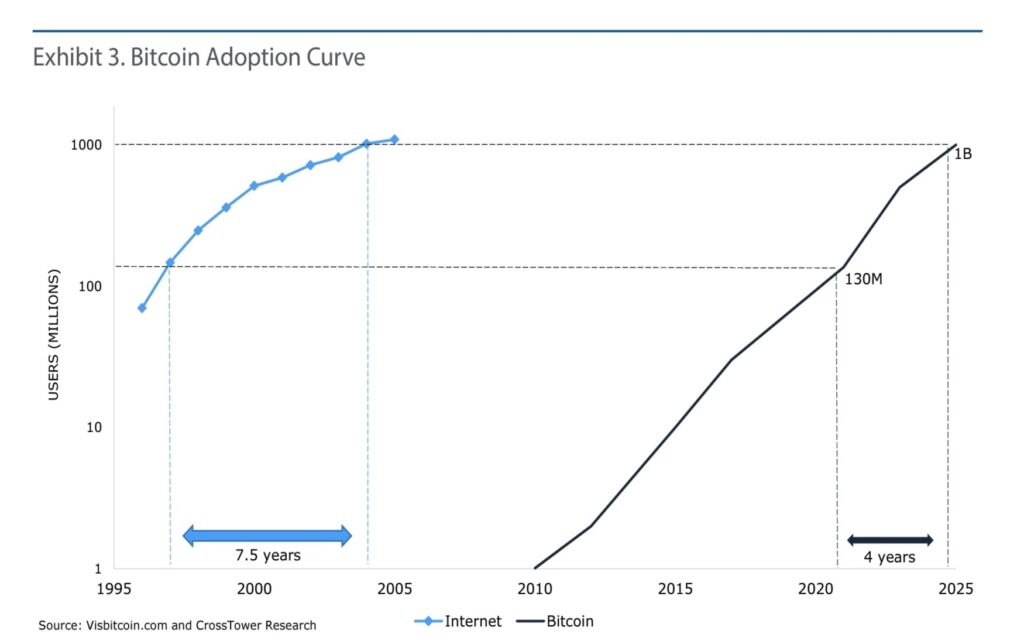

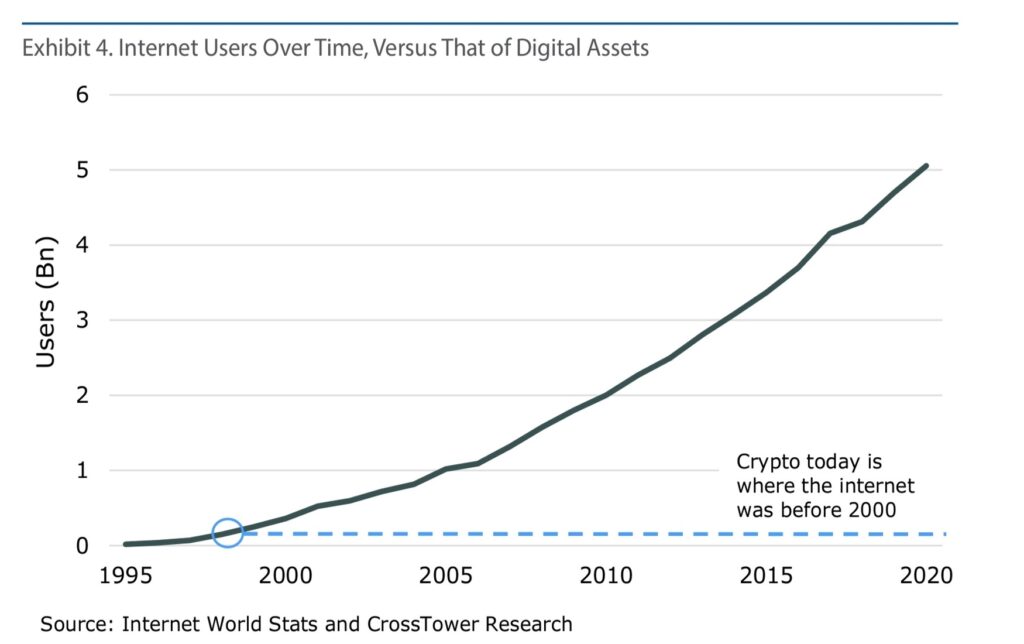

A September 2021 report published by the National Association of Software and Services Companies (NASSCOM) found that the digital asset industry in India could add $184 billion of economic value by 2030 and that the industry could employ several hundred thousand people in India over the same period. While this is an impressive amount, we believe the opportunity is much larger, and estimate the economic value to be conservatively $1.1 trillion by 2032. We see the internet sector as an appropriate comparison for the potential of the digital asset industry. Considering that the internet sector accounted for nearly 12% of the US GDP in 2020, or $2.45 trillion, and 16% of India’s GDP in 2020, or $537 billion, we expect digital assets to have significantly greater impact on GDP given the Web 3.0 growth across all industries, which is why we believe the $1.1 trillion in India is a very conservative estimate. The adoption of digital assets as reflected by accounts opened on centralized cryptocurrency exchanges seems to be growing nearly twice as fast as that of the internet9. It took the internet approximately 7.5 years to go from around 100 million users to 1 billion users, whereas Visualize Bitcoin expects adoption from 100 million to 1 billion users operating accounts at cryptocurrency exchanges to take roughly 4 years, as shown in Exhibit 310. There was approximately a 20-year period between the internet surpassing 100 million users and the internet sector accounting for 10% of US GDP. We are seeing digital asset adoption at twice the rate of the internet. Consequently, we believe it is reasonable to expect Web 3.0 to become a significant portion of the GDP of major economies, such as India’s, within half that time (~10 years). If nothing else, this adoption rate indicates significant growth and demand for the exciting use cases of Web 3.0.

One chart that should exemplify where we are in the adoption of digital assets in the development of Web 3.0 is above. It illustrates how much farther we have to grow to be Web 3.0.

2.2 Digital Assets Can Create significant

Economic Value for India

We strongly believe Web 3.0 driving $1.1 trillion of economic value for India by 2032 is reasonable, but only with the right policies and regulatory framework. In the early days of the internet, it was difficult to predict how vast an impact such technology could have – few people fully understood how the internet would touch nearly every aspect of our lives from communication to trade to finance to travel. Today, the internet is a major part of all industries and every year many new businesses and innovations that rely on the internet are created – the economic contributions from the internet continue to grow.

We expect digital asset-enabled Web 3.0 technology to evolve in a similar way today. We believe the bulk of this $1.1 trillion in economic growth for India over these 11 years would be derived from ancillary digital asset-related businesses that have yet to be invented. Digital assets have tremendous potential based on just what we know today – they are able to power more frictionless global financial services and foster financial inclusion by lowering barriers to entry. The global financial services market is estimated to be over $22 trillion in 2021 and to grow to over $28 trillion by 202511. Digital asset applications stand to capture an enormous slice of this market alone.

Moreover, other Web 3.0 applications are set to capture a part of this nearly $8 trillion global information technology market. For example, there are startups right now working on creating decentralized social media where users would own their data, in comparison to today’s leading social media platforms like Facebook and Twitter. Another burgeoning digital asset technology that could drive economic value creation is non fungible tokens (NFTs), which represent a claim on unique items. Society is progressing to a virtual world and NFTs have major potential in enabling this digital metaverse. From digital art to ticket sales, music, collectibles, luxury items, and gaming, NFTs could transform the way we interact day-to day. While still nascent, NFTs are projected to emerge into a market of $1 trillion or more12.

