Executive Summary

This Report focuses on the implications of India’s expanding economic relations with the European Union (EU), the most important economic bloc for India in terms of trade and investment. In 2022 India

and the EU, as strategic partners, declared their intent to strengthen their economic partnership and strategic cooperation by reviving their suspended negotiations on economic partnership after a nine-years lag. The revived negotiations will include three separate agreements in the areas of trade (Free Trade Agreement – FTA), investment protection (Investment Protection Agreement – IPA), and geographic indications (GI – a form of intellectual property used as a sign on products that have a specific geographical origin and specific qualities).

The Report presents the trade and investment patterns for the last five years between India and the EU and elaborates India’s engagement with major economic partners within the EU. The discussion on the mutual benefits of the ongoing negotiations on the agreements highlights the benefits of the economic cooperation between India and the EU in the current geopolitical environment. The last section of the Report describes various aspects, status, and issues under deliberation in the current negotiations as well as the positions of the two sides.

The Conclusion highlights that, while the FTA negotiations are still at work, India and the EU continue to participate in many global fora, such as the WTO and the G-20. India can leverage its G-20 Presidency for 2023 to drive its priority areas where the EU positions coincide, such as integration of small and medium enterprises in resilient global value chains, sustainable development through trade, and reforms in the international financial institutions. India and the EU are moving in the right direction to strengthen their economic ties through negotiating binding agreements; however, given the complexity and the sensitivity of several languishing issues, the negotiations may go beyond the scheduled December 2023 conclusion deadline. It will be crucial for both sides to see the success of the negotiations while maintaining the ambition of the perceived Agreements to the maximum extent possible for their long-term relations. The deal is expected to have geopolitical implications for the global value chains while providing a template for India’s future deals with other major economies of the world.

Trajectory of India-EU Economic Partnership

The European Union (EU) is a single-currency economic bloc of 27 countries, primarily from Europe.01 Political and economic relations between India and the EU have intensified in recent years. India’s relations with the EU’s predecessor, the European Economic Community (EEC), date back about eight decades, but the two sides started recognizing their full potential around 2000, which led to the India-European Union Strategic Partnership Agreement in 2004 for enhancing multilateralism, sustainable development, and economic relations.

In 2007, India and the EU started negotiations for the Bilateral Trade and Investment Agreement (BTIA), but the talks failed despite several rounds spanning five years due to technical disagreements from both sides on several issues, like tariffs, entry barriers, market access, and investment protection. Eventually, the trade negotiations were officially stalled in 2013.

Since 2014, the India-EU relation has evolved into development partners, with cooperation in different areas like sustainable urbanization, digital transformation, climate change, and renewable energy. By 2016, shifts in trade and investment outlooks led the two sides to acknowledge the significance of partnership in core areas like climate change and sustainable development, and in its 2018 Strategy on India document, the EU declared India as an equal partner. The Roadmap 2025 document, adopted in 2020, sets out the plan for the expansion of relations. In 2021 India and the EU announced a ‘Comprehensive Connectivity Partnership’ to support resilient and sustainable connectivity projects in India and other regional economies (such as Africa, Central Asia, and the Indo-Pacific) where India is focusing on deeper integration.

In the meantime, Brexit and Chinese economic aggression created fresh developments in the global trade arena, necessitating the EU and India change their stances. India has been seeking trade diversification, drifting away from its dependency on imports from China. Both sides realized the need for a comprehensive Free Trade Agreement (FTA), and on June 17, 2022, negotiations on the proposed FTA were revived after an almost nine-year hiatus. The first round of talks in New Delhi between June 27 and July 1, 2022, was followed by two additional rounds in October and December 2022. Since then, the expedited talks are progressing with scheduled meetings to wrap up the FTA negotiations before scheduled elections in India and the EU in 2024. Sweden, as the EU Presidency for 2023, has declared the successful conclusion of FTA discussions with India as one of its main priorities in 2023.

