EXECUTIVE SUMMARY

This report is the second in a series of USISPF Studies conducted to assess India’s competitiveness for participation in Global Value Chains (GVCs) within the Electronics sector. The fi rst Report “Enhancing India’s Competitiveness in GVCs” fi ndings prompted the forum to deep dive to understand the reasons and the areas where the gaps are, and how these gaps can be bridged through policy intervention fthereby improving India’s competitiveness. This report provides a comparative analysis and evaluation of the Ease of Doing Business (EODB) in India viz-a-viz Vietnam and Thailand for moving goods across borders in the supply chain. The report indicates the gaps that India needs to fi ll if it wants to a‹ ract investments from the GVCs. The comparative analysis is based on our secondary and primary research on the performance across various EODB parameters, such as conformity assessment of product safety standards, predictability of policies, customs procedures and logistics.

The report also includes:

- The current regulatory compliance landscape in India around conformity of standards and its associated challenges;

- Description of international best practices;

- Recommendations to address the gaps; and

- The expected impact of recommendations on India’s competitiveness as a GVC partner.

Comparative performance of all the EODB parameters are illustrated in a table, with a brief analysis from India’s perspective. Results of the analysis show that the barriers to trade/manufacturing activities can be improved through policy intervention in areas like:

- Conformity assessment of product standards

- Predictability of policies, and

- logistics

Recommendations for the Government of India include

Improving the regulatory administration of conformity assessment of standards

Key areas include self declaration for products which are under low risk, bringing in more focus to the CRO compliance, learnings from international standards, improving e“ ciency in systems and process at BIS / WPC etc.

Ensuring the predictability in policies

Key areas include increasing predictability, transparency, and clarity in regulatory policies, adoption and enforcement of government-wide standards for public consultation, and implementing the single-window concept / deemed approval.

Improving customs procedures

Key areas include improvement in faceless assessment, extension of payment timeline for duty deferment, penalty on re-export for voluantary request not to be levied.

Improving logistics

Key areas include improving the pace of execution of infrastructure projects, improving connectivity across all modes of transport, and enhancing warehouse operations.

The report also highlights benchmarking conformity assessment against countries like Vietnam and Thailand, and regulatory procedures against the EU and the US. Recommended policy changes can immensely improve India’s ease of doing business. These policy changes can raise India’s competitiveness among the GVCs setting up global production units/manufacturing plants. Additionally, these policy measures will provide more trade facilitation at the border, enhancing India’s exports and strengthening its MSMEs. By ensuring a predictable and stable policy environment, India can regain global investors’ confidence.

The research shows that the prospects of attracting investments from GVCs in its current policy environment are not positive. The major areas of weakness require focused attention from Indian policymakers for rapid curative policy measures to adhere to international trade practices.

A recent report by the United States Trade Representative, the ‘2021 National Trade estimate report on Foreign trade barriers” highlights similar problems in India. (https://ustr.gov/sites/default/files/fi les/reports/2021/2021NTE.pdf)

INTRODUCTION & BACKGROUND

India has been one of the fastest-growing economies over the last decade. This growth is expected to continue, considering multiple factors like the infrastructure requirements of the country, a younger working-age population, and an expanding manufacturing base. India has rightly set out on the path of reaching a USD 5 trillion economy by 2024 and USD 10 trillion by 2030, but this can only be achieved by sustaining a GDP growth of 9-10% per annum, year after year.

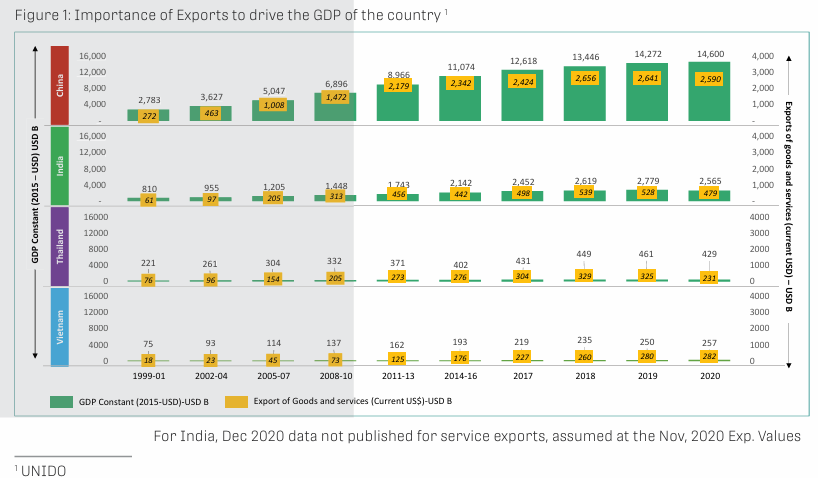

With increasing globalization, India needs to ensure that value chains are effectively used. Many countries have grown rapidly with globalization and active participation in the global value chain. Neighboring country China was able to lift a large population out of poverty due to these efforts. Many countries like China, Korea, Thailand, Vietnam, etc., have grown by tapping into their export potential. Exports account to a large extent in helping the growth of the country.

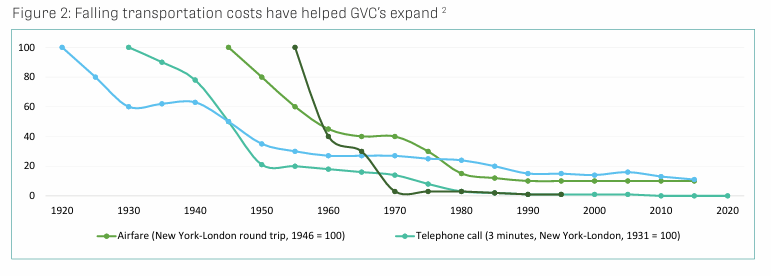

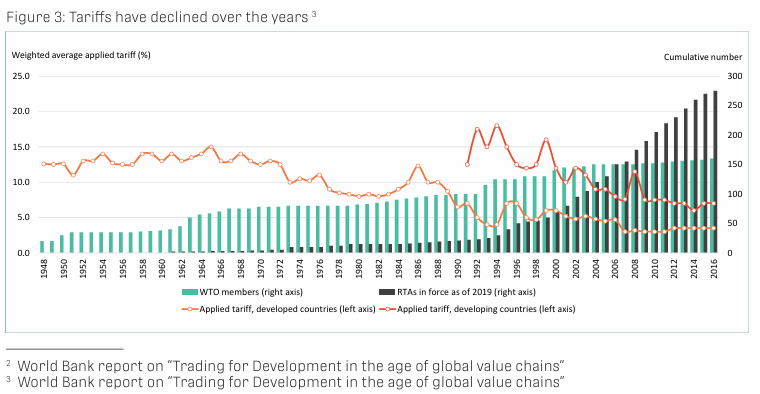

The wave of a global supply chain in the 1990s and 2000s was driven by a combination of factors. The information and communication technology (ICT) revolution brought forth affordable and more reliable telecommunication tools, new information management software, and increasingly powerful computing technology. Manufacturing firms were able to outsource and coordinate complex activities at a distance and ensure the quality of their inputs. Additionally, with reducing transportation costs, firms were able to disperse their production across the world. Declining air and sea freight costs boosted trade in goods, while services benefited from cheaper communication costs. Successive rounds of trade liberalization have resulted in rapidly falling barriers to trade and investment for both developed and developing countries. Tariffs have declined, especially for manufactured goods, and the gradual, although still insufficient, lowering of non-tariff barriers has facilitated the international trade of Goods and Services.

