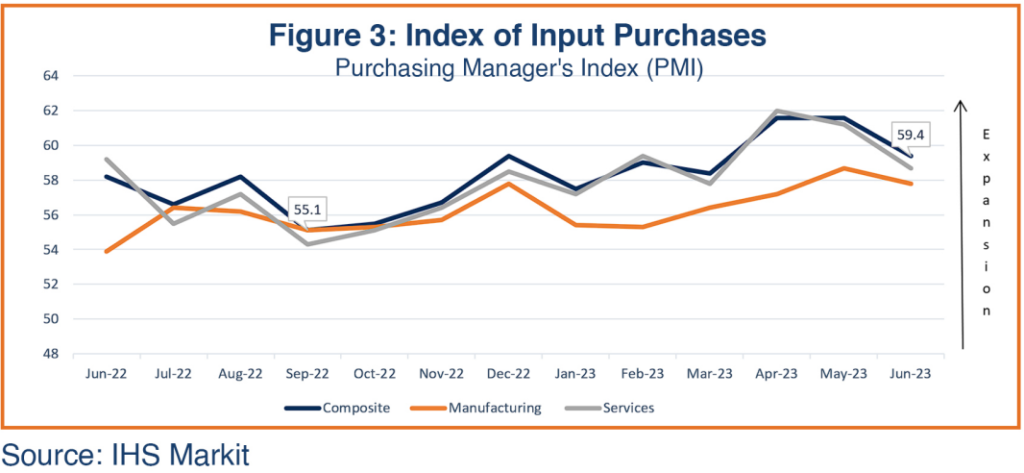

India’s economic performance for June 2023 reflected diverse signs, featuring slower growth in most indicators, namely demand, exports, imports, manufacturing and services activities, and inflation. But positive movements appeared in industrial output growth, GST collections, capital expenditure, and foreign exchange reserves. Overall, market sentiment remained high as India’s economic recovery continued albeit at a relatively slower pace than in the previous month.

Retail sales in June 2023 showed moderate year-on-year (YOY) growth on slowing consumer demand. On the supply side, the Markit Purchasing Managers’ Indices (PMI) for Manufacturing and Services both dropped slightly yet remained well above the break-even point. The overall unemployment rate in June increased, mainly in the rural sector on the back of a patchy monsoon and less than expected rainfall in the first half of June. Goods and Services Tax (GST) collection was steady on account of increased compliance and increased transactions, and capital expenditure in May was up from the previous month.

As anticipated due to continued volatile global conditions, India’s external sector performance was lackluster in June, with exports and imports decelerating on account of lower demand, compared to the previous month; as a result, the trade deficit was also down. Net FDI flows were a tad down from the previous month’s level as foreign investors continue to face global headwinds. India’s foreign exchange reserves, however, improved in June as the Indian rupee recovered marginally against the US dollar from the previous month.