Now consider all the other known potential use cases of digital assets and the blockchain. Blockchain technology stands to transform so many other major industries, such as supply chain, record keeping, accounting, and more. The broader digital asset industry is poised to capture hundreds of billions, if not trillions, of economic value from these industries alone.

What we don’t know yet about digital assets and blockchain technology is likely where much of its economic value will be generated. Just like with the internet, there will be countless businesses innovating with digital asset technology. It took years after the 1999 tech craze for tech behemoths like Google and Amazon to see their products take hold – such groundbreaking innovations and businesses are likely to emerge in the future from digital assets as well.

Projections

Digital assets in the various industries set forth below have an estimated growth based upon industry data available, compiled by organizations such as PWC, Statista, Business Wire, Market Reports World and Fortune Insights. The growth rate applied is based upon PWC’s estimates of India’s growth in the blockchain sector. We note this figure may underestimate the total impact of digital assets on India’s economy as it likely does not reflect the contribution from digital asset businesses that are being innovated today.

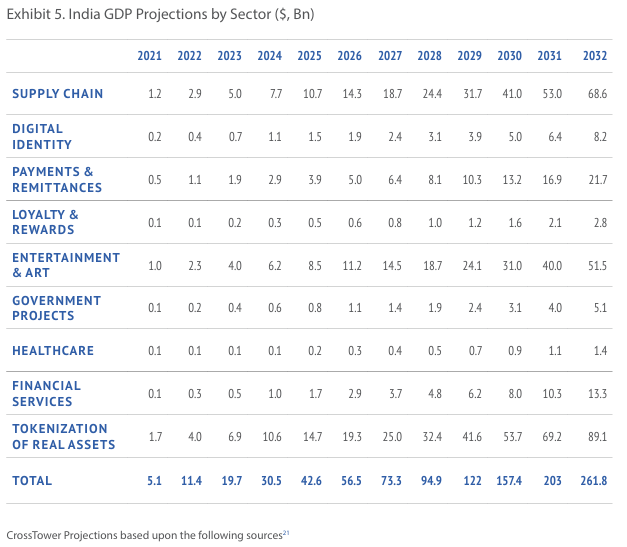

We conservatively estimate the digital asset economy’s value to India’s GDP will grow at a healthy 43.1% CAGR from $5.1 billion in 2021 to $261.8 billion over an 11-year period, resulting in a $1.1 trillion contribution to India’s GDP.

Sector by sector analysis of blockchain technology usage and its contribution to India’s GDP is provided below:

- Government Projects. The transparency that blockchains offer make it remarkably simple for regulators to view and analyze data and could be a cornerstone of enhanced regulation and consumer protection in financial services. Having data that blockchain provides leads the way for the application of predictive analytics like AI and machine learning to be incorporated, further incorporating how blockchain technology can enhance the protection of society as a whole and the individuals operating within that society. CBDCs also facilitate numerous benefits, such as taxation. Programmable CBDCs or other tokens with a smart contract could facilitate an immediate tax payment to a central authority. Taxes on goods and services could also be built into different layers of a protocol. We estimate government related blockchain projects to drive as much as $0.1 billion of GDP to India in 2021, ramping up to $5.1 billion in 2032.

- Digital Identity. Creating digital identity that is tamper-proof, hack proof, instantaneously verifiable, whose ownership solely lies with the holder but is verifiable by the government. It could include birth certificates, Digital identity would prevent forgery, theft, hacking, illicit activity, but removes it from a centralized database which creates risks. We project that digital identity could contribute $8.2 billion to India’s GDP in 2032.

- Healthcare. The healthcare industry is another area where blockchain unlocks the value of data by facilitating data sharing across hospitals, patients, insurers, scientists, and researchers. Medical records, for example, can be stored on the blockchain, meaning that patients, doctors, nurses, and pharmacists can have access to a patient’s most recent medical data, such as whether someone has been vaccinated for COVID or is allergic to a particular medicine. Scientists would have the ability to use this data not only to help make better decisions about patient care, but to create new treatments. We estimate the healthcare industry will add $1.4 billion to India’s GDP in 2032 from such blockchain-driven efficiencies.

- Supply Chain. Supply chain applications are perfect for a blockchain network. AI and machine learning could be incorporated into supply chain management and would allow the Indian government to track and monitor food production and supply, for example. Given the tremendous advancements blockchain can drive in the supply chain sector, we expect economic contribution to be significant from this sector. We project it to contribute $1.2 billion to India’s GDP in 2021 and expect this to grow materially within the next few years, contributing $68.6 billion in 2032.

- Customer Engagement/Loyalty & Rewards. Blockchain could prevent loyalty programs from falling out of use. Loyalty and reward programs, gift cards, airline points, and other retail engagement programs could utilize blockchain technologies. PwC singled out this sector as one of the 5 top drivers of blockchain innovation over the next 10 years and predict it will generate $54 billion for the global economy in 203013. We expect it will grow from generating $0.1 billion to India’s GDP in 2021 to contributing $2.8 billion in 2032.

- Payments & Remittances. Blockchain remittance is a financial solution that incorporates blockchain technology 9 into the various needs of the remittance economy. Unlike conventional channels for remittance, blockchain remittance does not rely on centralized authorities like payment systems, foreign exchange, or banks. Instead, the transaction takes place between sender and receiver. Roxe is currently working with IPAY as a node provider to enable cross-broader remittances flow between the US and India, charging no more than 1%. Estimates for remittance fees in India is as high as 5.4%, and considering the World Bank’s estimate of $83 billion in inbound remittance volume for 2020, this could represent a saving of $3.7 billion to consumers14. The Stellar protocol has partnered with the ICICI bank to enable cross-broader payments in India, Africa and the Philippines15. A study by Juniper Research showed that blockchain can be used to save banks up to $27 billion by the end 2030 on cross broader payment alone16. We project this sector to contribute $21.7 billion to India’s GDP in 2032, as blockchain drives efficiencies for payments.

- Financial Services. Blockchain is poised to transform traditional financial services by enabling global, autonomous capital markets that operate 24/7. It enables peer-to-peer financial services, such as trading, borrowing, and lending, which creates efficiencies by cutting out intermediaries. It can also help expand access to financial services to everyone with an internet connection. Moreover, the blockchain enables triple-entry accounting, which can bring greater transparency for all stakeholders of public or private entities. There are 272 blockchain financial services companies in India, including CoinSwitch, Coin DCX and Juno17. We forecast blockchain’s impact on financial services will help generate approximately $13.3 billion to India’s GDP in 2032.

- Tokenizing Real-World Assets. Blockchain makes it easy to fractionalize ownership of almost any real-world asset, which benefits investors in that it increases the liquidity of otherwise illiquid assets. Moreover, tokenization increases investor access to assets that may have been unavailable to them previously. In addition, tokenized assets can be used as collateral on blockchain-based f inancial applications, such as Centrifuge, which has already issued over $40 million of loans against tokenized real world assets18. Accounting firm Moore Global estimates that the tokenized real estate market could reach $1.4 trillion in 5 years, if 0.5% of the global property market were to be tokenized over this period19. Tokenized real-world assets is a huge opportunity and we project this sector will grow substantially to contribute $89.1 billion to India’s GDP in 2032, up from $1.7 billion in 2021.

- Entertainment & Art. Web 3.0 stands to give artists and creators more power over their work by cutting out middlemen, which allows them to directly interact and sell to their fans. It enables them to tokenize their work, or in the case of music, royalties for songs, allowing fans to participate in the upside of their favorite artists. NFTs are also significant in that they allow for provenance of items via the blockchain. By preserving the traits and features of digital objects, NFTs lay the groundwork for the metaverse, which could be worth $1 trillion in annual revenue, according to Grayscale20. We believe the entertainment & art industry could see explosive growth from these innovations and project it to contribute $51.5 billion to India’s GDP in 2032.

