India’s economic performance for September 2023 was strong, with positive movements in demand parameters, input purchases, trade deficit, monetary and employment indicators, on top of an impressive recovery in industrial output for August. Capital expenditure expanded in August, but foreign investment and exports remained weak.

Retail activity in September 2023 continued to show upbeat demand and consumer spending. With the festival and wedding season picking up, retail sales gained 4% while the number of passenger vehicle sales recorded a nine-month peak. On the supply side, the Markit Purchasing Managers’ Indices (PMI) for Services improved from the previous month while the PMI for manufacturing was a bit down, yet still well above the breakeven level. The overall unemployment rate in September dropped from the previous month with better labor participation in urban areas. Goods and Services Tax (GST) and rail freight revenues were steady in tandem with the market activities and increased compliance. Government investment in infrastructure projects (capital expenditure) was up about 50% from the previous month’s level.

India’s external sector continues to reflect the impacts of volatile conditions and tightening liquidity globally, with merchandize export earnings falling in September. Nonetheless, India’s trade deficit improved significantly during the month owing to reduced import bills. Net Foreign Direct Investment (FDI) remained low due to weaker investment sentiment globally. India’s foreign exchange reserves were down by $12 billion from the previous month and the Indian Rupee tumbled to record low of 83.01 against the US Dollar.

Easing vegetable and fruit prices led to the significant fall in the consumer price index (CPI), which dropped to 5.01% in September 2023 from the previous month’s 6.83%, well within the RBI target band. The RBI expects CPI inflation to continue its downward trajectory for the next few months. While core inflation in India is now controlled, the risks of higher commodity prices continue. The wholesale price index (WPI) also dropped but the pace of wholesale prices declines has reduced. The RBI-Digital Payment Index (RBI-DPI), which reflects usage of digital payments in India, has risen steadily over the last five years, implying faster liquidity flow in the market.

India’s impressive economic growth of 7.8% during the first quarter of FY2023-24 was driven by solid domestic demand, improved government spending, and impressive performances of the agriculture and services sectors. Manufacturing continues to expand and government investment in infrastructure is growing. Indian monetary authorities stand ready to manage inflation if required. Economists have, however, cautioned that the risks of resurgent inflation, severe climatic and monsoon conditions, and geopolitical challenges arising from the continuing Ukraine-Russia war and the new Israel-Hamas conflict may dent the pace of the economic growth going forward. India’s external sector remain uncertain due to geopolitical tensions, a depreciating currency, and suppressed global demand.

Demand Indicators

Retailers reported growth in urban and rural consumer spending, as seen in the higher sales of two-wheel vehicles and four-wheel passenger vehicles. According to auto industry statistics, September saw the best sales in nine months, with car dispatches of over 363,700 units. Automakers are optimistic that the demand momentum will sustain and lift sales across segments this festive season.

The onset of the festival season since August has given a boost to domestic demand, with retail sales rising year-on-year (yoy) 4% in September 2023. The growth rate of bank credit was a healthy 20%, marginally up from the previous month’s 19.8%, even though the cost of credit remains high due to liquidity tightening in effect since April 2023. The sustained positive sentiment in the market during FY2023-24 indicates resilient consumer demand will drive expansion of the Indian economy in the short and medium terms.

