The performance of high-frequency indicators for July 2023 continued to reflect mixed trends. Despite the continuing worldwide challenges of inflation and supply chain disruptions, overall business sentiment in India remained optimistic. On the positive side, domestic demand remained resilient despite the continuing global challenges: manufacturing and service activities peaked with fresh orders, industrial output grew (albeit at a slower pace), the unemployment rate dipped, tax collections rose, and public capital expenditures (i.e., investments) increased. On the other hand, retail inflation crossed the RBI-prescribed ceiling, the external. sector remained gloomy with falling exports and imports, and the Indian rupee (INR) further weakened against the US dollar.

Strong growth in demand indicators seems to be driving the growth of economic activity in India. Retail sales in July 2023 showed decent year-on-year (YOY) growth and the number of passenger vehicle sales (a proxy for urban demand) was 7.6% more than the previous month. The bank credit YOY growth rate was robust despite continuing high interest rates. On the supply side, the Markit Purchasing Managers’ Indices (PMI) for Manufacturing and Services were buoyant, pointing to a sustaining upbeat market sentiment. The overall unemployment rate in July declined. The Goods and Services Tax (GST) and rail freight collections were larger than the previous month’s marks, reflecting an uptick in transactions and increased tax compliance, and capital expenditure was almost double the previous month’s level.

On the external front, as expected, India’s foreign trade performance in July was not so impressive compared with the last several months; merchandise exports continued downward trends, sliding more than 2% from the previous month’s level, while imports moderated marginally. Equity FDI equity witnessed a net outflow of about $500 million in July. India’s foreign exchange reserves, though still reasonably high, have been affected by macroeconomic uncertainties, slipping to around $574 billion in July while the Indian rupee depreciated by nearly 0.5% against the US dollar during the month.

The consumer price index (CPI) was much higher than expected in July due to the continued spike in vegetable prices. After remaining within the Reserve Bank of India’s (RBI) target band of 2-6% for four consecutive months, the skyrocketing tomato and other food prices led the retail inflation rate much beyond the RBI-prescribed ceiling. The wholesale price index (WPI), in contrast, contracted further, maintaining its deflationary trajectory since April. the beginning of the current Indian fiscal year (FY2023-2024).

India recorded impressive annual growth of 7.2% during FY2022-23. Domestic demand remains a vital factor in India’s GDP growth, backed by solid agriculture and service sector activities. Growth in manufacturing continues to recover, albeit slowly, and government investment in infrastructure is growing. Economists have, however, cautioned that the risks of resurgent inflation, severe climatic and monsoon conditions, and geopolitical challenges may dent the growth in agriculture output and export orders. Therefore, the near-term economic growth outlook for India remains subject to inflation and global market conditions while the longer-term prospects appear strong. Moody’s Investors Service expects India’s economic growth to outpace all other G20 economies through at least the next two years, driven by domestic demand; and it has recently retained India’s rating at Baa3 affirming a stable outlook.

Demand Indicators

Retailers reported growing urban and rural demand with the easing of inflation in India, as seen in the higher sales of two-wheel vehicles and four-wheel passenger vehicles. According to the Retail Association of India (RAI), July 2023 sales were up by 9.0% year-on-year, as consumers have started their end-of-summer season purchases just before the upcoming festival season beginning August. The RBI reported healthy bank credit (with retail loans share of 28%) and growth at about 20% at the end of July, more than four basis points above the previous month, even though the cost of credit remains high due to liquidity tightening during the last fiscal year. The sustained positive sentiment in the market during FY2022-23 suggests resilient consumer demand will drive expansion of the Indian economy in the short and medium terms.