We project blockchain and Web 3.0 innovations will contribute significantly to India’s GDP over the next 11 years, assuming the right policies are implemented. As shown in Exhibit 5, we expect these technologies to contribute $5.1 billion to India’s GDP in 2021 and increase significantly over the next several years to $261.8 billion in 2032. Tokenization of real assets, supply chain, and entertainment & art are the sectors poised to generate the most economic value to India from Web 3.0. The potential impact from financial services to GDP is a larger unknown given that the extent to which public and private entities can extract value from blockchain-based financial applications remains to be seen, considering these applications tend to be open source. Consequently, financial services could contribute far more to India’s GDP than we currently forecast.

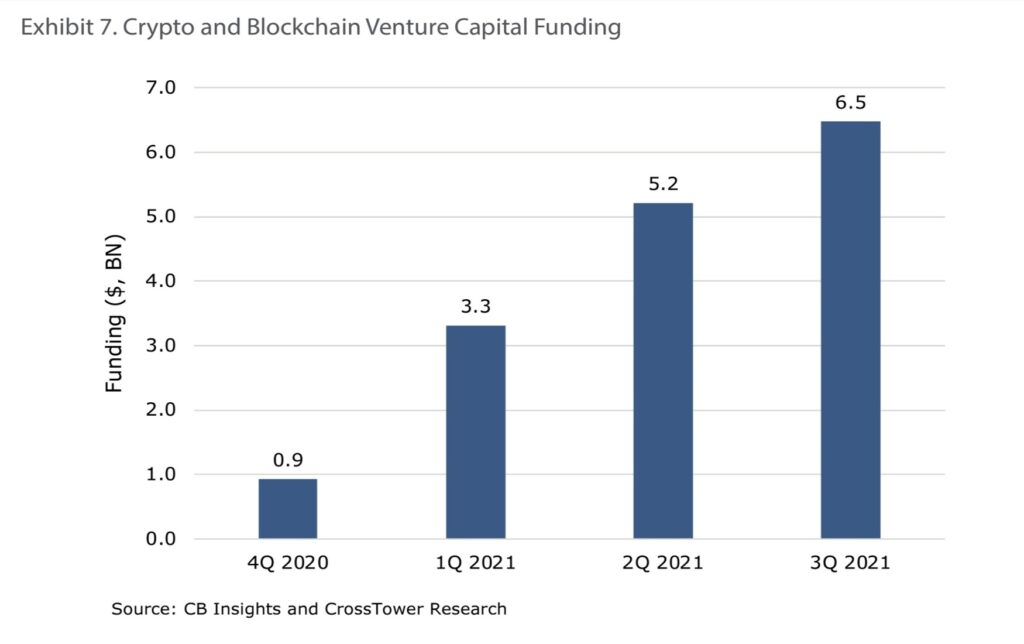

2.3 Investment

India also stands to gain billions in economic gains from the jobs, education, and investment that supporting the growing digital asset industry can bring. To illustrate the private investment opportunity for India, there has been roughly $15.9 billion of private funding globally in the digital asset industry on an LTM basis as of Q3 2021, according to CB Insights22.

Today, several blockchains are fueling the growth of Web 3.0 through the help of private investment. In November 2021, the Avalanche Foundation launched Blizzard, a $200 million fund to bolster building on the Avalanche smart contracts platform across areas such as enterprise applications, DeFi, NFTs and culture applications, self sovereign identity, and security token issuances23. Moreover, Binance announced a $1 billion growth fund in October 2021 to develop Web 3.0 applications on the Binance Smart Chain network, such as those focused on decentralized social networking, f inancial services, and gaming24. Similarly, the Algorand Foundation launched a GDP GDP with Web 3.0 $300 million fund in September 2021 to support the development of exchanges, money markets, and NFT platforms on the Algorand platform25. Such initiatives underscore the vast potential of Web 3.0.

Such eye-popping funding figures indicate investor appetite for digital asset-related companies remains strong and there is reason to believe demand will continue to rise as more and more people become involved in Web 3.0 technology. Many companies receiving funding are based in the US and abroad, a reflection of certain countries’ openness to digital asset business.

India is already seeing meaningful venture capital investment, and digital assets could attract even more. For example, lending tech startups in the Indian city of Bengaluru attracted $682 million dollars in venture capital (VC) funding in 2020. Given lending is a significant part of DeFi, digital asset startups can likely add on to this funding f igure. VC investment in India is concentrated in several cities, with Mumbai, Bengaluru, and Delhi attracting nearly 80% of VC funding. Although the COVID-19 pandemic contributed to a drop in VC funding in 2020 ($5 billion versus $8 billion in 2019), funding rebounded in 202126. According to intelligence firm GlobalData, there were 828 VC funding deals announced in India between January and July 2021, with a total disclosed funding value of US$16.9 billion27.

Encouraging the adoption of digital assets and related technologies could also drive notable foreign direct investment (FDI). If India becomes a leader in the digital asset and blockchain industry, it is poised to benefit from foreign companies investing in India-based research and development (such as at their India offices).

According to a UN report, India received $64 billion of FDI in 2020, up from $51 billion in 2019, driven in part by M&A activity in the information and communication technology industry. India is extraordinarily positioned to receive considerable FDI due to digital asset innovation.

According to SelectUSA, a government-wide program established to facilitate business investment in the United States, 46% of total FDI in the U.S. in 2018 was related to the high-tech sector, an area in which we believe digital assets would qualify, and India would be a natural beneficiary. Moreover, the 5-year compound annual growth rate (CAGR) for this figure stood at 10.1% over 2013 to 201828.

We expect digital asset-related FDI to exhibit a significantly greater CAGR, given that we are still in the early innings of digital asset adoption, and particularly given how revolutionary digital asset-related technology and applications are. Considering that the majority of digital asset VC funding has f lowed to the US, which has been receptive to the digital asset industry, with $7.8 billion of crypto funding on an LTM basis as of Q3 2021, we anticipate that India’s annual digital asset FDI will follow similar explosive growth and estimate it could total in the tens of billions by 203229. It is already on this path with several Indian digital asset firms raising considerable investment. One example of this is Indian digital asset startup CoinSwitch Kuber, which announced in October 2021 that it raised $260 million at a $1.9 billion valuation30.

2.4 Embracing Digital Assets is India’s Opportunity to Successfully Launch CBDC

In addition to the economic value that digital assets can bring to India, they can also ensure India is set up for a successful launch of its potential digital rupee. Like other central banks, The Reserve Bank of India has hinted that it is considering launching a digital currency, also known as a central bank digital currency (CBDC)31. Importantly, it should consider that digital assets and CBDC’s can complement each other. Fostering innovation by supporting digital asset companies and initiatives sets up the infrastructure and rails for a CBDC to operate on. In the future, it is likely digital asset users will swap between a digital rupee and other digital assets, such as cryptocurrencies, as they do today with actual rupees.

CBDCs will likely coexist with the most popular digital assets, but could replace those whose roles they make redundant, such as stablecoins. CBDCs will likely become integrated into the digital asset ecosystems springing up today, such as vendors who accept digital assets and popular DeFi protocols. To be successful from the start, CBDCs may need to lean on existing digital asset infrastructure, and to be well positioned to do that, they need to ensure their digital asset industry is as developed as possible. So, as India looks to the future, embracing digital asset technologies and applications stands to not only drive economic gains, but also ensure India stays on the forefront of the transition from cash to digital currencies. Enacting policies to support digital asset innovation within its borders could allow India’s digital rupee to become integrated into the burgeoning world of DeFi and take share from other stablecoins or CBDCs. CBDCs are also programmable, therefore providing the Indian government the ability to program tax collection into smart contracts. There is significant opportunity with CBDCs.

