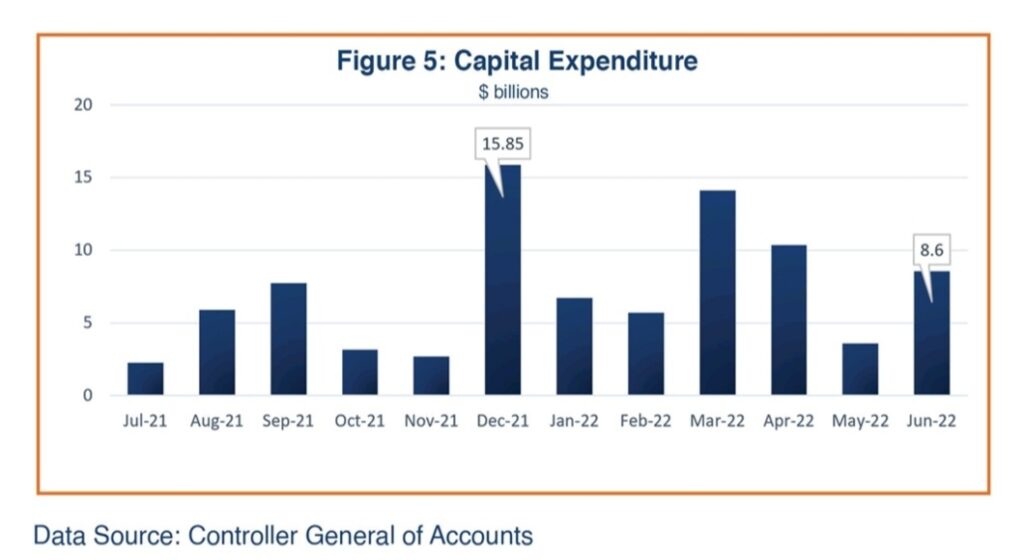

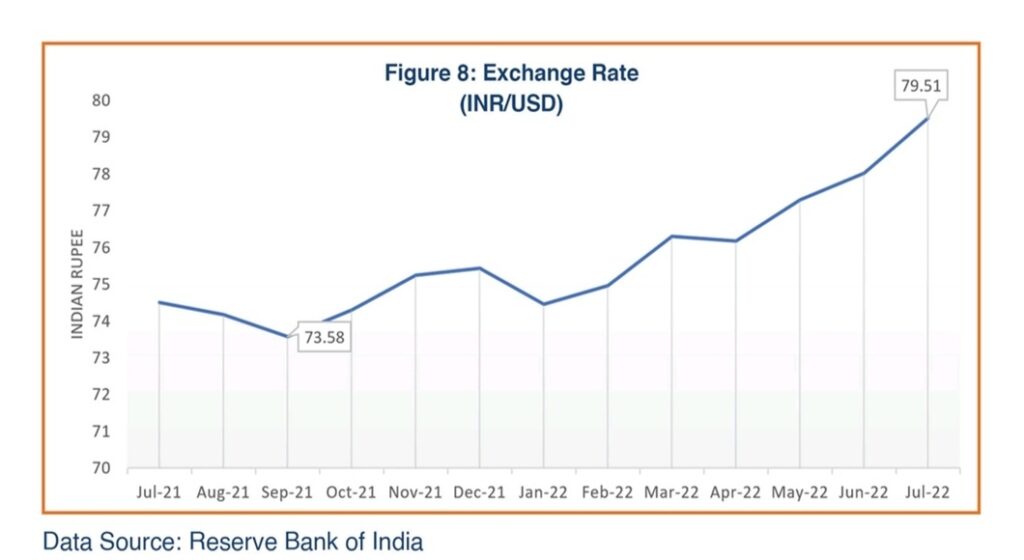

India witnessed an overall upturn in economic activities during July 2022 backed by rising manufacturing activity and a more-than-expected industrial growth, though inflationary pressures continue to impact demand-supply balance. India’s central bank, the Reserve Bank of India (RBI), has responded by raising repo interest rates three times since May 2022 to tackle the inflation challenge and is expected to continue intervening until the inflation rate comes below the target ceiling of 6%. The predicted “normal” monsoon this year is expected to accelerate agricultural growth. While food inflation is moderating in response to policy measures, the problems of non-food inflation and a high trade deficit (the most important component of current account deficit) are constraining greater economic activity. The Indian rupee dived to its lowest point ever against the US Dollar in July and foreign exchange reserves also dipped due to a higher import bill. That said, the business sentiment so far seems positive on news of softening oil prices globally, though it remains uncertain due to continuing disruptions from the Russia-Ukraine conflict and COVID, and the onsetting of global recessionary pressures.