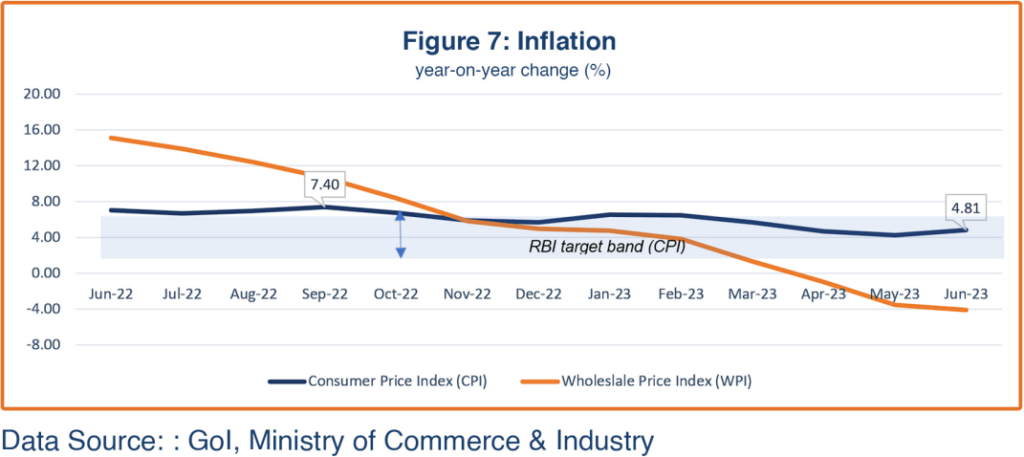

The consumer price index (CPI) inflation was higher than expected in June due to a spike in vegetable prices, but it remained within the Reserve Bank of India’s (RBI) target band of 2-6% for the fourth consecutive month. The wholesale price index (WPI), in contrast, contracted further, maintaining the downward trajectory it has had for the last seventeen months.

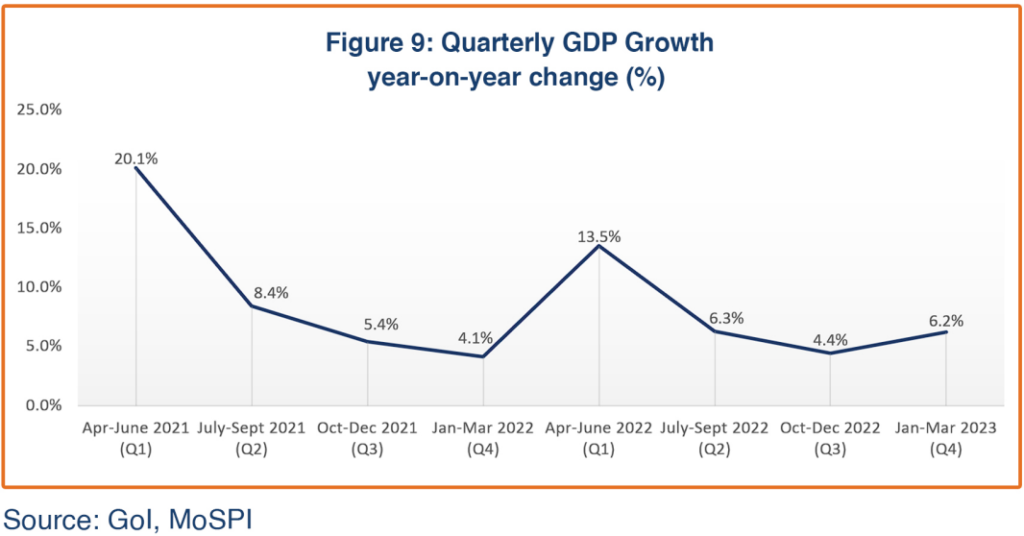

India recorded impressive cumulative growth of 7.2% during FY2022-23. Domestic demand remains a vital factor in India’s GDP growth backed by solid agriculture and service sector activities. Growth in manufacturing continues to recover albeit with an uneven pattern, and government investment in infrastructure is set to grow in the current fiscal year, pointing to positive signals for achieving the targeted 6.5% growth. Economists have, however, cautioned that the risks of unpredictable weather and geopolitical challenges could lower demand in advanced economies.

Demand Indicators

Retailers reported growing urban and rural demand with the easing of inflation in India, as seen in the higher sales of two-wheel vehicles and a decent number of passenger vehicle retail sales. According to the Retail Association of India (RAI), June 2023 sales were up moderately, by 7.0% year-on-year, as consumers are now getting back into their normal business routines, while the upcoming festival season beginning August is expected to push consumer spending up further. The RBI reported healthy bank credit growth at 15.4% at the end of June, unchanged from the previous month, even though the cost of credit remains high due to liquidity tightening during the last fiscal year. The sustained positive sentiment in the market during FY2022-23 suggests domestic demand continues to drive the economic recovery in India.