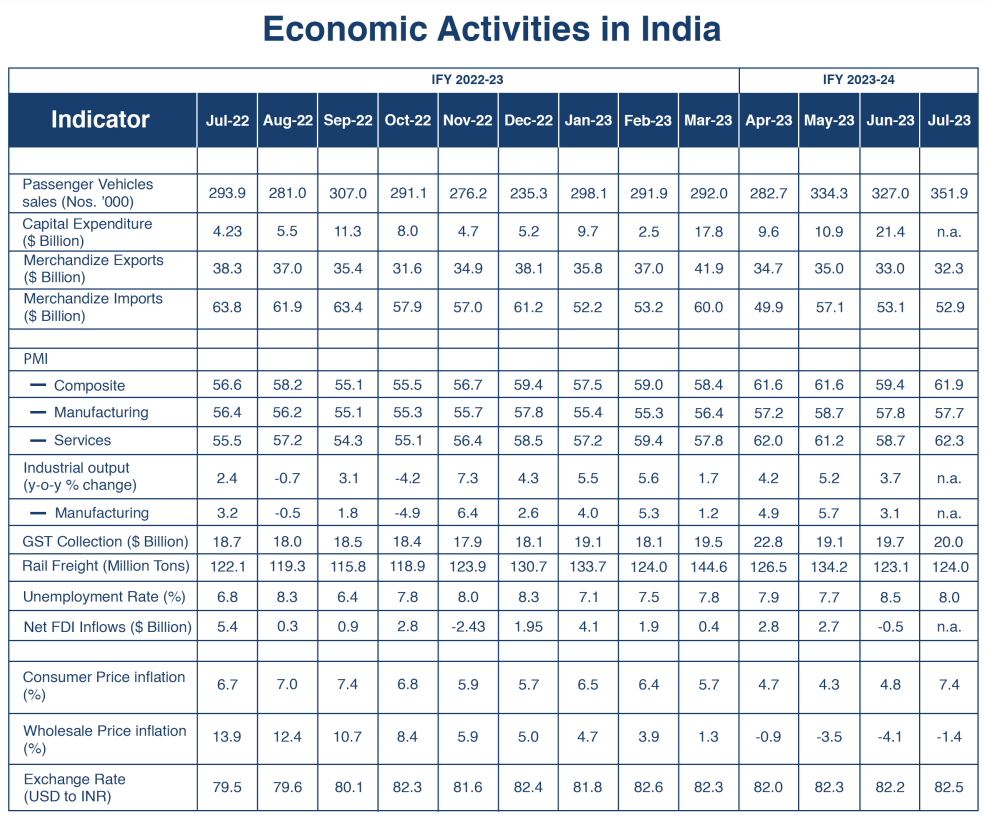

Capital Expenditure

Public sector capital expenditure (capex) was erratic during FY2022-23 (Figure 1), and private sector capex did not pick up to the desired extent. However, companies from capital-intensive sectors including oil and gas, metals, and power have reported impressive growth in their capex in FY2023-24 from the previous year. The government’s Production-Linked Incentives in select sectors, such as electronics and appliances, are also helping increase private sector participation in investments. According to analysts at ICRA (an Indian credit rating agency), India’s corporates are likely to invest more in capex amidst a relatively stable domestic macroeconomic environment and global opportunities, especially with the China+1 strategy. Nonetheless, some observers remain cautious, saying that India’s capex cycle still lacks durability and will not see a meaningful revival until borrowing costs fall and demand rises.

Trade

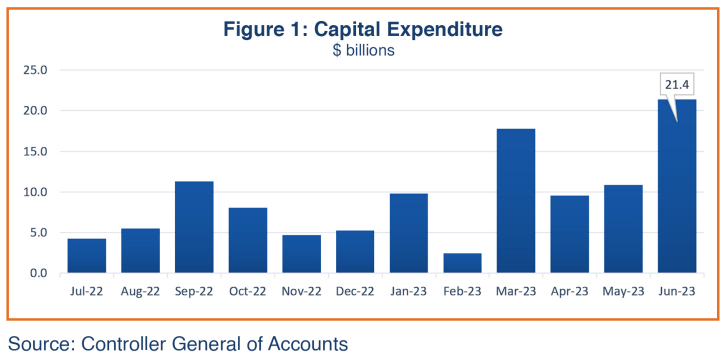

Like many other major economies of the world, India’s merchandize exports sank to a nine -month low at $32.25 billion in July 2023 from $32.97 billion recorded in the previous month (Figure 2). Export performance continues to lag since the onset of the global economic slowdown and due to high inflation in developed economies that has reduced demand and impacted supplier economies. While a few categories, such as electronic goods, pharmaceuticals, and iron ore, grew significantly in July, most major categories decelerated, such as petroleum products, gems and jewelry, textiles, chemicals, and plastics. At the same time, services exports were up only marginally in July, to $27.17 billion from the previous month’s $27.12 billion. The Indian Department of Commerce (DOC) along with the Department for Promotion of Industry and Internal Trade (DPIIT), Invest India and Indian missions abroad, has identified 40 export markets for enhancing merchandize exports, including the United States and European Union, which collectively account for 85% of India’s total exports. Indian policymakers target a total of $900 billion worth exports of goods and services in FY2023-24, up from the previous year’s exports of $770 billion, through focusing on select markets. According to Commerce Ministry officials India is engaging to sign free trade agreements (FTAs) with more countries, especially in Latin America and Africa, which is expected to improve its export performance in coming years and help the country reach its target of $2 trillion exports by 2030.

India’s merchandize imports, at $53.1 billion in July 2023, were unchanged from June, when the pace of India’s imports across most product categories began decelerating.

