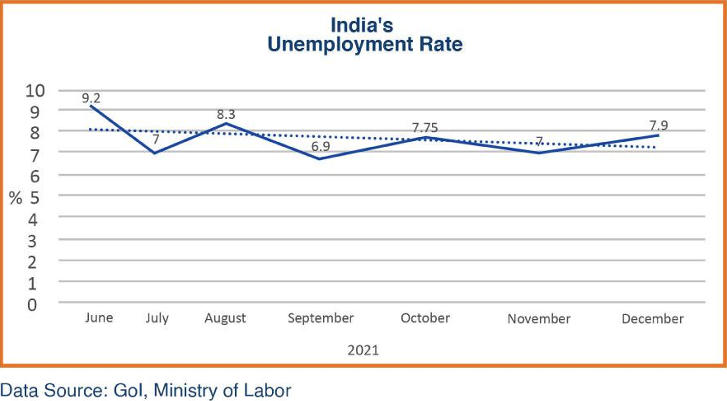

Economic activity continued to expand in December 2021, albeit at a slightly slower pace than previous months. Both, economic activity, and consumer sentiment took a hit during the latter part of December 2021 after a rise in cases of the Omicron coronavirus and the resultant caution-measures/restrictions in many states. Economists are skeptical about the durability of the economic recovery witnessed during the last three months of 2021, mainly due to the third wave of the pandemic in the country that may worsen income levels in the informal sector. While the Reserve Bank of India (RBI) has not changed its full-year growth forecast from 9.5%, Governor Shaktikanta Das has alerted caution, saying “it is too premature to gauge”. According to the Government of India (Gol) Statistics Department, the economy is expected to grow at 9.2% in IFY 2021-22, lower than the 9.5% estimated by the IMF as well as the RBI. The World Bank sticks to its forecast of 8.3% GDP growth for India for IFY 2021-22, keeping in view the rising risk from the Omicron variant and the needed revival in private capital expenditure

Demand Recovery

Changes in passenger vehicle and retail sales (household consumption) reflect increasing demand patterns, probably due to the pandemic-driven safety measures, such as increased use of health foods, hygiene/immunity-building nutrients/digital products and personal mobility preferences. The month of December is usually viewed as a high vehicle sales month in India because of the attractive discounts that are usually offered around this time; but it was not the case this year, probably due to the continuing semiconductor shortage in the passenger vehicle segment. While the December 2021 passenger vehicle sales in India grew nearly 4% from the previous month, the sales fell 8% from the December 2020 level.

On the retail side, a recent survey by the Retailers Association of India (RAI) has reported a 26% rebound in retail sales in December 2021 compared to December 2020, and a 7% rise over the pre-pandemic December 2019. That said, the RAI survey has also highlighted a slowdown in sales towards the end of December 2021 due to the increasing cases of the Omicron virus. With many Indians now shopping online rather than visiting the marketplace physically due to the continuing pandemic threats, the Indian e-commerce sector has witnessed an increase. According to the NASSCOM (a trade body and chamber of commerce of the Indian tech industry), despite COVID-19 challenges/disruptions, India’s e-commerce market continues to grow at 5%, with expected total sales of $56.6 billion in 2021. Momentum in consumption is also reflected in the bank credit data released by the RBI, which rose 9.2% on Year-on-Year basis on December 31, 2021, compared with the 6.6% growth seen on December 31, 2020.

Supply Side Dynamics

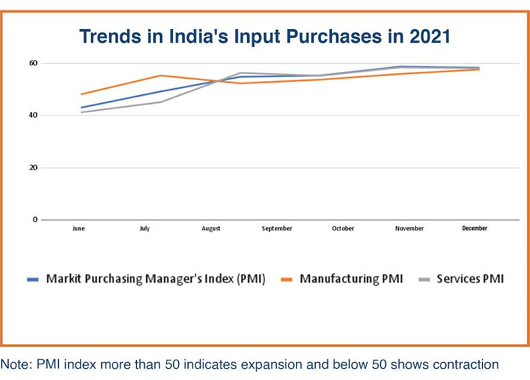

The sustained increase in economic activity and demand is reaffirmed by a steady rise in the Markit PMI Manufacturing Index which reflects the mood of businesses that have made input purchases in anticipation of increased demand. The overall PMI in December 2021 fell to 55.5 from the November 2021 level of 58.3, indicating slower but still relatively strong growth. (PMI index more than 50 indicates expansion and below 50 shows contraction.) India’s Services Business Activity Index fell to 55.5 in December from 58.1 in November; the overall Manufacturing Activity Index also slipped to 55.5 in December 2021 from the peak of 58.7 in November 2021.