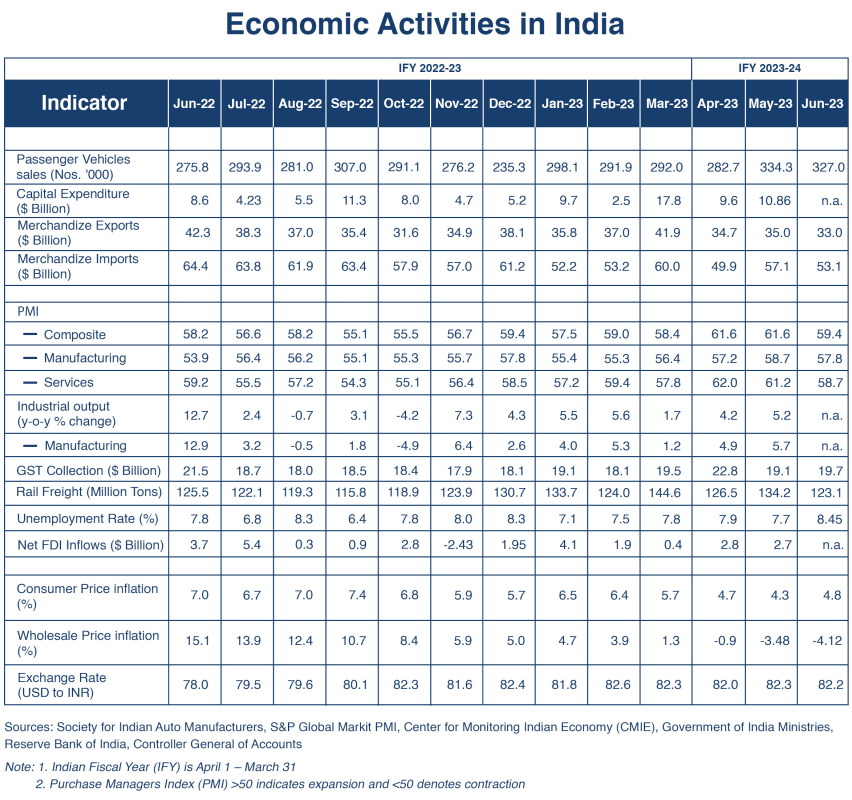

Government Capital Expenditure

Public sector capital expenditure (capex) was erratic during fiscal year 2022-23 (Figure 1), and private sector capex did not pick up to the desired extent. However, the combination of an upswing in the property cycle and several large government infrastructure initiatives is likely to drive capex in FY2023-24. Nonetheless, market observers believe India’s capex cycle still lacks durability and will not see a meaningful revival until borrowing costs fall and demand rises.

The private corporates and banks in India have reported healthy profits for the first quarter of the current fiscal year, which is conducive for pushing private sector capex cycle in coming months. Strong growth in cement and steel production in May and June also indicates better prospects for sustaining growth in capex. The government also released additional tax revenues to states in June to push the capex, announcing more than $686 million of interest-free and long-term capital expenditure loans to 16 states.