Trade and Investment

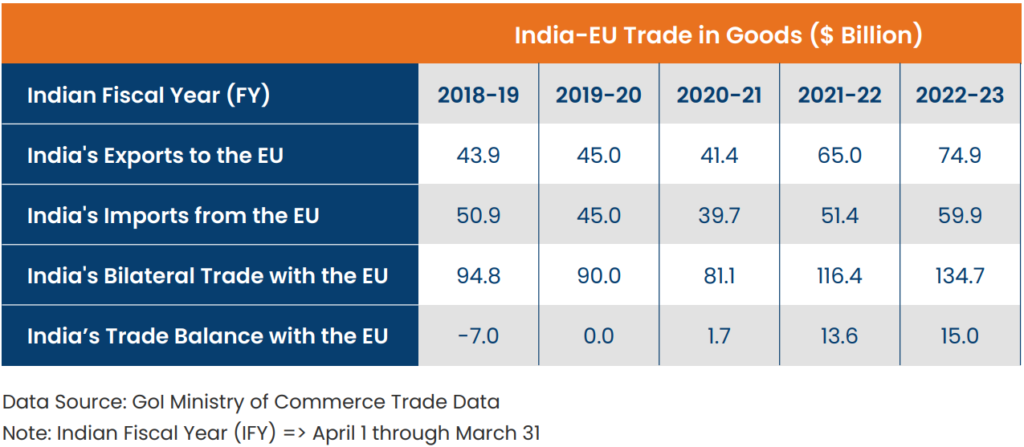

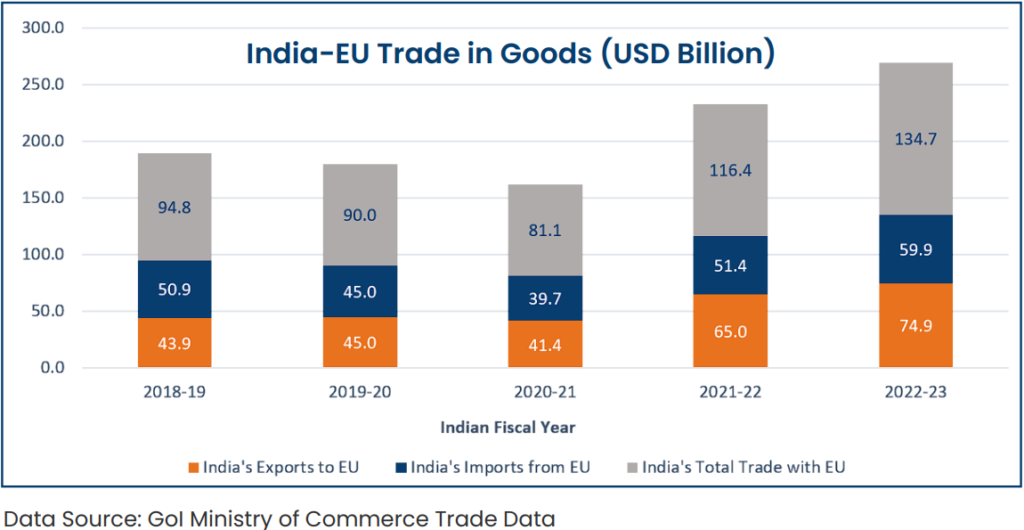

India and the EU are already important economic partners for each other. With a two-way merchandize trade value of $134.7 billion in FY2022-23, the EU was India’s top trading partner, accounting for 11.6% of India’s global merchandize trade; however, in terms of single country partnership, the United States was India’s top trading partner with an 11.1% share. Trade in goods between India and the EU has increased by 42% over the last five years. India’s services trade with the EU is focused on transport, information and technology, and business services. With almost $44 billion total two-way service trade in 2021, a significant potential remains untapped.

The largely balanced EU-Indian trade covers the entire range of the manufacturing economy; however, India has been able to manage a trade surplus with the EU since FY2020-21. The EU assumes a great significance for India as a trade partner. India’s merchandize exports to the EU grew year-on-year 15.2% in FY2022-23, accounting for 16.6% share in India’s total merchandize exports, while imports grew 15.2% in the corresponding period, accounting for 8.4% share in India’s total merchandize imports. From the EU perspective, India is its tenth largest trading partner, accounting for only 2.1% of the EU’s total trade in goods, well behind China (16.2% share) and the US (14.7% share). That said, in recent years the EU has recognized India as an important economic player in the global market, showing immense interest in advancing economic partnership with India.