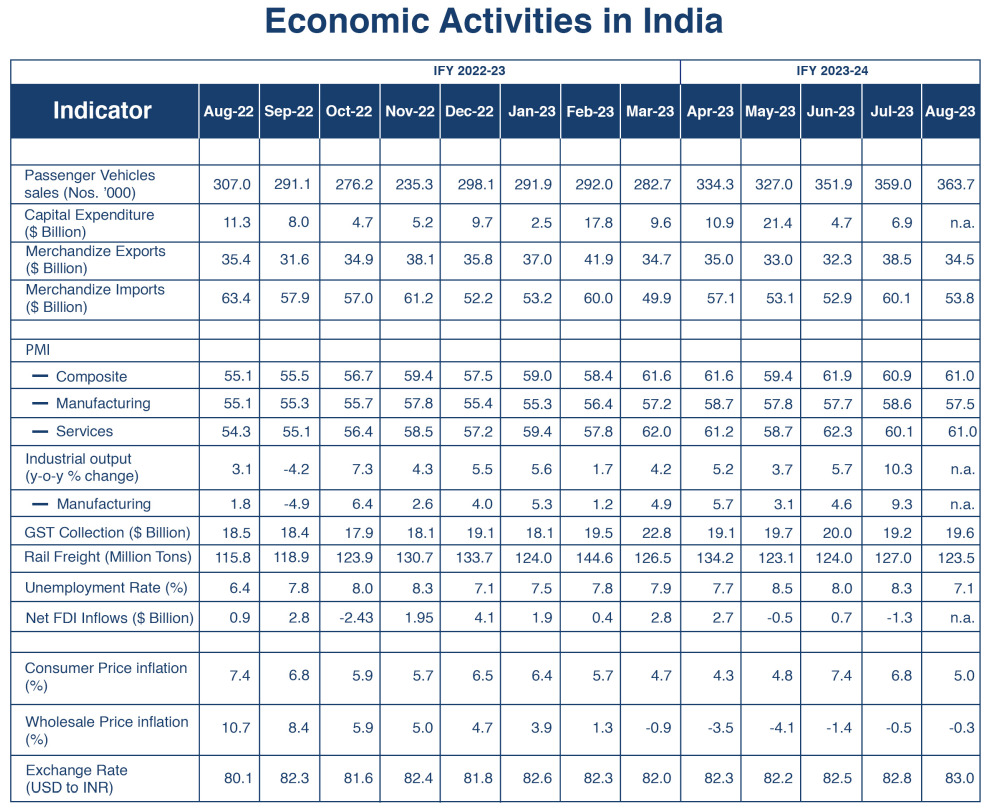

Capital Expenditure

Public sector capital expenditure (capex, a proxy for infrastructure investment) maintained an upward trajectory during the first quarter of the current fiscal year (Figure 1) and contributed substantially to India’s GDP growth rate of 7.8% for the quarter. The private sector capex has also reportedly picked up, compared to the previous year. Companies from capital-intensive sectors including oil and gas, metals, and power have reported impressive capex growth in the first quarter of FY2023-24 compared to the previous year. The government’s Production-Linked Incentives (PLIs) in select sectors, such as electronics and appliances, are also helping increase private sector participation in investments. A relatively stable domestic macroeconomic environment and global opportunities may translate into increasing profitability of Indian corporates. Nonetheless, India’s capex phase still lacks sustainability.