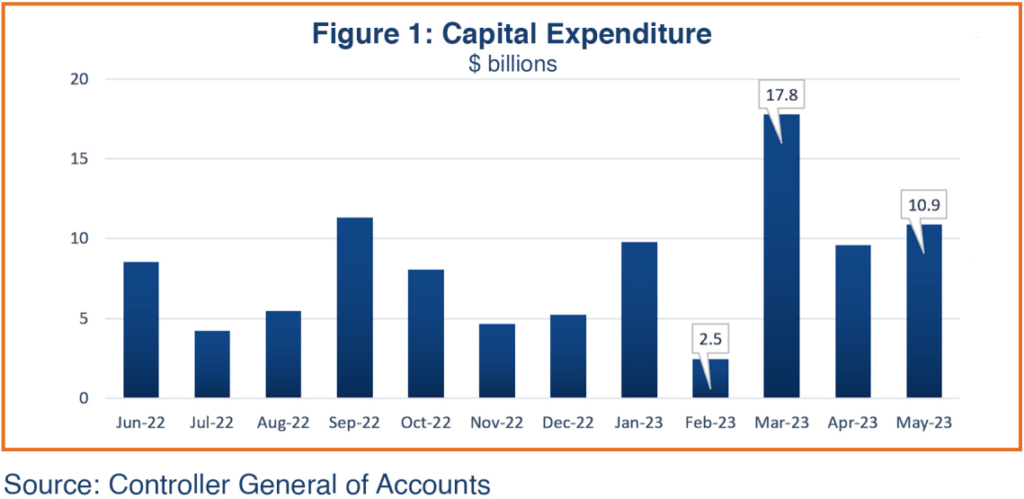

Trade

India’s merchandize exports were $32.97 billion in June 2023, down 5.8% from the previous month’s $34.98 billion (Figure 2). Export performance continues to lag since the onset of the global economic slowdown and due to high inflation in developed economies that has reduced demand. Exports of electronic goods, oil seeds, and iron ore grew significantly in June while most other major categories decelerated, such as petroleum products, gems and jewelry, textiles, chemicals, and plastics. In contrast, services exports in June were $27.12 billion, up 7.2% from the previous month’s $25.30 billion. The Indian Department of Commerce (DOC) announced that they, along with the Department for Promotion of Industry and Internal Trade (DPIIT), Invest India and Indian missions abroad, would focus on enhancing exports to 40 countries, including the United States and European Union, which collectively account for 85% of India’s total exports.

India’s merchandize imports, at $53.1 billion in June 2023, were significantly down from $57.1 billion in May, when India’s imports across most product categories decelerated. On the other hand, services imports in June rose more than 17% to $15.88 billion from $13.53 billion in May 2023.

Overall, India’s merchandize trade deficit in June narrowed about 9% $20.13 billion from $22.12 billion, in line with the symmetrical decline in exports and imports.

Supply Side Indicators

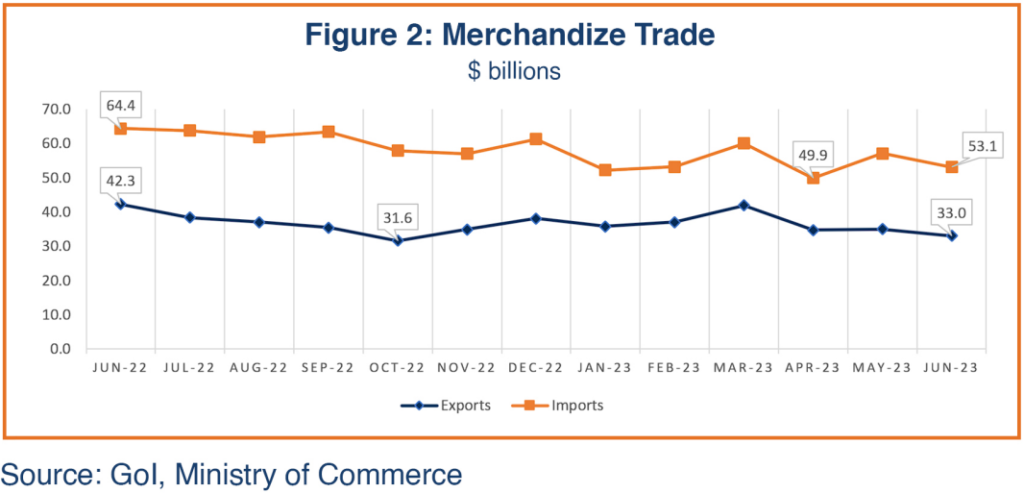

Input Purchases

Overall business sentiment in June 2023 was strong, with the Composite Markit Purchase Managers Index (PMI) at 59.4. Continuing demand for goods and services, albeit a bit slower than the previous month, led to decent expansion in both manufacturing and services activities (Figure 3; a PMI above 50 reflects the optimistic mood of businesses that have made bold input purchases in anticipation of increased demand). The latest reading recorded the 24th consecutive month of business activity expansion, reaffirming sustained economic recovery in India. The Services PMI for June 2023, at 58.7, weakened from the previous month’s 61.2, but it still reflects continued momentum in service activities. India’s services PMI reading has been above breakeven for nearly two years, the longest stretch since August 2011.

India’s June Manufacturing PMI at 57.8 was also down from the previous month’s two-year high of 58.7; India’s manufacturing industry expanded at the second-fastest rate this year in June on the back of resilient demand. According to the S&P Global Survey, output growth was sharp and among the fastest over the past 18 month. New orders expanded at the steepest rate of increase since January 2021, boosting business confidence and increasing new employment, including in factories.