In terms of direct investments, the EU is one of the most important foreign investors in India, along with Mauritius (mostly pass-through US investments) Singapore, and the United States. Foreign investment from the EU to India has increased over the years, with the EU foreign investment stock in India at around $95.5 billion in 2020.

Among the EU countries, India’s trade and investment relations with Netherlands, Germany, Italy, France, and Spain have witnessed a decent progress during the last five years, which is discussed below:

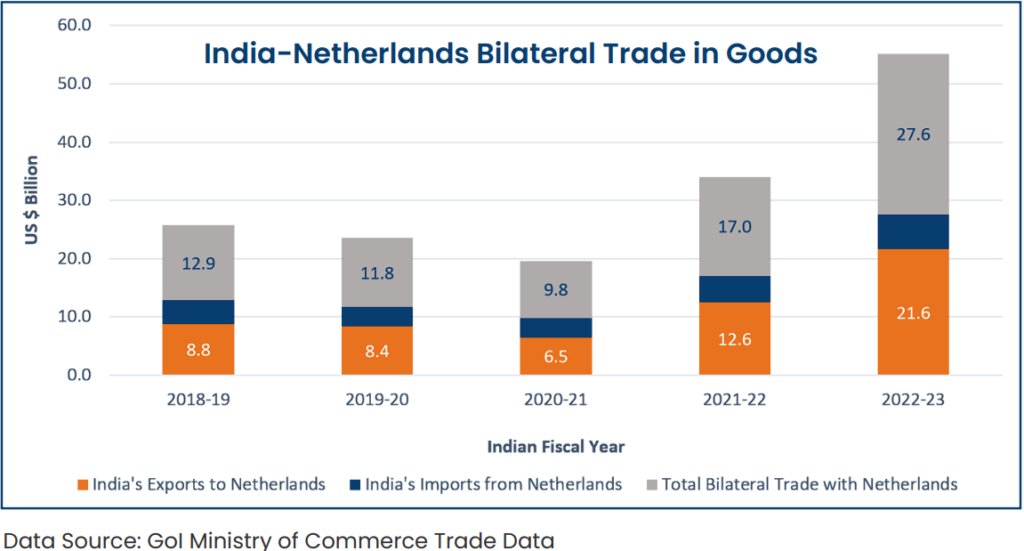

Netherlands

Post-COVID, the Netherlands has emerged as a major destination for India’s exports of petroleum products (aviation turbine fuel and diesel), electronic goods (mainly smart phones), chemicals, and aluminium goods. The Netherlands became India’s top trading partner among the EU countries in FY2022-23, surpassing Germany, which had remained at the top for the last five years. India’s trade surplus with the Netherlands nearly doubled to $15.7 billion in FY2022-23 from $8.1 billion in the previous year, mainly due to a healthy growth of 71.4% in exports. India’s major imports from the Netherlands include petroleum products, machinery, medical devices, edible oil, and plastics. According to the Federation of Indian Export Organizations (FIEO), the Netherlands has emerged as a hub for Europe with efficient ports and multimodal connectivity with the EU.

The Netherlands is India’s fourth largest source of foreign direct investment (FDI), with a cumulative $43.76 billion FDI between April 2000 and March 2023. Several Dutch companies are present in India, including Philips, Akzo, Nobel, KLM, and Rabobank. Similarly, several Indian companies are operating in the Netherlands, including IT majors TCS, HCL, Wipro, Infosys, Tech Mahindra as well as Sun Pharmaceuticals and Tata Steel.