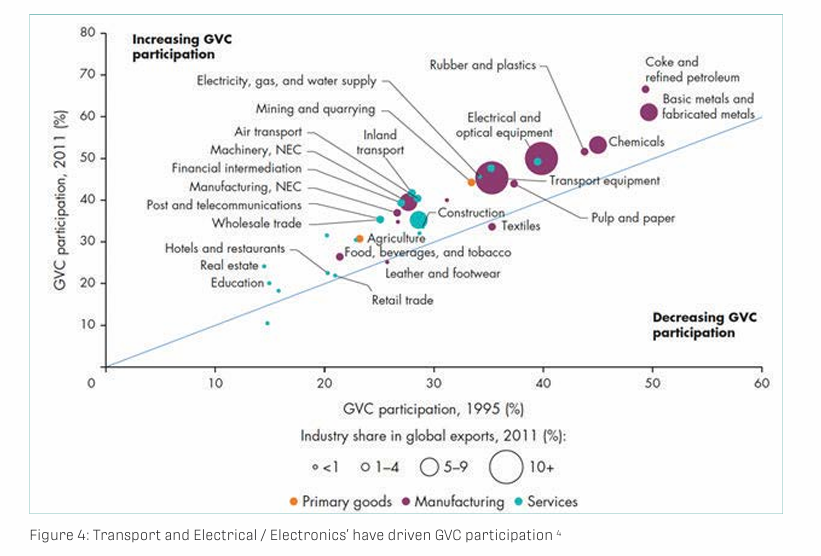

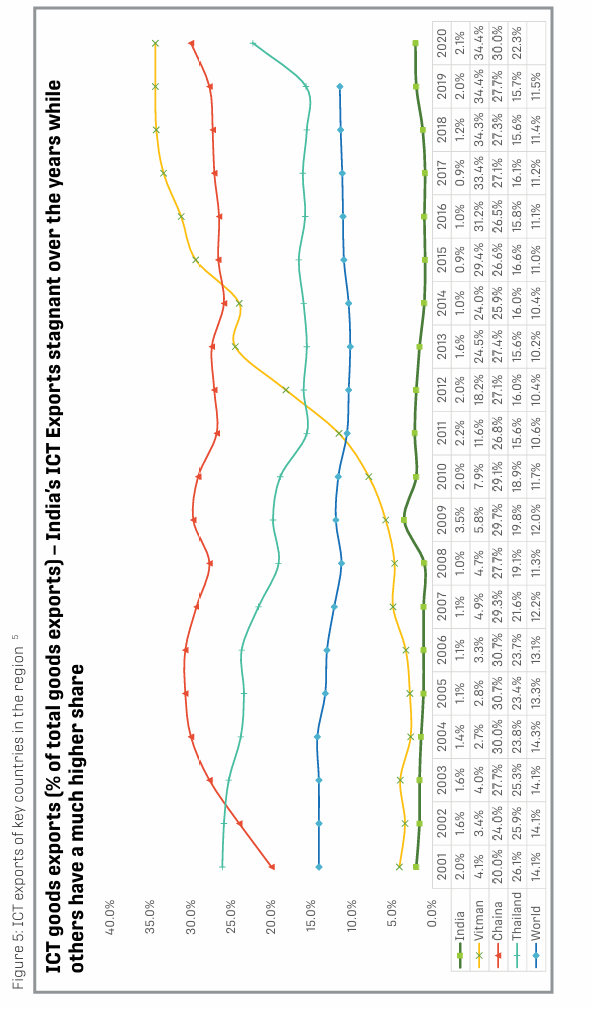

Most of these countries have benefited by expanding into markets like the USA and Europe. India’s current share in global exports has been at a low ~2%, with a considerable contribution from electronics. This was aided by the introduction of the Production Linked Incentive (PLI) scheme last year. Trends show that countries that gained entry into the electronic assembly markets have shown considerable growth in their export by expanding into other value chain areas in electronics.

Hence, there has been an urgent need to improve the Ease of Doing Business (EoDB) in the electronics sector. The government of India introduced the Production Linked Incentive (PLI) scheme to boost the sector’s performance and competitiveness. With a digital transformation driving the world, accelerated even further by the onset of COVID-19, the need for electronics/components will be even higher. The emphasis on being a globalized economy is of utmost importance for India to participate in global value chains (GVCs), irrespective of whether it’s low-tech or high-tech manufacturing. Being an integral part of GVCs will not only help India generate millions of employment opportunities but also help its cause in reaching the GDP milestone.

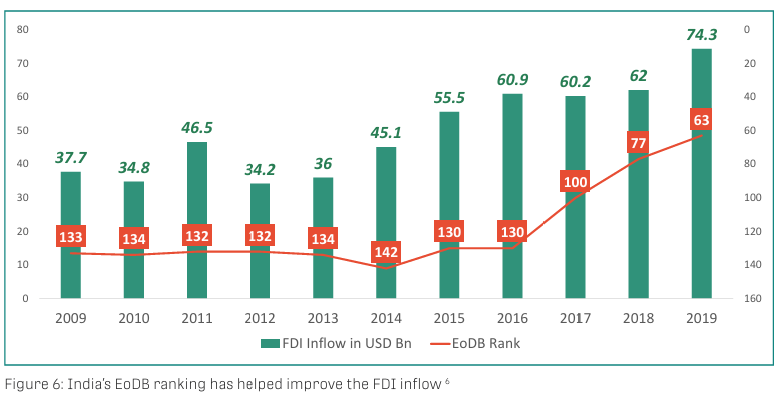

Another important factor, and also our focus in this report, is the Ease of Doing Business (EoDB) standardization. Over the last few years, the government has been actively working on improving the EoDB by doing away with many archaic rules, procedures, and laws. India has quashed over 1,300 laws in the last 4-5 years to enable better and easier participation of the private sector. India has remarkably jumped up by 79 positions in the last 5 years in the World Bank Ease of Doing Business ranking. However, with its current ranking at 63 in 2020, much remains to be done. To be able to reach the USD 10 trillion GDP market by 2030, India needs to be in the top 25 rank in the next 5 years.

The USISPF recently undertook a comprehensive use report/study titled “Enhancing India’s Competitiveness in Global Value Chains,” to weigh India’s competitiveness viz-a-viz its neighboring competitors on broad parameters for setting up a manufacturing plant, such as Ease of Doing Business, Cost of Doing Business, and Labor Markets. The previous report recommended corrective measures to improve India’s competitiveness on these parameters.

Our analysis in the above-mentioned study shows that India’s performance in the three broad parameters is almost comparable with Vietnam and Thailand. In a few areas like labor markets, land, and infrastructure, India has rather performed better. These findings have prompted the Forum to further deep dive to understand the gaps, the reasons for the gaps, and ways to address them through policy intervention, thereby increasing India’s competitiveness. The OECD stresses that GVCs do not respond in a policy ecosystem that is changed haphazardly. Ease of moving goods across borders is a major criterion for GVCs; therefore, it is of utmost importance to reform policies that play an active role in facilitating trade.

The USISPF undertook phase II of the study “Shifting GVCs to India – Addressing the Key EoDB Challenge.” This study evaluates India’s competitiveness viz-a-viz other countries like Vietnam, Thailand, and China. It also highlights the key areas that India needs to focus on to be more competitive in attracting GVCs in the electronics sector. The study has a special focus on the following parameters:

- Conformity Assessment of Standards

- International best practices

- Custom Rules & procedures

- Logistics & Warehousing

UNDERSTANDING CURRENT LANDSCAPE

To understand India’s competitiveness, it is important to compare the same with that of key countries which have become an alternative to business houses, post the anti-China sentiment across the globe. Amongst the countries in Asia, Vietnam and Thailand have emerged as the key sought out destinations. Vietnam and Thailand have emulated what China did way back in 1980, starting from an import substitution step to an export-oriented economy. Vietnam in the last 10 years has grown its export trade of merchandise by 4 times to reach USD 266 Bn in the year 2020. On the other hand, India has only managed to reach only USD 193 Bn by 2020. The Information communication and Technology (ICT) exports have been a major contributor in Vietnam’s growth, contributing ~35% of its total merchandise exports currently from hardly 5% a decade ago. India’s ICT exports still account for less than 3%.

India has now taken an aggressive stance on increasing its Electronics sector export through PLI and other sectoral reforms. It is also very important for India to improve its EODB ranking (As per World Bank standards).

Some of the key concerns that India needs to address are as listed below

Issues related to

IT product safety

requirement and

conformity assessment

Issues related to Custom

clearance and related

processes

Issues related

to Logistics and

warehousing

Current standing of India from Technical Barriers to Trade, ICT product safety requirement and conformity assessment and key challenges

Non-Tari– Measures (NTM’s) are regulations like packaging requirements, standards and conformity testing, labelling requirements, quotas on imports that a– ect trade. While some measures are necessary there are others which are an impediment to free trade. Analysis of NTM data is very important in understanding and improving trade policies. Also, a comparative analysis on EoDB, for broad IT Product Safety requirements provide some insights into the current standing of India viz a viz other key competitors in the region. In this section we analyze the impact of few such parameters and also the key challenges that are impacting GVC’s from moving goods globally.

- Technical barriers to trade

- ICT product safety regulations and their impact on the EoDB

- Regulatory impact assessments and avoiding unnecessary obstacles to trade

- Portability of conformity assessment results

- Predictability of policies

- Key challenges faced by manufacturers in India

- International best practices

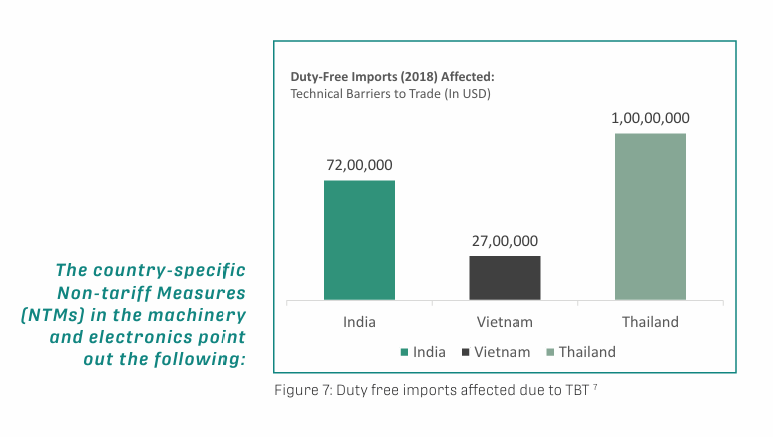

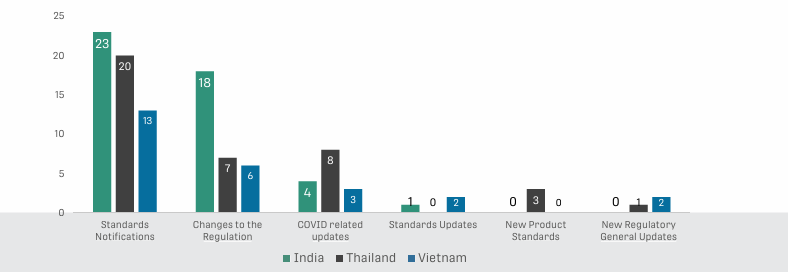

Non-Tariff Measures (NTM) leading to Technical barriers to trade

Standards and conformity assessment facilitate market transactions at borders, by enhancing market competition, but they also impose additional costs to importers and exporters. Di– erent countries impose di– erent product standards and di– erent testing and certifi cation procedures to ensure conformity as conditions for entry, which results in Technical Barriers to Trade (TBTs). Although conformity assessment requirements ensure that products meet appropriate quality and safety standards, such requirements may also serve as signifi cant trade barriers, increasing manufacturers’ costs. Conformity assessment requirements should ideally be administrated in the least trade restrictive manner so that GVCs can move goods promptly from one destination to the other.