Retail businesses reported sales value gained 18% over the pre-Covid July 2019 value. Passenger vehicle sales picked up about 7% from the previous month. On the supply side, the Markit Purchasing Managers’ Indices (PMI) for Manufacturing was up, but the PMI for Services was down significantly from the previous month. The Composite PMI also moved downwards a tad from June but remained above 50 points, indicating continued expansion in business transactions, albeit at a slower pace. The overall unemployment rate was down to 6.8% from the previous month’s 7.8%, mainly on account of recovery in agriculture activities during the monsoon season.

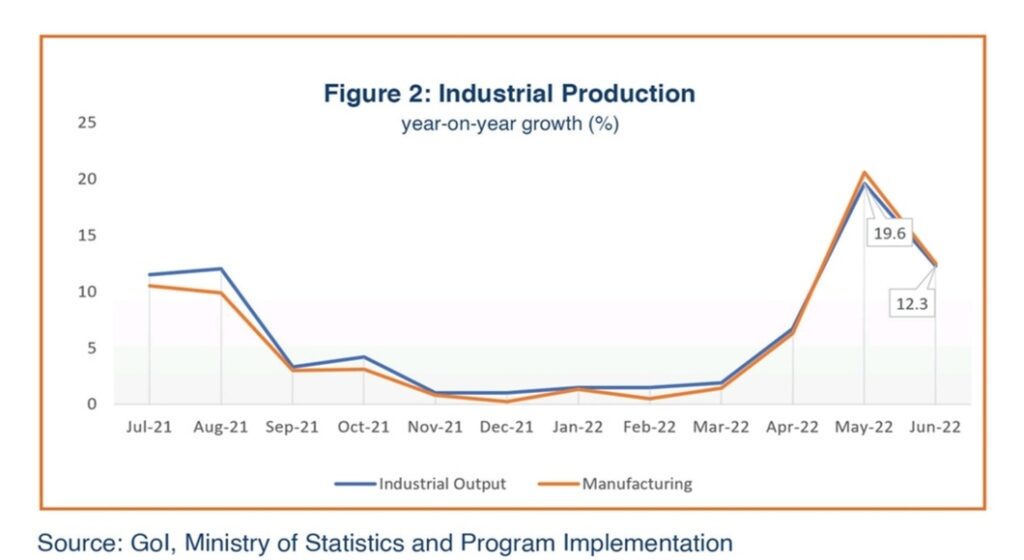

Goods and Services Tax (GST) collections were decent in July in rupee terms, reflecting an uptick in industrial transactions and increase in tax compliance; however, monthly collections in dollar terms appear lower due to depreciation in the currency.