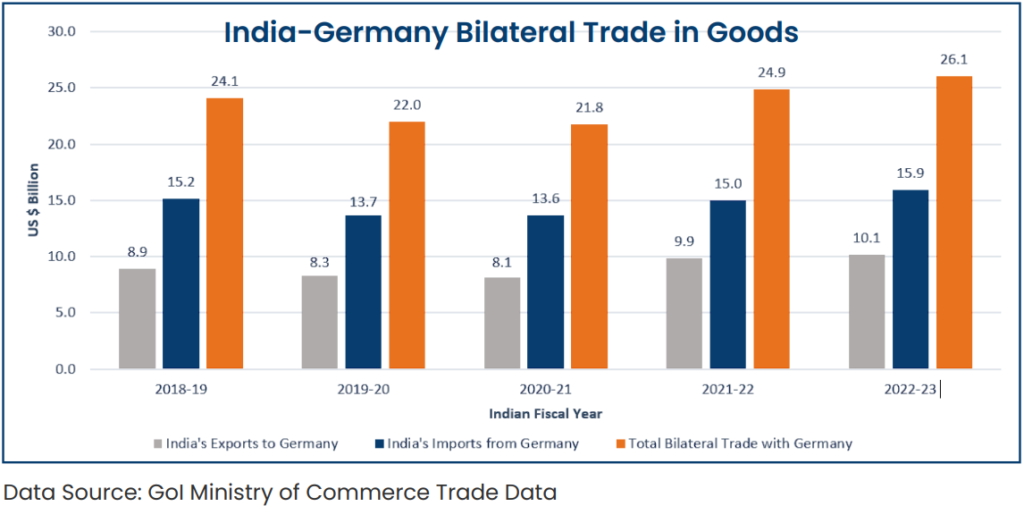

Germany

Germany and India are strategic cooperation partners. Germany was India’s second largest trading partner among the EU countries, with bilateral trade at $26.1 billion in FY2022-23. India’s trade relations with Germany have been rising steadily. Major Indian exports to Germany include electric machinery and equipment, cotton garments and accessories, and chemicals. The balance of trade has remained in favor of Germany for several years. In FY2022-23, India’s imports were pegged at $15.9 billion, including its major imports of medical devices, machinery and mechanical appliances, vehicles, and accessories.

Germany was India’s 10th largest foreign investor, with cumulative foreign direct investment (FDI) of $14.14 billion during the April 2000–March 2023 period. Key areas of German investment in India have been transportation, electrical equipment, metallurgical industries, the services sector (insurance), chemicals, construction activity, trading, and automobiles.

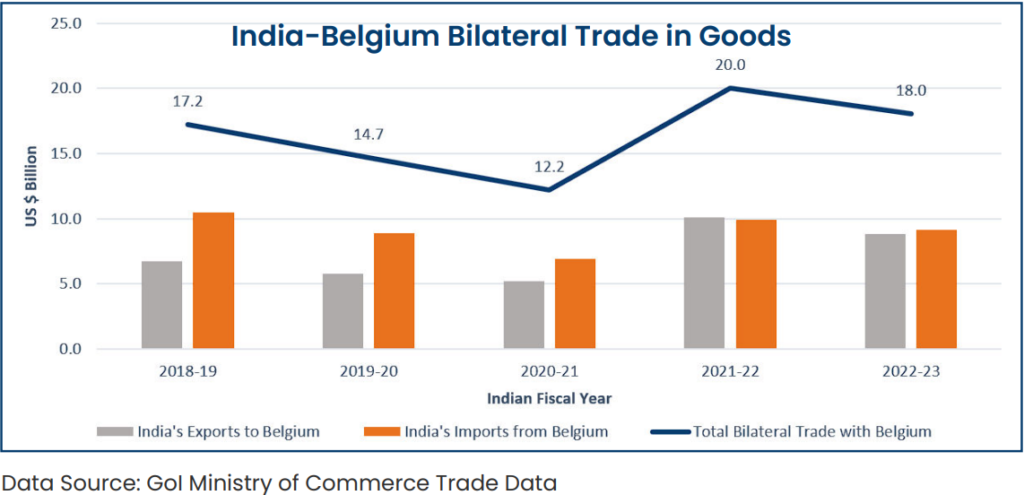

Belgium

The trade relationship is the most important pillar between Belgium and India and the increasing trade volume reflects a close economic partnership between them. Belgium was the third largest export market within the EU bloc for India in FY2022-23, with shipments of goods worth $8.9 billion. India’s trade with Belgium has been more balanced than any other major EU member country. Belgium is the second biggest supplier of goods to India among the EU economies, and in FY2022-23 India’s imports from Belgium were $9.2 billion. Trade in diamonds dominates the bilateral trade between the two countries.

In terms of investments, numerous Belgian companies are based in India and vice versa. By FY2022-23, Belgian investments in India were pegged at $361.7 million.