TBTs are measures that can regulate markets and protect consumers, but they can also be used to make imports and exports more diŠcult to protect domestic markets. TBTs are not always intentional; often, they are the result of regulatory di erences and contradictions. This makes it crucial for regulators to weigh the necessity of new or modified regulations to ensure that unintended TBTs do not arise. These can also aid the ‘Make in India’ initiative, which aims to transform India into a global design-and-manufacturing hub.

Technical regulations on trade can a negative impact on India’s overall growth and economy. The goal to achieve a USD 5 Tn GDP by 2025 largely depends on how India can be an active participant in the global GVCs. If companies face barriers in importing intermediate and capital goods, they are less likely to select India as a manufacturing destination. This especially holds true for high value-added manufacturing with complex and long value chains. However, if India embraces imports, it is likely to attract more foreign direct investments under the Make in India campaign.

Vietnam appears to be the best among the three competing countries and has widely based its standards for machinery and electronics on international standards (IEC). By incorporating minor national deviations that do not create unnecessary compliance burden on the manufacturers/ importers, Vietnam has managed to improve the EoDB. The standards conformity assessment regulatory environment of Vietnam augurs well for global supply chain participants who rely heavily on the hassle-free and speedy movement of goods across borders.

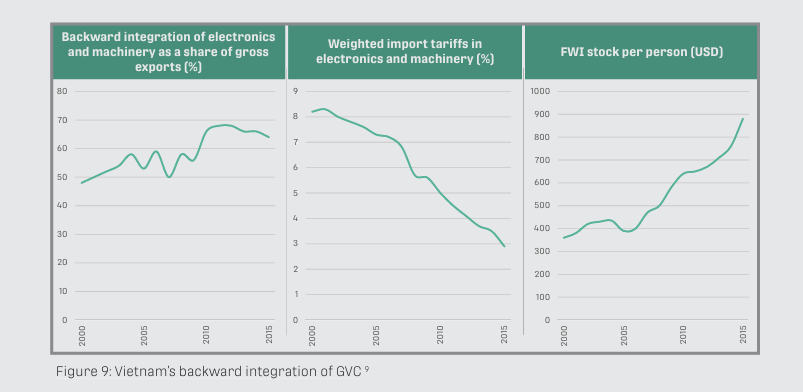

Vietnam is the second largest smartphone exporter in the world. Vietnam’s participation in electronics GVCs increased from 47 percent in 2000 to 67 percent in 2010, and then declined slightly after 2012. Import tari¡ s in the sector dropped from about 8 percent in 2000 to less than 3 percent by 2015. Vietnam’s success in the electronics sector can be attributed to a stable investment climate, abundant low skilled, low-cost labour, proximity to key markets like China, Japan, Korea, Taiwan etc., and port connectivity.

ICT Product Safety Regulations and their Impact on the Ease of Doing Business

Regulatory impact assessments and avoiding unnecessary obstacles to trade

Assessing regulatory impact and avoiding unnecessary obstacles to trade entails

- Using international standards as a basis

- Recognizing the equivalence of other countries’ technical regulations

- Defining available technical infrastructure

- Using international non-discriminatory systems for conformity assessment

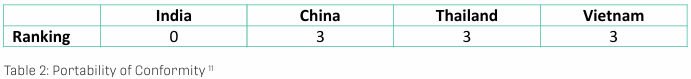

Definition of ranking as mentioned below

- 0 – No application

- 1 – Some application but inconsistent or incomplete

- 3 – Adequate application

- 5 – Broad, comprehensive application

USISPF members engaged in manufacturing/contract manufacturing of electronic components have repeatedly pointed out the diŒ culties and delays faced by them while complying with the conformity assessment regulatory requirements practiced in India. This is in specifi c to the compulsory BIS registration/certifi cation, refusal of Certifi cation of IEC accredited foreign labs leading to duplicative testing of products, and the associated bureaucratic hurdles. Forum members have witnessed operational ineŒ ciencies in the system and drastic increase in the BIS certifi cation time leading to delays with no clear Turn Around Time (TAT) for the last few months. GVCs need enough ease of moving goods across the value chain, so that they can avoid losses due to regulatory bo• lenecks leading to delays and disruptions in supplies. India has been a member of the IEC Conformity Assessment for Electrotechnical Equipment and Components (IECEE CB Scheme) for more than 22 years. The Bureau of Indian Standards (BIS) acts as India’s member body in charge of certifi cation; but the scope of standards are very limited (covering only Low Voltage Switchgear and Control Gear). The lack of laboratories linked to BIS, adds to the limitations. Therefore, the implementation of the IECEE CB Scheme has been limited in India.

India’s Conformity Assessment procedures are overly stringent for providing surety of conformity with the requirements. The WTO’s TBT Commi’ ee’s underlying principles for regulatory practices to avoid unnecessary obstacles in conformity assessments are not being practiced in India. Vietnam, Thailand and China have used international standards and they recognize the results of conformity assessment done in other countries, using the international non-discriminatory systems. India’s domestic product standards are not well-aligned to international standards (IEC) and India does not recognize the equivalence of technical regulations from other countries, thus resulting in unnecessary duplication of sample testing in domestic labs, from each factory. By not using international non-discriminatory systems for conformity assessment, India sends negative signals to not only the new ICT manufacturers/importers, but also creates a burdensome business environment for existing businesses. India’s domestic product safety standards should be broadly based on international standards (IEC) with few national deviations that do not create unnecessary delays/costs/barriers for traders/manufacturers. By ensuring minimal national deviations in product standards, India can provide a hassle-free conformity assessment that can help the GVCs tremendously in movement of their goods across borders.

Portability of Conformity Assessment Results

EODB can be enhanced to a great extent, if results from testing or certifying a product once can be used to meet requirements in multiple markets. This can prevent duplication of work, resulting in cost and time saving for importers/manufacturers.

- 0 – No application

- 1 – Some application but inconsistent or incomplete

- 3 – Adequate application

- 5 – Broad, comprehensive application

India neither recognizes the equivalence of technical regulations nor the results of testing done in labs of other countries. It results in duplication in product testing that have been already tested in the exporting country, effectively increasing costs and causing delays in movement of goods. On the contrary, China, Thailand and Vietnam accept test results/certification from foreign labs, which saves time, fees, and e† orts of manufacturers/importers

Predictability of Policies

Unpredictable and frequent policy changes a† ect the reliability of supplies in the chain, which can directly impact the expansion plans and return on investments of the GVC participants. Businesses perceive India as a diœ cult place to do business due to an unstable regulatory climate. Besides frequent changes in the Conformity Assessment procedures, other recent examples include the expansion of the equalization levy, the GFR Order on Public Procurement, and addition of stringent provisions and restrictions for import based supplies to the Public Procurement Order (PPO). Multiple stakeholders at a State and Central level, lead to a complex regulatory framework, that needs simplification. For instance, the medical devices sector is controlled by 13 different departments and a manufacturer needs to get approval from 13 different divisions.