Services activities have restored to a positive growth trajectory since August 2021 and manufacturing activities have been expanding for the last six months. According to the Markit index analysis, India’s manufacturing sector activities moderated in December 2021, but the output remained on the growth trajectory, with slower rise in sales and new orders due to the suspected supply-chain disruptions and inflationary pressures. In December 2021, the input cost inflation was still running at one of its highest rates in more than seven years, but most of the businesses, per the HIS Markit Survey, have decided to keep their selling prices unchanged to boost sales, with overall charges up only marginally in December. Manufacturers remain optimistic that output would continue to increase in 2022.

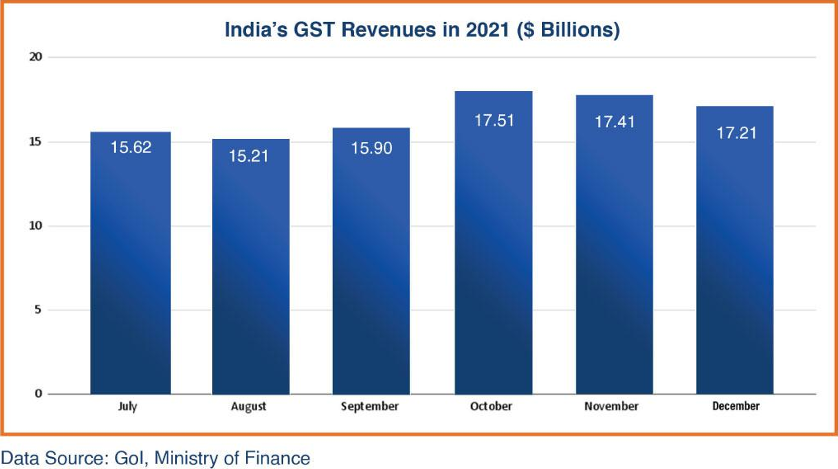

Changes in value of Goods and Services Tax (GST) collection is considered an indicator of business transactions. The GST revenue collections for December 2021 appear marginally down to $17.2 billion from November level of $17.4 billion in dollar terms, probably due to a higher Rupee to USD exchange rate. GST collections are reflecting an upward trend, in tandem with the restored economic activity. The GST revenues have so far been maintained; however, with Omicron-driven uncertainty, specific segments of services may be impacted, leading to lower GST collections in coming months.

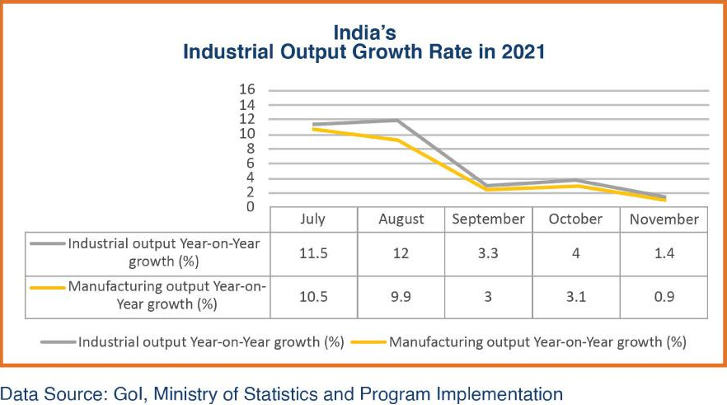

Industrial production in India increased 1.4% year-on-year in November 2021, dropping from 4% growth of October 2021; it was the slowest growth rate since March 2021. Production in November 2021 slumped in all sectors compared with the previous month, namely manufacturing (0.9 percent vs 3.1 percent), mining (5 percent vs 11.5 percent) and electricity (2.1 percent vs 3.1 percent). The pick-up in production in core industries during the last several months raised hopes of a stronger revival of industrial growth; however, a less-than expected performance of the manufacturing sector (that accounts for more than 77% in the industrial output) coupled with a 3.6% contraction in capital. goods production, has moderated the expectations of the industrial sector for December 2021.

Rail freights volume at 126.78 million tons also increased 8.5% from November 2021, recording more than 7% year-on-year growth.

Government efforts to bolster growth

In September 2021, the Gol announced expenditure plans of more than $11 billion for a production-linked incentive (PLI) scheme for automobile/drone industries/consumer goods/Solar Modules and for various export promotion schemes. On December 15, the Gol approved a more than $10 billion PLI scheme to boost semi-conductor production over the next six years as a part of an effort to make India a global hub for the design and manufacturing of electronic systems. With the implementation of these plans, the escalated government spending is expected to boost India’s manufacturing and export capabilities. While the upcoming Budget announcement for IFY 2022-23 on February 1, 2022, is expected to focus on fiscal consolidation, an increased spending on infrastructure can help revive the demand in the economy and relieve the impact of the pandemic on the economy.