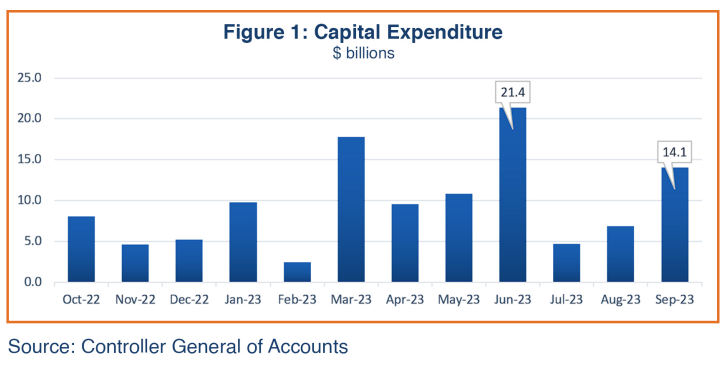

Trade

India’s Ministry of Commerce revised August’s trade data upwards, with exports to $38.5 billion from $34.5 billion, and imports to $60.1 billion from $58.6 billion. In tandem with global trends, India’s merchandize exports shrunk more than 10% in September 2023, to $34.5 billion from the previous month’s $38.5 billion (Figure 2). Export performance remains impacted by the global economic slowdown and high inflation rates that have reduced demand in developed economies. While a few categories, such as electronic goods, seafood, ceramics, pharmaceuticals, and engineering items witnessed growth in September, most major categories moderated, such as petroleum products, gems and jewelry, textiles, chemicals, and plastics. The growth in electronics exports is led by mobile phones exports (52% of total electronic exports), which have shown tremendous growth following the government’s announcement of the Smartphone Production-linked Incentive (PLI) Scheme in 2020. Services exports increased to $29.4 billion in September from $26.4 billion in August 2023. According to Commerce Ministry officials, India is keenly pursuing free trade agreements (FTAs) with many countries, such as the United Kingdom, and countries in Latin America and Africa, which they hope will improve export performance and help the country reach its target of $2 trillion in exports by 2030.

India’s merchandize imports, at $53.8 billion in September, were down more than 10% from the revised $60.1 billion in the previous month, narrowing the country’s merchandize trade deficit to $19.4 billion, much below the previous month’s $26.7 billion. Services imports, however, increased to $14.9 billion in September from the previous month’s $13.9 billion.

Supply Side Indicators

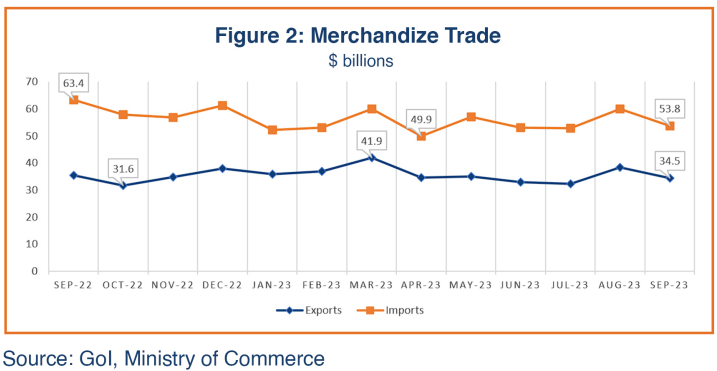

Input Purchases

Overall business sentiment in September 2023 was upbeat, with the Composite Markit Purchase Managers Index (PMI) at 61, marginally up from the previous month’s peak of 60.9. Continuing demand for goods and services led to decent expansion in both manufacturing and services activities (Figure 3; a PMI above 50 reflects the optimistic mood of businesses that have made bold input purchases in anticipation of increased demand). The latest reading recorded the 27th consecutive month of business activity expansion, reaffirming sustained economic recovery in India.

The Services PMI for September 2023, at 61 points, improved from the previous month’s 60.1, and service exports remained robust. India’s services PMI reading has sustained a level above breakeven for more than 25 months, heightening optimism on the sector’s outlook for the remainder of the year. Manufacturing activity PMI slowed to 57.5 in September 2023, falling to a five-month low, primarily due to a softer increase in new orders; but better output levels are expected over the next few months according to the S&P Global Market Survey Reports.

Despite slowing global growth, Economists view domestic demand broadly holding up along with a likely strong infrastructure performance. However, on the inflation front, PMI data showed pressures building on input prices, with crude prices rising since the breakout of the Israel-Hamas conflict.

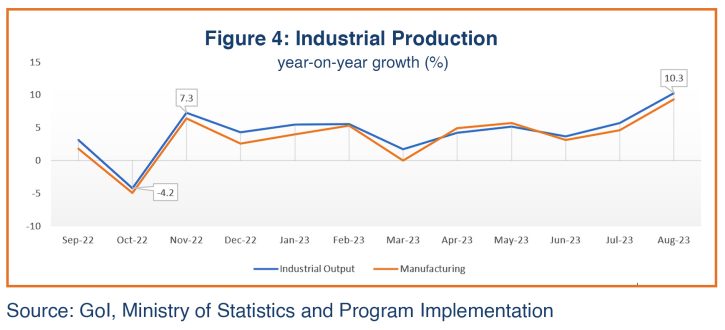

Industrial Production

India’s year-on-year industrial production growth rate rose to 10.3% in August 2023 from 5.7% in the previous month (Figure 4). A stellar performance by electricity, mining, and manufacturing output and a resilient domestic demand drove impressive industrial growth in August 2023. Resilient domestic demand helped industrial output, with all three major sectors registering remarkable growth in August.