Why India is Poised to Benefit from Web 3.0

3.1 Demographics

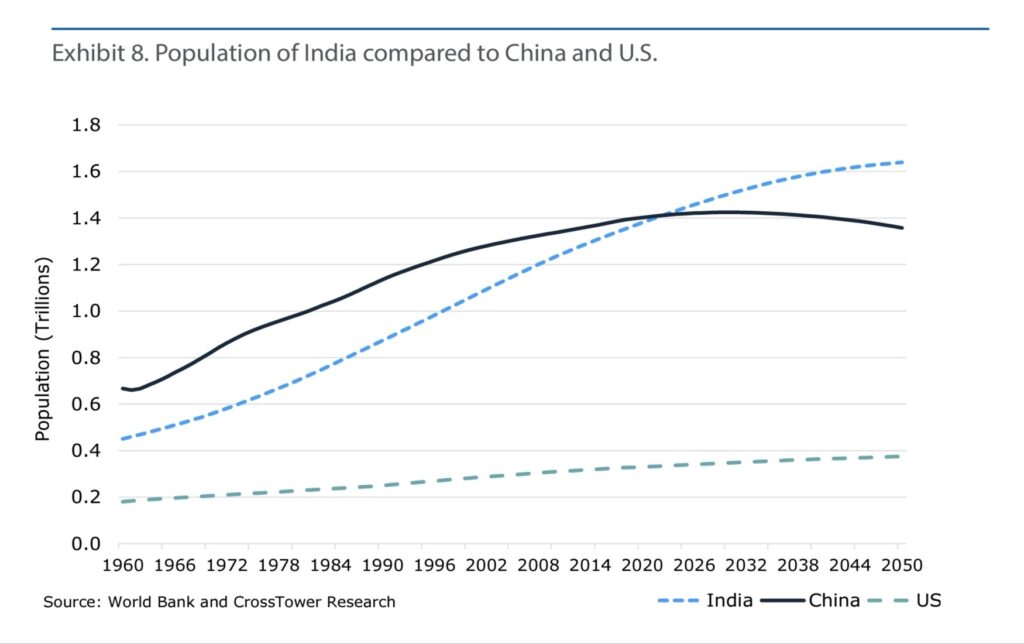

With one of the largest youth populations in the world, India has the ideal demographics to use and benefit from digital assets and Web 3.0 technology. India currently has the second largest population in the world behind China, as shown in Exhibit 8, with a population of approximately 1.4 billion people. According to data from the IMF as well as the World Bank’s population projections, India is on track to become the world’s most populous country within the next several years32.

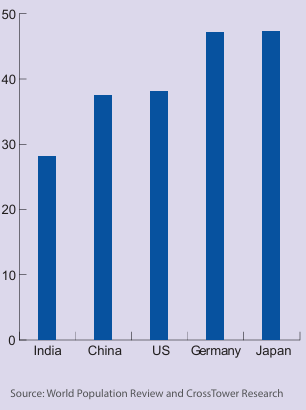

India also has one of the largest young populations in the world. The median age of an Indian citizen is nearly 20 years younger, compared to that of other major economies such as Japan, as shown in Exhibit 933.

It is remarkable how young India’s population is. In 2020, 26% of India’s population was between 0 and 14 years old and 67% was between 15 and 64 years old, according to the World Bank. In fact, in 2011, the most recent year that India’s Census was conducted, approximately 58% of India’s population (705 million people) was under the age of 3034. Moreover, there is an increasing percentage of the population in this working age bracket. With a large and growing working age population, India is well positioned to benefit from the opportunities and efficiencies Web 3.0 innovates. Its workforce is the right demographic to use and understand such technology.

Exhibit 9. Median Age of Select Countries, 2021

3.2 Economy

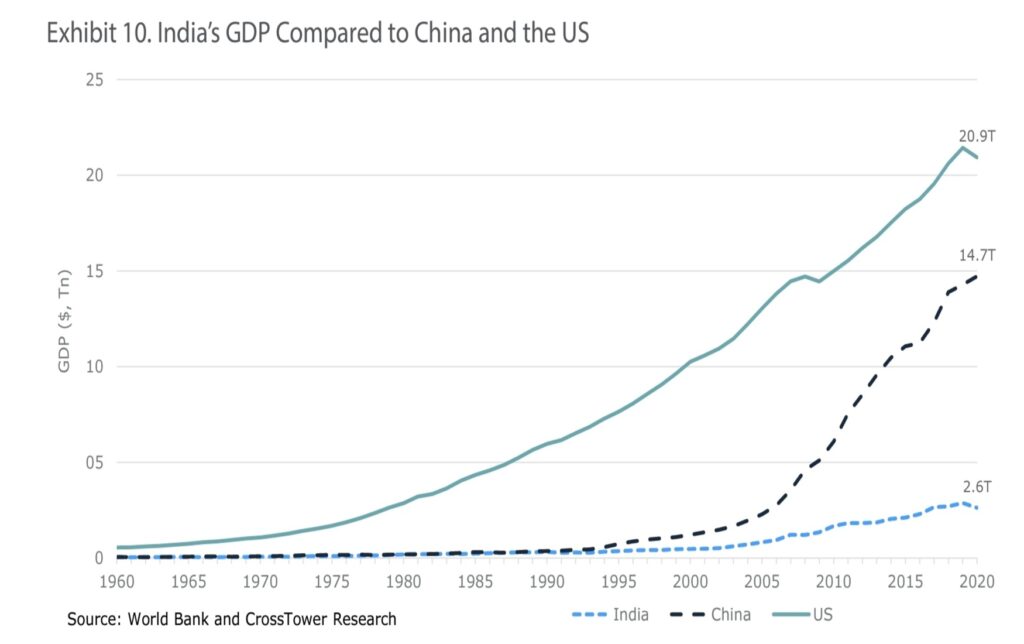

The adoption of digital assets and related technologies could help further accelerate India’s shift into a service economy and drive GDP growth. India is one of the world’s fastest-growing economies and is a member of the G-20 major economies35. Its gross domestic product (GDP) is approximately $2.6 trillion and has been increasing rapidly since 2002, as shown in Exhibit 1036. When comparing India’s GDP to that of other major economies such as the US and China, we see that India’s GDP is roughly 12% of the US GDP and 18% of China’s GDP. We also observe that the relative rate of growth of GDP for India is much slower compared to that of the US and China.