Trade Trends

India’s exports posted a 5% increase in October 2021 on top of 1.5% growth of September 2021. However, November witnessed a drop of 15.7% in exports activity. India shipped out goods worth $37.3 billion in December 2021, recording an impressive month-on-month 24.8% growth the highest ever in a month as the global demand increased after many countries eased the travel restrictions. The Government of India has set a target of $400 billion in exports for FY22. During the IFY 2021-22 so far (April-December 2021), exports have grossed nearly $300 billion. India’s target of $400 billion of merchandize exports seems achievable if the growth momentum continues. India’s merchandize imports were $59.3 billion in December 2021, up from $53.15 billion from the previous month The uptrend in imports reflects the increase in industrial activities in the country.

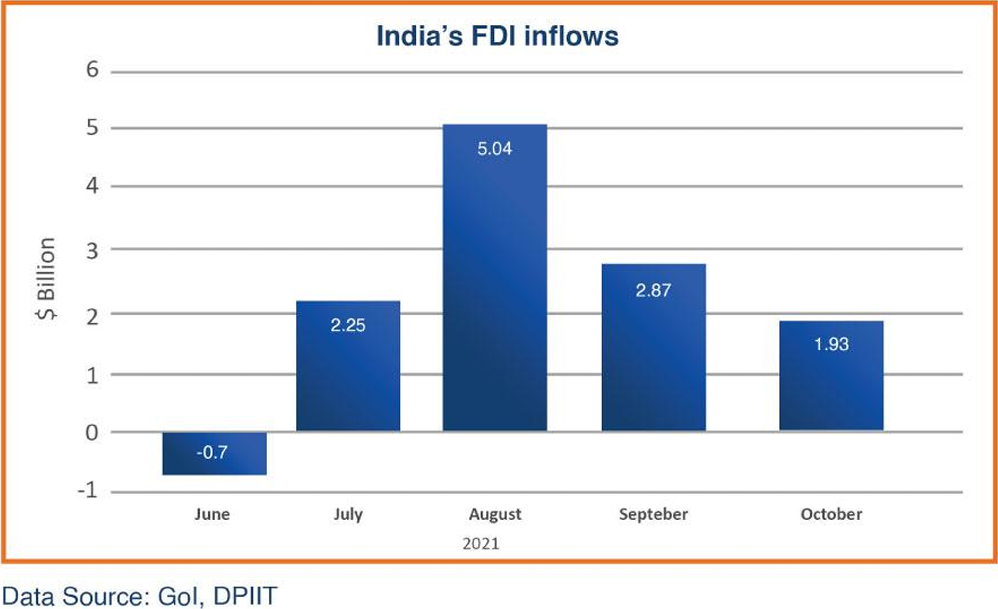

FDI Trends

India attracted $32.4 billion in foreign direct investment (FDI) inflows between April-August 2021. Data for FDI inflow is available until October 2021. The monthly FDI inflows peaked in August to $5 billion, after which the inflows have slid to $2.87 billion in September and further to $1.93 billion in October.

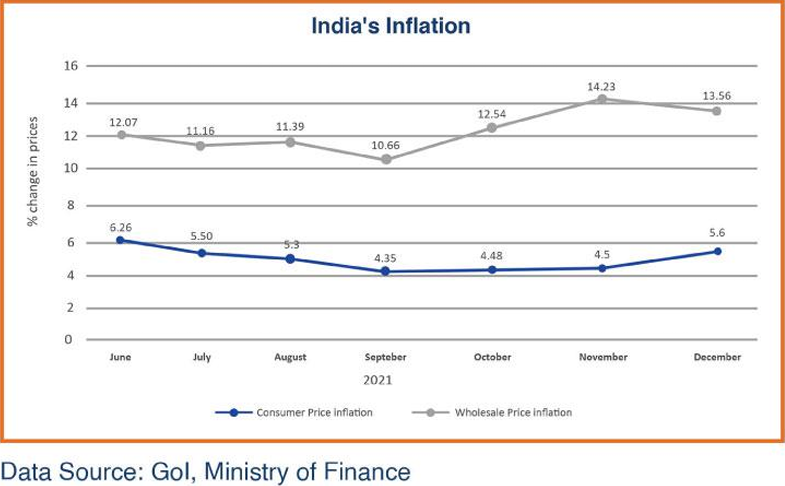

Inflation

The consumer price index (CPI) increased to 5.6% in December after remaining in a 4-5% range between September and November 2021. Food prices have risen while fuel prices have cooled somewhat. The RBI has projected the CPI inflation at 5.3% for FY2021-22 (ending March 31, 2022) and 5% for the first half of the next financial year. The wholesale inflation (WPI) softened to 13.6% in December 2021 from 14.2% recorded in November 2021; however, input costs remained high. The RBI has reportedly decided to maintain its supporting monetary policy going into 2022 despite rising inflation pressure.