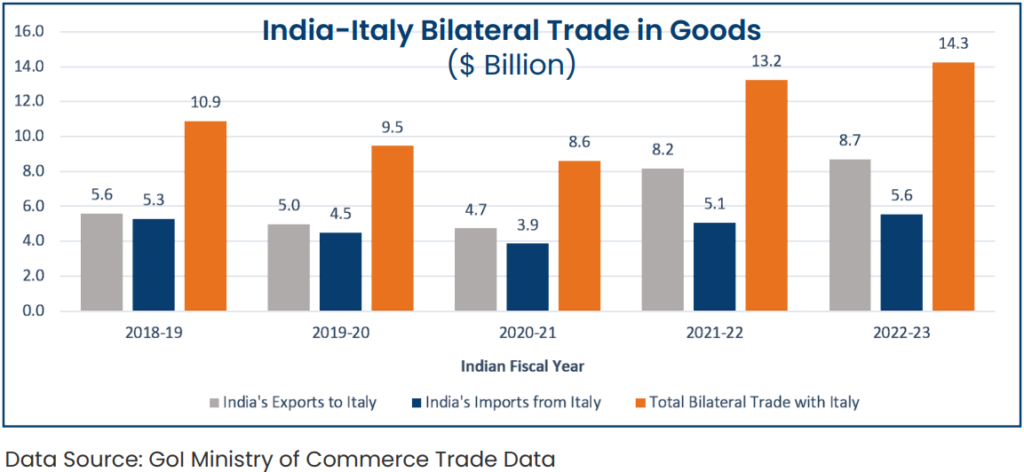

Italy

Italy is India’s 4th largest trading partner in the EU, and it has emerged as one of the significant econom ic partners for India with both signing a series of agreements in 2020. Both countries upgraded the relationship to a strategic defense partnership status in March 2023. The volume of merchandize bilat eral trade between India and Italy stood at $14.3 billion in FY2022-23, with a surplus in favor of India. Major exported items from India to Italy in FY2022-23 include iron and steel, and electronic goods (smart phones) while India’s major imports from Italy include industrial machinery for dairy, residual, chemicals, and allied products.

Italy’s FDI in India between April 2000 and March 2023 are estimated at $3.3 billion.

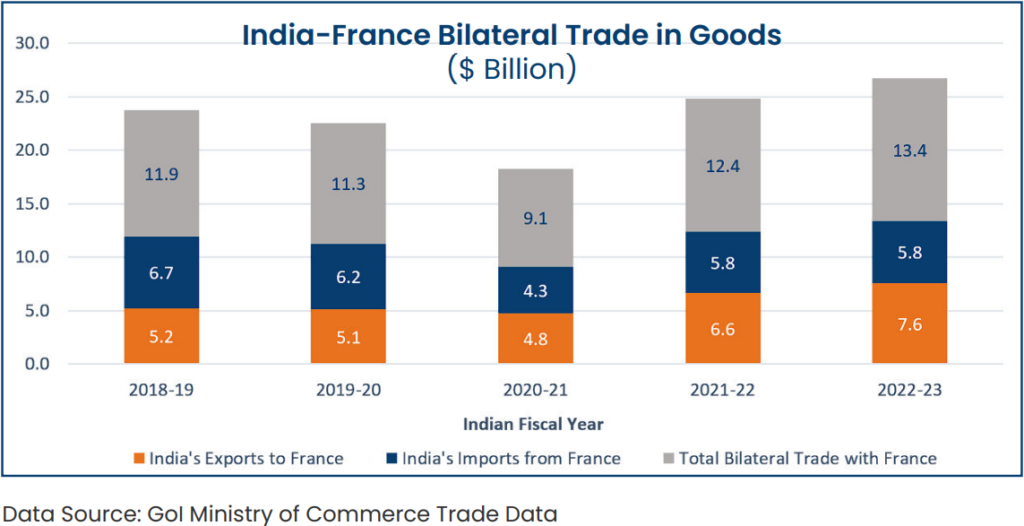

France

India and France have shared a strategic partnership for the last 25 years. They have broadened their economic engagement over the years, and France is India’s 5th largest trading partner among the EU members. Post-COVID, India has maintained a positive trade balance in goods with France; however, India was concerned in the pre-COVID era regarding the imbalance in trade. In FY2022-23, India-France two-way trade stood at $13.4 billion. India’s major exports to France include petroleum products, electric machinery, and equipment, while India’s major imports from France include aircraft, spacecraft and their parts, and petroleum products.