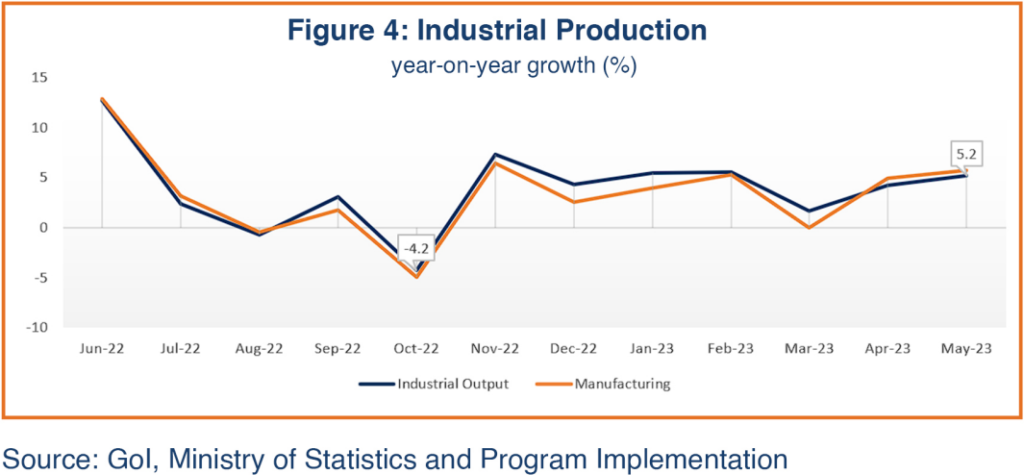

Industrial Production

India’s industrial production growth rate accelerated to 5.2% year-on-year in May 2023 from 4.5% in the previous month. Growth in industrial production was led by manufacturing output (Figure 4). Manufacturing, which accounts for 77% of total industrial production, recorded 5.7% growth, compared with 4.9% growth in the previous month; the mining output growth rate, which comprises 14% of total industrial output, was 6.4%, compared to the 5.1% growth in the previous month; and power generation (8.0% of total industrial production) rose 0.9%, compared with the previous month’s decline of 1.6%. Capital goods production (a proxy for investments) within the manufacturing sector increased 8.2% in May, better than the 6.2% increase seen in April.

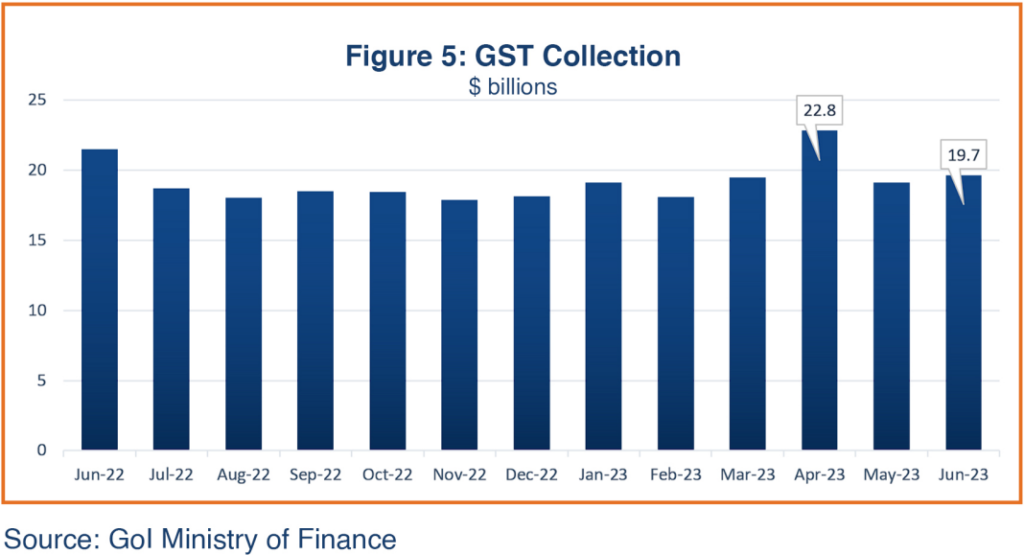

GST Revenues

June 2023 collections, maintaining a robust pace, were pegged at $19.7 billion in June, up from the previous month’s $19.1 billion on continuing economic momentum (Figure 5). Analysts note that rising GST collections reflect a combination of increased economic activity, tax rates, and compliance, and some effect of inflation.