Key challenges faced by GVC Players in India

Some of the challenges faced by global manufacturers in India include:

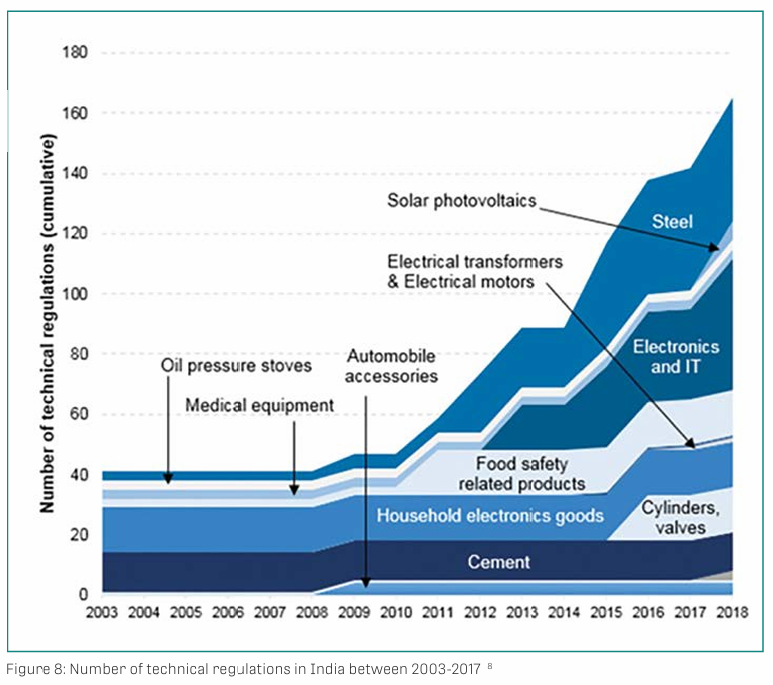

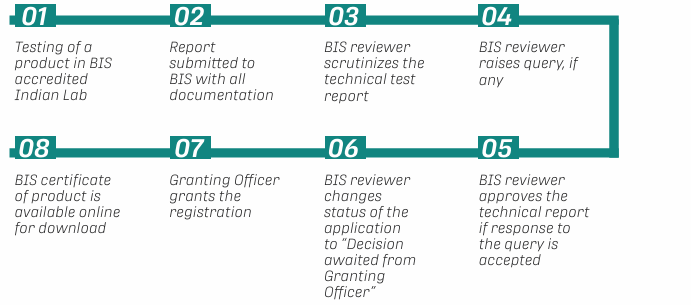

Compulsory Registration Order

India’s Ministry of Electronics and Information Technology (MeitY) implemented the Compulsory Registration Order (CRO) in 2012, originally covering 15 product categories. Compulsory registration with the Bureau of Indian Standards (BIS) – the GOI agency responsible for the administration of Product Safety Standards – is now required for 76 product categories under the CRO. BIS registration allows manufacturers to declare that their articles conform to Indian standards.

In addition to BIS Registration, manufacturers/importers have to provide test results of products to complete conformity assessment. India does not accept certification/test results from foreign labs. Manufacturers have reported that they must get samples tested/certified from each factory by government-approved domestic laboratories.

The existing certification process under the Compulsory Registration Scheme (CRS) has been operational since 2012, taking 4-6 weeks for issuance until 2019. However, the certification process improved remarkably in 2020, and the issuance of certificates was expedited to 1 to 5 days, reflecting the concerted efforts of BIS over the past several years. However, Forum members have again witnessed a drastic increase in the BIS certification time, leading to inefficiency and delays with no clear Turn Around Time (TAT) for the last few months.

When a product under CRS requires certification from BIS, the following steps must be undertaken

Manufacturers undertake steps 1 and 2, after which BIS starts processing through steps 3 to 8. Our members report that steps 3 to 6, as described above, have been working smoothly. However, all applications see a break as they reach step 7, leading to limited or no BIS certifications.

The above delays have also impacted the certification of products covered under the CRO. BIS approval delays have started impacting new product launches, resulting in business losses to our member companies. The delays in granting BIS certification are also affecting Indian consumers’ interest in accessing products.

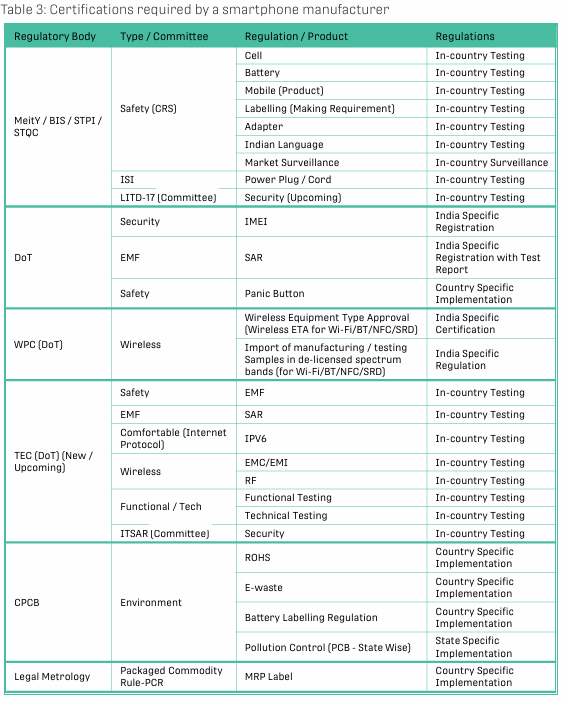

An example of the number of certifications and testing required for manufacturing a smartphone in the country is shown in Table 3. There are multiple regulatory bodies and committees involved that a smartphone manufacturer has to approach to get a smartphone certified.

WPC (ETA) Approval For Wi-Fi and Bluetooth-enabled Products

Wireless and Planning Co-ordination Cell (WPC) approval is mandatory for sale of Wireless and Bluetooth IT and Electronic products that operate on unlicensed frequency bands and meet human safety requirements. WPC approval system called “ETA (Equipment Type Approval) through self certification” was instituted in India in 2018 to facilitate speedy faceless approvals through an online portal. Our members report that it was working very efficiently until January 2020; however, since Feb 2020, the WPC approval timelines have changed from one week to several weeks sans expected Turn Around Time (TAT). This has been impacting the sales/operations of the manufacturers significantly.

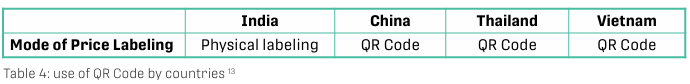

E-Pricing – Use of Quick Response (QR) Code

Physical labeling requirements have long created major barriers to trade. For ease of doing business, regulations should allow for the use of electronic labeling (e-labeling) on a device’s screen via a machine-readable code (such as a QR code) or web link on the product or packaging.

The Legal Metrology (Packaged Commodities) Rules 2011 mandate the affixing of a label stating the Maximum Retail Sale Price (MRP) on a package. India’s practice of MRP was originally designed to protect consumers, but our members have found this requirement to pose more challenges than benefits. A physical MRP label forces dynamic pricing of products to become static and is against consumer interest. Prices of products, especially electronic products, drop significantly within the first two to three months from the date of launch. Consumers would thus remain unaware in case of price drops and may end up paying a higher amount as displayed on the physical MRP label. Moreover, changes in tax levies require re-labeling of running stock and increase costs for manufacturers. Today, India has 55% internet penetration, with over 43 million internet users and over 500 million smartphone users. Further, QR Codes are already a trusted and well-established concept in India, being propelled by UPI. Thus, India needs to capitalize on the critical infrastructure and consumer habits already in place.

Digitalization of pricing can be done in a phased manner where compliance can be ensured via digital pricing instead of a physical MRP label. Affixing physical MRP labels results in delays in making products available to Indian consumers at par with global launches. Given that the requirement of declaring MRP at customs is no longer valid, it is an Ease of Doing Business issue. Among the 193 UN Member states, only four mandate MRP labeling—India, Nepal, Bangladesh, and Mauritius. The remaining 98% of the UN members do not follow the MRP system and have moved to the digital mode of pricing (refer to table 4).

Risk Assessment of Products subject to Compulsory Registration

India’s decision-making on the applicability of the CRO does not appear to be based on risk-assessment analysis. The scope of the CRO has been expanding ever since its inception, and professional products, such as servers and storage equipment, are also subject to registration under the CRO. While high-risk products should be subject to stringent conformity procedures, businesses have expressed concerns regarding the expansion notifications that are focusing on low-risk products, contrary to the spirit of openness of trade and ease of doing business. In October 2020, MEITY issued a notification adding seven electronics and IT product categories, including wireless microphones, digital cameras, video cameras, webcams, smart speakers (with and without display), dimmers for LED products, and Bluetooth speakers, for compliance with the domestic standards under the CRO. The notification is expected to take effect in October 2021.

Global best practices

India could also emulate international best practices for improving the ease of compliance on conformity assessment of product standards. Some of the best practices are followed by developed region / countries like the European Union and the United States:

The European Union

USISPF highlights the following best practices in the EU that may be considered by India’s policymakers to improve the EODB in conformity assessment regulations:

Combination of conformity assessment routes

The EU uses a combination of conformity assessment routes, ranging from the least stringent Self Declaration of Conformity (SDoC) to the more complex Third Party Assessment (through an independent EU-authorized test lab, called a Notified Body) – similar to the BIS compulsory certification. However, most products within the scope of European product legislation (New Approach Directives) may be self-certified by the manufacturer and do not require the intervention of a Notified Body (in the form of a license/registration/certification).

Supplier’s Declaration of Conformity

The SDoC is a document informing authorities that the product meets the essential requirements of the applicable directives and that a manufacturer is responsible for completing all the procedures required by law, or that the product has been issued an EC type examination certificate. Products that may not be self-certified are subjected to an EC type-examination through inspection by a Notified Body within the EU.

Maintaining a Technical file

Before the product can be placed on the market, all manufacturers (both covered under SDoC and Notified Body) are required to maintain a Technical File. This file includes detailed justifications and demonstrations of technical conformity as well as the product safety aspects. Surveillance authorities can ask manufacturers to produce the Technical File at any time.