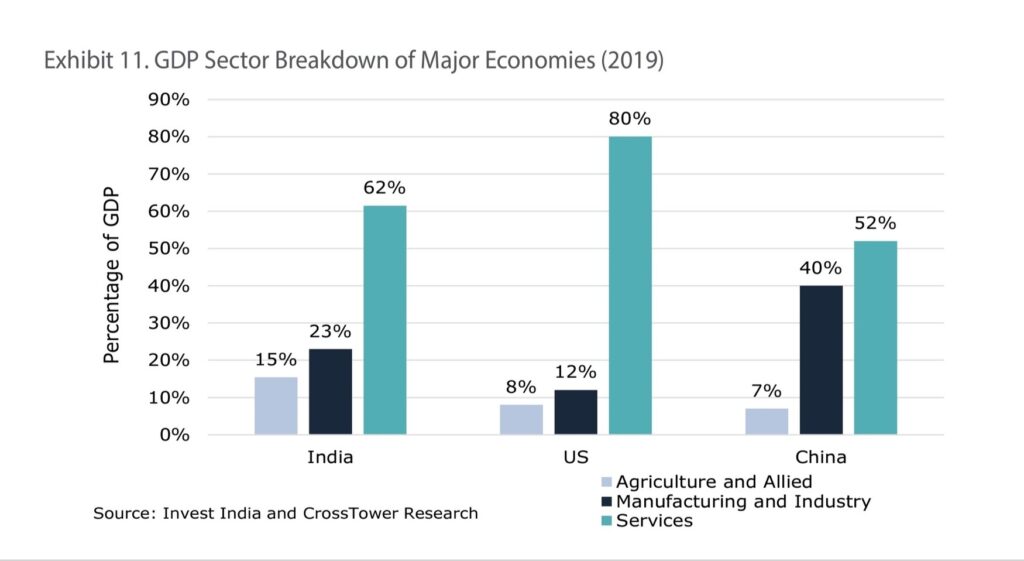

Manufacturing has historically played a key role in the overall development of India’s economy. However, in recent years, the service sector has become the most important economic contributor due to an increasing urban population. As shown in Exhibit 11, India’s service sector comprised over 60% of India’s total GDP in 2019, according to Invest India. Leading service industries include telecommunications and software, underscoring India’s presence in technology. Embracing digital asset applications and businesses could further drive India’s shift from a manufacturing economy to a service economy, similar to that of developed nations such as the US. Expanding the development of service industries such as digital assets could lead to an acceleration of India’s GDP growth.

3.3 Tech Savviness

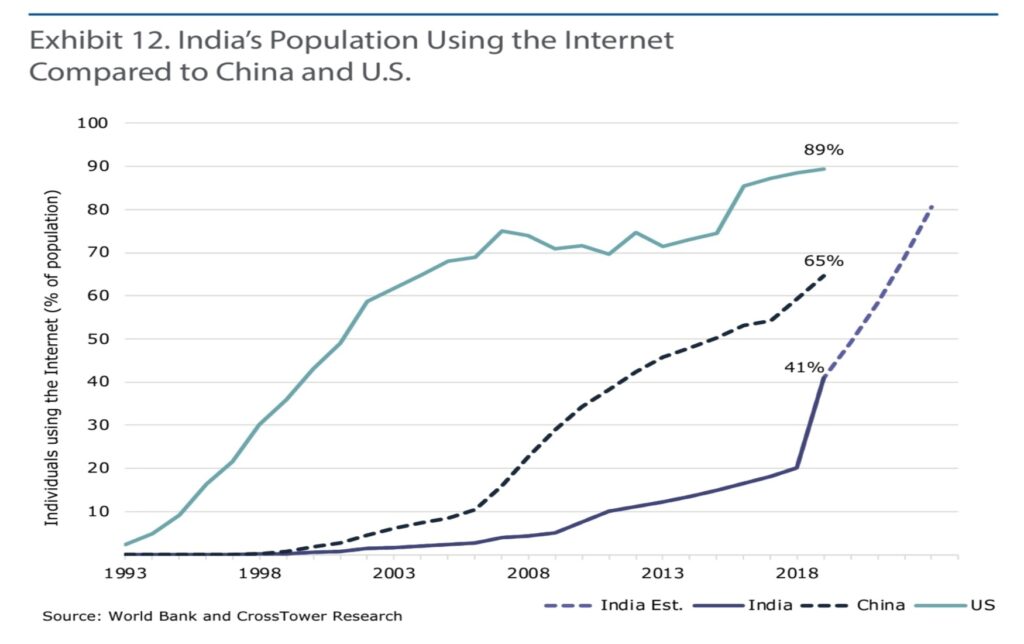

India is the ideal country for digital asset applications and projects given its tech-savvy population. This is demonstrated by its growing number of internet users and its large developer base. Internet usage in India is rapidly growing, as shown in Exhibit 12, with around 622 million internet users in 2020. Considering the recent 50% increase in the percentage of India’s population that used the internet between 2018 and 2019, we predict that this figure will again double within the next 2 to 3 years. The increase in internet usage has been driven by India’s rural population, which has seen 3x faster growth compared to its urban population. Access to smartphones has driven this increase, with researchers finding that almost all users actively access the internet through their mobile phone37. Furthermore, India’s internet users spend over six hours on the web per day, on average38. We estimate that the number of internet users in India will reach 1 billion as early as 2023, resulting in over 70% of India’s population having access to the internet.

Furthermore, online retail has seen massive growth in India. Currently 64% of transactions in India are happening in online marketplaces, the market size of which is projected to grow from $50 billion in 2018 to $200 billion by 202739. The average number of hours Indians are spending on social media is also increasing40. There is a growing trend in India with people preferring to do business both remotely and digitally. For such a change in behavior, better implementation of technologies, such as blockchain technology and digital assets, is vital for any future business model. The impact of the recent Covid-19 pandemic has also led to an increasing digitalization of India as a whole. This has led to the fostering of innovations in technology, specifically in keeping people connected and communicating, and was of pivotal importance in rural India. Notably, an EY survey found that health and human services (HHS) professionals in India were among the highest adopters of digital tech following the start of the Covid-19 pandemic, with 51% of respondents increasing their use of digital tech during this time41.

Over the last decade there has been an increase in the number of Indian citizens with access to an account with a bank or other financial institution. In 2017, 80% of the adult population had access to banking services and this is now believed to be 90%42. Adoption of digital assets and their applications, such as DeFi, can help further bridge this gap between the banked and unbanked and further develop India’s digital economy.

The digital asset sector in India is believed to currently employ approximately 50,000 people across areas such as trading, software development, and analytics43. In 2020, India had 2.8 million developers and is predicted to have 5.2 million by next year. This means India will have amongst the largest concentration of software developers in the world, overtaking the US, making it uniquely positioned to become involved in digital assets44. Nearly every digital asset f irm requires software engineers to help them launch applications, tokens, and interact with blockchains. There is currently significant demand for engineers that are f luent in blockchain programming languages, especially for those that can support Web 3.0 applications. India’s talented and technologically adept population could fill this unmet need and drive India forward as a hub for digital asset and blockchain development. Just as the US’ Silicon Valley was seen as an innovation hub during the technological revolution, India could become a global center for digital asset innovation. This will only inspire young Indians to view India as not only a global industry leader, but a place of great opportunity.

3.4 Entrepreneurial Culture and Ability

India’s position today as a startup hub has fostered a strong entrepreneurial culture among Indians, which could help them become leaders in the fast-growing digital asset industry. India’s business landscape changed considerably following the advent of the liberalization policy in 199145. Family businesses, which had dominated India’s economy, saw stiff competition from global competitors that had better technology and more managerial and financial resources. India’s response was to refocus initiatives towards business and competitiveness. Consequently, India’s government has been fostering businesses through campaigns such as MUDRA, Startup India, and Digital India46. So much so that in 2019 the India Brand Equity Foundation predicted that India would be one of the top 3 economic powers in the world within 15 years47.

India is especially positioned to take advantage of digital asset-enabled technology due to its entrepreneurial culture.

It is the 3rd largest startup ecosystem in the world, according to Startup India, home to approximately 50,000 startups in 2018. Of these, nearly 20% were technology startups48.

According to the Global Entrepreneurship Monitor, 20% of Indians aged 18 to 64 in 2020 intended to start a business within the next year. Moreover, a whopping 82% of Indians believed they had the required knowledge and skills to start a business, which compared to 61% globally. In addition, 83% of Indians saw good opportunities to start a firm in the area where they live, far above the global average of 51%49.