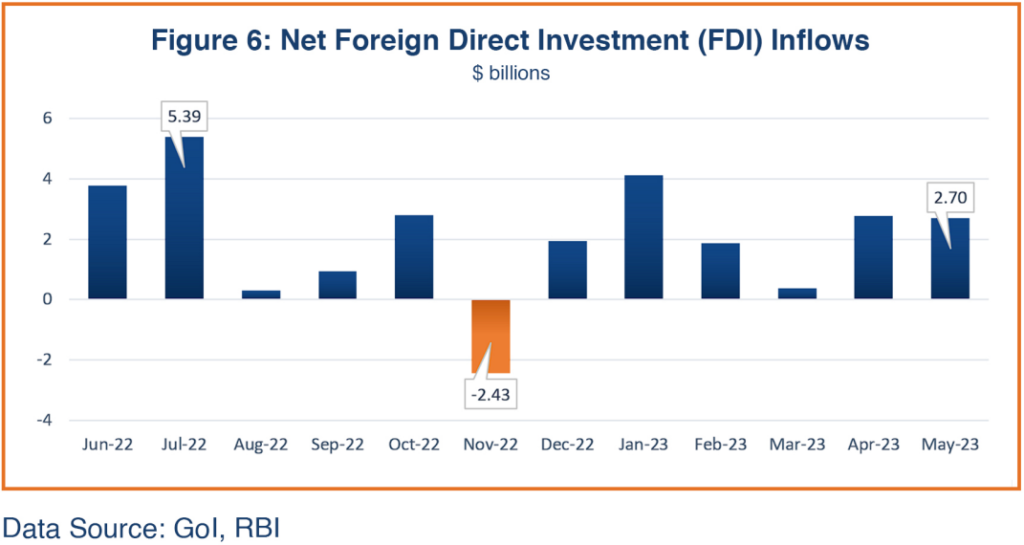

Net Foreign Direct Investment

Foreign direct investment (FDI) flows showed mixed trends throughout FY2022-23. Net FDI inflows peaked in July 2022 at $5.39 billion, after which flows reversed drastically, becoming a $2.43 billion net outflow in November 2022. FDI inflows regained momentum starting in December 2022, albeit with little stability (Figure 6), which the government attributed to the uncertainty of geopolitical tensions and economic slowdown. In keeping with the UNCTAD World Investment Report, 2022 warning that “investor uncertainty and risk aversity could put significant downward pressure on global FDI”, net FDI inflows in India in FY2022-23 collapsed by more than 27%, to $28 billion from the previous year’s $38.62 billion. Nonetheless, the RBI has reported solid net FDI inflows of $2.77 billion and $2.70 billion in April and May, respectively in FY2023-24.

Inflation

Consumer Price Index (CPI) inflation unexpectedly fell to a two-year low of 4.3% in May 2023; though it surged back to 4.8% in June it remains well below the Reserve Bank of India’s (RBI) upper target limit for the fourth consecutive month. Food prices, which account for about 40% of the CPI total, firmed up a bit on a steeper-than-expected surge in the price of vegetables, especially tomatoes, over the past few weeks; core inflation (non-food excluding fuel) also eased slightly in May, to 5.3% from 5.5% in the previous month. Amidst the ongoing excess rainfall in India’s northern states, the increase in the prices of vegetables will likely harden the food inflation further in coming months. In its June Monetary Policy meeting, the RBI highlighted that the pace of monetary tightening has slowed in recent months, but uncertainty remains on its future trajectory as inflation continues to rule the policy.

The Wholesale Price Inflation rate in June 2023 further contracted to 4.12% year-on-year from a contraction of 3.48% in May, on account of falling prices of mineral oils, basic metals, food products, textiles, non-food articles, crude petroleum and natural gas, and chemicals. Business sentiment appears to be improving following the easing of input prices.