Both partners share a healthy investment relationship. The French cumulative FDI in India between April 2000 and March 2023 amounted to more than $10.4 billion.

Prospects of India-EU Negotiations

Mutual Benefits – The Inspiration for Negotiations

There are currently no agreements for bilateral trade or investment between India and the EU. The EU extended some tariff preferences to India, but these have been suspended since January 1, 2023, because of increased imports in the EU that exceeded the defined safeguard threshold levels. India unilaterally terminated almost all its investment protection treaties, including with EU member states, in 2017.

Both India and the EU will likely gain from a free trade agreement (FTA), as both align on economic growth driven by sustainable development and international cooperation (multilateralism). Both sides will benefit if the current FTA negotiations see fruition as planned. While the EU wants to diversify its relations with the Indo-Pacific states and underlines India’s prominent position given India’s status as a growing economy in the region, India aims to advance its economic and technological modernization for a greater international role. The EU and India are now more aligned on geopolitical issues than ever before, especially regarding China. Unlike the earlier failed negotiations between 2007 and 2013, both sides have now shown understanding and willingness for the success of the negotiations, keeping in view the prospects of their long-term strategic partnership.

Successful negotiations will, however, depend on some tough decisions needed on concessions from both sides. The current dynamics in India, such as market size, demographic dividends expected from its young population, and the immense need to advance the industrialization and exports sector, augur well for India’s deeper integration with the EU, which is already one of its major partners in terms of trade and investments. India is keen to enhance its integration with the global market and an FTA with the EU will not only improve India’s competitiveness, but it will also be a gateway to other major markets of the world. An FTA will strengthen the India-EU synergy, supporting EU businesses with new market access while providing India an opportunity to expand its manufacturing capacity and greater participation in global supply chains.

Focus Areas of The Negotiations

The current India-EU negotiations are focused on three areas, namely, Trade, Investment Protection, and Geographical Indications (GI). Interestingly, departing from regular practice, each agreement will be negotiated separately, and not as sections of one single umbrella agreement, thus increasing the chances of success in at least some areas, if not in all.

Free Trate Agreement (FTA) Negotiations

India-EU FTA negotiations are aimed at:

- Removing barriers to exports;

- Market access for services and public procurement;

- Protecting intellectual property rights; and

- Pursuing ambitious commitments on trade and sustainable development.

The EU and India Positions

- Tariffs: Some tariff negotiations may be difficult for India, such as agriculture products, dairy products, and poultry farming, but the FTA is expected to boost market access for India’s domestic industries, such as textiles, leather, and sports goods, resulting in more export-oriented production. The EU’s demands for lower tariffs on automobiles, wines, and spirits may now find a way in the FTA, as the market access for wine and spirits may not pose a threat for the Indian industry, with the Scotch whiskey suppliers exit by way of 2020’s Brexit.

- Services: India wants access to the EU market as a service provider. India seeks a relaxed, harmonized, and preferential Mode 1 (cross-border services like Information Technology Enabled Services/Business Process Outsourcing) and Mode 4 (movement of natural persons like software professionals) access for service supplies as provided under the General Agreement on Trade and Services (GATS) of WTO. The EU disagrees with India with respect to Mode 3 services (commercial presence like establishment of banks and hotels in India) and seeks further liberalization of FDI rules in financial services, i.e., the insurance and banking sectors. India has so far given limited access to foreign banks and insurance companies in the domestic market.

- Data Protection: The EU currently does not recognize India as a data secure country and wants India to ensure free flow of sensitive data between India and EU. The EU wants unrestricted cross-border flow of data between the two sides, which includes allowing storage of data in EU countries under the proposed free trade agreement. While India is currently working on its Data Protection implementing regulations, a clear position is yet to emerge regarding the storage of data provisions that can help bring down compliance costs for companies from the EU and India.

- Labor: India is in a better position now to negotiate labor standards, having joined the International Labor Organization (ILO) Convention on Child Labor in 2017.