Manufacturing, which accounts for 77% of total industrial production output, recorded growth of 9.3% in August, compared with 4.6% in the previous month. The growth rate in mining output, comprising 14% of total industrial output, also improved, rising 12.3% compared to 10.7% in the previous month. Power generation (8.0% of total industrial production) rose 15.3%, compared with the previous month’s growth of 8%. Production of capital goods (indicative of growth in investments) within the manufacturing sector posted a 12.6% growth rate in August 2023, compared with the 4.6% recorded in July 2023.

Domestic demand will be the key driver of industrial performance in India for the rest of the current fiscal year as merchandize exports will likely remain weaker due to continued gloominess in global economy. But industrial output faces downside risks from increasing inflation.

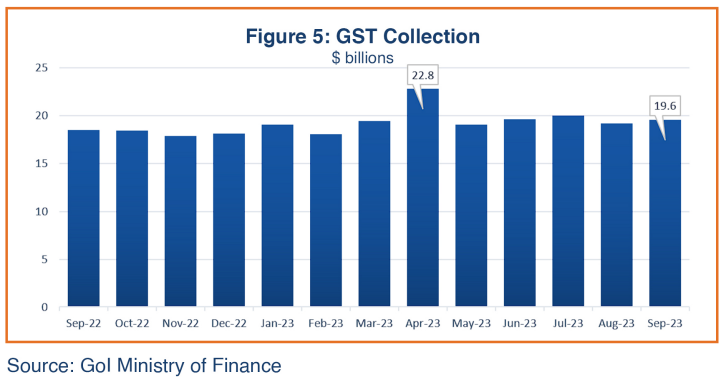

GST Revenues

August 2023 Goods and Services Tax (GST) collections, maintaining a robust pace, were more than $19.6 billion in September 2023, up from the previous month’s $19.2 billion (Figure 5). Analysts note that rising GST collections reflect a combination of increased domestic transactions, higher tax rates, improved compliance, and some effects of inflation. Industry expects the GST authorities will be more open to a rate rationalization proposal as the growth in GST collections stabilize. The gross GST collections for the first half of the current fiscal (April-September 2023) are about $120.4 billion, up 11% у-о-у, and monthly collections will likely rise further in the next quarter as festive demand in India lifts consumer purchases.

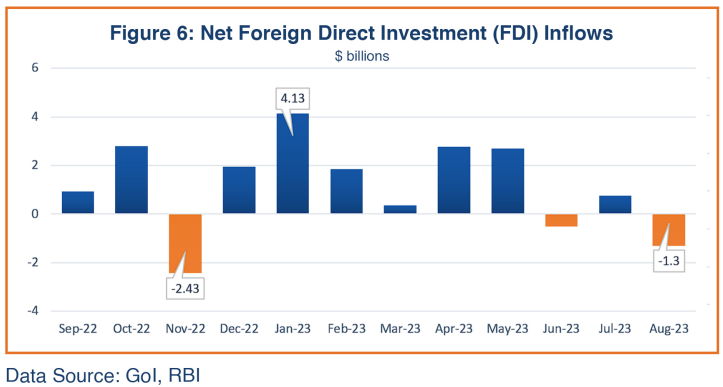

Net Foreign Direct Investment

FDI inflows remain lackluster (Figure 6), mainly due to the uncertain geopolitical tensions that are weighing upon investor sentiment globally. According to the latest RBI data, total net FDI for the five month period from April-August 2023 was only $3 bn, compared to $18 bn for the same five months in the previous year on account of moderating gross FDI and a rise in repatriation.