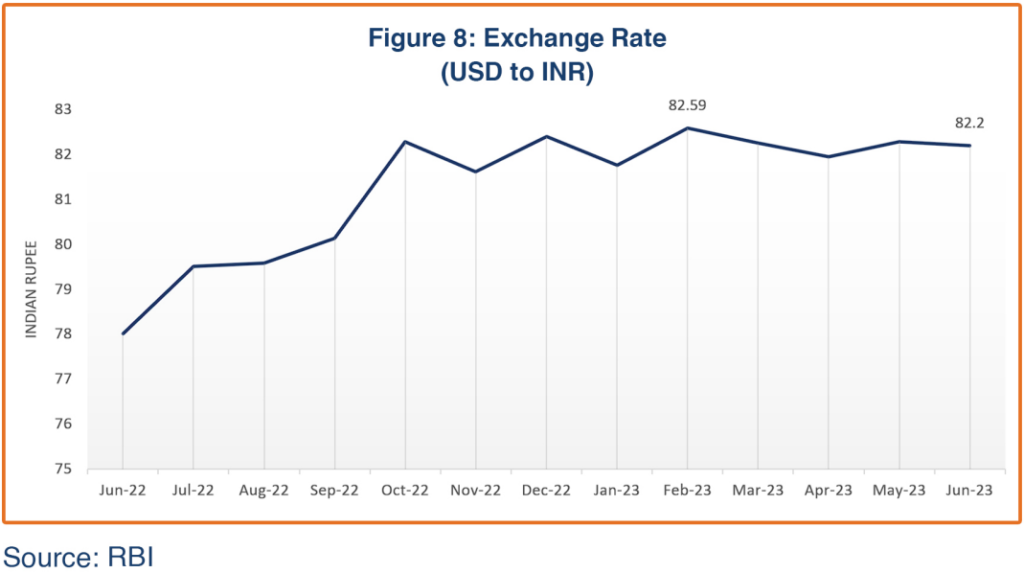

Foreign Exchange

India’s foreign exchange reserves were more than $595 billion at the end of June 2023, up $1.9 billion from the May-end level. The reserves have been showing mixed trends since October 2021 as the RBI has been deploying the pool to defend the rupee amid pressures caused by global developments. The RBI intervened intermittently in the foreign exchange market for liquidity management, including the selling of dollars to manage depreciation in the rupee, which impacted exchange reserves. The Indian rupee (INR) remained weak throughout June, recovering only a few basis points, and the average monthly exchange rate for June was INR 82.20/USD, compared to the previous month’s INR 82.29/USD (Figure 8).

Economic Outlook

India’s gross domestic product (GDP) grew more than expected at 6.1% in the last quarter of FY2022-23 (Jan-Mar 2023), leading to an estimated growth rate of 7.2% for the full fiscal year. The robust performance of services (travel and retail) and the farm sector, coupled with resilient demand drove India’s growth in FY2022-23.

In a positive movement, growth in industrial and manufacturing output has started increasing. In addition, continuing growth in the agriculture and services sectors, along with sustained growth in domestic demand and credit, augur well for sustained GDP growth; however, continuing volatility in global conditions, as well as India’s lackluster export performance, continue to weigh upon GDP growth prospects. The government’s continued thrust on capital expenditure imply an investment-friendly climate that will likely push India’s economic growth in the current and next fiscal year; however, India’s exports may continue to be lackluster if the global slowdown prolongs, which would in turn hobble faster GDP growth. The RBI has also stated in its latest financial stability report, released on June 27, 2023, that the rising pace of local economic activities along with stronger corporate sector balance sheets and efficient financial system has brightened the prospects of the Indian economy, though persistent core inflation above 5% and volatility in the global financial system could pose risks to the growth trajectory.

The RBI projects the Indian economy to grow at 6.5% during FY2023-24. However, economists have cautioned that moderation in real wages and intermittent tempering of private consumption, alongside the weakening export orders, may constrain the full growth potential.