Risk Assessment

Most New Approach Directives require a risk evaluation of the products they govern. Assessing risks in the design phase of a product is an established practice, whereby the designer is required to legally defend the safety aspects of their design. A systematic risk assessment also forms the basis of self-certification and is the essence of the Technical File. The EU has specific Harmonized Standards to assist the manufacturer in the risk assessment of machinery (EN 1050).

The United States

Following conformity assessment practices followed in the U.S. are noteworthy:

Combination of conformity assessment routes

The US uses a combination of conformity assessment routes, including the Declaration of Conformity (DoC) and the Supplier’s Declaration of Conformity (SDoC), along with Third Party Assessment through an independent FCC-authorized test lab for select sectors. The U.S. system is comparatively more intricate than the one in the EU, as an additional step of registration is required for SDoC.

Supplier’s Declaration of Conformity

The U.S. has adopted the Declaration of Conformity (DoC) system for PCs and certain types of radio receivers, with or without the Federal Communications Commission (FCC) marking. The FCC Certification (similar testing as the FCC Verification) is not mandatory; however, for specified products (such as non-wireless equipment), the FCC Supplier’s Declaration of Conformity is required, under which safety testing must be carried out by an approved Nationally Recognized Test Laboratory (NRTL).

The telecom manufacturer must register with FCC for FCC Supplier’s DoC (SDoC), after which they will receive an FCC registration number. The testing and certification of products is then done through an Occupational Safety and Health Administration (OSHA) recognized Nationally Recognized Testing Laboratory (NRTL). Certified products are marked by the manufacturer with the NRTL mark, and they are published in a “Listing Book” by the NRTL.

Custom clearance and related processes

South and South East Asian economies have grown rapidly in the last few decades. This growth has been fueled by expanding regional production networks, integration with the global economy, foreign direct investment (FDI), falling trade and investment barriers, a commodity boom, and heightened demand from a rising Asian middle class. However, integration of trade and investment between these two subregions, while making progress, has been hindered by various bottlenecks and gaps in trade infrastructure, trade barriers, and limited regional cooperation. More recent studies indicate that smaller trade gains in these two regions are mainly due to inadequate attention paid to trade facilitation measures such as efficiency of customs and other border procedures, quality of transport, and cost of international and domestic transport. In short, South East Asia is more integrated into Global Value Chains (GVCs) than South Asia.

Trade facilitation addresses the logistics of moving goods through ports or customs at the border. A broader definition may be the environment in which trade transactions take place, including the transparency of regulatory environments, harmonization of standards, and conformity to international or regional regulations. Broadly, there could be four indicators that measure four different categories of trade facilitation efforts:

- Custom port efficiency

- Custom costs as well as administrative transparency of customs laws

- Regulatory environment: Designed to measure the country’s approach to regulations.

- E-business usage: Designed to measure the extent to which an economy has the necessary domestic infrastructure, telecommunications, financial intermediaries, and logistics firms.

In examining trade facilitation, it is important to recognize the economic and overall development differences between economies. Most trade facilitation procedures and processes (customs) are governed by national, not international legislation. Thus, the various border “control” agencies are mandated by the various national acts, regulations, or instructions issued by the respective ministries. The net result is that trade facilitation constraints are not necessarily standardized.

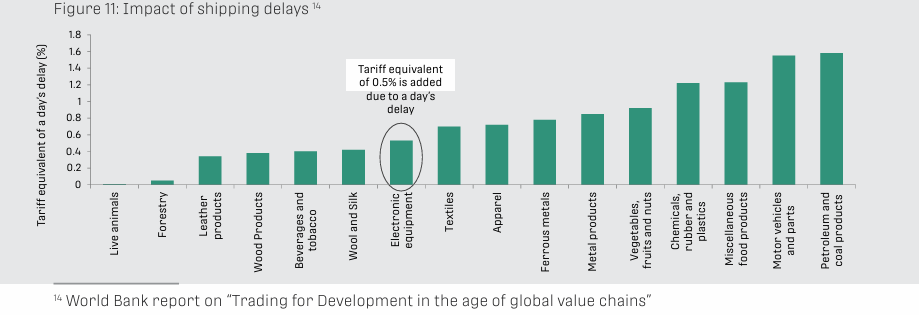

GVCs are impeded not only by the slow movement of goods but also by their unpredictable movement, which disrupts the ability of a value chain to perform its steps in the appropriate sequence.

International organizations and conventions like the World Customs Organization represent the standards to which countries should ideally aspire to adhere in terms of establishing “benchmarks,” but compliance with such standards is dependent on national policies. Consequently, while there may be similar constraints among the countries, their relative impacts could differ significantly.

Custom related issues facing GVC players in India

Excessive Documentation

Documentation is predominantly required by customs for clearance and processing purposes. Importers and exporters have to provide predefined documentation to confirm the shipment complies with appropriate import, export, or transit regulations. It is generally recognized that customs act as the lead agency at the border for the processing of freight traffic, but at most borders, there are at least four to five other public service agencies also present with a clearance role requiring the production of documentation. There have been some improvements in some countries, generally in relation to excessive documentation, particularly in terms of standardization and harmonization of their formats, mainly driven by the automation process within the customs environment. The core problem is the overall volume of documentation required to achieve clearance, rather than its particular format; the more documents required, the longer clearance takes and the higher the border transaction costs. Feedback from some of the clearing and forwarding (C&F) agents reveals that the collection of all the necessary paperwork at one physical location to lodge a clearance entry is the greatest obstacle.

Limitations to the Application of Information and Communication Technology

The use of information and communication technology (ICT) systems in the trade facilitation environment is most pronounced in relation to customs operations, and this is an area where international agencies like ADB and the World Bank have provided invaluable assistance to some of the less developed countries. Customs declarations are now generally submitted across both regions in electronic format. Unfortunately, the implementation of ICT within the customs environment has, in many cases, widened the gap between the most advanced and least developed countries in the region. This situation has evolved partly as a result of differences in both the application and funding of ICT, and partly due to ICT expertise being available within particular customs organizations. The first issue is that some of the countries have introduced bespoke or “off-the-shelf” ICT systems in such a way that they act solely as a transaction recording system, a database of submitted declarations rather than an actual processing system. A common complaint by C&F agents and traders in India and parts of Southeast Asia is that the introduction of ICT by customs has not resulted in any significant enhancement of clearance timeframes or a reduction of documentation.

Another constraint has been the manner in which the software has been introduced. In some cases, the development process has been to automate the existing manual processes, in effect using the existing system as the design “base,” rather than the goal of a fully automated paperless system. This type of approach leads to the development of a short-term transaction-recording goal, and not the enhanced process. The clearance is still undertaken as before, using mainly manual processes with approval stamping and signatures by various officers, but with these manual actions additionally being recorded within the IT system. This duplication of processing is still relatively common. Ironically, some stakeholders have suggested that automation has actually increased the workload of both agents and individual customs officers with no clear payback for the major investment, instead of making for faster processing with less manpower as anticipated.

USISPF notes that countries like Singapore, Malaysia, and Thailand have the most advanced ICT systems, thus there is a correlation between ICT development and good levels of trade facilitation. It is clear that good facilitation will be difficult to achieve without ICT systems that process, as well as record, shipments.

Complex import–export procedures and impractical timelines

Modern customs operations—and to a major extent trade facilitation—is about “informed compliance.” Under this concept, traders who comply with the appropriate legislation and regulations on a regular basis should be entitled to a facilitated service, usually in the form of expedited clearances. In order to be compliant, it is essential to be aware of the import, export, and transit requirements. Previous studies on trade facilitation have highlighted the governance issues arising from a lack of transparency, but this problem often arises from inadequate publication of clear import-export requirements.

Complex procedures and requirements

Non-compliance can either be deliberate, as in the case of “smuggling,” or accidental, whereby a genuine error has been made because the rules were either not clear or were misinterpreted. The latter cases are by far the most common, especially in an environment with large numbers of one-off importers or small traders, as well as many small C&F agents with limited experience. While the most familiar documentation problems are simple typing errors during the entering of data or in the transposition process, there are many instances of submission of incorrect supporting documents or the lack of them. The latter occurs principally because the relevant party has failed to comprehend what was required.

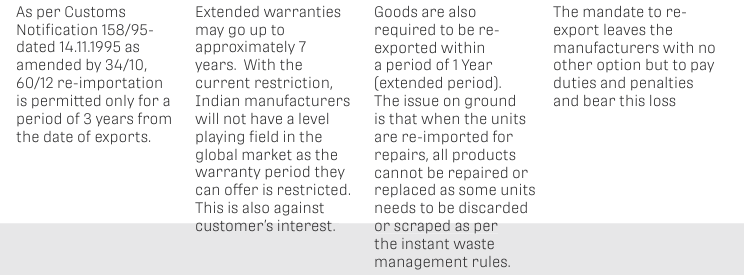

Penalty on re-export

- Due to oversight or errors at ports of origin, goods imported into India are often required to be re-exported. Presently, a penalty is levied on the premise of treating such instances as a misdeclaration.