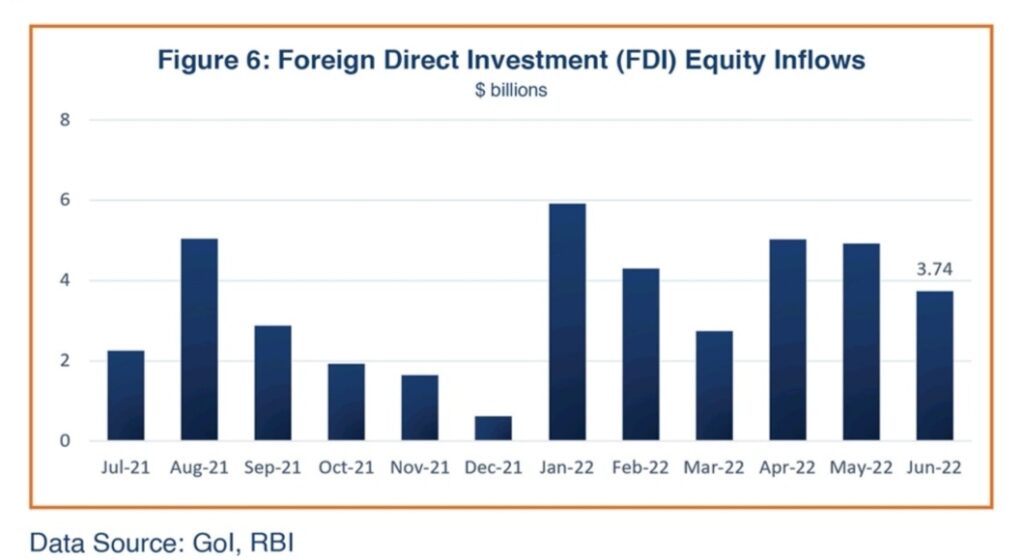

On the external side, as expected, India’s foreign trade performance in July was not so impressive compared with the last several months; merchandise exports dropped about 10% from the previous month, while imports were almost stable resulting in record high trade deficit. The FDI equity inflows in May 2022 (latest available data) witnessed a downward revision to $5 billion from the previously reported $7 billion. India’s foreign exchange reserves, though still high, have been affected by macroeconomic uncertainties, slipping to around $574 billion in July while the Indian rupee fell by nearly 2% against the US dollar.

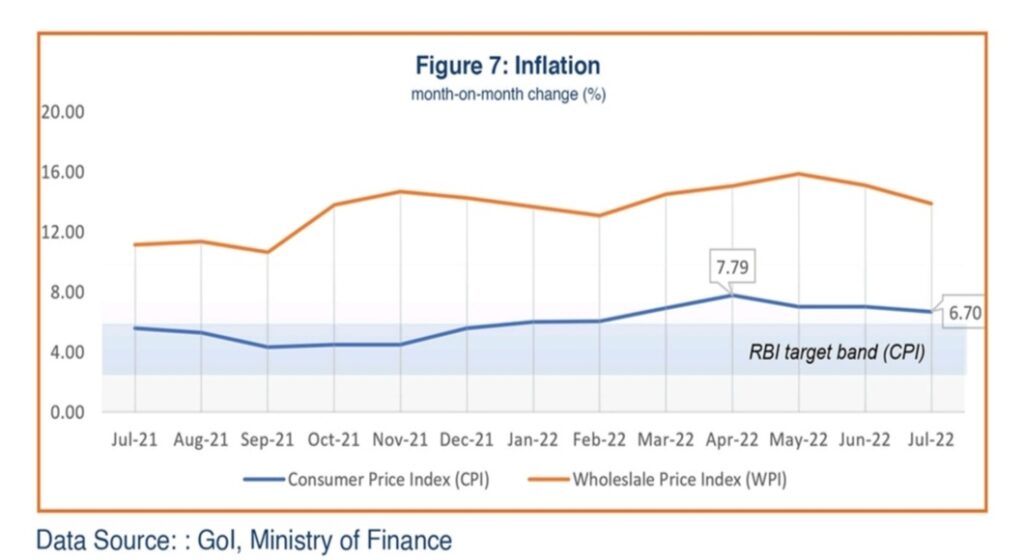

Softer food prices and lower global edible oil prices moderated the overall consumer price index (CPI) to 6.7% in July 2022 from the previous month’s 7.01%; however, non-food inflation continues to remain a concern. The CPI is still above the RBI target ceiling of 6.0%. The wholesale price index (WPI) dropped to 13.9% in July from the previous month’s 15.1%, but input costs remain an issue for manufacturers.

India’s corporate sector has reportedly shown optimism upon the easing inflation. The near-term economic growth outlook for India remains uncertain on account of global inflationary pressures, COVID cases, continuing supply chain disruptions, and mounting fear of global recessionary conditions, but long-term growth prospects remain strong once international energy and commodity prices stabilize. The RBI, IMF, World Bank and ADB have all revised downward their estimates for India’s GDP growth, to the 7.2-7.5% range for FY 2022-23, considering the continuing uncertainties. The government’s fiscal and RBI’s monetary policies will determine the pace of recovery for the Indian economy.