Inflation

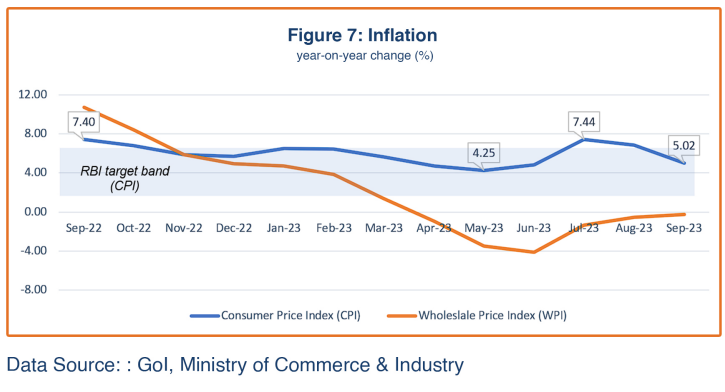

As the RBI expected, India’s retail inflation dropped to 5.02% in September 2023, compared to 6.83% in August. The year-on-year Consumer Price Index (CPI) inflation rate at 5.02% is well within the RBI target band of 2-6% (Figure 7). Food prices, which account for about 40% of the CPI total, eased substantially during the month. RBI economists have acknowledged that core inflation in rural as well as urban areas is stabilizing, as reflected in a broad-based easing of price pressures across goods and services. The stability of core inflation may be due to prevailing lower input costs for producers, which currently exerts limited pressure on consumer prices.

Wholesale price index (WPI) deflation continued for a sixth consecutive month, with prices declining 0.26% in September, albeit at a slower pace than the previous several months. Lower prices of chemicals, textiles, basic metal, and mineral oils led to the WPI deflation.

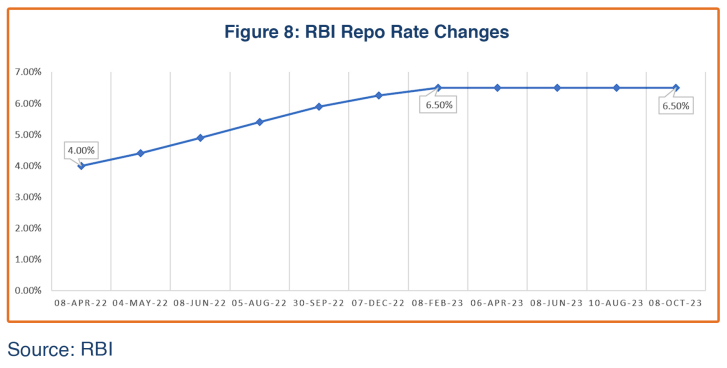

The velocity of money in the economy continues to accelerate with the widespread adoption of digital payments in India, as reflected by the steady rise in the RBI-Digital Payment Index. The RBI’s Monetary Policy Committee, in its October meeting, decided to maintain the repo rate at 6.5% (Figure 8), with inflation forecast for the FY2023-24 at 5.4%, and projections of 6.4%, 5.6%, and 5.2% for Q2, Q3, and Q4, respectively. However, the Israel-Hamas conflict adds to the concerns of oil prices exceeding current assumptions, which could subsequently exert pressure on inflation.

Foreign Exchange

India’s foreign exchange reserves were nearly$586 billion at the end of September 2023, a total reduction of about $9 billion from the previous month. The most affected component of foreign exchange reserves was foreign currency assets, which decreased by $7 billion, whereas other components, including foreign currency assets, gold, special drawing rights (SDRS, or supplementary reserve assets maintained by the IMF) were down by $2 billion. The reserve levels have declined since their October 2021 peak of $645 billion as the RBI has actively bought and sold foreign exchange in the market to smooth volatility caused by global developments.