- These are genuine instances and not errors or misdeclarations, which are practical in nature.

Limited time period for reimportation

Duty Deferment

- Current rules mandate the payment of deferred duty on the 17th of the month for all clearances made between the 1st and 15th of the said month, and on the 3rd of the following month for the duties deferred from the 15th till the 30th/31st of any month. Any delay in payment entails the imposition of interest and also has an impact on the AEO status/accreditation.

- Two days are not sufficient for an entity to reconcile the accurate duty deferment availed and pay the deferred amount. Any delays in meeting the deadline have an impact on the AEO accreditation, apart from additional interest. This is a deterrent for the industry to avail the said benefit.

Issues impacting the industry

Import of second-hand capital goods under EPCG

- Under this scheme, capital goods (like machinery) can be imported duty-free if they are deployed for manufacturing finished products meant to be exported out of India.

- Couple of years ago, the Export Promotion Capital Goods (EPCG) scheme also allowed imports of all capital goods, including used ones. However, the import of used capital goods/machinery was disallowed under the EPCG scheme in the year 2016-2017 due to concerns of the Ministry of Environment, Forests, and Climate Change (MoEFFC).

- MoEFFC, in June 2018, allowed the import of used capital goods subject to the criterion that they have 5 years (80%) of residual life as ratified by a Chartered Engineer. While this was a positive development, the EPCG rules of import continue to restrict the import of used machinery.

- In order to become a global manufacturing hub, India requires a high focus on exports. The present National Policy on Electronics 2019 lays significant emphasis on exports.

- To encourage shifting of the manufacturing base and their respective supply chains to India, existing machinery from other global manufacturing plants would also need to be moved to India. Hence, the EPCG scheme should recognize and align with the national objective to boost exports from India.

- Restricting imports under the EPCG scheme increases the cost of investment, thus restricting companies from investing or expanding in India. Therefore, used capital goods also need to be allowed under the EPCG scheme to enable companies to set up units within the country as well as be competitive in the global market.

Value Addition criteria for Advance Authorization

Value Addition Criteria for Advance Authorization: Most of the mobile manufacturers operate out of Domestic Tariff Areas (DTAs), and for them to export finished products and components from India to various geographies, it is imperative that export promotion schemes should be aligned with the realities of the sector, such as value addition in the form of allowing for a net foreign exchange positive scenario.

As per Para 4.09 of the Foreign Trade Policy, the minimum value addition to be achieved under Advance License is 15%. In contrast, under other export schemes (viz., SEZ, 100% EOU), the criteria applied is Net Foreign Exchange positive, which leads to only positive value addition as against the 15% norm.

Repair and Re-export opportunity

- The global warranty services market is growing rapidly, and we do not have any policy to look at this sector. However, we do have a barrier with secondhand goods being restricted as per Para 2.31(d) of the Foreign Trade Policy.

- We need to have a policy to import used products for repair and re-export irrespective of whether they were manufactured in India or not.

MOOWR, 2019 – Manufacture and Other Operations in Warehouse Regulations

Domestic Tariff Area – Lack of clarity during inter-unit transfer

- As per the provisions, the manufactured product can be cleared into the DTA upon payment of duties on the parts which were dutiable at the point of import. There is a clear provision for manufacturers who import parts/components for the manufacture of the final product and export or clear them into the DTA.

- However, in manufacturing, we also have ancillary units who manufacture intermediate products and supply to units who manufacture the final product. If both these units are bonded and need to do an inter-unit transfer, it’s unclear as to what duties the unit manufacturing the final product would pay on the component while clearing the finished product into the DTA. This leaves room for interpretation.

Scrap sale of capital equipment

There are no clear guidelines to enable manufacturers to destruct / scrap the CAPEX.

Faceless Assessment – Issues in Implementation

- Customs Department introduced the “faceless assessment” system for import and export shipments in June 2020. The objective was to eliminate contact, improve integrity, and bring about systemic transparency and digitization of the assessment process. However, the delays in clearance have increased from an earlier 7 days to 15 days. This is significantly impacting businesses and increasing cost

- No appropriate Turn-Around-Time (TAT) – Shipments take 5-8 days to clear, even for AEO awardees. For SMEs, the clearing time could go up to 15 working days.

- There is no grievance redressal mechanism at the port of import. There should be a system in place to address issues immediately for importers.

- Delays IS causing loss of production and an increase in financial losses, which is an obstacle for PLI applicants.

- In some cases, assessing officers enquire about WPC, which ideally is not required for around 200 products, including mobile, EPR, etc. This unnecessarily causes delays.

Logistics

Poor border infrastructure is often cited as an important factor that manifests itself in long queues at borders and resultant delays in transit. The Indian Government is investing in the development of large integrated check posts (ICPs) at its main land borders with Bangladesh, Bhutan, Myanmar, Nepal, and Pakistan to resolve this issue by moving the existing border operations outside the border towns and creating large border terminals connected by bypasses. Pedestrian traffic will continue to use the existing urban crossings, whereas vehicular traffic will predominantly be diverted to the new facilities. Thailand is adopting a similar strategy by separating freight and passenger traffic, with freight bypassing the border towns to connect with new border terminals being constructed at the borders with Myanmar and Cambodia.

Logistical infrastructure is a critical enabler in economic development and growth. Despite having a comparable ranking vis-a-vis Thailand and Vietnam, there are practical issues. In this section, we highlight challenges associated with infrastructure, air cargo, and warehousing that are adversely impacting the performance of the logistics sector. Freight traffic in India is expected to treble in the coming decade and thus it is critical for investments and reforms to keep pace.

Infrastructure

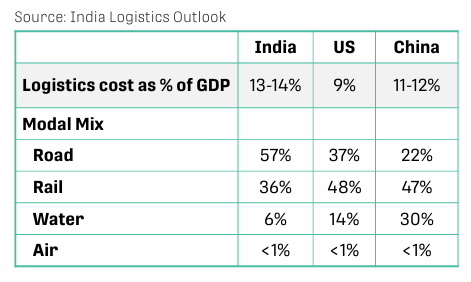

Logistics infrastructure covering road, rail, waterways, and air network of a country is the underlying foundation that supports all economic activity. The following table provides the modal mix of India vis-a-vis the US and China, with comparable continental surface area.

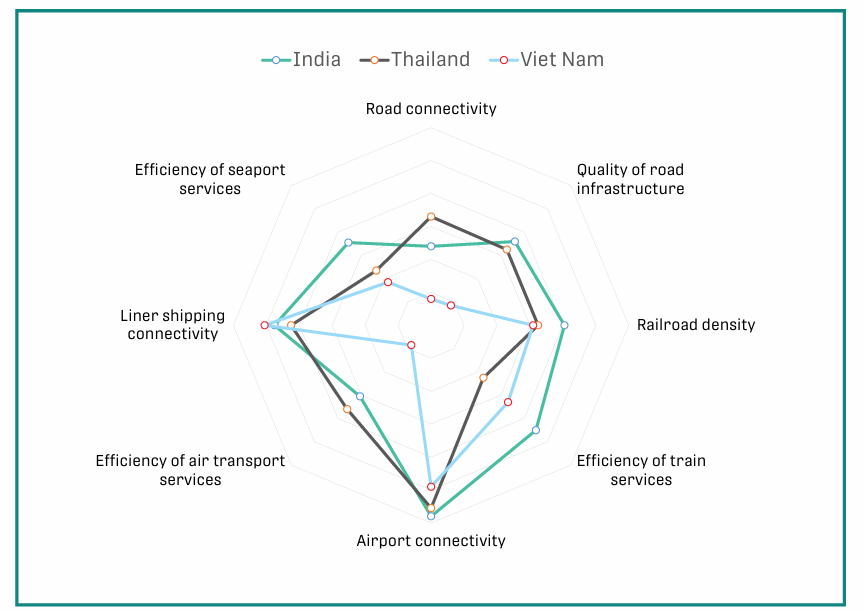

Efficient logistics connect firms to domestic and international markets, positively affecting the efficiency of the manufacturing global value chains and the competitiveness of a country’s economy within these value chains. As is evident from the numbers, logistics costs as a percentage of GDP for India are well above the similar ratios for the U.S. and China. Logistics costs are known to be strongly (inversely) correlated with the Logistics Performance Indicator (LPI), and thus it comes as no surprise that India needs to reduce these costs to improve its LPI ranking.

The share of rail freight in India’s modal mix is currently at 36 percent when compared to China and the U.S., which are almost at 50 percent. When coupled with the fact that the cost for coastal shipping is INR 0.15-0.2 per ton km, INR 1.5 for railways, and INR 2.5 for roads, it reveals the entire story – there is an overuse of high-cost modes like roads at the expense of cost-effective and sustainable modes like inland waterways and railways in India. Due to the higher dependence on road transport, businesses bear higher transportation costs, slower and inconsistent transfer efficiency, all while adversely impacting the environment. Carbon Dioxide or CO2 emissions from road are 84g per ton km compared to 28g from railways and 15g from waterways.