The IBM Institute for Business Values released a report in 2016 that detailed the findings of a survey of approximately 1,300 Indian executives. Their results showed that startups can take advantage of India’s unique attributes, such as its economical openness and skilled young, technologically adept workforce. The survey found that India’s entrepreneurship had grown dramatically, and that its startups are beginning to have a significant impact on the economy. In fact, new company registrations grew from 15,000 in the 1980s to 100,000 in 201050. Moreover, the average age of an Indian entrepreneur is only 28, ranking them some of the youngest in the world, and is a testament to India’s entrepreneurial spirit51.

Current State of Digital Assets in India

4.1 Investment and Ownership of Digital Assets

A total of $270 million of corporate funding has been invested in the digital asset sector in India, demonstrating growing investor appetite for digital assets. Around $6.6 billion has been invested into digital assets by over 15 million retail investors representing 1.8% of the population in India. Notably, 75% of digital asset investors in India are aged between 18 to 35 years old52.

With its young, technologically adept population, India is not only primed to take advantage of all the exciting opportunities that digital asset technology provides, but also to be a leading nation in further developing this burgeoning industry.

Digital assets are already gaining in hold in India. A recent Triple A report54 found that 7% of India’s population own digital assets. Moreover, a study by BrokerChoose found that India has the 5th largest rate of digital asset ownership worldwide at 7.3% of the population55. Such figures make sense given India’s young, tech savvy population, and demonstrate how well positioned it is to be on the forefront of Web 3.0 adoption.

In an October 2021 report from Chainalysis, India was ranked second in terms of digital adoption worldwide, just behind Vietnam. The study considered different metrics in its adoption index, including on-chain value received and on-chain retail value. It gave India an overall index score of 0.37, placing it ahead of the US, which received a score of 0.22. Chainalysis also ranked India 6th in the world regarding exploring the next generation of financial services56.

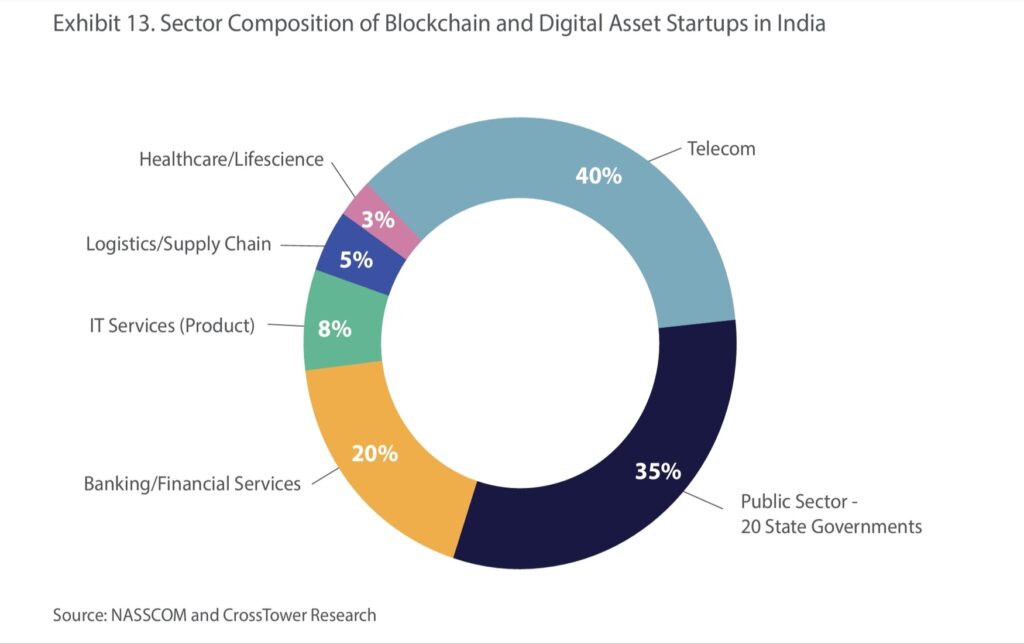

4.2 India’s Digital Asset and Blockchain Pilots

India is leading the way in terms of innovation with pilot studies and live projects being deployed throughout over 60% of India’s states that are adopting digital assets or related technology. We are seeing DeFi, tokenization, and NFTs being used for Chit fund operations, food distribution, citizen services, benefit distribution, and certification of ownership and achievement. In addition, smart contracts deployed on blockchains are being used for land title registration, agriculture supply chains, citizen digital health records, and citizen services57. Moreover, digital currencies and blockchain technology offer use cases in duty payments, remittances, insurance, and digital certification.

India has had several important blockchain and digital asset milestones already, including successful digital asset firms. One notable digital asset startup is Polygon, best known for its scaling solution for the Ethereum blockchain, whose core team is based in India. In March 2021, the Polygon token (MATIC) reached a market capitalization above $1 billion, bestowing it the achievement of reaching “unicorn status”. Two other Indian digital asset companies that have achieved unicorn status in 2021 are CoinSwitch Kuber and CoinDCX.

The Government of India has embraced digital asset technology when seeking to solve certain challenges. For instance, The Telecom Regulatory Authority of India has used distributed ledger technology to solve the problem of spam calls and messages58. Furthermore, the Ministry of Shipping has partnered with public blockchain firm CargoX59 to digitize bills of trade documents for Indian port operation via the countries’ Port Community System60. In addition, market regulator SEBI61 has mandated that blockchain or distributed ledger technology should be used to record and monitor the status of bonds and listed debt securities62.

The fact that leading countries such as India and others are running experiments with digital asset technology is a testament to the potential of the space. Yet, with digital asset applications still nascent, India has an opportunity to reap the benefits of transforming itself into a leader in this space by further embracing it today.

Policies That Will Benefit Digital Asset Adoption in India

5.1 Learning From the US’s Approach to Technology during the Internet’s Birth

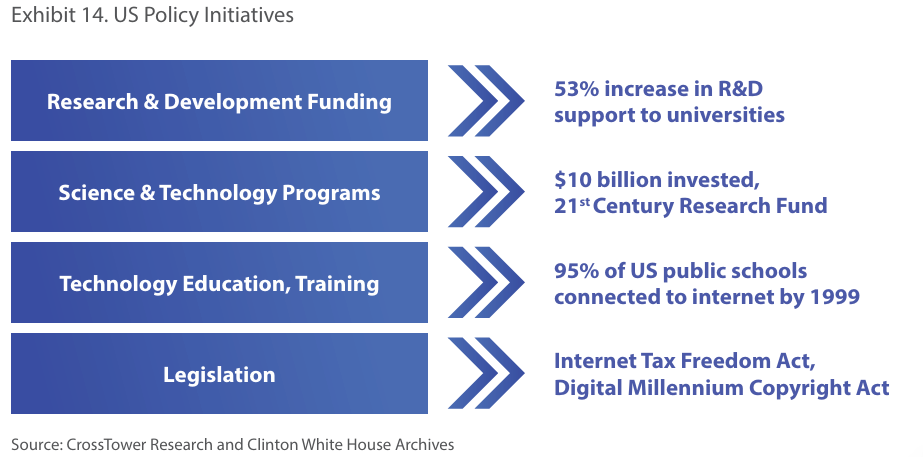

The US focused on four core pillars when it approached the development of the internet: Research & Development (R&D), Science & Technology Programs, Technology Educa tion and Training, and Legislation/Regula tion. While this should not be a prescriptive approach for India, it might be helpful for Indian regulators to understand what poli cies worked well when the US developed a framework for innovation with respect to the birth of the internet. We focused on the US’s approach because the framework led to the creation of companies such as Google and Amazon, while this same type of innovation did not occur, for example, in Europe. While it’s not dispositive that these pillars led to global internet companies like Google and Amazon, there is a strong likelihood that the right environment will foster the new genera tion of technology.