Demand Recovery Trends

Retail sales in July 2022 showed an overall uptrend in consumption demand. Vehicle sales were up almost 7% from the previous month. RBI reported bank credit growing 14.5% at the end of July, compared with 13.16% in June, pointing to the sustained demand for credit. The monthly survey by the Retailers Association of India (RAI) reported 18% higher sales during July compared to the pre-pandemic sales recorded for July 2019. A steady increase in sales was visible across all sectors but the RAI survey points out that retail business is exhibiting healthy growth (and has now reached pre-covid levels) and important retail categories like clothing and footwear are showing strong traction among the consumers. Passenger vehicle sales in India jumped 6.6% percent from the previous month to 293,865 units in July 2022, after a 9.9% gain in June; however, the recent round of monetary tightening has raised interest rates and made auto loans costlier, potentially affecting sales going forward.

Supply Side Dynamics

Input Purchases

The overall business sentiment in July 2022 improved slightly from June. The Composite Markit Purchase Managers Index (PMI) slid to 56.6 (from 58.2 in June), though remains above 50, reaffirming the expansion in economic activity (Figure 1). A PMI above 50 reflects the optimistic mood of businesses that have made bold input purchases in anticipation of increased demand. The Services index was down for the first time in several months, falling considerably to 55.5 in July from 59.2 in the previous month despite opening of contact-based activities, probably due to the persisting inflationary pressures. The market expected a PMI for services at 58.5.

The PMI for Manufacturing was higher than expected, at 56.4 compared with 53.9 from in June, indicating continued growth in factory activities. Manufacturing PMI turned to expansion mode in July 2021 and has consistently remained above 50 since then, showing a sustainable expansion pattern in production activities and recovery across the manufacturing sector. Output expansion in July was the fastest seen since November 2021. Input price inflation eased to the slowest pace in five months on declining fuel prices. Manufacturing activity in July saw a drop in export production due to lower global demand as signs of recession are appearing. S&P Global reports that employment increased fractionally, although government data on the unemployment rate shows a decline to 6.8% from 7.8% in the June, primarily due to an increase in agricultural and rural activities in the monsoon season.