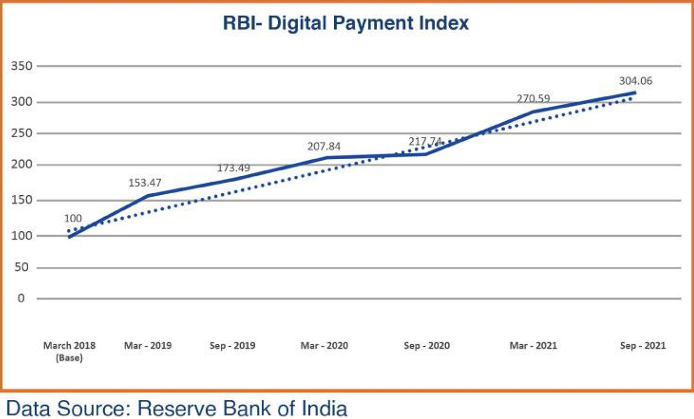

Digital Payments Trends

A steep growth in the Reserve Bank of India Digital Payments Index (RBI-DPI) indicates deepening of digital payments in recent years in the country. RBI-DPI gained 63 points in March 2021 over a penod of one year, well during the pandemic, as compared to 54 points in the preceding one-year period. The RBI in October 2021 announced an increase in the limit for IMPS transactions that is expected to catalyze digital transfers of funds within the banking system. In its Monetary Policy Review of December 8, 2021, the REBI has proposed to introduce a UPI-based payments product on feature phones; the implementation of the same will augment the pace of the adoption of digital payments in India. The RBI recently released the DPI index for September 2021 at 304.06, rising more than 33 points from its previous data point (March 2021). The trends in RBI-DPI Index demonstrate a consistent growth in the adoption and deepening of digital payments across the country

Economic Outlook

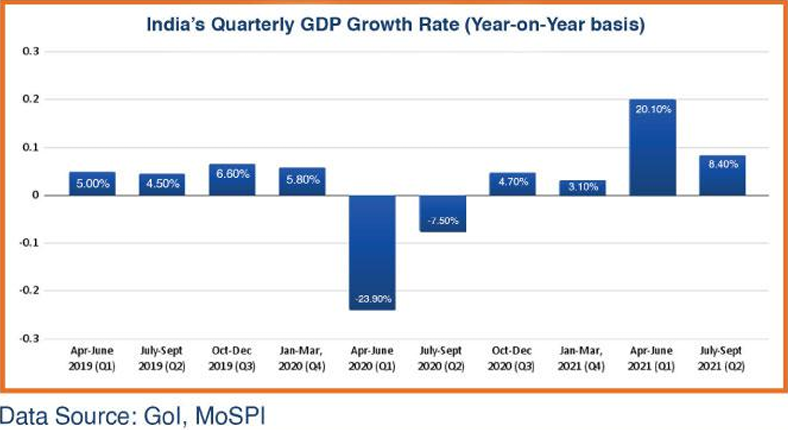

The Government of India’s fast track measures to vaccinate India’s public and the ongoing reforms for uplifting the economy/trade/industry, have led to a remarkable GDP growth of 20.1% in Q1 (April-June 2021) FY 2021-22 despite several partial lockdown conditions in various states. After the sharp decline in 2020 growth registered strong growth of 8.4% in 2021, bringing real GDP back to its pre-pandemic level try the end of the year. India’s economic recovery has been showing positive trends in the recent months supported by an impressive progress in vaccinations and economic reforms; major economic and business indicators have shown noteworthy improvements in the last six months, on the back of a significantly improved consumer and business sentiments.

Most economists have cautioned that the economic recovery witnessed since July 2021 has not been broad-based (across sectors) and certain sectors, such as trade, transport, tourism, still require Government’s consistent support and increased private investments. The Gol recently released the annual FDI inflows data for IFY 2020-21 (April 1, 2020-March 31, 2021), according to which India attracted “the highest ever annual FDI inflow of $81.97 billion”. During 2021, the Government of India took several tax reforms and certain ease of doing business measures, such as labor reforms. GST rationalization, relaxed FDI norms in select sectors, implementation of Single Window System and easier Customs procedures, that should help retain investors’ confidence.

USISPF hopes to see provisions for increased capital expenditure and policy support for attracting higher foreign investments in the upcoming Budget for IFY 2022-23. Restrictions to curb the spread of the pandemic between December 2021 and January 2022 may temporarily interrupt the economic recovery, but overall, the Indian economy may sustain high growth rates with incremental private investments and increased demand. The REII, the Asian Development Bank (ADB) and the Center for Monitoring Indian Economy (CMIE) have all underscored the need to segment the domestic demand and increased capital expenditure. As major economic and business indicators are on a positive trajectory, bolstering pace of vaccination, financial inclusion through increased digital transactions, government support for increasing consumption and private investments in addition to a robust infrastructure expenditure, can enhance the economic performance of the country.