Based on the competitiveness report by WEF, India scores better than its peers in most aspects of infrastructure. But Vietnam surpasses India with its liner shipping connectivity. India, being a peninsula, has not been able to leverage its waterways, which ideally is the most efficient transport system to reduce logistics costs. The Government of India is looking to leverage this with the Sagarmala project, but such projects have a substantial gestation period. There has been a call to increase allocation for these projects in the budget.

Air Cargo

ndia has a network of approximately 154 airports; of these, 114 are domestic airports, 10 are for customs, and 14 are international airports. At present, private air freighters are permitted to use only the international airports for international cargo handling. However, problems such as procedural bottlenecks of customs clearance, congestion at cargo terminals, reducing dwell time, and challenges of handling hazardous cargo are causing significant delays, leading to demurrage charges. Air cargo typically involves the shipment of highly time-sensitive, temperature-controlled, and high-value goods with very little tolerance for delays.

Given that India is developing as one of the fastest-growing air cargo markets across the globe, it presents ample opportunities for industry operators. The government should consider opening up the domestic airports to international air freighters to ease the existing congestion and procedural bottlenecks.

Warehousing

Sophisticated warehousing systems are another important trigger for trade, and an efficient warehouse can bring a 15-20% cost reduction in the entire logistics operations. India’s warehousing sector achieved a much-needed impetus triggered by GST in 2017 and the grant of “Infrastructure status” to warehousing. Since then, the sector has witnessed a rapid change towards institutionalization – transforming from being unorganized to attracting international players, towards consolidation and formalization. On the demand side, the increasing dominance of e-commerce, third-party logistics players, and corporates has catapulted operations. In our analysis, we comment on the existing regulatory and policy environment as a key enabler to enhancing competitiveness.

The National Logistics Policy is in the discussion stage; each of the 29 states in India has its independent logistics and warehousing policy infrastructure. Research by Knight Frank indicates that as of May 2020, only eight states have a valid policy infrastructure, with an additional two working on it. The remaining 19 states do not have policy provisions covering warehousing. In an environment where attracting domestic and foreign investment is central to development, states need to focus on creating investor-friendly policies as well as creating monetary and non-monetary incentives.

USISPF understands that the Government of India has been working on a draft National Logistics Policy and Unified Logistics Law, with a focus on creating more dedicated freight corridors, making railways a major mode of freight, and increasing the use of inland waterways. While some of our members in the express delivery business have pointed to a few concerns, we hope to get a chance to comment on the draft Unified Logistics Law when it is released for public comment.

USISPF RECOMMENDATIONS & IMPACT ANALYSIS

IT product safety requirement and conformity assessment

Conformity Assessment of Standards

- Practice self-declaration mode of conformity assessment for the majority of products that are considered low risk, as per global definitions.

- Adopt a risk-based approach to regulate product safety, taking a cue from international norms for conformity assessment requirements; high-risk products can be regulated while low-risk products (such as storage devices) can be left out of CRO compliance. By following a risk-based approach, India can provide a more predictable and internationally aligned conformity assessment regulatory environment that can augur well for expansion plans of existing manufacturers.

- Adopt international best practices by harmonizing more domestic standards to IEC standards and by recognizing IECEE accredited lab reports. Acceptance of IECEE accredited labs would support WTO TBTs principles of non-discriminatory treatment and increase India’s score in the portability of conformity assessment parameters. Businesses will appreciate the increased ease of doing business and save unnecessary costs and time from duplicative testing. Adhering to globally accepted standards boosts exports with inherent trust in quality and safety among a wide number of stakeholders; it helps attract investments to support domestic manufacturing products of globally acceptable standards.

- Expand the scope of standards in the IECEE CB Scheme, which facilitates acceptance of product safety test results among participating laboratories and certification organizations of over 50 countries. Product tests and assessment results that underpin IEC Conformity Assessment certificates, issued by a member, are fully portable. In the absence of harmonized standards and requirements combined with country-specific national standards, the expanded implementation of the CB Scheme will be very helpful to manufacturers.

- Restore the efficiency in systems and processes that existed until February 2020 at both BIS and WPC for the issuance of CR Certificates and ETAs, respectively. Alternatively, introduce a concept of “Deemed Approval” if the approvals are not received within 2-3 days of applying. By restoring efficiency in BIS CR registration and WPC (ETA) approvals, India can eliminate bottlenecks and unnecessary delays.

- Adopt a simplified and speedy approval process for compliant companies; AEO model tier-based faster approvals may be given for compliant companies.

- Accord priority to OEMs who are large investors engaged in manufacturing in India for exports while granting approvals for both CRO and ETA.

- Use an auto-escalation process if approvals are delayed beyond TAT.

- Move to digital modes of pricing by adopting either printing a website or a QR code on a product that a consumer can access. We propose that the mode of disclosing MRP be kept optional, either in the form of a physical label, website, or QR code; this can be treated as a pilot project for electronic products and, after periodic reviews, may be extended to other product segments. E-pricing is a win-win for governments, consumers, and manufacturers alike. E-pricing aligns with the Modi Government’s vision of digitalization of Indian society – ‘Digital India’ initiative, UPI, GST e-invoicing, etc. This will ensure Ease of Doing Business, improve the accuracy of MRP for consumers, ensure global product launches in India on par with the rest of the world, and remove the grey market to increase revenue to the Government exchequer.

Predictability of Policy

- Increase predictability, transparency, and clarity in regulatory policies to provide a stable and conducive business climate. Unexpected policy decisions without consultations with all stakeholders and insufficient time to adapt create financial and investment challenges for businesses. India can gain investors’ confidence if regulatory policies are predictable and transparent and reduce the surprises that serve as a major impediment to investments. India will score a higher rank on the WEF Competitiveness Index and the Ease of Doing Business evaluation by ITI, thereby improving its reputation among global businesses.

- Provide a stable policy regime: Encourage and incentivize businesses by reducing the frequency of changes in regulatory regimes and rollback of announcements.

- Adopt and enforce government-wide standards for public consultation: India can improve predictability for industry across sectors by adopting and adhering to a legislative procedure implemented across government agencies, which provides for a standard and consistent notice/comment period and a meaningful consultation where stakeholder input is taken genuinely.

- Implement the single-window concept for approvals: Ensure the industry interacts with only one regulator who, in turn, can coordinate and complete intra-agency processes/clearances across all states. Adhere to the terms of international treaty rulings and honor International Arbitration Court decisions in a swift manner to demonstrate that India is a predictable place to do business.

Customs Procedures

By improving the import and export clearance procedures/rules, India will cut delays and hassles of unnecessary procedural formalities. This will result in reduced costs for importers/exporters and move India up in ranking in the World Bank’s Ease of Doing Business Index, thereby improving India’s reputation among global investors. Trade facilitation measures will also help increase trade volumes for India. We recommend the following steps for better trade facilitation:

Duty Deferment: Payment Timeline to be extended

The timeline for payment of duty deferment should be at least 7 days from the 15th of the month for the industry. This would enable the industry to validate all the duties to be paid accurately and also give sufficient time to make the payment well within the stipulated timeline.

Penalty on re-export should not be levied for voluntary requests

Due to oversight or errors at the port of origin, goods imported are at times required to be re-exported. Presently, a penalty is levied on the premise of treating such instances as a misdeclaration. These are genuine instances and not errors or misdeclarations, which are practical in nature. In cases where there is a voluntary request for re-export, no penalties should be imposed.

Re-Import Timeline Extension in line with life of Exported Product

The re-import timeline needs to be extended from 3 years to at least 10 years. In view of the industry practice and customer requirement for extended warranty, the time period of re-importation should be at least 8-10 years instead of the current 3 years. Extending the time period would also help manufacturers in India dispose of electronics that are beyond repair or replacement, in accordance with the provisions prescribed under the Hazardous Waste Management Rules, without incurring additional costs, duties, and penalties.

Import of Second-hand Capital Goods under EPCG should be permitted

The EPCG scheme may be amended to allow the import of used machinery (Used Capital Goods) on zero duty in line with the criteria permitted by MOEFFC – i.e., allowing the import of used machinery with 5 years (80%) residual life. This will go a long way in encouraging the needed shift of manufacturing plants and the supply chain for mobile handsets and electronics to India.

Value Addition criteria for Advance Authorization

Advance Authorization is an important instrument of export for electronics manufacturers operating in the Domestic Tariff Area. This allows the use of the same production lines for both domestic sales and exports. For ease of doing business and to encourage exports, the value addition norm of 15% needs to be replaced with a Net Foreign Exchange positive criterion in the case of advance licenses, thus aligning it with other Export Promotion schemes.

Repair and Re-Export: A new manufacturing opportunity emerging

There is a need to have a policy to import used products for repair and re-export, irrespective of whether they were manufactured in India or not. Though this is presently allowed under the Special Economic Zone (SEZ) scheme, it is not allowed for any unit located within a Domestic Tariff Area. The policy needs to be extended to units situated in the Domestic Tariff Area as well, and guidelines can be introduced to ensure that these products are not cleared for domestic consumption. This would allow manufacturers to use the existing manufacturing lines more efficiently and to their complete capacity.