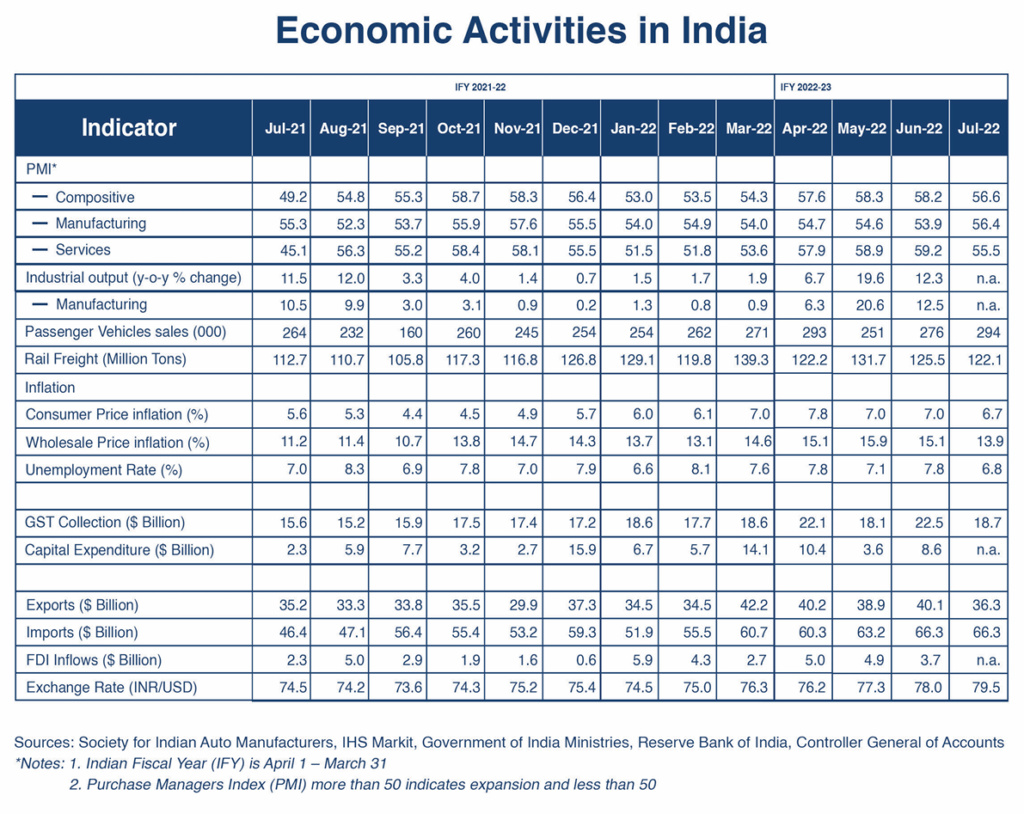

Industrial Production

Total industrial production continues to advance compared to last year, rising by 12.3% year-on-year in June 2022, followed by a robust 19.6% growth in May (Figure 2). Impressive growth across all segments, albeit slower compared to the previous month, generated the growth in industrial production.

Manufacturing, which accounts for 77% of total industrial production, increased 12.5% year-on-year in June, albeit softer than the 20.6% of the previous month; mining, which comprises 14% of total industrial output, rose almost 7.5% year-on-year in June, compared with the growth rate of 11% of May, and the growth rate in electricity production (8% of total industrial production), at 16.4%, was down compared to the 23.5% achieved in May. Capital goods production within the manufacturing sector showed a significant 26% Y-O-Y growth in June 2022, implying growth in investment; however, the recovery in this segment is relatively slower as the result was only slightly higher than the corresponding period of FY 2019-20.

A rise in industrial production growth is indicative of positive strides in India’s economic recovery, but high input costs and unfavorable geopolitical trends hobble the sustainability in growth. Happily, there have been recent signs of a reduction in global oil prices, which can benefit manufacturing by way of reduced input costs while helping cut in overall inflation.

GST Revenues

Changes in the value of Goods and Services Tax (GST) collection are an indicator of business transactions and increased tax compliance. The GST collections for July 2022 were up in rupee terms, but down in dollar terms to $18.7 billion, due to the 2%-rupee depreciation during the month (Figure 3). Analysts have indicated that GST collections are more or less stabilized, aligned to the positive trajectory in economic activities.

Trade

As expected, India’s merchandize exports value dropped to $36.3 billion in July 2022, falling almost 10% from the previous month’s $40.1 billion (Figure 4). India’s export story had so far in the year remained very positive; however, amidst fears of a global recession and suppressed demand, exports have started showing downward trends. Engineering items, gems and jewelry, and plastics all witnessed a fall while chemicals and electronics exports recorded impressive growth rates. The Ministry of Commerce estimates total services export for July at almost $25 billion. The Federation of Indian Export Organizations has reportedly said that signs of a likely slowdown in exports are visible as global inventories are high and the global demand is on the decline.

India’s merchandize imports were static at $66 billion in July 2022. The rise in energy commodities, such as natural gas, coal, and metals (such as gold), have mainly contributed to the ballooning import bill of India for the last several months. India is the world’s third largest importer of crude oil. Imports of crude and petroleum products alone accounted for nearly one third of India’s total imports during July; in addition, imports of coal, coke and briquettes also shot up.

India’s elevated trade deficit continues to remain a cause of concern as it is a major component in the country’s current account deficit (CAD) and can impact the macroeconomic balance. The Ministry of Commerce has started close monitoring of imports in an effort to contain the rising CAD and maintain the country’s macroeconomic balance.

The RBI in June allowed global trade settlements in rupees to facilitate trade with countries that are subject to sanctions. Indian policymakers expect India’s exports of certain commodities, such as tea, will grow to Russia and Iran, and cheaper oil imports from Russia will also be easier under the new mechanism.