Research & Development

Before 1993, most of the US federal government’s R&D spending was allocated towards defense research. With the birth of the internet, the US government focused on civilian R&D spending, increasing it by 43%. Governments can act in a way that private companies cannot. Governments can support exploratory industry research, experimentation and innovation that is not possible for private companies. Private companies also generally do not approach their competitors to build and innovate. Therefore, it’s critical that the government have a role in funding development. The 53% increase in R&D support to universities $10 billion invested, 21st Century Research Fund 95% of US public schools connected to internet by 1999 Internet Tax Freedom Act, Digital Millennium Copyright Act US government partnered with private companies in pursuit of innovation, which enabled the private sector to generate new ideas and adopt novel technologies, which in turn led to commercial successes. Economists estimate that private rates of return on federal R&D spending averaged about 24%, and it had an overall economic “spillover” effect on the economy of 66%. Examples of US R&D included developing computers, semiconductors, aerospace, satellites, software, and superconductivity.

India is poised to get Web 3.0 jobs that pay significantly more than average wages. Similarly, the US government wrote in 2000:

Science & Technology Programs

The US invested in both science and technology, increasing America’s access to computers and the internet. Consequently, between 1993 and 2000, $10 billion was invested into a range of science and technology programs. One such was the 21st Century Research Fund, which trained the next generation of American engineers and scientists. It provided a major source of funding for US university research, especially in mathematics and computer science.

Science & Technology Programs

Improving technology access via education was another key pillar of US’s efforts. The Department of Education provided grants to train over 600,000 new teachers how to use technology in their classrooms. Moreover, the US government set the goal of ensuring every child is technologically literate and making home internet access as common as the home telephone. To do this, the US increased investing in educational technology and training by $746 million over the years 1993 to 2000, which resulted in 95% of US public schools being connected to the internet in 1999, up from 35% in 1994. This helped bring the percentage of public school classrooms connected to the internet from 3% in 1994 to 63% in 1999.

Legislation/Regulation

Finally, the US signed telecommunications reform legislation which lowered prices and increased the speed of innovative technology being deployed. The government also brought several internet friendly acts to law to enable America to take advantage of the technology revolution including the Internet Tax Freedom Act (3-year moratorium on Internet access taxes and taxes that discriminate against e-commerce, which was extended to 7 years), Digital Millennium Copyright Act (protecting America’s intellectual property in cyberspace), and the Electronic Signatures in Global and National Commerce Act (ensuring online contracts have the same laws as paper contracts). One interesting aspect about the legislation passed during that time was the Internet Tax Freedom Act. US Congress enacted the Internet Tax Freedom Act to establish a moratorium on the imposition of state and local taxes that would interfere with the free flow of interstate commerce over the internet. This was transformative because the lack of taxation permitted internet companies to flourish and develop to the point that when taxes were imposed, they facilitated state and local gains. By not applying taxes to young technologies, it helped these young companies grow.

India may want to create “core pillars” to foster the development of Web 3.0, certainly around R&D, science and technology programs, education, and appropriate legislation and regulation. Government funded programs for the industry, public/private partnerships, investments and facilitating educational programs, and training educators, could all be a part of the pillars of India’s program. Given the many coding languages of the multiple blockchains, India could develop coding programs in schools to help create new blockchain use cases. Innovation begets innovation, which attracts funding. If India is considered a hotbed of potential ideas and blockchain applications, inevitably funding dollars from the foundations of these blockchain companies themselves will naturally follow. Venture capital dollars will be attracted to the talent and new companies that emerge as well. It could add significant jobs and wealth and increase the quality of life of Indian citizens.

5.2 How Major Economies Have Approached

Digital Asset Regulation

United States

In the US, the dialogue related to the potential of Web 3.0 is in early discussions, and the focus by multiple potential regulators is developing. Most certainly, the US Congress is just beginning to consider the breath and potential for this technology. The dialogue in the US is very jurisdictionally focused, with regulators focusing on how to define the technology in order to obtain oversight. There is a turf war and regulatory jockeying to regulate the digital asset markets among the SEC, the CFTC, the IRS, the OCC, and individual US states. Under the US Bank Secrecy Act, FinCEN regulates money services businesses (MSBs) which include digital asset exchanges. The US Congress is generally seeking education and holding hearings. Most noticeably, the SEC has approved a Bitcoin fund to be offered to retail investors, but only a fund that trades underlying regulated derivative products. It remains to be seen what framework given the many different stakeholders at play in the US.

China

China has taken a strict approach to digital assets like cryptocurrencies. In 2021, it released a joint statement from its central bank and nine other government departments, that called for a crackdown on digital asset related activities. All digital asset related business activities, including digital asset exchanges, are deemed “illegal f inancial activities.” Both financial and non banking payments institutes are banned from providing any cryptocurrency-related services. The National Development and Reform Commission of China (NDRC) also issued a notice at the same time stating that the country will be cracking down on cryptocurrency mining, citing efforts to reduce carbon emissions. Consequently, this has resulted in Chinese cryptocurrency miners relocating operations to countries with more favorable digital asset policies, especially the US. That being outlined, it’s very difficult to gauge where China is with respect to Web 3.0, but they did launch their programmable CBDC.

UK

The United Kingdom’s approach to digital asset regulation post Brexit has been to allow its citizens to buy and sell digital assets. Starting in 2021, however, the Financial Conduct Authority (FCA) banned the sale of crypto derivatives to retail customers64. HM Revenue Customs, the UK tax authority, has updated its guidelines as recently as March 2021. Taxes on digital assets are based on trading activity and are subject to capital gains taxes when selling an asset, over the UK tax-free allowance. The UK set up a Cryptoassest Taskforce in 2018, which consists of HM treasury, the Bank of England, and the Financial Contact Authority. The Taskforce produced a report in 2018 on the layout of the UK’s policy and regulations towards digital assets and distributed ledger technology in financial services. HM Treasury guidance issued via the UK crypto taskforce in January 2021 called to bring certain digital assets under the scope of regulators and mentioned regulating stablecoins.

5.3 India’s Opportunity to Be a World Leader in Web 3.0

As other jurisdictions are grappling with appropriate digital asset frameworks to put into place, India has an opportunity to implement effective and forward-thinking policies and pillars to put it ahead of other countries when it comes to the digital asset revolution. India, being as technologically savvy as it is with as many coders as it has, may have the ability to see the promise of Web 3.0. India could create several core pillars around R&D, science and technology programs, education, and appropriate legislation and regulation. It may consider taking the “big-picture” approach, both directly investing in the industry and supporting companies by creating a favorable environment for them. It may also bring together public/ private partnerships to develop the technology that will both promise growth and protection of Indian citizens.

India’s government may want to consider focusing on its current digital asset and blockchain pilot projects, in schools, with universities, with direct government investments and with public private partnerships. Giving that blockchain technology is still relatively new, many of its potential use cases are yet to be discovered. Already, India is experimenting with NFT certification for school exam certification, a blockchain based health care system, and tracking the supply chain via blockchains to allow real time monitoring of the process. By experimenting with blockchain on multiple fronts, India stands to become a first mover in unlocking the potential of such technologies.

Conclusion

If India grabs the opportunity now to implement the right policies to foster digital asset innovation, it could see its own watershed moment. With its young and tech-savvy population, which is arguably the ideal demographic to understand and use digital assets and their applications, India may be the best situated country in the world for digital asset adoption. Moreover, its status as a startup hub and the entrepreneurial drive of its people makes it likely that India will see great success from encouraging digital asset adoption and business. While we estimate the potential economic value of digital assets to be $1.1 trillion through 2032, this could well be conservative. The digital asset industry could see growth that is far more explosive, given how revolutionary it is. Just like the internet, digital assets stand to impact most, if not all, industries. In fact, we believe the potential impact of digital assets is much larger than that of the internet. To seize the prosperity that digital assets can bring, India must take appropriate actions now.