Domestic Tariff Area – Clarity on interunit transfer

In inter-unit transfers, the provision for self-certification of the unit manufacturing the intermediate product on the dutiable parts manufactured should be in place. The unit manufacturing the final product should be able to discharge the duties as per the self-certification

Scrap sale of capital equipment needs to have a clear provision

There needs to be a clear provision within the rules to enable manufacturers to destruct/scrap the CAPEX in all cases where the CAPEX is obsolete. This needs consideration, as technology changes very fast, and therefore, if the CAPEX is of no use, manufacturers should not suffer additional costs in terms of duties/taxes.

Faceless Assessment

To make Faceless Assessment more effective, the government has to undertake multiple reforms so that the process becomes seamless, truly faceless, and improve the efficiency of the entire system.

- To address the issue of delays, a concept of “Deemed Approval” should be introduced. All applications with documents uploaded online beyond 24 hours should be considered deemed approved. Any queries or clarifications can be addressed subsequently. However, a complete application on the portal should be cleared within 24 hours of filing, else should be considered deemed approved.

- All AEO and In-Bond Manufacturing entities, as well as manufacturing entities that have qualified for PLI, SPECS, or EMC, should be allowed to import/export through a “green channel” for self-assessment and automatic clearing for both import and export shipments to promote faster capacity addition and greatly improve the ease of doing business.

- The Faceless System may be used for other segments, but AEOs in the electronics sector and Bonded Manufacturers may be exempted.

- In conclusion, the basic objective is to reduce compliance costs and manage inventory. There is no fear of revenue loss since AEOs are selected based on rigorous criteria and subjected to a comprehensive audit later on.

Improve Execution of Infrastructure Project

USISPF welcomes the recent steps taken by the Government, particularly the launch of the National Infrastructure Pipeline. We believe that it will uplift and improve national infrastructure, which will also aid the manufacturing sector in the country. USISPF recommends that the government induce further private sector investment in the country to aid in infrastructure development projects via the Public-Private-Partnership (PPP) model that has proven to be successful in recent years. USISPF would like to submit the following specific long-term and short-term recommendations on this matter.

Long-term priorities

- Develop structural solutions: Establish a government nodal office and mechanisms for centralized coordination of policy and regulatory issues from tendering to execution of long-term projects.

- Curate an Infrastructure Regulatory Council: Form a General Infrastructure Council of experts mandated to oversee all aspects of PPPs in India, including regulation, issue resolution, and skills development.

- Identify pilot projects: Select 1-2 pilot projects or sectors for a deep dive on specific issues and challenges, and prepare a set of recommendations or a white paper by the HLWG. Potential sectors can include Railways, Ports, or others.

Short-term priorities

Develop a model PPP contract for the implementation of infrastructure projects in India. This contract should be prepared in consultation with the government and the private sector and should incorporate aspects related to:

- Appropriate distribution of risks for controllable and uncontrollable factors

- Arbitration of international standards

- Best practices from successful infrastructure projects from other emerging and developed economies

Improve Connectivity

The foremost consideration for a business while deciding to set up a manufacturing unit is cost efficiency. Integrated logistics and manufacturing activities can result in substantial cost savings and efficient business operations. The following issues may be addressed by policymakers:

- The present multi-modal mix is skewed towards road: While highways have been developed well in the Central Indian Provinces, this needs to be extended to other parts of the country.

- Government policies and laws should not mandate the usage of specific modes of delivery: Leaving it at the discretion of the logistics companies and the manufacturers will facilitate the reliability of supplies in the chain.

- CII members find the entry tax system for states too cumbersome, causing delays: The waybill system is not working properly in all parts of the country due to a lack of broadband availability at all checkpoints.

- India should adopt a model, such as Industrial Corridors, that allows manufacturers and logistics companies to work closely without geographical considerations: Industrial corridors integrate logistics and manufacturing activities, resulting in cost savings and efficient business operations.

- Companies often use express delivery service providers to ensure uninterrupted and timely delivery/shipment of consignments: We recommend that priority be given to facilitate the operations of global logistics companies that can freely provide solutions to the supply chain participants.

- Our express delivery member companies have voiced concern regarding the uncertainty in business continuity due to the existing licensing regime: It provides discretionary power to the authorities to cease the license from express delivery service providers.

Improve Warehousing Operations

Imported parts can be warehoused for a period of 90 days as per the warehousing regulations. However, if the parts are not used within a period of 90 days, then interest would be leviable as there is no clarification within the notification. From a cost perspective, there are certain products that manufacturers might need to import in bulk for a period of almost one year. If this condition is placed, then the manufacturers cannot avail this cost advantage.

The period of warehousing should be increased to between 12 to 18 months. The warehousing infrastructure needs to be augmented in line with global standards as India moves forward to become a global manufacturing and trade hub. Improving warehouse infrastructure at ports will support India’s long-term logistics policy that is aimed at multiplying bulk traffic at ports. With the improved warehousing infrastructure, the importers will be able to get clearances of the goods from the warehouses and avoid the current problems and damages caused by excess storage of goods in the existing warehousing facilities at the ports.

A fully operational statutory framework is critical to achieving success at the policy level. Emphasis should be given to the operationalization of warehousing in the existing state policy frameworks. Where these are missing, states should be given timelines to create and implement their independent policies regarding warehousing. The Center can assist the states by providing centralized data resources for guidance on policy formulations and institute a monitoring mechanism.

States should compete with one another to attract investments in warehousing.

CONCLUSION

India needs a revamp of its current trade policy environment to attract investment prospects from Global Value Chains (GVCs). There is significant scope for improvement, requiring dedicated attention from policymakers and industry alike. India can only “Make for the World” and increase its manufacturing capability if trade barriers are removed and the ease of moving goods is prioritized. Facilitation of imports of inputs/components is essential in the absence of a strong ecosystem within the country. U.S. manufacturers in India continue to struggle with market access restrictions, from high tariffs to technical barriers to trade, such as duplicative testing requirements and domestic standards. Meanwhile, India’s competitors in the region have successfully attracted many global manufacturers.

they offer a predictable policy environment for investors and adhere to international best practices in the movement of goods across borders. (In our first study, we found that India provides a reasonably good business environment for setting up factories, with specific areas of improvement remaining for better ease of doing business.)

The second phase of the study highlights the gaps in Ease of Doing Business (EODB) for manufacturers already engaged in manufacturing activities in India through direct/contract manufacturing. By addressing these gaps through the adoption of global best practices in Standards and Customs, ensuring a reliable policy environment, and improving logistics, India can enhance its exports and attract fresh investments to further develop its manufacturing sector. India’s electronics manufacturing sector can play a vital role in realizing India’s goal to be self-reliant (Aatmanirbhar) in its true spirit.

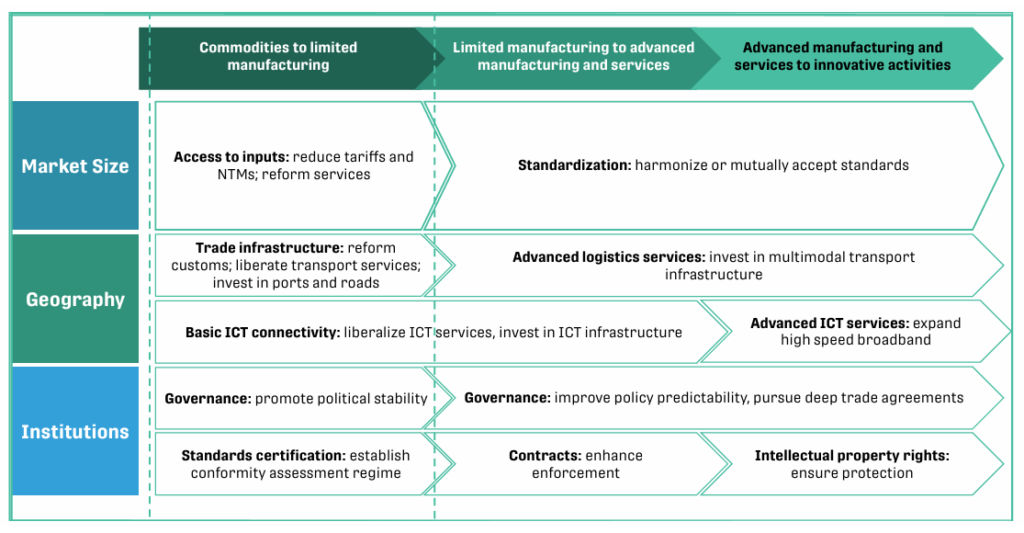

For the electronics industry, imported inputs play a large role in basic manufacturing for Global Value Chains (GVCs). India should give priority to measures that support trade, including those that improve physical connectivity, particularly through critical trade-related physical infrastructure such as ports and first-generation trade facilitation reforms. Tariff reforms—to start with selected goods—may ensure access to competitively priced inputs or involve the use of mechanisms such as bonded warehouses, duty drawbacks, or SEZs.

Methodology

USISPF methodology is a combination of secondary research of the various published information on government websites, Ease of Doing Business scorings for countries engaged in ICT trade, and inputs from Forum members. Our research has been supplemented with primary meetings with Fortune 500 foreign multinationals engaged in manufacturing/contract manufacturing in electronics in India for the last several years.