The Government of India has been monitoring the influx of electronic goods into the Indian market that has led to an increase in their share in India’s total imports in the first four months of the current fiscal year (April-July 2023), to 12.91% from 10.25% in the previous year’s corresponding period. India’s digital push and changing lifestyle choices are increasing the demand for electronic merchandise such as smartphones, laptops, tablets, and related products, creating a gap in demand and supply due to India’s limited ecosystem of component supplies for manufacturing finished electronic products. To slow the increase the Commerce Ministry of India recently restricted imports of laptops, tablets, and PCs, requiring import license from November 1. Services imports in July dropped to $14.85 billion from $15.88 billion in the previous month.

Overall, India’s merchandize trade deficit in July was marginally up to $20.67 billion from the previous month’s $20.13 billion.

Supply Side Indicators

Input Purchases

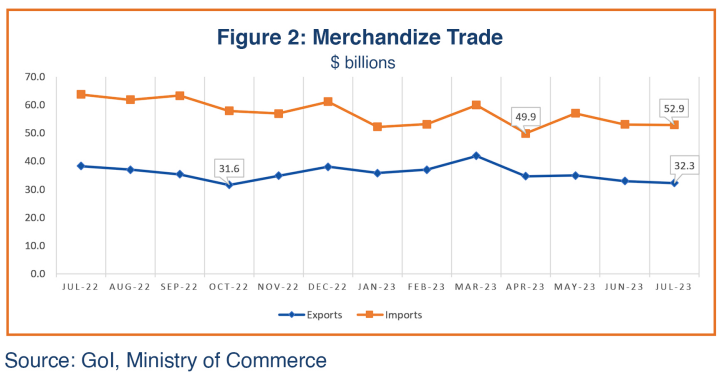

Overall business sentiment in July 2023 was robust, with the new Composite Markit Purchase Managers Index (PMI) peak of 61.9, more than 4% stronger than the previous month’s 59.4. Continuing demand for goods and services led to decent expansion in both manufacturing and services activities (Figure 3; a PMI above 50 reflects the optimistic mood of businesses that have made bold input purchases in anticipation of increased demand). The latest reading recorded the 25th consecutive month of business activity expansion, reaffirming sustained economic recovery in India. The Services PMI for July 2023, at 62.3, strengthened from the previous month’s 61.2. India’s dominant services sector PMI saw its fastest growth since June 2010 and has maintained positive growth for two years consecutively. India’s services PMI reading has likewise been above breakeven for two years, pointing to the sector’s crucial contribution to GDP so far for the current fiscal.

India’s July Manufacturing PMI at 57.7 was down from the previous month’s two-year high of 58.8; however, it expanded at the third-fastest rate this year in July on the back of resilient demand. According to the S&P Global Survey, manufacturing output growth moderated a bit while new orders remained robust. The Survey report cautioned that the overall level of positive sentiment slipped from June’s six-month high due to concerns surrounding extreme weather.

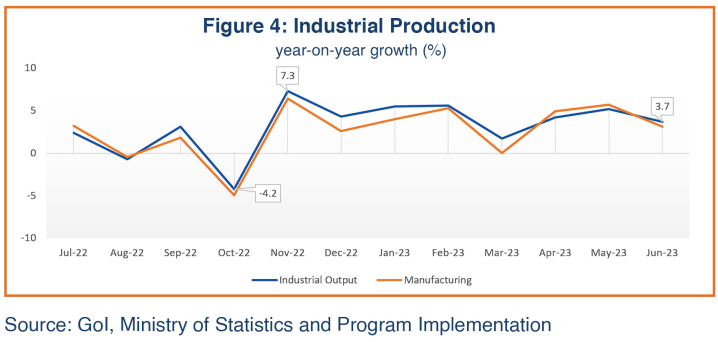

Industrial Production

India’s year-on-year industrial production growth rate dropped to 3.7% in June 2023 from 5.32% in the previous month (Figure 4). A moderation in manufacturing output due to pressures from the global slowdown pushed industrial growth rate to a three-month low. Manufacturing, which accounts for 77% of total industrial production output, recorded growth of 3.1%, compared with the 5.7% in the previous month; however, the mining output growth rate improved, which comprises 14% of total industrial output, to 7.6%, from 6.4% in the previous month; and power generation (8.0% of total industrial production) rose 4.2%, compared with the previous month’s growth of 0.9%. Capital goods production (a proxy for investments) within the manufacturing sector increased only 2.2% in June, much less than the 8.1% increase seen in May. Industrial output faces downside risks in coming months due to increasing inflation that can weigh down demand, uncertain monsoon conditions, and continuing global slowdown.