Government Spending

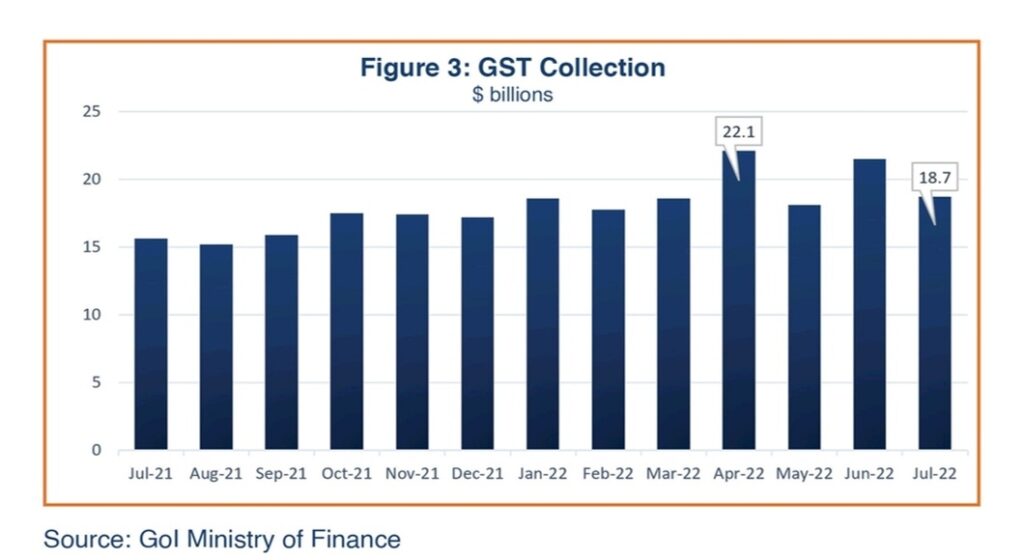

Capital expenditure has been showing mixed trends since January 2022 (Figure 5). The Finance Ministry officials earlier pronounced their commitment to planned capital expenditure, noting it will catalyze the country’s economic growth in the remaining months of the year despite inflationary challenges and the surging import bill; meanwhile, the government will manage non-capital expenditures, such as wages and subsidies, to avoid fiscal slippage. The government in its latest monetary policy stated that the Gol is not planning to slash the fertilizer subsidy rates now, despite having to bear the elevated burden. The government’s fertilizer subsidy bill is expected to exceed its FY23 budget estimates due to the higher global prices.

Foreign Direct Investment

Foreign direct investment (FDI) equity flows showed mixed trends throughout the previous fiscal year. According to the latest data released by the Department of Industrial Policy and Internal Trade (DPIIT), in FY2021-22, FDI equity contracted marginally, by 1%, to $58.8 billion. However, total foreign direct investment (including equity inflows, reinvested earnings, and other capital) into India rose by 2%, peaking at $83.7 billion in 2021-22. The first month of the new fiscal 2022-23 (April 2022) witnessed India attracting $5 billion in FDI inflows, followed by an additional $4.92 billion in May and $3.74 billion in June (Figure 5).

Inflation

The overall inflation trajectory remains volatile given changes in international commodity prices. The consumer price index (CPI) slid by a few points to 6.71% in July 2022 from 7.01% recorded in June, but it remained above the RBI’s inflation target ceiling of 6.0% for the seventh month in a row (Figure 6). While food prices have moderated and global edible oil prices have come down in India, worries about non-food inflation persist among government circles; the supply-chain disruptions owing to the ongoing geopolitical factors and increasing global inflation rates are constantly pushing up domestic inflation. The RBI continued to give priority to price stability by raising the benchmark policy repo rate by additional 50 basis points in its July policy meeting. The RBI has increased the repo rate three times in the last six months to deal with mounting inflationary pressure. Raising interest rates typically restrain demand in the economy, thereby helping inflation to decline; however, a prolonged period of high interest rates runs the risk of recessionary conditions in the economy.

Wholesale Price inflation moderated to 13.9% in July from 15.1% in June, but it has remained at a very high level for more than a year now, impacting inputs costs for manufacturers. Persistent high oil prices in the international market also continue to impact output growth.

Foreign Exchange

India’s foreign reserves were estimated at $574 billion at the end of July 2022. The RBI has sold more than $40 billion so far through a mix of spot and forward-market interventions to support the depreciating Indian rupee against the US Dollar. The rupee crossed the peak of 80/USD in July 2022; however, it gained strength towards the end of the month. Persistent foreign fund inflows into capital markets and softening crude oil prices boosted the local currency. The average monthly exchange rate for July was INR 79.51/USD (Figure 8). The rupee has lost nearly 8% against the US Dollar since January, mainly due to a rise in global crude oil prices, a strengthening dollar and continuing foreign capital outflows from India. Forward contracts have so far helped maintain India’s foreign exchange reserves over the last three months in the face of rising imports. The RBI’s June announcement allowing global trade in rupees may help enhance foreign exchange inflows and stabilize the rupee going forward.