- Public Procurement: India has also started opening its public procurement market, albeit limited in scope, as was seen in the India-UAE Comprehensive Economic Partnership Agreement (CEPA) signed in 2022.Intellectual property protection: Intellectual property standards within the FTA may be a difficult area as the EU and India have different views regarding the ban of ‘ever-greening’ of patents and the exclusivity of test data (protection of clinical trial data) within the Indian Patents legislation.

Investment Protection Agreement (IPA) Negotiations

The investment protection negotiations are aimed at providing investors with a predictable investment environment, through commitments on:

- Non-discriminatory treatment;

- Protection against expropriation without compensation and unfair treatment of investors and their

- investments, while preserving the right to regulate;

- Transfer of returns; and

- An effective and state-of-the-art dispute settlement mechanism to enforce the rules.

The EU and India Positions

Historically, both sides have found the investment protection area the most controversial segment of the agreements. From the EU perspective, the Investment Protection Agreement goes through a tedious process of approvals from the Council of the EU and the European Parliament before its ratification by each of its 27 members. An Investment Protection Agreement, on the other hand, will be particularly difficult to reach. India fears the Investment Protection Agreement will provoke resistance from different political groups and civil society. India has adopted the new Investor-State Dispute Settlement (ISDS) as the template for new Bilateral Investment Treaties (BITs), mandating investors to use all domestic procedures before seeking international arbitration, which may become a contentious issue in negotiations.

Geographic Indications (GI) Negotiations

A Geographical Indication (GI) is an intellectual property, typically a sign used on products that have a specific geographical origin and specific qualities. Both sides seem to be better aligned on protecting Geographic Indications than in any other areas within the current negotiations. India is in the process of implementing its GI laws Europe’s and India’s production patterns tend to complement each other.

CONCLUSION

While the FTA negotiations are still at work, in the absence of a bilateral agreement India and the EU continue to participate in trade discussions in multiple global fora, such as the G20 and the World Trade Organization (WTO). India’s G-20 2023 Presidency provides an opportunity to get EU support on India’s G20 priority areas, such as making trade more inclusive and growth-oriented for developing countries, resilient global value chains (GVCs) while integrating the micro, small and medium enterprises (MSMEs), logistics for trade, and international institutional (WTO) reforms.

India and the EU are moving in the right direction for expanding their bilateral economic relations by way of mutually beneficial economic agreements. The ambitious timeline set forth at the beginning of the negotiations was aimed at the conclusion by December 2023. The FTA negotiations are on track so far, with the 6th Rounds scheduled in October 2023 in Brussels. The May 2023 Brussels visit of India’s Commerce and Industry Minister Piyush Goyal has added momentum to the negotiations, providing Indian businesses an opportunity to work with their EU counterparts to resolve sensitive issues, including market access barriers. While EU businesses have raised high tariff related issues in India’s dairy, alcoholic beverages, and automobiles and auto-components sectors, the Indian businesses are concerned about regulatory issues (technical standards) and the EU’s carbon tax. The India-EU Trade and Technology Council (TTC), formed in 2022, is expected to deliberate on some of these issues along with the ongoing FTA negotiations. The SMEs chapter and the Government Procurement chapter within the FTA have been reportedly concluded.

In view of the complexity of the languishing issues, such as agriculture and dairy, re-manufactured products tariffs, digital framework, IPR reforms that are considered beyond TRIPS in India, retail trade, services and financial market openings, and investor protection, the prospects of the India-EU partnership agreements will be contingent upon the ability of both sides to find common ground on such issues. Ideally, it would be appropriate to conclude the negotiations before the two sides go on election mode in 2024. However, it appears the India-EU trade deal includes many complicated and politically sensitive issues requiring longer and deeper talks and is unlikely to be concluded by the end of 2023 as hoped.

That said, the two sides would want to see the success of negotiations, but they must maintain the ambition of the deal in their negotiations to the maximum extent, irrespective of the delays in outcome. Even a small success in one area (Trade/Investment Protection/GI) may prove to be an inspiration for continuing negotiations in other areas for long-term cooperation. Trade observers are keenly monitoring the progress of the India-EU deal, as it will have geopolitical implications for the GVCs. From India’s perspective, this will be India’s benchmark deal (if successful) that can integrate it with a major bloc in the global market and can possibly serve as a model ‘Way Forward’ for an FTA with its top trade partner country – the United States!