DISCLOSURES

The research team may own the cryptocurrencies mentioned in this report, and as such this should be seen as a disclosure of any potential conflict of interest. This report belongs to CrossTower and represents the opinions of its research team.

This report does not provide legal advice. People should do their own research as to whether the entity that they are utilizing for purchases or sale has appropriate licenses and registrations. In general, people should consult their tax, legal and other advisers as to the risks involved in investing in digital assets.

CrossTower does not receive compensation from the companies, entities, or protocols they write about. Compensation is not received on any basis contingent upon communicating a positive opinion in this report. The authors were not hired by the covered entity to prepare this report. CrossTower did not receive compensation from the entities covered in this report for non-report services, such as presenting at author sponsored investor conferences, distributing press releases or other ancillary services. The entities covered in this report have not previously paid the author in cash or in stock for any research reports or other services. The covered entities in this report are not required to engage with CrossTower.

The research team has obtained all information herein from sources they believe to be accurate and reliable. However, such information is presented “as is,” without warranty of any kind whether expressed or implied. All market prices, data and other information are not warranted as to completeness or accuracy, are based upon selected public market data, reflect prevailing conditions, and the research team’s views as of this date, all of which are accordingly subject to change without notice. CrossTower has no obligation to continue offering reports regarding this topic.

Reports are prepared as of the date(s) indicated and may become unreliable because of subsequent market or economic circumstances. The graphs, charts and other visual aids are provided for informational purposes only. None of these graphs, charts or visual aids can and of themselves be used to make investment decisions. No representation is made that these will assist any person in making investment decisions and no graph, chart or other visual aid can capture all factors and variables required in making such decisions.

Endnotes

- https://www.coingecko.com/en/global_charts

- https://www.startupindia.gov.in/content/sih/en/international/go-to-market-guide/indian-startup-ecosystem.html

- https://www.gemconsortium.org/economy-profiles/india

- https://economictimes.indiatimes.com/news/politics-and-nation/india-has-worlds-largest-youth-population-unreport/articleshow/45190294.cms

- https://goremotely.net/blog/how-many-software-engineers-are-there/

- https://companiesmarketcap.com/tech/largest-tech-companies-by-market-cap/

- https://grayscale.com/wp-content/uploads/2021/11/Grayscale_Metaverse_Report_Nov2021.pdf

- https://twitter.com/woonomic/status/1334809917211873285/photo/1

- https://twitter.com/visbitcoin/status/1359267589973803008

- https://www.businesswire.com/news/home/20210310005386/en/Global-Financial-Services-Market-Outlook

- https://loupfunds.com/the-1-trillion-nft-market/

- https://pwc.blogs.com/technology-insights/2021/05/reviving-loyalty-reward-cards-with-blockchain.html

- https://www.pymnts.com/blockchain/2021/using-blockchain-to-improve-cross-border-remittances/

- https://www.ibtimes.co.uk/stellar-connects-icici-bank-offers-cross-border-payments-india-africa-philippines-1595052

- https://www.businesswire.com/news/home/20180801005064/en/Juniper-Research-Blockchain-Deployments-Save-Banks-27bn

- https://tracxn.com/explore/Blockchain-in-Financial-Services-Startups-in-India

- https://centrifuge.io/

- https://cointelegraph.com/news/tokenized-real-estate-market-could-hit-1-4t-despite-a-slow-start-report-claims

- https://www.cbinsights.com/research/report/blockchain-trends-q3-2021/

- https://medium.com/avalancheavax/avalanche-foundation-launches-fund-worth-over-200m-dedicated-to-supporting-ecosystem-development-799b34304f0e

- https://www.binance.org/en/blog/binance-launches-one-billion-binance-smart-chain-fund-to-reach-one-billion-crypto-users/

- https://algorand.foundation/news/viridis

- https://www.statista.com/statistics/882293/india-startup-deals-value/

- https://www.globaldata.com/indian-startups-next-chinese-counterparts-apac-us16-9bn-vc-funding-january-july-2021-reveals-globaldata/

- https://blog.trade.gov/2020/02/05/fdi-in-high-tech-innovation-and-growth-in-the-united-states/

- https://www.reuters.com/technology/indias-cryptocurrency-platform-coinswitch-kuber-raises-over-260-mln-2021-10-06/

- https://www.cnbc.com/2021/08/27/india-central-bank-rbi-digital-rupee-trials-could-begin-by-december.html

- https://data.worldbank.org/

- https://worldpopulationreview.com/country-rankings/median-age

- https://censusindia.gov.in/2011census/C-series/C-13.html

- https://www.g20.org/about-the-g20.html

- https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?locations=IN

- https://images.assettype.com/afaqs/2021-06/b9a3220f-ae2f-43db-a0b4-36a372b243c4/KANTAR_ICUBE_2020_Report_C1.pdf

- https://www.statista.com/statistics/718575/india-time-spent-online-by-activity/

- https://www.ibef.org/download/E-Commerce-July-2020.pdf

- India Digital Payments: 2020 Country Adoption Report

- https://www.livemint.com/technology/tech-news/india-among-highest-adopters-of-digital-tech-during-pandemic-ey-survey-11616049834484.html

- https://globalfindex.worldbank.org/sites/globalfindex/files/chapters/2017%20Findex%20full%20report_chapter1.pdf

- https://nasscom.in/knowledge-center/publications/cryptotech-industry-india-decentralized-systems-centerstage-digital

- Cryptotech Industry in India- Decentralized Systems at the Center stage of Digital Evolution

- Triple A’s Digital Asset Across the World report

- https://goremotely.net/blog/how-many-software-engineers-are-there/

- Jain, K. (2011). Indian entrepreneurship and challenge to growth. Ivey Business Journal, 75(5), 9. https:// iveybusinessjournal.com/publication/indian-entrepreneurship-and-the-challenges-to-indias-growth/

- https://www.researchgate.net/publication/346927810_Entrepreneurial_Culture_in_India_A_Comparison_with_the_BRICS_Economies

- https://www.ibef.org/uploads/IBEF_Annual_Report_2019-20.pdf

- https://www.startupindia.gov.in/content/sih/en/international/go-to-market-guide/indian-startup-ecosystem.html

- https://www.gemconsortium.org/economy-profiles/india

- https://d1iydh3qrygeij.cloudfront.net/Media/Default/New%20release%20images%20and%20reports/Entrepreneurial%20India%20IBV%20mid%202016.pdf

- https://www.oxfordeconomics.com/recent-releases/Entrepreneurial-India

- https://brokerchooser.com/education/crypto/crypto-countries

- https://go.chainalysis.com/rs/503-FAP-074/images/Geography-of-Digital-asset-2021.pdf

- https://www.ledgerinsights.com/how-it-works-india-anti-spam-telecoms-blockchain/

- https://cargox.io/press-releases/government-india-drives-digitalization-bill-lading-and-trade-documents-portall-and-cargox/

- https://indianpcs.gov.in/IPA_PCS/

- https://www.sebi.gov.in/

- https://www.ledgerinsights.com/india-securities-regulator-sebi-mandates-blockchain-to-track-bond-status/

- https://clintonwhitehouse4.archives.gov/textonly/WH/New/html/20000615_2.html

- https://www.fca.org.uk/news/press-releases/fca-bans-sale-crypto-derivatives-retail-consumers