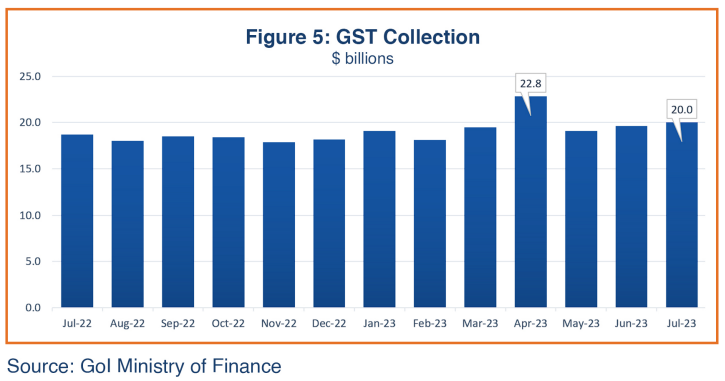

GST Revenues

July 2023 general service tax (GST) collections, maintaining a robust pace, were pegged at $20.0 billion, up slightly from the previous month’s $19.7 billion on continuing economic momentum (Figure 5). Analysts note that rising GST collections reflect a combination of increased economic activity, higher tax rates, improved compliance, and some effects of inflation. Industry expects the GST authorities will be more open to a rate rationalization proposal given the recent sustainability in GST collections.

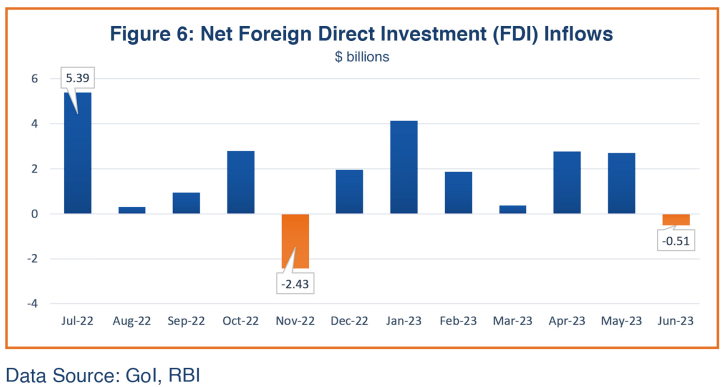

Net Foreign Direct Investment

Foreign direct investment (FDI) flows showed mixed trends throughout FY2022-23. After peaking in July 2022 at $5.4 billion, India’s net FDI inflows reversed to become a $2.43 billion net outflow in November 2022. FDI inflows regained momentum gradually, albeit with little stability (Figure 6), owing to the uncertain geopolitical tensions and economic slowdown conditions weighing down investments. Net FDI inflows in India in FY2022-23 collapsed by more than 27%, to $28 billion from the previous year’s $38.62 billion. Nonetheless, the current fiscal year started with solid net FDI inflows of $2.77 billion, but it seems the erratic trends continue, and June 2023 witnessed a net outflow of $512 million.

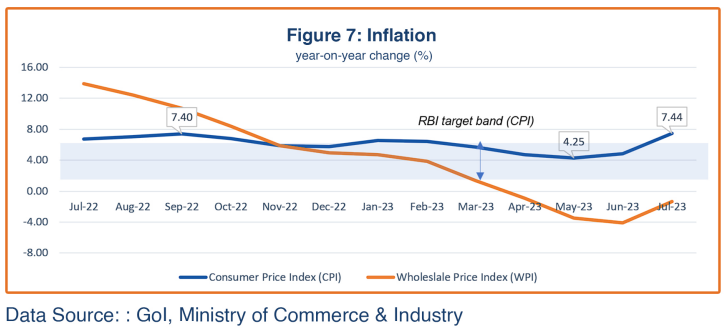

Inflation

The year-on-year Consumer Price Index (CPI) inflation rate rose more than expected to a ten-month high of 7.44% in July 2023, again surpassing the upper limit of the RBI target band of 2-6 per cent after staying within the band for four consecutive months. Food prices, which account for about 40% of the CPI total, firmed up, especially tomato prices, amid an erratic monsoon over the last two months. Economists do not see a respite from the surging inflationary pressures for the next two or three months. In its August Monetary Policy meeting, the RBI revised its FY2023-24 inflation forecast upward to 5.4% from 5.1% forecast in its June Policy meeting. While the RBI held the repo rate steady in August, Governor Shaktikanta Das has stated that the RBI stands ready to deploy monetary policy tools when necessary.