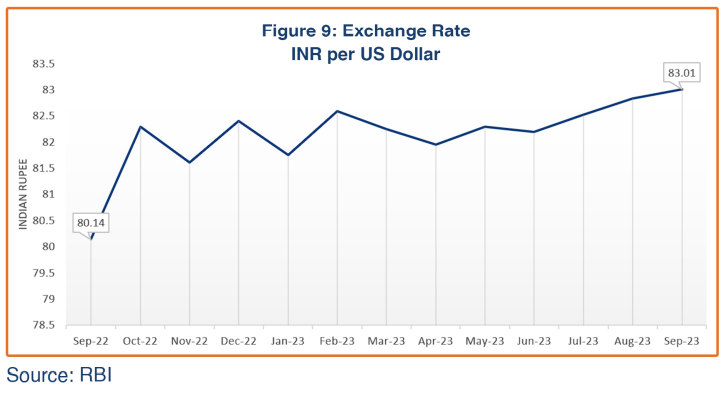

The Indian currency has weakened since the beginning of September as foreign institutional investors (FIls) started withdrawing their investments from the local markets. According to market analysts, FIls pulled out a net $2 billion in September following the hardening of US bond yields. The rupee remained weak throughout September, depreciating by 0.2% from the previous month. The average monthly exchange rate peaked in September at INR 83.01/USD, compared to the previous month’s INR 82.83/USD (Figure 9).

Economic Outlook

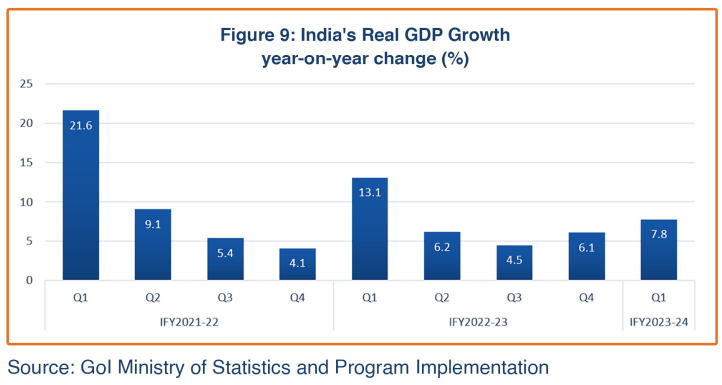

India’s real gross domestic product (GDP) grew 7.8% in the first quarter of FY2023-24 (April-June 2023; Figure 10), mainly driven by robust consumer demand, increased investments, and impressive output growth in the agriculture and services sectors. The RBI had, however, expected a growth of 8% in Q1 FY2023-24.

The RBI maintains its forecast of annual economic growth of 6.5% for FY2023-24, with Q2 at 6.5%, Q3 at 6.0%, and Q4 at 5.8%. According to the RBI Governor, domestic economic activity is strong due to robust domestic demand, but risks to India’s outlook prevail, including geopolitical tensions, global economic slowdown, and uneven monsoon rains. The start of the festival season and sustained buoyancy in service activities are expected to push up private consumption while increasing corporate profits will promote investment activities. The International Monetary Fund (IMF) on July 27 projected India’s real GDP growth at 6.1% in FY2023-24, up from 5.9% estimated in April, citing momentum from stronger-than-expected growth in the fourth quarter of 2022 and stronger domestic investment. The World Bank has retained India’s growth forecast for FY2023-24 at 6.3% in its India Development Update released on October 3, 2023, projecting strong investment to drive growth. However, these projections were frozen before the terror attacks on Israel in October 2023, and subsequent geopolitical developments may impact the economic growth outlook going forward.

While domestic demand in India remains buoyant, the downside risk of inflation, financial instability, and intensifying conflicts around the world remain in FY2023-24. India’s export sector remains impacted by the continuing gloominess in the global economy. Overall, external demand, uncertain inflation, and geopolitical tensions continue to pose risks to the RBI’s forecast, but India’s strong economic fundamentals hold, and the long-term outlook remains optimistic.