Economic Outlook

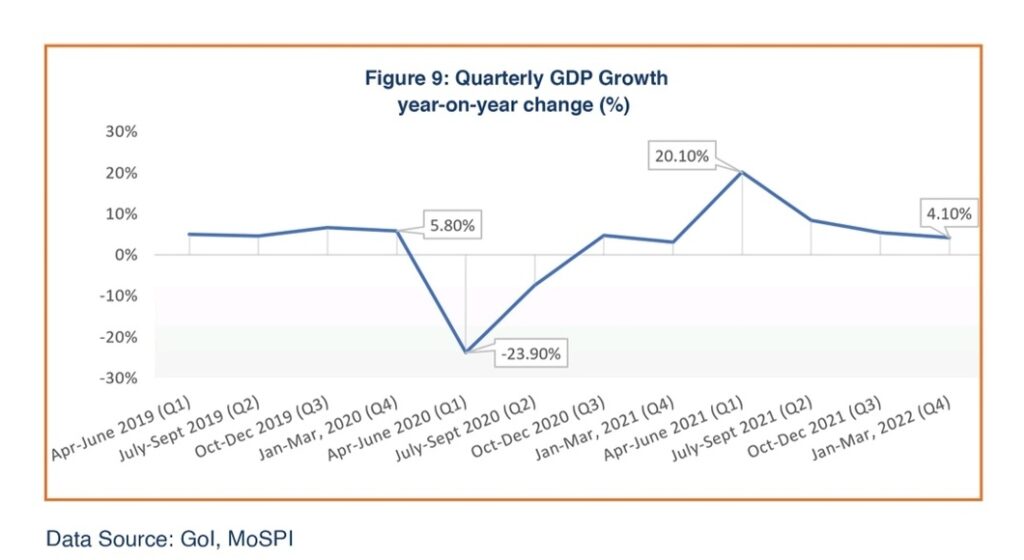

The government’s GDP growth data for the last quarter of Indian Fiscal Year (IFY) 2021-22 (January-March 2022), released in May, showed slower growth of 4.1% on the back of the inflationary pressures, Omicron coronavirus impact, and the supply disruptions caused by the Russian invasion of Ukraine. The government estimates overall GDP growth for IFY 2021-22 at 8.7%, compared with the contraction of 6.6% recorded in IFY 2020-21. These numbers confirm that all GDP segments have emerged stronger than their pre-Covid levels, showing sustained momentum of economic activity for most of FY 2020-21.

In view of the continuing uncertainties of the pandemic, Russia-Ukraine crisis, supply chain bottlenecks, international fuel inflation, and slower global growth, the RBI, and other observers such as the IMF and World Bank, have revised India’s GDP growth estimates downwards to the 7.2-7.5% range for FY2022-23. The RBI has also raised its inflation projections to 6.7% for the current fiscal year, while the government has pronounced its intention to manage inflation without reducing the capital expenditure.

The Indian corporates have reportedly shown their optimism over the softening CPI and international prices of fuel, fertilizers, and edible oils. Businesses have stayed afloat despite rising input and logistics costs. Industrial and manufacturing activities have sustained on the positive trajectory and capital expenditure by the government is also rising. Consumer demand seems to be improving as the festival season is onsetting in India. However, crude prices will likely make a significant difference on the performance of the economy as India’s external sector components in the GDP can prove to be spoilsport and it is important that the policymakers address the problem of expanding trade deficit.

Major economies around the world, including India, face challenges of inflation and currency depreciation, but RBI officials have noted that India is relatively well placed to deal with these challenges because of its stable financial sector and its vaccination success, which enablied the economy to reopen. Finance Ministry officials have noted that India’s medium-term growth prospects remain bright as capacity expansion in the private sector is expected to drive capital formation and employment generation for the rest of this decade. Nonetheless, the economic growth outlook for India continues to remain uncertain currently and will be influenced by how the global geopolitical scenario unfolds.