Wholesale price index (WPI) inflation continued its downward trajectory for a fourth consecutive month in July, with prices declining 1.36% in July, following the 4.12% decline recorded in the previous month. Lower prices of chemicals, textiles, manufactured food, and mineral oils led the fall in WPI inflation. Observers have, however, alerted that wholesale prices will start rising from September 2023 as base effects fade and stickiness in primary article prices persists.

Foreign Exchange

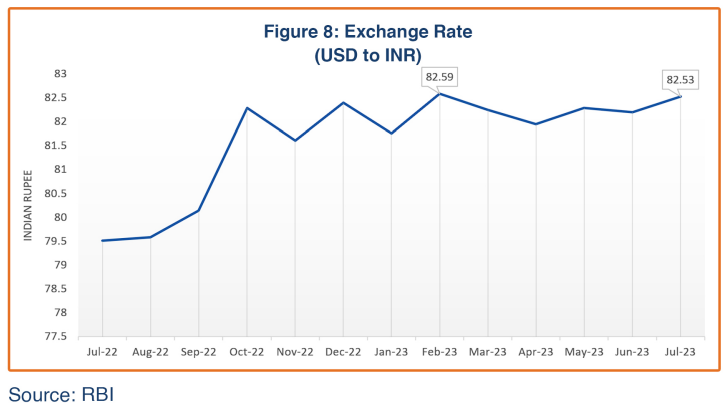

India’s foreign exchange reserves were about $601.5 billion at the end of July 2023, up $6.5 billion from the June-end level. The reserve levels have been showing diverse trends since October 2021, when reserves peaked at $645 billion, as the RBI has been actively buying and selling foreign exchange to smooth market volatility caused by global developments. The RBI intervened intermittently in the foreign exchange market for liquidity management, including the selling of dollars to manage depreciation in the rupee, which impacts exchange reserves. The Indian rupee (INR) remained weak throughout July, depreciating by 0.4% from the previous month. The average monthly exchange rate for July was INR 82.53/USD, compared to the previous month’s INR 82.20/USD (Figure 8).

In a significant move to internationalize its currency, India has allowed more than a dozen banks to settle trades in Indian rupees with 18 countries since last year. India’s recent agreements to trade in rupees with the United Arab Emirates and Bangladesh, as well as its agreement with Russia last year for oil purchase are testimony to India’s bid to promote the INR in the global market.

Economic Outlook

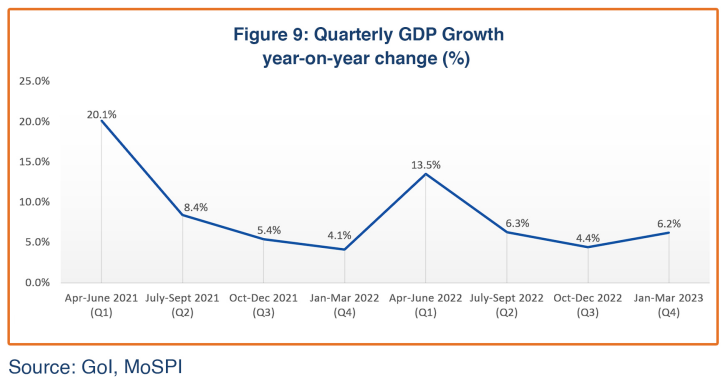

India’s gross domestic product (GDP) grew more than expected at 6.1% in the last quarter of FY2022-23 (Jan-Mar 2023), leading to an estimated growth rate of 7.2% for the full fiscal year. The robust performance of services (travel and retail) and the farm sector, coupled with resilient demand drove India’s growth in FY2022-23.

The RBI has reaffirmed its forecast on Indian economic growth at 6.5% for FY2023-24, with Q1 at 8.0%, Q2 at 6.5%, Q3 at 6.0%, and Q4 at 5.7%. According to the RBI, the pickup in consumer spending in rural areas reflects the incipient revival of rural demand, and it will likely boost with a good Kharif harvest. In addition, the upcoming festival season and sustained buoyancy in service activities will likely push up private consumption and investment activities despite the upwardly revised retail inflation of 5.4%. The International Monetary Fund (IMF) on July 27 projected India’s real GDP growth at 6.1% in FY2023-24, up from 5.9% estimated in April, citing momentum from stronger-than-expected growth in the fourth quarter of 2022 and stronger domestic investment. However, it also cautioned that the global economy is not “out of the woods” yet and that the battle against inflation is far from over.

While the IMF’s projections remain below the RBI projections even after upward revision, and external demand, uncertain inflation, and the geopolitical tensions pose risks to the RBI’s forecast, the overall outlook for India’s economic growth for FY2023-24 remains optimistic.